Professional Documents

Culture Documents

Accounting Transactions in PO

Uploaded by

venkatsssCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Transactions in PO

Uploaded by

venkatsssCopyright:

Available Formats

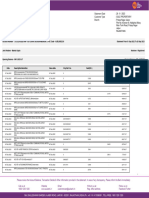

Accounting transactions in PO

Submitted by Anonymous on Mon, 04/06/2009 - 17:59 Tag:

Purchasing /

Definition of Items used in Purchasing There are 3 kinds of Items used in Purchasing. Expense Items Referred to as Item A Inventory Expense Items - Referred to as Item B Inventory Asset Items - Referred to Item C 1) Expense Items - Referred to as Item A. These items normally have the following attributes. INVENTORY_ASSET_FLAG = N PURCHASING_ITEM_FLAG = Y INVENTORY_ITEM_FLAG = N 2) Inventory Expense Items - Referred to as Item B These items normally have the following attributes. INVENTORY_ASSET_FLAG = N PURCHASING_ITEM_FLAG = Y INVENTORY_ITEM_FLAG = Y 3) Inventory Asset Items - Referred to Item C These items have the following attributes. INVENTORY_ASSET_FLAG = Y PURCHASING_ITEM_FLAG = Y INVENTORY_ITEM_FLAG = Y COSTING_ENABLED_FLAG = Y PO Account Generator The account generator behaviour will also depend on - the destination org (on the po shipment) - the destination type (inventory or expense) on the po distribution You also need to remember that the item expense account defaults from the org when items are created, but you probably need to set a specific value for an item. PO Accountings 1. Receving A/C - Defaults fro receving options for the receving organization 2.1. Inventory A/P Accrual account A/C - Defaults from Org parameter Other Acc tab 2.2 Expense A/P accrual A/C - Default from purchasing parameter Receipt Accounting tab

3.1 PO Distribution Charge (Delivery Acc) for Non Inventory Expense A/C - Defaults from Item Exp A/C 3.2 Delivery Acc for Asset Item A/C - Mat. A/C from i>Sub Inevntory ii>Org Parameter 3.3 PO Distribution Charge Delivery Acc for Inevntory Expense A/C - Defaults from A/Cs in following precedence i>Sub Inventory Expense A/C ii>Expense A/c in Item Master if above A/C is not available iii>Expese A/C from Org parameter if above 2 A/Cs are not avaialble 3.4 When Purchase Order is created with out an item number (In case of Non_inventory Items, item number exists but the inventory field is disabled but PO can also be created for items which are not defined in inventory) with value basis as Amount (i.e. Purchase basis as Service) - The PO charge A/C needs to be manually entered. Notes: 1. We can have two differnt distribution lines for a single shipment. In case of inventory items if the item is received in two differnt subinventories then we can create two differnt distribution lines for the same shipment and the charge a/c would default from subinventories if exits In case of Non-Inventory items we can manually select as many charge a/cs as required. 2. In standard PO WF For an inventory expense PO charge a/c to default from the subinventory level, the item must be restricted to the subinventory. 1. Inventory Asset Items Receiving: Receiving Inspection account @ PO price XX Dr. Inventory A/P Accrual account @ PO price XX Cr. Delivery: Subinventory accounts(PO Charge A/c) @ standard cost XX Dr. Receiving Inspection account @ PO price XX Cr. Debit/Credit Purchase Price Variance and, if applicable Subinventory Mat Over Head XX Dr MOH Absorption XX Cr PPV = (PO unit price standard unit cost) x quantity received Invoice: Inventory A/P Accrual account Dr. Supplier Liability A/C cr. 2. Inventory Expense Items Receiving: Receiving Inspection account @ PO price XX Dr.

