Professional Documents

Culture Documents

Capital Morgage Insurance

Uploaded by

Emil Eskenazy LewingerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Morgage Insurance

Uploaded by

Emil Eskenazy LewingerCopyright:

Available Formats

Case 1

Capital Mortgage Insurance Corporation (A)

Frank Randall hung up the telephone, leaned across his desk, and fixed a cold stare at Jim Dolan.

OK, Jim. Theyve agreed to a meeting. Weve got three days to resolve this thing. The question is, what approach should we take? How do we get them to accept our offer?

Randall, president of Capital Mortgage Insurance Corporation (CMI), had called Dolan, his senior vice president and treasurer, into his office to help him plan their strategy for completing the acquisition of Corporate Transfer Services (CTS). The two men had begun informal discussions with the principal stockholders of the small employee relocation services company some four months earlier. Now, in late May 1979, they were developing the terms of a formal purchase offer and plotting their strategy for the final negotiations. The acquisition, if consummated, would be the first in CMIs history. Furthermore, it represented a significant departure from the companys present business. Randall and Dolan knew that the acquisition could have major implications, both for themselves and for the company they had revitalized over the past several years. Jim Dolan ignored Frank Randalls intense look and gazed out the eighth-floor window overlooking Philadelphias Independence Square.

Thats not an easy question, Frank. We know theyre still looking for a lot more money than were thinking about. But beyond that, the four partners have their own differences, and we need to think through just what theyre expecting. So I guess wed better talk this one through pretty carefully.

Company and Industry Background

CMI was a wholly owned subsidiary of Northwest Equipment Corporation, a major freight transporter and lessor of railcars, commercial aircraft, and other industrial equipment. Northwest had acquired CMI in 1978, two years after CMIs original parent company, an investment management corporation, had gone into Chapter 11 bankruptcy proceedings. CMI had been created to sell mortgage guaranty insurance policies to residential mortgage lenders throughout the United States. Mortgage insurance provides banks, savings and loans, mortgage bankers, and other mortgage lenders with protection against financial losses when homeowners default on their mortgage loans. Lending institutions normally protect their property loan investments by offering loans of only 70 percent to 80 percent of the appraised value of the property; the

Source: Capital Mortgage Insurance Corporation (A), Harvard Business School Case 9-480-057. Copyright 1980 by the President and Fellows of Harvard College. This case was prepared by James P. Ware as a basis for class discussion rather than to illustrate either effective or ineffective handling of an administrative situation. Reprinted by permission of the Harvard Business School. This case written in 1979. For a variety of reasons, it is not possible to update the financial information or the fact pattern in the case. We contiune to use it in this book because of the teaching value of the case, in spite of its age. 567

568

Case 1

remaining 20 to 30 percent constitutes the homeowners down payment. However, mortgage loan insurance makes it possible for lenders to offer so-called high-ratio loans of up to 95 percent of a homes appraised value. High-ratio loans are permitted only when the lender insures the loan; although the policy protects the lender, the premiums are paid by the borrower, as an addition to monthly principal and interest charges. The principal attraction of mortgage insurance is that it makes purchasing a home possible for many more individuals. It is much easier to produce a 5 percent down payment than to save up the 20 to 30 percent traditionally required. CMI had a mixed record of success within the private mortgage insurance industry. Frank Randall, the companys first and only president, had gotten the organization off to an aggressive beginning, attaining a 14.8 percent market share by 1972. By 1979, however, that share had fallen to just over 10 percent even though revenues had grown from $18 million in 1972 to over $30 million in 1979. Randall attributed the loss of market share primarily to the difficulties created by the bankruptcy of CMIs original parent. Thus he had been quite relieved when Northwest Equipment acquired CMI in January 1978. Northwest provided CMI with a level of management and financial support it had never before enjoyed. Furthermore, Northwests corporate management had made it clear to Frank Randall that he was expected to build CMI into a much larger, diversified financial services company. Northwests growth expectations were highly consistent with Frank Randalls own ambitions. The stability created by the acquisition, in combination with the increasing solidity of CMIs reputation with mortgage lenders, made it possible for Randall to turn his attention more and more toward external acquisitions of his own. During 1978 Randall, with Jim Dolans help, had investigated several acquisition opportunities in related insurance industries, with the hope of broadening CMIs financial base. After several unsuccessful investigations, the two men had come to believe that their knowledge and competence was focused less on insurance per se than it was on residential real estate and related financial transactions. These experiences had led to a recognition that, in Frank Randalls words, we are a residential real estate financial services company.

