Professional Documents

Culture Documents

DCBL (Archives) Arfy09

Uploaded by

neerajsinghusa123Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DCBL (Archives) Arfy09

Uploaded by

neerajsinghusa123Copyright:

Available Formats

..-a.+ n.

....-=+. |=. i

....=+.+

... r-a..+ ii

..-a.+ n.

....-=+. |=. i

....=+.+

... r-a..+ ii

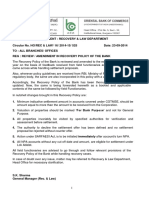

Corporate Office:

11th & 12th Floor, Hansalaya Building

15 Barakhamba Road, New Delhi - 110001

Registered Office:

Dalmiapuram - 621 651

District: Tiruchirapalli, Tamil Nadu w

w

w

.

a

r

i

n

s

i

g

h

t

.

c

o

m

Dalmia Cement (Bharat) Limited ANNUAL REPORT 2008-09

A

N

N

U

A

L

R

E

P

O

R

T

2

0

0

8

-

0

9

D

A

L

M

I

A

C

E

M

E

N

T

(

B

H

A

R

A

T

)

L

I

M

I

T

E

D

Message from Vice Chairmen 2

Key Financial Highlights 4

Session with the Managing Director 8

Demonstrating Values 10

Management Discussion & Analysis 24

Index

Directors Report 36

Report on Corporate Governance 42

Standalone Financials 54

Consolidated Financials 81

Board of Directors

Pradip Kumar Khaitan

Chairman and Non Executive Director

Jai Hari Dalmia

Vice Chairman

Yadu Hari Dalmia

Vice Chairman

Puneet Dalmia

Managing Director

Gautam Dalmia

Joint Managing Director

Mridu Hari Dalmia

Non Executive Director

J. S. Baijal

Independent Non Executive Director

M. Raghupathy

Independent Non Executive Director

Donald Peck

Independent Non Executive Director

G. N. Bajpai

Independent Non Executive Director

N. Gopalaswamy

Non Executive Director

T. Venkatesan

Whole Time Director

Corporate Information

Bankers

Axis Bank Limited

BNP Paribas

Canara Bank

Central Bank of India

Corporation Bank

ICICI Bank Limited

Indian Bank

LBBW Landesbank Baden-

Wuerttemberg

Laxmi Vilas Bank

Oriental Bank of Commerce

Punjab National Bank

State Bank of India

State Bank of Travancore

Union Bank of India

United Bank of India

Vijaya Bank

Yes Bank limited

Auditors

Head Office

Registered Office

Statutory

S.S. Kothari Mehta & Co.

Internal

KPMG

Axis Risk Consulting Services Pvt. Ltd.

T. R. Chadha & Co.

11th & 12th Floors, Hansalaya Building

15, Barakhamba Road

New Delhi 110 001

Dalmiapuram 621 651

District Tiruchirapalli

Tamil Nadu

-.-+ =.+

|.- +.-=+..+ i

.- ... =.+. .

|.-++ =+. +-+ ii

Arise, awake!

Having obtained the company of

saints, attain knowledge.

The seers affirm that the path

to realisation is as difficult

to traverse as is the sharp

edge of a razor.

th

2009 is a landmark year for Dalmia Cement. In the 70 year

of its business journey, Dalmia Cement is more than doubling

its cement production capacity and taking it to 9 million tons

per annum.

Cherished values and fair conduct have differentiated Dalmia

Cement for long. It has revisited and recast its governing

values. Summed up in a simple acronym - LeTS Excel - its

recently adopted values of Learning, Teamwork, Speed and

Excellence will work as four pillars of its future growth

foundations.

Dedicating this Annual Report to VALUES, Dalmia Cement has

chosen 'Subhashitams' - inspirational and wisdom sayings

from the rich heritage of Sanskrit literature to depict its

commitment to values based growth.

Values outlast time

1

The Subhashit on the cover highlights the virtues of good conduct and defines it as the source that

prolongs life, inculcates demeanour in the progeny, generates ever-lasting wealth; and helps

overcome ones shortcomings.

readied ourselves to take your company on the aggressive

growth path, the promoter family and the professional

managers alike were of the opinion that our goodwill and

inclusive growth philosophy have been our biggest strengths

and we must build tomorrow's Dalmia Cement on these robust

growth foundations. A series of internal debates across the

rank and file of your company were conducted to identify, delve

upon, evolve and adopt the governing values. Values that

would act as lighthouses in the growth journey.

We are happy to share with you the meaning and objective of

these new values and how they translate into day-to-day

functioning of your company. Our Values Logo is inspired by

Akshay Patra the vessel of plenty. Mythology suggests that

this vessel could go on producing limitless food for innumerable

time period - never ending in meeting its purpose. We believe

that our company too can continue creating unlimited value for

stakeholders and it can go on doing it for times to come.

These values have been adopted across your company and

all the executives are enthused by these. It gives us pleasure

in observing the unifying and

motivating power of our values.

We have been successful in

maki ng our vast human

resource pool adopt them as

their values and view them as

enablers not only in their

professional conduct but also

in their personal lives. A

beautifully coined acronym

LeTS Excel Learni ng,

Te a mwo r k , Sp e e d a n d

Excellence is working as a

great reminder to all of us.

By consistently practicing

these values in day-to-day

functioning, each employee will

strengthen these values to become an integral part of the

companys culture.

It is a matter of extreme privilege to address you in the 70th year

of our enterprise. Having commenced with a mini Polysius Kiln

at Dalmiapuram in Tamil Nadu, our enterprise has transformed

i nto a di versi fi ed mul ti -l ocati on, mul ti -commodi ty

manufacturing Company with significant scale in cement and

sugar and an annual turnover of about Rs. 20 billion.

The calendar year 2009 will be a year of great significance for

your company, as it will see your installed capacity in cement

more than double. The year will witness your company's two

Greenfield cement plants commence operations in Southern

India, at Kadapa in Andhra Pradesh and Ariyalur in Tamil Nadu.

A legacy of 70 years in itself is a great asset for an organisation.

What makes your company special is its drive to chart

aggressive growth in the ensuing years. And to see that very

drive, competence and resolve in the management of your

company is heartening.

Success and profit are obvious objectives of any business.

Maintaining profitability for

several decades and still being

contemporary for today and

tomorrow, needs much more. It

needs the deep rooted values

that govern the conduct of the

company and a philanthropic

philosophy of inclusive and

sustainable growth. From the

very beginning of this enterprise,

we have been driven by the

inclusive and sustainable growth

objectives of our founders, Shri

Ramkrishna Dalmia and Shri

Jaidayal Dalmia.

To us, the most significant

development in your company during the year was the

development and institutionalisation of its values. As we

Values that transcend generations

Message from Vice Chairmen

Dear Shareholders,

Annual Report 2008-09

2

Shri Ramkrishna Dalmia Shri J Dalmia

Increased capacities in cement operations will bring the

economy of scale and newer markets shall drive better growth

and profitability, going forward. Global diversion of sugarcane

towards energy sector is likely to keep sugar as a profitable

business of your company, in both import and export situations

for the country. Both these factors will favourably aid to value

creation by your company.

In conclusion, we will like to express our gratitude to our

founders and their vision and rededicate ourselves to keep the

vibrancy of your company in ensuing years. We will like to

congratulate your company's management on institutionalising

a strong set of values and weaving the company executives'

thought process around them. We appreciate the projects team

for successful commissioning of Kadapa plant while wishing

them luck for the soon to commission Ariyalur Plant. To all the

employees of Dalmia Cement, we have this message While

we are transiting through one of the most exciting times of our

business journey, we are glad to have you on board. Your

efforts and contributions made in the last year are laudable.

We sincerely appreciate all our stakeholders for their continued

support and patronage and look forward to the same as we

move ahead to scale greater heights in coming years.

