Professional Documents

Culture Documents

Quarterly Market Report

Quarterly Market Report

Uploaded by

hozaeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quarterly Market Report

Quarterly Market Report

Uploaded by

hozaeCopyright:

Available Formats

Quarterly

Market

Report

3rd QUARTER

July–September, 2009

Prepared exclusively

for use by

Beverly-Hanks

& Associates

29100046 BevHanksQuarterly.indd 1 10/16/09 12:34 PM

Your source for

the most up-to-date

real estate information

A personal message

from Owner & President

Neal Hanks, Jr.

I

am pleased to report the positive momentum

which began in the second quarter of this year has

continued locally and nationwide into the third quarter

of 2009. The statistics in the fourth quarter should show continued improvement over the prior year as

the fourth quarter of 2008 was one of the most difficult in recent history.

The statistical gain in unit sales is encouraging and confirms to us that we have reached the bottom

of the two year slide in gross sales numbers and are in fact now moving in a positive direction. This is

great news!

A thorough analysis of the statistics, however, reveals that the improvements experienced to date are

moderate and challenges still lie ahead. Numbers reported on the overall market tell two very different

stories. Sales in the lower price ranges, under 250 thousand dollars, are up nationwide and inventory

in this price range has been depleted in many markets and is currently at almost normal levels here (6

months of inventory is considered a balanced market). Sales in the moderate to upper price ranges,

however, have continued to languish. In fact sales nationwide for price points above 250 thousand are

down, significantly. This is also the case for properties over 1 million dollars.

The data contained in this report clearly demonstrates the stark difference in sales and inventory

levels by price range. Pricing in the real estate business, like most others, is significantly impacted

by supply and demand. In the lower price points, with brisk sales and declining inventory, pricing has

stabilized and is in fact on an upward trajectory in many markets. Home sales in the upper tier remain

soft with abundant inventory that is moving at a much slower sales pace. As always, pricing is subject

to variables such as location, condition, neighborhood desirability, and stability etc. but the underlying

economic fundamentals cannot be ignored. In order to move property in today’s competitive

environment, it must be well priced, well positioned and aggressively marketed.

Many folks now recognized that now is in fact a great time to buy and are reentering the marketplace.

It remains a buyer’s market at present, but sellers who recognize this fact and position their properties

accordingly are having success in selling them. At Beverly-Hanks & Associates, our team of highly

trained professionals stands ready to assist you in making wise decisions whether buying or selling

real estate in this evolving marketplace.

Warm Regards

W. Neal Hanks, Jr.

29100046 BevHanksQuarterly.indd 2 10/16/09 12:34 PM

J U LY – S E P T E M B E R

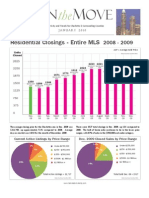

Number of Homes Sold

COUNTY 2009 2008 % change

Buncombe 1,585 2,019 –21.5.%

Haywood 364 443 –17.8%

Year to Date 2009

Henderson 765 971 –21.2%

Madison 55 85 –35.3%

Polk 78 83 –6.0%

Rutherford 134 131 +2.3%

Transylvania 162 205 –21.0%

*TOTAL 3,143 3,937 –20%

Average Home Selling Price

COUNTY 2009 2008 % change

Buncombe $260,418 $276,560 –5.8%

Year to Date 2009

Haywood $209,012 $219,734 –4.9%

Henderson $212,589 $235,033 –9.5%

Madison $210,803 $229,300 –8.1%

Polk $182,038 $297,820 –38.9%

Rutherford $194,153 $227,928 –14.8%

Transylvania $276,443 $315,237 –12.3%

*AVERAGE $220,779 $257,373 –14.2%

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service

does not guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real

estate activity in the market. These figures are based upon actual closed transactions as reported through the above mentioned service.

* These totals and averages include all sales reported through the North Carolina Mountains Multiple Listing Service.

