Professional Documents

Culture Documents

Currency Options: Pricing and Strategies

Uploaded by

Santanu DasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Options: Pricing and Strategies

Uploaded by

Santanu DasCopyright:

Available Formats

Currency Options: Pricing and Strategies

FINC 456

Currency Options: Hedging Euros, yet again

Consider an exporter, who sells stuff in Europe and is expecting to receive 100,000,000 euros in 6 months.

Euro rates are 4% and U.S. rates are 2%, and spot is 1.25.

Risk here is that the Euro

Could sell the euros forward at 1.23756, and receive for sure $123,756,000 in six months. But what if manager expects the Euro to appreciate?

Could also protect against the risk by buying an option to sell euros at 1.23756.

Say that costs $40,000 for each 1,000,000 euros. Where does the exporter break even?

Currency Hedging: Forwards vs. Options

The forward contract gives a sure payoff in the future, but provides no room for appreciation of the currency to profit the exporter The option contract allows hedging while retaining profit potential, but incurs a cost that must be accounted for in calculating the breakeven.

In a very real sense, the profit potential given up in the forward contract pays for a lower breakeven value Well get back to this in a minuteright now, where did that $40,000 per 1,000,000 Euros come from?

Also, what does the payoff to the exporter look like?

Pricing Currency Options

Analogous to the case of forward contracts, currency options require only a small modification to our basic pricing formulas The first thing to remember though, is that currency options can get very confusing unless we lay down some rules: $ The spot rate (S) and strike price (X) are always in For

A call option is the right to buy FOR at X for $. A put option is the right to sell FOR at X for $.

The problem is that few currencies are quoted as $/FORso the answer is to always convert.

Pricing Currency Options Keeping it straight

The preceding rules ensure that call options get cheaper as X is set higher than S

Paying foreign currency in the future implies that you are exposed to an appreciation of the currency To hedge against currency appreciation, you buy the right to buy the currency at X > S

That is, you buy call options to buy FOR with $ at X, OTM.

Put options get cheaper as X is set lower than S

Receiving foreign currency in the future implies that you are exposed to a depreciation of the currency To hedge against currency depreciation, you buy the right to sell the currency at X < S.

That is, you buy put options to sell FOR with $ at X, OTM.

rf, the foreign interest rate

When we priced forwards on currency, we had to adjust the cost of carrying the asset

That is, the forward price was

To price currency options, the adjustment is exactly the same!

We replace the riskfree rate with rd-rf, and we need to discount the spot rate at the foreign interest rate

Why?

F0 = S 0 e

( r r f )T

This leads to the formula for pricing currency options in the Black-Scholes world:

Note: occasionally this is called the Garman-Kohlhagen formula, in what must be the easiest naming opportunity

The Black-Scholes Formula

The Black-Scholes (GK) formula is:

c = Se

r f T

N (d1 ) Xe rdT N (d 2 )

r f T 2

p = Xe rdT N ( d 2 ) Se d1 = d2 = ln S

( X )+ (r

N ( d1 ) 2

rf + rf

T 1 T Recall that the currency forward formula was:

ln S

( X )+ (r

T

2 d

)T

)T = d

F = S0e

( r r f )T

Options and Forwards: Pricing Relationships

If we know the forward price on the currency, the B-S formula simplifies to: c = e rd T [FN (d1 ) XN (d 2 )] ln F p = e rdT [ XN ( d 2 ) FN ( d1 )]

d1 =

T 2 ln F T X 2 = d T d2 = 1 T

( X )+ ( T 2 )

2

( ) (

Lets look at that again

Heres a question:

If a call and a put with similar strike prices on a currency cost the same amount, whats the strike price?

Currency Hedging Strategies

How would you hedge a payment in pesos in 1 year?

Say you have to pay 500,000,000 pesos for McDonalds franchises in Baja California The spot rate is 10 pesos/$, MXN rates are 8% and USD rates are 2%.

What is your risk? One idea: buy pesos forward at 10.6184 MXN/$.

