Professional Documents

Culture Documents

Euribor: From Wikipedia, The Free Encyclopedia

Uploaded by

Đurđica StanojkovićOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Euribor: From Wikipedia, The Free Encyclopedia

Uploaded by

Đurđica StanojkovićCopyright:

Available Formats

18.6.13.

Euribor - Wikipedia, the free encyclopedia

Euribor

From Wikipedia, the free encyclopedia

The Euro Interbank Offered Rate (Euribor) is a daily reference rate based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market (or interbank market).

Contents

1 Scope 2 Technical features 3 Panel Banks 3.1 Interest rate swaps 4 Eonia 5 See also 6 References 7 External links

Euribor-12m (red), 3m (blue), 1w (green) value between years 1998 and 2013

Scope

Euribors are used as a reference rate for euro-denominated forward rate agreements, short term interest rate futures contracts and interest rate swaps, in very much the same way as LIBORs are commonly used for Sterling and US dollar-denominated instruments. They thus provide the basis for some of the world's most liquid and active interest rate markets. Domestic reference rates, like Paris' PIBOR, Frankfurt's FIBOR, and Helsinki's Helibor merged into Euribor on EMU day on 1 January 1999. Euribor should be distinguished from the less commonly used "Euro LIBOR" rates set in London by 16 major banks.[1]

Technical features

Official reference: EURIBOR Technical features (http://www.euriborebf.eu/assets/files/Euribor_tech_features.pdf) A representative panel of banks provide daily quotes of the rate, rounded to three decimal places, that each panel bank believes one prime bank is quoting to another prime bank for interbank term deposits within the Euro zone, for maturity ranging from one week to one year. Every Panel Bank is required to directly input its data no later than 10:45 a.m. (CET) on each day that the Trans-European Automated Real-Time Gross-Settlement Express Transfer system (TARGET) is open. At 11:00 a.m. (CET), Reuters will process the Euribor calculation and instantaneously

en.wikipedia.org/wiki/Euribor 1/4

18.6.13.

Euribor - Wikipedia, the free encyclopedia

publish the reference rate on Reuters pages 248-249, which will be made available to all its subscribers and to other data vendors. The published rate is a rounded, truncated mean of the quoted rates: the highest and lowest 15% of quotes are eliminated, the remainder are averaged and the result is rounded to 3 decimal places. Euribor rates are spot rates, i.e. for a start two working days after measurement day. Like US money-market rates, they are Actual/360, i.e. calculated with an exact daycount over a 360-day year. Euribor was first published on 30 December 1998 for value 4 January 1999.

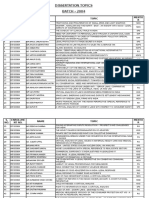

Panel Banks

The contributors to Euribor are the banks with the highest volume of business in the euro zone money markets. As of 20 September 2012, The panel of banks contributing to Euribor consists of 44 banks:[2] Banks from EU countries participating in the euro from the outset. Banks from EU countries not participating in the euro from the outset. Large international banks from non-EU countries but with important euro zone operations. Country Austria Belgium Finland Banks Erste Group Bank AG RZB Raiffeisen Zentralbank sterreich AG Belfius KBC Nordea Pohjola Banque Postale BNP-Paribas HSBC France Socit Gnrale Natixis Crdit Agricole s.a. Crdit Industriel et Commercial CIC Landesbank Berlin Bayerische Landesbank Girozentrale Deutsche Bank Commerzbank DZ Bank Deutsche Genossenschaftsbank Norddeutsche Landesbank Girozentrale Landesbank Baden-Wrttemberg Girozentrale Landesbank Hessen Thringen Girozentrale National Bank of Greece Intesa Sanpaolo Monte dei Paschi di Siena

2/4

France

Germany

Greece Italy

en.wikipedia.org/wiki/Euribor

18.6.13.

Euribor - Wikipedia, the free encyclopedia

Unicredit UBI Banca Ireland Luxembourg Netherlands Portugal Spain Bank of Ireland AIB Banque et Caisse d'pargne de l'tat ING Bank Rabobank Caixa Geral de Depsitos (CGD) Banco Bilbao Vizcaya Argentaria Banco Santander Central Hispano Confederacion Espaola de Cajas de Ahorros CaixaBank S.A.

