Professional Documents

Culture Documents

The Venture Capital Method

Uploaded by

sidthefreak809Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Venture Capital Method

Uploaded by

sidthefreak809Copyright:

Available Formats

The Venture Capital Method (VC Method) was first described by Professor Bill Sahlman at Harvard Business School

in 1987 in a case study and has been revised since. It is one of the useful methods for establishing the pre-money valuation of pre-revenue startup ventures. The concept is simplysince: Return on Investment (ROI) = Terminal (or Harvest) Value Post-money Valuation (in the case of one investment round, no subsequent investment and therefore no dilution) Then: Post-money Valuation = Terminal Value Anticipated ROI So, lets address each of these: Terminal Value is the anticipated selling price (or investor harvest value) for the company at some point down the road; lets assume 5-8 years after investment. The selling price can be estimated by establishing a reasonable expectation for revenues in the year of the sale and, based on those revenues, estimating earnings in the year of the sale from industry-specific statistics. For example, a software company with revenues of $20 million in the harvest year might be expected to have after-tax earnings of 15%, or $3 million. Using available industry specific Price/Earnings ratios, we can then determine the Terminal Value (a 15X P/E ratio for our software company would give us an estimated Terminal Value of $45 million). It is also known that software companies often sell for two times revenues, in this case, then, a Terminal Value of $40 million. OKlets split the difference. In this example, our Terminal Value is $42.5 million. Anticipated ROI: Angel investing is risky business. Based on the Wiltbank Study, investors should expect a 27% IRR in six years. Most angels understand that half of new ventures fail and the best an investor can expect from nine of ten investments is return of capital for a portfolio of ten. Consequently, the tenth investment must be a home run of 20X or more. Since investors do not know which of the ten will be the homerun, all investments must demonstrate the possibility of a 10X-30X return. Lets assume 20X for purposes of this example. Assuming our software entrepreneurs needs $500,000 to achieve positive cash flow and will grow organically thereafter, heres how we calculate the Pre-money Valuation of this transaction: From above: Post-money Valuation = Terminal Value Anticipated ROI = $42.5 million 20X Post-money Valuation = $ 2.125 million Pre-money Valuation = Post-money Valuation Investment = $2.125 $0.5 million Pre-money Valuation = $1.625 million OKbut what if the investors anticipate the need for subsequent investment? I have seen some complex methods for accommodating anticipated dilution, but here is an easy way to adjust the pre-money valuation of the current round. Reduce the pre-money valuation (above) by the estimated level of dilution from later investors. If investors in this round anticipate eventually being diluted by half, the pre-money valuation for the current round would be about $800,000. If only 30% dilution is anticipated, reduce the pre-money valuation of this round by 30% to about $1.1 million.

Most venture capital investment scenarios involve investment in an early stage company that is showing great promise, but typically does not have a long track record and its earnings prospects are perhaps volatile and highly uncertain. The initial years following the venture capital investment could well involve projected losses. The venture capital method of valuation recognizes these realities and focuses on the projected value of the company at the planned exit date of the venture capitalist. The steps involved in a typical valuation analysis involving the venture capital method follow. Step 1: Estimate the Terminal Value The terminal value of the company is estimated at a specified future point in time. That future point in time is the planned exit date of the venture capital investor, typically 4-7 years after the investment is made in the company. The terminal value is normally estimated by using a multiple such as a priceearnings ratio applied to the projected net income of the company in the projected exit year. Step 2: Discount the Terminal Value to Present Value In the net present value method, the firms weighted average cost of capital (WACC) is used to calculate the net present value of annual cash flows and the terminal value. In the venture capital method, the venture capital investor uses the target rate of return to calculate the present value of the projected terminal value. The target rate of return is typically very high (30-70%) in relation to conventional financing alternatives. Step 3: Calculate the Required Ownership Percentage The required ownership percentage to meet the target rate of return is the amount to be invested by the venture capitalist divided by the present value of the terminal value of the company. In this example, $5 million is being invested. Dividing by the $17.5 million present value of the terminal value yields a required ownership percentage of 28.5%. The venture capital investment can be translated into a price per share as follows. The company currently has 500,000 shares outstanding, which are owned by the current owners. If the venture capitalist will own 28.5% of the shares after the investment (i.e. 71.5% owned by the existing owners), the total number of shares outstanding after the investment will be 500,000/0.715 = 700,000 shares. Therefore the venture capitalist will own 200,000 of the 700,000 shares. Since the venture capitalist is investing $5.0 million to acquire 200,000 shares the price per share is $5.0/200,000 or $25 per share. Under these assumptions the pre-investment or pre-money valuation is 500,000 shares x $25 per share or $12.5 million and the post-investment or post-money valuation is 700,000 shares x $25 per share or $17.5 million. Step 4: Calculate Required Current Ownership % Given Expected Dilution due to Future Share Issues