This costs you $47,088,227 in a year.

Or perhaps you buy the right to buy pesos at .10 $/peso (thats 10 pesos/$)

Whats your maximum cost (At 11.5% volatility)?

Hedging Peso Payments

Well, if the option costs about $1,000,000, then the most that could be paid is about $51,000,000

Since I have the right to buy pesos at 10, and 500,000,000/10=$50,000,000, and then theres the option cost Might be interested in the rate where I do as well as the forward.

Currency Option Pricing

Paying Currency (buying call)

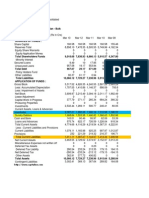

Inputs

Notional Amount

Hedging Prices

0.09418 10.61836547 0.00209 0.00780 $ $ $ $ 1,044,740 3,898,856 47,088,227 47,088,227

500,000,000 MXN Forward 0.1000 Spot Rate (USD/MXN) 10.000 Call (buy MXN) 0.1000 Strike Price (USD/MXN) 10.000 Put (sell MXN) 2.00% Riskfree Rate USD Cost to buy MXN Riskfree Rate MXN Volatility Maturity (days) Maturity (years) 8.00% 11.50% 365 1 Cost to sell MXN Cost at 10.859 Cost at forward

Hedging Peso Payments

Hedged Cost, Peso Payment

$52,000,000

$50,000,000

$48,000,000

$46,000,000

Cost F at Forward

$44,000,000

$42,000,000

$40,000,000

9 .0 9 .1 9 .2 9 .3 9 .4 9 .5 9 .6 9 .7 9 .8 9 .9 10 . 0 10 . 1 10 . 2 10 . 3 10 . 4 10 . 5 10 . 6 10 . 7 10 . 8 10 . 9 11. 0 11. 1 11. 2 11. 3 11. 4 11. 5

Another Currency Strategy

How could I reduce the cost of the option strategy?

Weve already seen one way to get it down to zero!

A classic strategy for hedging currency risk is called a range forward

The idea is to buy an option and sell an option such that there is zero net cost up front (just like a forward) The buyer can set a level of protection that he is comfortable with, and that determines the profit appreciation available to him

The more risk taken, the more profit potential:

In fact, the range forward is the most clear illustration of the trade-off between risk and return available with options Also a dramatic example of customizability

Range forward example in Euros

Reconsider the exporter who is receiving 100,000,000 Euros in 6 months.

Buy a forward at 1.23756 and lock in $123,756,000. Buy an option to sell euros at 1.23756 for $4,000,000

Here you breakeven only if the euro goes above 1.127-ish.

But you could also buy an option to sell euros at 1.2 and sell an option to buy euros at 1.279costs you nothing!

Worst case is that you receive 120 million, best case is that you get 127.9 million

Other pairs are: 1.22 and 1.257 or 1.15 and 1.336.

The more risk, the more profit!

Euro Range Forwards

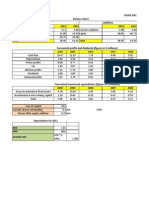

Range Forward Example

Exchange Rate Domestic Int. Rate Foreign Int. Rate Volatility Term (in days) Strike Step Forward 1.25 2.00% 4.00% 12.00% 182.5 0.01 1.23756

Range Forward Curve

1.350 1.340 1.330 1.320 1.310 1.300 1.290 1.280 1.270 1.260 1.250 1.240 1.14

1.336 1.325 1.313 1.301 1.290 1.279 1.268 1.257 1.246

1.16 1.18 1.20 1.22 1.24

Call Strike

Put Strike Put Strike Call Strike Put Price Call Price $ $ 1.150 1.336 1.160 1.325 1.170 1.313 1.180 1.301 1.190 1.290 1.200 1.279 1.210 1.268 1.220 1.257 1.230 1.246 1.23756 1.23756 0.041 0.041 (0.00)

