Professional Documents

Culture Documents

Case Study 1 - Requirements - Travel Agency, All Abroad

Uploaded by

Dinesh YogiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study 1 - Requirements - Travel Agency, All Abroad

Uploaded by

Dinesh YogiCopyright:

Available Formats

ALL ABROAD PTY LIMITED

Background

All Abroad Pty Limited (All Abroad) was formed 10 years ago as a retail suburban travel agency. The company does not specialise in any one area of travel but has attempted to develop a strategy of quality service for quality travel arrangements. A substantial amount of business comes from tour groups travelling abroad to New Zealand, Fiji and the United States. It also arranges local tours for inbound tourists who arrive from all over the world. The company has expanded rapidly in the last three years, establishing six new outlets in suburban shopping centres, and employing 20 staff. This expansion has significantly increased sales; however, margins have suffered significantly. In 2012, in order to fund the expansion, the company needed to borrow money. The bank it applied to for the loan required an audited financial report. An audit is also required by the Travel Compensation Fund (TCF) in order to maintain membership of the Fund and the International Air Transport Association (IATA), the travel industry peak body, responsible for licensing travel agents. The audit has been a continuing engagement since the company was formed. Over the years the company has received an unqualified audit report; however, a number of minor compliance breaches of TCF regulations have been reported. The audit report is required to be lodged within 90 days of the year end in order to avoid significant penalties.

Organisational structure

The company is owned by two directors, Tim Addison and Jim Badcock. Tim Addison is entirely involved in the day-to-day running of the business. Jim Badcock works one day per week and is involved entirely in the financial aspects of the company. Each of the six outlets has at least one senior consultant/manager and a junior. The head office has four consultants, an office administrator, and an accounts clerk. All employees report directly to Tim Addison who is also involved actively in selling and is the company's top salesperson.

Accounting systems and internal controls

Each agent is responsible for his or her own booking files. On the back of each file are the accounting records, which form the input of the month end trust account reconciliation. All manual trust cheques are approved and signed by Tim Addison or Jim Badcock, for all locations.

Page 1 of 12

ALL ABROAD PTY LIMITED

This year EFT was introduced which allows all agents to directly pay wholesalers and airlines for travel arrangements. Each payment is entered directly into the file by the agent. No hard copies of the EFT transactions are made. Receipts are issued for all money received, although they are not pre-numbered or accounted for. Banking is done daily with all cheques and cash being brought to the main agency at the end of each day. At the end of each month a trial balance of the files is taken out and reconciled by Jim Badcock to the bank account. All payments that are not client-related are made by Jim Badcock through a 'general' bank account. Only Tim Addison and Jim Badcock have access to the general bank account. Financial statements are produced annually. For the remainder of the year the company manages its 'cash flow' through the trust account. When travel by a client has commenced, the balance on the file is transferred as 'profit' to the general account.

Industry data

A receiver was appointed on 28 June 2013 to Eurodream, a large wholesaler specialising in quality European tours. All Abroad paid large sums to the wholesaler for a group of 10 travellers in 2011. The industry is in a state of change, with most agencies finding that in order to maintain margins they have to align with a large group. This has resulted in three major travel companies dominating the market. All Abroad has yet to join one of these large groups. Technology in the industry is advancing rapidly with a number of the large groups adopting the 'Internet' with preferred customers. This will enable customers to complete their own bookings and ticketing, a feature common with most airlines. In the United States a number of airlines have introduced a flat dollar commission level of $20 per domestic booking, rather than pay percentage commissions. One Australian airline has introduced a policy of nil commission on domestic bookings.

Page 2 of 12

ALL ABROAD PTY LIMITED

The following industry data is generally available in the trade press: AGENTS' Billing & Settlement Plan TURNOVER ($VALUES GIVEN IN THOUSANDS) June 2013 June 2012 Year to date 2012 $ 000 % $ 000 % Gross sales 437,658 +16.72 2,186,917 +18.2 Refunds 14,176 +19.2 70,474 +15.7 Net sales 384,058 +13.1 1,940,283 +15.4 Commission 53,598 +52.1 194,028 +15.4 Transactions 580,916 2,989,887 OUTBOUND MARKET

