Professional Documents

Culture Documents

Breakeven

Uploaded by

Noble S WolfeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Breakeven

Uploaded by

Noble S WolfeCopyright:

Available Formats

Break-even Analysis1

Break-even Analysis Lester M. Legette Trident University International

ACC501- Accounting for Decision Making Dr. Ralph Wayne Ezelle 05 March 2012

Break-even Analysis2

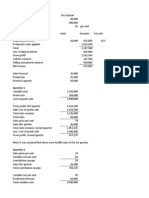

Compute break-even at each level A break-even analysis to determine the point at which revenue received equals the costs associated with receiving the revenue. Break-even analysis calculates what is known as a margin of safety, the amount that revenues exceed the break-even point. This is the amount that revenues can fall while still staying above the break-even point. Pringly division seems to break even at all anticipated levels. The breakeven point is calculated when total sales equal total cost. An example of this would be sales under the lower price level would be $25,500,000 and cost associated with this is $24,500,000 they broke even and had a profit of $1,000,000

Is the company likely to achieve its desired target profit of $4,000,000 or more? Support your discussion with financial analysis

It is likely that the desired profit will be met under both pricing conditions (see expected value in Excel, attached). The only time where Pringly will not meet its desired target is when the demand is for 150,000 in both pricing levels, however, there is a higher probability that the minimum profit will be exceeded and perhaps exceeded by a considerable margin (75% probability of meeting or exceeding). Should the company go ahead with the new product? The company should go ahead with the new product only if the demand is greater than 150,000. If they decide to go with the new product and the demand is 150, 000 or less then they will be disappointed with low sales once again. Would this type of analysis be useful to a large company with a wide range of products?

Break-even Analysis3

This method would not be useful to a company such as Wal-Mart on every particular item. The company could use this on certain commodities such as flu shots to see if they could make money by offering this type of service. This would be too much to do on every particular item and should only be used on items that companies intend to generate a certain profit from in a specified time period. ROI (return on investment) and residual income are two other methods that can helpful for this type of decisions. Could they be applied in this situation? Support your answer with financial analysis. ROI is a performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. To calculate ROI, the benefit (return) of an investment is divided by the cost of the investment; the result is expressed as a percentage or a ratio. ROI is useful (assuming fixed costs are a good proxy for investment). Residual income is also possible and just requires knowing a required rate of return (I assumed 6%). ROI is used to compare investments and would not be useful in this situation because it would not give them an accurate reading of what there break-even point would be. Residual Income is the amount of income that an individual has after all personal debts. This would definitely not be a good tool to use, because it does not measure where the breakeven point is, and would not give an accurate reading on how to go forward with the selling of a new product.

Break-even Analysis4

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sheep Fatening ProposalDocument25 pagesSheep Fatening ProposalSemir100% (2)

- Business Plan Maggah Marcus (Repaired)Document33 pagesBusiness Plan Maggah Marcus (Repaired)carol86% (29)

- Mas - Activity Cost and CVP Analysis Part 1Document6 pagesMas - Activity Cost and CVP Analysis Part 1Ma Teresa B. CerezoNo ratings yet

- Marketing Project Car WrapDocument20 pagesMarketing Project Car Wrapamad0028100% (2)

- Event Planning Business PlanDocument27 pagesEvent Planning Business PlanSwetness Ndapanda ShitengaNo ratings yet

- Calculate package price and break-even pointDocument2 pagesCalculate package price and break-even pointWeeLun LiewNo ratings yet

- Garden of EdenDocument118 pagesGarden of Edensean lee100% (2)

- AirplaneDocument4 pagesAirplaneNoble S WolfeNo ratings yet

- Pockett Company 31 Dec 2011 Balance Sheet: AssetsDocument2 pagesPockett Company 31 Dec 2011 Balance Sheet: AssetsNoble S WolfeNo ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- Ekland DivisionDocument4 pagesEkland DivisionNoble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- AbsorptionDocument2 pagesAbsorptionNoble S WolfeNo ratings yet

- Financial Statements Lester M. Legette Trident University InternationalDocument5 pagesFinancial Statements Lester M. Legette Trident University InternationalNoble S WolfeNo ratings yet

- GuitarDocument8 pagesGuitarNoble S WolfeNo ratings yet

- Absorption CostingDocument2 pagesAbsorption CostingNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- Lessons Learned From The Clinic1Document8 pagesLessons Learned From The Clinic1Noble S WolfeNo ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- World ComDocument2 pagesWorld ComNoble S WolfeNo ratings yet