29100046 BevHanksQuarterly.indd 3 10/16/09 12:34 PM

Quarterly Market Report

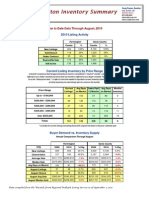

Housing Supply vs. Demand

Western North Carolina Region

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 22 21 19 22 25 26 25 34 25 219 24.3 140 5.8

$75,000–$149,999 42 61 87 88 79 102 110 124 110 803 89.2 1.395 15.6

$150,000–$199,999 46 55 88 66 73 95 123 97 92 735 81.7 1.320 16.2

$200,000–$249,999 37 38 53 53 71 62 78 70 69 531 59.0 1.230 20.8

$250,000–$299,999 15 25 27 27 25 51 52 40 40 302 33.6 1.164 34.6

$300,000–$349,999 13 11 22 14 23 33 26 29 23 194 21.6 671 31.1

$350,000–$399,999 10 14 19 11 18 25 1 20 26 164 18.2 727 39.9

$400,000–$449,999 10 12 9 8 9 16 17 9 21 111 12.3 365 29.7

$450,000–$499,999 7 8 9 6 6 7 11 4 6 65 7.2 399 55.4

$500,000–$549,999 3 5 3 4 8 5 4 7 7 46 5.1 205 40.2

$550,000–$599,999 2 3 2 1 3 7 3 1 2 24 2.7 271 100.4

2009 Totals

$600,000–$699,000 2 5 6 1 3 5 3 2 6 33 3.7 303 81.9

$700,000–$799,000 1 3 0 3 0 4 6 1 4 22 2.4 198 82.5

$800,000–$899,999 2 1 3 3 1 1 6 2 4 23 2.6 139 53.5

$900,000–$999,999 1 2 1 1 3 1 0 1 1 11 1.2 143 119.2

$1 Million–$1.9 Million 3 0 3 4 2 1 6 3 5 27 3.0 434 144.7

$2 Million–$2.9 Million 1 0 0 0 0 0 0 0 0 1 0.1 84 840

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 36 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 10 unknown

TOTALS 217 265 351 312 349 441 491 444 441 3,311 367.9 9,234 25.1

Buncombe County

YTD

YTD 7/08/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 4 4 3 5 9 9 5 7 8 54 6.0 36 6

$75,000–$149,999 13 20 31 29 30 48 51 54 45 324 36.0 438 12.2

$150,000–$199,999 21 32 49 30 37 52 67 49 56 393 43.7 511 11.7

$200,000–$249,999 20 27 34 25 28 23 33 24 34 248 27.6 465 16.8

$250,000–$299,999 7 14 14 17 11 23 23 23 20 160 17.8 434 24.4

$300,000–$349,999 6 5 11 7 13 20 17 16 7 102 11.3 251 22.2

$350,000–$399,999 6 7 13 7 8 12 12 6 13 84 9.3 258 27.7

$400,000–$449,999 6 7 6 5 6 10 12 7 14 73 8.1 159 19.6

$450,000–$499,999 3 3 6 4 4 5 4 2 3 34 3.8 155 40.8

$500,000–$549,999 1 3 1 3 5 5 2 7 4 31 3.4 77 22.6

$550,000–$599,999 1 2 2 1 2 2 1 1 1 13 1.4 91 65

2009 Totals

$600,000–$699,000 2 3 5 1 1 3 1 1 3 20 2.2 93 42.3

$700,000–$799,000 1 3 0 1 0 3 5 0 2 15 1.7 80 47.1

$800,000–$899,999 2 1 2 2 0 1 4 0 2 14 1.6 58 36.2

$900,000–$999,999 1 2 1 1 2 1 0 0 1 9 1.0 61 61

$1 Million–$1.9 Million 2 0 3 4 1 1 2 1 4 18 2.0 212 106

$2 Million–$2.9 Million 1 0 0 0 0 0 0 0 0 1 0.1 28 280

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 18 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 3 unknown

TOTALS 97 133 184 142 157 218 236 198 217 1,585 176.1 3,428 19.5

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service does not

guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real estate activity in the

market. These figures are based upon actual closed transactions as reported through the above mentioned service.

** Absorption Rate: The “projected” months it will take to absorb all of the listings in a particular price range.

29100046 BevHanksQuarterly.indd 4 10/16/09 12:34 PM

Henderson County

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 2 6 1 5 3 6 1 8 2 34 3.8 24 6.3