The calculation in Step 3 assumes that no additional shares will be issued to other parties before the exit of venture capitalist. Many venture companies experience multiple rounds of financing and shares are also often issued to key managers as a means of building an effective, motivated management team. The venture capitalist will often factor future share issues into the investment analysis. Given a projected terminal value at exit and the target rate of return, the venture capitalist must increase the ownership percentage going into the deal in order to compensate for the expected dilution of equity in the future. The required current ownership percentage given expected dilution is calculated as follows: Required Current Ownership = Required Final Ownership divided by the Retention Ratio

You might also like

- NYSF Walmart TemplateDocument50 pagesNYSF Walmart TemplateTung Ngo100% (2)

- Founders Pocket Guide Cap TableDocument10 pagesFounders Pocket Guide Cap TableVenkatesh Mahalingam100% (1)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Investment Memo: NVSTRDocument8 pagesInvestment Memo: NVSTRAnthony Bellafiore100% (3)

- Venture Capital Deal Terms - A Guide To Negotiating and Structuring Venture Capital TransactionsDocument208 pagesVenture Capital Deal Terms - A Guide To Negotiating and Structuring Venture Capital Transactionskamini88No ratings yet

- To Buy or Not To Buy - Issues and Considerations Surrounding Share RepurchaseDocument24 pagesTo Buy or Not To Buy - Issues and Considerations Surrounding Share Repurchasepjs15No ratings yet

- Sample Investment Term SheetDocument10 pagesSample Investment Term SheetBrrrody100% (2)

- Venture CapitalDocument5 pagesVenture CapitalMichel KropfNo ratings yet

- Venture Capital ValuationDocument8 pagesVenture Capital Valuationgnachev_4100% (4)

- Bowne VentureCapital GuidebookDocument152 pagesBowne VentureCapital GuidebookVipul Desai100% (2)

- LinkedIn Bessemer Venture Partners PDFDocument7 pagesLinkedIn Bessemer Venture Partners PDFAnkit Goel100% (1)

- The Way of the VC: Having Top Venture Capitalists on Your BoardFrom EverandThe Way of the VC: Having Top Venture Capitalists on Your BoardNo ratings yet

- VC financing process stagesDocument11 pagesVC financing process stagessanabaghlaNo ratings yet

- A Guide To Venture Capital in The Middle East and North Africa1Document40 pagesA Guide To Venture Capital in The Middle East and North Africa1moemikatiNo ratings yet

- Handbook of Venture CapitalDocument455 pagesHandbook of Venture CapitalAlabancheto100% (3)

- How to Evaluate Startup IdeasDocument36 pagesHow to Evaluate Startup IdeasShatir Launda0% (1)

- Leading Cryptoart Marketplace SuperRareDocument2 pagesLeading Cryptoart Marketplace SuperRareAshish Rp100% (1)

- VC Introduction and Players OverviewDocument35 pagesVC Introduction and Players Overviewblake0528100% (1)

- Private EquityDocument293 pagesPrivate EquityKumar Gaurav100% (4)

- Ey Educate To EmpowerDocument52 pagesEy Educate To Empowersidthefreak809No ratings yet

- Canon 80D InvoiceDocument1 pageCanon 80D Invoicesidthefreak809No ratings yet

- MFRS133-LECTURE NOTES 1-FAR570 For StudentsDocument20 pagesMFRS133-LECTURE NOTES 1-FAR570 For StudentsJICNo ratings yet

- Start-Up Valuation Clinic: Venture Capital SeriesDocument18 pagesStart-Up Valuation Clinic: Venture Capital SeriesRajeev GulrajaniNo ratings yet

- Venture CapitalDocument34 pagesVenture CapitalAnu NigamNo ratings yet

- Stages of Venture Capital FinancingDocument7 pagesStages of Venture Capital FinancingcoolchethanNo ratings yet

