Professional Documents

Culture Documents

Takeovers Can Be Both A Problem and A Solution Takeovers That

Takeovers Can Be Both A Problem and A Solution Takeovers That

Uploaded by

Gee LankOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Takeovers Can Be Both A Problem and A Solution Takeovers That

Takeovers Can Be Both A Problem and A Solution Takeovers That

Uploaded by

Gee LankCopyright:

Available Formats

Apa argument anda terhadap pernyataan berikut (dengan contoh yang memadai): 1.

Terjadi dampak transfer kekayaan dari kreditor (pemegang obligasi) ke pemegang saham pada LB s. !. ". Related diversification showed positive returns but unrelated diversification showed negative returns. Winners Curse supports the Hubris hypothesis. #. MBOs can be an effective solution to agency problems . $. Disadvantages of trategic !lliances" #reater opportunities for opportunistic behavior by merger partners. %. Biaya pengembangan perusahaan yang bersifat instan lebih besar dari pada biaya pengembangan yang bersifat internal (natural& pertumbuhan laba ditahan). $% hareholders can diversify their portfolios much less e&pensively than companies can do this for shareholders' (% )ertically related firms do poorly compared to more focused firms *% +he high valuations made it more difficult for directors to challenge C,Os of companies whose stoc- rose rapidly 1'. The e(aluations are sometimes conducted by )n(estment bankers. This can create an issue of conflict of interest as they may ha(e a stake in the deal. 11. ne theory of ac*uisitions closely related to the +ubris hypothesis is that managers of companies ac*uire other companies to increase their size ,hich& in turn& allo, them to enjoy higher compensation and benefits (-illiam Baumol& 1.$.) 12. Takeovers can be both a problem and a solution Takeo(ers that reduce market (alue may be bad deals& assuming the market correctly assesses them& and this is a problem/ The deals market& ho,e(er& may take care of the problem through another takeo(er of the 0bad bidders1

13. Jensen and Ruback (1983): Target shareholders gained an a(erage of "'2 from hostile takeo(ers& Target shareholders gained an a(erage of !'2 from friendly takeo(ers (3ains came in the form of premiums) Jensen on e icienc!: Belie(es that markets are (ery efficient: 4ince stock prices in his study rose& this implies that firms are more efficient (+e says that higher

stock price does not come from greater market po,er so it must come from greater efficiency) 14. "!nerg! rom #erger: 5ombined firm is more (aluable than the (alue of the separate firms perating economies: 6eduction in operating costs (1. 7limination of duplicate facilities& !. 6eduction in (arious departments) 15. 5ritical issue on 3ro,th: 8remium paid for this speed 9 price of target: :oes the price of *uicker de(elopment e;ceed the price paid for internal de(elopment by too much to justify difference <se project e(aluation techni*ues (i.e.& =8> or )66)

9999o'o9999

You might also like

- Solution Manual For Corporate Finance 4th Edition by BerkDocument3 pagesSolution Manual For Corporate Finance 4th Edition by Berka38476880414% (7)

- Advanced Portfolio Management Finals CheatsheetDocument2 pagesAdvanced Portfolio Management Finals CheatsheetKoh ziyangNo ratings yet

- Technical Interview Questions - MenakaDocument15 pagesTechnical Interview Questions - Menakajohnathan_alexande_1No ratings yet

- Sample Leave of Absence FormDocument1 pageSample Leave of Absence FormM GrâShâ VANo ratings yet

- Corporate Governance QuizzesDocument8 pagesCorporate Governance QuizzessNo ratings yet

- R R D DE R E DE R R R D DE: Modigliani-Miller TheoremDocument13 pagesR R D DE R E DE R R R D DE: Modigliani-Miller TheoremPankaj Kumar BaidNo ratings yet

- Vices and Its Effects To The StudentsDocument11 pagesVices and Its Effects To The StudentsRuby Lorenz Daypuyart81% (16)

- Harvard Business Review on Winning NegotiationsFrom EverandHarvard Business Review on Winning NegotiationsRating: 3.5 out of 5 stars3.5/5 (3)

- Request For Cash AdvanceDocument1 pageRequest For Cash AdvanceMD LebriaNo ratings yet

- Personality Disorder ClustersDocument3 pagesPersonality Disorder ClustersMissy Wyckoff HartNo ratings yet

- Family Nursing Care PlanDocument5 pagesFamily Nursing Care PlanSherallene Aluarte100% (4)

- IFM10 CH 01 Test BankDocument11 pagesIFM10 CH 01 Test Bankreflecti0nNo ratings yet

- Takeovers Can Be Both A Problem and A Solution Takeovers That ReduceDocument2 pagesTakeovers Can Be Both A Problem and A Solution Takeovers That ReduceGee LankNo ratings yet

- MM ModelDocument91 pagesMM ModelBenjamin TanNo ratings yet

- Manajemen KeuanganDocument13 pagesManajemen KeuanganFefeng FefengNo ratings yet

- IFM10 Ch01 Solutions ManualDocument13 pagesIFM10 Ch01 Solutions Manualmugendc4No ratings yet

