Professional Documents

Culture Documents

Fear and Risk in Audit

Uploaded by

Elena Angelica IvanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fear and Risk in Audit

Uploaded by

Elena Angelica IvanCopyright:

Available Formats

Fear and risk in the audit process

Henri Gunin-Paracini

a,

, Bertrand Malsch

b

, Anne March Paill

c

a

Universit Laval, 2325, rue de la Terrasse, Qubec, Qubec G1V 0A6, Canada

b

Queens School of Business, 140, Union Street, Kingston, Ontario K7L 3N6, Canada

c

Ghent University, Department of Psychoanalysis and Clinical Consulting, H. Dunantlaan 2, 9000 Ghent, Belgium

a b s t r a c t

Relying on an ethnographic study conducted in the French branch of a big audit rm and

using a psychodynamic perspective to interpret the collected data, we show that auditors

sense of comfort (Pentland, 1993) arises only at the end of the audit process, and that the

rest of the time, public accountants are inhabited primarily by fear. Fear plays a crucial but

ambivalent role in auditing. On one hand, auditors and audit rms cultivate this feeling

through informal and formal techniques to stimulate vigilance, encourage self-surpass-

ment, mitigate the anesthetizing effect of habit and maintain reputation. On the other

hand, audit teams members strive to alleviate their fear in order to form and convey their

conclusions with a certain degree of comfort. In the eld, driven by fear, they manage to

nally become comfortable either by mobilizing their practical intelligence (an intelli-

gence of the body which helps them handle that which, in their mission, cannot be

obtained through the strict execution of standardized procedures) or by adopting defensive

strategies (such as distancing themselves from work-related problems, mechanically

applying audit methodologies or relaxing their conception of a job well done). Fear and risk

are closely related phenomena. Michael Power (2007a, p. 180) notes that the signicant

driver of the managerialization of risk management is an institutional fear and anxiety.

Yet the experience of fear and the role that fear plays in risk management processes is most

often overlooked in the literature. In this respect, our study contributes to emotionalize

and challenge the cognitive and technical orientation adopted by most academics and reg-

ulators in their understanding of audit risks and auditors scepticism. We also discuss a

number of avenues for future research with a view to encouraging further examination

of the role that emotions play in the audit process.

2014 Elsevier Ltd. All rights reserved.

Introduction

Comfort [...] is what you feel at the end of an audit,

when youre just about certain that youve done your

job properly. But you spend the rest of the time feeling

anxious. [...]. As an auditor, if you have even a modicum

of professional conscientiousness, you just cant avoid

caring about your job. In some ways, thats what were

paid to do. Our lives arent at risk, thats true, but if I

may draw on my taste in movies, Id say auditing is to

some extent the wages of fear.

1

(One senior interviewed

during the study)

As argued by Maitlis and Ozcelik (2004, p. 375), we

now widely accept organizations as emotional arenas

(Fineman, 1993, p. 9) and acknowledge the emotionally

http://dx.doi.org/10.1016/j.aos.2014.02.001

0361-3682/ 2014 Elsevier Ltd. All rights reserved.

Corresponding author. Tel.: +1 418 656 3936.

E-mail addresses: henri.guenin-paracini@fsa.ulaval.ca (H. Gunin

-Paracini), bertrand.malsch@queensu.ca (B. Malsch), anne.marche-paille

@ugent.be (A.M. Paill).

1

A lm by Henri-Georges Clouzot.

Accounting, Organizations and Society 39 (2014) 264288

Contents lists available at ScienceDirect

Accounting, Organizations and Society

j our nal homepage: www. el sevi er. com/ l ocat e/ aos

saturated nature of peoples work experience (Ashforth &

Humphrey, 1995). Barsade and Gibson (2007, p. 36) note

that [i]n the last 30 years, an affective revolution has

taken place, in which academics and managers alike have

begun to appreciate how an organizational lens that inte-

grates employee affect provides a perspective missing from

earlier views.

In the eld of auditing, this revolution has yet to occur.

One of the most widespread accounting stereotypes still

depicts the auditor as an actor who is almost entirely de-

void of feeling (see e.g., Beard, 1994; Bougen, 1994; Dimnik

& Felton, 2006). This image is reinforced by the emotional

labor (Hochschild, 1983) in which most auditors are asked

to engage in order to project and maintain an aura of pro-

fessionalism at work: because accounting work is inter-

personal, the adoption of an unemotional attitude is

actually part of the work and of course unemotional is

a misnomer for a particular emotional orientation, that of

a professional-seeming coolness consistent with technoc-

racy (Gill, 2009, p. 34). On the evidence of professional

audit standards, audit work only appears to involve emo-

tionless methods of algorithmic reasoning (Francis,

1994). And academic papers devoted to investigating the

emotional dimension of public accounting remain extre-

mely rare (McPhail, 2004; Nelson & Tan, 2005), with the

exception of those examining the causes and/or conse-

quences of auditors (role) stress (Smith, Derrick, & Koval,

2010).

For example, in the prolic audit judgment and deci-

sion-making (JDM) literature, only four studies (based on

laboratory experiments) have, to our knowledge, examined

the impact of affective states on the formation of audit

opinions. Bhattacharjee and Moreno (2002) established

that when provided with irrelevant, negative affective

information, inexperienced public accountants tend to

overestimate the risk of inventory obsolescence, while

experienced professionals do not. Schafer (2003) reached

a similar conclusion in respect of the fraud risk assessment.

Chung, Cohen, and Monroe (2008) demonstrated that posi-

tive-mood auditors have the lowest consensus and make

the least conservative judgments when required to evalu-

ate inventories. Finally, Cianci and Bierstaker (2009) indi-

cated that public accountants in a negative mood often

make poor ethical decisions.

Importantly, the above-mentioned studies are not only

few in number: like most of the papers that have addressed

the issue of stress in auditing, they also tend to present

affective states as being mainly disruptive.

2

The assump-

tion is that feelings are the antithesis of rationality. How-

ever, this assumption has been strongly challenged for at

least two decades. As shown by many researches, affect

and reason far from being antinomic are in fact interre-

lated (e.g., Damasio, 1994; Putman & Mumby, 1993).

Whether we like it or not, emotions inform all our choices,

actions and interactions, for better or for worse, and are

themselves profoundly inuenced by our working environ-

ment (Domagalski, 1999; Fineman, 1996). From this per-

spective, emotions need to be thought of as a vital and

permanent aspect of the workplace an aspect that shapes,

and is shaped by, organizational processes, through various

means requiring further examination.

In this area, audit research has made scant progress.

Although the survey by Garcia and Herrbach (2010) found

that the audit environment produces a wide range of pleas-

ant and unpleasant feelings among auditors, the way in

which these feelings mold, and are molded by, the audit

process remains under-researched. Since Humphrey and

Moizer (1990), who were the rst to emphasize the impor-

tance of gut feel in auditor decision-making, only a small

number of studies have increased our understanding of the

subject: Pentland (1993) showed that public accountants

cannot form an audit opinion without getting comfortable

and that acting ritualistically enables them to reach this

affective state; Carrington and Catass (2007) added that

the production of comfort in audit teams requires acts of

creativity to remove a sufcient amount of discomfort;

some studies have drawn on these analyses to better

understand the functioning of audit committees (Gendron

& Bdard, 2006; Sarens, De Beelde, & Everaert, 2009; Spira,

2002); but beyond this, very little research has been con-

ducted to enhance our awareness of the affective dimen-

sion of the audit process.