FY09 proved to be a truly testing year for global economies,

one of the severest in the post globalisation times of last

decade. The underlying and accumulating financial crisis of

developed world came to light coinciding with the saturation of

their economic growth. This dual blow has impacted their

economies almost instantly and the consequent impact on

emerging economies like ours have also felt the tremors,

though with a time lag.

Your company has been a big believer in India story and the

extent of insulation witnessed in the last financial year testifies

our belief. Our economy draws strength from being domestic

consumption led and regulated banking & financial system.

Basis these very strengths, growth is the only way forward for

our economy.

In the near term, following months will be challenging for Indian

Cement Industry, as there is significant new capacity in the

pi pel i ne, at di ff erent st ages of i mpl ement at i on.

Commencement of these capacities will create over capacity

situation, causing pressure on pricing and utilisations due to

demand supply mismatch. To meet this challenge, we have

entered new markets with aggressive marketing plans and at

the same time consolidated our position in our core markets. le

and newer markets shall drive better growth and profitability,

going forward. Global diversion of sugarcane towards energy

sector is likely to keep sugar as a profitable business of

your company, in both import and export situations for the

country. Both these factors will favourably aid to value creation

by your company.

Jai Hari Dalmia Yadu Hari Dalmia

3

While we are transiting

through one of the most

exciting times of our business

journey, we are glad to have

you on board. Your efforts

and contributions made in the

last year are laudable.

Financial Highlights

Previous year figures have been regrouped/rearranged wherever necessary for comparison with current year numbers

^ Face Value Rs 10 per share, split to Rs 2 per share in FY06

# Based on shares outstanding at year end

* Includes Capital Work In Progress

Particulars

Total Operating Income Rs. Mn 4,640 5,855 10,069 15,078 17,787

EBITDA from Operations Rs. Mn 728 986 2,698 4,960 5,257

Cash Profits from Operations Rs. Mn 478 650 2,047 3,299 3,474

Profits before Tax Rs. Mn 357 1,089 2,964 4,341 2,599

Profit after Tax Rs. Mn 309 848 2,289 3,472 1,586

Share Capital Rs. Mn 77 77 85 162 162

Reserves & Surplus Rs. Mn 3,507 4,199 7,449 11,310 12,520

Loan Funds Rs. Mn 4,988 6,832 10,146 15,833 23,383

Net Block* Rs. Mn 6,159 7,886 13,436 18,260 26,666

Net Current Assets Rs. Mn 2,130 2,199 1,752 4,536 5,010

Operating Profit Margin % 16% 17% 27% 33% 30%

Net Profit Margin % 7% 13% 20% 21% 9%

Return on Average Net Worth % 12% 28% 45% 40% 14%

EPS (fully diluted) Rs. 4.91 11.78 29.18 42.87# 19.61

Cash EPS (fully diluted) Rs. 8.52 17.60 43.40 57.70# 38.50

Debt Equity Ratio x 1.39 1.60 1.35 1.38 1.84

Interest coverage x 2.59 5.64 6.49 4.84 2.82

Current Ratio x 2.66 2.02 1.34 1.83 1.78

Dividend Rate % 50% 100% 150% 200% 150%

Dividend Payout Ratio % 12% 9% 6% 9% 15%

Share Price (as on March 31) Rs. 392 264 361 285 78

Market Capitalization Rs. Mn 2,999 10,119 15,438 23,020 6,338

FY05 FY06 FY07 FY08 FY09

^

4

Annual Report 2008-09

5

TOTAL OPERATING INCOME

4640

5855

10069

15078

17787

FY05 FY06 FY07 FY08 FY09

728

986

2698

4960

5257

FY05 FY06 FY07 FY08 FY09

12%

9%

6%

9%

15%

FY05 FY06 FY07 FY08 FY09

2658

3419

6750

10748

12057

FY05 FY06 FY07 FY08 FY09

478

650

2047

3299

3474

FY05 FY06 FY07 FY08 FY09

CAGR 40%

CAGR 64% CAGR 64%

CASH PROFIT OPERATING PROFIT

DIVIDEND PAYOUT RATIO

CAGR 46%

NET WORTH

(Rs. Mn)

(Rs. Mn) (Rs. Mn)

(Rs. Mn) (%)

Annual Report 2008-09

5%

12%

83%

Sugar Co-gen Distillery

SUGAR REVENUE MIX (FY09)

FY05 FY06 FY07 FY08 FY09

Production Sales

162

73

84

108

246

108

75

100

93

141

5%

5%

30%

60%

Tamilnadu Kerala Karnataka Others

CEMENT GEOGRAPHIC MIX (FY09)

1151

1405

1262

1569

2055

2737

2444

3294

2571

3384

FY05 FY06 FY07 FY08 FY09

SUGAR PRODUCTION & SALES

CLINKER & CEMENT PRODUCTION

Clinker Cement

6

( 000T) ( 000T)

7

FY08 FY09

3197

3499 3521

3541

3645

3767

3891 3892

Q1 Q2 Q3 Q4

FY08 FY09

3482

3547

3633

4145 4146

4492

4041

4849

Q1 Q2 Q3 Q4

FY08 FY09

13108 13030

13375

14072

14555

16456

17112

19380

Q1 Q2 Q3 Q4

SUGAR SALES REALISATION

NET SALES

CEMENT SALES REALISATION

811

1292

1309

1167

1058

1013

1782 1785

FY08 FY09

Q1 Q2 Q3 Q4

EBITDA

(Rs./T) (Rs./T)

(Rs. Mn) (Rs. Mn)

What challenges did the cement business face and how

satisfied are you with its performance in FY09?

Cement is the single largest contributor in our

diversified business and accounted for 74% of the total net

sales of the Company in FY09. During the year, cement net

sales grew by 14% to reach Rs. 12,927 million. Cement sales

volumes at 3.4 million tons depicted single digit growth of just

about 4%.

In my opinion, FY09 was a difficult year traversed well

for the entire cement industry. The industry witnessed volatility

of all hues; across regions, players and quarters. Exports

ban, influx of imported cement, escalating input cost,

production constraints, softening of demand, reversal of

exports ban Indian cement industry weathered all to

emerge amongst the leading contributors to the National GDP

growth of 6.7%.

The challenges and achievements of your company were no

different than those of the industry on operational fronts. The

company adapted to the changing environment while speedily

readying the new capacities at one hand and tackling the

escalating operating costs - which could not have been passed

through fully. Despite these, the company delivered growth at

both top line and operating EBITDA levels. In my view, FY09

has tested the Companys ability to survive and grow in

challenging times through collaboration and innovation. These

set of values are expected to hold us in good stead in the near

term, where the industry is likely to face challenges on account

of demand-supply mismatches.

revenue

How do you view the companys performance in FY 09?

FY09 was a year of multiple challenges for the company.

We tackled simultaneous Capex and Opex pressures

during the year and achieved encouraging results on both

fronts of capacity expansion and meticulous operations.

Our gross sales at Rs. 19,715 million were up 17% from

Rs. 16,908 million last year. Despite the rising input cost and

cost pressure on our products prevalent through most part

of the year, our operating EBITDA grew by 6% to reach

Rs. 5,257 million. Cement gross revenues were up by 13% at

Rs. 14,807 million and gross revenues from integrated sugar

business improved by 29% to Rs. 3,776 million. Sugar EBITDA

saw a marked improvement at Rs. 601 million, up 154% on

a small base while Cement business had a 4% fall in operating

profits at Rs. 4,402 million.

Our Greenfield projects progressed at rapid pace through the

year, weathering the storm of economic slowdown and liquidity

crunch. Kadapa plant of your company got commissioned in

March 2009 and is currently under ramping up stage.

