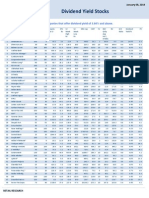

Company

Current Price (Rs)

% Change

Volume

Equity

Face Value

Market Cap (Rs Cr)

Tata Consultancy

2,188.30

+0.46

52849

195.87

4,28,622.32

Reliance Inds.

810.40

-0.25

160983

3,231.00

10

2,61,840.24

ITC Ltd.

321.90

+0.64

120076

793.55

2,55,443.75

ONGC

282.05

0.00

115927

4,277.76

2,41,308.44

Infosys

3,782.70

+0.85

104926

286.00

2,16,370.44

HDFC Bank

670.80

+0.09

101354

478.92

1,60,629.77

Coal India Ltd.

246.35

-2.26

202935

6,316.36

10

1,55,603.53

Wipro Ltd

595.15

+2.95

161151

493.10

1,46,734.23

Tata Motors Ltd.

398.60

+0.50

311480

643.78

1,28,305.35

Sun Pharma.

618.60

-0.28

337770

207.12

1,28,124.43

HDFC

811.00

+0.04

80579

311.85

1,26,455.18

Hindustan Unilever L

554.20

-0.11

47224

216.26

1,19,851.29

ICICI Bank

1,030.70

-0.53

197482

1,154.59

10

1,19,003.59

Bharti Airtel

287.35

+1.57

806919

1,998.70

1,14,865.29

HCL Technologies

1,548.95

+1.18

115831

139.77

1,08,248.37

SBI

1,506.75

-0.26

232746

684.03

10

1,03,066.22

L&T

1,088.15

+0.61

191898

185.21

1,00,768.13

NTPC

115.80

-1.07

1753034

8,245.46

10

95,482.43

Cairn India Ltd.

324.60

-0.03

44587

1,910.80

10

62,024.57

Indian Oil Corp

247.45

+1.41

68728

2,427.95

10

60,079.62

Axis Bank Ltd.

1,235.15

-0.03

196505

469.25

10

57,959.41

Mahi. & Mahi

942.00

-0.10

65344

295.16

55,608.14

Bajaj Auto Ltd.

1,902.00

+2.14

24836

289.37

10

55,038.17

�Tata Consultancy Services Limited

Tata Consultancy Services Limited (TCS) is an Indian multinational information

technology (IT) services, business process and consulting company headquartered

in Mumbai, Maharashtra. TCS operates in 46 countries and has 199 branches across the

world. It is a subsidiary of the Tata Group and is listed on the Bombay Stock

Exchange and the National Stock Exchange of India. TCS is the largest Indian company

bymarket capitalization and is the largest India-based IT services company by 2013

revenues.TCS is ranked 40th overall in the ForbesWorld's Most Innovative Companies

ranking, making it both the highest-ranked IT services company and the top Indian

company.

2,182.05-6.25 [0.3]%

BSE

Day's High | Low

Day's Volumes

52Wk High | Low

Open Price

Turnover

2,185.80-3.10 [0.1]%

Feb 26,10:57

2,195.00 | 2,180.45

10,977

2,384.20 | 1,364.00

2,191.00

115,836,688.00

NSE

Day's High | Low

Day's Volumes

52Wk High | Low

Open Price

Turnover

Feb 26,10:50

2,195.00 | 2,182.20

348,730

2,384.80 | 1,365.00

2,194.00

3,621,772,652.95

Deliverable Vol.

12,431

Deliverable Vol.