0.011 $ 0.013 $ 0.015 $ 0.018 $ 0.021 $ 0.025 $ 0.029 $ 0.033 $ 0.038 $ 0.011 $ 0.013 $ 0.015 $ 0.018 $ 0.021 $ 0.025 $ 0.029 $ 0.033 $ 0.038 $ 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

$ Cost on a million $ $ Cost on a million $

10,701 $ 12,881 $ 15,369 $ 18,187 $ 21,349 $ 24,869 $ 28,758 $ 33,022 $ 37,664 $ 41,427 10,701 $ 12,881 $ 15,369 $ 18,187 $ 21,349 $ 24,869 $ 28,758 $ 33,022 $ 37,664 $ 41,427

Currency Hedging Conclusions

Options add a near infinite degree of customizability to the hedging decision

Can tailor solutions directly to views and expectations Can also replicate the forwards we used before

Pricing currency options requires only some small changes to the Black-Scholes formulabut is tricky!

Need to ensure that spot rates are quoted consistently Need to be very clear about whether we are buying or selling the currency

Range forwards show dramatically the tradeoff between profit potential and risk (even in a forward!)

You might also like

- FOFch 17Document48 pagesFOFch 17ferahNo ratings yet

- 35 Summary ForexDocument15 pages35 Summary ForexRevati GalgaliNo ratings yet

- Ch07 Questions and Problems Answers1Document9 pagesCh07 Questions and Problems Answers1Fung PingNo ratings yet

- Shapiro Chapter 07 SolutionsDocument12 pagesShapiro Chapter 07 SolutionsRuiting Chen100% (1)

- International Business FinanceDocument43 pagesInternational Business FinancesiusiuwidyantoNo ratings yet

- 5 Derivatives On FXJNDocument40 pages5 Derivatives On FXJNNo Longer ExistingNo ratings yet

- International Arbitrage and Interest Rate Parity: From International Finance by Jeff MaduraDocument49 pagesInternational Arbitrage and Interest Rate Parity: From International Finance by Jeff Maduraabdullah.zhayatNo ratings yet

- Multinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFDocument33 pagesMultinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFheadmostzooenule.s8hta6100% (8)

- Multinational Financial Management 9th Edition Shapiro Solutions ManualDocument12 pagesMultinational Financial Management 9th Edition Shapiro Solutions Manualdecardbudgerowhln100% (35)

- Ch07 Questions and Problems AnswersDocument8 pagesCh07 Questions and Problems AnswersCarter JayanNo ratings yet

- Triangular ArbitrageDocument5 pagesTriangular ArbitrageSajid HussainNo ratings yet

- Multinational Financial Management 10th Edition Shapiro Solutions ManualDocument15 pagesMultinational Financial Management 10th Edition Shapiro Solutions Manualcoactiongaleaiyan100% (24)

- Currency Derivatives (Or Chapter 7)Document25 pagesCurrency Derivatives (Or Chapter 7)Lincy KurianNo ratings yet

- Lecture04 Derivatives StudentDocument22 pagesLecture04 Derivatives StudentMit DaveNo ratings yet

- IFM Assignment 1Document15 pagesIFM Assignment 1Azrul AzliNo ratings yet

- Management of Transaction ExposureDocument10 pagesManagement of Transaction ExposuredediismeNo ratings yet

- We Sell I Want To Buy Foreign Currency We Buy I Want To Sell Foreign CurrencyDocument8 pagesWe Sell I Want To Buy Foreign Currency We Buy I Want To Sell Foreign CurrencyDR LuotanNo ratings yet

- Understanding Exchange RatesDocument14 pagesUnderstanding Exchange RatesJumoke FadareNo ratings yet

- CH 3 CF (EMBF 10th Batch)Document45 pagesCH 3 CF (EMBF 10th Batch)thar tharNo ratings yet

- CH 6Document11 pagesCH 623blahblahNo ratings yet

- SPT, Cross, ForwardDocument38 pagesSPT, Cross, Forwardseagul_1183822No ratings yet

- Dozier Hedging AlternativesDocument2 pagesDozier Hedging Alternativesacastillo1339No ratings yet