$75,000–$149,999 12 22 19 31 23 28 29 28 36 228 25.3 287 11.3

$150,000–$199,999 15 11 20 20 24 23 23 23 20 179 19.9 280 14.1

$200,000–$249,999 6 3 7 14 17 22 21 20 18 138 15.3 287 18.8

$250,000–$299,999 3 6 9 8 7 13 8 8 6 68 7.6 230 30.3

$300,000–$349,999 3 3 3 5 5 6 6 4 6 41 4.6 120 26.1

$350,000–$399,999 0 4 3 3 4 5 6 4 7 36 4.0 143 35.7

$400,000–$449,999 1 2 2 2 1 5 3 0 2 18 2.0 58 29

$450,000–$499,999 2 2 0 2 1 1 4 1 1 14 1.6 74 46.2

$500,000–$549,999 1 2 0 0 1 0 1 0 1 6 0.7 40 57.1

$550,000–$599,999 0 0 0 0 1 1 0 0 0 2 0.2 55 275

$600,000–$699,000 0 2 0 0 1 2 1 0 2 8 0.9 53 58.9

2009 Totals

$700,000–$799,000 0 0 0 1 0 1 0 0 0 2 0.2 34 170

$800,000–$899,999 0 0 0 0 0 0 1 1 0 2 0.2 26 130

$900,000–$999,999 0 0 0 0 0 0 0 1 0 0 0 17 unknown

$1 Million–$1.9 Million 1 0 0 0 0 0 0 1 0 2 0.2 40 200

$2 Million–$2.9 Million 0 0 0 0 0 0 0 0 0 0 0 9 unknown

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 4 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 2 unknown

TOTALS 46 63 62 91 87 113 104 99 101 769 85.4 1,783 20.9

Haywood County

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 5 1 6 4 5 5 5 7 4 42 4.7 19 4.0

$75,000–$149,999 9 7 12 8 11 11 18 15 11 102 11.3 224 19.8

$150,000–$199,999 4 7 5 5 3 8 13 12 4 61 6.8 187 27.5

$200,000–$249,999 5 2 3 6 15 8 10 10 7 66 7.3 168 23

$250,000–$299,999 3 1 1 1 4 3 7 7 7 34 3.8 201 52.9

$300,000–$349,999 1 1 3 1 1 2 1 4 4 18 2.0 96 48

$350,000–$399,999 4 2 0 0 2 2 1 5 2 18 2.0 105 52.5

$400,000–$449,999 1 2 0 0 2 0 0 0 3 8 0.9 45 50

$450,000–$499,999 2 2 2 0 0 0 0 0 0 6 0.7 54 77.1

$500,000–$549,999 0 0 1 0 0 0 0 0 1 2 0.2 31 155

$550,000–$599,999 1 0 0 0 0 0 0 0 1 2 0.2 33 165

2009 Totals

$600,000–$699,000 0 0 0 0 0 0 1 0 0 1 0.1 42 420

$700,000–$799,000 0 0 0 0 0 0 1 0 0 1 0.1 22 220

$800,000–$899,999 0 0 0 0 0 0 0 0 0 0 0 16 unknown

$900,000–$999,999 0 0 0 0 1 0 0 0 0 1 0.1 20 200

$1 Million–$1.9 Million 0 0 0 0 1 0 2 0 0 3 0.3 34 113.3

$2 Million–$2.9 Million 0 0 0 0 0 0 0 0 0 0 0 6 unknown

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 1 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 0 n/a

TOTALS 35 25 33 25 45 39 59 60 44 365 40.6 1,304 32.1

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service does not

guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real estate activity in the

market. These figures are based upon actual closed transactions as reported through the above mentioned service.

** Absorption Rate: The “projected” months it will take to absorb all of the listings in a particular price range.

29100046 BevHanksQuarterly.indd 5 10/16/09 12:34 PM

Quarterly Market Report

Housing Supply vs. Demand

Rutherford County

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 3 2 2 2 5 1 0 2 3 20 2.2 26 11.8

$75,000–$149,999 1 4 6 7 3 5 6 8 2 43 4.8 64 13.3

$150,000–$199,999 3 3 2 2 0 1 5 6 2 24 2.7 66 24.4

$200,000–$249,999 0 0 3 1 2 3 3 3 1 16 1.8 66 36.7

$250,000–$299,999 0 1 0 0 1 2 2 1 1 8 0.9 67 74.4

$300,000–$349,999 2 0 2 1 0 1 0 2 2 11 1.2 39 32.5

$350,000–$399,999 0 0 1 0 1 1 0 2 1 6 0.7 41 58.6

$400,000–$449,999 0 0 0 0 0 0 0 1 0 1 0.1 20 200

$450,000–$499,999 0 0 0 0 0 0 0 0 0 0 0 25 unknown

$500,000–$549,999 0 0 0 1 1 0 1 0 0 3 0.3 8 26.7

$550,000–$599,999 0 0 0 0 0 0 0 0 0 0 0 20 unknown

2009 Totals

$600,000–$699,000 0 0 0 0 0 0 0 0 0 0 0 17 unknown

$700,000–$799,000 0 0 0 0 0 0 0 0 0 0 0 13 unknown

$800,000–$899,999 0 0 0 0 1 0 0 0 0 1 0.1 6 60

$900,000–$999,999 0 0 0 0 0 0 0 0 0 0 0 9 unknown

$1 Million–$1.9 Million 0 0 0 0 0 0 1 0 0 1 0.1 16 160

$2 Million–$2.9 Million 0 0 0 0 0 0 0 0 0 0 0 3 unknown

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 2 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 1 unknown