- Agency Problem in Corporate Finance PDFDocument24 pagesAgency Problem in Corporate Finance PDFSuchismita SenNo ratings yet

- Agency ProblemsDocument5 pagesAgency ProblemsFBUK54No ratings yet

- FIN 303 Chap 1 Spring 2010Document18 pagesFIN 303 Chap 1 Spring 2010Wedaje AlemayehuNo ratings yet

- Topic 9 Tutorial SolutionsDocument4 pagesTopic 9 Tutorial SolutionsNguyễn Mạnh HùngNo ratings yet

- Questioins - Ch1 - GovrDocument4 pagesQuestioins - Ch1 - GovrMohamed HegazyNo ratings yet

- Agency Costs, Mispricing, and Ownership Structure: Sergey Chernenko, C. Fritz Foley, and Robin GreenwoodDocument30 pagesAgency Costs, Mispricing, and Ownership Structure: Sergey Chernenko, C. Fritz Foley, and Robin GreenwoodAtiq Ur RehmanNo ratings yet

- 22BSP422 1 EX1 OutlineAnswersDocument6 pages22BSP422 1 EX1 OutlineAnswersalexwilliamduffNo ratings yet

- The Objective of Corporate Finance and Corporate Governance: Ch.2 and CFA Reading (Available in My Office)Document33 pagesThe Objective of Corporate Finance and Corporate Governance: Ch.2 and CFA Reading (Available in My Office)ANSHU_KHESENo ratings yet

- FIN 36054 Intermediate Financial Management Lecture Notes For Chapter 1 Dr. Ramana SontiDocument5 pagesFIN 36054 Intermediate Financial Management Lecture Notes For Chapter 1 Dr. Ramana SontiflowerkmNo ratings yet

- Leverage TheoryDocument5 pagesLeverage TheorySuman SinghNo ratings yet

- Financial ManagementDocument21 pagesFinancial ManagementraqthesolidNo ratings yet

- 2011 Za Exc CFDocument13 pages2011 Za Exc CFChloe ThamNo ratings yet

- Intermediate Corporate Finance: Fall Semester, 2012Document22 pagesIntermediate Corporate Finance: Fall Semester, 2012uofm4everNo ratings yet

- Exam Strategic Financial Management January 2021Document4 pagesExam Strategic Financial Management January 2021jaouratjawadNo ratings yet

- Essay Question For Final ExamDocument5 pagesEssay Question For Final ExamKhoa LêNo ratings yet

- Money Banking and The Financial System 3rd Edition Hubbard Test BankDocument41 pagesMoney Banking and The Financial System 3rd Edition Hubbard Test Bankhebexuyenod8q100% (31)

- Essay Questions - 1 & 2Document3 pagesEssay Questions - 1 & 2Muhammad AtherNo ratings yet

- Does Industry-Wide Distress Affect Defaulted FirmsDocument48 pagesDoes Industry-Wide Distress Affect Defaulted Firmsvidovdan9852No ratings yet

- The Separation of Ownership and ControlDocument33 pagesThe Separation of Ownership and Controllegalmatters75% (4)

- 07 ACF Asymmetric Information II Adverse Selection 2020-21Document22 pages07 ACF Asymmetric Information II Adverse Selection 2020-21FlaminiaNo ratings yet

- CH 2 ProbsDocument4 pagesCH 2 ProbsEnas FandosNo ratings yet

- Gearing Policy 23-24Document43 pagesGearing Policy 23-24Ivan AlimirzoevNo ratings yet

- Jaykumar Patel Assignment 1 Fin 515 William WinnDocument5 pagesJaykumar Patel Assignment 1 Fin 515 William WinnJay PatelNo ratings yet

- Unit 27: The Basic Tools of FinanceDocument4 pagesUnit 27: The Basic Tools of FinanceMinh Châu Tạ ThịNo ratings yet

- A. Efficiency Arguments: Motives For Mergers and Merger Theory-How Value Is AddedDocument12 pagesA. Efficiency Arguments: Motives For Mergers and Merger Theory-How Value Is AddedMahesh HadapadNo ratings yet

- 08 LasherIM Ch08 1Document20 pages08 LasherIM Ch08 1PaulineBiroselNo ratings yet

- Industrial Organization Foundations For FinanceDocument44 pagesIndustrial Organization Foundations For FinanceLDaggersonNo ratings yet

- Myers 1977 - 2Document23 pagesMyers 1977 - 2Hiển HồNo ratings yet

- M and ADocument5 pagesM and AChe Tanifor BanksNo ratings yet

- Financial Management - MasenoDocument42 pagesFinancial Management - MasenoPerbz JayNo ratings yet

- Trial Med Anagement-1Document2 pagesTrial Med Anagement-1Youssef NabilNo ratings yet

- MODUL 11 Capital StructureDocument24 pagesMODUL 11 Capital StructureMentally Ill SinnerNo ratings yet

- Current Papers Solved by Fin 622 Subjective Papers by Adnan AwanDocument9 pagesCurrent Papers Solved by Fin 622 Subjective Papers by Adnan AwanShrgeel HussainNo ratings yet