Yet comfort constitutes only a small part of the emo-

tional experience of public accountants. This became par-

ticularly apparent to us in the course of an ethnographic

study conducted in the French branch of a big audit rm,

aimed at better understanding the work performed by

auditors in the eld. We found Pentlands (1993) paper

truly stimulating and sometimes observed auditors talking

about comfort and looking relieved, but in the audit teams

we monitored, signs of comfort nevertheless remained rel-

atively rare. Instead, it was not uncommon for us to see our

informants frowning, turning a bit pale or red, biting their

nails, shaking their legs, getting irritable, looking drawn,

sweating, taking pills against stomach ache, holding their

breath, double checking one thing or the other, and so

forth. Altogether, these behaviors were in our eyes more

suggestive of concern than comfort, and our semi-struc-

tured interviews conrmed this interpretation.

As stated by the senior quoted in the epigraph, in real

audit settings, comfort only arises at the very end of the

audit task. The rest of the time, auditors seek to feel com-

fortable, but are generally inhabited primarily by fear. Of

course, fear is not experienced by them all day long and

varies in intensity from individual to individual and

depending on the circumstances. It may simply take the

form of a slight disquiet or degenerate into an oppressive

anxiety. However, in general, public accountants have to

deal with this emotion. The present paper aims to provide

a better understanding of the role of fear in audit practice,

focusing specically on the following questions: (1) What

exactly is it that auditors worry about? (2) How do auditors

manage fear in the eld? (3) How does fear shape, and how

is it shaped by, auditors work activity?

To interpret our empirical data and present our results,

we mainly used the psychodynamics of work theory

2

Admittedly, a few articles examining the outcomes of auditor stress

have underlined the positive effects that a moderate level of stress can have

in auditing (see e.g., Choo, 1986; Fogarty, Singh, Rhoads, & Moore, 2000).

However, the fact remains that there tends to be far more emphasis in the

audit literature on the negative consequences of stress.

H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288 265

developed by Dejours (1993). In adopting a perspective at

once psychological and socio-constructionist, this theory

provides an interesting insight into the interplay of fear

and work activity. Drawing on eld studies conducted in

a range of industries, Dejours (1993) argues that fear is

present in all kinds of professional tasks, including in

[. . .] ofce jobs (p. 81). He highlights the reasons why

working generally tends to be a source of fear and indicates

how this feeling usually shapes, and is shaped by, ofcial

work prescriptions and unofcial techniques and pro-

cesses. Based on Dejourss rich and well-documented

reections, the present study of fear in auditing may be

seen in some sense as a psychodynamic interpretation of

audit work. In this respect, our ndings are not entirely

specic to the audit profession. To a large extent, they re-

ect what working involves in practice and resonate with

the ndings of many studies of fear conducted in other sec-

tors of activity.

3

In a sense, this reinforces the plausibility of

our results and provides a reminder that nancial auditing

is performed by people doing a job like any other (Power,

1999, p. 37). To date, the role played by fear in this particular

job has not, however, been studied, and our paper needs

therefore to be seen as exploratory.

In the post-Enron climate and after the enactment of

the SarbanesOxley Act which is the time and regulatory

context of our eld study the professional risks associ-

ated with auditing and the non-accounting consequences

of sensitive audit decisions have increased dramatically

(Malsch & Gendron, 2013). Being attentive to news, calcu-

lating, learning from experience and making decisions on

the basis of a mix of trust and distrust, the average auditor

has found himself beset by risks (Gill, 2009, p. 82). Would

his rm lose the audit? Would his reputation be damaged?

Would his career suffer? If one considers that fear is the

emotional experience of risk, our observations suggesting

that this emotion is largely experienced by auditors in

the eld should hardly come as a surprise: fear and risk

are closely related phenomena (Furedi, 2007). Lupton

notes (1999, p. 17) that risk has come to stand as one of

the focal points of feelings of fear, anxiety and uncertainty,

while Power (2007a, p. 180) observes that the signicant

driver of the managerialization of risk management is an

institutional fear and anxiety. Yet, while generally associ-

ated with the perception of risk, the subjective experience

of fear and the role that fear plays in risk management pro-

cesses are most often overlooked in the literature. The fo-

cus tends to remain on the notion of risk rather than on

the study of fear. In this respect, our analysis on the role

fear plays in the audit process aims to emotionalize and

challenge the dominant cognitive orientation adopted by

academics and regulators in their understanding of audit

risks and auditors skepticism. It is designed as a response

to the many recent calls for a richer understanding of

actual audit practice, which remains poorly understood

(e.g. Gendron & Spira, 2009; Hopwood, 1996; Hopwood,

1998; Humphrey, 2008; ODwyer, 2011; Power, 2003;

Skrbk, 2009). Ultimately, it contributes to the growing

interpretive literature seeking to question rationalized ac-

counts of the audit judgement process, and to explore the

complex back stage of practice in its social and organiza-

tional context (Power, 2003, pp. 379380).

The remainder of the article begins by providing a de-

tailed outline of our research methods, before expounding

our theoretical lens in more depth. Four sections are then

devoted to presenting the results of our analysis, and the

implications of the latter are nally discussed.

Research methods

Data collection

The data reported and analyzed in this paper were col-

lected as part of a grounded interpretive eld study (Glaser

& Strauss, 1967; Van Maanen, 1979) on the work per-

formed by auditors in the course of their assignments.

The broad objective of the study was to identify and better

understand key aspects of audit practice that ofcial audit

prescriptions do not address.

As part of this goal, we secured the consent of the

French branch of a Big Four rm (CAB) to observe several

of its audit teams in their work. The precise number of

audits to be observed was not determined in advance. It

was agreed that we would examine as many audits as nec-

essary to reach theoretical saturation (Glaser & Strauss,

1967). Ultimately, a total of 7 audit teams, including 44

auditors (9 partners, 5 managers, 11 seniors and 19 assis-

tants), were monitored in real time in June and July 2002

and between November 2003 and July 2004. The main cri-

teria used for their selection was one of diversity (in terms

of industry, rm and audit team size, geography, engage-

ment type and duration).

In May 2002, as a preamble to our eldwork, we began

by examining the various rules imposed on French auditors

by the CNCC (Compagnie nationale des commissaires aux

comptes) and the state, as well as the formal prescriptions

in force within CAB. We focused in particular on the audit

methodology, the standards of documentation, the evalua-

tion criteria and the roles imposed by the Big Four on its

employees. The following month, we were ready to begin

the monitoring process, which included participant obser-

vation (Spradley, 1980), examinations of work papers,

informal discussions and semi-structured interviews

(Spradley, 1979).

We observed auditors at work during 50 of the 88 days

they took to complete their tasks, yielding 455 h of obser-

vation (9.1 h on average per day) and 557 pages of hand-

written notes (see Table 1). As noted by Ahrens and

Mollona (2007, p. 312), compared to inquiries based solely

on interviews, ethnographies can lay more credible claim

towards studying organisational practices, partly because

direct observation makes it possible to study taken-for-

granted aspects of [. . .] [work] on which organisational

members could not report, and to exploit the revealing

3

The question of the dynamics of fear in the workplace has been

examined, for example, in studies of managers (Geuser, 2006; Flam, 1993;

Jackall, 1988), nurses (Menzies-Lyth, 1960), reghters (Douesnard &

Saint-Arnaud, 2011), construction workers (Dejours, 1993), ghter pilots

(Dejours, 1993), funeral staff (Trompette & Caroly, 2004), lumberjacks

(Schepens, 2005), prison guards (Demaegdt, 2008), workers in the petro-

chemical industry, workers in the nuclear industry (Dejours, 1993),

warehousemen and railroaders (Moulini, 2004), etc.