The Residential Real Estate Industry

Frank Randall and Jim Dolan knew from personal experience that real estate brokers, who play an obvious and important role in property transactions, usually have close ties with local banks and savings and loans. When mortgage funds are plentiful, brokers often steer prospective home buyers to particular lending institutions. When funds are scarce, the lenders would then favor prospective borrowers referred by their favorite brokers. Randall believed that these informal relationships meant that realtors could have a significant impact on the mortgage loan decision and thus on a mortgage insurance decision as well. For this reason, CMI had for many years directed a small portion of its marketing effort toward real estate brokers. CMIs activities had consisted of offering educational programs for realtors, property developers, and potential home buyers. The company

Capital Mortgage Insurance Corporation (A)

569

derived no direct revenues from these programs, but offered them in the interest of stimulating home sales and, more particularly, of informing both realtors and home buyers of how mortgage insurance makes it possible to purchase a home with a relatively low down payment. Because he felt that real estate brokers could be powerful allies in encouraging lenders to use mortgage insurance, Randall had been tracking developments in the real estate industry for many years. Historically a highly fragmented collection of local, independent entrepreneurs, the industry in 1979 appeared to be on the verge of a major restructuring and consolidation. For the past several years many of the smaller brokers had been joining national franchise organizations in an effort to gain a brand image and to acquire improved management and sales skills. More significantly, in 1979, several large national corporations were beginning to acquire prominent real estate agencies in major urban areas. The most aggressive of these appeared to be Merrill Lynch and Company, the well-known Wall Street securities trading firm. Merrill Lynchs interest in real estate brokers stemmed from several sources; perhaps most important were the rapidly rising prices on property and homes. Realtors commissions averaged slightly over 6 percent of the sales price; Fortune magazine estimated that real estate brokers had been involved in home sales totaling approximately $190 billion in 1978, netting commissions in excess of $11 billion (in comparison, stockbrokers commissions on all securities transactions in 1978 were estimated at $3.7 billion).1 With property values growing 10 to 20 percent per year, commissions would only get larger; where 6 percent of a $30,000 home netted only $1,800, 6 percent of a $90,000 sale resulted in a commission well in excess of $5,000for basically the same work. There were also clear signs that the volume of real estate transactions would continue to increase. Although voluntary intercity moves appeared to be declining slightly, corporate transfers of employees were still rising. One of Merrill Lynchs earliest moves toward the real estate market had been to acquire an employee relocation company several years earlier. Working on a contract basis with corporate clients, Merrill Lynch Relocation Management (MLRM) collaborated with independent real estate brokers to arrange home sales and purchases for transferred employees. Like other relocation companies, MLRM would purchase the home at a fair market value and then handle all the legal and financial details of reselling the home on the open market. MLRM also provided relocation counseling and home search assistance for transferred employees; its income was derived primarily from service fees paid by corporate clients (and augmented somewhat by referral fees from real estate brokers, who paid MLRM a portion of the commissions they earned on home sales generated by the transferred employees). Later, in September 1978, Merrill Lynch had formally announced its intention to acquire at least 40 real estate brokerage firms within three to four years. Merrill Lynchs interest in the industry stemmed not only from the profit opportunities it saw but also from a corporate desire to become a financial services supermarket, providing individual customers with a wide range of investment and brokerage services. In 1978 Merrill Lynch had acquired United First Mortgage Corporation (UFM), a mortgage banker. And in early 1979 Merrill Lynch was in the midst of acquiring

570

Case 1

AMIC Corporation, a small mortgage insurance company in direct competition with CMI. As Fortune reported,

In combination, these diverse activities hold some striking possibilities. Merrill Lynch already packages and markets mortgages through its registered representatives. . . . If all goes according to plan, the company could later this year be vertically integrated in a unique way. Assuming the AMIC acquisition goes through, Merrill Lynch will be able to guarantee mortgages. It could then originate mortgages through its realty brokerages, process and service them through UFM, insure them with AMIC, package them as pass-through or unit trusts, and market them through its army of registered representatives.2

It was this vision of an integrated financial services organization that also excited Frank Randall. As he and Jim Dolan reviewed their position in early 1979, they were confident that they were in a unique position to build CMI into a much bigger and more diversified company. The mortgage insurance business gave them a solid financial base, with regional offices throughout the country. Northwest Equipment stood ready to provide the capital they would need for significant growth. They already had relationships with important lending institutions across the United States, and their marketing efforts had given them a solid reputation with important real estate brokers as well. Thus Randall, in particular, felt that at least he had most of the ingredients to begin building that diversified residential real estate financial services company he had been dreaming about for so long. Furthermore, Randalls reading of the banking, thrift, and real estate industries suggested that the time was ripe. In his view, the uncertainties in the financial and housing industries created rich opportunities for taking aggressive action, and the vision of Merrill Lynch bulling its way into the business was scaring realtors just enough for CMI to present a comforting and familiar alternative.

The Metropolitan Realty Network

Frank Randall spent most of the fall of 1978 actively searching for acquisition opportunities. As part of his effort, he contacted David Osgood, who was the executive director of the Metropolitan Realty Network, a national association of independent real estate brokers. The association, commonly known as MetroNet, had been formed primarily as a communication vehicle so its members could refer home buyers moving from one city to another to a qualified broker in the new location. Randall discovered that Osgood was somewhat concerned about MetroNets longterm health and viability. Though MetroNet included over 13,000 real estate agencies, it was losing some members to national franchise chains, and Osgood was feeling increasing pressures to strengthen the association by providing more services to member firms. Yet the entrepreneurial independence of MetroNets members made Osgoods task particularly difficult. He had found it almost impossible to get them to agree on what they wanted him to do. One service that the MetroNet brokers were agreed on developing was the employee relocation business. Corporate contracts to handle transferred employees were especially attractive to the brokers because the contracts virtually guaranteed repeat business in the local area, and they also led to intercity referrals that almost always resulted in a home sale.