Barclays Capital Other EU Banks Den Danske Bank Svenska Handelsbanken UBS (Luxembourg) S.A. Citibank Non-EU Banks J.P. Morgan Chase & Co Bank of Tokyo Mitsubishi

Interest rate swaps

Interest rate swaps based on short Euribors currently trade on the interbank market for maturities up to 50 years. A "five year Euribor" will be in fact referring to the 5 year swap rate vs 6 month Euribor. "Euribor + x basis points", when talking about a bond, will mean that the bond's cash flows have to be discounted on the swaps' zero-coupon yield curve shifted by x basis points in order to equal the bond's actual market price.

Eonia

The other widely used reference rate in the euro-zone is Eonia, also published by the European Banking Federation, which is the daily average of overnight rates for unsecured interbank lending in the euro-zone, i.e. like the federal funds rate in the US. The banks contributing to Eonia are the same as the Panel Banks contributing to Euribor.

See also

Euro European Banking Federation Prime rate federal funds rate EONIA SONIA

en.wikipedia.org/wiki/Euribor 3/4

18.6.13.

Euribor - Wikipedia, the free encyclopedia

SARON MUTAN LIBOR

References

1. ^ http://www.investopedia.com/terms/e/eurolibor.asp 2. ^ "Euribor Panel Banks" (http://www.euribor-ebf.eu/euribor-org/panel-banks.html). Retrieved May 14, 2012.

External links

European Central Bank (http://www.ecb.int/) Euribor homepage (http://www.euribor.org/) Euribor historical data (informative) (http://www.euribor.org/euribor-org/euribor-rates.html) Euribor Page on Wikinvest Euribor Rate, Daily Update (Bank of Finland) (http://www.suomenpankki.fi/en/tilastot/korot/kuviot.htm) Euribor reference rates are published on the Moneyline Telerate (http://www.moneyline.com/) pages 248-249 and 47860-66. Informative historical data can also be found at the Euribor homepage (http://www.euribor.org/html/content/euribor_data.html). Retrieved from "http://en.wikipedia.org/w/index.php?title=Euribor&oldid=557653450" Categories: Eurozone fiscal matters Banking Finance Interest rates This page was last modified on 31 May 2013 at 08:56. Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

en.wikipedia.org/wiki/Euribor

4/4

You might also like

- Lesson 15 The Eurocurrency MarketDocument7 pagesLesson 15 The Eurocurrency Marketjitinwadhwani0% (1)

- Chapter 7 Hours of WorksDocument24 pagesChapter 7 Hours of WorksANN ONYMOUSNo ratings yet

- Texaco Overseas Petroleum Co. v. Libya 17 ILM or 53 ILR 389,1978Document1 pageTexaco Overseas Petroleum Co. v. Libya 17 ILM or 53 ILR 389,1978reyna amor condes0% (1)

- Rabobank Statement of Facts PDFDocument42 pagesRabobank Statement of Facts PDFZerohedgeNo ratings yet

- International Finance: Euro Currency (Offshore Market)Document67 pagesInternational Finance: Euro Currency (Offshore Market)Rohan NairNo ratings yet

- Euro CurrencyDocument3 pagesEuro CurrencyShabnabasheerNo ratings yet

- Euro Currency Market PDFDocument34 pagesEuro Currency Market PDFnancyagarwalNo ratings yet

- International Debt MarketDocument6 pagesInternational Debt MarketRetemoi CookNo ratings yet

- EuromarketDocument3 pagesEuromarketLawrence StokesNo ratings yet

- IBM Team6Document2 pagesIBM Team6Eswari VenkatNo ratings yet

- European Depository Receipt - EdrDocument10 pagesEuropean Depository Receipt - EdrkrupamayekarNo ratings yet

- Ibf Group 2Document34 pagesIbf Group 2QUADRI YUSUFNo ratings yet

- Presented By:-Sumit Singal MBA-I (3129)Document34 pagesPresented By:-Sumit Singal MBA-I (3129)Inderpreet SinghNo ratings yet

- Int Money EarkrtDocument4 pagesInt Money EarkrtGyan PrakashNo ratings yet

- The Foreign Exchange MarketDocument33 pagesThe Foreign Exchange MarketShantanu ChoudhuryNo ratings yet

- Forex MarketDocument33 pagesForex MarketRiad TalukderNo ratings yet

- Ibf Group 3Document18 pagesIbf Group 3QUADRI YUSUFNo ratings yet

- Eurocurrency Market10-1Document11 pagesEurocurrency Market10-1Neha FatimaNo ratings yet

- Inter Finance Banking Report FinalDocument13 pagesInter Finance Banking Report FinalEvan NoorNo ratings yet