TOTALS 9 10 16 14 14 14 18 25 12 132 14.7 509 34.6

Polk County

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 0 1 2 0 0 1 3 1 3 11 1.2 4 3.3

$75,000–$149,999 0 5 4 1 1 3 1 2 3 20 2.2 20 9.1

$150,000–$199,999 0 1 3 4 0 5 3 2 3 18 2.0 33 16.5

$200,000–$249,999 1 0 1 1 1 0 3 1 0 8 0.9 38 42.2

$250,000–$299,999 1 0 1 1 0 2 3 0 1 9 1.0 37 37.0

$300,000–$349,999 0 0 0 0 2 1 0 1 0 4 0.4 19 47.5

$350,000–$399,999 0 0 0 0 0 1 0 0 0 1 0.1 30 300

$400,000–$449,999 0 0 0 0 0 0 0 0 0 0 0 12 unknown

$450,000–$499,999 0 0 0 0 0 0 1 0 0 1 0.1 13 130

$500,000–$549,999 0 0 0 0 1 0 0 0 0 1 0.1 1 10

$550,000–$599,999 0 0 0 0 0 0 1 0 0 1 0.1 9 90

2009 Totals

$600,000–$699,000 0 0 0 0 0 0 0 0 0 0 0 14 unknown

$700,000–$799,000 0 0 0 0 0 0 0 0 0 0 0 6 unknown

$800,000–$899,999 0 0 0 0 0 0 0 0 0 0 0 5 unknown

$900,000–$999,999 0 0 0 0 0 0 0 0 0 0 0 7 unknown

$1 Million–$1.9 Million 0 0 0 0 0 0 0 0 0 0 0 28 unknown

$2 Million–$2.9 Million 0 0 0 0 0 0 0 0 0 0 0 12 unknown

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 1 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 1 unknown

TOTALS 2 7 11 7 5 13 15 8 10 78 8.7 290 33.3

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service does not

guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real estate activity in the

market. These figures are based upon actual closed transactions as reported through the above mentioned service.

** Absorption Rate: The “projected” months it will take to absorb all of the listings in a particular price range.

29100046 BevHanksQuarterly.indd 6 10/16/09 12:34 PM

Transylvania County

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 0 2 0 1 0 1 1 3 0 8 0.9 9 10

$75,000–$149,999 3 0 4 5 2 3 1 9 3 30 3.3 87 26.4

$150,000–$199,999 2 1 3 2 5 2 4 4 3 26 2.9 106 36.5

$200,000–$249,999 2 4 1 4 4 3 6 2 3 29 3.2 77 24.1

$250,000–$299,999 2 1 2 0 1 6 4 0 4 20 2.2 72 32.7

$300,000–$349,999 1 1 0 1 2 2 2 1 3 13 1.4 66 47.1

$350,000–$399,999 0 1 1 0 0 3 1 2 2 10 1.1 63 57.3

$400,000–$449,999 0 1 0 1 0 1 0 1 1 5 0.6 27 45

$450,000–$499,999 0 1 0 0 0 1 0 1 1 4 0.4 30 75

$500,000–$549,999 1 0 1 0 0 0 0 0 1 3 0.3 20 66.7

$550,000–$599,999 0 1 0 0 0 3 1 0 0 5 0.6 33 55

2009 Totals

$600,000–$699,000 0 0 0 0 0 0 0 1 1 2 0.2 41 205

$700,000–$799,000 0 0 0 0 0 0 0 1 2 3 0.3 18 60

$800,000–$899,999 0 0 0 1 0 0 0 0 2 3 0.3 16 53.3

$900,000–$999,999 0 0 0 0 0 0 0 0 0 0 0 14 unknown

$1 Million–$1.9 Million 0 0 0 0 0 0 0 0 1 1 0.1 51 510

$2 Million–$2.9 Million 0 0 0 0 0 0 0 0 0 0 0 16 unknown

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 6 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 2 unknown