MONTH OF JUNE only NUMBER OF PASSENGERS

INBOUND MARKET

MONTH OF JUNE only NUMBER OF PASSENGERS % change

2012

2013 2,800 6,300 4,600 3,700 25,000 1,200 75,200 71,600

2012 Africa North America Other America

Africa Canada United States

Other

+64.0 -41.0 -18.0 +33.0 +8. +3.3

2013 % change 2,300 3,100 +35.0 24,900 28,900 +116.0 700 51,900 67,400 15,000 900 56,500 79,400 15,300 +28.0 +8.8 +18.0 +2.0

30,700 900 69,500 69,300

Japan Other Asia

United Kingdom Europe Middle East

America Asia 2

United Kingdom/ Europe Middle East Fiji

5,300 8,400 24,400 11,000

4,700 7,200 23,600 12,000

11.0 14.0 -3.3 +9.0

18,200 2,000 40,700 8,000

20,000 2,100 47,000 8,100

+9.0 +5.0 +15.0 +1.2

New Zealand

Other Oceania

New Zealand

Other

Oceania

228,600 228,800 +0.1

TOTAL

TOTAL

231,100

261,300

+13.0

Page 3 of 12

ALL ABROAD PTY LIMITED

OUTBOUND MARKET

JULY TO JUNE (YEAR TO DATE) NUMBER OF PASSENGERS

INBOUND MARKET

JULY TO JUNE (YEAR TO DATE NUMBER OF PASSENGERS

2012

2013

Africa Canada United States Other America Asia United Kingdom/ Europe Middle East Fiji New Zealand Other Oceania TOTAL

30,000 36,000 291,100 17,700 826,000 498,600

% change 35,500 +18.0 38,600 +7.2 +0.9 +17.0 +7.8 +6.4

2012

2013

293,900 20,800 890,800 530,400

Africa North America Other America Japan Other Asia United Kingdom Europe Middle East New Zealand Other Oceania TOTAL

41,100 342,600 11,700 690,000 789,100 317,200

% change 42,000 +2.1 354,800 +3.6 14,200 742,300 999,200 354,500 +21.0 +7.5 +26.0 +11.0

47,100 79,700 350,700 118,400

52,900 78,500 361,200 111,400

+12.0 -1.5 +3.0 -5.9

359,300 22,200 487,400 102,800

392,900 25,700 501,800 106,800

+9.3 +16.0 +2.9 +3.9

2,295,300

2.414,000

+5.1

3,163,400

3,534,200

+11.7

Page 4 of 12

ALL ABROAD PTY LIMITED

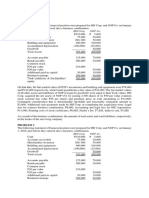

The draft financial report of All Abroad Pty Ltd is as follows:

ALL ABROAD PTY LIMITED DETAILED INCOME STATEMENT FOR THE YEAR ENDING 30 JUNE 2013 UNAUDITED NOTES 2013 $ 1 16,565,171 1,142,912 2 6,958 4,753 TOTAL REVENUE 1,154,623

REVENUE Gross sales revenue Commission earned Interest received Sundry income

AUDITED 2012 $ 14,324,400 1,284,798 6,059 12,195 1,303,052

EXPENSES Amortisation - leasehold improvements Accounting and audit fees Advertising and promotions Bank charge and merchant fees Bad debts Courier expenses Depreciation IT expenses General expenses Insurance Interest paid IATA Licence and qualification fees Light and power Motor vehicle expenses Postage Printing and stationery Rent Refurbishment cost Repairs, replacements and renewals Salaries and wages Staff amenities Educational and staff training Subscriptions and fees Superannuation Telephone TOTAL EXPENSES PROFIT/(LOSS)

8,837 11,600 3,799 15,397 0 5,017 53,931 44,915 15,370 4,933 96,554 7,517 3,974 8,369 10,941 31,842 86,130 4,134 5,249 868,856 1,457 56,062 3,852 78,197 58,255 1,485,189 (330,566)

8,837 10,638 14,719 17,963 14,203 4,025 45,416 36,133 14,203 4,255 93,802 7,457 3,892 4,245 9,308 39,567 85,813 14,088 7,948 775,271 2,712 30,418 2,737 69,774 46,805 1,364,225 (61,172)

