Professional Documents

Culture Documents

Bns Auto

Uploaded by

surapong2005Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bns Auto

Uploaded by

surapong2005Copyright:

Available Formats

Global Economics

June 27, 2013

Global Auto Report

Carlos Gomes (416) 866-4735 carlos.gomes@scotiabank.com

Crossover Utility Vehicles: The Growth Leader In China & The World However, Canadian Assembly Plants Are Not Benefitting

lobal vehicle sales continued to move higher in May, but the pace of growth moderated to 3.5% y/y from an average of 5% during the previous four months. Slower sales gains reflect a recent softening in purchases in Eastern Europe especially Russia and India, as well as ongoing declines in the euro zone. Outside of these regions, activity remains strong led by doubledigit gains in South America particularly Brazil and China. However, the pace of growth in Brazil is likely to moderate in coming months, constrained by the 75 basis point increase in interest rates since late last year and high inflation. Auto loan rates in Brazil have climbed by more than a percentage point since March and now exceed 20%.

1.4

Chinese Consumers Outperform

ratio millions of units, annualized

17.0 16.0

1.3

Retail Sales/Industrial Production

15.0 14.0

1.2

Car & Utility Sales

13.0 12.0 11.0 10.0 2013

1.1

1.0 Canadian passenger vehicle sales have averaged an incentive2010 2011 2012 induced seasonally adjusted annual rate of 1.75 million units in Jan-May of each year. April and May, well above our previous full-year forecast. As a result, we are increasing our 2013 Canadian passenger vehicle sales forecast to a record 1.72 million units, from 1.69 million. This assumes that despite the recent sharp backup in bond yields since Federal Reserve Chairman Ben Bernanke indicated that the U.S. central bank will likely begin to reduce liquidity later this year, automakers will maintain current incentives through the end of 2013.

DOUBLE-DIGIT SALES GAINS IN CHINA China has become the worlds largest auto market, accounting for one-quarter of global vehicle sales (cars and trucks) and production. As a result, it is crucial to have a good handle on economic developments in China a task made much harder by limited data availability, as well as concerns over data quality. However, in China, as in other markets, employment and income trends, as well as credit availability are the key drivers of industry volumes. Deciphering developments in China is particularly important at the moment because some economic surveys point to a loss of momentum in the Chinese economy in recent months. We believe that much of the moderation in economic activity reflects weaker investment spending and slow export growth. In contrast, vehicle sales gains bottomed last summer and have accelerated to a double-digit increase so far this year. Vehicle output has also gained momentum and automakers continue to expand and build new assembly plants in China. In particular, a North American automaker recently completed a 300,000-unit facility in China, while another just broke ground on a new 160,000-unit plant, which is scheduled to start producing vehicles in 2015. To highlight the shift from investment-led growth towards increased reliance on household spending, we divide retail sales growth by the increase in industrial production, which has slowed to 9% so far this year from 10.3% at the end of 2012. In contrast, retail sales have continued to expand in excess of 12% y/y, leading to an increase in the ratio of retail sales to industrial production to 1.36 so far this year, from 1.32 in 2012 and only 1.10 three years ago (see chart above). Scotiabank Economics

Scotia Plaza 40 King Street West, 63rd Floor Toronto, Ontario Canada M5H 1H1 Tel: (416) 866-6253 Fax: (416) 866-2829 Email: scotia.economics@scotiabank.com

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor its affiliates accepts any liability whatsoever for any loss arising from any use of this report or its contents.

TM

Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Global Auto Report is available on: www.scotiabank.com, Bloomberg at SCOT and Reuters at SM1C