TOTALS 11 13 12 15 14 25 20 25 27 162 18 754 41.9

Madison County

YTD

YTD 10/02/2009

Monthly Absorption

Units Active

Average Rate**

Sold Units

PRICE RANGE JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Units Sold

$0–$74,999 2 0 1 1 0 0 1 0 0 4 0.4 3 7.5

$75,000–$149,999 0 1 3 1 3 1 2 1 2 12 1.3 36 27.7

$150,000–$199,999 1 0 3 0 2 0 2 0 1 7 0.8 40 50

$200,000–$249,999 0 1 1 0 1 3 1 4 2 13 1.4 39 27.8

$250,000–$299,999 0 1 0 0 0 0 3 0 1 5 0.6 40 66.7

$300,000–$349,999 0 0 0 0 2 0 0 2 1 5 0.6 35 58.3

$350,000–$399,999 0 0 1 0 0 0 0 1 0 2 0.2 31 155

$400,000–$449,999 0 0 0 0 0 0 1 0 0 1 0.1 13 130

$450,000–$499,999 0 0 0 0 0 0 0 0 0 0 0 15 unknown

$500,000–$549,999 0 0 0 0 0 0 0 0 0 0 0 13 unknown

$550,000–$599,999 0 0 0 0 0 0 0 0 0 0 0 16 unknown

2009 Totals

$600,000–$699,000 0 0 0 0 0 0 0 0 0 0 0 17 unknown

$700,000–$799,000 0 0 0 0 0 0 0 0 0 0 0 9 unknown

$800,000–$899,999 0 0 0 0 0 0 0 0 0 0 0 2 unknown

$900,000–$999,999 0 0 0 0 0 0 0 0 0 0 0 4 unknown

$1 Million–$1.9 Million 0 0 0 0 0 0 1 0 0 0 0 16 unknown

$2 Million–$2.9 Million 0 0 0 0 0 0 0 0 0 0 0 2 unknown

$3 Million–$4.9 Million 0 0 0 0 0 0 0 0 0 0 0 1 unknown

$5 Million Plus 0 0 0 0 0 0 0 0 0 0 0 0 n/a

TOTALS 3 3 9 2 8 4 11 7 7 43 4.8 332 69.2

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service does not

guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real estate activity in the

market. These figures are based upon actual closed transactions as reported through the above mentioned service.

** Absorption Rate: The “projected” months it will take to absorb all of the listings in a particular price range.

29100046 BevHanksQuarterly.indd 7 10/16/09 12:34 PM

Quarterly Market Report

Residential Vacant Lots

with Restrictions from 0 to 3

Closed Lot/Land Sales

January–September , 2009

Transyl–

Buncombe Haywood Henderson Madison Polk rutherford NCMtnsMLS

PRICE vania

RANGE

2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008 2009 2008

$0–$100,000 78 120 41 63 56 72 14 20 3 14 31 34 34 65 270 415

$100,000–$200,000 19 25 4 15 10 29 1 2 1 2 1 6 1 6 37 89

2009 Year to Date

$200,000–$300,000 9 23 0 9 1 8 0 2 0 0 0 0 1 0 12 44

$300,000–$400,000 4 3 0 0 0 8 0 0 0 1 0 0 0 0 4 15

$400,000–$500,000 1 4 0 0 0 0 0 0 0 0 0 0 0 0 1 6

$500,000–$750,000 2 2 0 0 0 0 0 0 0 0 0 0 0 0 2 3

$750,000–$1,000,000 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 1

$1 Million+ 0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 2

TOTALS 113 179 45 87 67 117 15 24 4 17 32 41 36 71 326 575

Percentage Change –36.9% –48.3% –42.7% –37.5% –76.5% –22.0% –49.3% –43.3%

Residential Active Lot/Land Inventory 0–3 Acres

As of 10/06/09

ruther-

PRICE RANGE Buncombe Haywood Henderson Madison Polk Transylvania NCMtnsMLS

ford

$0–$100,000 867 983 670 226 178 621 532 4,453

$100,000–$200,000 477 505 398 84 68 157 240 2,020

$200,000–$300,000 212 109 86 36 33 50 96 660

$300,000–$400,000 146 43 22 5 28 34 40 342

2009 Year to Date

$400,000–$500,000 66 19 13 4 11 19 22 168

$500,000–$750,000 86 14 11 3 8 8 21 160

$7500,000–$1,000,000 35 12 4 1 1 5 11 71

$1 Million+ 38 12 7 1 2 9 20 98

TOTALS 1,927 1,697 1,211 360 319 903 982 7,972

Totals as of 07/10/09 1,631 1,310 1,062 227 257 838 734 6,467

Percentage Change 18.1% 29.5% 14.0% 58.6% 24.1% 7.8% 33.8% 23.3%

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service does

not guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real estate activity

in the market. These figures are based upon actual closed transactions as reported through the above mentioned service.