Strategically, we have started grinding operations at Ariyalur

plant ahead of the clinker kiln commissioning, which

incidentally is expected to be commissioned in the second

quarter of current financial year. I am glad to inform you that

your company achieved a rare feat of commissioning the

Kadapa plant within 24 months from placing orders for major

plant and machinery. Considered against industry average of

30-36 months, the projects team has achieved a tremendous

feat and the time saved shall cover up for the ramp up time.

Values that drive us into future

Session with the Managing Director

8

Since becoming the Managing Director in 2007, Puneet Dalmia has been spearheading the aggressive growth strategy of Dalmia

Cement. An IIT and IIM alumnus, Puneet features amongst the youngest MDs of India Inc. Known for his passion for perfection, he

has been the catalyst in transformation of HR Culture of the company. He speaks on a host of issues facing the company.

Annual Report 2008-09

our Green Agenda by producing bio-fuel. Our sugarcane

crushing capacity at 22,500 TPD is significant and I anticipate

cane friendly policies from the governments in near future. For

a profitable business unit helping farming community,

generating employment across production and distribution

channel, producing green energy and bio-fuel; our sugar

business will continue to be an important area in our inclusive

and sustainable growth pursuit.

What is your message to shareholders for FY10 and

beyond?

I feel humbled and privileged to thank our shareholders for their

continued trust and patronage. Growth in commodity business

and especially cement has always been volume-driven. We

have worked relentlessly in the last five years towards building

volumes, Brownfield, Greenfield and through strategic

investments. And by March 2010, we will command close to

10 million tons of capacity in cement including your companys

share in OCL India, a leading player in the eastern region.

Being able to grow without significant dilution, in my opinion,

is a rare feat of your company and the same will go a long way

in maximizing shareholder value. We have built strong

capacities in both our businesses of cement and sugar, funding

all this growth through internal accruals and debts. As we knock

the doors of the bigger league, all our perseverance including

your continued trust will come in handy and shall help us reap

rich dividends.

How do you view the sugar businesss performance in FY09?

Our sugar business performed exceptionally well on the sales

and realisation front in FY09, recording 31% growth in net sales

and 15% growth in sales volume. While net sales rose to

Rs. 3,550 million, EBITDA from our integrated sugar operations

rose significantly to Rs. 601 million recording a jump of 154%

over Rs. 237 million in the previous year. EBITDA margin also

rose to 17% from 9% in the previous year.

Sugar production however, saw a significant drop on account of

acute shortage of sugarcane, across the industry. Our crushing

season got reduced to 98 days. During the year, the industry

witnessed the lowest sugar cane yields and sugar recoveries in

last 15 years. The impact of lower sugarcane availability was

visible in co-generation and distillery operations too. We

anticipate better realisations trend to continue in FY10,

because of this lower production. Since the country will need to

import sugar to cover the gap, central government has allowed

duty free import of raw sugar under OGL, to be processed and

sold in domestic market without any re-export obligation. Your

company is availing this opportunity of importing raw sugar,

which will be processed at our facility at Jawaharpur.

Cements domination will strengthen further in your

business mix. How relevant will the sugar business be,

going forward?

Our sugar business differentiates us from our cement peers. Its

strong co-generation prowess brings green energy to our fold

reducing our carbon footprint. Integrated distillery strengthens

Being able to grow without significant

dilution, in my opinion, is a rare feat of

your company and the same will go a

long way in maximizing shareholder

value.

9

=-+ .. |=.

+==-+ + -++ i

=r =-+=.s+.

.|.= =+.+ ii

10

Annual Report 2008-09

Values that sustain value creation

Values are beliefs about what is right and wrong and what is

important in life. Values are what drive our conduct every

moment. Values are the rich cultural heritage of any society.

Values are the binding force and the guiding principles behind

the evolution and prosperity of all civilisations.

Like mankind, companies too with the right set of values, have

prospered over a long period of time. As an organisation which

believes in fair conduct, our shared values have been our

means to achieve inclusive and sustainable growth.

Entering the aggressive growth trajectory, we will be guided and

governed by our newly adopted values. Binding 3500 people

across 15 locations and driving the cumulative energies of one

company, one belief and one dream are our four core values of

LEARNING, TEAMWORK, SPEED and EXCELLENCE.

Dalmia

Lets Excel

We are committed to creating exceptional value for our customers, employees,

shareholders, vendors and the communities we operate in, through our core values of

Learning, Teamwork, Speed and Excellence

Our values mission

11

The Subhashit on the adjacent page signifies the importance of imbibing right virtues; presence of

which, by itself ensures development of the person.

.-. =.-+

+.+ . =..+ i

.. =- =+. +.

=. =- =+. .=+ ii

Annual Report 2008-09

12

Values that incubate Learning

and production team ensured grinding, processing and

clinkerisation in no time.

Better quality oil-well cement was produced, this time at a lower

cost due to fuel efficiency we achieved. The desired quantities

were despatched within the stipulated deadline. The path of

past failures led us to success this time, because of our

previous leaning and openness to learn through the entire

process.

Considering the fuel efficiency of the process, which could

result in substantial savings for the company in future, we feel

proud to have embarked on this PATH OF LEARNING.

A sudden demand for large volume of Oil-well cement came

when we were transiting from the old Polysius to Modern KHD

Kiln for Oil-well cement. KHD Kiln's efficiency for this special

cement was yet to be established.

Meeting this unexpected demand within a tight deadline was a

big challenge. Previous attempts of producing oil-well cement

through KHD Kiln were unsuccessful. Designated teams

spurned into action and after deliberation decided to use the

KHD Kiln for the purpose.

With drive and conviction to succeed, meticulous planning was

initiated. Quality control team estimated raw material

requirement; mining team undertook exploration and supply;

13

Learning from failure, we met with success

The subhashit professes the utilisation of every moment towards learning and every particle towards

earning. It alarms further that no knowledge can accrue if time is lost and no wealth can be created if

particles, however small, are lost.

. =r+. +..

==.. =|+-+. i

+ r ...++.=

+.+.= =r-+s-.==.+ ii

Annual Report 2008-09

14

Values that inculcate Teamwork

defined, as the needs were unique at each location. Slight

delay in planning and ordering ate into execution time.

Realigning across functions, resources were scaled up. The

underlying collaboration and commonality of purpose ensured

optimisation of resources. Constant exchange of learning from

experience and sharing of resources between functions and

locations exemplified the value of teamwork.

Our collaborative efforts bore fruits with all the plants getting

commissioned in a record time of 12-15 months. Our success

signified the POWER OF TEAMWORK.

With our Ramgarh plant performing well, we decided to expand

our sugar business with two proximate Greenfield plants at

Jawaharpur and Nigohi. The project also included setting up of

a distillery at Jawaharpur and a power-plant each at all the

three locations to make our sugar business integrated.

With no experience in co-generation and distillery, expanding

at three locations was a big challenge. Poor infrastructure,

inclement weather and increased demand load on suppliers in

the region added significantly to the challenge.

We formed a central project team from existing resource pool.

Smaller location-wise teams were formed with roles clearly

15

Extensive collaboration made our sugar expansion easy

The subhashit compares the weathering of storm by a well-planned plantation cluster against the

uprooting of a standalone tree and thereby highlights the power of collaboration.

=-| =.=.+

= =- -+. .+-+ i

+ -+ =...=

=.+ +.+.= ii

Annual Report 2008-09

16

Values that value Speed

sub-contractors and offered on-the-spot bonus on intermediate

stage completions. Our passion to make things happen

as well as empowerment towards decision making across

levels helped us achieve this daunting task in less than

. 10 months

We were surely not the first one to construct pre-heater

tower, but amongst the fastest ones to accomplish this feat.

PASSION FOR SPEED- shall we say!

Commissioning Kadapa plant on time was of strategic

importance to the Company. Though land acquisition was

completed quickly, heavy rains and consequential flooding of

the site resulted in a loss of 45 days for civil construction.

We aimed to cover up this time-loss in the construction of pre-

heater tower; the tallest structure (139 m, 8-floor in our case)

which generally takes about 12-14 months to complete.