Global Economics

June 27, 2013

Global Auto Report

We continue to expect a 10% increase in vehicle sales in China this year as employment growth and urban income growth show no sign of abating. Employment in China is advancing 5% year-over-year triple the pace of job creation in North America and urban incomes continue to post double-digit gains. In addition, demand will be buoyed by the launch of new models in China. According to the China Passenger Car Association, more than 50 models were introduced during the first quarter, and a raft of new models will be launched through the remainder of the year. CROSSOVER UTILITIES LEAD THE WAY The auto market in China and the rest of the world is undergoing significant changes, especially the escalating popularity of crossover utility vehicles (CUVs). According to data from IHS Automotive, global sales of CUVs surged by more than 35% between 2007 and 2012 and exceed 13 million per annum 18% of the global auto market. This rising popularity of SUVs and CUVs first emerged several decades ago in North America with these models accounting for at least 20% of the U.S. market since the new millennium. These vehicles now garner one-third of the Canadian and U.S. market, but the trend has recently become a global phenomenon. In particular, IHS indicates that CUV sales in China have been posting explosive growth in recent years, including a 20% surge in 2012 triple the increase in car sales to 2.5 million units. Estimates suggest that these models will account for one-quarter of the passenger vehicle market in China by 2020, as consumers are increasingly attracted to the practicality and fuel economy of these all-wheel-drive vehicles. As a result, we expanded our collection of sales data for China beyond just cars to also include crossover utility vehicles from 2005 onward. This change increases Chinas 2012 sales in the table below to 13.18 million units from 10.68 million previously. In India, this segment is still small by global standards, with sales of 360,000 units last year 15% of the market. However, estimates suggest that volumes could exceed 1 million units by the end of the decade, enabling India to become the third largest CUV market in the world behind the United States and China. Even in Europe, where car sales have slumped to 20-year lows, estimates suggest that utility vehicles have made progress, and are only the segment with sales gains since 2005. (However, since we have not been able to collect good data on utility vehicles for India or Europe, we will continue to track only car sales in both regions for the time being.) Canada would seem to be well positioned to be a significant beneficiary of the rising popularity of crossover utility vehicles. These models account for 40% of Canadian vehicle production and their share will increase further as Toyota continues to ramp up RAV4 output in Woodstock. However, the reality is that, with the exception of the Ford Edge assembled in Oakville, almost all of the crossovers produced in Canada remain in North America either in Canada or exported to the United States. Instead, most automakers are opting to build new plants to assemble these popular models in the jurisdiction where these vehicles are sold, and are not considering Canada the premier CUV manufacturing nation in North America as an export base from which to ship these vehicles overseas. As result, Canadian CUV production is flat so far this year, while demand for these products has soared in excess of 20% y/y through May.

International Car Sales Outlook

1990-99 2000-09 2010 (millions of units) 58.58 13.96 1.56 11.55 0.85 12.98 2.92 3.14 1.91 24.23 11.17 1.87 4.27 2.69 2011 2012 2013f

TOTAL SALES North America* Canada United States Mexico Western Europe Germany Eastern Europe Russia Asia China ** India South America Brazil

39.20 16.36 1.27 14.55 0.54 13.11 3.57 1.18 0.78 6.91 0.43 0.31 1.64 0.94

49.93 18.38 1.59 15.79 1.00 14.39 3.33 2.71 1.53 11.93 3.85 0.89 2.52 1.57

60.80 15.22 1.59 12.73 0.90 12.80 3.17 3.90 2.65 24.41 12.16 1.95 4.47 2.64

64.94 17.07 1.68 14.40 0.99 11.76 3.08 4.14 2.93 27.25 13.18 2.02 4.72 2.84

67.19 18.26 1.72 15.50 1.04 11.17 2.96 4.01 2.83 28.59 14.53 1.81 5.16 3.12

*Includes light trucks.** Includes crossover utility vehicles from 2005.

Global Economics

June 27, 2013

Global Auto Report

Canada/U.S. Motor Vehicle Sales Outlook

1991-05 Average 2006-10 2011 2012 2013 Jan-Apr ** Annual f 1,693 750 482 286 268 943 15.2 7.5 7.7 1,720 760 490 290 270 960 15.5 7.6 7.9

CANADA Cars Domestic Transplants Imports Light Trucks UNITED STATES Cars Light Trucks NORTH AMERICAN PRODUCTION* CANADA UNITED STATES MEXICO

(thousands of units, annualized) 1,398 1,586 797 815 583 500 178 270 214 315 601 771 (millions of units, annualized) 15.5 13.5 8.3 6.7 7.2 6.8 (millions of units, annualized) 15.58 2.50 11.67 1.41 13.03 2.16 8.83 2.04

1,589 691 433 257 258 898 12.7 6.1 6.6

1,677 760 470 280 290 917 14.4 7.2 7.2

13.11 2.13 8.64 2.34

15.77 2.46 10.30 3.01

16.25 2.31 11.02 2.92

16.60 2.50 10.90 3.20

*Inc ludes transplants; light, medium and heavy truc ks. **U.S. sales and North Americ an produc tion to May. Canadian sales are Sc otiabank estimates.

Vehicle Sales Outlook By Province*

(thousands of units, annual rates) 1994-05 Average CANADA ATLANTIC CENTRAL Quebec Ontario WEST Manitoba Saskatchewan Alberta British Columbia 1,446 102 936 366 570 408 42 36 166 164 2006-10 2011 2012 2013 Jan-Apr * Annual f 1,693 126 1,026 408 618 541 54 59 258 170 1,720 128 1,049 417 632 543 55 58 255 175

1,586 118 985 408 577 483 44 44 220 175

1,589 119 997 408 589 473 47 50 218 158

1,677 126 1,034 416 618 517 50 55 239 173

*Includes cars and light trucks.* Scotiabank estimates.