29100046 BevHanksQuarterly.indd 8 10/16/09 12:34 PM

Sold Properties

1%

$1,000,000+

Percentage of 5%

$500,000 - $999,999

Closed

Residential

Sales by Price

94.0%

Up to $499,999

$338,475,671

Properties Sold Year to Date 2009

by the Top 5 WNC Real Estate Firms

Property Types: residential, improved and unimproved

Closed Sales Volume

$189,354,651

$54,825,411 $54,079,641 $50,050,561

Keller Coldwell

Williams ReMax Banker

Professionals Prudential Mountain Kasey

Asheville Lifestyles Realty Associates

NOTE: Information as reported by the North Carolina Mountains Multiple Listing Service. The North Carolina Mountains Multiple Listing Service does

not guarantee or is in any way responsible for its accuracy. Data maintained by the Multiple Listing Service may not reflect all real estate activity

in the market. These figures are based upon actual closed transactions as reported through the above mentioned service.

29100046 BevHanksQuarterly.indd 9 10/16/09 12:34 PM

Peace

of mind.

Beverly-Hanks & Associates is proud to offer a Job Loss

Protection Program. The program assists buyers who purchase a

Beverly-Hanks listing covered by Job Loss Protection in the event

of an involuntary job loss within the first 24 months of the home

loan. Job Loss Protection, available now at Beverly-Hanks &

Associates, gives sellers a way to differentiate their property and

gives homebuyers additional security in their purchase.

Get all the details on

Job Loss Protection at

beverly-hanks.com

m

29100046 BevHanksQuarterly.indd 10 10/16/09 12:34 PM

NOW

is the time to refinance your home!

Don’t miss out on low mortgage rates - while they last!

Now Available - Best Rate in 46 Years

Monday, March 9th, 2009

6:30 - 7:30 pm Historic Rates!

Double Tree Hotel, Biltmore Village

Copyright © 2009 Mortgage-X.com. Source: www.mortgage-x.com. Reprinted with permission. The National Average Contract Mortgage Rate is derived

from the Federal Housing Finance Board’s Monthly Interest Rate Survey (MIRS) and is reported by the FHFB on a monthly basis.

Cameron Lewis Doug Bebber For additional information, please give

Direct: 828-258-1945 Direct: 828-210-2979 one of our mortgage loan officers a call.

clewis@beverly-hanks.com dbebber@beverly-hanks.com

Michael Phelan Lisa Hart

Direct: 828-654-6402 Direct: 828-674-4242

michael_phelan@beverly-hanks.com lisahart@beverly-hanks.com

29100046 BevHanksQuarterly.indd 11 10/16/09 12:34 PM

300 Executive Park

Asheville, NC 28801

3rd Quarter 2009

Market Report

Downtown Asheville 828-254-7221

South Asheville 828-684-8999

Hendersonville 828-697-0515

North Asheville 828-251-1800

www.beverly-hanks.com Weaverville 828-658-9500

Waynesville 828-452-5809

Biltmore Park 828-684-9020

Lake Lure 828-625-8846

29100046 BevHanksQuarterly.indd 12 10/16/09 12:34 PM

You might also like

- Summary of December Finance CommitteeDocument43 pagesSummary of December Finance CommitteeAthertonPOANo ratings yet

- Quarterly Market: 2Nd QuarterDocument12 pagesQuarterly Market: 2Nd Quarterhozae100% (2)

- Quarterly Market Report 1st QUARTER January-March, 2009 Prepared ExclusivelyDocument12 pagesQuarterly Market Report 1st QUARTER January-March, 2009 Prepared ExclusivelyhozaeNo ratings yet

- Quarterly Market: 3Rd QuarterDocument12 pagesQuarterly Market: 3Rd QuarterhozaeNo ratings yet

- Nest Realty's Charlottesville Real Estate Q4 2010 Market ReportDocument9 pagesNest Realty's Charlottesville Real Estate Q4 2010 Market ReportJonathan KauffmannNo ratings yet

- Quarterly Market: 2Nd QuarterDocument12 pagesQuarterly Market: 2Nd QuarterhozaeNo ratings yet

- Austin Residential Sales Report February 2011Document12 pagesAustin Residential Sales Report February 2011Bryce CathcartNo ratings yet

- Q3 10 Alameda 1.1Document1 pageQ3 10 Alameda 1.1pamoettelNo ratings yet

- N Ove: What's Driving Our Market?Document4 pagesN Ove: What's Driving Our Market?hhesterNo ratings yet

