Professional Documents

Culture Documents

Chad Mason Peer Review

Uploaded by

api-252878379Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chad Mason Peer Review

Uploaded by

api-252878379Copyright:

Available Formats

Mason 1

Chad Mason Instructor: Malcolm Campbell English 1102 February 12, 2014 Stockbrokers: Separating the Wolves from the Sheep

Money, greed, and controversy I! you"ve seen the recent bo# o!!ice hit The Wolf of Wall Street, chances are these are some o! the $ords that come to mind $hen thin%ing o! the notorious pro!ession o! being a stoc%bro%er &he movie portrayed the speci!ic 'ourney o! (ordan )el!ort, a !ormer *toc%bro%er $ho ran pump and dump schemes that cost his clients hundreds o! millions o! dollars !or his o$n bene!it &his led many vie$ers to believe that all stoc%bro%ers ma%e their money immorally and $ith no regard !or society $hatsoever, yet, are there stoc%bro%ers $ho ma%e their living the right $ay and still obtain great success+ &his essay see%s to decipher the positives and negatives o! hiring a bro%er, !ind an e#planation o! $hat separates the success!ul stoc%bro%ers !rom the many that !ail, and i! they can achieve this success $ithout sacri!icing their moral values Key Terms &o understand many o! the terms and concepts throughout this essay it $ould be help!ul to !amiliari,e yoursel! $ith some o! the vernacular used everyday on -all *treet Boiler Room: . non/reputable bro%erage !irm that uses high/pressure telephone sales tactics, scripts, and an uneducated, immoral $or%!orce to push dubious securities &he boiler room bro%erage era sa$ its pea% in the 1000"s as the !irms made mar%ets in manipulated stoc%s and made secret payments to the bro%ers $ho pushed them 1)ac%stage -all *treet, 23

Mason 2

Broker: *omeone $ho earns commission !or providing the lin% bet$een buyers and sellers )ro%ers generally ta%e little to no ris%, as they match buyers $ith sellers 123 Capital Gain: &he amount by $hich an asset4s selling price e#ceeds its initial purchase price . reali,ed capital gain is an investment that has been sold at a pro!it .n unreali,ed capital gain is an investment that hasn4t been sold yet but $ould result in a pro!it i! sold Capital gain is o!ten used to mean reali,ed capital gain 143 Dividend: . payment by a company to shareholders o! its stoc%, usually as a $ay to distribute pro!its to shareholders 143 Do !ones "nd#strial $verage %D!"$&: 5rice/$eighted average o! 20 actively traded shares o! blue/chip 6* industrial corporations listed on the 7e$ 8or% *toc% E#change 143 '(#ity: &he ris% sharing part o! capital or the sta%e in $hich the investor o$ns in the company 143 ')change*traded f#nd %'T+&: .n inde# !und that is traded on the stoc% mar%et 193 ,rice-'arning %,-'& ratio: . !igure indicating the investor con!idence a company en'oys &his is calculated by the current share price divided by the most recent !igure !or the earnings per share, the higher the !igure, the more con!ident the investors 1:3 .ield: &he return on an investment 8ields on bonds move inversely to prices 1103

Mason 2

What is a stockbroker/ It is !irst important to note $hat e#actly it is that a stoc%bro%er does )ro%ers are people $ho handle customer"s transactions and are in control o! buying and selling securities &hey act sort o! as a middleman, such as a retail store that o!!ers your !avorite brand o! clothing .ccording to the 7e$ 8or% *toc% e#change, $hich is the largest e;uity/based e#change center in the $orld, stoc%bro%ers have been around since 1:00, $hen the government issued <=0 million in bonds to help repay $ar debt !rom the >evolutionary -ar, this mar%ed the birth o! the 6nited *tates investment mar%ets &he main !ocus o! being a bro%er is that it is a sales 'ob )ro%ers ma%e their living by receiving a commission !or the trades they process &hey must be able to identi!y trends and relationships in the mar%et, !or e#ample, i! the price o! corn goes up, ho$ does this a!!ect the car industry+ .ccording to the ?uman Capital >esearch Collaborative, a partnership $ith the Federal >eserve )an% o! Minneapolis, the *ecurities and E#change Commission 1*EC3, $hich oversees and regulates all trades in the 6nited *tates, states that to be a stoc%bro%er in the 6nited *tates, you must pass t$o licensing e#aminations !rom the 7ational .ssociation o! *ecurities @ealers 17.*@3: the *eries : and the *eries A2 &hese e#ams prove that a bro%er is in!ormed about $hat he or she is selling and %no$s all the regulations and la$s in the securities industry &he %noc% against bro%ers is that their interests may not al$ays align $ith their clients, they ma%e a commission on the amount o! money that they can get their customer to invest, so the incentive is not necessarily to ma%e their clients the most money, but instead to get them to invest as much as possible &his has led to much o! society portraying a negative image upon bro%ers, especially a!ter the !inancial crisis o! 200= $here much o! the blame $as put on the greedy culture o! -all