266 H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288

tensions between what organisational members say and

do (p. 310).

To ensure that we did not miss any signicant events in

the course of the monitoring process, we were always

present at the beginning and end of each audit examined

and only chose not to come at other times during the

audits when we thought that nothing new would occur

in our absence.

The days we spent with the informants were very in-

tense. We remained with the participants when they were

all in their clients boardroom, accompanied those who

went to see an auditee or to have a coffee, and lunched

where and when the teams chose to lunch. Whenever an

audit was performed in a provincial location, we made

the trip with the auditors involved, stayed with them

throughout the duration of their assignment, shared their

informal social activities, and slept in the same hotel. In

the eld, we were often prompted to ask our informants

for clarications, in the heat of the action, about their

specic goals, the techniques they used, the feelings they

experienced, etc.

Semi-structured interviews were also conducted with

31 auditors from the audit rm (4 partners, 3 managers,

8 seniors and 16 assistants). Apart from 2 seniors and 3

partners, all these auditors worked for the teams moni-

tored during the study. Overall, the total duration of the

interviews amounted to 38 h, summarized in Table 2.

Interviews were always conducted outside the audited

companies at the end of audit tasks and lasted approxi-

mately 1 h. In the course of the interviews, the auditors

were invited to assess the validity of our observations

and to highlight important features of the audit that we

had failed to notice. They were encouraged to elaborate

on key aspects of their job and to provide us with informa-

tion that would have been impossible to collect through

visual inspection (concerning, for example, what they

had thought or felt at critical moments). We did not hesi-

tate to question what they were telling us and strongly

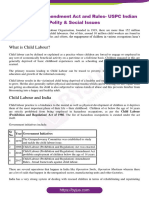

Table 1

Observations.

Observation phases

Interim

a

Final

b

Total

OBSERVATIONS

Audit observations

Mandate 1 In days 4 4

In hours 57 57

No of handwritten note pages 50 50

Mandate 2 In days 4 4

In hours 36 36

No of handwritten note pages 45 45

Mandate 3 In days 6 8 14

In hours 55 62 117

No of handwritten note pages 100 67 167

Mandate 4 In days 3 3

In hours 24 24

No of handwritten note pages 65 65

Mandate 5 In days 5 5

In hours 64 64

No of handwritten note pages 52 52

Mandate 6 In days 10 10

In hours 68 68

No of handwritten note pages 70 70

Mandate 7 In days 10 10

In hours 89 89

No of handwritten note pages 108 108

Total In days 13 37 50

In hours 136 319 455

No of handwritten note pages 215 342 557

Additional observations

Training courses new managers

c

In days 2

In hours 15

No of handwritten note pages 40

Technical information meeting

d

In days 0.25

In hours 2

No of handwritten note pages 5

Grand total In days 52.25

In hours 472

No of handwritten note pages 602

a

The interim audit phase is prior to the year-end of the audited nancial statements and is used for planning purposes as well as an initial evaluation of

internal controls.

b

The nal audit phase occurs after the year-end of the audited nancial statements and consists of various procedures performed by auditors to

corroborate their nal written report.

c

All new CAB managers had to undergo a two day training course in order to develop the skills required by their higher functions.

d

Technical information meeting are internally developed by CAB in order to remind or update auditors on audit norms and procedures.

H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288 267

encouraged them to challenge our own analyses. In other

words, each interview was an opportunity to collect sup-

plementary data, to highlight the themes that actors con-

sidered more or less signicant, and to correct and enrich

our interpretation of our eld notes.

Throughout the research process, various precautions

were taken to ensure that the collected data were reliable

and valid. To gain the trust of our informants, we took care

to clarify the objectives of the study. We insisted that we

were researchers and not auditors of auditors in the pay

of the Big Four; that our goal was to better understand

audit work as performed in the eld with a view to produc-

ing several research papers; that complete condentiality

and anonymity were guaranteed

4

; that our study would

be an opportunity for them to reect on their work habits;

and that they would hopefully gain a new perspective on

their practices. Ultimately, the signicant amount of time

we spent living with auditors enabled us to develop genuine

relationships with them (Patton, 2002). Apart from 3 indi-

viduals who remained somewhat on the defensive, all the

participants gladly cooperated in the study.

In addition, the use of multiple methods of data collec-

tion, the diversity of the audits examined and the vast ar-

ray of auditors observed and interviewed enabled us to

check our data through triangulation (Eisenhardt, 1989;

Lincoln & Guba, 1985). For example, participant observa-

tion was used as a means of questioning and contextual-

izing the comments of interviewees, while interviews

served to supplement, conrm or refute our observations

(member checking; Werner & Schoepe, 1987). Overall,

these precautions enabled us to collect evidence deemed

credible enough to be considered for theorizing.

Data analysis

The collected material was analyzed using qualitative

procedures (Eisenhardt, 1989; Miles & Huberman, 1994).

Table 2

Interviews.

Partners Managers Seniors Assistants Total

INTERVIEWS

Audit interviews

Mandate 1 Position 1 1 2 4

Interviewees 1 2 3

Time in hours 1 2 3

Mandate 2 Position 1 1 1 2 5

Interviewees 1 1 2

Time in hours 1 1 2

Mandate 3 Position 2 1 1 2 6

Interviewees 1 1 2 4

Time in hours 1 1 2.5 4.5

Mandate 4 Position 2 1 2 1 6

Interviewees 0

Time in hours 0

Mandate 5 Position 1 1 1 3 6

Interviewees 1 1 3 5

Time in hours 1 1.5 3 5.5

Mandate 6 Position 1 1 3 8 13

Interviewees 1 1 7 9

Time in hours 1 1.5 7 9.5

Mandate 7 Position 1 2 1 4

Interviewees 2 1 3

Time in hours 2.5 1 3.5

Total Position 9 5 11 19 44

Interviewees 1 3 6 16 26

Time in hours 1 3.5 7 16.5 28

Additional interviews (in hours)

Interviews with seniors not within audits 18/07/2002: Senior A 1.5 1.5

19/07/2002: Senior B 1.5 1.5

Executive meetings

a

23/09/2003: DHR

b

1 1

16/10/2003: DHR&DAT

c

1 1

20/02/2004 : DAQRM

d

1 1

Debrieng committee meetings

e

02/02/2004: DHR&DAT 1.5 1.5

03/02/2005: DHR&DAT 1.5 1.5

19/05/2010: DRH 1 1

Grand total (in hours) 8 3.5 10 16.5 38

a

Executive meetings were used to plan the research project.

b

Director of human resources.

c

Director of audit training.

d

Director of audit quality and risk management.

e

Debrieng committee meetings were used to discuss and validate the results of the research project.

4

To full this promise, we will use the broad categories assistant,

senior auditor, manager and partner to refer to the source of our quotes

and will not link these quotes to any of the audit assignments listed in

Tables 1 and 2.

268 H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288

Following the suggestions of many researchers (Hammers-

ley & Atkinson, 1983; Oswald, Schoepe, & Ahern, 1987;

Spradley, 1979), we prepared analytical notes on a very

regular basis i.e. at the end of each day of observation,

interview, and audit. This enabled us to gradually [. . .] de-

velop an empathy with the data (Dent, 1991, p. 711) and

to continuously revise our understanding of them.

Our attention was quickly drawn to a number of unof-

cial features of audit work, including the role of fear in

audit practice. While our reading of Pentland (1993)s work

had left us with the impression that comfort was the main

emotion experienced and transmitted within audit teams,

our rst observations and interviews highlighted the prev-

alence of anxiety among auditors. As soon as we came to

this conclusion, themes related to fear such as signs of

fear, sources of fear, effects of fear and fear manage-

ment were incorporated into the coding scheme. In the

eld, we became particularly attentive to these issues

and began to discuss them during interviews.