- Financing and Valuing Your StartupDocument34 pagesFinancing and Valuing Your StartupMaximillian HeartwoodNo ratings yet

- Investment Process at VC FirmsDocument60 pagesInvestment Process at VC FirmsEvgeniy Shlieffier100% (1)

- Early-Stage Startup Valuation - Jeff FaustDocument15 pagesEarly-Stage Startup Valuation - Jeff FausthelenaNo ratings yet

- The Venture Capital Method: How VCs Determine Required OwnershipDocument19 pagesThe Venture Capital Method: How VCs Determine Required OwnershipHoang KimNo ratings yet

- Study On Venture CapitalDocument31 pagesStudy On Venture CapitalShaheen Books50% (2)

- 7 M&A Documents Demystified GuideDocument30 pages7 M&A Documents Demystified Guidewhaza789No ratings yet

- Private Equity QuestionsDocument74 pagesPrivate Equity QuestionsKumar PrashantNo ratings yet

- BCG - Corporate Venture Capital (Oct - 2012)Document21 pagesBCG - Corporate Venture Capital (Oct - 2012)ddubyaNo ratings yet

- Venture CapitalDocument48 pagesVenture CapitalErick Mcdonald100% (2)

- First Round Capital Slide Deck PDFDocument10 pagesFirst Round Capital Slide Deck PDFEmily StanfordNo ratings yet

- Venture Capital - Fund Raising and Fund StructureDocument52 pagesVenture Capital - Fund Raising and Fund StructureSimon ChenNo ratings yet

- Venture CapitalDocument51 pagesVenture Capitaljravish100% (6)

- IAVC - Venture Capital Training PDFDocument77 pagesIAVC - Venture Capital Training PDFvikasNo ratings yet

- The Startup To Venture Capital Financing StoryDocument8 pagesThe Startup To Venture Capital Financing StoryBlueBook100% (2)

- Venture Capital Fund and Venture Capital FinancingDocument5 pagesVenture Capital Fund and Venture Capital Financingpavitra AcharyaNo ratings yet

- How Do Private Equity Investors Create Value - 2006 - Ernst and YoungDocument12 pagesHow Do Private Equity Investors Create Value - 2006 - Ernst and YoungAsiaBuyoutsNo ratings yet

- PitchBook 2H 2014 VC Valuations and Trends ReportDocument16 pagesPitchBook 2H 2014 VC Valuations and Trends ReportsunnypankajNo ratings yet

- Various Stages of Venture Capital FinancingDocument19 pagesVarious Stages of Venture Capital Financingjoy9crasto100% (2)

- Wharton Venture CapitalDocument9 pagesWharton Venture CapitalMarthy RavelloNo ratings yet

- Startup ValuationDocument55 pagesStartup ValuationJose Antonio Vega100% (1)

- How To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldDocument12 pagesHow To Set Up A KPI Dashboard For Your Pre-Seed and Seed Stage Startup - Alex IskoldLindsey SantosNo ratings yet

- 04 - VC Fund PerformanceDocument22 pages04 - VC Fund Performancejkkkkkkkkkretretretr100% (1)

- Venture Capital - MithileshDocument88 pagesVenture Capital - MithileshTejas BamaneNo ratings yet

- Fund Structuring-NDADocument77 pagesFund Structuring-NDAVishal MishraNo ratings yet

- Private Equity Insiders GuideDocument13 pagesPrivate Equity Insiders GuidemsmetoNo ratings yet

- Guide To Venture Capital 2011Document35 pagesGuide To Venture Capital 2011graceenggint8799No ratings yet

- Inside The Black Box of Venture CapitalDocument77 pagesInside The Black Box of Venture Capitaljeffan123No ratings yet

- Valuation Methods for Startups Under 40 CharactersDocument16 pagesValuation Methods for Startups Under 40 CharactersVaidehi sonawani50% (2)

- Venture CapitalDocument7 pagesVenture CapitalRag LakNo ratings yet

- Limited PartnersDocument2 pagesLimited PartnersDavid TollNo ratings yet

- Stages of Company Development and Investor TypesDocument5 pagesStages of Company Development and Investor TypesLuis DiazNo ratings yet

- Private EquityDocument26 pagesPrivate EquitySumitasNo ratings yet

- The Handbook of Financing GrowthDocument6 pagesThe Handbook of Financing GrowthJeahMaureenDominguezNo ratings yet