Inventory A/P Accrual account @ PO price XX Cr. Delivery: Sub inv Expense A/c(PO Charge) Dr. Reciving Valuation A/c Cr. Invoice: Inventory A/P Accrual account Dr. Supplier Liability A/C cr. 3. Fixed Asset Item (Same as 4. Expense Items Accrual @ Receipt) Receiving: Receiving Inspection account @ PO price XX Dr. Parameter Expense A/P Accrual account @ PO price XX Cr. Purchaing Parameter Delivery: Asset clearing accounts(PO Charge A/c) @ standard cost XX Dr. item/employee Receiving Inspection account @ PO price XX Cr. Debit/Credit Purchase Price Variance PPV=Chrage AC Invoice: Expense A/P Accrual account Dr. Supplier Liability A/C cr. Supplier Site POST Mass addition: Asset Cost A/C Dr. Asset category Asset Clearing A/C Cr. Depriciation : Depriciation expense A/C Dr. A/C Accumulate Depriciation Exp Cr.

Org

Asset - Expense Asset Category

4. Expense Items Accrual @ Receipt Receiving: Receiving Inspection account @ PO price XX Dr. Expense A/P Accrual account @ PO price XX Cr. Delivery: Item Expense A/c(PO distribution charge A/C) @ PO price XX Dr. Receiving Inspection account @ PO price XX Cr. Encumbrance @ PO price XX Dr. Reserve for Encumbrance @ PO price XX Cr. Invoice: Expense A/P Accrual account Dr. Supplier Liability A/C cr. 5. Expense Receipts AccrualsPeriod End There would be no accounting in exepnse material receving and delivery.

When an invoice is created and matched to the PO for the expense item, charge a/c is debited to Supplier Liability A/C. PO Charge A/C (Item Exp./Sub Exp.) Dr. Supplier Liability A/C Cr. Purchasing does not record any accounting entries for expense during a receiving transaction if you use periodend accruals. You record all of your uninvoiced liabilities at month end using the Receipt Accruals PeriodEnd process. Use the Receipt Accruals Period End process to create periodend accruals for your uninvoiced receipts for expense distributions. Purchasing creates an accrual journal entry in your general ledger for each uninvoiced receipt you choose using this form. If you use encumbrance or budgetary control, Purchasing reverses your encumbrance entry when creating the corresponding accrual entry. Purchasing never accrues an uninvoiced receipt twice. Each time you create accrual entries for a specific uninvoiced receipt, Purchasing marks this receipt as accrued and ignores it the next time you run the Receipt Accrual PeriodEnd process. Purchasing creates accrual entries only up to the quantity the supplier did not invoice for partially invoiced receipts. Purchasing creates the following accounting entries for each distribution you accrue using the Receipt Accruals PeriodEnd process: PO charge account @ Uninvoiced Quantity x PO unit Price XX Dr. Expense A/P accrual account @ Uninvoiced Quantity x PO price XX Cr. As soon as you open the next period, Purchasing reverses the accrual entries using the following accounting entries: Expense A/P accrual account @ Uninvoiced Quantity x PO price XX Dr. PO charge account @ Uninvoiced Quantity x PO unit Price XX Cr. 6. Standard Invoice Charge Acoount Dr. Supplier Liability A/C Cr. Encumbrance Accounting 1. PO Approval/Fund reserved Encumbrance (Budget A/C in PO distribution) A/C Dr. When the program - Create Journal runs in GL the encumbrance A/C is created and after posting into GL the Reserve Encumbrance A/C is credited. So Final Accounts Encumbrance A/C Dr. Reserve for Encumrance Cr. 2. Receving Recving Inspection A/C Dr. A/P Accrual A/C cr. 3. Delivery Inv valuation Dr. Receiving Inspection Cr.

