Professional Documents

Culture Documents

Colliers Top European Logistics Hubs 2013

Uploaded by

vdmaraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Colliers Top European Logistics Hubs 2013

Uploaded by

vdmaraCopyright:

Available Formats

WWW.COLLIERS.COM/RESEARCH | P.

1 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

The enlargement of the European Union, continual infrastructure development and the

growth of a consumer mass market in CEE are contributing to redefne distribution

patterns in Europe and supporting the development of new freight trafc routes. These

developments are in turn impacting European logistics markets and leading to the

emergence of new industrial and distribution hubs. Some of these hubs are in competition

with more established centres in Western Europe as alternative locations for undertaking

pan-European distribution activities or for setting up a manufacturing business.

Against this evolving background, we look at how the most mature and emerging logistics

and industrial centres in Europe compare with each other against a series of key parameters

that typically play a determining role in site selection for manufacturing and distribution

activities, whereby the onus is on road-based distribution. Our key fndings include:

> Blue banana hubs remain the ideal platform for pan-European distribution activities

for the majority of the European consumer market. .

> Some of these hubs, such as Liege and Lille, ofer a good balance between market

access maximization and competitive operational costs.

Top European

Logistics Hubs

COLLIERS INTERNATIONAL | WHITE PAPER

IRELAND

UNITED

KINGDOM

SPAIN

PORTUGAL

BELGIUM

LUXEMBOURG

FRANCE

NETHERLANDS

GERMANY

DENMARK

SWEDEN

NORWAY

FINLAND

RUSSIA

ESTONIA

LATVIA

LITHUANIA

BELARUS

POLAND

UKRAINE

SWITZERLAND

AUSTRIA

CZECH REPUBLIC

SLOVAKIA

HUNGARY

CROATIA

ROMANIA

BULGARIA

TURKEY

GREECE

ITALY

Warsaw

Kiev

Bucharest

Sofa

Istanbul

Athens

Izmir

Belgrade

Budapest

Bratislava

Prague

Munich

Frankfurt

Dusseldorf

Rijeka/Koper

Paris

Hamburg

Le Havre

Lille

Amsterdam

Antwerp

Brussels

Venlo

Rotterdam

Liege

Lyon

Marseille

Madrid

Zaragoza

Valencia

Rome

Bologna

Milan

Barcelona

Tricity

Poznan

Upper Silesia

Klaipeda

St Petersburg

Moscow

MARKETS THAT WERE ANALYSED

TOP 10 MARKETS

Balanced Scenario

1 Dusseldorf

2 Antwerp

3 Rotterdam

4 Brussels

5 Hamburg

6 Venlo

7 Amsterdam

8 Lille

9 Paris

10 Liege

Distribution Scenario

1 Antwerp

2 Rotterdam

3 Dusseldorf

4 Brussels

5 Hamburg

6 Amsterdam

7 Liege

8 Venlo

9 Lille

10 Frankfurt

Manufacturing Scenario

1 Kiev

2 Istanbul

3 Bratislava

4 Upper Silesia

5 Sofa

6 Antwerp

7 Lille

8 Budapest

9 Dusseldorf

10 Prague

Source: Colliers International

WWW.COLLIERS.COM/RESEARCH | P. 2 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

> Northern Italy also ofers good growth potential for distribution activities, especially

given the expected increase in freight trafc through northern Adriatic ports.

> From a distribution perspective, Western Europes dominance will be increasingly

challenged by some CEE hubs, such as Prague or Bratislava, as the centre of Europe

gradually shifts to the east.

> Eastern Europe is the best location for low cost manufacturing but its distribution

benefts remain of a local or sub-regional nature.

> Strategically located hubs in Turkey and Russia, such as Istanbul or Moscow,

are increasingly integrated in the global supply chain and will gain further importance

as trade links with the Far and Middle East strengthen.

> In our analysis, Southern Europe has no clear competitive advantages, but this might

change on the back of structural reforms being implemented in some countries.

Overall, each hub should be considered for its specifc merits, as cities within the same

region might not be equally suitable depending on the business needs.

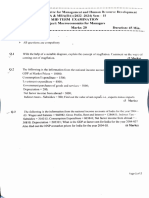

The factors considered in this study are categorised into six diferent groupings:

1. Infrastructure & Accessibility scores each location in terms of accessibility to

European ports/market entry points, and the quality of existing transport infrastructure.

2. Market Access the size and depth of the surrounding catchment area in terms of both

population, GDP and forecast GDP growth.

3. Operational Base Costs basic operational costs including comparable labour, rental

and land costs.

4. Labour Market Capacity size of working population and volume of unemployment.

5. Logistics Competence specialised workforce and logistics indices.

6. Business Environment ease of doing business.

In addition to looking at the corresponding ranking for each of the categories listed above,

we have analysed the relative attractiveness of each city according to three main

scenarios. Each scenario applies a diferent weighting per category, highlighted below,

to derive the results represented in this report:

1. Balanced

I&A MA OC LMC LC BE

2. Distribution

I&A MA OC LMC LC BE

3. Manufacturing

I&A MA OC LMC LC BE

I&A

MA

OC

LMC

LC

BE

Infrastructure & Accessibility

Market Access

Operational Base Costs

Labour Market Capacity

Logistics Competence

Business Environment

20% 20% 20% 15% 15% 10%

25% 45% 15% 5% 5% 5%

15% 10% 45% 15% 5% 10%

WWW.COLLIERS.COM/RESEARCH | P. 3 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

BALANCED SCENARIO: NORTHERN EUROPE BEST IN CLASS

Our simulation shows that in a hypothetical situation where decisions would be almost

indistinctly determined, for example, as much by costs as by accessibility or workforce-

related considerations, traditional hubs in northern Europe would be the uncontested

winners. Dusseldorf came in frst and virtually all Belgian and Dutch cities form part

ofthetop ten under the assumptions made in this scenario. Looking at the profle of each

of these cities, it is clear that they tick more boxes than other locations in Europe.