- Related Topics: The Financial System Multiple Choice QuestionsDocument2 pagesRelated Topics: The Financial System Multiple Choice QuestionspatrickNo ratings yet

- Corporate Finance Asia Edition (Solution Manual)Document3 pagesCorporate Finance Asia Edition (Solution Manual)Kinglam Tse20% (15)

- The Corporation: ©2017 Pearson Education, LTDDocument3 pagesThe Corporation: ©2017 Pearson Education, LTDhung TranNo ratings yet

- OTC Derivatives General Paper 112010 AaaaDocument5 pagesOTC Derivatives General Paper 112010 Aaaaredearth2929No ratings yet

- Finance: Capital StructureDocument3 pagesFinance: Capital StructureJay Koli100% (1)

- Topic 2 - Equity 1 AnsDocument6 pagesTopic 2 - Equity 1 AnsGaba RieleNo ratings yet

- Homework 4 AnswersDocument2 pagesHomework 4 AnswersFeric KhongNo ratings yet

- New Microsoft Word DocumentDocument4 pagesNew Microsoft Word Documentමිලන්No ratings yet

- Topic4 PDFDocument26 pagesTopic4 PDFAzhariya ZulfaNo ratings yet

- Ch.7 FinanceDocument18 pagesCh.7 FinanceJohnCharles ShawNo ratings yet

- Wiley, Financial Management Association International Financial ManagementDocument16 pagesWiley, Financial Management Association International Financial Managementsamon sumulongNo ratings yet

- Mock Exam II Midterm WITH SOLUTIONSDocument6 pagesMock Exam II Midterm WITH SOLUTIONSAlessandro FestanteNo ratings yet

- EIB Working Papers 2018/08 - Debt overhang and investment efficiencyFrom EverandEIB Working Papers 2018/08 - Debt overhang and investment efficiencyNo ratings yet

- Analytical Essay RevisedDocument6 pagesAnalytical Essay RevisedRey BacalangcoNo ratings yet

- QuestionnaireDocument4 pagesQuestionnaireSuhayl Azmin100% (1)

- Pigeons at DayBreak (Gender and Literary Criticism)Document16 pagesPigeons at DayBreak (Gender and Literary Criticism)Syafa QiesyazNo ratings yet

- The Times of India VK Singh Cools TempersDocument3 pagesThe Times of India VK Singh Cools Tempersdilip_scribdNo ratings yet

- Econ 110 Syllabus Spring19Document4 pagesEcon 110 Syllabus Spring19Anonymous PZODPRNo ratings yet

- MFRS 137Document2 pagesMFRS 137Mija Lovenovel0% (1)

- Mna Short FormDocument1 pageMna Short FormFetria MelaniNo ratings yet

- Sample 1Document3 pagesSample 1kimNo ratings yet

- Atty. Henedino Joseph P. Eduarte Jr. I SDocument6 pagesAtty. Henedino Joseph P. Eduarte Jr. I SHappynako WholesomeNo ratings yet

- Surf Excel Creative BriefDocument11 pagesSurf Excel Creative BriefravisittuNo ratings yet

- 72 - Communication Within WorkplaceDocument1 page72 - Communication Within WorkplaceYakeen AgarwalaNo ratings yet

- Atlantic Trade DBQDocument8 pagesAtlantic Trade DBQzca270No ratings yet

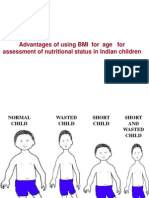

- Use of BMIDocument11 pagesUse of BMIArthurBangguanNo ratings yet

- Memo Re NakayamaDocument2 pagesMemo Re NakayamaLatoya StewartNo ratings yet

- Poslovni Engleski TestDocument5 pagesPoslovni Engleski TestDragana AnticNo ratings yet

- Ews Release: Spring Break Students Rescued From Overturned CanoeDocument2 pagesEws Release: Spring Break Students Rescued From Overturned Canoeapi-243850372No ratings yet

- HRMDocument2 pagesHRMHumera SomaniNo ratings yet

- Walkathon - Hoofin' It With Heritage Parent Info SheetDocument1 pageWalkathon - Hoofin' It With Heritage Parent Info SheetrobbuffoneNo ratings yet

- Johari WindowDocument4 pagesJohari WindowChhavi TevatiaNo ratings yet

- Unethical Practices of Mike Duke FinalDocument18 pagesUnethical Practices of Mike Duke FinalNayomi EkanayakeNo ratings yet

- Obc CirtificateDocument1 pageObc Cirtificatejnaneswar_125467707No ratings yet

- Pushpa Basnet CNN HeroDocument2 pagesPushpa Basnet CNN HeroDhirendra Thapa100% (1)

- ECON 303 Homework 01 Microeconomics: Real Price of ButterDocument2 pagesECON 303 Homework 01 Microeconomics: Real Price of Butteralexsheep17No ratings yet

- Perfect Competition: The Number of Firms in The MarketDocument1 pagePerfect Competition: The Number of Firms in The Marketkach41No ratings yet

- Short Test 10ADocument1 pageShort Test 10AKasiaNo ratings yet