- FNCE 4047 Exchange Rate Problems and SolutionsDocument19 pagesFNCE 4047 Exchange Rate Problems and SolutionsDanial TorabianNo ratings yet

- Digital OptionsDocument6 pagesDigital OptionsAparnaNo ratings yet

- International Financial Management 8th Edition Madura Test BankDocument40 pagesInternational Financial Management 8th Edition Madura Test Bankvioletciara4zr6100% (33)

- USM1 FIN 614 Week02 WorkProblemsWorksheetDocument13 pagesUSM1 FIN 614 Week02 WorkProblemsWorksheetwaszenvNo ratings yet

- Solnik & McLeavey - Global Investment 6th EdDocument5 pagesSolnik & McLeavey - Global Investment 6th Edhotmail13No ratings yet

- ch6 328Document5 pagesch6 328Jeremiah KhongNo ratings yet

- 09Document10 pages09Suryakant KaushikNo ratings yet

- Foreign Exchange Market, Exchange Rate Determination & Currency DerivativesDocument28 pagesForeign Exchange Market, Exchange Rate Determination & Currency DerivativesParomita SarkarNo ratings yet

- Foreign Exchange Markets, End of Chapter Solutions.Document27 pagesForeign Exchange Markets, End of Chapter Solutions.PankajatSIBMNo ratings yet

- Session 2 - The Foreign Exchange MarketDocument12 pagesSession 2 - The Foreign Exchange MarketVipin Kumar CNo ratings yet

- FINS3616 Tutorial 3Document25 pagesFINS3616 Tutorial 3Rafid MashrurNo ratings yet

- Techniques For Managing ExposureDocument26 pagesTechniques For Managing Exposureprasanthgeni22100% (1)

- Int Finance Practice - SolDocument7 pagesInt Finance Practice - SolAlexisNo ratings yet

- 02 EconomicsDocument94 pages02 EconomicsTecwyn LimNo ratings yet

- Answers To End of Chapter 5 QuestionsDocument11 pagesAnswers To End of Chapter 5 QuestionsAbdul wahabNo ratings yet

- PS7 Primera ParteDocument5 pagesPS7 Primera PartethomasNo ratings yet

- Solution Manual CH 7 Multinational Financial ManagementDocument5 pagesSolution Manual CH 7 Multinational Financial Managementariftanur100% (2)

- Currency Derivatives C (Chapter 5)Document10 pagesCurrency Derivatives C (Chapter 5)Evelina WiszniewskaNo ratings yet

- Tutorial 2-SolutionsDocument3 pagesTutorial 2-SolutionsSruenNo ratings yet

- The Foreign Exchange MarketDocument29 pagesThe Foreign Exchange MarketSam Sep A Sixtyone100% (1)

- InflationDocument11 pagesInflationZakaria ZrigNo ratings yet

- Forex Trading CourseDocument69 pagesForex Trading Courseapi-3703868No ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- Week8-Chapter 11Document43 pagesWeek8-Chapter 11Bhen ChodNo ratings yet

- Cfa QaDocument21 pagesCfa QaM Fani MalikNo ratings yet

- An Introduction To Computational Finance: P.A. Forsyth June 17, 2003Document16 pagesAn Introduction To Computational Finance: P.A. Forsyth June 17, 2003Gopinath KrishnanNo ratings yet

- Currency Future and OptionsDocument60 pagesCurrency Future and Optionspanicker_maheshNo ratings yet

- Chno7 International Arbitrage and Interest Rate ParityDocument19 pagesChno7 International Arbitrage and Interest Rate ParitySaqib NiaziNo ratings yet

- Risky InvestmentDocument35 pagesRisky InvestmentbellohalesNo ratings yet

- Chapter 1 - Foreign Currecies Exchange MarketDocument47 pagesChapter 1 - Foreign Currecies Exchange MarketThư Trần Thị AnhNo ratings yet