Although, as one may expect, most of these cities generally score relatively low in terms

ofcost, they generally boast an excellent level of infrastructure, a favourable business

climate and a developed logistics market. They also beneft from proximity to major

European seaports and airports and the largest consumer markets. They can also tap

into a vast and relatively skilled workforce pool.

DISTRIBUTION SCENARIO: THE DOMINANCE OF THE BLUE BANANA

For companies active in distribution activities, the proximity to fnal consumers and the

presence of a reliable and developed infrastructure network to deliver goods on time are

paramount. In the distribution scenario, we therefore attribute a higher weighting to the

Market Access (45%) and Infrastructure & Accessibility (25%) dimensions. The results

are somewhat expected and similar to the balanced scenario, with the Blue Banana cities

dominating the top positions. Antwerp tops the table, followed closely by Rotterdam, Brussels,

Dusseldorf and Hamburg. The frst non-Belgian-Dutch-German city is Lille in 9th position.

BALANCED SCENARIO

TOP 20 MARKETS

1 Dusseldorf

2 Antwerp

3 Rotterdam

4 Brussels

5 Hamburg

6 Venlo

7 Amsterdam

8 Lille

9 Paris

10 Liege

11 Istanbul

12 Frankfurt

13 Milan

14 Bratislava

15 Prague

16 Munich

17 Lyon

18 Upper Silesia

19 Budapest

20 Barcelona

Rotterdam Port

Source: Colliers International

WWW.COLLIERS.COM/RESEARCH | P. 4 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

BLUE BANANA

Antwerp

Rotterdam

Brussels

Venlo

IRELAND

UNITED

KINGDOM

SPAIN

PORTUGAL

BELGIUM

LUXEMBOURG

FRANCE

NETHERLANDS

GERMANY

DENMARK

SWEDEN

NORWAY

FINLAND

RUSSIA

ESTONIA

LATVIA

LITHUANIA

BELARUS

POLAND

UKRAINE

SWITZERLAND

AUSTRIA

CZECH REPUBLIC

SLOVAKIA

HUNGARY

CROATIA

ROMANIA

BULGARIA

TURKEY

GREECE

ITALY

Helsinki

Stockholm

Copenhagen

Leipzig

Vienna

Lisbon

Zurich

Luxembourg

Koln

Gatwick

Heathrow

Stansted

East Midlands

Manchester

Warsaw

Kiev

Bucharest

Sofa

Istanbul

Athens

Izmir

Belgrade

Budapest

Bratislava

Prague

Munich

Frankfurt

Dusseldorf

Rijeka/Koper

Paris

Hamburg

Le Havre

Lille

Amsterdam

Liege

Lyon

Marseille

Madrid

Zaragoza

Valencia

Rome

Bologna

Milan

Barcelona

Tricity

Poznan

Upper Silesia

Klaipeda

St Petersburg

Moscow

These cities are strategically located at the economic heart of Europe, which spans

the conurbation of cities stretching from the Netherlands, Belgium, Western and Southern

Germany down to Switzerland and Northern Italy. Being the most densely populated

and richest area in Europe, it is the logical choice for those companies seeking to reach

thelargest number of customers as quickly and readily as possible.

From Antwerp, for example, approximately 143 million people can be reached by lorry

within 9-hours. This number increases to 153 million from Liege, 163 million from

Dusseldorf and to 190 million people from Frankfurt, which posts the highest population

within its catchment among all the cities considered, equal to three times the size

of the UKs population. In terms of GDP, this amounts to over 6,000 billion eurosthree

times thenominal GDP of France.

The high score of most Blue Banana cities in this scenario has also to do with their

privileged position near some of Europes largest freight airports and seaports, which

function as gateways towards non-EU markets and through which a large proportion

of the goods leaving or entering the continent transit. For many companies, having their

distribution centres located not too far away from these points of entry is an important

factor deciding a location. This obviously does not mean locating necessarily on the port

site itself. For instance, cities such as Dusseldorf (4th) and Liege (7th) beneft from lying

on the corridors through which a large volume of freight unloaded in Antwerp, Rotterdam

and Amsterdam ports makes its way towards the inland of the continent.

DISTRIBUTION SCENARIO

TOP 20 MARKETS

1 Antwerp

2 Rotterdam

3 Dusseldorf

4 Brussels

5 Hamburg

6 Amsterdam

7 Liege

8 Venlo

9 Lille

10 Frankfurt

11 Paris

12 Munich

13 Lyon

14 Prague

15 Milan

16 Le Havre

17 Bratislava

18 Rijeka/Koper

19 Bologna

20 Istanbul

Airports Container ports

BELGIUM

LUXEMBOURG

NETHERLANDS

Zeebrugge

Dusseldorf

Lille

Amsterdam

Antwerp

Brussels

Venlo

Rotterdam

Liege

Source: Colliers International

WWW.COLLIERS.COM/RESEARCH | P. 5 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

Outside Western Europe, the city that obtained the best score under a distribution-driven

scenario is Prague (14th), followed by Bratislava (17th). From the former, a consumer base

of more than 150 million people is reachable in 9-hours, which amounts to a GDP of

approximately 4,000 billion euros, against a national GDP for Czech Republic of 130 billion

euros. The potential appeal of both cities also stems from the lower cost of inputs, such

aslabour and real estate, with rents for prime distribution space in Bratislava 25% lower

than the average for Western Europe and employee remuneration averaging just a third

of the compensation payable in the Netherlands.