When trying to make sense of our data, we were aware

that the eld study was conducted in the aftermath of the

Enrons scandal, the fall of Arthur Andersen, the Sarbanes

Oxley Act vote and the creation of regulatory agencies

independent from the profession to oversee public com-

pany audits. We reasonably assumed that such a modica-

tion of the regulatory environment, by pointing out

auditors failures and putting pressure on audit rms

internal controls (Malsch & Gendron, 2011), had increased

auditors level of professional anxiety. However, we were

also puzzled by the fact that our observations of public

accountants as fearful professionals contrasted greatly

with ofcial accounts suggesting auditors negligence and

lack of skepticism.

5

This prompted us to explore the literature on emotions

at work in search of a model that might enlighten us (e.g.

Ashforth & Humphrey, 1995; Barsade & Gibson, 2007;

Domagalski, 1999; Fineman, 1993; Hochschild, 1983;

Maitlis & Ozcelik, 2004). Along the way, we looked at

how risk theorists (e.g. Bauman, 1991; Beck, 1992; Doug-

las, 1992) had integrated the treatment of fear, the emo-

tion of risk, in their analysis. Ultimately, we concluded

that the psychodynamic approach elaborating on how

our personal anxieties, fears and yearnings can be seen

to underpin some of the routines and rituals of work orga-

nizations or to put it another way, how our deepest exis-

tential fears are camouaged by the very act of working

and organizing (Fineman, 1993, p. 2) was well-suited

to help us better understand the role of fear in the audit

process. We explored and tried various psychodynamic

perspectives (e.g. Dejours, 1993; Klein, 1981; Menzies-

Lyth, 1960; Stevens, 1990; Wollheim, 1971). Moving back

and forth between the latter and the data, we opted for

the psychodynamics of work theory developed by Dejours

(1993) as a means of interpreting our rst-order ndings

(Van Maanen, 1979). In the end, the interpretations we

made on this basis were validated through member check-

ing in the course of many interviews. In saying this, we do

not contend that Dejours (1993) model was the only valu-

able framework for interpreting the collected material.

Other theoretical perspectives would have brought to light

other facets of the fear-risk relationship in auditing. In this

sense, there is absolutely no claim of interpretive closure

here, but only an invitation to further the discussion that

this paper aims to initiate.

To conclude this section, it is worth noting that analyz-

ing emotions presents signicant epistemological difcul-

ties. The rst involves conceptualizing emotions in ways

that can guide empirical research. What is an emotion?

rarely generates the same answer from different individu-

als, academics or laymen. In this paper, we use the term

emotion in the standard denition of a conscious mental

reaction subjectively experienced as feeling and accompa-

nied by physiological and behavioral manifestations

(Scherer, 2005). Accordingly, we do not think of emotions

and cognition as two independent dimensions of human

activity: in our view, actors are not held captive by their

emotive reactions and can mobilize their reexivity to

manage and act on them. The second epistemological chal-

lenge arises from the conceptual proximity and overlap

that can exist between different affective states (Goodwin,

Jasper, & Polletta, 2001). Concepts like fear, vigilance, con-

dence, trust and skepticism can be given operational

meanings in empirical psychology, but they are inherently

slippery, not least because there is some ambiguity both

as to whether they are individualistic or collective in nat-

ure and as to whether they are attributed by the authors

as external observers or self-reported by auditors as some

kind of inner experience (in which case self-deception is

possible).

The only way out of these difculties is, as far as possi-

ble, clarity. In this respect, when we started incorporating

themes related to fear in our coding scheme, we sought to

adopt a denition of fear that would be broad enough to

capture fear through different variations of intensity and

duration, but also constraining enough to prevent us from

seeing fear everywhere and confuse it with other families

of emotions. We were particularly attentive to distinguish-

ing, from the beginning, between fear and anguish, which

are commonly confused by individuals experiencing them

(see below). By triangulating our data, we conrmed our

observations with interviews and controlled, to a certain

extent, self-deception. Admittedly, we cannot be sure that

our informants correctly labeled their feelings. The rela-

tively undened character of affects constitutes an inher-

ent limitation to the study of emotions, but only more

research (and certainly not less) will help build a credible

body of knowledge that will bring forward the affective

revolution in the auditing space.

Fear: the emotion of risk

Fear is often treated as an afterthought in todays

audit risks literature; the focus tends to remain on the

5

A 2010 discussion paper of the Financial Reporting Council - entitled

auditor skepticism: raising the bar - stated for instance: [The issue of

skepticism] is particularly timely as, in the wake of the banking crisis,

regulators have challenged audit rms on whether sufcient skepticisms

was demonstrated and the need for audit rms to exercise greater

professional skepticism was a key message in the Audit Inspection Unit

(p. 3).

H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288 269

cognitive and technical dimensions of risk management

processes rather than on the role that fear may play in

the latter. Indeed, [even] in sociological debates, fear

seems to have become the invisible companion to debates

about risk (Furedi, 2007, p. 1). And yet it is widely

acknowledged by risk theorists that fear and risk are clo-

sely related phenomena (Hollway & Jefferson, 1997).

In his most famous book, Beck (1992) argues that mod-

ern society has become a risk society, in the sense that it

is increasingly occupied with debating and managing risks

that it has itself produced. Risk society is faced in particular

with the awkward problem of having to make risk man-

agement decisions on the basis of more or less unadmitted

not-knowing (Beck, 2006, p. 335). All possible scenarios,

more or less improbable, have to be taken into consider-

ation. [T]o knowledge, therefore, drawn from experience

and science, there now also has to be added imagination,

suspicion, ction, [and] fear (p. 497). In other words, be-

cause we have no means of knowing for sure where risk

and safety lie, nothing can be trusted and fear thus poten-

tially nds a location in any area of daily life.

For Mary Douglas (1992, p. 10), although anger, hope

and fear are part of most risky situations, contemporary

societies, by trying to turn uncertainties into probabilities,

attempt to make risk management accessible to imper-

sonal and emotionless administrative regulation, based

on scientic and neutral principles. Blaming, which at all

places and all times has been a key component of risk man-

agement systems, is not banished by the modern dis-

course. Rather, it now tends to be expressed in the claim

that real blaming is possible a claim rooted in the polit-

ical and moral realm of modernitys search for order and

certainty. In this sense, real blaming, that Douglas sees

as a fantasy, can be seen as a defence against uncertainty

produced and reproduced at the cultural level (Hollway &

Jefferson, 1997, p. 261).

The desire to eliminate uncertainty is also at the heart

of Zygmunt Baumans conceptualization of modernity

(1991). Modernitys task of tasks, maintains Bauman, is

to produce order. According to him, this struggle, always

doomed to be lost, is essentially a ight from the ambiva-

lence at the heart of orders opposite, namely, chaos. We

have to get used to the idea of living without foundations

(Bauman, 1991, p. 16). However, obsessed with self-scru-

tiny, man does not admit contingency and ambivalence

is transformed into the nagging fear of own inadequacy.

Like real blaming, denying ambivalence functions as a de-

fense against the anxiety that may result from uncertainty.