We divided the marathon project into smaller floor-wise

targets; did minute detailing; collaborated within and even with

17

Creating speed benchmarks

The subhashit praises the wisdom of doing tomorrows bit today in the backdrop of uncertainties of

future and highlights the virtue which results in speedy execution and higher productivity by mankind.

+ =c.a +=.= =. i

a. +=+r+. +-+-+ +. ii

+= |= |=| a+r-+.=. i

a. .++==. = |=-+ ii

Annual Report 2008-09

18

With no prior experience or external help, we showed the

courage to take on this challenge, stayed focused on the end

objective, shared knowledge, implemented quickly in the

process and went on to achieve this feat.

We succeeded because we believed. Simply put, we won

because of our consistent PURSUIT OF EXCELLENCE.

We undertook to upgrade our KHD Kiln's capacity from 1800 to

3000 TPD. The job involved construction of pre-heater tower

(108m) over the running kiln.

Just being good was not enough. What was needed was

an exemplary belief in self and fellow colleagues, immaculate

planning and detailing, sharing of responsibilities across

sub-groups, collaborative furtherance of concurrent and

sequential development of assigned task, adherence to

the timelines and working with an impeccable alternate

contingent plan.

Values that worship Excellence

19

Aiming high, we reached sky

The spirit of resilience and winning over the obstacles are highlighted by this Subhashit. Excellent

people are defined as the ones who go on to achieve their aim, displaying this spirit.

Year 2009 holds greater significance for Dalmia Cement. Its

first Greenfield cement plant at Kadapa in Andhra Pradesh

commenced operations in March 2009, followed closely by

commencement of trial grinding at its second Greenfield plant

at Ariyalur in May 2009. With a net Capex of over Rs. 13,300

million incurred till March 2009, these two plants shall ramp up

and start contributing soon.

Commencement of these two plants will mark the transition of

Dalmia Cement from a single-location, single-plant entity to a

three-location, three-plant cement major having presence

across multiple markets. With combined capacity of 9 million

tons, the company will go on to further strengthen its market

leadership in the southern region.

Kadapa unit is Dalmia Cement's first cement plant outside

Tamil Nadu. With installed capacity of 2.5 million tons at 100%

PPC, the plant has added significantly to company's 4 million

tons existing capacity at Dalmiapuram. The plant marks the

company's entry into cement markets of Andhra Pradesh &

Kadapa Plant

Value-creators that multiply value

Annual Report 2008-09

20

Our Joint Managing Director, has led

the capacity expansion projects from the front. Putting best

of his experience to use, he has made significant

contribution in the growth phase of the company.

Mr. Gautam Dalmia

Karnataka and shall go a long way in strengthening its footprint

in Southern India.

A masterpiece of tomorrow's technology, the plant has latest

equipments and machineries including Robolab, which collects

samples at each stage of manufacturing and calibrates

the equipment to attain the desired output. The plant is

expected to establish a new benchmark in emission norms and

energy efficiency.

Being located in limestone rich belt with proximity to other raw

material sources, the unit is well connected by rail and road and

is almost equidistant to major markets of Hyderabad, Chennai,

Bangalore and Vijayawada.

The Kadapa plant was completed within 21 months from

ground breaking. The pre-heater construction was completed

in less than 10 months against a much higher industry average.

With immaculate planning, the unit obtained all statutory

clearances necessary for commissioning the plant well

in advance.

Company's second Greenfield project at Ariyalur in Tamil Nadu

is strategically located amidst another limestone rich belt and is

40 kilometers away from the Dalmiapuram plant. The final

stage of development at this site is progressing at a fast pace.

More than 80% of the construction work was completed at the

time of this report going to print.

Ariyalur Plant

Panoramic view of newly commissioned Kadapa plant

21

Pre-heater tower at Ariyalur

As a 70 year old enterprise, we have grown with the

contributions from three generations of promoters and

employees. The company strongly believes in preserving a

cleaner and greener environment for communities of today

and tomorrow.

Dalmia Cement continually takes numerous initiatives towards

ecology and environment conservation including emission

reduction measures, extensive plantation around its plant,

recycling and treatment of sewage and effluents from plant and

colonies, rain water harvesting, cow breeding etc. It has

constructed a pond in Dalmiapuram and several watch towers

at a bird sanctuary near Karaivetti Lake, near Dalmiapuram.

An ongoing Clean Development Mechanism project on

optimization of Clinker has made significant progress in FY09.

At Dalmia Cement, energy self-sufficiency and efficiency is

pursued with an ideology which establishes it as a business

imperative and social responsibility too. It has consciously

responded to this cause by evolving in-house power generation

Values that respect nature and humanity

Annual Report 2008-09

22

approach on one hand and optimisation of all forms of energy

through various measures in its cement and sugar businesses on

the other.

Dalmia Cement's community development initiatives aim at

four core areas of basic education, healthcare, livelihood

enhancement and civic infrastructure improvement. It

undertook several initiatives in the adjoining areas of its cement

and sugar plants in FY09. The year saw its community

development programs also reaching Andhra Pradesh, in the

adjoining areas of the Kadapa plant.

Distribution of books and stationary, construction and repair of

school buildings, promotion of vocational training programs,

arrangement of medical camps, donation for higher education,

construction and repair of village infrastructure including roads

and dhobi ghaat and donation of a 34-seater ambulance to

Rajiv Gandhi Institute of Medical Sciences, Kadapa were some

of the community development initiatives undertaken during

the year.

Ambulance for community service

A school aided by Dalmia Cement

fast by setting up godowns in strategic locations and deploying

relationship managers and service-oriented carrying &

forwarding agents.

Innovative promotions for channel engagement have been the

hallmark of Dalmia Cement. With a clear focus on below-the-

line activities in the previous years, it has optimised the

promotional investments. Its market share has grown by 20%

CAGR since 2004 in Tamil Nadu & Kerala markets. Dalmia

Cement's prudent strategy of expanding in the focussed region

of southern India, where it enjoys the long legacy of 70 years

and which has been the fastest growing market will help it reap

rich dividends in coming years.

Dalmia Cement intends to undertake an aggressive mass-

media promotion campaign including outdoor and electronic

advertising, which shall give a major fillip to the groundwork

done by its sales team and help it stamp its leadership in new

markets in addition to maximising its sales in traditional

markets. All these brand building activities shall translate into

an increased brand preference, which is an impeccable tool of

maximising yield in short-supply situation and enhancing

capacity utilisation in over-supply situation.

Dalmia Cement has always enjoyed tremendous preference in

its traditional markets of Tamil Nadu and Kerala. Respected for

its product quality and strong business ethics, it is a household

name. Its flagship brand Vajram's premium perception rates

high in the peer group. Believing in the inside-out approach

of brand building, it has persevered through out the year

towards leveraging its traditional market brand premium to

newer markets.

Extensive mapping exercise was undertaken to identify

potential dealers from traditional and even allied channels.

Identifying district-wise trends & needs, development of a

strong network of wholesalers and retailers has been initiated

during the year. The dealer network is aggressively being

scaled up with special focus on exclusive dealers and by

upgrading a few existing sub-dealers as dealers for Dalmia

Cement. DCBL continues to motivate the channel partners by

recognising the volume sales with various incentives.

Dalmia Cement sales force of over 150 dynamic professionals

is managing the dual task of fortifying its dominant market-

share in Tamil Nadu & Kerala and establishing sizeable market-

share in Andhra Pradesh & Karnataka. With the seed sales

already done in these two states, logistics are being scaled up

23

Values that create winning brands

Management Discussion and Analysis

Annual Report 2008-09

Indian economy too was not completely insulated from these

global events. According to the quick estimates released by

the Central Statistical Organisation, GDP growth in FY09 was

down to 6.7%, in sharp contrast to the sustained growth

momentum of over 9% achieved during previous three years.