The apparent cost-market access trade-of is clearly illustrated by the following chart.

Cities ofering a particularly good compromise between cost and market access include,

from the highest to the least expensive, Venlo, Lille, Liege, Prague, Bratislava, Upper Silesia

(Katowice) and Poznan. Examples of recent lettings testify theappeal of these cities from

adistribution point of view: giant e-retailer Amazon forinstance has recently announced

itwill open a new 90,000 sq m distribution centre inLilles region, Nord-pas-de-Calais,

itsfourth in France. Compared to other French logistics areas, Nord-pas-de-Calais boasts

cheaper warehousing costs and a relatively abundant supply of land relative to denser

urban areas. It also has an advantage of being situated at the crossroads of freight routes

connecting Northern Europe, Southern Europe and the British Isles, due to its location

near the Channel Tunnel.

Source: Colliers International

CORRELATION BETWEEN COST AND MARKET ACCESS

C

o

s

t

Market Access

Rijeka/Koper

Frankfurt

Budapest

Marseille

Barcelona

Mnich

Brussels

Dsseldorf

Rotterdam

Kiev

Warsaw

Tricity

Bucharest

Sofa

Klaipeda

Izmir

St Petersburg

Moscow

Valencia

Zaragoza

Istanbul

Belgrade

Poznan

Upper Silesia

Bratislava

Madrid

Rome

Athens

Prague

Liege

Lille

Antwerp

Lyon

Le Havre

Hamburg

MIlan

Bologna

Venlo

Amsterdam

Paris

WWW.COLLIERS.COM/RESEARCH | P. 6 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

Our analysis shows that a further shift eastward entails a further reduction in total costs,

but equally comes with reduced market access, which is assumed as a crucial dimension

under this scenario. As Central and Eastern Europes (CEE) economies grow further,

increasing GDP/capita rates in CEE, the rationale for having more than one pan-European

centre both inside and outside the Blue Banana will gain more credence. There is

already aneed for certain goods to be distributed to the markets of CEE, and for

manufactured product to be distributed back into the production lines of Western European

companies but infrastructure and market access issues remain a constraint limiting

thegenuine capacity for CEE hubs to act as a competitor to more established Western

European hubs within the Blue Banana. These locations complement each other,

particularly for operators looking to a supply-chain platform with which to cover

pan-European markets.

Frankfurt

Dusseldorf

Munich

Prague

Liege

Venlo

Brussels

Antwerp

Hamburg

Amsterdam

Rotterdam

Lille

Paris

Lyon

Bratislava

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

190 million

163 million

161 million

156 million

154 million

152 million

149 million

143 million

137 million

135 million

135 million

135 million

133 million

132 million

119 million

9h

TOP 15 POPULATION CATCHMENTS PER CITY

= 10 mln people

Source: Colliers International

WWW.COLLIERS.COM/RESEARCH | P. 7 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

MANUFACTURING SCENARIO: LOOK EAST

As much as accessibility matters for distribution-related activities, cost is typically viewed

as one of the main determinants of location decisions in the manufacturing sector, which

tends to be more labour intensive than logistics and distribution. The prominence of cost

as a key consideration is easily illustrated by the historic of-shoring of manufacturing from

high-cost countries to lowercost geographies although there are signs that this trend

isreversing, as cost advantages dwindle.

Compared to the previous scenarios, weve also given a higher weighting to the capacity

ofthe local market to meet workforce requirements (measured as a combination of volume

of workforce and unemployed) and to the regulatory environment, as companies are more

likely to be drawn to countries ofering a higher degree of protection to their investment

(which is typically higher in the case of manufacturing as opposed to logistics).

Perhaps unsurprisingly, the higher part of the table is dominated by cities in CEE and

neighbouring countries to the east (e.g. Ukraine), with only six Western European cities

featuring in the top-20, in order: Antwerp (6th), Lille (7th), Dusseldorf (9th), Venlo (11th),

Liege (14th), Brussels (17th).

Kiev occupies the highest spot in the ranking, followed by Istanbul, Bratislava, Upper Silesia

(Katowice) and Sofa. With an average remuneration per worker of ca. 3,500/annum

inthe transportation and warehousing sector, Kievs competitive advantage in our ranking

rests to a large extent on the cost of labour. Industrial land values in the Ukrainian capital

are also the cheapest in our sample of 40 cities.