- MD4 Assgn Escalona LDocument7 pagesMD4 Assgn Escalona LLidia EVNo ratings yet

- Forex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.From EverandForex Trading for Beginners: The Ultimate Trading Guide. Learn Successful Strategies to Buy and Sell in the Right Moment in the Foreign Exchange Market and Master the Right Mindset.No ratings yet

- On-Line Trading Binary Options (A book for Beginners in Binary Option Trading)From EverandOn-Line Trading Binary Options (A book for Beginners in Binary Option Trading)Rating: 4.5 out of 5 stars4.5/5 (6)

- Scalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeFrom EverandScalping and Pre-set Value Trading: Football Double Chance Market - Betfair ExchangeNo ratings yet

- The Market Calls: A Primer on the Strategy of Writing Covered CallsFrom EverandThe Market Calls: A Primer on the Strategy of Writing Covered CallsNo ratings yet

- FIFA 16 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!From EverandFIFA 16 Trading Secrets Guide: How to Make Millions of Coins on Ultimate Team!No ratings yet

- Code Rules PDFDocument32 pagesCode Rules PDFSantanu DasNo ratings yet

- Train Number Train Name From Station Destination Station Runs From Source OnDocument2 pagesTrain Number Train Name From Station Destination Station Runs From Source OnSantanu DasNo ratings yet

- Capital Liquidity LCRDocument61 pagesCapital Liquidity LCRSantanu DasNo ratings yet

- BCG Online Case Example PDFDocument8 pagesBCG Online Case Example PDFSantanu DasNo ratings yet

- Cover Headline: Second Line Lorem IpsumDocument25 pagesCover Headline: Second Line Lorem IpsumSantanu DasNo ratings yet

- ICTMS 2013 eAbstractBookDocument68 pagesICTMS 2013 eAbstractBookSantanu DasNo ratings yet

- ICTMS 2013 - Program ScheduleDocument3 pagesICTMS 2013 - Program ScheduleSantanu DasNo ratings yet

- Britania ValuationDocument28 pagesBritania ValuationSantanu DasNo ratings yet

- Siib c1Document38 pagesSiib c1Santanu Das100% (1)

- Amul Ice Cream: Cost Sheet AnalysisDocument9 pagesAmul Ice Cream: Cost Sheet AnalysisSantanu Das50% (2)

- Cost Sheet of Amul Ice-CreamDocument5 pagesCost Sheet of Amul Ice-CreamSantanu DasNo ratings yet

- Cost & Management Accounting: Total 70Document1 pageCost & Management Accounting: Total 70Santanu DasNo ratings yet

- Extra Component - Amul Ice CreamDocument7 pagesExtra Component - Amul Ice CreamSantanu DasNo ratings yet

- Libor ScandalDocument16 pagesLibor ScandalSantanu Das100% (1)

- TreesampDocument19 pagesTreesampSantanu DasNo ratings yet

- Monday Tuesday Wednesday: 10-Mar-14 11-Mar-14 12-Mar-14Document6 pagesMonday Tuesday Wednesday: 10-Mar-14 11-Mar-14 12-Mar-14Santanu DasNo ratings yet

- Specialty Toys Problem PDFDocument37 pagesSpecialty Toys Problem PDFSantanu Das80% (5)

- Cipla LTD Industry:Pharmaceuticals - Indian - Bulk Drugs & Formln LRGDocument2 pagesCipla LTD Industry:Pharmaceuticals - Indian - Bulk Drugs & Formln LRGSantanu DasNo ratings yet

- Beta of A Stock Represents The Contritbution of That Stock To The Overall Risk of A Diversified PortfolioDocument2 pagesBeta of A Stock Represents The Contritbution of That Stock To The Overall Risk of A Diversified PortfolioSantanu DasNo ratings yet

- DR Reddys Laboratories LTD Industry:Pharmaceuticals - Indian - Bulk Drugs & Formln LRGDocument4 pagesDR Reddys Laboratories LTD Industry:Pharmaceuticals - Indian - Bulk Drugs & Formln LRGSantanu DasNo ratings yet