The Economic Advisory Council to the Prime Minister has

anticipated that the Indian economy will slowly pickup from

second quarter onwards and go on to show fairly strong

recovery in the second half of FY10. The council identified that

accelerated implementation of the infrastructure projects is the

INDIA GDP GROWTH (%)

Source: Central Statistical Organisation, Govt. of India

24

Economic Overview

Year 2008 proved to be a watershed year for the global

economy with unprecedented financial crisis and slump in

activity engulfing the economies worldwide. The liquidity

ceased in the credit markets and growth expectations turned

negative in the developed economies. According to the World

Economic Outlook released by the IMF recently, the advanced

economies experienced an unprecedented 7.5% decline in real

GDP during the fourth quarter of 2008 and emerging economies

also contracted 4% in aggregate during the same quarter.

XITH FIVE YEAR PLAN:

SECTOR-WISE PROJECTED INVESTMENT (INR Billion)

Source: Planning Commission, Govt. of India

6665 : Power

3142 : Roads & Bridges

2618 : Railways

2553 : Irrigation

1437 : Water & Sanitation

880 : Ports

310 : Airports

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

FY05

7.5

FY06

9.4

FY07

9.9

FY08

9.0

FY09

6.7

25

Standalone Financials

(Rs. Mn) FY08 Growth

Gross Sales 16,908 19,715 17%

Net sales 14,807 17,528 18%

Total Income from Operations 15,078 17,787 18%

EBITDA from Operations 4,960 5,257 6%

PBT 4,341 2,599 (40%)

PAT 3,472 1,586 (54%)

FY09

Performance Highlights - Standalone

Of the total net sales, cement business unit along with wind

farm accounted for 74% in the FY09 while integrated sugar

business increased its contribution in the revenue mix from

18% to 20% on account of sales volume growth and improved

realisations. Other businesses include revenue streams from

refractory and other units.

Earnings Per Share for the company for FY09 stood at

Rs. 19.61. EBITDA from operations improved at Rs. 5,257

million, with integrated sugar business performance improving

significantly. Profits for the Company as a whole suffered on

account of a negative swing of Rs 1,733 million in Other Income

in FY09 mainly due to loss in temporary surplus treasury

against profits of Rs. 1,374 million booked last year.

REVENUE MIX (FY09)

FY08 FY09

4960

5257

EBITDA FROM OPERATIONS (Rs. Mn)

74%

20%

6%

Other

Sugar

Cement

(Rs Mn) FY08 09 Growth

Gross Sales 16,908 19,715 17%

Net sales 14,807 17,528 18%

Total Income from Operations 15,106 17,807 18%

EBITDA from Operations 4,970 5,274 6%

PBT 4,393 2,181 (50%)

PAT * 3,688 1,412 (62%)

* Including Share of Profit from Associates

. FY

foremost factor impacting the economy's recovery in FY10.

With Government spends on infrastructure accounting for

about 30% of India's cement consumption, the cement industry

and your company shall expect a further fillip to demand in FY10.

FY09 witnessed severe power shortage across many States

including Tamil Nadu and Andhra Pradesh, where your

company's cement units are located. Persistent shortage of

coal also resulted in power utilities cutting down on generation,

further worsening the power situation in the country. With the

availability of gas from Krishna-Godavari basin to gas-based

power plants in Andhra Pradesh, power availability is expected

to improve not only in that state but also in neighbouring Tamil Nadu.

International Sugar Organisation's recent estimates suggest a

global sugar deficit of over 7.5 million tons in Sugar Season

2008-09 and forecasts sugar import by India to be at 2.4 million

tons to meet its annual demand. These shortages have led to a

favourable commodity pricing scenario. Your company's

integrated sugar business shall benefit from better realisations,

offsetting part of the impact of lower production.

Despite uncertainties in the operating environment, overall

performance of your company was satisfactory in FY09.

Consolidated Financials

Financial Highlights

FY08 FY09

14807

17528

NET SALES (Rs. Mn)

three year CAGR of 10%. Indian Cement exports at 3.2 MnT

and Clinker exports at 2.9 MnT were flat for the year. Southern

region (including Maharashtra) recorded consumption of about

76 MnT and grew year on year at 9.2 %, lower than its 3 year

CAGR 10.7%. With 43% of All India consumption, it continues

to be a promising region for cement in India.

With new capacity additions, capacity utilization fell to 88% in

FY09 from 94% in previous year for both, South as well as All

India. This however did not have any significant impact on prices,

as lower capacity utilization, was partly on account of longer

stabilization period for new capacities, and partly on account of

capacity lost due to infrastructure constraints. However there is

significant new capacity in the pipeline. As per CMA estimates,

during FY10, about 60 MnT of new capacity is expected to go on

stream, of which about 22MnT would be in South.

Performance Review

During FY09, your company's cement unit (including wind

farm) net sales reached Rs. 12,927 million, recording an

increase of 14%. With input cost of coal, fly ash, gypsum and

other materials rising, cement EBITDA from operations

recorded a decline of 4% at Rs. 4,402 million. Employee cost

too increased mainly on account of significant increase in

manpower towards managing and marketing new capacities at

Kadapa and Ariyalur.

Annual Report 2008-09

26

Business Overview

Cement

Indian cement industry started FY09 with installed capacity of

192 MnT (excluding closed capacities of 6 MnT) as per data

released by Cement Manufacturers Association, India. Against

expected capacity addition of 40 MnT during FY09, industry

added only 21 MnT primarily owing to delays in project

executions. The total capacity reached 219 MnT at the close of

FY09. Capacity in the Southern Region (including 13 MnT of

Maharashtra) was 75 MnT, as on March 31, 2008 and

increased by about 16 MnT during FY09, reaching 91 MnT.

During FY09, all India cement consumption rose by 8.4% to

reach 178 MnT, slightly lower than the 3 Year Compounded

Annual Growth Rate (CAGR) of 9.5%. Considering the

economic slowdown and sharp decline in the realty sector, this

was an encouraging growth though lower than the previous

Higher interest costs at Rs 1,426 million too impacted the

profitability. Enhanced debt and higher borrowing cost due to

tight financial market conditions led to this 26% increase.

Greenfield cement expansion project at Kadapa in Andhra

Pradesh was commissioned in March 09 and volume growth

from the same would be available in FY10.

94%

54

88%

168

181

FY 09 FY 08

60

India South India Utilisation

PRODUCTION AND CAPACITY UTILISATION (MnT)

Source: Cement Manufacturers Association

EXPENSE MIX

28%

24%

14%

9%

6%

6%

4%

10%

Repair & Maintenance

Depreciation

Salaries

Freight

Interest

Others

Raw Material

Power & Fuel

CEMENT SCENARIO: ALL INDIA & SOUTH INDIA (MnT)

Source: Cement Manufacturers Association

India South India

198

179

168

219

205

181

62

57

54

78

68

60

Capacity Effective Capacity Despatches

FY08 FY08 FY09 FY09

First truckload being flagged off at Kadapa plant

In the cement business, your Company was able to increase

sales volumes by about 4% to 3.4MnT. Capacity utilization for

the Dalmiapuram plant continued to be above 90%.

Despite better price realisation in the southern region, margins

got squeezed, due to unprecedented increase in price of

imported coal by over 60% in the first half of the financial year,

which also impacted the cost of self generated power.

Presently the prices have come down, and are close to FY08

average. Foreign exchange losses on imports, owing to 26%

depreciation in Rupee against the US Dollar, during FY09,

further impacted the imported material costs. Together, fuel

and power cost per ton of cement increased by 47% year on

year. Your company managed to restrict increase in its freight

costs per ton to 4% despite increase in diesel prices, by

optimising its logistics mix.