In all three of these major risk theorists accounts, a

subject is inferred who apprehends and makes sense of

risks characterizing our society through the experience of

fear. However, although recognized, this emotional experi-

ence is not placed at the heart of the analysis. In particular,

its effects on risk perception and risk management

processes are not seriously examined. In each case, the

concepts that are brought into play (projection of fear, de-

fense against uncertainty and denial of ambivalence),

cohering around feelings of fear, would benet from a

psychodynamic perspective for their operational and

empirical development (Hollway & Jefferson, 1997). In this

paper, we use the psychodynamics of work theory

elaborated by Dejours as an interpretive tool to better

understand and account for how auditors experience and

manage fear when confronted with risks in their work envi-

ronment, and how, in return, they experience and manage

risks under the inuence of this emotion. Dejours psychody-

namic framework shares many common points with other

psychodynamic models, focusing in particular on the

defensive strategies which actors may adopt to alleviate

their anxiety. It nevertheless distinguishes itself in that it

relies not only on an explicit theorization of the subject,

but also on an explicit theorization of work and risks at

work, which is very helpful for better understanding the

interplay of fear and risk in the audit process.

Fear and risk at work: Dejours psychodynamic

perspective

Like most psychologists (Hollway & Jefferson, 1997) and

many sociologists (Furedi, 2007), Dejours (1993) argues

that fear is an emotion caused by the realization of a risk,

whether real or imagined. Accordingly, he uses the word

fear as an umbrella term encompassing a broad range of

affective states of varying intensity and duration, including

disquiet, concern, worry, apprehension, anxiety, dread, ter-

ror, fright and panic, which are all different types of fear.

However, Dejours (1980) insists that fear should not be

confused with anguish. While both of these feelings imply

a painful state of suspense, they differ signicantly. An-

guish emerges from an intrapsychic conict, i.e. from a

conict between two drives, two desires, two psychoana-

lytic structures (such as the id and the super-ego) or two

systems (for example, the conscious and the unconscious).

It relates to the personality of the subject, has no prede-

ned object (i.e. it may attach itself to absolutely any-

thing), and tends to give rise to pathological behaviors.

By contrast, fear is caused by a risk regarded as plausible

and whose materialization might impair the actors physi-

cal or mental integrity. It responds in a somewhat rational

and understandable way to a threat largely independent

of the person, and may stimulate adaptive and relevant

behaviors.

Fear at work: main object and sources

What rst emerges from studies on the psychodynam-

ics of work is the existence of fear in the activity of most

workers (Dejours, 1980, p. 30). As noted by Dejours

(1980, 1993, 2005), work situations tend to generate fear,

which, beyond its various manifestations, often amounts

to a fear of failure.

To better understand the prevalence of this type of fear

in the workplace, Dejours (1993) draws on two theories: a

theory of work derived from the ndings of French ergon-

omists (e.g. Wisner, 1995) and a theory of the subject in-

spired from Freud (1920). According to the rst theory,

ofcial prescriptions are rarely sufcient to perform a task

successfully. Working fundamentally implies coping with

unforeseen events and conicting requirements and there-

fore inventing compromises whose relevance is not guaran-

teed in advance. Here lies, argues Dejours (1993, 2005), the

270 H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288

rst reason why individuals at work are often afraid to fail:

they know that their effectiveness is doomed to be uncer-

tain, or, to put it another way, that failure is always

possible.

Yet the uncertainty and the risks surrounding their ef-

cacy would not be a concern for workers if they were com-

pletely indifferent to success. However, people tend to

attach great importance to achieving their goals. Most ac-

tors leave childhood with an unnished identity, are in

quest of self-accomplishment, and can blossom in two dif-

ferent ways: either by succeeding in their erotic life and/or

by doing well in a job that makes sense in their biography.

In both cases, their self-image depends on the judgment

that they pass and that is passed on their performances

(see also Roberts, 2009). In the workplace, actors strive to

attain their objectives when they recognize themselves in

what they do and, in any case, to benet from the recogni-

tion of their work by others (peers, superiors, clients, etc.).

If they succeed and are praised for their achievements,

their self-esteem tends to increase; if they fail or are

blamed for not being good enough, their self-esteem tends

to decline. In other words, avoiding failure is usually, in

their eyes, a matter of identity. This is the second reason

why they often are afraid of failure.

Fear at work: a cultivated resource

Now, the fear of failure inhabiting workers does not

only impact their inner life experience. It also inuences

their choices, behaviors and attitudes, thereby interacting

with organizational processes in many ways.

The fear of failing, argues Dejours (1993) is often a req-

uisite for a job well done: when they are unafraid and over-

condent, people tend to act negligently, thus increasing

the likelihood of making serious mistakes. In this sense,

as maintained by Hood (2011, p. 184), blame and the fear

of blame are not all bad, if we are led to think twice about

bending or disobeying important rules. A work environ-

ment without professional blame would be one in which

the only pressure to stay on the right track would have

to come from individuals own self-image and moral com-

pass notoriously cranky instruments.

Consequently, a range of methods are used in the work-

place to cultivate anxiety, which might otherwise decline

over time from the anesthetizing effect of habit (Dejours,

1993). Some formal management techniques are designed

to achieve this objective, and in the eld, workers them-

selves sometimes use informal strategies to remain suf-

ciently worried or anxious. For example, in some high-

risk jobs, they gladly tell each other stories of frightening

accidents in order not to forget the risks they face and to

remember that ofcial safety measures never provide per-

fect protection.

From fear to comfort through practical intelligence

The fear of failure, insists Dejours (2005), is one of the

main sources of intelligence at work. Ideally, the positive

dynamics triggered by fear is a dynamics of body-propria-

tion (Henry, 1987). By preparing workers for risks, fear

heightens their motor tension and sensory attention. It

drives them to go into a kind of body-to-body with the

main elements of their working situation and to appropri-

ate them in a very personal way. The greater the symbio-

sis with these elements, the more able people are to feel

them as part of their own body, and thus to perceive the

smallest cues that might indicate risks. As soon as one of

these cues is noticed (an abnormal sound, smell, visual sig-

nal or whatever), individuals react. Since they are at one

with their environment, they are quickly able to outline a

diagnosis or to identify a corrective measure. Throughout

the process, because they are afraid of making a mistake,

they regularly return to what they have done in order to

verify that nothing has been forgotten and that everything

is as it should be. At this stage, they often use ofcial guid-

ance to conrm, revise and legitimize their intuition. When

they eventually start to feel reassured, they are able to con-

template the fruits of their work, from which they may de-

rive different kinds of pleasure.

However, they cannot be certain that they have handled

the situation in a fully efcient and acceptable way. At this

point, their pleasure thus remains incomplete and their

fear of failure is not entirely relieved. As a result, driven

again by anxiety, they usually seek to discuss their prac-

tices with their colleagues, superiors and/or clients.

According to Dejours (1993), discussion is the most crucial

part of the whole process. When the debate is constructive,

actors see their work recognized and thus strengthen their

identity; they may learn from others about how to do bet-

ter; the community of practice grows; the unwritten rules

of the job are enriched; and with sufciently exible man-

agement, ofcial directives improve through experience

feedback.

From fear to comfort through defensive strategies

That said, the outcome may not always be so positive.

Although fear plays a central role in the development of

intelligence at work, a specic condition must be met in or-

der for fear to produce this positive effect: condence. An

actor who is afraid of failing would be reluctant to confront

difcult situations if she had no condence in her own

ability to succeed, the instruments put at her disposal,

and the willingness of her colleagues to help her in case

of necessity. She would hardly dare discuss her work with

her peers, superiors and clients if she felt completely inse-

cure about their willingness to judge her work fairly. If

they are overcondent and unworried, workers tend, as

noted above, to act imprudently. However, without any

condence in themselves, in others and in their working

tools, they will have a pathogenic fear of failure.