Page 5 of 12

ALL ABROAD PTY LIMITED

ALL ABROAD PTY LIMITED BALANCE SHEET AS AT 30 JUNE 2013 NOTES

UNAUDITED 2013 $

AUDITED 2012 $

ASSETS CURRENT ASSETS Cash Accounts Receivable Investments TOTAL CURRENT ASSETS NON-CURRENT ASSETS Eurodream business Property, plant and equipment TOTAL NON-CURRENT ASSETS TOTAL ASSETS LIABILITIES CURRENT LIABILITIES Accounts payable Current portion of long-term borrowings TOTAL CURRENT LIABILITIES NON-CURRENT LIABILITIES Loans from directors Long term borrowings - secured TOTAL NON-CURRENT LIABILITIES TOTAL LIABILITIES NET ASSETS EQUITY Share Capital Accumulated profits Retained Income at the beginning of the year Retained Income (loss) for the year Retained Income at the beginning of the year NET EQUITY

9,705 28,268 139,150 177,123

52,497 120,000 172,497

212,142 2,092,289 2,304,431 2,481,554

2,138,781 2,138,781 2,311,278

6,105 10,000 16,105

5,263 5,263

4 5

1,500,000 870,000 2,370,000 2,386,105 95,449

1,000,000 880,000 1,880,000 1,885,263 426,015

10,000 85,449 416,015 (330,566) 85,449 95,449

10,000 416,015 477,187 (61,172) 416,015 426,015

Page 6 of 12

ALL ABROAD PTY LIMITED

NOTES TO THE FINANCIAL STATEMENTS NOTE 1 - GROSS SALES REVENUE

UNAUDITED 2013

AUDITED 2012

Revenue is recognised and measured at the fair value of the consideration received or receivable for tour arrangements and tickets issued to customers consistent with an agency arrangement. Amounts disclosed as revenue are net of returns, trade allowances, rebates and amounts collected on behalf of third parties. NOTE 2 - COMMISSION EARNED Commissions from the arrangement of tours and travel are recognised when tickets, itineraries or travel documents are issued, consistent with an agency relationship. Commission earned is recognised as the net amount of commission received or receivable. NOTE 3 - PROPERTY, PLANT AND EQUIPMENT (NON-CURRENT) Leasehold improvements at cost Provision for amortisation

$ $

88,370 (17,674) 70,696 1,953,830 (110,902) 1,842,928 827,110 (648,445) 178,665 2,092,289

$

88,370 (8,837) 79,533 1,953,830 (104,984) 1,848,846 810,834 (600,432) 210,402 2,138,781

$

Land and Buildings on freehold land at cost Provision for depreciation

Plant and equipment at cost Provision for depreciation

Total written down value of property, plant and equipment NOTE 4 - LOANS FROM DIRECTORS Loans payable The loans from directors are unsecured and carry no interest NOTE 5 - LONG TERM BORROWINGS Long term borrowings - secured The bank loans are secured against the Property, Plant and Equipment assets in Note 3

1,500,000

1,000,000

870,000

880,000

Page 7 of 12

ALL ABROAD PTY LIMITED

Financial viability tests

All licensed travel agents in Australia are required to have both their financial statements and trust account audited and submit a report to the Travel Compensation Fund (TCF). TCF monitors the financial security of all licensed travel agents and any persons, companies, etc., wishing to carry on business as a licensed travel agent in Australia are required to be participants in the TCF. To become a participant in the TCF, applicants must be able to demonstrate they have sufficient financial resources to carry on the business of a travel agent. In order to meet TCF financial requirements, the travel agent's financial statements should pass the following tests: Test 1 2 3 The company must have a minimum of 10 out of 20 points: Points A Trust Account subject to certain specific rules 4 Net Tangible Assets should be at least 1.5% of the turnover 8 Working Capital should be at least equal to one month's 8 overhead expenses. and 20 Sufficient amount of Net Capital and Reserves to meet the See minimum amount of Capital and Reserves below

Additional information

Test 1: Trust Account for clients

All Abroad has already satisfied all the rules applicable for this test.

Test 2: Net tangible asset to turnover ratio (expressed as %)

This ratio equates the net tangible assets of an agency with its turnover and recognises that the greater the turnover of an organisation the greater should be its tangible net worth. Turnover is defined as gross annual sales, not commission income. This test recognises that a ratio of 1.5% is adequate and allocates the majority of the available points (5 out of 8) for this ratio. However, in recognition of the greater margin of safety afforded by a higher ratio, maximum points are allocated for a ratio of 3%. All tangible assets of the applicant together with long-term and current liabilities are considered in assessing net worth.