Mason 4

*treet and put an e#ceedingly amount o! bro%ers out o! $or%, even prompting (ay Beno host o! the Tonight Show to 'o%e CMy *toc%bro%er as%ed me something very important today: paper or plastic+D @espite the ma'or hit the !inancial services industry too% a!ter 200=, stoc%bro%ers still seem to not only recover, but thrive, $hich has been a trend that has been prominent throughout history, $here bro%ers continually bounced bac% a!ter &he Ereat @epression and the stoc% mar%et crash o! 10=: Benefits of hiring a stockbroker In order to purchase securities, commonly re!erred to as stoc%s, some type o! bro%erage is al$ays re;uired &hese are divided into !ull service stoc%bro%ers and discount bro%ers Full service bro%ers are the pro!essionals and Eoldman *achs gurus o! the $orld that personally use their e#pertise to help pic% stoc%s and manage their client"s port!olio @iscount bro%ers are typical online accounts such as E-Trade that charge much less commission !or their services due to lo$ overhead costs, the do$nside is that customers must do their o$n research &his section o! the essay $ill discuss the bene!its o! having a !ull time service bro%er that provides services above and beyond e;uity sales &he !irst %ey advantage is that a !ull time bro%er can ma%e investment recommendations !or their clients . success!ul stoc%bro%er is clearly able to assess investment goals, create a timeline, and determine ho$ much money their client $ishes to invest &his is an advantage to the .verage (oe investor because the bro%er has typically devoted their $hole career to learning about di!!erent types o! investments and has many more resources and %no$ledge available to their disposal .nother %ey advantage is that a bro%er can help maintain and manage their client"s port!olio &he bro%er $ill go over their client"s investment goals to determine the direction and plan in $hich they should set . typical trait success!ul stoc%bro%ers also possess is

Mason 9

that they can have a broad vision !or their clients port!olio and share the %no$ledge they have attained to their clients in order to bene!it all parties Cons of hiring a stockbroker -hen it comes to hiring a !ull service bro%er there are t$o main disadvantages that must be ta%en into consideration &he !irst one is that bro%ers ta%e a percentage o! money o! every trade their client ma%es &his can add up ;uic%ly especially $hen investing large amounts o! money, $here according to @r Ed$in Ehiselli, a pro!essor at the 6niversity o! Cali!ornia at )er%ley, one must beat the mar%et by 2 9F 'ust to ma%e a pro!it $hich is increasingly harder to do in an economic do$nturn 7o$adays one can save a large amount o! money using the $ide range o! online discount bro%ers that charge much less commission &he second one is that bro%ers can easily ta%e advantage o! their clientele by utili,ing their e#ceptional sales ability to invest in stoc%s that are o! poor value 'ust so they can receive their commission chec%s &his e#ample is easily depicted in the earlier mentioned bo# o!!ice hit The Wolf of Wall Street. Bead character (ordan )el!ort manipulated clients into buying penny stoc%s that are almost all o! the time lo$ ;uality stoc%s that are e#tremely volatile due to being traded at such lo$ price points )el!ort $ould drive their prices up by getting his clients to invest a great amount o! money in these stoc%s there!ore driving the prices s%y/high and $ay past their true value, at the same time )el!ort $ould also create accounts in other names $here he $ould simultaneously be short selling these stoc%s, $hich is betting a stoc% $ill go do$n, so $hen they reached pea% prices he then proceed to pull all o! the money out o! the stoc%s causing himsel! to gain enormous pro!it $ith the declining prices $here his clients that invested into them long term $ould lose almost all o! their o$n money, this is commonly re!erred to as a boiler room