Encumbrance Reversal Cr. Purchase price variance or rate variance 4. Invoice In case of matched with a PO, Payables encumbers funds for variances during Payables Invoice Validation for purchase order and receipt matched invoices. If you enter a non-purchase order matched invoice, Payables will encumber funds for it during Payables Invoice Validation. All Payables encumbrances are reversed when you create accounting entries. If you enable Use Requisition Encumbrance, you must also enable this option. Expense Items Receiving: Reciving Valuation A/c Dr. Expense A/P Accrual A/c Cr. Delivery: Expense A/c Dr. Reciving Valuation A/c Cr. Inventory Expense Items Receiving: Reciving Valuation A/c Dr. Inv. A/P Accrual A/c Cr. Delivery: Expense A/c Dr. Reciving Valuation A/c Cr. Asset Items Receiving: Reciving Valuation A/c Dr. Inv. A/P Accrual A/c Cr. Delivery: Mat. Valuation A/c Dr. Reciving Valuation A/c Cr.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Oracle Inventory Cycle CountingDocument7 pagesOracle Inventory Cycle CountingvenkatsssNo ratings yet

- Order ManagementDocument49 pagesOrder ManagementpvlnraoNo ratings yet

- Oracle PO Charge AccountDocument13 pagesOracle PO Charge AccountvenkatsssNo ratings yet

- Back To Back Sales OrderDocument6 pagesBack To Back Sales OrdervenkatsssNo ratings yet

- Oracle SCM QuestionsDocument2 pagesOracle SCM QuestionsvenkatsssNo ratings yet

- Business Need For Chart of AccountsDocument3 pagesBusiness Need For Chart of AccountsvenkatsssNo ratings yet

- Bom Operational RoutingsDocument2 pagesBom Operational RoutingsvenkatsssNo ratings yet

- Oracle PlanningDocument88 pagesOracle PlanningvenkatsssNo ratings yet

- Oracle CostingDocument3 pagesOracle CostingvenkatsssNo ratings yet

- Ascp - 103Document19 pagesAscp - 103Sandeep GandhiNo ratings yet

- Basics of Accounting From Oracle PerspectiveDocument16 pagesBasics of Accounting From Oracle PerspectiveRajesh ChowdaryNo ratings yet

- Item RelationshipsDocument6 pagesItem RelationshipsvenkatsssNo ratings yet

- Items Accounting in Oracle AppsDocument3 pagesItems Accounting in Oracle AppsRahul JainNo ratings yet

- Oracle CostingDocument3 pagesOracle CostingvenkatsssNo ratings yet

- Oracle Plannnig PeggingDocument35 pagesOracle Plannnig PeggingvenkatsssNo ratings yet

- Oracle SCM AccountsDocument16 pagesOracle SCM AccountsvenkatsssNo ratings yet

- Setting Up and Implementing Sourcing StrategiesDocument11 pagesSetting Up and Implementing Sourcing StrategiesvenkatsssNo ratings yet

- Historicity Era of Lord Rama PDFDocument20 pagesHistoricity Era of Lord Rama PDFramkiscribd100% (2)

- Setting Up and Implementing Sourcing StrategiesDocument11 pagesSetting Up and Implementing Sourcing StrategiesvenkatsssNo ratings yet

- Oracle Subledger AccountingDocument318 pagesOracle Subledger AccountingvenkatsssNo ratings yet

- Indian History PDFDocument188 pagesIndian History PDFNaveed Khan AbbuNo ratings yet

- Inventory ControlsDocument6 pagesInventory ControlsvenkatsssNo ratings yet

- Horoscope Matching - Kundali Matching - Kundali MilanDocument2 pagesHoroscope Matching - Kundali Matching - Kundali Milanvenkatsss100% (1)

- General Ledger Advanced Training Ge4Document5 pagesGeneral Ledger Advanced Training Ge4venkatsssNo ratings yet

- Ivas Training Exercises For DepartmentsDocument3 pagesIvas Training Exercises For DepartmentsvenkatsssNo ratings yet

- Oracle Defining FlexfieldsDocument304 pagesOracle Defining FlexfieldsvenkatsssNo ratings yet

- APS Payables Basic TrainingDocument6 pagesAPS Payables Basic TrainingvenkatsssNo ratings yet

- General Ledger Budgeting Training (GLR)Document6 pagesGeneral Ledger Budgeting Training (GLR)venkatsssNo ratings yet

- Ivas Training Exercises For DepartmentsDocument3 pagesIvas Training Exercises For DepartmentsvenkatsssNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- HW 7Document2 pagesHW 7Mishalm96No ratings yet