Capital Mortgage Insurance Corporation (A)

571

MetroNet brokers were also resentful of how Merrill Lynch Relocation Management and other relocation services companies were getting a larger and larger share of their referral fees. Osgood told Randall that he had already set up a committee of MetroNet brokers to look into how the association could develop a corporate relocation and thirdparty equity capability of its own.3 Osgood mentioned that their only effort to date was an independent firm in Chicago named Corporate Transfer Services, Inc. (CTS), that had been started by Elliott Burr, a prominent Chicago broker and a MetroNet director. CTS had been formed with the intention of working with MetroNet brokers, but so far it had remained relatively small and had not met MetroNets expectations. As Randall explained to Osgood what kinds of activities CMI engaged in to help lenders and increase the volume of home sales, Osgood suddenly exclaimed, Thats exactly what were trying to do! The two men ended their initial meeting convinced that some kind of working relationship between CMI and MetroNet could have major benefits for both organizations. Osgood invited Randall to attend the next meeting of MetroNets Third-Party Equity Committee, scheduled for March 1. Lets explore what we can do for each other, said Osgood. Youre on, concluded Randall.

The Third-Party Equity Business

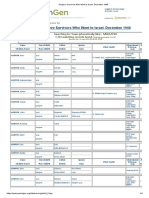

Randalls discussion with David Osgood had opened his eyes to the third-party equity business, and he and Jim Dolan spent most of their time in preparation for the March 1 committee meeting steeped in industry studies and pro forma income statements. They quickly discovered that the employee relocation services industry was highly competitive, though its future looked bright. Corporate transfers of key employees appeared to be an ingrained practice that showed no signs of letting up in the foreseeable future. Merrill Lynch Relocation Management was one of the two largest firms in the industry; most of the prominent relocation companies were well-funded subsidiaries of large, well-known corporations. Exhibit 1 contains Jim Dolans tabulation of the seven major relocation firms, along with his estimates of each companys 1978 volume of home purchases. Dolan also developed a pro forma income and expense statement for a hypothetical firm handling 2,000 home purchases annually (see Exhibit 2). His calculations showed a potential 13.1 percent return on equity (ROE). Dolan then discovered that some companies achieved a much higher ROE by using a home purchase trust, a legal arrangement that made it possible to obtain enough bank financing to leverage a companys equity base by as much as 10 to 1. Randall and Dolan were increasingly certain that they wanted to get CMI into the employee relocation services business. They saw it as a natural tie-in with CMIs mortgage insurance operationsone that could exploit the same set of relationships that CMI already had with banks, realtors, savings and loans, and other companies involved in the development, construction, sale, and financing of residential real estate. The two men felt that real estate brokers had a critically important role in the process. Brokers were not only involved in the actual property transactions, but in addition they almost always had local contacts with corporations that could lead to the signing of employee relocation contracts. Equally important, from Randalls and Dolans perspective, was their belief that a close relationship between CMI and the MetroNet brokers would also lead to significant sales of CMIs mortgage insurance policies.

572 Parent Organization Merrill Lynch Peterson, Howell, & Heather Equitable Life Insurance Chicago Title and Trust Control Data Corporation Sears/Coldwell Banker Transamerica, Inc. 13,000 12,000 5,000 5,000 3,000 3,000 3,000 Estimated 1978 Home Purchases Estimated Value of Home Purchases* $975,000,000 900,000,000 375,000,000 375,000,000 225,000,000 225,000,000 225,000,000 Estimated Gross Fee Income $26,800,000 24,750,000 10,300,000 10,300,000 6,200,000 6,200,000 6,200,000

EXHIBIT 1 | Major Employee Relocation Services Companies

Relocation Company

Merrill Lynch Relocation Homequity Equitable Relocation Employee Transfer Relocation Realty Corporation Executrans Transamerica Relocation

*Assumes average home values of $75,000.

Assumes fee averaging 2.75 percent of value of homes purchased.

Capital Mortgage Insurance Corporation (A)

573

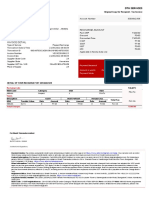

EXHIBIT 2 | Hypothetical Employee Relocation Company Pro Forma Income Statement

Key assumptions 1. Annual purchase volume of 2,000 homes. 2. Assume average holding period of 120 days. Inventory turns over three times annually, for an average of 667 units in inventory at any point in time. 3. Average home value of $75,000. 4. Existing mortgages on homes average 50 percent of property value. Additional required capital will be 40 percent equity, 60 percent long-term debt. 5. Fee income from corporate clients will average 2.75 percent of value of properties purchased (based on historical industry data). 6. Operating expenses (marketing, sales, office administration) will average 1 percent of value of properties purchased (all costs associated with purchases, including debt service, are billed back to corporate clients). Calculations Total value of purchases (2,000 units at $75,000) Average inventory value Capital required Existing mortgages New long-term debt Equity Fee income at 2.75% Operating expenses at 1% Net income Tax at 50% Profit after tax Return on equity

$150,000,000 50,000,000 25,000,000 15,000,000 10,000,000 4,125,000 1,500,000 $2,625,000 (1,312,500) $1,312,500 13.1%