Operations Highlights

With the commissioning of second thermal power plant of 18

MW at Dalmiapuram unit, your company enjoys complete self

sufficiency in power insulating its operations from the prevailing

power-cuts in Tamil Nadu. In order to bring the fuel cost down,

the company is also focusing on alternate fuels, benefits of

which are expected to be realised in FY10. During the year

company lowered its power consumption to below 72kwh/T,

which is amongst the lowest in the industry.

Your company's 2.5 MnT, based on 100% PPC mix, Kadapa

project got commissioned within 24 months of placing major

machinery orders. The project got some what delayed, as

compared to the original plan, but it was still executed in good

time frame, when compared to other projects, ordering for

27

NET SALES AND EBITDA FROM OPERATIONS (Rs. Mn)

FY08 FY09

EBITDA from Operations

Net Sales

4591 4402

12927

11322

CEMENT PRODUCTION AND SALES (MnT)

3.29

3.38

3.26

3.38

Production Sales

FY08 FY09

Rail despatch from the Dalmiapuram plant

which was initiated around the same time. Your company's

second 2.5 MnT, based on 100% PPC mix, Greenfield Ariyalur

project is in advanced stage of completion and is expected to

be commissioned in the second quarter of FY10. Thermal

Power plant of 27 MW, at Ariyalur, is expected to be

commissioned in the third quarter of FY10 to provide self

sufficiency in power requirements of the unit.

Strategic Investment

As mentioned last year, your subsidiary Dalmia Cement

(Meghalaya) Ltd merged with OCL India Ltd. Consequent

to this merger, your company acquired 21.7% strategic

stake in OCL India Ltd. It had 2MnT cement capacity as on

March 31, 2008. With the completion of its expansion project,

the capacity has increased to 4.3 MnT (based on own clinker)

including 0.9 MnT grinding unit commissioned in FY09. This

strategic investment is expected to add significant value to the

company in long run and also provide a footprint in the fast

growing eastern region where cement consumption grew

11.3% (3 year CAGR 7.6%) against All India growth of 8.4%.

OCL recorded impressive performance in FY09 with Gross

Sales at Rs. 12,763 million, PBT at Rs. 1,771 million and Profit

After Tax at Rs.1,157 million. Your company added Rs. 251

million as share of profit from OCL in its Consolidated Profits

After Tax.

Annual Report 2008-09

Growth Plans

In order to move up in scale and increase footprint, your Board,

in FY09, approved further investments towards Greenfield

cement projects of up to 10 MnTPA to be set up in a phased

manner, through subsidiary companies. The Company made

progress on this by obtaining mining leases and environmental

clearances. Land acquisition and other business development

activity across a few sites were also initiated. However,

considering the global turmoil and consequent economic

slowdown, the management found it prudent to put the

expansion plans on hold for the time being. The growth plans

and prospects will continue to be monitored closely.

Outlook

Kadapa and Ariyalur units will add significantly to the volume

and revenues from FY10 onwards. Keeping in view the

expected capacity additions across the region, and

stabilisation of capacities commissioned in FY09, we expect

that pressure on prices could start appearing from second half

of FY10. Softening of imported coal prices, and other cost

cutting measures with alternate fuels, are expected to help the

company on the cost front. Long term prospects of cement in

our view continue to be good with per capita cement

consumption in India still being very low, even when compared

with some of the developing economies.

Early morning aerial view of Dalmiapuram plant 28

Performance Review

Sugar

FY09 proved to be a good year for your company's sugar

business with the company recording 31% growth in net sales

and 15% growth in sales volume. The availability of sugarcane

has been an issue during the current season due to diversion of

sugarcane to gur and khandsari industries and adverse agro

climatic conditions. On account of shortage in cane production

and lower yields, crushing season for your company reduced

drastically to 98 days during the year as compared to 179 days

in the previous year. The company crushed 1.19 MnT of cane

across its three plants in Uttar Pradesh, down from 2.44 MnT in

the previous year. Recovery rates too fell by over 120 basis

points. Consequently, sugar production during the year

dropped to 0.11 MnT as against 0.25 MnT last year. Capacity

utilisation for the industry was significantly lower, with your

company utilisation featuring in top percentile.

Sugar

The Indian sugar industry witnessed a sharp decline in

sugarcane crushing and sugar production in Sugar Season

(SS) 09. Sugar production is estimated to decline by 44% to

14.7 MnT against estimated consumption of 23 MnT in

the current year. The closing inventory is expected to decline to

6% of annual consumption. India is expected to import

2.5 MnT of sugar in SS 09 as compared to an export of 5 MnT in

previous year.

Acute supply shortage of sugarcane caused a sharp decline in

sugar production in the country. In the absence of clear

direction on sugarcane prices, farmers diverted significant

cultivable area to other competing crops. Incessant rain

leading to water logging in fields adversely impacted the cane

yields. UP region has not witnessed such drop in yields of

15%-20% in the last 15 years, as was experienced in this

season. Recovery from cane too dropped significantly. Hence

overall sugar production suffered across the region. While it led

to low capacity utilisation in plants, it had positive impact on the

commodity prices. Sugar prices were on an uptrend for most

part of the year.

Particulars 05-06 06-07 07-08 08-09 09-10

(E) (P)

Total Opening Stocks 40 36 92 80 14

Production during

the Season 193 283 263 147 204

Imports 0 0 0 25 35

Total Availability 233 320 355 252 253

a) Indigenous 185 210 225 230 237

b) Exports 11 17 50 8 2

Total Off Take 196 227 275 238 239

- Indigenous 36 92 80 14 13

- Imported 0 0 0 0 0

Total Closing Stocks 36 92 80 14 13

% of Consumption 20% 44% 36% 6% 6%

Source: Indian Sugar Mills Association

SUGAR PRICE REALISATION TREND- CENTRAL UP REGION

24,000

21,000

18,000

15,000

Rs./Tonne

S

p

o

1

P

r

i

c

e

s

o

f

K

a

n

p

u

r

M

a

r

k

e

t

source:www.ncdex.com

Mar-

08

Apr-

08

May-

08

Jun-

08

Jul-

08

Aug-

08

Sep-

08

Oct-

08

Nov-

08

Dec-

08

Jan-

09

Feb-

09

Mar-

09

29

141

162

246

108

Production Sales

SUGAR PRODUCTION & SALES (000 T)

FY08 FY09

Sugar plant at Jawaharpur

year. Sales for the distillery unit stood at 6819 KL against 7490

KL last year. However, the realisation improved to about Rs. 25

per litre from Rs. 17 per litre in previous year leading to net

positive earnings.

Due to low availability of molasses, Uttar Pradesh Government

has reserved 30% molasses for country liquor manufacturers,

up from 25% last year. The State Government has also banned

export of molasses to ease the supply situation in the State.

Operations Highlights

Net Sales in the integrated sugar business improved by 31% in

the FY09 at Rs. 3,550 million, with higher realisations and

volume momentum providing the required impetus to this

growth. In sugar, average realisations were up 27% at

Rs. 17,139 per ton on enhanced sugar sales volume of

Co-generation and Distillery

Both co-generation and distillery units witnessed significant

drop in operating days on account of lower cane crushed by the

sugar unit. Due to lower bagasse availability, power generation

dropped to 195 million units from about 300 million units in the

previous year. Net power exported during the year fell to 143

million units as compared to 195 million units last year.

The company is bound by the long term power purchase

agreement and sells power to grid at just above Rs.3/unit.

However, representations have been made by the industry for

upward revision of tariff on account of increased cost of production

which is expected to be considered favourably by the State.

Similarly, due to lower availability of molasses, production in

the distillery unit in FY09 was 6556 KL, down 31% from last

30

Net Sales EBITDA from Operations EBITDA Margin (%)

NET SALES & EBITDA FROM OPERATIONS (Rs. Mn)

2710

3550

237

601

FY 08 FY 09

9%

17%

In order to augment sugar stocks in the country, Central

Government allowed duty free import of raw sugar under

Advance Authorization Scheme up to September 30, 2009 with

a condition to re-export within 36 months from the date of

import. Further, Central Government also allowed duty free

import of raw sugar under Open General License up to August

1, 2009 to be processed and sold in domestic market without

any re-export obligation. Your company too has availed the

opportunity of importing raw sugar under the latter scheme, for

processing at its facility at Jawaharpur in FY10.