- Euro Currency MarketDocument24 pagesEuro Currency MarketAlina RajputNo ratings yet

- Chapter 6Document4 pagesChapter 6Duy Anh NguyễnNo ratings yet

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- International Financial MarketsDocument26 pagesInternational Financial MarketsMary LouisNo ratings yet

- Unit 2 International Financial Markets: StructureDocument32 pagesUnit 2 International Financial Markets: StructureBilal AhmadNo ratings yet

- Euro Currency MarketDocument30 pagesEuro Currency MarketHarmeet KaurNo ratings yet

- Characteristics of EuroDocument10 pagesCharacteristics of EuroSujith PSNo ratings yet

- H. Int. Financial MKTDocument18 pagesH. Int. Financial MKTsamy7541No ratings yet

- Euro Banking and Euro Currency MarketDocument17 pagesEuro Banking and Euro Currency MarketNeena TomyNo ratings yet

- Euro Currency Deposits: Aakash Bafna (Tybms A) 9100108Document3 pagesEuro Currency Deposits: Aakash Bafna (Tybms A) 9100108Akash BafnaNo ratings yet

- Unit 19. Eurocurrency MarketsDocument10 pagesUnit 19. Eurocurrency Marketsu4u2664570No ratings yet

- Euro-Currency and Euro-Dollar MarketDocument17 pagesEuro-Currency and Euro-Dollar MarketShiva ShettyNo ratings yet

- The Euro Currency and Euro Bond MarketsDocument26 pagesThe Euro Currency and Euro Bond MarketsRutvik PanditNo ratings yet

- Chapter 1 - International Banking & Money MarketDocument21 pagesChapter 1 - International Banking & Money MarketFaiz FahmiNo ratings yet

- Euro Currency Market PDFDocument2 pagesEuro Currency Market PDFSarahNo ratings yet

- Unit - 3 Foreign Exchange MarketDocument27 pagesUnit - 3 Foreign Exchange Marketrajsp2208No ratings yet

- Eurocurrency MarketDocument46 pagesEurocurrency MarketBhavyaNo ratings yet

- Banking On Bonds - The New Links Between States and MarketsDocument19 pagesBanking On Bonds - The New Links Between States and MarketsAdrian SanduNo ratings yet

- By:-Niharika, Surbhi & YogeshDocument32 pagesBy:-Niharika, Surbhi & YogeshNiharika Satyadev JaiswalNo ratings yet

- If - Eurocurrency FinalDocument33 pagesIf - Eurocurrency FinalAniket NaikNo ratings yet

- Inbound 2983251778108401687Document3 pagesInbound 2983251778108401687atenanlheyNo ratings yet

- Euro Currency MarketDocument17 pagesEuro Currency Marketrahul_khanna4321No ratings yet

- International Markets TypesDocument9 pagesInternational Markets TypesHaji Saif UllahNo ratings yet

- Final Project of EcoDocument32 pagesFinal Project of EcosangeethaNo ratings yet

- List of Acronyms Associated With The Eurozone CrisisDocument8 pagesList of Acronyms Associated With The Eurozone Crisisjosh321No ratings yet

- The Euro Interest Rate Swap MarketDocument10 pagesThe Euro Interest Rate Swap MarketAnatoni Roby CandraNo ratings yet

- Barclays Statement of Facts From The Justice DepartmentDocument23 pagesBarclays Statement of Facts From The Justice DepartmentDealBookNo ratings yet

- 16-F-324-Eurocurrency Markets & Syndicated Credits PDFDocument22 pages16-F-324-Eurocurrency Markets & Syndicated Credits PDFDhaval ShahNo ratings yet

- LiborDocument4 pagesLiborDaisy AggarwalNo ratings yet

- Eurocurrency Market: Features of The Euro Currency MarketDocument6 pagesEurocurrency Market: Features of The Euro Currency MarketNandini JaganNo ratings yet

- Euro CurrencyDocument53 pagesEuro CurrencyShruti Kalantri0% (1)

- Eurex FundamentalsDocument14 pagesEurex FundamentalsukxgerardNo ratings yet

- The Euromarkets1Document22 pagesThe Euromarkets1Shruti AshokNo ratings yet

- What Is EurobondDocument4 pagesWhat Is EurobondmissconfusedNo ratings yet

- What Are Eurobonds?: ItalianDocument5 pagesWhat Are Eurobonds?: ItalianRekha SoniNo ratings yet

- The Incomplete Currency: The Future of the Euro and Solutions for the EurozoneFrom EverandThe Incomplete Currency: The Future of the Euro and Solutions for the EurozoneNo ratings yet