The March 1 meeting with MetroNets Third-Party Equity Committee turned into an exploration of how CMI and MetroNet might help each other by stimulating both home sales and high-ratio mortgage loans. After several hours of discussion, Frank Randall proposed specifically that CMI build an operating company to handle the corporate relocation business jointly with the MetroNet brokers. As a quid pro quo, Randall suggested that the brokers could market CMI mortgage insurance to both potential home buyers and lending institutions. The committees response to this idea was initially skeptical. Finally, however, they agreed to consider a more formal proposal at a later date. MetroNets board of directors was scheduled to meet on April 10; the Third-Party Equity Committee could review the proposal on April 9 and, if they approved, present it to the full board on the 10th. As the committee meeting broke up, Randall and Dolan began talking with Elliott Burr and Thomas Winder, two of the four owners of Corporate Transfer Services, Inc. (CTS). Though Burr had been the principal founder of CTS, his primary business was a large real estate brokerage firm in north suburban Chicago that he operated in partnership with William Lehman, who was also a CTS stockholder.

574

Case 1

The four men sat back down at the meeting table, and Randall mentioned that his primary interest was to learn more about how an employee relocation business operated. Burr offered to send him copies of contracts with corporate clients, sample financial statements, and so on. At one point during their discussion Burr mentioned the possibility of an acquisition. Randall asked, somewhat rhetorically, How do you put a value on a company like this? Burr responded almost immediately, Funny you should ask. Weve talked to an attorney and have put together this proposal. Burr reached into his briefcase and pulled out a two-page document. He then proceeded to describe a complex set of terms involving the sale of an 80 percent interest in CTS, subject to guarantees concerning capitalization, lines of credit, data processing support, future distribution of profits and dividends, and more. Randall backed off immediately, explaining that he needed to learn more about the nature of the business before he would seriously consider an acquisition. As Jim Dolan later recalled,

I think they were expecting an offer right then and there. But it was very hard to understand what they really wanted; it was nothing we could actually work from. Besides that, the numbers they were thinking about were ridiculously highover $5 million. We put the letter away and told them we didnt want to get specific until after the April 10 meeting. And thats the way we left it.

Preparation for the April 10 Meeting

During the next six weeks Randall and Dolan continued their investigations of the employee relocation industry and studied CTS much more closely. One of their major questions was how much additional mortgage insurance the MetroNet brokers might be able to generate. Frank Randall had CMIs marketing staff conduct a telephone survey of about 25 key MetroNet brokers. The survey suggested that most brokers were aware of mortgage insurance, although few of them were actively pushing it. All of those questioned expressed an interest in using CMIs marketing programs, and were eager to learn more about CMI insurance. By early May a fairly clear picture of CTS was emerging. The company had been founded in 1975; it had barely achieved a break-even profit level. Annual home purchases and sales had reached a level of almost 500 properties, and CTS had worked with about 65 MetroNet brokers and 35 corporate clients. Tom Winder was the general manager; he supervised a staff of about 25 customer representatives and clerical support staff. Conversations with David Osgood and several MetroNet brokers who had worked with CTS suggested that the company had made promises to MetroNet about developing a nationwide, well-financed, fully competitive organization. To date, however, those promises were largely unfulfilled. Osgood believed that CTSs shortage of equity and, therefore, borrowing capacity, had severely limited its growth potential. Jim Dolan obtained a copy of CTSs December 1978 balance sheet that, in his mind, confirmed Osgoods feelings (see Exhibit 3). The company had a net worth of only $420,000. Three of the four stockholders (Elliott Burr, William Lehman, and Michael Kupchak) had invested an additional $2 million in the company$1.3 million in short-term notes and $700,000 in bank loans that they had personally guaranteed. While CTS owned homes valued at $13.4 million, it also had additional bank loans and

Capital Mortgage Insurance Corporation (A)

575

EXHIBIT 3 | CTS Balance Sheet

CORPORATE TRANSFER SERVICES, INC. Unaudited Balance Sheet December 1978 Assets Cash Homes owned Accounts and acquisition fees receivable Other (mainly escrow deposits) ($ 000) $ 190 13,366 665 143 $14,364

Liabilities Client prepayments Notes payable to banks Assumed mortgages payable Loan from stockholders Advance from MetroNet Other liabilities Capital Subordinated debenture due stockholder (April 1981) Common stock Deficit

$ 1,602 4,161 5,670 700 300 211 $12,644

1,300 450 (30) $14,364

assumed mortgages totaling $9.8 million. Furthermore, the company had a highly uncertain earnings stream; Frank Randall believed the current business could tail off to almost nothing within six months. During late March both Randall and Dolan had a number of telephone conversations with Burr and Winder. Their discussions were wide ranging and quite open; the CTS partners struck Randall as being unusually candid. They seemed more than willing to share everything they knew about the business and their own company. On one occasion, Burr asked how much of CTS Randall wanted to buy and how Randall would feel about the present owners retaining a minority interest. Burrs question led Randall and Dolan to conclude that in fact they wanted full ownership. They planned to build up the companys equity base considerably and wanted to gain all the benefits of a larger, more profitable operation for CMI. In early April, Randall developed the formal proposal that he intended to present to MetroNets board of directors (see Exhibit 4). The proposal committed CMI to enter negotiations to acquire CTS and to use CTS as a base for building a third-party equity company with a capitalization sufficient to support an annual home purchase capability of at least 2,000 units. In return, the proposal asked MetroNet to begin a program of actively supporting the use of CMIs insurance on high-ratio loans.