800 700 800 700

300 275 300 275 70 70

thousands of units

thousands of units

thousands of units

Ontario

600 500 400 300 200 600 500

250 225 200 175 150

Alberta

250 225

60

Manitoba

60

British Columbia

200 175 150 125 100

50

50

40

40

Quebec

400 300 200

125 100 75

30

30

Atlantic

80 84 88 92 96 00 04 08 12

75 50 20 80 84 88 92

Saskatchewan

96 00 04 08 12 20

80

84

88

92

96

00

04

08

12

50

Includes cars and trucks (light, medium and heavy). Shaded bars indicate U.S. recession periods.

Global Economics

June 27, 2013

Global Auto Report

Auto Market Share By Manufacturer Canada*

(thousands of units, not seasonally adjusted) 2012 Jan to May Units % of Total TOTAL Big Three General Motors Ford Chrysler Japanese Honda Toyota Nissan Mazda Mitsubishi Subaru Hyundai Volkswagen Kia BMW Mercedes-Benz Other 321.1 80.4 31.0 29.2 20.2 132.9 33.4 45.7 19.8 22.9 3.4 6.3 42.2 20.0 22.7 7.9 7.8 7.2 100.0 25.0 9.6 9.1 6.3 41.4 10.4 14.2 6.2 7.1 1.1 2.0 13.2 6.2 7.1 2.5 2.4 2.2 2013 Jan to May Units % of Total 315.6 84.0 31.7 28.8 23.5 126.9 35.8 42.3 16.5 22.6 3.8 5.2 40.6 22.3 20.3 8.0 7.0 6.5 100.0 26.6 10.0 9.1 7.5 40.2 11.3 13.4 5.2 7.2 1.2 1.6 12.9 7.1 6.4 2.5 2.2 2.1 2012 May Units % of Total 84.0 23.4 7.9 9.8 5.7 32.7 8.0 11.6 5.1 5.4 0.9 1.4 10.6 5.3 6.4 2.0 2.0 1.6 100.0 27.9 9.5 11.7 6.7 38.9 9.5 13.8 6.0 6.5 1.1 1.7 12.6 6.3 7.6 2.4 2.4 1.9 2013 May Units % of Total 86.0 24.2 8.2 9.0 7.0 34.1 9.6 12.9 4.0 5.0 1.1 1.4 11.1 5.4 5.7 2.0 1.8 1.7 100.0 28.2 9.6 10.4 8.2 39.6 11.2 15.0 4.6 5.8 1.3 1.6 12.9 6.3 6.7 2.3 2.0 2.0

*Source: Dealer sales from the Association of International Automobile Manufacturers of Canada.

Truck Market Share By Manufacturer Canada*

(thousands of units, not seasonally adjusted) 2012 Jan to May Units % of Total TOTAL Big Three General Motors Ford Chrysler Other Domestic Japanese Honda Toyota Nissan Mazda Mitsubishi Subaru Hyundai Kia Other Imports LIGHT TRUCKS 390.8 232.2 63.3 82.5 86.4 17.9 89.5 24.9 33.2 17.4 7.5 4.8 5.8 15.6 8.8 26.8 374.9 100.0 59.4 16.2 21.1 22.1 4.6 22.9 6.4 8.5 4.5 1.9 1.2 1.5 4.0 2.3 6.8 95.9 2013 Jan to May Units % of Total 413.1 242.5 65.0 88.0 89.5 19.7 98.2 25.8 36.6 18.6 7.7 5.4 8.8 16.6 8.6 27.5 398.3 100.0 58.7 15.7 21.3 21.7 4.8 23.8 6.3 8.9 4.5 1.9 1.3 2.1 4.0 2.1 6.6 96.4 2012 May Units % ot Total 95.4 58.4 15.3 22.5 20.6 3.9 21.2 5.7 8.2 4.1 1.7 1.0 1.4 3.7 2.0 6.2 91.9 100.0 61.3 16.1 23.6 21.6 4.0 22.2 6.0 8.6 4.3 1.7 1.0 1.4 3.8 2.2 6.5 96.4 2013 May Units % of Total 104.4 61.1 15.4 23.5 22.2 5.6 25.2 7.1 9.4 4.4 1.9 1.1 2.2 4.5 1.8 6.2 100.6 100.0 58.6 14.8 22.5 21.3 5.4 24.1 6.8 9.0 4.2 1.8 1.0 2.1 4.3 1.7 5.9 96.3

*Source: Dealer sales from the Association of International Automobile Manufacturers of Canada.