EMPLOYEE COST BY MARKET; /ANNUM

1 Kiev

2 Istanbul

3 Bratislava

4 Upper Silesia

5 Sofa

6 Antwerp

7 Lille

8 Budapest

9 Dusseldorf

10 Prague

11 Venlo

12 Izmir

13 Poznan

14 Liege

15 Moscow

16 Bucharest

17 Brussels

18 Hamburg

19 Belgrade

20 Warsaw

MANUFACTURING

SCENARIO TOP 20 MARKETS

Paris

Rotterdam

IRELAND

UNITED

KINGDOM

SPAIN

PORTUGAL

BELGIUM

LUXEMBOURG

FRANCE

NETHERLANDS

GERMANY

DENMARK

SWEDEN

NORWAY

FINLAND

RUSSIA

ESTONIA

LATVIA

LITHUANIA

BELARUS

POLAND

UKRAINE

SWITZERLAND

AUSTRIA

CZECH REPUBLIC

SLOVAKIA

HUNGARY

CROATIA

ROMANIA

BULGARIA

TURKEY

GREECE

ITALY

Warsaw

Kiev

Bucharest

Sofa

Istanbul

Athens

Izmir

Belgrade

Budapest

Bratislava

Prague

Munich

Frankfurt

Dusseldorf

Rijeka/Koper

Hamburg

Le Havre

Lille

Amsterdam

Antwerp

Rotterdam

Brussels

Venlo

Liege

Lyon

Paris

Marseille

Madrid

Zaragoza

Valencia

Rome

Bologna

Milan

Barcelona

Tricity

Poznan

Upper Silesia

Klaipeda

St Petersburg

Moscow

30 40 thousands

20 30 thousands

10 20 thousands

0 10 thousands

Employee costs represent people employed in transport and storage sectors.

Source: Colliers International

Source: Eurostat, various

WWW.COLLIERS.COM/RESEARCH | P. 8 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

As well as boasting relatively lower labour costs than most of the other cities, Istanbul

stands out for its good level of infrastructure, which will see further improvements

as aseries of on-going and planned projects in the Istanbul region reach completion.

These include the construction of a third bridge linking the European and Asian sides

ofIstanbul and a new airport, as well as various state-backed projects to increase

theindustrial and warehousing capacity of the citys metro area.

A measure of the growing attractiveness of Istanbul and Turkey towards foreign

manufacturing companies is the evolution of FDI (Foreign Direct Investment) for that

sector. Ofcial statistics show that this has increased by almost 330% between 2005 and

2011 at the national level, to ca 2,600 million from 604 million. The bulk of this is split

between three branches of activity:

1. the manufacturing of refned petroleum products and nuclear fuel

2. the manufacturing of electrical and optical equipment, and

3. the manufacturing of food products, beverages and tobacco.

Turkeys place in the global supply chain will also be enhanced by the completion of a new

port in Candarli, north of Izmir (13th in this scenario), which will have an estimated

container handling capacity of 4 million TEUs/year. That would make it the 6th largest

container port in Europe when compared to trafc fgures for 2011 published by the Port

ofRotterdam Authority.

Further down the ranking, Bratislava and the surrounding region has rapidly emerged as

aglobal automotive centre since Volkswagen started car production near the Slovak capital

city in the early 1990s. PSA Peugeot Citron and KIA Motors also have an important

presence in the country. Car production in Slovakia is estimated to have increased from

ca42,000 units in 1997 to 925,000 in 2012.

Source: Sario

Istanbul

EVOLUTION OF CAR PRODUCTION IN SLOVAKIA

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

WWW.COLLIERS.COM/RESEARCH | P. 9 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

Often cited regarding BPOs, Polish regions such as Upper Silesia (4th) score well under

our cost-driven scenario, despite labour costs here being signifcantly higher than in Sofa

(5th): 9,000 eur vs ca 3,800 eur/annum/worker.

INDUSTRIAL HERITAGE

Interestingly, all the Western European cities in the top league have a distinct industrial

heritage: some of them have partly managed to preserve it, in some cases by reorienting

their specialisation towards higher added value industrial production, not least through

publicly-funded incentive schemes. Some, on the other hand, have struggled to cope

with competition from typically lower cost geographies and have seen their industrial

base thin out.

MANUFACTURING AS % OF TOTAL GROSS VALUE ADDED FOR SELECTED CITIES

30.0%

28.0%

26.0%

24.0%

22.0%

20.0%

18.0%

16.0%

14.0%

1

9

8

0

1

9

8

2

1

9

8

4

1

9

8

6

1

9

8

8

1

9

9

0

1

9

9

2

1

9

9

4

1

9

9

6

1

9

9

8

2

0

0

0

2

0

0

2

2

0

0

4

2

0

0

6

2

0

0

8

2

0

1

0

2

0

1

2

Antwerp

Lille

Dsseldorf

Liege

Venlo

Source: Experian

The province of Liege, in Belgium, for example, has historically been an important

metallurgical centre in Belgium and Europe. Although metallurgy still remains one of the

drivers of local industrial production - with Arcelor Mittal maintaining a notable presence

inthe area new high-tech industries such as aerospace, biotechnologies and chemistry

have also been developing.

The UK also ofers some examples of successful industrial transformation. The East

Midlands region has gradually seen its production base shift away from coal-mining to

carassembly. Sunderland, once a shipbuilding centre in the north-east of England, has

become a car assembly platform mainly thanks to investment from Nissan. The ongoing

success of the Nissan plant has seen it increase its share of global production and move

up the value chain to produce vehicles at the premium end of the scale.

WWW.COLLIERS.COM/RESEARCH | P. 10 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

SUMMARY: THE REGIONAL PERSPECTIVE

Each hub examined in this study highlights the extent to which certain locations

have distinct advantages over others, depending upon the requirements of occupiers.

Thegeographical aggregation of results provides a good overall picture of the relative

attractiveness of Europes main sub-regions under the scenarios considered.