576

Case 1

EXHIBIT 4 | Letter of Intent

Board of Directors The Metropolitan Realty Network New York, NY April 9, 1979 Gentlemen: It is our intention to enter negotiations with the principals of Corporate Transfer Services, Inc., for the acquisition of the equity ownership of this Company by Capital Mortgage Insurance Corporation. In the event Capital Mortgage Insurance Corporation is successful in the acquisition of Corporate Transfer Services, Inc., it is our intention to capitalize this Company to the extent required for the development of a complete bank line of credit. The initial capital and bank line of credit would provide the MetroNet association members an annual equity procurement of 1,500 to 2,000 units. In addition, we would be prepared to expand beyond this initial capacity if the MetroNet Association volume and profitability of business dictate. We are prepared to develop an organizational structure and support system that can provide a competitive and professional marketing and administrative approach to the corporate transfer market. Our intentions to enter negotiations with Corporate Transfer Services, Inc., are subject to the following: 1. The endorsement of this action by you, the board of directors of MetroNet, for Capital Mortgage Insurance Corporation to acquire this organization. 2. The assurance of the MetroNet Association for the continuation of their support and use of CTS. Upon completion of the acquisition, the MetroNet Association would agree to sign a Letter of Agreement with the new owners of Corporate Transfer Services. 3. The assurance of the MetroNet Association to cooperate in the development of a close working relationship with CMI for the influence and control they may provide when seeking high-ratio conventional mortgage loans using mortgage insurance. Capital Mortgage Insurance will need the support of expanded business by the MetroNet Association, due to the heavy capital commitment we will be required to make to CTS to make this acquisition feasible. In this regard, CMI is prepared to offer the MetroNet nationwide members a range of marketing programs and mortgage financing packages that will help earn and deserve the mortgage insurance business and expand the listings, sales, and profitability of the MetroNet members. Upon receiving the endorsement and support outlined in this letter from the board of directors of MetroNet, we will proceed immediately with the negotiations with Corporate Transfer Services, Inc. It would be our intention to have the acquisition completed and the company fully operational by the time of the MetroNet national convention in San Francisco in July 1979. Sincerely,

Franklin T. Randall President and Chief Executive Officer

Capital Mortgage Insurance Corporation (A)

577

Randall and Dolan met again with the Third-Party Equity Committee in New York on April 9 to preview the CMI proposal. The committee reacted favorably, and the next day MetroNets board of directors unanimously accepted the proposal after discussing it for less than 15 minutes.

Formal Negotiations with Corporate Transfer Services

On the afternoon of April 10, following the MetroNet board meeting, Randall and Dolan met again with Elliott Burr and Tom Winder. Now that CMI was formally committed to acquisition negotiations, Burr and Winder were eager to get specific and talk numbers. However, Randall and Dolan remained very cautious. When Burr expressed an interest in discussing a price, Randall replied, We dont know what youre worth. But well entertain any reasonable argument you want to make for why we should pay more than your net worth. The meeting ended with a general agreement to firm things up by April 25. Later, reflecting on this session, Jim Dolan commented,

Our letter of agreement committed us to having an operating company by July 12, so the clock was running on us. However, we know that after the April 10 board meeting they would be hard pressed not to be bought, and besides they were obviously pretty eager. But at that point in time we had not even met the other two stockholders; we suspected the high numbers were coming from them.

Further Assessment of CTS

Even though the April 10 meeting had ended with an agreement to move ahead by April 25, it quickly became evident that a complete assessment of CTS and preparation of a formal offer would take more than two weeks. Other operating responsibilities prevented both Randall and Dolan from devoting as much time as they had intended to the acquisition, and the analysis process itself required more time than they had expected. During the first week of May, Jim Dolan made a reconnaissance trip to Chicago. His stated purpose was to examine CTSs books and talk with the companys local bankers. He also scrutinized the office facilities, met and talked with several office employees, observed Tom Winder interacting with customers and subordinates, and generally assessed the companys operations. Dolan spent most of his time with Winder, but he also had an opportunity to have dinner with William Lehman, another of CTSs stockholders. Dolan returned to Philadelphia with a generally favorable set of impressions about the companys operations and a much more concrete understanding of its financial situation. He reported to Randall, Theyre running a responsible organization in a basically sensible manner. At the same time, however, Dolan also reported that CTS was under increasing pressure from its bankers to improve its financial performance. Dolans trip also provided him with a much richer understanding of the four men who owned CTS: Elliott Burr, William Lehman (Burrs real estate partner), Michael Kupchak (a private investor), and Tom Winder. Of these four, only Winder was actively involved in the day-to-day management of the company, although Elliott Burr stayed in very close touch with Winder and was significantly more involved than either Lehman