1,357,237

6 Mth. Avg. Vol.

111,693.12

6 Mth. Avg. Vol.

1,259,389.46

�Key Ratios

Years

Debt-Equity Ratio

Long Term Debt-Equity Ratio

Current Ratio

Fixed Assets

Inventory

Debtors

Interest Cover Ratio

PBIDTM (%)

PBITM (%)

PBDTM (%)

CPM (%)

APATM (%)

ROCE (%)

RONW (%)

PE

EBIDTA

DivYield

PBV

EPS

Mar-13

0.0

0.0

2.1

5.9

9,241.8

4.8

513.8

34.2

32.5

34.1

28.1

26.4

53.7

44.6

25.5

16,536.7

1.4

9.5

61.6

Mar-12

0.0

0.0

1.7

5.7

8,013.6

5.5

816.0

36.9

35.1

36.9

30.6

28.8

59.3

49.5

22.5

14,070.9

2.1

9.2

51.9

Mar-11

0.0

0.0

1.6

5.4

4,819.0

7.2

435.8

31.6

29.8

31.6

27.7

25.9

49.9

43.8

32.6

9,258.3

1.2

11.9

36.3

Mar-10

0.0

0.0

1.6

5.0

1,942.3

6.5

668.8

29.7

27.7

29.7

26.4

24.4

44.6

39.5

30.9

6,849.3

2.6

10.2

25.3

Mar-09

0.0

0.0

1.9

5.9

1,312.6

6.0

691.8

24.8

23.0

24.8

22.8

21.0

42.0

38.7

11.9

5,564.6

2.6

4.0

45.5

�Reliance Industries Limited

Reliance Industries Limited (RIL) is an Indian conglomerate holding

company headquartered in Mumbai, Maharashtra, India. The company operates in five

major segments: exploration and production, refining and

marketing, petrochemicals, retail and telecommunications.

RIL is the second-largest publicly traded company in India by market capitalization and

is the second largest company in India by revenue after the state-run Indian Oil

Corporation.[5] The company is ranked No. 107 on the Fortune Global 500 list of the

world's biggest corporations, as of 2013. RIL contributes approximately 14% of India's

total exports.

810.800.25 (0.0%)

810.700.30 (0.0%)

BSE

Feb 26,12:01

NSE

Day's High | Low

813.90 | 809.25

Day's High | Low

Day's Volumes

45,485

Day's Volumes

52Wk High | Low

927.90 | 765.00

52Wk High | Low

Open Price

812.75

Open Price

Turnover

130,693,693.00

Turnover

Deliverable Vol.

73,176

Deliverable Vol.

1,067,323

6 Mth. Avg. Vol.

313,950.35

6 Mth. Avg. Vol.

2,687,479.22

Feb 26,11:55

813.60 | 809.10

698,166

927.90 | 763.90

811.00

1,306,981,466.15

�Key Ratios

Years

Mar-13

Mar-12

Mar-11

Mar-10

Mar-09

Debt-Equity Ratio

0.4

0.4

0.5

0.6

0.6

Long Term Debt-Equity Ratio

0.3

0.3

0.4

0.5

0.5

Current Ratio

1.3

1.2

1.0

1.1

1.1

Fixed Assets

1.8

1.6

1.2

1.2

1.2

Inventory

9.4

10.3

9.1

9.6

10.1

24.5

19.0

17.8

24.7

27.1

9.7

10.7

11.8

11.3

11.6

Debtors

Interest Cover Ratio

PBIDTM (%)

10.5

11.7

15.9

16.5

17.3

PBITM (%)

7.9

8.4

10.7

11.3

13.8

PBDTM (%)

9.6

10.9

15.0

15.5

16.2

CPM (%)

8.2

9.3

13.1

13.3

14.0

APATM (%)

5.7

5.9

7.8

8.1

10.5

ROCE (%)

12.2

12.8

13.6

11.9

13.2

RONW (%)

12.3

13.0

14.8

13.4

15.7

PE

12.2

12.5

17.2

22.1

16.0

EBIDTA

38,785.0

39,811.0

41,178.0

33,041.2

25,373.8

DivYield

1.1

1.0

0.7

0.6

0.8

PBV

1.4

1.5

2.4

2.7

2.1

EPS

63.7

60.0

60.8

48.6

95.2