AVERAGE SCORE OF EACH REGION IN THE TWO MAIN SCENARIOS

100.0

80.0

60.0

40.0

20.0

0.0

South Eastern Europe

Southern Europe

Eastern Europe

Turkey

Central Europe

Western Europe

0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 100.0

D

i

s

t

r

i

b

u

t

i

o

n

Manufacturing

SEE

SEE

EE

EE

SE

SE

CE

CE

T

T

WE

WE

Source: Colliers International

WESTERN EUROPE: DISTRIBUTION & HIGH-END MANUFACTURING

What comes out clearly is Western Europes appeal as a platform for pan-European

distribution activities, for the reasons previously discussed. Every other region scored higher

in our manufacturing scenario, yet Western Europe is starting to see a revolution in the

growth of higher-end manufacturing. Particularly for products well suited to the local market.

CENTRAL & EASTERN EUROPE:

COMPLEMENTARY DISTRIBUTION & MANUFACTURING

The sub-region has, by a relatively small margin, the second best overall score for

distribution, making it a suitable location for pan-European distribution. As far

asmanufacturing is concerned, it sits within a pack of four regions best suited to low-cost

production led by Turkey but also including South Eastern Europe. Both Western Europe

and Southern Europe scored far lower.

COMPARATIVE

ADVANTAGE

IN DISTRIBUTION

COMPARATIVE

ADVANTAGE

IN COST-DRIVEN

MANUFACTURING

WWW.COLLIERS.COM/RESEARCH | P. 11 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

SOUTH EASTERN EUROPE, EASTERN EUROPE AND TURKEY:

SUB-REGIONAL/LOCAL DISTRIBUTION AND MANUFACTURING

Hubs in these territories are best suited to manufacturing, notably lower-cost production

of goods for which there is no immediate demand requirement. Given their reduced

access to Europes concentrations of population and GDP, their only distribution benefts

are of a local or sub-regional nature. Russia and Turkey have the added benefts of acting

as a gateway for trade reaching Europe from the East, but only as complementary

to existing distribution centres in Western Europe and those which have developed

more recently in CEE.

SOUTHERN EUROPE

All in all, Southern Europe is the region with the lowest total score when looking at

the two rankings combined. It equally appears as the region with no clear competitive

advantage, be it cost, infrastructure or market potential, over the other regions in both

scenarios. Particularly, weak cost competitiveness is typically seen as one of the main

structural problems of these peripheral economies. However, data shows that this is

gradually improving as unit labour cost falls or is growing more slowly in these countries.

In some cases, this might be partly on the back of the measures adopted in some countries

in response to the on-going economic crisis in the Eurozone.

UNIT LABOUR COST INDEX, Y-O-Y VARIATION (%)

8.0

6.0

4.0

2.0

0.0

-2.0

-4.0

-6.0

-8.0

-10.0

-12.0

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

Greece

Spain

France

Italy

Portugal

Source: Eurostat

WWW.COLLIERS.COM/RESEARCH | P. 12 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

Whilst the geographical aggregation of results provides a good overall picture of the relative

attractiveness of Europes main sub-regions under the scenarios considered, this can

conceal an ample dispersion of a hubs qualities around the regional mean. For example,

inthe distribution scenario, Milan, in Southern Europe, ranks 15th, Bologna ranks 19th

whileRome lies well below in 35th place. With Amazon due to open a new distribution

centre in 2013 only 70 km away from Lombardys largest city, this highlights the extent

towhich each hub should be considered for its specifc merits.

Equally, as Europe moves towards rail freight as an alternative and more energy/emissions

efcient transport mode, the relative attractiveness of each hub is likely to shift

inaccordance. For the time being, road distribution will continue to dominate, and location

decisions are likely to follow the pattern outlined in this report.

We appreciate that real world decisions as to where to locate a distribution centre

or anew production facility are more complex and infuenced by a number of additional

factors. For example, we have not factored in the various constraints arising from trade

barriers which can impact the geographic remit of certain locations to act as distribution

or manufacturing hubs. Despite this, our simulations provide a good sense of the relative

strengths and weaknesses of the 40 locations considered and of the fundamental merits of

choosing one location over another depending on the specifc circumstances and priorities.

482 ofces in

62 countries on

6 continents

United States: 140

Canada: 42

Latin America: 20

Asia Pacifc: 195

EMEA: 85

1.5 billion in annual revenue

104 million square meters under management

13,500 professionals

COLLIERS INTERNATIONAL

EMEA HEADQUARTERS

50 George Street

London W1U 7GA

United Kingdom

TEL +44 20 7935 4499

EMAIL emea@colliers.com

The information contained herein has been obtained from

sources deemed reliable. While every reasonable efort has

been made to ensure its accuracy, we cannot guarantee it.

No responsibility is assumed for any inaccuracies. Readers are

encouraged to consult their professional advisors prior to

acting on any of the material contained in this report.

This publication is the copyrighted property of Colliers

International and/or its licensor(s). 2013. All rights reserved.