578

Case 1

or Kupchak. From their meetings and telephone conversations, Randall and Dolan pieced together the following pictures of the four men: Elliott Burr, in his middle 50s, had been the driving force behind Corporate Transfer Services. He was a classic real estate salesmana warm, straightforward, friendly man who enthusiastically believed in what he was doing. An eternal optimist, he had been an early advocate of MetroNets getting into the employee relocation business. Burr knew the relocation business extremely well; he personally called on many of the large Chicago corporations to sell CTSs services. Burr appeared to be very well off financially. Burr and Lehman Real Estate was one of the largest realty firms on Chicagos North Shore, and Burr was held in high regard by local bankers. One banker had told Dolan, Burrs word is his bond. William Lehman, Burrs real estate partner, was in his mid-60s. He appeared to be much more of a financial adviser and investor than an operating manager. Lehman personally owned the shopping center where Burr and Lehman Real Estate was located, as well as the office building where CTS was leasing space. Dolan characterized Lehman as an elder statesmana true gentleman. Dolan recalled that when he had had dinner with Lehman during his visit to Chicago, Lehman had kept the conversation on a personal level, repeatedly expressing concern about Dolans plane reservations, hotel accommodations, and so on. He had hardly mentioned CTS during the entire dinner. Michael Kupchak was the third principal stockholder. Kupchak, about 50, had been a mortgage banker in Chicago for a number of years. Recently, however, he had left the bank to manage his own investments on a full-time basis. Dolan met Kupchak briefly during his Chicago visit, and characterized him as a bulldogan aggressive, ambitious man much more interested in financial transactions than in the nature of the business. He had apparently thought Dolan was coming to Chicago to make a firm offer and had been irritated that one had not been forthcoming. Frank Randall had not yet met Kupchak face-to-face, although they had talked once by telephone. Thomas Winder, 44, had spent most of his career in real estaterelated businesses. At one time he had worked for a construction company, and then he had joined the mortgage bank where Michael Kupchak worked. Kupchak had actually brought Winder into CTS as its general manager, and the three original partners had offered him 25 percent ownership in the company as part of his compensation package. Winder was not only CTSs general manager, but its lead salesperson as well. He called on prospective corporate clients all over the country, and he worked closely with MetroNet. That activity primarily involved appearing at associationsponsored seminars to inform member brokers about CTS and its services.

It was obvious to Jim Dolan that CTS had become an important source of real estate sales commissions for the Burr and Lehman partnership. Most of CTSs clients were in the Chicago area, and a large portion of the real estate transactions generated by CTS were being handled by Burr and Lehman Real Estate.

Capital Mortgage Insurance Corporation (A)

579

Dolan also inferred that the three senior partnersBurr, Lehman, and Kupchak were close friends socially as well as professionally. The men clearly respected each other and valued each others opinions. On one occasion Burr had told Dolan, Its because of Bill Lehman that I have what I have today. I can always trust his word. Tom Winder was also woven into the relationship, but he was apparently not as closely involved as the other three. Randall and Dolan both sensed that Elliott Burr was the unofficial spokesman of the group. I have the impression he can speak for all of them, commented Dolan. In late April, Randall obtained a copy of a consultants report on the employee relocation industry that had been commissioned by MetroNets Third-Party Equity Committee. The report estimated that there were more than 500,000 homeowner/ employees transferred annually, generating over 1 million home purchases and sales. However, fewer than 55,000 of these transfers were currently being handled by relocation services companies. Dolans own analysis had projected a 10 to 15 percent annual growth rate in the use of relocation companies, leading to industry volume estimates of 60,000 in 1979, 67,000 in 1980, and 75,000 by 1981. The consultants report stressed that success in the relocation business depended on a companys ability to provide services to its corporate clients at lower cost than the clients could do it themselves. In addition, profitability depended on a companys ability to turn over its inventory of homes quickly and at reasonable prices. Dolans own financial projections showed a potential return on equity of over 30 percent by 1983, assuming only an 8 percent share of the market. And that return did not include any incremental profits resulting from new sales of CMI mortgage insurance policies generated by MetroNet brokers. Randall in particular was confident that the close ties between CMI and MetroNet would result in at least 5,000 new mortgage insurance policies annuallya volume that could add over $400,000 in after-tax profits to CMIs basic business. On May 10, Randall and Dolan attended a Northwest Equipment Corporation financial review meeting in Minneapolis. Prior to their trip west Randall had prepared a detailed analysis of the CTS acquisition and the employee relocation industry. The analysis, in the form of a proposal, served as documentation for a formal request to Northwest for a capital expenditure of $9 million. Randall had decided that he was willing to pay up to $600,000 more than the $420,000 book value of CTSs net worth; the remaining $8 million would constitute the initial equity base required to build CTS into a viable company. The financial review meeting evolved into a lengthy critique of the acquisition proposal. Northwests corporate staff was initially quite skeptical of the financial projections, but Randall and Dolan argued that the risks were relatively low (the homes could always be sold) and the potential payoffs, both economic and strategic, were enormous. Finally, after an extended debate, the request was approved.