Global Economics

June 27, 2013

Global Auto Report

Auto Sales By Province

(thousands of units, not seasonally adjusted) 2012 Jan to Apr CANADA ATLANTIC Newfoundland Nova Scotia New Brunswick Prince Edward Island CENTRAL Quebec Ontario WEST Manitoba Saskatchewan Alberta British Columbia 236.9 18.9 4.2 8.0 5.8 0.9 168.0 75.7 92.3 50.0 5.0 3.9 18.4 22.7 2013 Jan to Apr 230.8 19.4 4.4 8.1 5.8 1.1 160.7 72.5 88.2 50.7 5.4 3.7 18.9 22.7 2012 Apr 76.4 6.7 1.5 2.8 2.1 0.3 54.6 25.3 29.3 15.1 1.6 1.2 5.3 7.0 2013 Apr 77.1 7.1 1.7 3.0 2.0 0.4 53.9 25.0 28.9 16.1 1.9 1.3 6.0 6.9

Truck Sales By Province*

(thousands of units, not seasonally adjusted) 2012 Jan to Apr CANADA ATLANTIC Newfoundland Nova Scotia New Brunswick Prince Edward Island CENTRAL Quebec Ontario WEST Manitoba Saskatchewan Alberta British Columbia

*Light, medium and heavy trucks.

2013 Jan to Apr 308.1 21.6 6.1 7.6 6.9 1.0 164.6 58.9 105.7 121.9 11.5 14.0 62.2 34.2

2012 Apr 85.0 6.1 1.8 2.1 1.9 0.3 48.3 17.4 30.9 30.6 3.2 3.5 15.4 8.5

2013 Apr 98.0 7.2 2.0 2.5 2.3 0.4 54.2 19.9 34.3 36.6 3.8 4.5 18.6 9.7

296.5 20.6 5.7 7.3 6.6 1.0 163.5 58.5 105.0 112.4 10.8 13.0 57.1 31.5

Global Economics

June 27, 2013

Global Auto Report

Canadian Motor Vehicle Production* (thousands of units, not seasonally adjusted)

2012 Jan to May TOTAL CAR Chrysler GM Honda Toyota TRUCKS** Chrysler Ford GM Honda Toyota Others 1,072.1 459.3 102.3 135.2 108.4 113.4 612.8 146.7 105.5 163.9 72.4 119.6 4.7 2013 Jan to May 996.4 410.3 104.6 121.6 101.9 82.2 586.1 126.7 110.9 146.4 79.0 119.4 3.7 2012 May 225.9 92.6 22.3 28.5 18.7 23.1 133.3 34.3 23.7 31.2 18.7 24.5 0.9 2013 May 208.7 84.4 23.1 20.0 19.1 22.2 124.3 28.9 22.5 28.5 16.2 27.4 0.8

*Production data from Wards Automotive Reports. **Light, medium and heavy trucks.

Canada Motor Vehicle Production

3.4

quarterly

3.4

50

Canada World Auto Trade Balances

billions of dollars

50

3.0 Total 2.6

3.0

40 Assembled vehicles

40

2.6

30

30

2.2

2.2

20 Total 10

20

1.8 Cars 1.4

1.8

10

1.4

1.0 Trucks* 0.6

1.0

-10 Parts

-10

0.6

-20

-20

0.2

82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 Millions of units, seasonally adjusted annual rates. * Light, medium and heavy trucks.

0.2

-30

82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 2013 data are January-April annualized.

-30

Global Economics

June 27, 2013

Global Auto Report

New & Used Car Prices

Scotiabank Car Price Indicators Canada

25 year-over-year per cent change 25

Used*

15

New

15

CPI

-5 -5

-15

79 80

82

84

86

88

90

92

94

96

98

00

02

04

06

08

10

12

-15

* Scotiabank estimate from Canadian Black Book data.

20 18 16 14 12 10 8 6 4 2

Scotiabank Car Price Indicators Canada

thousands of dollars by age of car, seasonally adjusted

20 18 16 14

1 Year 2 Year 4 Year

12 10 8 6 4 96 98 00 02 04 06 08 10 12 13 2

79 80

82

84

86

88

90

92

94

Scotiabank estimate from Canadian Black Book data.

Scotiabank Car Price Indicators United States

25 year-over-year per cent change 25

15

Used

15

CPI New

-5

-5

-15

79 80

82

84

86

88

90

92

94

96

98

00

02

04

06

08

10

12

-15

Consumer price indices for new and used cars. Shaded areas indicate recession periods.