Page 8 of 12

ALL ABROAD PTY LIMITED

Net tangible asset to turnover ratio Points Greater than 3% 8 1.5% to 3% 5 Less than 1.5% 2 No Tangible Assets -3 Test 3: Working capital available to meet overheads

This test is the ratio of working capital to average monthly overheads. Working capital is the surplus of current assets over current liabilities. An agency should have sufficient working capital to meet at least one month's overhead expenditure to ensure adequate working capital commensurate with the size of its operations. Intangible assets, loans to, or investments in related parties and any assets used as security for loans which do not appear on the balance sheet or for guarantees on behalf of third parties are excluded from the test. Agencies with a deficiency in working capital will score -3 points.

Monthly coverage Points Greater than 2 months 8 1 to 2 months 5 Less than 1 month 2 Less than 1 month 2 No working capital -3 Test 4: Minimum Capital and reserves

Agents must maintain a minimum level of capital and reserves (as defined below) dependent upon the scale of operations of each enterprise measured by the annual turnover (both travel and non-travel). Turnover is defined as gross sales, not commission.

Turnover

Less than $750,000 $750,000 to $1.5 million Greater than $1.5 million to $4 million Greater than $4 million to $50 million

Page 9 of 12

Minimum capital and reserves $15,000

25,000 40,000 80,000

Note: Minimum capital levels may increase from time to time

ALL ABROAD PTY LIMITED

Definition of capital and reserves

A company having contributed capital calculates its capital and reserves as: The sum of: Paid-up share capital Paid-up redeemable shares are only allowed if Articles of Association prohibit redemption without the written approval of Trustees of the TCF Minimum of $10,000 paid-up share capital (forming part of the minimum share capital and reserves) regardless of existence of other reserves (for example, issued share capital of $5,000 and capital profits reserve of $5,000 would not be acceptable). If less than $10,000 a bank guarantee for the shortfall would be required Realised capital profits reserve Asset revaluation reserve (only if supported by a written valuation from an independent licensed valuer - that is, a directors' valuation will not be accepted) Share premium reserve Accumulated profits Bank guarantee provided to TCF Less: Accumulated losses Intangibles including goodwill, deferred tax assets, etc

Related party loans and related party investments

A related party is an individual or corporation defined as an associate in terms of the Income Tax Assessment Act and includes shareholders, directors, trustees, partners, proprietors or their immediate family. a Liabilities Loans from directors (and other related parties) are included in liabilities in the annual financial review calculations unless it can be adequately demonstrated that the loans are a long-term commitment to the agency. Any loans will be excluded only if the auditor confirms that a loan of a substantially similar amount has existed throughout the whole audit period and does not represent balance date 'window dressing'.

Page 10 of 12

ALL ABROAD PTY LIMITED

b Assets Loans to or investments in related parties are excluded as assets in the annual financial review calculations.

Audit requirements

The financial report must be audited in accordance with Australian Auditing Standards (ASAs) by a registered company auditor. Audit reports for corporations must be in the form required under the Corporations Act 2001. Reports for noncorporate entities must comply with the ASAs issued by the Institute of Chartered Accountants in Australia and the Australian Society of CPAs and guidelines issued by the TCF. A signed report on the financial report of the agency is required in addition to the 'Statement of Auditor' forming part of the annual financial review. The audit should embrace financial transactions relating to moneys received from or on behalf of intending travellers including those transacted through a trust or client's account. Any deficiency in such an account not otherwise recorded on the balance sheet is to be recorded as a current liability of the agency with a corresponding reduction in equity and reserves.

Audit staffing

A total of 85 hours audit time has been allocated to this audit. The audit has the following staff and charge out rates: John White Mary Black George Green Julie Brown

Partner Manager Senior Graduate

$500 per hour $300 $200 $100

Page 11 of 12

ALL ABROAD PTY LIMITED

REQUIRED 1. Develop a time budget and realistic fee estimate for this audit. 2. Conduct planning analytical procedures. 3. Determine planning audit materiality. Justify the base utilised and the percentage applied to the base. 4. Detail an assessment of key business risks associated with All Abroad Pty Ltd. For the risks detailed determine the account balance/s affected and the key audit assertions (as per ASA 315, A111). You may use a tabular matrix as follows:

FACTORS affecting ALL RISK ABROAD (may have headings with multiple points underneath) ACCOUNT ASSERTION

5. Make an assessment of the control environment and consider the effect on business risks. 6. Briefly outline an audit approach (where you would concentrate your efforts) for the account balances for which risks exist. Indicate for each account the key assertion at risk. MARK ALLOCATION

Part 1 Time Budget and fee estimate 2 Planning Analytical procedures 3 Materiality 4 Key risks Table 5 Control environment 6 Audit approach Marks 5 35 10 10 25 10 5 100

MAXIMUM LENGTH RUBRIC CRITERIA

5 PAGES (NO MORE THAN 1,500 WORDS) See SEPARATE files

Page 12 of 12

You might also like

- Greens2020TraderTaxGuide PDFDocument132 pagesGreens2020TraderTaxGuide PDFvej100% (2)

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKNo ratings yet

- Financial Ratios2Document72 pagesFinancial Ratios2Junel Alapa100% (1)

- Financial PlanDocument18 pagesFinancial Planashura08No ratings yet

- At Segment OutlineDocument16 pagesAt Segment OutlineDinesh YogiNo ratings yet

- Reverse Acquisition MillanDocument5 pagesReverse Acquisition MillanJessica IslaNo ratings yet

- TridentDocument65 pagesTridentEr Puneet GoyalNo ratings yet

- Confidential Private Placement Memorandum: Offering of Preferred Limited Liability Company InterestsDocument99 pagesConfidential Private Placement Memorandum: Offering of Preferred Limited Liability Company Interestsapi-544985744100% (1)

- Travel Agent Handbook 818g EngDocument390 pagesTravel Agent Handbook 818g Enghomework8589No ratings yet

- Sugar Factory ProjectDocument75 pagesSugar Factory Projectabhijeet100886% (21)

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- IAS 20 Accounting For Government Grants0Document44 pagesIAS 20 Accounting For Government Grants0ontykerls100% (1)

- Cash and Accrual Basis, Single Entry SystemDocument6 pagesCash and Accrual Basis, Single Entry SystemEuniceChung100% (1)

- DB Corp: Key Management TakeawaysDocument6 pagesDB Corp: Key Management TakeawaysAngel BrokingNo ratings yet

- Ig Group Annualres - Jul12Document39 pagesIg Group Annualres - Jul12forexmagnatesNo ratings yet

- MMDZ Audited Results For FY Ended 31 Dec 13Document1 pageMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- Annual Report 12Document83 pagesAnnual Report 12Master SeriesNo ratings yet

- 981 1370516495Document262 pages981 1370516495Rajendran KajananthanNo ratings yet

- Annual Report EnglishDocument17 pagesAnnual Report EnglishAhmed FoudaNo ratings yet

- What Are Quantitative FactorsDocument5 pagesWhat Are Quantitative FactorsJunaid CheemaNo ratings yet

- Af314 Group Assignment 2020 2021Document11 pagesAf314 Group Assignment 2020 2021HugsNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyNo ratings yet

- Samba Annual Report 2012Document88 pagesSamba Annual Report 2012Azam Inam SheikhNo ratings yet

- Standard Chartered PLC - Half Year 2013 Press ReleaseDocument187 pagesStandard Chartered PLC - Half Year 2013 Press ReleaseSu JitdumrongNo ratings yet

- Procredit Alb 2019Document62 pagesProcredit Alb 2019Thomas SzutsNo ratings yet

- EasyCred Georgia. Financial Statement 2010Document34 pagesEasyCred Georgia. Financial Statement 2010Anatoli KorepanovNo ratings yet

- PhilipsFullAnnualReport2013 EnglishDocument250 pagesPhilipsFullAnnualReport2013 Englishjasper laarmansNo ratings yet

- Danish - FinancialDocument5 pagesDanish - FinancialAtul GirhotraNo ratings yet

- 073.ASX IAW March 22 2010 14.40 Presentation by Man - Dir. FowlerDocument27 pages073.ASX IAW March 22 2010 14.40 Presentation by Man - Dir. FowlerASX:ILH (ILH Group)No ratings yet

- RPC Annual Report 2009-2010Document124 pagesRPC Annual Report 2009-2010Prabhath KatawalaNo ratings yet

- BK Adbl 030079 PDFDocument18 pagesBK Adbl 030079 PDFPatriciaFutboleraNo ratings yet