Formal Negotiations with CTS

When Randall and Dolan returned from Minneapolis, they felt it was finally time to proceed in earnest with the acquisition negotiations. Randall sensed that at present CTS was limping along to no ones satisfactionincluding Elliott Burrs. The company was sucking up

580

Case 1

much more of Burrs time and energy than he wanted to give it, and its inability to fulfill MetroNets expectations was beginning to be an embarrassment for Burr personally. In spite of these problems, Randall remained interested in completing the acquisition. Buying CTS would get CMI into the relocation business quickly, would provide them with immediate licensing and other legal documentation in 38 states, and would get them an experienced operations manager in Tom Winder. More important, Randall knew that Elliott Burr was an important and respected MetroNet broker, and buying CTS would provide an effective, influential entry into the MetroNet old boy network. Though he couldnt put a number on the value of that network, Randall believed it was almost more important than the acquisition of CTS itself. Randall was convinced that the connection with the MetroNet brokers would enable him to run CTS at far lower cost than the established relocation companies, and he also expected to realize a significant increase in CMIs mortgage insurance business.

May 21, 1979

Now, as Randall and Dolan sat in Randalls office on May 21, they discussed the draft of a formal purchase offer that Dolan had prepared that morning (see Exhibit 5 for relevant excerpts). The two men had decided to make an initial offer of $400,000 more than the $420,000 book value of CTSs net worth, subject to a formal audit and adjustments depending on the final sales prices of all homes owned by CTS as of the formal purchase date. This opening bid was $200,000 below Randalls ceiling price of $600,000 for the firms goodwill. The offer was for 100 percent of the ownership of the company. The $2 million in outstanding notes would pass through to the new company owned by Randall and Dolan. The offer also included a statement of intent to retain Tom Winder as CTSs general manager and to move the company to CMIs home office in Philadelphia. As Randall and Dolan reviewed their plans, it was clear that they were more concerned about how to conduct the face-to-face negotiations than with the formal terms themselves. In the telephone call he had just completed, Randall had told Elliott Burr only that they wanted to meet the other stockholders and review their current thinking. At one point during the conversation Jim Dolan commented,

I really wonder how theyll react to this offer. Weve been putting them off for so long now that Im not sure how they feel about us anymore. And our offer is so much less than theyre looking for.

Randall replied,

I know thatbut I have my ceiling. It seems to me the real question now is what kind of bargaining stance we should take, and how to carry it out. What do you think they are expecting?

Discussion Questions

1. 2. Prepare, and be ready to discuss, a negotiation strategy for Randall and Dolan. What should CMI be expecting from CTS?

Capital Mortgage Insurance Corporation (A)

581

EXHIBIT 5 | Draft of Purchase Letter

The Board of Directors and Stockholders Corporate Transfer Services, Inc. Chicago, IL May 24, 1979 Gentlemen: Capital Mortgage Insurance Corporation (the Purchaser) hereby agrees to purchase from you (the Stockholders), and you, the Stockholders, hereby jointly and severally agree to sell to us, the Purchaser, 100 percent of the issued and outstanding shares of capital stock of Corporate Transfer Services (the Company) on the following terms and conditions. Purchase Price. Subject to any adjustment under the following paragraph, the Purchase Price of the Stock shall be the sum of $400,000.00 (four hundred thousand dollars even) and an amount equal to the Companys net worth as reflected in its audited financial statements on the closing date (the Closing Date Net Worth). Adjustment of Purchase Price. The Purchase Price shall be reduced or increased, as the case may be, dollar-for-dollar by the amount, if any, by which the net amount realized on the sale of homes owned as of the Closing Date is exceeded by, or exceeds, the value attributed to such homes in the Closing Date Net Worth. Continuation of Employment. Immediately upon consummation of the transaction, the Purchaser will enter into discussion with Mr. Thomas Winder with the intent that he continue employment in a management capacity at a mutually agreeable rate of pay. Mr. Winder will relocate to Philadelphia, Pennsylvania, and will be responsible for the sale of all homes owned by the Company at the Closing Date. Covenant-Not-to-Compete. At the closing, each Stockholder will execute and deliver a covenant-not-to-compete agreeing that he will not engage in any capacity in the business conducted by the Company for a period of two years. If the foregoing correctly states our agreement as to this transaction, please sign below. Very truly yours,

CAPITAL MORTGAGE INSURANCE CORPORATION The foregoing is agreed to and accepted. By ___________________________ President

Endnotes

1. 2. 3. Why Merrill Lynch Wants to Sell Your House, Fortune, January 29, 1979. Ibid., p. 89. The term third-party equity capability derived from the fact that a relocation services company actually purchased an employees home, freeing up the owners equity and making it available for investment in a new home. Within the industry, the terms third-party equity company and employee relocation services company were generally used interchangeably.