- How a VC Fund Works: Structure, Returns & What Founders Should KnowDocument5 pagesHow a VC Fund Works: Structure, Returns & What Founders Should KnowKanya RetnoNo ratings yet

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDocument14 pagesPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellNo ratings yet

- TVCN - Venture Capital Guide For TanzaniaDocument37 pagesTVCN - Venture Capital Guide For TanzaniaAnonymous iFZbkNw100% (1)

- Raising Angel & Venture Capital Finance PDFDocument238 pagesRaising Angel & Venture Capital Finance PDFvikasdeepNo ratings yet

- Investthesis 160425213014Document32 pagesInvestthesis 160425213014OblackNo ratings yet

- Guide Venture CapitalDocument22 pagesGuide Venture CapitalAnand ArivukkarasuNo ratings yet

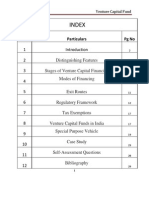

- Venture Capital Fund ProjectDocument29 pagesVenture Capital Fund ProjectAdii AdityaNo ratings yet

- Rent Agreement 2022-2023Document10 pagesRent Agreement 2022-2023sidthefreak809No ratings yet

- Final Invoice for 1 room hotel stayDocument1 pageFinal Invoice for 1 room hotel staysidthefreak809No ratings yet

- Atcae Audit Updates - 1Document8 pagesAtcae Audit Updates - 1sidthefreak809No ratings yet

- Learning Tracker - Week 5 & 6Document4 pagesLearning Tracker - Week 5 & 6sidthefreak809No ratings yet

- OnePlus Service Centres India PDFDocument3 pagesOnePlus Service Centres India PDFsidthefreak809No ratings yet

- TYBBA-Investment Analysis & Portfolio Management (Finance Elective)Document4 pagesTYBBA-Investment Analysis & Portfolio Management (Finance Elective)sidthefreak809No ratings yet

- Order ID 4758803723Document1 pageOrder ID 4758803723sidthefreak809No ratings yet

- Learning Tracker - Week 3 & 4Document5 pagesLearning Tracker - Week 3 & 4sidthefreak809No ratings yet

- Atcae Audit Updates - 1Document8 pagesAtcae Audit Updates - 1sidthefreak809No ratings yet

- PEDICON 2019 Delegate CertificateDocument2 pagesPEDICON 2019 Delegate Certificatesidthefreak809No ratings yet

- Atcae Audit Updates - 1Document8 pagesAtcae Audit Updates - 1sidthefreak809No ratings yet

- IIM Indore Fellow Profile Siddharth Jain Finance AccountingDocument1 pageIIM Indore Fellow Profile Siddharth Jain Finance Accountingsidthefreak809No ratings yet

- Cat 2016 Score Card: Common Admission Test (Cat) 2016 Indian Institutes of ManagementDocument1 pageCat 2016 Score Card: Common Admission Test (Cat) 2016 Indian Institutes of Managementsidthefreak809No ratings yet

- A Theory of Merger-Driven IPOsDocument40 pagesA Theory of Merger-Driven IPOssidthefreak809No ratings yet

- Do Banks Have A FutureDocument38 pagesDo Banks Have A Futuresidthefreak809No ratings yet

- Comparison of CAPM & APTDocument31 pagesComparison of CAPM & APTRikesh Daliya100% (3)

- Siddharth 2017FPM016Document3 pagesSiddharth 2017FPM016sidthefreak809No ratings yet

- List of Courses Received For Term-II 2017 BatchDocument4 pagesList of Courses Received For Term-II 2017 Batchsidthefreak809No ratings yet

- PGP+FPM Term III Time TableDocument6 pagesPGP+FPM Term III Time Tablesidthefreak809No ratings yet

- Employee Transfer Request PDFDocument1 pageEmployee Transfer Request PDFsidthefreak809No ratings yet

- CV-Dr. Dilip JainDocument1 pageCV-Dr. Dilip Jainsidthefreak809No ratings yet

- Employee Transfer Request PDFDocument1 pageEmployee Transfer Request PDFsidthefreak809No ratings yet

- MenuDocument2 pagesMenusidthefreak809No ratings yet

- Siddharth JainDocument1 pageSiddharth Jainsidthefreak809No ratings yet

- Employee Transfer Request PDFDocument1 pageEmployee Transfer Request PDFsidthefreak809No ratings yet