Bruno Berretta

Senior Research Analyst

TEL +44 207 344 69 38

EMAIL bruno.berretta@colliers.com

Damian Harrington

Director of Research | Eastern Europe

TEL +358 400 90 79 72

EMAIL damian.harrington@colliers.com

Mark Charlton

Head of Research & Forecasting UK

TEL +44 20 7487 1720

EMAIL mark.charlton@colliers.com

IRELAND

UNITED

KINGDOM

SPAIN

PORTUGAL

BELGIUM

LUXEMBOURG

FRANCE

NETHERLANDS

GERMANY

DENMARK

SWEDEN

NORWAY

FINLAND

RUSSIA

ESTONIA

LATVIA

LITHUANIA

BELARUS

POLAND

UKRAINE

SWITZERLAND

AUSTRIA

CZECH REPUBLIC

SLOVAKIA

HUNGARY

CROATIA

ROMANIA

BULGARIA

TURKEY

GREECE

ITALY

WESTERN

EUROPE

CENTRAL

& EASTERN

EUROPE

SOUTH

EASTERN EUROPE,

EASTERN EUROPE

AND TURKEY

Distribution

Local

distribution

High End

Manufacturing

Manufacturing

MAIN ADVANTAGE FOR EACH REGION

WWW.COLLIERS.COM/RESEARCH | P. 13 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

Infrastructure & Accessibility Market Access Operational Costs Labour Market Capacity Logistics Competence

1 Rotterdam Frankfurt Sofa Paris Hamburg

2 Antwerp Dusseldorf Kiev Istanbul Frankfurt

3 Amsterdam Venlo Poznan Venlo Brussels

4 Hamburg Brussels Upper Silesia Milan Paris

5 Istanbul Liege Bratislava Dusseldorf Istanbul

6 Brussels Munich Klaipeda Madrid Izmir

7 Valencia Rotterdam Bucharest Rotterdam Dusseldorf

8 Lille Amsterdam Tricity Amsterdam Rotterdam

9 St Petersburg Antwerp Budapest Moscow Amsterdam

10 Dusseldorf Lille Belgrade Brussels Venlo

11 Le Havre Paris Warsaw Lille Antwerp

12 Barcelona Lyon Prague Barcelona Prague

13 Liege Hamburg Rijeka/Koper Antwerp Warsaw

14 Paris Prague Izmir Upper Silesia Barcelona

15 Milan Milan St Petersburg Izmir Zaragoza

16 Venlo Le Havre Valencia Liege Madrid

17 Rijeka/Koper Bologna Moscow Rome Munich

18 Lyon Bratislava Istanbul Hamburg Belgrade

19 Marseille Rijeka/Koper Zaragoza Frankfurt Milan

20 Moscow Poznan Liege Bratislava Bologna

21 Izmir Upper Silesia Lille Kiev Rome

22 Budapest Budapest Le Havre Athens Budapest

23 Tricity Marseille Marseille Munich Liege

24 Athens Rome Athens St Petersburg Sofa

25 Kiev Barcelona Barcelona Valencia Bratislava

26 Bratislava Madrid Venlo Belgrade Lille

27 Frankfurt Warsaw Antwerp Lyon Lyon

28 Bologna Kiev Lyon Marseille Le Havre

29 Madrid Zaragoza Bologna Budapest Marseille

30 Sofa Valencia Dusseldorf Bucharest Tricity

31 Poznan Tricity Milan Bologna Poznan

32 Warsaw Moscow Rome Warsaw Valencia

33 Upper Silesia St Petersburg Hamburg Prague Bucharest

34 Prague Bucharest Brussels Zaragoza Rijeka/Koper

35 Munich Sofa Munich Le Havre Klaipeda

36 Rome Belgrade Madrid Tricity Upper Silesia

37 Zaragoza Istanbul Frankfurt Poznan Kiev

38 Belgrade Izmir Rotterdam Klaipeda Athens

39 Klaipeda Klaipeda Paris Sofa Moscow

40 Bucharest Athens Amsterdam Rijeka/Koper St Petersburg

Many markets ranked the same under the Environment category. Detailed rankings available upon request.

OVERALL HUB RANKINGS BY CATEGORY

APPENDIX

WWW.COLLIERS.COM/RESEARCH | P. 14 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

GEOGRAPHIC COVERAGE

This report covers 40 cities /regions across Europe. For some

regions, the most representative/central location has been used

as a reference where a precise location was needed to perform

calculations

GROUPINGS AND METRICS

All the cities included in the analysis are scored against a series

of individual metrics, which form part of broader categories. The

number of variables comprised by each of these grouping varies.

The composition of each grouping and a description of the

metrics included and the measurement adopted are provided

inthis section:

INFRASTRUCTURE & ACCESSIBILITY

> Quality of infrastructure: measures the quality of trade and

transport related infrastructure. It is based on the

Infrastructure component of the Logistics Performance Index

2012 compiled by the World Bank. Only available at country

level.

> Air freight capacity of airports within 1-hour: total annual

freight volume handled by all the airports reachable within

1-hour drive time from the city in question (assuming a speed

of 80/km/h). Latest fgures available (typically 2011-2012).

> Container capacity of seaports within 1-hour: total volume

ofcontainers trafc (in x1,000 TEUs) handled by all seaports

reachable within 1-hour drive time from the city in question

(assuming a speed of 80/km/h). Latest fgures available

(typically 2011-2012).

> Container capacity of seaports within 2-hour: total volume

ofcontainers trafc (in x1,000 TEUs) handled by all seaports

reachable within 1-hour drive time from the city in question

(assuming a speed of 80/km/h). Latest fgures available

(typically 2011-2012).

> Rail accessibility: measure the degree of accessibility by rail

and specifcally whether each of the hubs considered is on

arail freight corridor.

MARKET ACCESS

> Current GDP: total annual nominal GDP for 2012 enclosed

within the area reachable within a 9-hour drive time,

at aspeed of 80km/h. Nine hours is the maximum permissible

drive time per day for lorry-driver under European legislation.