You might also like

- Your Salvation Is The Struggle Against Fascism': Yugoslav Communists and The Rescue of Jews, 1941-1945Document18 pagesYour Salvation Is The Struggle Against Fascism': Yugoslav Communists and The Rescue of Jews, 1941-1945Emil Eskenazy LewingerNo ratings yet

- Osmo Tree PDFDocument1 pageOsmo Tree PDFEmil Eskenazy LewingerNo ratings yet

- List of Children Who Applied For Israel KosovoDocument2 pagesList of Children Who Applied For Israel KosovoEmil Eskenazy LewingerNo ratings yet

- AUFBAU1Document1 pageAUFBAU1Emil Eskenazy LewingerNo ratings yet

- Sarajevo Survivors Who Went To Israel, December 1948 PDFDocument4 pagesSarajevo Survivors Who Went To Israel, December 1948 PDFEmil Eskenazy LewingerNo ratings yet

- 8 Jure KristoDocument20 pages8 Jure KristoEmil Eskenazy LewingerNo ratings yet

- The Jewish Paratroopers and The Partisan PDFDocument31 pagesThe Jewish Paratroopers and The Partisan PDFEmil Eskenazy LewingerNo ratings yet

- Yugoslav Jews in SwitzerlandDocument11 pagesYugoslav Jews in SwitzerlandEmil Eskenazy LewingerNo ratings yet

- Sanski Most PDFDocument285 pagesSanski Most PDFEmil Eskenazy LewingerNo ratings yet

- My LifeDocument2 pagesMy LifeEmil Eskenazy LewingerNo ratings yet

- CemeteryDocument28 pagesCemeteryEmil Eskenazy LewingerNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cash Management BPA Questionnaire 8.8 NMDocument6 pagesCash Management BPA Questionnaire 8.8 NMdeepikag50% (1)

- Thailand Package - Mr. VinayDocument6 pagesThailand Package - Mr. Vinayganiguruprasad1_2582No ratings yet

- Invoice 3033842509 Njgzndy3mza1mjqwmzg1otq1nl42odm0njczmduwnta4oduzmjq4Document1 pageInvoice 3033842509 Njgzndy3mza1mjqwmzg1otq1nl42odm0njczmduwnta4oduzmjq4SpandanaNo ratings yet

- Investment Banking Personal Cover LetterDocument1 pageInvestment Banking Personal Cover LetterbreakintobankingNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- Annual Report 2008Document90 pagesAnnual Report 2008ericmacknorrNo ratings yet

- Assignment - Journal, Ledger - Trial BalanceDocument2 pagesAssignment - Journal, Ledger - Trial BalanceishitaNo ratings yet

- Eurocity Corporate Structure 2Document6 pagesEurocity Corporate Structure 2simon1608No ratings yet

- Alternate PetaDocument2 pagesAlternate PetaAngel Ann AgaoNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationFem FataleNo ratings yet

- KPMG Top 100 FintechDocument112 pagesKPMG Top 100 FintechJagdeepNo ratings yet

- Sage 50Document68 pagesSage 50Pau Jagna-anNo ratings yet

- Final Course (Group - III) Paper 13: Corporate and Economic Laws (Cel) 100 MarksDocument3 pagesFinal Course (Group - III) Paper 13: Corporate and Economic Laws (Cel) 100 MarksSridhanyas kitchenNo ratings yet

- Priority Sector Lending Prescriptions by Reserve Bank of India (A Case Study of IDBI Bank LTD.)Document7 pagesPriority Sector Lending Prescriptions by Reserve Bank of India (A Case Study of IDBI Bank LTD.)SKIT Research JournalNo ratings yet

- Financial Performance Analysis of Lanka Bangla Finance Ltd.Document36 pagesFinancial Performance Analysis of Lanka Bangla Finance Ltd.VagabondXiko50% (6)

- India Today December 03 2018Document98 pagesIndia Today December 03 2018simran singhNo ratings yet

- RCBC VS BdoDocument3 pagesRCBC VS BdoPao InfanteNo ratings yet

- Week 05 - Compendium V - Factoring & Forfaiting v3Document16 pagesWeek 05 - Compendium V - Factoring & Forfaiting v3ximenaNo ratings yet

- Cardholder Change Account Form: Citibank Government Travel Card ProgramDocument4 pagesCardholder Change Account Form: Citibank Government Travel Card ProgramcskjainNo ratings yet

- The Federal Reserve SystemDocument17 pagesThe Federal Reserve SystemQuennie A BismanosNo ratings yet

- Banking - IntroductionDocument15 pagesBanking - Introductionsridevi gopalakrishnanNo ratings yet

- Account Closure RequestDocument2 pagesAccount Closure Requestsankar22No ratings yet

- Merger and AcquisitionDocument49 pagesMerger and AcquisitionVivek Singh0% (1)

- Bba FileDocument81 pagesBba FileVaibhav GuptaNo ratings yet

- Number Style: General RulesDocument2 pagesNumber Style: General RulesFaizan Ahmed KiyaniNo ratings yet

- OpTransactionHistory17 08 2020Document5 pagesOpTransactionHistory17 08 2020mouna guruNo ratings yet

- Auto-Estradas / Motorways: Portagens / Toll SDocument9 pagesAuto-Estradas / Motorways: Portagens / Toll Scry19912617No ratings yet

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account SummaryDaniela100% (1)

- FTP MultiPeriod Pricing 2016 FinalProof DermineDocument12 pagesFTP MultiPeriod Pricing 2016 FinalProof DermineSumair ChughtaiNo ratings yet

- Political Economy, Vol. 108 No. 1, 1-33: Daftar PustakaDocument3 pagesPolitical Economy, Vol. 108 No. 1, 1-33: Daftar PustakaRian SopianNo ratings yet