When this occurs, argues Dejours (1993), preventing

and managing risks that may harm production is no longer

a priority: the enemy that people strive to dominate be-

comes fear itself, and various defensive strategies are then

developed in order to suppress this feeling. Operating on

the principle of the ostrich policy, these strategies enable

workers not to think about what worries them. To avoid

facing the risks of the eld, an actor may, for example, hole

up in her ofce or not delve deeper in her analyses. How-

ever, in order to achieve their full effectiveness, defensive

strategies need to be implemented collectively (Dejours,

H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288 271

1993). Not thinking about obvious risks is difcult and re-

quires the complicity of each actor. As a result, the group

usually tends to exert a strong discipline on its members

and to exclude anyone who fails to comply with the social

defenses in force. When the latter prevail, the organization

experiences a form of cultural alienation (Douglas, 1992):

it sinks into a kind of foolishness which protects organiza-

tional members from the fear that something could go

wrong, while also increasing that very probability.

In the remainder of the paper, we mobilize this psycho-

dynamic perspective on work to organize and present our

interpretations of the interplay of fear and risk in the audit

process.

6

First, we specify the main object and sources of

auditors fear. We then show that fear tends to be viewed

by auditors as a requisite for a job well done (a kind of episte-

mic resource) and that such a viewis at the root of many for-

mal and informal audit techniques designed to cultivate this

emotion. Finally, the paper provides a detailed examination

of the process through which fear shapes public accountants

practices that in turn alleviate and transform it into comfort.

Auditors fear: main object and sources

What is it exactly that auditors worry about? What is

the main object of their fear? Since fear is the emotion of

risk, which risk makes them feel afraid? To clarify this is-

sue, let us return to the conceptual framework on which

professional audit standards draw. At the heart of this

framework lies the concept of audit risk, dened in ISA

200 (International Standards on Auditing) as the risk of

inappropriately certifying nancial statements with signif-

icant anomalies. On the basis of our analyses, this deni-

tion, couched in institutional language, provides an

accurate representation of the fear experienced by public

accountants, i.e. the fear of overlooking a material mis-

statement (a fear of failing or of being mistaken).

Doing your job properly means nding a mistake if

theres a mistake to be found. Because at the end of

the process, if you tell people: you can trust these

nancial statements and youre actually wrong, the

consequences can be truly disastrous. [. . .] We all have

a huge responsibility in the matter, from the trainee

right up to the partner, who even risks going to prison.

So thats what scares us: getting it wrong. (One senior)

When you control a given section for the rst time and

its a bit complicated, you do your best, but you still have a

doubt. You ask yourself: am I missing something really

important here? Its worrying. (One assistant)

In the rest of this section, we argue that auditors fear of

getting it wrong subjective corollary of the audit risk

is the product of two factors, both underlined by the

psychodynamics of work: the impossible nature of the

audit mission, and auditors desire to do a good job.

The audit mission: impossible

The fear of failing to detect signicant anomalies results

rst fromthe impossible nature of the mission assigned to

auditors, and more precisely from auditors awareness of

having to perform an impossible task: although audit pro-

fessionals can never be entirely sure that they have not

missed a material misstatement, they are required to ex-

press relatively categorical conclusions (Gill, 2009).

In the eld, public accountants are confronted with a

high degree of uncertainty. To begin with, as noted by a se-

nior comparing his occupation to the job of a police ofcer:

We [auditors] are in a more uncomfortable position

than a policeman investigating a case because the

policeman knows for a fact that a crime has been com-

mitted [...]. In auditing, were also required to carry out

an investigation, but we dont actually know if there

was a crime in the rst place. So unlike a police detec-

tive, we dont set out with any denite certainties.

Thus, the rst uncertainty faced by public accountants

is this: do the audited accounts contain signicant anoma-

lies? When they begin a job, auditors cannot possibly know

the answer to this question. But that is not all. One assis-

tant observed:

In the accounts of a large company, there are hundreds

of thousands of recorded operations. [. . .] When you

think about it [. . .], it makes you feel all dizzy! Because

what youre being asked to do is to put your nger on a

mistake deemed to be signicant in what is essentially a

gigantic hotchpotch. [. . .] Its a bit like looking for a nee-

dle in a haystack. Wheres the mistake? That is the

question! It could be anywhere. . . everywhere and

nowhere.

In other words, even assuming that an account actually

contains a misstatement, auditors cannot possibly know

where to look for it. In referring to Shakespeares Hamlet

(That is the question!) and a feeling of dizziness, the assis-

tant suggests the extent to which the question Wheres

the mistake? may be anxiogenic for her.

In practice, the anxiety induced by this question is made

worse by the fact that auditors do not operate at home, i.e.

within the connes of their audit rm. The nancial state-

ments that have to be certied, the records that these state-

ments synthesize, the various aspects of the reality that

accounts are designed to translate and the processes by

means of which this translation is carried out are all located

in the audited company. In the latter, where are the ele-

ments that may suggest the presence of accountancy er-

rors? In order to nd them, which factories, warehouses

and ofces need to be visited? Which pieces of furniture

need to be searched? Which les and folders need to be

examined? Which documents need to be scrutinized? In

these documents, which cues need to be extracted? At the

start of a newassignment, auditors do not have the answers

to these questions. They have no map for nding their way

around the audited organization, and it is sometimes

6

As noted by Radcliffe (1999, p. 345): The writing of ethnography is

always a delicate process, if not a struggle. There are several possible

tactics. For instance, some authors successively present their rst- and

second-order ndings in accordance with Van Maanens (1979) suggestion

(e.g. Fischer, 1996; Dirsmith, Heian, & Covalevski, 1997), while others

prefer a thematic exposition of their results structured according to their

analytical framework (e.g. Barrett, Cooper, & Jamal, 2005; Pentland, 1993;

Radcliffe, 1999). The second of these options was chosen here.

272 H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288

possible to see in their eyes, and in their hesitant move-

ments, their fear of failing to nd the way to the relevant

data.

Yet the questions Wheres the mistake? and Where

are the elements necessary to nd it? would not be partic-

ularly distressing if public accountants could peruse the

entirety of the mass of accounts under investigation

unhurriedly and methodically. This is not, however, the

case. Since the means at their disposal are fatally limited,

particularly in terms of time and numbers, auditors know

in advance that their research will not be exhaustive. As

one senior remarked, a complete audit would constitute

an economic aberration:

You see, in this company, [. . .] if you wanted to check

every accounting operation based on actual audit evidence,

youd need roughly ten people and youd have to work for

an entire year. [. . .] In purely economic terms it just

wouldnt work out. [. . .] As a result, there arent ten of us

but more like three or four, and we dont have a whole year

to do the job [. . .] but more like two weeks. So we cant go

looking everywhere.

Finally and importantly, contrary to what one might

think, the extensive body of audit guidance does little to

reduce the uncertainties and risks faced by auditors in

the eld. As emphasized by many of our informants,

blindly relying on ofcial audit technologies would even

actually be the surest way to failure (a source of risk!).

Two reasons were given to account for this. First, while

business risk methodologies aim at least partly to reduce

the time required to perform an audit task (Knechel,

2007), their highly structured elaboration does not appear

to be conducive to such a result. The audit team members

we monitored all agreed on one point, namely that the pre-

scribed tools were too unwieldy to be applied as such. For

example, one senior, commenting on the predened risk

assessment matrices, noted: Filling in these templates en-

tirely? My god, it would be a never-ending job! [. . .] You

could easily spend two weeks formalizing them. In this

case, we only had four days, so you see. Second, as put for-

ward by a number of interviewees, mechanically resorting

to formal audit tools would prevent auditors to correctly

feel the eld and would thus be counterproductive. One se-

nior noted:

The time you spend lling in a questionnaire is time you

dont spend in the factory. And if you go all the same,

your eyes are riveted on the form, and you may then fail

to see that right behind it there are machines on their

last legs. So you miss everything!