- MenuDocument2 pagesMenusidthefreak809No ratings yet

- A Critical Review of Modigliani and Miller's Theorem of Capital StructureDocument11 pagesA Critical Review of Modigliani and Miller's Theorem of Capital Structurea230820551100% (4)

- 2017FPM0200Document2 pages2017FPM0200sidthefreak809No ratings yet

- Multiple ChoiceDocument6 pagesMultiple ChoicelllllNo ratings yet

- Acca f7Document20 pagesAcca f7Sam MahNo ratings yet

- Chapter 10 Subsidiary Preferred StockDocument28 pagesChapter 10 Subsidiary Preferred StockNicolas ErnestoNo ratings yet

- FAR570 Topic 2 EARNINGS PER SHAREDocument25 pagesFAR570 Topic 2 EARNINGS PER SHARE2022920039No ratings yet

- UntitledDocument18 pagesUntitledjake ruthNo ratings yet

- ZBB Energy Corporation: Form S-1Document53 pagesZBB Energy Corporation: Form S-1Ankur DesaiNo ratings yet

- Understanding Rights Issues - InvestopediaDocument4 pagesUnderstanding Rights Issues - InvestopediaZekria Noori AfghanNo ratings yet

- Convertible Bonds ExplainedDocument34 pagesConvertible Bonds ExplainedAsmae KhamlichiNo ratings yet

- 2-1 Accounting ReviewerDocument15 pages2-1 Accounting ReviewerJulienne S. RabagoNo ratings yet

- PAS 32: Financial Instruments - Presentation (Questions)Document6 pagesPAS 32: Financial Instruments - Presentation (Questions)LEIGHANNE ZYRIL SANTOSNo ratings yet

- Curefoods Board CTC Allotment of CCPS PDFDocument18 pagesCurefoods Board CTC Allotment of CCPS PDFAbhishekShubhamGabrielNo ratings yet

- FIN 600 - Financial Analysis InfoDocument37 pagesFIN 600 - Financial Analysis InfoVipulNo ratings yet

- Book Value Per ShareDocument2 pagesBook Value Per ShareShe Rae PalmaNo ratings yet

- 100 Top Banking Interview Questions and How To Answer ThemDocument10 pages100 Top Banking Interview Questions and How To Answer ThemhusokijemailurenetNo ratings yet

- How To Choose The Best Funding Path For Your Startup - Lighter CapitalDocument17 pagesHow To Choose The Best Funding Path For Your Startup - Lighter Capitalyousef0% (1)

- Capital Structure Theory and ApplicationsDocument288 pagesCapital Structure Theory and ApplicationsGen AbulkhairNo ratings yet

- Y Combinator's Pocket Guide To Seed FundraisingDocument1 pageY Combinator's Pocket Guide To Seed FundraisingsarahansaripkNo ratings yet

- MBA Competency Exam 3 Spring 2011 PDFDocument7 pagesMBA Competency Exam 3 Spring 2011 PDFSankalan GhoshNo ratings yet

- Financial Reporting Analysis: Income Statements, Balance Sheets, and Cash Flow Statements AnswersDocument101 pagesFinancial Reporting Analysis: Income Statements, Balance Sheets, and Cash Flow Statements AnswersMayura KatariaNo ratings yet

- ACCT3103 ppt5Document73 pagesACCT3103 ppt5Nicholas LeeNo ratings yet

- MGMT2023 Lecture 7 STOCK VALUATION - Parts I, II IIIDocument86 pagesMGMT2023 Lecture 7 STOCK VALUATION - Parts I, II IIIIsmadth2918388No ratings yet

- Basic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesDocument3 pagesBasic EPS Diluted EPS: Basic EPS Net Income Preferred Dividends Weighted Average of Ordinary SharesRenz AlconeraNo ratings yet

- Delta Corp 2011Document144 pagesDelta Corp 2011RahulSatijaNo ratings yet

- c12 - T3-Key Bai Tap Sach Ias 33 - Gui SVDocument4 pagesc12 - T3-Key Bai Tap Sach Ias 33 - Gui SVDuongHaNo ratings yet

- CH - 03financial Statement Analysis Solution Manual CH - 03Document63 pagesCH - 03financial Statement Analysis Solution Manual CH - 03OktarinaNo ratings yet