Global Economics

June 27, 2013

Global Auto Report

Canadian Corporate Financial Performance Motor Vehicle Dealers and Repair Shops

Net Income After Tax ($ mil) 400 521 773 594 571 799 942 1089 1142 1392 1649 1702 2149 2268 2596 1688 2044 1632 738 -68 Pre-Tax Profit Margin (%) 0.75 0.75 1.02 0.91 0.69 0.93 1.20 1.41 1.43 1.84 2.06 2.04 2.41 2.65 2.77 1.88 2.35 1.93 1.19 0.10 Inventory Turnover Ratio 6.79 7.06 7.48 5.30 4.98 5.35 5.16 5.05 5.04 5.34 4.91 5.16 4.87 4.50 4.95 5.05 4.99 4.41 6.15 4.38 Interest Coverage Ratio 2.10 2.13 3.09 2.65 2.25 2.55 2.64 3.36 3.51 4.85 5.34 5.14 5.60 5.81 6.74 4.60 5.32 4.71 2.92 1.10 Debt/ Equity Ratio 2.02 1.98 2.04 2.91 3.17 2.74 2.75 2.56 2.44 2.07 2.11 1.92 1.78 1.92 1.88 1.69 1.64 1.68 2.37 3.57 Return on Shareholders Equity (%) 6.46 8.37 11.28 10.14 10.49 12.90 14.37 15.13 14.66 16.99 18.09 17.01 18.81 21.03 23.37 14.43 16.87 13.13 11.08 -1.20

Annual

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Quarterly at annual rates 2012Q1 Q2 Q3 Q4 2013Q1 Average (89-12) Low (89-12)

Definition of Ratios: Pre-tax Profit Margin: pre-tax income/sales Inventory Turnover Ratio: sales/inventory

Interest Coverage Ratio: (pre-tax income and interest payments)/(interest payments) Debt/Equity Ratio: (short-term and long-term debt)/total equity Return of Shareholders Equity: after-tax income/total equity

Retail Auto Dealer Bankruptcies

10

number of bankruptcies

10

2013 2012

2011

Jan.

Feb.

Mar.

Apr.

May

June

July

Aug.

Sept.

Oct.

Nov.

Dec.

New car dealers only; cumulative total during the year.

You might also like

- From the Cradle to the Craze: China's Indigenous Automobile IndustryFrom EverandFrom the Cradle to the Craze: China's Indigenous Automobile IndustryNo ratings yet

- Car Distribution World Summary: Market Values & Financials by CountryFrom EverandCar Distribution World Summary: Market Values & Financials by CountryNo ratings yet

- McKinsey Perspective On Chinas Auto Market in 2020 PDFDocument16 pagesMcKinsey Perspective On Chinas Auto Market in 2020 PDFMiguel Castell100% (1)

- Evmpay ReportDocument18 pagesEvmpay ReportphilsonmanamelNo ratings yet

- Auto Sector Monitor 2016 Q2 IssueDocument21 pagesAuto Sector Monitor 2016 Q2 IssueRohith SampathiNo ratings yet

- Credit Rating of Tata MotorsDocument11 pagesCredit Rating of Tata MotorsSharonNo ratings yet

- IB WorldDocument2 pagesIB Worldshobhit tripathiNo ratings yet

- Auto Industy Demand AnalysisDocument8 pagesAuto Industy Demand Analysisppc1110No ratings yet

- Global Auto Report 2009Document8 pagesGlobal Auto Report 2009orszag_idaNo ratings yet

- IB (Global Presence)Document4 pagesIB (Global Presence)Aditya MishraNo ratings yet

- Industry Analysis and Auto Demand - Part 2Document29 pagesIndustry Analysis and Auto Demand - Part 2HYUN JUNG KIMNo ratings yet

- Continued Growth in China For US AutomakersDocument7 pagesContinued Growth in China For US AutomakersMike HarmonNo ratings yet

- The Rise of China's Auto Industry and Its Impact On The U.S. Motor Vehicle IndustryDocument29 pagesThe Rise of China's Auto Industry and Its Impact On The U.S. Motor Vehicle IndustryJa DabNo ratings yet

- 2016 Auto Industry TrendsDocument7 pages2016 Auto Industry TrendsSasha KingNo ratings yet

- Industry: Key Points Supply DemandDocument4 pagesIndustry: Key Points Supply DemandHarsh AgarwalNo ratings yet

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaNo ratings yet

- India's Growing Automobile IndustryDocument79 pagesIndia's Growing Automobile Industry2014rajpoint0% (1)

- Analysis of Automobile IndustryDocument9 pagesAnalysis of Automobile IndustryNikhil Kakkar100% (1)

- Economics 1Document5 pagesEconomics 1Mansi SainiNo ratings yet

- Chapter-1 Introduction To Automobile IndustoryDocument64 pagesChapter-1 Introduction To Automobile IndustoryOMSAINATH MPONLINE100% (1)

- Auto Industry AnalysisDocument2 pagesAuto Industry AnalysismihirdoshiNo ratings yet

- Fundamental Analysis of Eicher Motors (AutoRecovered)Document12 pagesFundamental Analysis of Eicher Motors (AutoRecovered)pixix68281No ratings yet

- A Study On Customers Satisfaction Towards Selected Marketing Mix of Shubh Honda Raipur CGDocument51 pagesA Study On Customers Satisfaction Towards Selected Marketing Mix of Shubh Honda Raipur CGjassi7nishadNo ratings yet