- Reeby Sports SARY1Document13 pagesReeby Sports SARY1Santanu DasNo ratings yet

- Why Marketers Should Keep Sending You EmailsDocument3 pagesWhy Marketers Should Keep Sending You EmailsSantanu DasNo ratings yet

- Capital Markets Senior Vice President in New York City Resume David GrossmanDocument3 pagesCapital Markets Senior Vice President in New York City Resume David GrossmanDavidGrossman3No ratings yet

- US Interest Rates Outlook 2011 - Tug of WarDocument122 pagesUS Interest Rates Outlook 2011 - Tug of WarGeouzNo ratings yet

- Money MarketDocument20 pagesMoney Marketramankaurrinky100% (1)

- The Ultimate Guide What Is ABMDocument16 pagesThe Ultimate Guide What Is ABMSaratNo ratings yet

- Manual Trading in OptionsDocument206 pagesManual Trading in OptionsKenny Kee100% (10)

- Key Points:: Case Study: Rent Control in The Short Run and The Long RunDocument2 pagesKey Points:: Case Study: Rent Control in The Short Run and The Long Runnasper34No ratings yet

- Demand Supply Analysis CasesDocument16 pagesDemand Supply Analysis Casesheda kaleniaNo ratings yet

- Updates (Company Update)Document118 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- Security Analysis and Portfolio Management, Bond Market in India.Document26 pagesSecurity Analysis and Portfolio Management, Bond Market in India.Gagandeep Singh BangarNo ratings yet

- Chapter 7 - International Financial Markets and InstitutionsDocument28 pagesChapter 7 - International Financial Markets and Institutionsjdphan50% (2)

- Stock Trading BasicsDocument6 pagesStock Trading Basicssteam100deg8229No ratings yet

- Review Test Submission - Quiz 5 - 2016 - EMIC2714 BFN ON PDFDocument7 pagesReview Test Submission - Quiz 5 - 2016 - EMIC2714 BFN ON PDFTumi Mothusi100% (1)

- Defining The Bull & BearDocument8 pagesDefining The Bull & BearNo NameNo ratings yet

- Marketing Glossary For InterviewDocument14 pagesMarketing Glossary For Interviewramteja_hbs14No ratings yet

- Basics of Options: Dr. V. Raveendra SaradhiDocument33 pagesBasics of Options: Dr. V. Raveendra SaradhiIvneet VohraNo ratings yet

- Stock ExchangeDocument8 pagesStock ExchangeshaddydagerNo ratings yet

- VIX ManipulationDocument58 pagesVIX ManipulationZerohedge100% (2)

- Moving AverageDocument36 pagesMoving AverageFaisal KorothNo ratings yet

- Exam 1 LXTDocument31 pagesExam 1 LXTphongtrandangphongNo ratings yet

- Syllabus OBLICONDocument16 pagesSyllabus OBLICONJonah Rose Guerrero LumanagNo ratings yet

- Derivatives Commodity Derivatives FGLD EnglishDocument13 pagesDerivatives Commodity Derivatives FGLD EnglishrexNo ratings yet

- Distinguish Between Monopoly and Perfect CompetitionDocument2 pagesDistinguish Between Monopoly and Perfect CompetitionNikita T JoseNo ratings yet

- Share Market BasicsDocument8 pagesShare Market BasicsHardik ShahNo ratings yet

- Acroynms Capital MarketsDocument37 pagesAcroynms Capital MarketsAnuj Sharma100% (1)

- Decision Sheet P&GDocument2 pagesDecision Sheet P&GApurv Toppo100% (2)

- Supply Demand Study GuideDocument6 pagesSupply Demand Study GuideJoep MinderhoudNo ratings yet

- Financial DerivativesDocument24 pagesFinancial DerivativesResmi NidhinNo ratings yet

- Stock Market HistoryDocument10 pagesStock Market HistoryAdinanoorNo ratings yet

- Bala FindingsDocument5 pagesBala FindingsDeepan YasoNo ratings yet

- International Finance CaseDocument7 pagesInternational Finance CaseAl-Imran Bin KhodadadNo ratings yet