- Fa2 Mock Test 3Document14 pagesFa2 Mock Test 3chandoraNo ratings yet

- SPP R4 New An. Rahmadi - BanjarmasinDocument98 pagesSPP R4 New An. Rahmadi - BanjarmasinAlpiannoorNo ratings yet

- Financial Accounting Practice ProblemsDocument15 pagesFinancial Accounting Practice ProblemsFaryal Mughal100% (1)

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesMike SerafinoNo ratings yet

- MGT 201 Chapter 9Document41 pagesMGT 201 Chapter 9lupi99No ratings yet

- Coc Level 3 4TH RoundDocument15 pagesCoc Level 3 4TH Roundsolomon asfawNo ratings yet

- Kontni Okvir Srpski+EngleskiDocument18 pagesKontni Okvir Srpski+EngleskiSlavica Alajica HulalaNo ratings yet

- Nestle: Final Task in Fundamentals of Accountancy, Business and ManagementDocument43 pagesNestle: Final Task in Fundamentals of Accountancy, Business and ManagementApply Ako Work EhNo ratings yet

- Fitra I Services BusinessDocument16 pagesFitra I Services BusinessFitra AbdilahNo ratings yet

- Costing By-Product and Joint ProductsDocument36 pagesCosting By-Product and Joint ProductseltantiNo ratings yet

- ACCA F3 LRP - Questions PDFDocument64 pagesACCA F3 LRP - Questions PDFAdnanNo ratings yet

- Configuration of SAP Special GLDocument20 pagesConfiguration of SAP Special GLAtulWalvekar100% (3)

- DownloadDocument6 pagesDownloadanip amirNo ratings yet

- HOBO Accounting BeamsDocument34 pagesHOBO Accounting Beamskiki dwiNo ratings yet

- Logistics and Transportation Industry in IndiaDocument79 pagesLogistics and Transportation Industry in Indiaabdulkhaderjeelani14No ratings yet

- Journal Entry For Correction of Errors and CounterbalancingDocument9 pagesJournal Entry For Correction of Errors and CounterbalancingsharbularsNo ratings yet

- Retail Store Design (Unit IV)Document126 pagesRetail Store Design (Unit IV)Shikhar SrivastavaNo ratings yet

- Accounting L-III & IV COC 207 Multiple ChoicesDocument31 pagesAccounting L-III & IV COC 207 Multiple ChoicesYasinNo ratings yet

- CRM BrochureDocument9 pagesCRM BrochureMehdi AbdelNo ratings yet

- ServiceDocument37 pagesServiceDanica Balleta0% (2)

- TRƯƠNG THỊ QUỲNH NHƯ - ESSAY TEST - - ACC101 - IB17CDocument15 pagesTRƯƠNG THỊ QUỲNH NHƯ - ESSAY TEST - - ACC101 - IB17CTrương Thị Quỳnh NhưNo ratings yet

- Sales Midterms ReviewerDocument115 pagesSales Midterms ReviewerAnonymous fnlSh4KHIgNo ratings yet

- P5-4, 6 Dan 8Document18 pagesP5-4, 6 Dan 8ramaNo ratings yet

- 67 1 1 Accountancy Compart PaperDocument23 pages67 1 1 Accountancy Compart PaperManuj AroraNo ratings yet

- CashTOa JPDocument11 pagesCashTOa JPDarwin LopezNo ratings yet

- 04 - Audit of Payables and AccrualsDocument8 pages04 - Audit of Payables and AccrualsPhoebe WalastikNo ratings yet

- Project Cost Management Worksheet For Chapter TwoDocument5 pagesProject Cost Management Worksheet For Chapter TwoYonas AbebeNo ratings yet

- Outlet Classification Excel Eva UPDATEDocument24 pagesOutlet Classification Excel Eva UPDATEHaris PurnawanNo ratings yet

- 01 Sep 2022 To 26 Sep 2023-MinDocument33 pages01 Sep 2022 To 26 Sep 2023-MinRuloans VaishaliNo ratings yet