- Project On HondaDocument41 pagesProject On HondasrisathyasaminathanNo ratings yet

- OneMBA21Global Marketing Local Report - China V1Document19 pagesOneMBA21Global Marketing Local Report - China V1Anthony MuchiriNo ratings yet

- Focus On Emerging Truck MarketsDocument37 pagesFocus On Emerging Truck MarketsVibha SinghNo ratings yet

- Vegi Sree Vijetha (1226113156)Document6 pagesVegi Sree Vijetha (1226113156)Pradeep ChintadaNo ratings yet

- Industry Profile: Automobile Industry at Global LevelDocument21 pagesIndustry Profile: Automobile Industry at Global LevelTanzim VankaniNo ratings yet

- Indonesia Automotive Industry Outlook 2020Document31 pagesIndonesia Automotive Industry Outlook 2020Dallie Kurniawan100% (1)

- Hero MotorsDocument28 pagesHero MotorsNaveen KNo ratings yet

- Emerging Auto Markets Surpass Mature in Global SalesDocument2 pagesEmerging Auto Markets Surpass Mature in Global SalestomccNo ratings yet

- Customer's Satisfaction of Honda Two WheelersDocument58 pagesCustomer's Satisfaction of Honda Two WheelersKrishna Murthy A58% (12)

- 2022results_presentation_script_259_eDocument26 pages2022results_presentation_script_259_eMark Angelo M. BubanNo ratings yet

- Micro CSQ Practice For 15 AugDocument3 pagesMicro CSQ Practice For 15 Aug21hsmilesNo ratings yet

- Hyundai RegionalDocument43 pagesHyundai Regionalhariom sharmaNo ratings yet

- Customer Satisfaction Hyundai MotorsDocument72 pagesCustomer Satisfaction Hyundai MotorshariharaNo ratings yet

- Retail sector of automobile industry sees 8% YoY decline in March 2019Document10 pagesRetail sector of automobile industry sees 8% YoY decline in March 2019Aadhavan ParthipanNo ratings yet

- Background of The StudyDocument5 pagesBackground of The StudyRuthshe Sibayan Dela CruzNo ratings yet

- Automotive Marketing Online: Negotiating The Curves by EmarketerDocument19 pagesAutomotive Marketing Online: Negotiating The Curves by EmarketerRalph PagliaNo ratings yet

- Global Market Opportunity AnalysisDocument31 pagesGlobal Market Opportunity Analysisapi-295057707No ratings yet

- Final ProjectDocument64 pagesFinal ProjectAneesh Chorode0% (2)

- Indian Auto IndustryDocument55 pagesIndian Auto IndustrySk Rabiul IslamNo ratings yet

- RBC Motor WeeklyDocument11 pagesRBC Motor WeeklyJean Paul BésNo ratings yet

- Exercise of Reading UnderstandingDocument5 pagesExercise of Reading UnderstandingMARY DIAZNo ratings yet

- General Motors Internal Initiation (Buy-Side) ReportDocument62 pagesGeneral Motors Internal Initiation (Buy-Side) ReportZee Maqsood100% (1)

- Automobile Industry in India: Emerging Conflicts Between Scale and Scope Satyaki RoyDocument22 pagesAutomobile Industry in India: Emerging Conflicts Between Scale and Scope Satyaki RoyRamesh GowdaNo ratings yet

- Honda Marketing AssignmentDocument12 pagesHonda Marketing AssignmentYashasvi ParsaiNo ratings yet

- AT Auto Industry: The Industry's Also Resilient - Empirics and 2008 Crisis ProveDocument2 pagesAT Auto Industry: The Industry's Also Resilient - Empirics and 2008 Crisis ProveaesopwNo ratings yet

- DongFeng MotorsDocument21 pagesDongFeng MotorsSamia Minhas100% (2)

- Automobile IndustryDocument6 pagesAutomobile IndustrypriyaNo ratings yet

- Changes in The Marketing Strategies of Automobile Sector Due To RecessionDocument102 pagesChanges in The Marketing Strategies of Automobile Sector Due To RecessionVivek SinghNo ratings yet

- Analysis Report of Indian AutoDocument2 pagesAnalysis Report of Indian AutoShital PatilNo ratings yet

- Auto Component Sector Report: Driving Out of Uncertain TimesDocument24 pagesAuto Component Sector Report: Driving Out of Uncertain TimesAshwani PasrichaNo ratings yet

- 4 Key Points Financial Year '10 Prospects Sector Do's and Dont'sDocument3 pages4 Key Points Financial Year '10 Prospects Sector Do's and Dont'sBhushan KasarNo ratings yet

- About CompanyDocument13 pagesAbout CompanyDivya ChokNo ratings yet

- Forecast - 2009 04 02Document6 pagesForecast - 2009 04 02Víctor De Buen RemiroNo ratings yet