- Beginning Finished Goods Goods Available For SaleDocument2 pagesBeginning Finished Goods Goods Available For SaleNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- Transfer PricingDocument4 pagesTransfer PricingNoble S WolfeNo ratings yet

- Flexible Budget Breakdown by Variable and Fixed CostsDocument1 pageFlexible Budget Breakdown by Variable and Fixed CostsNoble S WolfeNo ratings yet

- Beginning Finished Goods Goods Available For SaleDocument2 pagesBeginning Finished Goods Goods Available For SaleNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Financial Statements Lester M. Legette Trident University InternationalDocument5 pagesFinancial Statements Lester M. Legette Trident University InternationalNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- ACC501 Mod 1 Case Financial StatementsDocument12 pagesACC501 Mod 1 Case Financial StatementsNoble S WolfeNo ratings yet

- Wal-Mart Pharmacy Flexible Budget Income Statement Units of ProductionDocument1 pageWal-Mart Pharmacy Flexible Budget Income Statement Units of ProductionNoble S WolfeNo ratings yet

- Assessment 1Document4 pagesAssessment 1Noble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- Chapter-18 Business StudiesDocument3 pagesChapter-18 Business StudiesUmme AfiaNo ratings yet

- Question 1 Hatem MasriDocument5 pagesQuestion 1 Hatem Masrisurvivalofthepoly0% (1)

- Session 12 CVP AnalysisDocument52 pagesSession 12 CVP Analysismuskan mittalNo ratings yet

- Hospital-Pharmacy Management System: A UAE Case Study: A. Khelifi, D. Ahmed, R. Salem, N. AliDocument9 pagesHospital-Pharmacy Management System: A UAE Case Study: A. Khelifi, D. Ahmed, R. Salem, N. AliAounaiza AhmedNo ratings yet

- 1-Managerial AccountingDocument2 pages1-Managerial AccountingHaleem KhanNo ratings yet

- Pickles ChutneyDocument9 pagesPickles ChutneySagar DholakiyaNo ratings yet

- Buss1 June 2011 Mark SchemeDocument11 pagesBuss1 June 2011 Mark SchemeBrãñdøn DzîñgáíNo ratings yet

- Chapter - IvDocument14 pagesChapter - IvohmygodhritikNo ratings yet

- Broccoli G2 Business PlanDocument17 pagesBroccoli G2 Business PlanBình Nguyễn Vũ HảiNo ratings yet

- Operating and Financial Leverages - FinalDocument51 pagesOperating and Financial Leverages - Finalchittesh23No ratings yet

- ACCOUNTING P2 GR11 QP NOV2022 - EnglishDocument10 pagesACCOUNTING P2 GR11 QP NOV2022 - Englishora mashaNo ratings yet

- ControllingDocument6 pagesControllingsuhaib shaikhNo ratings yet

- Solution Manual For Quantitative Analysis For Management 12th Edition by RenderDocument7 pagesSolution Manual For Quantitative Analysis For Management 12th Edition by RenderMusanif musanif100% (1)

- IM SciencesDocument53 pagesIM SciencesmanahilNo ratings yet

- MA2 (100 QS)Document30 pagesMA2 (100 QS)Alina NaeemNo ratings yet

- Profile On The Production of ChipboardDocument24 pagesProfile On The Production of ChipboardTeferi100% (5)

- Break Even WorksheetDocument12 pagesBreak Even WorksheetDipti BhundiaNo ratings yet

- Key Answer Isom 351Document14 pagesKey Answer Isom 351Yijia QianNo ratings yet

- 4 MarginalCostingDocument7 pages4 MarginalCostingSoham DeNo ratings yet

- Sales Mix Impact on Profits and Inventory CostsDocument3 pagesSales Mix Impact on Profits and Inventory CostsBob KaneNo ratings yet

- Cost Benefit Analysis of Mushroom Farming in HaryanaDocument7 pagesCost Benefit Analysis of Mushroom Farming in Haryanasachinjosh1984100% (1)

- EconomicsDocument2 pagesEconomicsPradeep ChandrasekaranNo ratings yet

- Paper 2 Marking Scheme Nov 2009Document11 pagesPaper 2 Marking Scheme Nov 2009MSHNo ratings yet

- Asi Mba 162 4 Sma 140917Document6 pagesAsi Mba 162 4 Sma 140917Danah Dela RosaNo ratings yet