Delays due to trafc jams and customs have not been taken

inaccount. Total GDP has been worked out by matching up

thecatchment for each city/region to the most appropriate

NUTS2 and NUTS3 regions. NUTS data have been sourced

from Experian. For non-European countries, regional GDP data

has been derived using a combination of sources, including

IMFs WEO Database (October 2012) and data from national

bureaus for statistics.

> Population: total population reachable in 2012 within a 9-hour

drive time, at a speed of 80km/h, from the city/region in

question. The same method used to estimate current nominal

GDP applies.

> GDP in 2017: projected total nominal GDP in 2017 contained

within the 9-hour catchment. Estimates have been obtained by

applying IMFs country-level GDP growth rates forecast up to

2017 to 2012 GDP data for NUTS2, NUTS 3 or equivalent regional

subdivisions (see above). Data aggregation has been performed

using the same method as described above.

OPERATIONAL BASE COSTS

> Rental cost: top open-market tier of rent that could be

expected for unit larger than 10,000 sq m designed for logistics

and distribution purposes (typically 6 to 12 metre ceiling

heights), of the highest quality and specifcation (Grade A)

inthe best location in the market. All loading is dock-height.

> Land cost: Top price payable for a sq m of land for logistics/

industrial use, in the best location, excluding taxes and any

other extra charges.

> Labour cost: total annual direct remuneration in euro for

employees working in the Transport & Storage sector,

asdefned by Eurostat. Direct remuneration includes basic

salary plus bonus and allowances. It does not include indirect

costs, such as social contributions and taxes. The data for EU

countries have been extracted from Eurostats 2008 Labour

Cost Survey. For cities outside the EU, labour cost has been

estimated integrating a variety of sources such as national

labour market statistics, in-house expert opinion, etc.. Where

regional data was impossible to obtain/derive, national level

data has been retained.

WWW.COLLIERS.COM/RESEARCH | P. 15 Q2 2013

EUROPEAN LOGISTICS | WHITE PAPER

LABOUR MARKET CAPACITY

> Workforce: total volume of the workforce - in million -

reachable within 1-hour drive time from the considered city,

assuming a speed of 80 km/h. Values are based on Experians

workforce data for NUT2 and NUT3 regions. Where regional

workforce data was not available, estimates have been derived

from population statistics available via national statistical

institutes and other sources.

> Unemployment: total volume of people unemployed within

the1-hour catchment described above. Values for cities in EU

arebased on Experian workforce and unemployment fgures for

NUT2 and NUT3 regions. For cities outside the EU, estimates are

based upon a variety of sources (national statistical ofces, labour

market survey, etc.).

LOGISTICS COMPETENCE

> Labour market specialisation: measures the portion

of people employed in the Transport & Storage sector,

asdefned by Eurostat, in the workforce total, in %. For cities

belonging to the EU, this has been calculated by dividing

Eurostats latest regional fgures (2010) on employment in the

Transport & Storage sector by total workforce data for 2010

provided by Experian for the corresponding regional units. The

area the data refers to do not necessarily match the catchment

utilised for estimating workforce and unemployment. Values

fornon EU-cities were estimated based on a variety of

sources. For some cities, national average data was

considered.

> Logistics competence: measures the competence and quality

of logistics services (e.g. transport operators, custom brokers).

It is based on the Logistics competence component of the

Logistics Performance Index 2012 compiled by the World Bank.

Only available at country level.

BUSINESS ENVIRONMENT

> Ease of doing business: Index created by the World Bank

thatmeasures various aspects of a countrys regulatory

environment. These include, among others, the easiness

toregister a new business and enforcing contracts and the

degree of investor protection. A high ranking on the ease

ofdoing business index means the regulatory environment

ismore conducive to the starting and operation of a local frm.

SCORING AND WEIGHTINGS

Each city/region included in the study has been given a score

ona scale of 0-100 for each of the factors described in the

previous section. Scores for larger groupings have been obtained

by aggregating sub-scores through a weighted average.

SCOREBOARDS

Scoreboards are available on demand.

You might also like

- CBRE EMEA Industrial and Logistics Q4 2014Document8 pagesCBRE EMEA Industrial and Logistics Q4 2014vdmaraNo ratings yet

- CW The Year Ahead 2015-2016Document32 pagesCW The Year Ahead 2015-2016vdmaraNo ratings yet

- JLL Industrial Capital Markets Outlook (2015 March)Document17 pagesJLL Industrial Capital Markets Outlook (2015 March)vdmaraNo ratings yet

- JLL Amsterdam Office Market Profile Q4 2014Document2 pagesJLL Amsterdam Office Market Profile Q4 2014vdmaraNo ratings yet

- Colliers H2 2014 EMEA OfficeDocument3 pagesColliers H2 2014 EMEA OfficevdmaraNo ratings yet

- CBRE H2 2014 Retail MVDocument5 pagesCBRE H2 2014 Retail MVvdmaraNo ratings yet

- Cushman Industrial Q4 2014Document1 pageCushman Industrial Q4 2014vdmaraNo ratings yet

- DTZ (2014) Choosing Key CitiesDocument20 pagesDTZ (2014) Choosing Key CitiesvdmaraNo ratings yet

- Colliers Industrial and Logistics Rents Map 2014Document5 pagesColliers Industrial and Logistics Rents Map 2014vdmaraNo ratings yet