- Market Players: A Guide to the Institutions in Today's Financial MarketsFrom EverandMarket Players: A Guide to the Institutions in Today's Financial MarketsRating: 5 out of 5 stars5/5 (4)

- Invest in Europe Now!: Why Europe's Markets Will Outperform the US in the Coming YearsFrom EverandInvest in Europe Now!: Why Europe's Markets Will Outperform the US in the Coming YearsNo ratings yet

- US Deloittereview The Corporate Lattice Jan11Document17 pagesUS Deloittereview The Corporate Lattice Jan11minnusiriNo ratings yet

- Principles of Transactional Analysis: From Our ArchivesDocument8 pagesPrinciples of Transactional Analysis: From Our ArchivesmanasNo ratings yet

- The VARK Model of Teaching StrategiesDocument3 pagesThe VARK Model of Teaching StrategiesĐurđica Stanojković100% (1)

- War For Talent - KPMGDocument2 pagesWar For Talent - KPMGĐurđica Stanojković100% (1)

- The War For TalentDocument8 pagesThe War For TalentJeeta SarkarNo ratings yet

- Build To Last - Next Steps 25% by 2025 - Reducing On Site Activity by 25%Document11 pagesBuild To Last - Next Steps 25% by 2025 - Reducing On Site Activity by 25%Đurđica StanojkovićNo ratings yet

- Breaking The Deadlock: Accelerating Towards A Genuinely Diverse WorkforceDocument16 pagesBreaking The Deadlock: Accelerating Towards A Genuinely Diverse WorkforceĐurđica StanojkovićNo ratings yet

- Learning Capability in Construction Projects: From The Learning Organisation To The Learning ProjectDocument10 pagesLearning Capability in Construction Projects: From The Learning Organisation To The Learning ProjectĐurđica StanojkovićNo ratings yet

- Learning OrganisationsDocument18 pagesLearning OrganisationsĐurđica StanojkovićNo ratings yet

- Simplypsychology Kolb Learning StylesDocument4 pagesSimplypsychology Kolb Learning Stylesmira jean de limaNo ratings yet

- M1 Kolb Learning Style InventoryDocument4 pagesM1 Kolb Learning Style Inventoryarhont1No ratings yet

- Urban Desi FinalDocument31 pagesUrban Desi FinalErnesto Urzaiz ChavezNo ratings yet

- Learning Needs Analysis Framework - UCLDocument4 pagesLearning Needs Analysis Framework - UCLĐurđica StanojkovićNo ratings yet

- Formal and Informal Learning in The Workplace: A Research ReviewDocument17 pagesFormal and Informal Learning in The Workplace: A Research ReviewHasnainNo ratings yet

- DSO - Relationship No Leadership Sustan Successful OrganisationsDocument14 pagesDSO - Relationship No Leadership Sustan Successful OrganisationsĐurđica StanojkovićNo ratings yet

- DSO - Developing Learning Managers Within Learning OrganisationsDocument32 pagesDSO - Developing Learning Managers Within Learning OrganisationsĐurđica StanojkovićNo ratings yet

- v1 - SE6588-L AU Lab HandoutDocument30 pagesv1 - SE6588-L AU Lab HandoutĐurđica StanojkovićNo ratings yet

- A Typical Day in The OfficeDocument1 pageA Typical Day in The OfficeĐurđica StanojkovićNo ratings yet

- Attachment FormDocument1 pageAttachment FormĐurđica StanojkovićNo ratings yet

- Fidic Conditions of ContractDocument18 pagesFidic Conditions of ContractHasan Fakhimi100% (1)

- Formal and Informal Learning in The Workplace: A Research ReviewDocument17 pagesFormal and Informal Learning in The Workplace: A Research ReviewHasnainNo ratings yet

- Fidic Conditions of ContractDocument18 pagesFidic Conditions of ContractHasan Fakhimi100% (1)

- Dog Breeds Special Regutations Extract-1Document5 pagesDog Breeds Special Regutations Extract-1Đurđica StanojkovićNo ratings yet

- Xsara Technical TrainingDocument228 pagesXsara Technical TrainingTherecomed2001100% (2)

- Spaces and Events: Bernhard TschumiDocument5 pagesSpaces and Events: Bernhard TschumiRadoslava Vlad LNo ratings yet

- Rules For Adjudication (HOAdj) and Explantory Notes 2011Document4 pagesRules For Adjudication (HOAdj) and Explantory Notes 2011Đurđica StanojkovićNo ratings yet