Annual Report 2008-09

Inside view of sugar plant

Balance Sheet Analysis

Capital Structure

The Company's equity capital increased marginally to Rs.

161.88 million as on March 31, 2009 comprising 8,09,39,303

equity shares (8,08,43,643 shares) of Rs. 2 each (fully paid up)

on account of 19,132 remaining warrant conversion.

Reserves & Surplus

The Company's reserves and surplus increased to Rs. 12,520

million in FY09. During the year under review, Debenture

Redemption Reserve increased by Rs. 129 million while

Revaluation Reserve has reduced by Rs. 97 million.

Loan Profile

The borrowed funds of the Company increased to Rs. 23,383

million in FY09. Secured loans at Rs. 19,020 million comprise

81% of the total loans. Borrowings increased mainly due to

fresh loans raised for Kadapa and Ariyalur Greenfield projects.

Out of the total borrowed funds, Rs. 4,695 million is to be repaid

during the year. For the year, average cost of borrowed funds of

the Company is around 9.6% per annum.

Total Assets

Total Assets of the Company increased by 33% to Rs. 38,352

million in FY09 from Rs. 28,935 million in FY08. The

Company's Net fixed assets as a proportion of total assets were

at 51% at the end of the year.

Gross Block and Depreciation

The 39% increase in gross block of the Company can be mainly

attributed to the capitalization of Greenfield project at Kadapa

and installation of new plant and machinery. The Company

continued to upgrade its infrastructure and technology across

its manufacturing facilities with added investments in land and

buildings. It provided depreciation of Rs. 872 million for FY09.

Capital Work in progress across various units but primarily the

Ariyalur cement project is Rs. 6,975 million.

Investments

Cumulative investments of the Company at Rs. 6,675 million

include strategic investments of Rs. 2,000 million towards

acquisition of 21.7% shares of de-merged OCL India Ltd. and

investments of Rs. 1,602 million in subsidiary companies. At

Rs. 4,235 million, 63% of the total investments are quoted,

market value of which is Rs. 1,949 million as on March 31, 2009.

31

0.16 MnT in FY09, up 15% from previous year. Similarly

realisations showed marked improvement in the Distillery

business. This led to higher EBITDA margins of 17% in the

integrated sugar business.

Outlook

Sugar Industry is amongst the key drivers of India's rural

economy supporting over 50 million farmers; owners and

employees of nearly 500 sugar mills and thousands of

wholesalers and distributors. Being the largest consumer and

second largest producer of sugar, India's sugar industry bears

significance in global sugar trade. Sugar output in India is likely

to be higher next year as farmers are likely to increase cane

acreage to benefit from a rise in sugarcane prices. This will

hopefully lead to marginal improvement in operating conditions

i.e., availability of cane and number of crushing days. The

country's sugar consumption next season may remain around

23 million tons and stockpiles at the start of next season may be

around 14 million tons.

Sugar prices are expected to remain firm for coming years,

primarily on account of declining sugar inventories. Your

company will lay special emphasis on improving cane

procurement strategies and thereby increasing capacity

utilisations as this plays a pivotal role for improvement in

company's performance in integrated sugar business.

Distillery at Jawaharpur

Annual Report 2008-09

32

Sundry Debtors

The debtors of the Company increased to Rs. 2,140 million in

FY09, of which 5% amounting to Rs. 105 million are more than

six months old.

Loans and Advances

Loans and Advances comprised 30% of the Company's current

assets. Loans and Advances made by the Company increased

to Rs. 3,412 million in FY09 due to higher deposits with

government departments and authorities and increase in

advance income tax payments.

Your company strongly believes that energy efficiency is not

just a business imperative but a social responsibility too.

Company's green power through wind farm and agro-based

cogeneration units along with energy optimization measures

are a step in that direction. It continues to explore and

implement various energy conservation initiatives by adopting

energy efficient equipments and effective utilization of waste

heat generated. Active employee participation is established

through information sharing and benchmarking amongst units

and associate companies with emphasis on waste utilization

and energy conservation.

The company has been recognised for such initiatives, through

various awards such as:

Excellent Energy Efficient Unit awarded by CII

Gold Award in Cement Sector for outstanding achievement

in Environmental Management by GREENTECH's

Environmental Excellence Award for 2008

Best Performing Wind Farms awarded by New and

Renewable Energy, Govt. of India

Your company has formulated an exhaustive energy policy and

has plans to conduct periodic energy audits.

Energy Conservation

Human Resources

Dalmia cement has always featured high amongst preferred

employers. The Company's resolve to transform as a

professionally managed organisation and its consistent efforts

to adopt tomorrow's Human Resource practices today has

been amply acknowledged.

A major achievement in HR was the integration of its vast

employee pool of almost 1000 executives at multiple locations

on the recently adopted values system. Through numerous

channels of communication, all your company executives have

been aligned with the management's vision and its belief in the

said values being the big enablers.

In order to build career options in the growing organisation of

over 3500 employees, the company appointed about 70

Engineering and Management Trainees in FY09. The

Company believes that its ability to attract, train, reward and

retain its human resources will play a critical role in its future

success. This challenge is being addressed through several

structured initiatives. The Company has also instituted a

Variable Pay Plan and Performance Management System for

evaluation purposes as per its excellence value of meritocracy.

The Company continued to enjoy healthy and mutually

respectful industrial relations this year too with excellent

support from its trade unions.

of plant maintenance related business processes across all the

units. A management information system for decision making

and control is also on our radar.

Employee and Partner Collaboration

As part of this journey we would be implementing

Human Resources Management System, intranet and a portal

for our channel partners. Company recognizes the power of

internet and would strive to improve collaboration and

communication with key stakeholders using latest

communication technology tools.

Economic uncertainty risk

The phenomenal growth of period 2003-2008 in the Indian

economy has been stalled by the global financial crisis and the

deep recession across major developed economies. The sharp

slowdown has happened at a time when companies have

ploughed back substantial portion of past earnings into their

business through investments in capacity expansions.

While the economies across the world are showing initial signs

of recovery, it seems to be led by governments' stimulus and

fiscal policy adjustment measures. Impact from both these

factors while welcome, cannot be assumed to be long lasting.

Risks & Concerns

Information Management

In today's fast paced world of fierce competition, technology

plays an important role. Your company has been at the forefront

of technology for many decades.

Importance of a technology of different kind - Information

Technology which we call Information Management (IM) is

equally acknowledged at DCBL. The IM up-scaling is a

continuous process in the company and aggressive expansion

across locations has added to the momentum in FY09.

Migration of our business applications to industry standard

SAP, ECC 6.0 suite has continued. SAP suite has been initiated

and partly implemented across business functions of Finance,

Costing, Sales & Distribution, Materials Management,

Production Planning and Quality in phase I. During FY09, SAP

was implemented at Dalmiapuram plant.

All the current locations country-wide enjoy same level of point

to multi-point video conferencing facilities in addition to

integrated data network. Going forward IM deployment in FY10

would be focussed largely on two work streams:

Business Process Automation and Control

As part of this journey SAP would be implemented at Kadapa

and Ariyalur plants along with automation and standardization

Coal stacker under construction at Kadapa plant

33

Annual Report 2008-09

or remedial liability and costs. Other concerns of the cement

industry are availability and cost of power, coal, adequate

logistic & infrastructure and quality of material procured.

The main external concerns in case of sugar operations are

availability of sugarcane, sugarcane procurement prices owing

to the different policies adopted by Central and State

Government in announcing the Statutory Minimum Price and

the State Advised Price and the Government policy on control

of sale and distribution of sugar.