- Tamawood Case Study - Accounting Analysis - Suggested AnswerDocument3 pagesTamawood Case Study - Accounting Analysis - Suggested AnswerAnonymous 8ooQmMoNs1No ratings yet

- TFG 2012 Annual ReportDocument48 pagesTFG 2012 Annual ReportTenGer Financial GroupNo ratings yet

- 188.ASX IAW Aug 14 2013 18.44 Full Year Financial Result and Dividend AnnouncementDocument12 pages188.ASX IAW Aug 14 2013 18.44 Full Year Financial Result and Dividend AnnouncementASX:ILH (ILH Group)No ratings yet

- General Motors Company Balance Sheet Fiscal Year Ended in December, 2014 USD in Millions Except Per Share Data USD in Millions Except Per Share DataDocument12 pagesGeneral Motors Company Balance Sheet Fiscal Year Ended in December, 2014 USD in Millions Except Per Share Data USD in Millions Except Per Share DataMhzn RazuNo ratings yet

- Analyst Presentation - Aptech LTD Q3FY13Document31 pagesAnalyst Presentation - Aptech LTD Q3FY13ashishkrishNo ratings yet

- 2010 ACE Limited Annual ReportDocument233 pages2010 ACE Limited Annual ReportACELitigationWatchNo ratings yet

- Cash Incentive Equity Incentive Total Direct CompensationDocument5 pagesCash Incentive Equity Incentive Total Direct CompensationRoxyChanNo ratings yet

- Procredit Alb 2016Document39 pagesProcredit Alb 2016Thomas SzutsNo ratings yet

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57No ratings yet

- Running Head: Income Statement Ford Motor Company 1Document5 pagesRunning Head: Income Statement Ford Motor Company 1Moses MachariaNo ratings yet

- Invast Securities Q3 FinancialsDocument9 pagesInvast Securities Q3 FinancialsRon FinbergNo ratings yet

- Dubai Islamic Bank Results Update 16 AugustDocument4 pagesDubai Islamic Bank Results Update 16 AugustEmran Lhr PakistanNo ratings yet

- Running Head: Financial Analysis AssessmentDocument14 pagesRunning Head: Financial Analysis Assessmentsonali_mathurNo ratings yet

- Management Accounting ProjectDocument15 pagesManagement Accounting Projecturvigarg079No ratings yet

- GrouponDocument9 pagesGroupondonna_tam_3No ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Itc LTD Financial Analysis: Group 4Document20 pagesItc LTD Financial Analysis: Group 4Kanav ChaudharyNo ratings yet

- Q1 2013 Investor Presentation Unlinked FINALDocument14 pagesQ1 2013 Investor Presentation Unlinked FINALMordechai GilbertNo ratings yet

- HSBC Holding Ar 2013 Media ReleaseDocument44 pagesHSBC Holding Ar 2013 Media ReleaseHillary KohNo ratings yet

- Infosys Results Q1-2009-10Document4 pagesInfosys Results Q1-2009-10Niranjan PrasadNo ratings yet

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNo ratings yet

- APQ3FY12Document19 pagesAPQ3FY12Abhigupta24No ratings yet

- Fitch RatingsDocument7 pagesFitch RatingsTareqNo ratings yet

- Local Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Document19 pagesLocal Youth Group: ? HEJ HI? /?IJ HIE #H 7J H I7F 7A 2008-2012Rushbh PatilNo ratings yet

- Technofab Annual Report - 2011-2012Document80 pagesTechnofab Annual Report - 2011-2012Kohinoor RoyNo ratings yet

- A Report On Financial Analysis of Next PLC 3Document11 pagesA Report On Financial Analysis of Next PLC 3Hamza AminNo ratings yet

- Project On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Document23 pagesProject On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Ravi GeraNo ratings yet

- GOME 2012Q3 Results en Final 1700Document30 pagesGOME 2012Q3 Results en Final 1700Deniz TuracNo ratings yet

- Cover and ContentsDocument3 pagesCover and ContentsPedro Ludovice NogueiraNo ratings yet

- Session 1 Financial Accounting Infor Manju JaiswallDocument41 pagesSession 1 Financial Accounting Infor Manju JaiswallpremoshinNo ratings yet

- Financial Analysis of Indigo Airlines From Lender's PerspectiveDocument12 pagesFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Lesson 4 Investment ClubDocument26 pagesLesson 4 Investment ClubVictor VandekerckhoveNo ratings yet