- Porter 5 and PestDocument16 pagesPorter 5 and Pestvaibhav chaurasiaNo ratings yet

- Customer S Satisfaction of Honda Two WheelersDocument58 pagesCustomer S Satisfaction of Honda Two WheelersAbhinash KanigelpulaNo ratings yet

- Industry Analysis On Heavy Motor Vehicles On Tata MotorsDocument65 pagesIndustry Analysis On Heavy Motor Vehicles On Tata MotorsChandan Srivastava100% (1)

- A Report On Indian Automobile IndustryDocument33 pagesA Report On Indian Automobile IndustryUniq Manju100% (1)

- Patents and Clean Energy - Bridging The Gap Between Evident and PolicyDocument50 pagesPatents and Clean Energy - Bridging The Gap Between Evident and Policysurapong2005No ratings yet

- DG TecnologiesDocument63 pagesDG Tecnologiessurapong2005No ratings yet

- โครงการศึกษาศักยภาพการผลิตและการใช้ระบบทำความเย็นด้วยพลังงานแสงอาทิตย์Document269 pagesโครงการศึกษาศักยภาพการผลิตและการใช้ระบบทำความเย็นด้วยพลังงานแสงอาทิตย์Artit BoonkoomNo ratings yet

- Know Your Power 2012 - 81334819606 - FileDocument16 pagesKnow Your Power 2012 - 81334819606 - Filesurapong2005No ratings yet

- Policies For Renewable HeatDocument50 pagesPolicies For Renewable Heatsurapong2005No ratings yet

- (2013) EIA Annual Energy Outlook 2013 - 0383 (2013)Document244 pages(2013) EIA Annual Energy Outlook 2013 - 0383 (2013)surapong2005No ratings yet

- ENERGY 2020 A Strategy For Competitive, Sustainable and Secure Energy.Document28 pagesENERGY 2020 A Strategy For Competitive, Sustainable and Secure Energy.EKAI CenterNo ratings yet

- Overview of Liquid Biofuel Technologies (07ren18)Document29 pagesOverview of Liquid Biofuel Technologies (07ren18)surapong2005No ratings yet

- โครงการศึกษาศักยภาพการผลิตและการใช้ระบบทำความเย็นด้วยพลังงานแสงอาทิตย์Document269 pagesโครงการศึกษาศักยภาพการผลิตและการใช้ระบบทำความเย็นด้วยพลังงานแสงอาทิตย์Artit BoonkoomNo ratings yet

- Woody Biomass For Biofuels (79013)Document22 pagesWoody Biomass For Biofuels (79013)surapong2005No ratings yet

- World Oil Transit Chokepoints (World-Oil-Chokepoints)Document10 pagesWorld Oil Transit Chokepoints (World-Oil-Chokepoints)surapong2005No ratings yet

- Emerging and Future Bioenergy Technologiesris-R-1430s18 - 22Document5 pagesEmerging and Future Bioenergy Technologiesris-R-1430s18 - 22surapong2005No ratings yet

- (2013) Renewables 2013 - Global Futures ReportDocument76 pages(2013) Renewables 2013 - Global Futures Reportsurapong2005No ratings yet

- Lignin ApplicationsDocument17 pagesLignin Applicationssurapong2005100% (1)

- Ch04 IngredientsDocument46 pagesCh04 Ingredientssurapong2005No ratings yet

- Ch04 IngredientsDocument46 pagesCh04 Ingredientssurapong2005No ratings yet

- Feed-In Tariff Policy (45549)Document23 pagesFeed-In Tariff Policy (45549)surapong2005No ratings yet

- Ch12 Basic Syrups Creams and SaucesDocument18 pagesCh12 Basic Syrups Creams and Saucessurapong2005No ratings yet

- Quick BreadsDocument29 pagesQuick Breadssurapong2005No ratings yet

- Biofuels - Opportunities and Risk For Developing Countries - Strategiepapier315!14!2011Document19 pagesBiofuels - Opportunities and Risk For Developing Countries - Strategiepapier315!14!2011surapong2005No ratings yet

- Ch12 Basic Syrups Creams and SaucesDocument18 pagesCh12 Basic Syrups Creams and Saucessurapong2005No ratings yet

- The Essential Guide To BakingDocument57 pagesThe Essential Guide To BakinghymerchmidtNo ratings yet

- The World of Wheat ScienceDocument26 pagesThe World of Wheat Sciencesurapong2005No ratings yet

- The Essential Guide To BakingDocument57 pagesThe Essential Guide To BakinghymerchmidtNo ratings yet

- Rich Doughs - Danish and CoissantsDocument10 pagesRich Doughs - Danish and Coissantssurapong2005No ratings yet

- The World of Wheat ScienceDocument26 pagesThe World of Wheat Sciencesurapong2005No ratings yet