Mason A

Rise of the disco#nt brokerage It"s no secret that technology is changing the $ay society !unctions, and the rate at $hich $e evolveG this is especially true in the bro%erage industry &he demand !or stoc%bro%ers has decreased signi!icantly since the dot/com era, than%s to the internet and mobile apps it is no$ much more simple and cost e!!ective !or customers, $hich has caused them to do most o! their investing online In a Forbes article titled "Are Stockbrokers Now Dinosaurs?" Wall Street attorney Jake Zamansky delves into the idea that stockbrokers may become replaced by the advancing technology that is starting to come to the forefront of the finance world. Facts to support this statement include research done by the Chicago based investment research firm Morningstar, which reported that in 2012 exchange trade funds sold by the likes of online discount brokers actually outperformed broker selected mutual funds by over 1.1%. This is not to even mention that the online discount firms are MUCH cheaper to operate, Zamansky states that the online firms only take a fraction of commission usually around 0.1% of the investors earnings while brokers usually take home at least 1% commission, that means it costs the average investor ten times more to invest with the human broker! The article goes on to explain that people are starting to lose trust in Wall Street due to consistent economic let downs, The move shows growing investor distaste for volatility, as the dot-com crash in the early 2000s, the financial crisis in 2008 and recent botched episodes such as Facebooks. initial public offering have shaken investor confidence, wrote Wall Street Journal reporter Kirsten Grind. Many argue that stockbrokers can provide an advising role to their investors that online brokerages cannot offer, but this is not necessarily true. New technology can provide instant access to SEC filings and company information for potential investments on the New York Stock Exchange, many of the discount brokerages also have

Mason :

recommended picks and background information on every available stock, just by looking at ones mobile phone an investor can see their investments progress and track their returns in realtime while receiving information such as the stocks yield and P/E ratio. Traits of s#ccessf#l stockbrokers Eood bro%ers are in as high o! demand as ever Hnly 22F o! investors actually beat the mar%et and the @o$ (ones Industrial .verage 1C773 In order to turn into one o! the multi/ millionaire -all *treet big shots that all bright eyed M). graduates dream o!, one must possess a !e$ %ey traits that are vital to success -hile the stories mentioned be!ore o! corruption and schemes $here $ealthy bro%ers s$indle their clients out o! money, this is an absolute rarity and is almost al$ays caught by the !ederal government In order to truly be success!ul, bro%ers must achieve their number one goal o! gro$ing their clients port!olio I! the bro%er is doing a poor 'ob o! ma%ing their clients money they $ill ;uic%ly lose these clients and develop a poor reputation that is hard to recover !rom *toc%bro%ers are $eeded out ;uic%ly and must endure long hours and high pressures especially in the !irst !e$ years o! their career It is important to develop a deep understanding o! the mar%et, it ta%es years o! studying and hands on e#perience to get a grasp o! ho$ the stoc% mar%et $or%s and start to discover its pattern o! behaviors *trong interpersonal and communication s%ills are also necessary in order to thrive . stoc%bro%er"s paychec% depends on their ability to sell people, especially those o! high net $orth that include CEH"s o! corporations that may be hard to reach Many times one must go through their secretary !irst $ho has the po$er to put them through or not, it is the bro%ers 'ob to charm their $ay into strong relationships $here a client chooses them over the vast variety o! their competition . good stoc%bro%er must %no$ ho$ to handle re'ection &he ma'ority o! their business is calling

Mason =

prospective clients on the phone trying to get them to give their money to a random stranger, !or every account they open they are re'ected a countless number o! times, persistence is %ey and the best ma%e it di!!icult !or those people to say no .nother role a stoc%bro%er plays is being able to e#plain concepts that may be hard to grasp &he average investor has very little idea o! ho$ or $hy the mar%et moves the $ay it does and it can be di!!icult to e#plain the speci!ic 'argon and %ey terms that are used in the investing realm It is not necessary to hold any degree to become a stoc%bro%er, ho$ever no$adays many employers $on"t even let you in the door $ithout an M). !rom a top target school, competition is !ierce and one must be able to di!!erentiate themselves one $ay or another, this includes investment e#perience or that o! similar 'obs that hold a bac%ground in !inancial services Bastly, the best stoc%bro%ers possess a sic%ening $or% ethic, it is common !or bro%ers to $or% $ell over 100 hours a $ee% 1-all *treet (ournal 20003, only the most dedicated rise to the top, i! one can provide that $ith a high intellect and %nac% !or investing, they have a bright !uture ahead o! them as a stoc%bro%er

Mason 0

Comments: 1 -or% cited+ 8ou probably 'ust haven"t added it yet I"m guessingI 2 I li%e the $ay you gave de!initions because not everyone has %no$ledge o! those terms It made the essay easier to understand 2 I really en'oyed your commentary It sounded li%e you had become an e#pert on your topic and had done some e#tensive research 4 I thin% there needs to be a parenthetical citation at the end o! this .ccording to the 7e$ 8or% *toc% e#change, $hich is the largest e;uity/based e#change center in the $orld, stoc%bro%ers have been around since 1:00, $hen the government issued <=0 million in bonds to help repay $ar debt !rom the >evolutionary -ar, this mar%ed the birth o! the 6nited *tates investment mar%ets 9 I really li%e the $ay you started the essay $ith 2 $ords that grabbed the readers" attention and made them $ant to %eep reading I also li%e ho$ you re!erenced The Wolf of Wall Street because a lot o! people have seen that so it ma%es them $ant to read !urther to hear $hat you"re going to be discussing >eally good 'obII I didn"t !ind any noticeable grammatical errors and it $as very interesting to read I didn"t get bored $hile reading at all and I li%e the $ay you ended by e#plaining $hat it ta%es to become a stoc%bro%er 8ou had a lot o! really credible sources Hverall, really a$esome essayI