- 3Q JulyMar 1213Document17 pages3Q JulyMar 1213frk007No ratings yet

- FMDocument233 pagesFMparika khannaNo ratings yet

- Balance of Payments & International Investment Position: For The Quarter Ended June 2013Document6 pagesBalance of Payments & International Investment Position: For The Quarter Ended June 2013BernewsAdminNo ratings yet

- Analysis of Sumsung Annual ReportDocument11 pagesAnalysis of Sumsung Annual ReportEr YogendraNo ratings yet

- Efoods Review - JsDocument1 pageEfoods Review - JssaaaruuuNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2016 HACM9102 TopicHandbookDocument27 pages2016 HACM9102 TopicHandbookDinesh YogiNo ratings yet

- TCF Financial CriteriaDocument7 pagesTCF Financial CriteriaDinesh YogiNo ratings yet

- Agents' Financial Evaluation Criteria 1. General Rule Audited Financial StatementsDocument1 pageAgents' Financial Evaluation Criteria 1. General Rule Audited Financial StatementsDinesh YogiNo ratings yet

- Tin ADocument15 pagesTin ADinesh YogiNo ratings yet

- Accountancy - Additional Questions MARKING SCHEMEDocument15 pagesAccountancy - Additional Questions MARKING SCHEMEseema chadhaNo ratings yet

- Ifrs For SmesDocument33 pagesIfrs For SmesJohn Cyril InsonNo ratings yet

- Lecture NotesDocument25 pagesLecture NotesPrecious Diarez Pureza67% (3)

- Chapter 5 - Dayag - MCSDocument2 pagesChapter 5 - Dayag - MCSMazikeen DeckerNo ratings yet

- Accounting and Auditing StandardDocument16 pagesAccounting and Auditing StandardErica NicolasuraNo ratings yet

- IPRO Mock Exam - 2021 - QDocument21 pagesIPRO Mock Exam - 2021 - QKevin Ch Li100% (1)

- Tarea Análisis Horizontal y Vertical StarbucksDocument4 pagesTarea Análisis Horizontal y Vertical StarbucksEmilio Nu�ez AvilesNo ratings yet

- AP 1901 Inventories PDFDocument8 pagesAP 1901 Inventories PDFToni Rhys ArguellesNo ratings yet

- Wins Package-A MCM Contract: Barakah Offshore PetroleumDocument8 pagesWins Package-A MCM Contract: Barakah Offshore PetroleumYGNo ratings yet

- Solvency Assessment IAISDocument50 pagesSolvency Assessment IAISthanhtam3819No ratings yet

- Chapter 2Document15 pagesChapter 2M.K. TongNo ratings yet

- Case Study-ParagonDocument5 pagesCase Study-ParagonDaniyal NasirNo ratings yet

- Basic Accounting ModelDocument3 pagesBasic Accounting Modeldlinds2X1No ratings yet

- ACT 202 Final ReportDocument16 pagesACT 202 Final ReportAbdullah Al-Rafi100% (1)

- Ikea Welcome Inside 2011Document26 pagesIkea Welcome Inside 2011DEon LimNo ratings yet

- ACCOUNTING NGOs ETHIOPIADocument10 pagesACCOUNTING NGOs ETHIOPIAIndrajit GoswamiNo ratings yet

- Artikel 8B - Bova (2018) Discussion of Avoiding Chinas Capital MarketDocument4 pagesArtikel 8B - Bova (2018) Discussion of Avoiding Chinas Capital MarketZheJk 26No ratings yet

- Statement of Cash FlowsDocument16 pagesStatement of Cash FlowsJmaseNo ratings yet

- Quiz Integ BusCom ForExDocument7 pagesQuiz Integ BusCom ForExPrankyJellyNo ratings yet

- Sample Risk Assessment QuestionnairesDocument6 pagesSample Risk Assessment QuestionnairesRaneesh MohamedNo ratings yet

- NFRS 8 - Operating SegmentsDocument14 pagesNFRS 8 - Operating SegmentsNareshNo ratings yet

- Financial Performance Analysis Thesis PDFDocument8 pagesFinancial Performance Analysis Thesis PDFCassie Romero100% (2)

- 858 Accounts QPDocument11 pages858 Accounts QPRudra SahaNo ratings yet