This comment provides a good illustration of the risk

associated with technical mediation highlighted by ergon-

omists: when standard technologies come between an

individual and her environment, the former may become

unable to perceive the latter correctly, and if her task in-

volves identifying and managing risks, this can be pretty

problematic. In a similar vein, most of our informants

saw the use of statistical tables as not reassuring. One se-

nior said: Its not because a stats chart tells me to examine

ten amounts that Ill feel comfortable with it. Perhaps Ill

need more, perhaps Ill need less. I cant possibly know that

in advance. Whats important is to feel when you can stop.

Ultimately, auditing is always a matter of judgment, of

which no amount of rationalistic analysis will ever pro-

duce a sufcient explanation (Pentland, 1993, p. 619). As

noted by one partner in referring to the obligation for

French commissaires aux comptes to justify their audit

opinions:

Managing to feel sufciently at ease to express an opin-

ion is often in itself to attempt the impossible. But pro-

ducing a written demonstration of the validity of this

opinion... In my view, its a bit like trying to square

the circle. Isnt a judgment precisely something that just

cant be explained? [. . .] [People] assume that auditing

simply involves applying procedures, but thats an

impoverished bureaucratic vision of auditing.

For all the reasons stated above, a statutory audit is a

task ridden with uncertainties and risks involving anxio-

genic effects. A parallel might be drawn with the situations

faced by workers in high-risk industries. On this subject,

Dejours writes (1993, p. 147, note no. 2): What generates

fear is the perception of a gap between the awareness of a

risk and the lack of knowledge about the precise nature of

the risk. This gap is often the cause of a fear of not being

up to the challenge of the task, either technically or psycho-

logically. Similarly, auditors experience fear in part be-

cause their job involves detecting misstatements in

accounts that may or may not exist, without any knowledge

of where such misstatements might be located, without the

means of verifying the entire range of the accounts under

investigation, and without the possibility of blindly relying

on prescribed audit tools. One manager commented:

We could miss a mistake without even realizing it. Im

afraid thats the risk of the job. Just because we havent

found anything doesnt necessarily mean there wasnt

anything there to nd in the rst place. Likewise, just

because we found a serious mistake doesnt mean there

wasnt another, bigger mistake to nd. Has anything

escaped our notice? Fundamentally, theres no objective

criterion that means we can be 100% certain.

This comment contains some of the key ideas developed

by a number of researchers in the eld. For example,

Fischer (1996, p. 224) argues that truly objective measures

of audit quality do not exist, while Power (1999, p. 28) re-

marks that [there is a] deep epistemological obscurity of

auditing [. . .], [i.e.] no way of specifying the assurance pro-

duction function independently of a practitioners own

qualitative opinion process. Finally, as noted by Pentland

(2000, p. 311): No wonder that audits are epistemologi-

cally obscure auditors have adopted the rhetoric of scien-

tic methodology without really being able to adopt much

of the substance. In short, the opinions expressed by pub-

lic accountants cannot possibly constitute mathematical

certainties. Faced with uncertainties and risks, public

accountants may at best experience a sense of comfort,

the central focus of Pentlands (1993) analysis. However,

based on our observations, their work is primarily a cause

of fear, particularly since they are required to express rel-

atively categorical conclusions.

The audit mission is a mission of certication. The word

is strong: to certify means to guarantee as certain (Oxford

H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288 273

English Dictionary); it suggests certainty more than skepti-

cism. Admittedly, ISA 200 insists that the assurance to be

provided by an audit is not absolute but reasonable. How-

ever, notwithstanding this qualication, a reasonable

assurance is still an assurance, i.e. a promise or engage-

ment making a thing certain (Oxford English Dictionary).

In practical terms, auditors, whatever their level of experi-

ence, do not have the luxury of displaying indecision. One

senior remarked: Its never a good thing to remain at the

level of uncertainties. [. . .] You cant submit a summary re-

port and say: there are areas of uncertainty. During one of

the tasks observed in the course of this study, the manager

suddenly exclaimed, turning towards an assistant and a

trainee:

This wont do! You havent concluded your report! This

is unacceptable! Our business is all about certication.

[. . .] What youre asked to do is to adopt a position, to

make a decision and to commit to it. Your job is to write

in black and white: there is not a single signicant mis-

take in the such and such account or this is the mistake

and it amounts to such and such.

In brief, to quote Pentlands elegant formula (1993, p.

611), it behooves the auditor to produce a certication of

the unknowable. It is in this sense that we portray auditing

as an impossible mission, typical of the desire of certainty

characterizing the risk society, despite more or less unad-

mitted not knowing (Beck, 2006). The phrase impossible

mission is borrowed from Freud (1961), who described

as impossible the professions in which one can be sure

beforehand of achieving unsatisfying results (p. 248).

Lastly, an audit mission is not merely impossible, but

is also generally considered essential. As noted by the se-

nior quoted at the beginning of this section, the conse-

quences [of an audit failure] can be truly disastrous. One

partner observed: For the few amnesiacs out there, the re-

cent scandals will have refreshed their memories. So let us

imagine for one moment being in an auditors position: the

task with which she is entrusted seems logically unachiev-

able, yet she knows that she cannot allow herself to fail

since her failure could have disastrous repercussions. Un-

der such conditions, who would not be afraid of failing?

Perhaps somebody who remains unconcerned by such

matters and cares very little about detecting mistakes in

an account. However, this does not appear to be the case

for auditors, whose fear of failure is also the result of their

desire to achieve a high standard in their work.

Auditors desire to do a good job

As argued by Dejours (1993, p. 225), most healthy sub-

jects want to provide a high-quality service at work. Under

this angle, the majority of public accountants can be said to

be healthy. Based on our analyses, some of them attach

great importance to being good at what they do, partly be-

cause the audit mission resonates with their own biogra-

phy. When asked about the roots of her professional

dedication, one assistant gave the following answer:

What drives me is telling myself that I work in the ser-

vice of truth. Im totally committed to the idea of truth.

Thats probably because of my education. [. . .] Checking

that accounts are telling the truth is really important to

me [. . .]. Its in tune with my principles. [...] I think we

live in a society thats dying from a lack of ethics, and

I tell myself that in some way I have a role to play in try-

ing to improve the situation.

One striking feature of this account is how the subject

appropriates the quest for truth assigned to statutory audi-

tors; how she conceives this quest as a reection of her

education, principles, beliefs, and so on, and how she iden-

ties with this mission. When she is engaged in an audit

task, she feels that she is in tune with herself. In the same

vein, one manager observed:

Shareholders, suppliers, customers, banks, anyone who

reads accounts: theyre our clients. [. . .] I tell myself

that [. . .] we all know them [...]. For example, [. . .] Ive

got a friend who works in a private business bank and

he spends his time reading nancial statements. My

father-in-law is a small-time speculator: hes a share-

holder. So ultimately those are the people I work for.

Again, this comment suggests how some auditors give

meaning to the mission that is entrusted to them by law,

especially when this mission is assigned a specic value

by other aspects of their personal life for example, when

a shareholder, a customer, a supplier, etc., is embodied in

their eyes by a loved one whom they wish to protect,

and to whom they hope to be useful. In the eyes of these

auditors, failing to detect a material error somehow means

betraying oneself, and this is partly why they are afraid of

being mistaken.