- Subcontractor's H&S Personnel For Monthly - July 14Document1 pageSubcontractor's H&S Personnel For Monthly - July 14Đurđica StanojkovićNo ratings yet

- Urban Desi FinalDocument31 pagesUrban Desi FinalErnesto Urzaiz ChavezNo ratings yet

- CMA 2011 Model Schedule 5Document7 pagesCMA 2011 Model Schedule 5Đurđica StanojkovićNo ratings yet

- Rules of Court - New Rule On AdoptionDocument11 pagesRules of Court - New Rule On AdoptionChristian Marko CabahugNo ratings yet

- General Arguments Against Protective DiscriminationDocument1 pageGeneral Arguments Against Protective DiscriminationSonatan PaulNo ratings yet

- Procurment Management Plan TemplateDocument15 pagesProcurment Management Plan TemplateMonil PatelNo ratings yet

- Asme Iii-1 NF 2013Document186 pagesAsme Iii-1 NF 2013Torres Ivan100% (1)

- Mennonite Church USADocument9 pagesMennonite Church USAjoshua33No ratings yet

- Dissertation Topic MailDocument57 pagesDissertation Topic MailJothsna ChikkodiNo ratings yet

- People V CantonDocument10 pagesPeople V CantonBiboy Sparks100% (1)

- BD 041222 ICC Update Bank ListDocument18 pagesBD 041222 ICC Update Bank ListArdian MantowNo ratings yet

- Dynashears StudyDocument2 pagesDynashears Studylika rukhadze100% (1)

- Decide Which Answer (A, B, C or D) Best Fits Each Space.: Inspector Crumbs InvestigatesDocument2 pagesDecide Which Answer (A, B, C or D) Best Fits Each Space.: Inspector Crumbs InvestigatesХристина КоникNo ratings yet

- The Future Is Calling (Part Two) Secret Organizations and Hidden AgendasDocument19 pagesThe Future Is Calling (Part Two) Secret Organizations and Hidden AgendasAndemanNo ratings yet

- Annexure-I: DOB............... Age... ... Date of Retirement...........................Document8 pagesAnnexure-I: DOB............... Age... ... Date of Retirement...........................Inked IntutionsNo ratings yet

- Vacancy Announcement Temporary MagistrateDocument3 pagesVacancy Announcement Temporary MagistrateAbraham McdanielNo ratings yet

- Possession FruitsDocument1 pagePossession FruitsJoedhel ApostolNo ratings yet

- Chapter 5Document19 pagesChapter 5Harsh SharmaNo ratings yet

- Module 7 Government AccountingDocument43 pagesModule 7 Government AccountingElla EspenesinNo ratings yet

- Report On ECL Rehabilitation ProjectDocument6 pagesReport On ECL Rehabilitation ProjectVivek BhanushaliNo ratings yet

- Moneymax X Citibank GCash Exclusive Campaign T&CsDocument3 pagesMoneymax X Citibank GCash Exclusive Campaign T&CsProsserfina MinaoNo ratings yet

- Geroche Vs People GR No. 179080, November 26, 2014Document6 pagesGeroche Vs People GR No. 179080, November 26, 2014salinpusaNo ratings yet

- IBM Tivoli Provisioning Manager V7.1.1 Deployment and IBM Service Management Integration Guide Sg247773Document762 pagesIBM Tivoli Provisioning Manager V7.1.1 Deployment and IBM Service Management Integration Guide Sg247773bupbechanhNo ratings yet

- Palma v. OmelioDocument12 pagesPalma v. OmelioMac SorianoNo ratings yet

- Expenses SheetDocument31 pagesExpenses SheetVinay SinghNo ratings yet

- Education - Justice and DemocracyDocument37 pagesEducation - Justice and DemocracyRicardo Torres RibeiroNo ratings yet

- Producers Bank of The Philippines V CA Digest 2Document2 pagesProducers Bank of The Philippines V CA Digest 2Angel UrbanoNo ratings yet

- Nicki Minaj LetterDocument5 pagesNicki Minaj LetterTHR50% (2)

- SHFC Applicant Data SheetDocument2 pagesSHFC Applicant Data SheetAlvy Faith Pel-eyNo ratings yet

- ConsortDocument8 pagesConsortCăluian - Zlatea IonelaNo ratings yet

- Beaches and Resorts TariffsDocument31 pagesBeaches and Resorts TariffskudaNo ratings yet