- DTZ Global Occupancy Costs: Logistics 2014Document12 pagesDTZ Global Occupancy Costs: Logistics 2014vdmaraNo ratings yet

- Colliers Residential Investment Market 2014Document6 pagesColliers Residential Investment Market 2014vdmaraNo ratings yet

- Savills Market in Minutes (Dec. 2014)Document2 pagesSavills Market in Minutes (Dec. 2014)vdmaraNo ratings yet

- Savills Residential Market Autumn 2014Document2 pagesSavills Residential Market Autumn 2014vdmaraNo ratings yet

- Cushman Marketbeat Industrial (2014 q2)Document1 pageCushman Marketbeat Industrial (2014 q2)vdmaraNo ratings yet

- CBRE European Data Centers 2014 Q2Document12 pagesCBRE European Data Centers 2014 Q2vdmaraNo ratings yet

- CBRE Hotel Marketview 2014 H1 NetherlandsDocument8 pagesCBRE Hotel Marketview 2014 H1 NetherlandsvdmaraNo ratings yet

- CBRE (2014 H1) Office Marketview The NetherlandsDocument4 pagesCBRE (2014 H1) Office Marketview The NetherlandsvdmaraNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SET5Document3 pagesSET5SANDEEP GAMING ALLNo ratings yet

- MBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFDocument3 pagesMBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFAvinash GowdaNo ratings yet

- Answers To H2 Economics 2007 GCE A Level ExamDocument13 pagesAnswers To H2 Economics 2007 GCE A Level ExamGordon BongNo ratings yet

- De Ocampo Mhel James A. Activity 4Document11 pagesDe Ocampo Mhel James A. Activity 4M J De OcampoNo ratings yet

- PreviewpdfDocument65 pagesPreviewpdfQuốc Khánh TrầnNo ratings yet

- An Comparative Analysis of Economic Growth Between India and ChinaDocument32 pagesAn Comparative Analysis of Economic Growth Between India and ChinasubornoNo ratings yet

- Chapter-2: Literature ReviewDocument3 pagesChapter-2: Literature ReviewPushti DattaniNo ratings yet

- Review MTDocument6 pagesReview MTAvtandil GagnidzeNo ratings yet

- Report On: Real Estate Companies in BangladeshDocument7 pagesReport On: Real Estate Companies in BangladeshAbdur RahmanNo ratings yet

- MarkDocument8 pagesMarkanhtlq21No ratings yet

- Vegas 2015Document16 pagesVegas 2015Rasha RabbaniNo ratings yet

- Macroeconomics A Contemporary Approach 10th Edition McEachern Test Bank 1Document36 pagesMacroeconomics A Contemporary Approach 10th Edition McEachern Test Bank 1tinacunninghamadtcegyrxz100% (23)

- Pest Analysis of SingaporeDocument34 pagesPest Analysis of SingaporeFelice LeeNo ratings yet

- Chapter 1 Summary Business EssentialsDocument10 pagesChapter 1 Summary Business EssentialsAhmad MqdadNo ratings yet

- Reading Notes For Mankiw's MacroDocument11 pagesReading Notes For Mankiw's Macromatthieutc100% (14)

- MCQs - Chapters 21-24Document12 pagesMCQs - Chapters 21-24Lâm Tú HânNo ratings yet

- TRL163Document25 pagesTRL163Anil MarsaniNo ratings yet

- ICICI Prudential Bharat Consumption Fund Series 2 INVESTOR PPT FinalDocument21 pagesICICI Prudential Bharat Consumption Fund Series 2 INVESTOR PPT FinalvistascanNo ratings yet

- Economics Notes - The Global Economy 4Document7 pagesEconomics Notes - The Global Economy 4Jasnoor MatharuNo ratings yet

- India GDP 1960-2020 Data 2021-2023 Forecast Historical Chart NewsDocument1 pageIndia GDP 1960-2020 Data 2021-2023 Forecast Historical Chart NewsShruti TanpureNo ratings yet

- Cross-Cultural Aspects of Tourism and HospitalityDocument96 pagesCross-Cultural Aspects of Tourism and Hospitalityarparat.pNo ratings yet

- GROUP1 Contemporary WorldDocument34 pagesGROUP1 Contemporary WorldSteve MarataNo ratings yet

- Visitor Profiling NotesDocument5 pagesVisitor Profiling NotesHaziqHambali100% (1)

- Chapter: 2 Economic Growth: Limitations of GDP As A Measure of GrowthDocument6 pagesChapter: 2 Economic Growth: Limitations of GDP As A Measure of GrowthAdeeba iqbalNo ratings yet

- NPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaDocument63 pagesNPP Response To Budget - 7 Year NDC Record - Alternative Vision Speech by DR BawumiaMahamudu BawumiaNo ratings yet

- Prioritization of Food Safety Issues 2019Document20 pagesPrioritization of Food Safety Issues 2019Francis Mwangi ChegeNo ratings yet

- City of Belgrade Development StrategyDocument102 pagesCity of Belgrade Development StrategyAleksandraNo ratings yet

- The Global Economy: Organization, Governance, and DevelopmentDocument24 pagesThe Global Economy: Organization, Governance, and DevelopmentKaye ValenciaNo ratings yet

- Aod Jgwef TkalcDocument324 pagesAod Jgwef Tkalcthehoang12310No ratings yet

- MacroDocument2 pagesMacroyashasvi pandeyNo ratings yet