Professional Documents

Culture Documents

Ranbaxy C

Uploaded by

Jaswinder Singh RandhawaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ranbaxy C

Uploaded by

Jaswinder Singh RandhawaCopyright:

Available Formats

RANBAXY C.A COMPOSITION The current assets of Ranbaxy co.

From the last 5 years consists of, Inventories Sundry debtors Cash and bank This is the data which is available to us and on the basis of this we were going to analyse the company C.A. let us take them one by one. INVENTORIES Every firm has to maintain a certain level of inventory of finished goods so as to able to meet the requirements of the business. It is therefore, be advisable to dispose off inventory as soon as possible. On the other hand, too low inventory may mean loss of business opportunities. Now, as we know that it is a very important asset of the company, a co. Cannot take any risk by mismanaging it. Now, let us analse the inventories year-on-year basis. A. COMPARISON BETWEEN 1 AND 2 YEAR As we see in the balance sheet that the inventories in 2 year rosed by 191.61 crores, which left us guessing that, (a) Demand for the product has increased (b) They mismanaged their inventory stock (c) Maybe some customers return back their stocks If the increase in stock is due to the 1 reason that will be beneficial for the company, otherwise the company think it twice. B. COMPARISON BETWEEN 2 AND 3 YEAR In this period the inventories were decreased by 5.41 crores which indicates that the demand for the Ranbaxy product is decreased or might be that they were short of finances available with them as we see in the current liab. Column that it also decreased by 28 crore. C. COMPARISON BETWEEN 3 AND 4 YEAR During this period there is substantial rise in the inventories. It rose almost about 64 crore. These are the positive signs for the company as it will generates more revenue for it and also helpful in the longer version of period. D. COMPARISON BETWEEN 3 AND 4 YEAR This period is also somewhat good for the company as it inventory rose only by 22 crore. As compared to 64 crore during the same period in last year. This may be due to the appreciating rupee in that period which ultimately affects their revenues. Therefore, they decided to cut short their production by little bit.

SUNDRY DEBTORS ONE POINT OF CONCERN FOR THE COMPANY IS THAT THE DEBTORS WERE INCREASING PROPORTIONALLY MORE THAN ITS INVENTORY PRODUCTION. Here are some facts, (a) In first 4 years the inventory is less than increase in debtors which is a concerning factor for the company. (b) Also the average collection period for the company is not good as it will goes on increasing year after year. CASH AND BANK The bank balance for the company in 2,3,4 year is deteriorating as they have very less amount of cash available with themselves. In this priod, the current liabilities were much more than its cash available.

According to the data given to us and the analysis which we have done in the last page suggests us that the company current asets in first 4 years were adequate enough to pay off its current liabilities on those very year. However,in 5 year, the current assets of the company is on declining stage whereas the current liabilities on the same year were increasing, and thats not the good sign for the company. Now, with the available data we can find out the current ratio of the company for last 5 years. Years 1 2 3 4 5 current ratio 1.65 1.69 1.75 2.02 1.63

What we can interpret from the raios is that the company in the first 4 years running good but in the last years its situation is somewhat concerning but still it is good enough to meet its short term liabilities, however co. needs to take some initiative to meet its long term liabilities.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Project ReportDocument110 pagesProject ReportAlaji Bah CireNo ratings yet

- Alcor's Impending Npo FailureDocument11 pagesAlcor's Impending Npo FailureadvancedatheistNo ratings yet

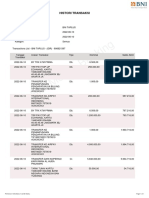

- BNI Mobile Banking: Histori TransaksiDocument1 pageBNI Mobile Banking: Histori TransaksiWebi SuprayogiNo ratings yet

- Fabozzi Ch13 BMAS 7thedDocument36 pagesFabozzi Ch13 BMAS 7thedAvinash KumarNo ratings yet

- 386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Document46 pages386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Ayush KumarNo ratings yet

- Bye, Bye Nyakatsi Concept PaperDocument6 pagesBye, Bye Nyakatsi Concept PaperRwandaEmbassyBerlinNo ratings yet

- The Making of A Global World 1Document6 pagesThe Making of A Global World 1SujitnkbpsNo ratings yet

- International Financial Management 8th Edition Eun Test BankDocument38 pagesInternational Financial Management 8th Edition Eun Test BankPatrickLawsontwygq100% (15)

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastNo ratings yet

- Module 2Document7 pagesModule 2Joris YapNo ratings yet

- Community Development Fund in ThailandDocument41 pagesCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Situatie Avize ATRDocument291 pagesSituatie Avize ATRIoan-Alexandru CiolanNo ratings yet

- Bahasa Inggris IIDocument15 pagesBahasa Inggris IIMuhammad Hasby AsshiddiqyNo ratings yet

- Environment Case Alcoa 2016Document4 pagesEnvironment Case Alcoa 2016Victor TorresNo ratings yet

- Traffic Problem in Chittagong Metropolitan CityDocument2 pagesTraffic Problem in Chittagong Metropolitan CityRahmanNo ratings yet

- Thai LawDocument18 pagesThai LawsohaibleghariNo ratings yet

- Democratic Developmental StateDocument4 pagesDemocratic Developmental StateAndres OlayaNo ratings yet

- Letter InsuranceDocument2 pagesLetter InsuranceNicco AcaylarNo ratings yet

- Clerks 2013Document12 pagesClerks 2013Kumar KumarNo ratings yet

- Correlations in Forex Pairs SHEET by - YouthFXRisingDocument2 pagesCorrelations in Forex Pairs SHEET by - YouthFXRisingprathamgamer147No ratings yet

- Monsoon 2023 Registration NoticeDocument2 pagesMonsoon 2023 Registration NoticeAbhinav AbhiNo ratings yet

- SKS Microfinance CompanyDocument7 pagesSKS Microfinance CompanyMonisha KMNo ratings yet

- Factors Affecting SME'sDocument63 pagesFactors Affecting SME'sMubeen Shaikh50% (2)

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocument5 pagesMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuNo ratings yet

- JK Fenner (India) LimitedDocument55 pagesJK Fenner (India) LimitedvenothNo ratings yet

- What Is Zoning?Document6 pagesWhat Is Zoning?M-NCPPCNo ratings yet

- Ethical Game MonetizationDocument4 pagesEthical Game MonetizationCasandra EdwardsNo ratings yet

- GL July KoreksiDocument115 pagesGL July KoreksihartiniNo ratings yet

- Table 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDocument11 pagesTable 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDeepak SharmaNo ratings yet

- Buku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiaDocument17 pagesBuku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiadianNo ratings yet