However, for the majority of the public accountants ob-

served in this study, the reader of the accounts was too ab-

stract, remote and disembodied a gure to give rise to

sufcient mobilization. By contrast, all of the informants

felt driven in some way or another by their concern for

other peoples opinions i.e. by their desire to be recog-

nized as good at their job or to avoid hurtful criticisms

(Anderson-Gough, Grey, & Robson, 2001; Gill, 2009; Korn-

berger, Justesen, & Mouritsen, 2011).

To hear my senior say Ive done a good job is a real

boost to my morale! The comment of this assistant illus-

trates the process governing her approach to auditing: con-

gratulated for her work, she takes the compliment

personally (Im doing a good job), thus strengthening

her identity, and this prospect is precisely what motivates

her to do her very best. To fulll their expectations in

terms of self-achievement, some auditors go further. They

feel the need to stand out and to outperform their peers in

order to be viewed (and to view themselves) as excellent.

This may involve securing a large bonus, an unprecedented

pay rise or an exceptional promotion. For example, one se-

nior noted: If I work like nuts, I dont mind telling you its

because I want to jump [a hierarchical level]. Likewise, one

manager said: I have a very clear goal to become a part-

ner and Im working hard to achieve it.

However, before achieving such a target, there are

many criticisms to be avoided that may impact an auditors

sense of self-worth. The risk and fear of being sanctioned

by a superior was displayed by many of our informants.

274 H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288

For example, one manager told a senior auditor during one

of the missions: Youd better take a good look at the cash

accounts. We completely botched the job last time, and

theres no way Im going to get shot down by [...] [the part-

ner] again! In his study on Accountants truth, Gill (2009,

p. 25) makes similar observations: When I asked Simon

when he had had to behave cautiously at work, he told

me about a time when he realized he had forgotten to

put a value added tax return in with its covering letter to

a client. Simon was afraid: those few moments were terri-

ble. Although Simon wanted to conceal his mistake, he

needed reassurance from someone else that he was behav-

ing appropriately [...] What was at stake was Simons more

general self-presentation as competent which he feared

that even this small error might undermine (p. 25).

Finally, it is worth noting that auditors hierarchical

superiors are not the only ones providing good or poor

assessments. Auditees may also pass judgment on the

work performed by public accountants. As noted by one se-

nior: When I say goodbye to a client and he says some-

thing nice because Ive been useful to him, Im as

delighted as can be. Its very gratifying. Its to hear things

like that that I work so hard. This is another good example

of the sequence recognition of the work done, identity

gratication, desire to do well. However, it is also fre-

quently out of a fear of being criticized by their interlocu-

tors and in order to protect their self-esteem that auditors

are so keen to perform at their best. One assistant com-

mented: Some [auditees] [. . .] will leap at your throat if

they think youre not up to the job. So I only ever consult

them if I know Im perfectly prepared, and I make it a point

of honor of nding out what might be wrong about their

accounts.

To summarize, being both aware of performing an

impossible mission and keen to achieve a high standard

in their work, auditors are inhabited by the fear of failing to

detect signicant anomalies. As noted by Gills (2009, p.

136), They want to maintain a standard of professionalism

in [. . .] [the] pursuit [of their tasks] despite not being able

to articulate that standard, [. . .] they make strenuous at-

tempts to do so despite the obstacles they face, but they

can never be sure to succeed and feel afraid for that reason.

Now, public accountants fear of failure does not only im-

pact their inner life experience. It also signicantly inu-

ences their choices, behaviors and attitudes, thereby

interacting with the audit process in at least two different

ways: on one hand, auditors tend to see fear as a valuable

resource needing to be cultivated; on the other hand, they

strive to alleviate it before the end of the audit engage-

ment, which is necessary for them to form and convey

their conclusions.

Auditors fear: a cultivated resource

Fear seen as a requisite for a job well done

One senior made the following comment:

We all experience fear [. . .] to a greater or lesser degree,

and its probably what keeps us on our toes. If you dont

take the job seriously, youre bound to miss something

thats really serious. It can be right there in front of you.

Worrying about getting something wrong is what max-

imizes your chances of being effective.

Many of our informants emphasized the connection be-

tween effectiveness and the fear of failure. In their eyes,

fear enables them to remain vigilant. Accordingly, an audi-

tor who fails to display any fear may become a source of

risk and thus a matter of concern for her colleagues. For

instance, one manager noted:

[Such and such] is really very bright. The only thing that

worries me sometimes is her detachment, her Zen atti-

tude whatever the circumstances. I know her well and I

know its the impression she wants to give. Still, Id pre-

fer it if she looked a tad more worried from time to time

so I could stop having to worry myself.

Focusing on comfort, Pentland (1993) argues that this

feeling is communicated from the bottom to the top of

the audit hierarchy as a basic product. By Pentlands ac-

count, every member of an audit team derives part of her

comfort from the comfort displayed by her subordinates.

This may be the case at the very end of an audit task. How-

ever, as the manager quoted above appears to suggest, if an

auditors sense of comfort is experienced at too early a

stage in the audit process, she is unlikely to reassure her

superior, who will instead begin to worry. Our conclusions

on the subject converge with those reached by Dejours

(1993), according to whom fear is a stimulating factor

causing subjects to surpass themselves. Most auditors are

aware of this, and in some cases may worry that they are

not sufciently anxious.

The risk and fear of not being sufciently anxious

As Dejours (1993, pp. 138139), remarks, even in the

most anxiogenic situations, habit produces ataraxic effects:

In one of the factories we studied [. . .], which had been im-

planted locally for several decades [. . .] and which had seen

every generation of equipment and manufacturing process,

it transpired that fear reached at least a high level. Some of

our informants clearly identied habit as a risk factor, a

kind of sedative of the fear of failure and of the vigilance

that such fear induces. According to them, working on an

audit task for several years may have this effect. One senior

commented:

Ive been working on the same audit [. . .] for nearly ve

years now. So now I really feel at home in the company

Im auditing. [. . .] In fact, there are many positive

aspects to working like that [...]. But at the same time,

perhaps thats also the greatest danger: [. . .] when

youre at home, you feel safe, and thats precisely whats

risky: your vigilance is sort of numbed.

As noted by the senior, habit is not only negative. It is a

necessary condition for the development of practical com-

petence and is synonymous with experience. However,

experience is not altogether positive, particularly if it gives

rise to excessive self-condence. One partner noted:

Taking on the audit of a companys accounts is a bit like

tackling a high summit. Youre faced with a huge

H. Gunin-Paracini et al. / Accounting, Organizations and Society 39 (2014) 264288 275

challenge, equipped with instruments which, in view of

the scale of the task, are completely inadequate. To be

successful in situations like that, you need to have a

lot of experience and to remain aware of the dangers

entailed at all times. [. . .] There are excellent moun-

tain-climbers who die because they lose sight of that

awareness as they gain in experience and competence.

Same thing for us auditors. The more experienced we

become, the more we need to cultivate a sense of

humility. Otherwise were condemned to falling.

The point emphasized by the partner is reminiscent of

the paradox of success (Audia, Locke, & Smith, 2000) or

of Icarus (Miller, 1992). The paradox is that our main

strength is sometimes our worst enemy. Like Icarus, audi-

tors with substantial experience, blinded by their own

competence, run the risk of falling from a lack of humility.

As for novices, they must beware of another kind of risk:

boredom. Auditing has the reputation of being on occasion

a boring occupation (Power, 1999). It is particularly true for

assistants, who may be given repetitive tasks during large-

scale jobs. In such cases, their fear of failure may be

numbed. When asked about this issue, one assistant said:

Last year, we were auditing the accounts of a group that