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Final EipDocument7 pagesFinal Eipapi-252878379No ratings yet

- Final EipDocument7 pagesFinal Eipapi-252878379No ratings yet

- Fast Draft 88Document5 pagesFast Draft 88api-252878379No ratings yet

- Nail Biting-Peer ReviewDocument6 pagesNail Biting-Peer Reviewapi-242260881No ratings yet

- Macy Topic ProposalDocument3 pagesMacy Topic Proposalapi-252878379No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Management RatiosDocument6 pagesFinancial Management RatiosCharlotte PalmaNo ratings yet

- Preferred Stock and Common StockDocument22 pagesPreferred Stock and Common StockSaMeia FarhatNo ratings yet

- Regulatory Notice 16 24Document13 pagesRegulatory Notice 16 24Kris SzczerbinskiNo ratings yet

- Intermediate Accounting 3 Finals Quiz 2: A. Multiple Choice Theories: Choose The BEST Answer. (1 PT Each)Document2 pagesIntermediate Accounting 3 Finals Quiz 2: A. Multiple Choice Theories: Choose The BEST Answer. (1 PT Each)Lai ChiNo ratings yet

- Gap Trading TechniquesDocument19 pagesGap Trading TechniquesAbhishek Pathak100% (1)

- Chapter 4 Security Market Indexes and Index FundsDocument9 pagesChapter 4 Security Market Indexes and Index FundsJilly AceNo ratings yet

- Equity #1Document11 pagesEquity #1johnNo ratings yet

- QuestionsDocument3 pagesQuestionslois martinNo ratings yet

- anthonyIM 09Document17 pagesanthonyIM 09Ki Umbara100% (1)

- Assignment 4 FA 03062021 102154pmDocument3 pagesAssignment 4 FA 03062021 102154pmMuhammad ArhamNo ratings yet

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- Tata Steel AGM Notice 2022Document22 pagesTata Steel AGM Notice 2022mohitbabuNo ratings yet

- Final Case 1Document2 pagesFinal Case 1Zahra EjazNo ratings yet

- Chapter 09Document18 pagesChapter 09simeNo ratings yet

- Candlesticks For Support and Resistance PDF (PDFDrive)Document40 pagesCandlesticks For Support and Resistance PDF (PDFDrive)Raja100% (2)

- Ibrahim AbdulateefDocument289 pagesIbrahim AbdulateefkayboiNo ratings yet

- CIA 1 (B) : Security Analysis and Portfolio ManagementDocument9 pagesCIA 1 (B) : Security Analysis and Portfolio ManagementMrigank MauliNo ratings yet

- Building Warehousing CompetitivenessDocument18 pagesBuilding Warehousing CompetitivenesspenelopegerhardNo ratings yet

- Overview of Equity Securities: Presenter Venue DateDocument26 pagesOverview of Equity Securities: Presenter Venue DateLupita Ade ArisantiNo ratings yet

- High Frequency and Algorithmic Trading - Indian School of Business (ISB)Document2 pagesHigh Frequency and Algorithmic Trading - Indian School of Business (ISB)tanujsoniNo ratings yet

- CH 15Document36 pagesCH 15BryanaNo ratings yet

- Sula Vineyards Limited RHPDocument483 pagesSula Vineyards Limited RHPRahul MehtaNo ratings yet

- Ch11 Corporation AccountingDocument101 pagesCh11 Corporation AccountingLoksa Restu Sianturi100% (1)

- Online Resources For Stock Investing and TradingDocument61 pagesOnline Resources For Stock Investing and TradingAJ JarillasNo ratings yet

- PT Hexindo Adiperkasa TBK.: Summary of Financial StatementDocument2 pagesPT Hexindo Adiperkasa TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Ratios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDocument5 pagesRatios Used To Evaluate Short-Term Financial Position Ratios Used To Evaluate Asset Liquidity and Management EfficiencyDan Miguel SangcapNo ratings yet

- Chapter 12 ProblemsDocument40 pagesChapter 12 ProblemsInciaNo ratings yet

- Khalaf Taani PDFDocument9 pagesKhalaf Taani PDFDuana ZulqaNo ratings yet

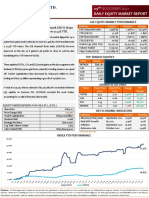

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- Ch18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalDocument2 pagesCh18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalSyed Qamar100% (2)