- Nest Report Charlottesville: 1st Quarter 2011Document9 pagesNest Report Charlottesville: 1st Quarter 2011Jonathan KauffmannNo ratings yet

- The Nest Report: 3rd Quarter, 2009Document10 pagesThe Nest Report: 3rd Quarter, 2009api-26005222No ratings yet

- March 09 Market WatchDocument16 pagesMarch 09 Market Watchdavid580No ratings yet

- Austin Residential Sales Report March 2011Document12 pagesAustin Residential Sales Report March 2011Bryce CathcartNo ratings yet

- Apartment Market Research Seattle 2010 3qDocument4 pagesApartment Market Research Seattle 2010 3qDave EicherNo ratings yet

- 3Q19 Southern New Jersey Office MarketDocument4 pages3Q19 Southern New Jersey Office MarketAnonymous xz5gLPdTNo ratings yet

- Real Estate Report For March, 2009Document2 pagesReal Estate Report For March, 2009longley-martins100% (2)

- Toronto Real Estate Market Report June 2010Document16 pagesToronto Real Estate Market Report June 2010Simson ChuNo ratings yet

- 2019-02 Monthly Housing Market WebinarDocument52 pages2019-02 Monthly Housing Market WebinarC.A.R. Research & Economics100% (2)

- San Mateo County Real Esetate Market Update - Feburary 2011Document4 pagesSan Mateo County Real Esetate Market Update - Feburary 2011Gwen WangNo ratings yet

- Marin Real Estate Update - Q1 2010: Single Family HomesDocument1 pageMarin Real Estate Update - Q1 2010: Single Family Homesapi-26311190No ratings yet

- Inventory Summary FarmingtonDocument1 pageInventory Summary FarmingtonCraigFrazerNo ratings yet

- 1Q20 Southern New Jersey Office Market SecuredDocument4 pages1Q20 Southern New Jersey Office Market SecuredKevin ParkerNo ratings yet

- EAL State: Falling Leaves and Falling P#cesDocument4 pagesEAL State: Falling Leaves and Falling P#cesChad LariscyNo ratings yet

- Walpole Massachusetts Realtor Local StatsDocument1 pageWalpole Massachusetts Realtor Local StatsMichael MahoneyNo ratings yet

- Counties W Blurbs - Keyes Luxury Report Q1 2023Document16 pagesCounties W Blurbs - Keyes Luxury Report Q1 2023Kevin ParkerNo ratings yet

- Washoe County 4th Quarter 2010 Market ReportDocument1 pageWashoe County 4th Quarter 2010 Market ReportNevadaHomesNo ratings yet

- Counties Q3 2023Document16 pagesCounties Q3 2023Kevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Ousing Orecast: P P: E G ADocument2 pagesOusing Orecast: P P: E G Aapi-26138061No ratings yet

- March 2019 Local Market UpdateDocument18 pagesMarch 2019 Local Market UpdateLuci EdwardsNo ratings yet

- March 2019 Housing Supply OverviewDocument7 pagesMarch 2019 Housing Supply OverviewLuci EdwardsNo ratings yet

- Real Estate Statistics For Clayton, MO Including Real Estate & Housing StatisticsDocument11 pagesReal Estate Statistics For Clayton, MO Including Real Estate & Housing StatisticskevincottrellNo ratings yet

- Farmington Update 2010 - 08Document1 pageFarmington Update 2010 - 08CraigFrazerNo ratings yet

- Austin Real Estate Market Statistics For March 2009Document15 pagesAustin Real Estate Market Statistics For March 2009Daniel PriceNo ratings yet

- Wild Card' Props Up Canadian Housing Markets Over Past Decade, Says RE/MAXDocument4 pagesWild Card' Props Up Canadian Housing Markets Over Past Decade, Says RE/MAXsladurantayeNo ratings yet

- Valleymls Mmi 2022-05Document14 pagesValleymls Mmi 2022-05Sean MagersNo ratings yet

- NMF 2018 Kansas City MF ReportDocument7 pagesNMF 2018 Kansas City MF ReportPhilip Maxwell AftuckNo ratings yet

- April Experiences Record Number of Buyers and Sellers: InsideDocument1 pageApril Experiences Record Number of Buyers and Sellers: Insideapi-27043054No ratings yet

- Beverly-Hanks & Associates: Annual Market Report 2010Document12 pagesBeverly-Hanks & Associates: Annual Market Report 2010hozaeNo ratings yet