Market and Competition Risks

The Company is launching its cement products in Andhra

Pradesh and parts of Karnataka. This necessitates creation of

large dealer network, building brand awareness and ensuring

product acceptability in the new markets. The Company is

making all endeavours to make this a success and expand its

reach and spread in the region.

Credit and Liquidity Risks

Fixing of credit limits, credit rating and credit period is crucial to

any running business. Lack of effective procedures and

recovery mechanisms may lead to liquidity crisis. DCBL

constantly reviews the credit worthiness of its existing

customers and also carries out credit checks which would

become more stringent, leading to reduction in credit risks over

a period of time.

The Corporate Finance Department ensures that the liquidity

position is satisfactory at all times. Effective recovery of dues

and proper investment of surplus cash, keeping in mind safety,

liquidity and returns are handled with utmost financial

prudence.

Currency risk

The Company's exposure to currency risk arises out of the

import of materials like coal for its cement plants and machinery

and equipment for its projects. The Company continuously

monitors exchange rate movements and hedges major

transactions in foreign currency by taking forward contracts in

the currency market, as considered appropriate.

Insider Trading Risk

Insider trading has always been matter of grave concern for

any organization. With a view to help mitigate this risk, the

Company has formulated guidelines which have been

implemented.

Duty related Risk

The country allowed duty-free imports of raw sugar until

September for processing and local sale in Sugar Season

2008-2009, without any export obligation. There may be a

recovery in output as farmers may increase the area planted

with sugar cane because of higher prices. This may again lead

to reintroduction of duties by Government at some stage.

Regulatory Risk

Any change in the existing policies of Government of India

and/or State Governments or new policies, providing or

withdrawing support to the industries in which the company

operates or otherwise affecting these industries, would

adversely affect the supply and demand balance and

competition in markets in which we operate there by impacting

the margins of the company. Taxes and other levies imposed by

the Government of India or State Governments that affect the

industries include excise duty, sales taxes, income tax and

other taxes and duties or surcharges introduced on permanent

or temporary basis from time to time. In the existing regulations,

we are currently required to pay to the State Government or

Government of India, royalty on extraction of limestone, land

tax on land under mining lease, excise duty on cement, duties

on power tariff, sales tax on stores and spares, packaging and

other raw materials. Any change in such levies may result in

higher operating costs and lower the sales realisation and

profitability.

The business operations are subject to various environmental

laws and regulations relating to control of pollution. These laws

and regulations are increasingly becoming stringent and may

in future create substantial environmental compliance issues

34

process. The Corporate Audit group also follows up the

implementation of the corrective actions and improvement in

business processes as per review by the audit committee and

senior management.

The audit activities are undertaken as per the Annual audit

plan developed based on the risk profile of the business

process and in consultation with outsourced firms and the

statutory auditors. The audit plan is approved by the

audit committee which regularly reviews compliance to the

approved plan.

During the year the audit committee met regularly to review the

reports submitted by the corporate audit division. All significant

audit observations and follow up actions thereon are reported

to the audit committee.

Internal Control System

and its Adequacy

The Company has proper and adequate systems of

internal controls to ensure that all its assets are

safeguarded. Company has established a strong internal audit

department which ensures adequate review of the whole

company's internal control systems through its audit partners

M/s. KPMG for Cement, M/s. AXIS Risk consulting for Sugar

and M/s. T.R.Chadda & Co for Projects. The effectiveness of

the internal control is continuously monitored by the Corporate

Audit Department of the company. The Corporate Audit's main

focus is to provide to the audit committee and the board of

directors, an independent, objective and reasonable

assurance of the adequacy and effectiveness of the

organizations risk management control & governance

35

Cautionary Statement

Certain statements in this management discussion and analysis describing the Company's objectives, projections, estimates and expectations may be 'forward looking

statements' within the meaning of applicable laws and regulations. Forward looking statements are identified in this report, by using the words 'anticipates', 'believes',

'expects', 'intends' and similar expressions in such statements.

Although we believe our expectations are based on reasonable assumptions, these forward-looking statements may be influenced by numerous risks and uncertainties

that could cause actual outcomes and results to be materially different from those expressed or implied. Some of these risks and uncertainties have been discussed in

the section on 'risks and concerns'. The Company takes no responsibility for any consequence of decisions made based on such statements and holds no obligation to

update these in the future.

Early morning view of Dalmiapuram plant

Annual Report 2008-09

Directors' Report

total dividend payout for the year Rs. 3/- per equity share as

against Rs. 4/- per share last year.

As reported last year, your Directors had exercised the call

option in respect of the detachable tradable warrants issued by

the Company in September, 2001 and out of the 76,51,621

outstanding warrants, warrant holders holding 76,22,990

warrants opted for conversion of the warrants and were allotted

3,81,14,950 equity shares of Rs. 2/- each in the financial year

ended 31-3-2008. The Board, as a gesture of goodwill, decided

to give a final opportunity to the remaining warrant holders to

opt for conversion of the outstanding warrants into equity

shares of the Company. Warrant holders holding 19,132

warrants exercised the option during the extended period of

time and were allotted 95,660 equity shares of Rs. 2/- each

during the financial year ended 31-3-2009. All the equity shares

issued on the conversion of warrants now stand listed on the

Stock Exchanges.

Please refer to the chapter on Management Discussion and

Analysis for a detailed analysis of the performance of the

Company during 2008-09. In addition, working results for key

businesses have been provided as an annexure to this report

(Annexure - A).

The Companys corporate governance practices have been

detailed in a separate chapter and is annexed to and forms part

of this Report. The Auditors certificate on the compliance of

Corporate Governance Code embodied in Clause 49 of the

Listing Agreement is also attached as annexure and forms part

of this Report.

The Companys shares continue to be listed on the Madras

Stock Exchange, National Stock Exchange and Bombay Stock

Exchange

The industrial relations during the year under review remained

harmonious and cordial. The Directors wish to place on record

their appreciation for the excellent cooperation received from

all employees at various units of the Company.

SHARE CAPITAL

OPERATIONS AND BUSINESS PERFORMANCE

CORPORATE GOVERNANCE

LISTING OF SHARES

INDUSTRIAL RELATIONS

FOR THE YEAR ENDED 31ST MARCH, 2009

The Directors have pleasure in submitting the Annual Report

and Audited Statements of Account of the Company for

the year ended 31st March 2009.

(Rs. Million)

FY 09 FY 08

Net Sales Turnover 17528 14807

Profit before interest,

depreciation and tax (EBITDA) 4898 6334

Less: Interest 1426 1129

Profit before depreciation and

tax (PBDT) 3472 5205

Less: Depreciation 872 864

Profit before tax (PBT) 2600 4341

Provision for current tax 337 513

Provision for deferred tax 657 337

Fringe Benefit tax 20 19

Profit after tax (PAT) 1586 3472

Add: Surplus brought forward 6118 3482

Profit available for appropriation 7704 6954

APPROPRIATIONS:

General Reserve 200 350

Debenture Redemption Reserve 129 108

Interim/Proposed Dividend 243 323

Dividend Distribution tax thereon 41 55

Balance carried forward 7091 6118

7704 6954

Your Directors had disbursed an interim dividend amounting to

Re. 1/- per equity share of face value of Rs.2/- each in February,

2009. In addition to the interim dividend, your Directors have

decided to recommend a final dividend amounting to Rs. 2/- per

equity share of the face value of Rs. 2/- each, thus making the

FINANCIAL RESULTS

DIVIDEND

36

EMPLOYEES' PARTICULARS

ENERGY CONSERVATION, TECHNOLOGY

ABSORPTION AND FOREIGN EXCHANGE

TRANSACTIONS

SUBSIDIARIES

The statement giving particulars of employees who were in

receipt of remuneration in excess of the limits prescribed under