- Ch12 Basic Syrups Creams and SaucesDocument18 pagesCh12 Basic Syrups Creams and Saucessurapong2005No ratings yet

- Ch04 IngredientsDocument46 pagesCh04 Ingredientssurapong2005No ratings yet

- Alternative Energy Scenarios For CO Emission Simulation: Sascha SamadiDocument50 pagesAlternative Energy Scenarios For CO Emission Simulation: Sascha Samadisurapong2005No ratings yet

- Explanation of The Fairness and Reasonableness of HEVC Advance RatesDocument48 pagesExplanation of The Fairness and Reasonableness of HEVC Advance RatesabdNo ratings yet

- Tk09 Report AssignmentDocument97 pagesTk09 Report AssignmentJessille silvNo ratings yet

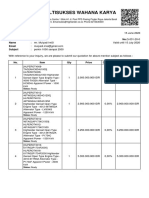

- Pt. Multisukses Wahana Karya: To No.Q-031-20-0 Name Email SubjectDocument2 pagesPt. Multisukses Wahana Karya: To No.Q-031-20-0 Name Email SubjectPrana HartadiNo ratings yet

- bsp1703 Project Sample - CompressDocument8 pagesbsp1703 Project Sample - CompressYorinNo ratings yet

- Amritsar Bus Terminal PPP ProjectDocument26 pagesAmritsar Bus Terminal PPP Projectsantu130% (1)

- Materi Kuliah Analisis Lingkungan Usaha - MikroDocument21 pagesMateri Kuliah Analisis Lingkungan Usaha - Mikrolavv khyuuNo ratings yet

- Berkshire Hathaway Annual MeetingDocument18 pagesBerkshire Hathaway Annual Meetingbenclaremon100% (8)

- Tutorial 3 SolutionDocument5 pagesTutorial 3 SolutionMinhNo ratings yet

- Ss - Maf551 Feb 22Document7 pagesSs - Maf551 Feb 22izwanNo ratings yet

- Macroeconomics 21st Edition Mcconnell Solutions ManualDocument19 pagesMacroeconomics 21st Edition Mcconnell Solutions Manualmouldywolves086ez100% (27)

- Ticket Shah PDFDocument2 pagesTicket Shah PDFAnisNo ratings yet

- BanksDocument5 pagesBanksapi-3838342No ratings yet

- Ebook 3 Trading Secrets Learn To Pick em Like Wall Street LegendsDocument34 pagesEbook 3 Trading Secrets Learn To Pick em Like Wall Street LegendsSujitKGoudarNo ratings yet

- Greeks: SensitivitiesDocument10 pagesGreeks: SensitivitiesTafadzwa bee MasumbukoNo ratings yet

- FINACC Chapter10Solutions (MultipComp)Document3 pagesFINACC Chapter10Solutions (MultipComp)Ems DelRosarioNo ratings yet

- Economisc 2Document11 pagesEconomisc 2Suneel Kumar PatelNo ratings yet

- Finmar Final Quiz Answer KeysDocument15 pagesFinmar Final Quiz Answer KeysGailee VinNo ratings yet

- Ballou 01Document27 pagesBallou 01Student_BUNo ratings yet

- Queen Toys trial balance September 2017Document1 pageQueen Toys trial balance September 2017Arum AnnisaNo ratings yet

- NEGOTIATIONSDocument7 pagesNEGOTIATIONSMohamed SabriNo ratings yet

- Top Down Pricing Template: Notes Your Costing Example (Unit Cost) Estimated Mark-Ups or Unit RatesDocument2 pagesTop Down Pricing Template: Notes Your Costing Example (Unit Cost) Estimated Mark-Ups or Unit RatesshashanksaranNo ratings yet

- UK Money Creation GuideDocument2 pagesUK Money Creation Guidematts292003574No ratings yet

- Transportation Management Final Class 01.14Document18 pagesTransportation Management Final Class 01.14ElmerNo ratings yet

- Sequoia Founders All HandsDocument52 pagesSequoia Founders All HandsJustinNo ratings yet

- CBB Lect 1Document41 pagesCBB Lect 1Navneet GillNo ratings yet

- 2014 SP CHSLDocument20 pages2014 SP CHSLRaghu RamNo ratings yet

- Egg Drop Challenge - 2018Document6 pagesEgg Drop Challenge - 2018api-310503032No ratings yet

- 4 93-F Y B A - Micro-EconomicsDocument3 pages4 93-F Y B A - Micro-EconomicsSanjdsgNo ratings yet

- Prefits and Gains-7Document52 pagesPrefits and Gains-7s4sahithNo ratings yet

- Annual Report 2009 10 EnglishDocument106 pagesAnnual Report 2009 10 Englishrabi_shah_2No ratings yet