- Minneapolis 100Document3 pagesMinneapolis 100Jason SandquistNo ratings yet

- Market Trends ReportDocument11 pagesMarket Trends ReportMike FotiouNo ratings yet

- Economic and Market Watch ReportDocument15 pagesEconomic and Market Watch ReportNevadaHomesNo ratings yet

- 2018-12 Monthly Housing Market OutlookDocument27 pages2018-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Nest Realty Charlottesville's February 2011 Market ReportDocument2 pagesNest Realty Charlottesville's February 2011 Market ReportJonathan KauffmannNo ratings yet

- Market Update: Jennifer PritchettDocument16 pagesMarket Update: Jennifer PritchettJennifer PritchettNo ratings yet

- BCREA REPORT 2011 02 - Vancouver Real EstateDocument3 pagesBCREA REPORT 2011 02 - Vancouver Real EstateAnna AsiNo ratings yet

- Market Update: Jennifer PritchettDocument41 pagesMarket Update: Jennifer PritchettJennifer PritchettNo ratings yet

- Bedford Hills SFDocument1 pageBedford Hills SFapi-23721120No ratings yet

- 2023 April MarketReportDocument26 pages2023 April MarketReportSuyapa SaucedaNo ratings yet

- Hitting Bottom? An Updated Analysis of Rents and The Price of Housing in 100 Metropolitan AreasDocument20 pagesHitting Bottom? An Updated Analysis of Rents and The Price of Housing in 100 Metropolitan AreasCenter for Economic and Policy Research100% (2)

- Austin Real Estate Market Statistics For July 2009Document15 pagesAustin Real Estate Market Statistics For July 2009Daniel PriceNo ratings yet

- Baltimore County Real Estate Market Update April 18, 2011Document1 pageBaltimore County Real Estate Market Update April 18, 2011tmcintyreNo ratings yet

- Colorado Association of Realtors Housing Market Report For April 2022Document15 pagesColorado Association of Realtors Housing Market Report For April 2022Michael_Roberts2019No ratings yet

- Quarterly Review: The Housing Boom: 2002-2005Document4 pagesQuarterly Review: The Housing Boom: 2002-2005Nicholas FrenchNo ratings yet

- The Wright Report:: Sacramento's Residential Investment AnalysisDocument26 pagesThe Wright Report:: Sacramento's Residential Investment AnalysisWright Real EstateNo ratings yet

- Valleymls Mmi 2022-12Document14 pagesValleymls Mmi 2022-12Sean MagersNo ratings yet

- WR May News 2010Document2 pagesWR May News 2010Wakefield Reutlinger RealtorsNo ratings yet

- Local Market Trends: The Real Estate ReportDocument4 pagesLocal Market Trends: The Real Estate Reportsusan6276No ratings yet

- Personal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyFrom EverandPersonal Finance 101 Canada’S Housing Market Analysis Buying Vs Renting a Home: A Case StudyNo ratings yet

- Beverly-Hanks & Associates: First Quarter Market Report 2011Document16 pagesBeverly-Hanks & Associates: First Quarter Market Report 2011hozaeNo ratings yet

- Beverly-Hanks & Associates: Annual Market Report 2010Document12 pagesBeverly-Hanks & Associates: Annual Market Report 2010hozaeNo ratings yet

- Mandatory RequirementsDocument3 pagesMandatory RequirementshozaeNo ratings yet

- Quarterly Market: 3Rd QuarterDocument12 pagesQuarterly Market: 3Rd QuarterhozaeNo ratings yet

- Quarterly Market: 2Nd QuarterDocument12 pagesQuarterly Market: 2Nd Quarterhozae100% (2)

- Apache Needs This Page To Exist in Case AnDocument1 pageApache Needs This Page To Exist in Case AnhozaeNo ratings yet

- Quarterly Market: 2Nd QuarterDocument12 pagesQuarterly Market: 2Nd QuarterhozaeNo ratings yet

- Sales Associate Awards 2008: Beverly Hanks AssociatesDocument12 pagesSales Associate Awards 2008: Beverly Hanks AssociateshozaeNo ratings yet

- Quarterly Market Report 1st QUARTER January-March, 2009 Prepared ExclusivelyDocument12 pagesQuarterly Market Report 1st QUARTER January-March, 2009 Prepared ExclusivelyhozaeNo ratings yet

- Sales Associate Awards 2008: Beverly Hanks AssociatesDocument12 pagesSales Associate Awards 2008: Beverly Hanks AssociateshozaeNo ratings yet