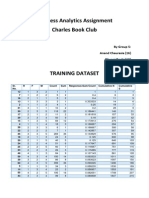

Professional Documents

Culture Documents

Cement August 2013

Uploaded by

Rachit PradhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cement August 2013

Uploaded by

Rachit PradhanCopyright:

Available Formats

Second largest Cement

market

With nearly 300 million tonne of cement production capacity, India is the second largest

cement producer in the world

Dominated by private

players

Of the total capacity, 98 per cent lies with the private sector and the rest with public sector

Higher share of large

plants

185 large cement plants together account for 97 per cent of the total installed capacity,

while 365 small plants account for the rest

Large concentration in

South and West

Of the total 185 large cement plants in India, 77 are located in the states of Andhra

Pradesh, Rajasthan and Tamil Nadu

Source: Planning Commission, Aranca Research

The engineering sector is delicensed;

100 per cent FDI is allowed in the

sector

Due to policy support, there was

cumulative FDI of USD14.0 billion into

the sector over April 2000 February

2012, making up 8.6 per cent of total

FDI into the country in that period

Growing demand

Source: Edelweiss

Notes: FY20E Estimated market size for 2020

Robust demand

Robust infrastructure growth

during 12

th

Five Year Plan to drive

growth

Demand is expected to be

boosted by growth in real estate

sector

Long-term potential

Oligopoly market, where large

players have partial pricing control

Low threat from substitutes

Attractive opportunities

The North-East, which is witnessing

a construction boom, offers

attractive investment opportunities

Large planned investments in

infrastructure and housing is likely to

boost demand for cement in the

coming years as well

Increasing investments

Robust investments are being

made by the existing players to

expand their capacity

Increasing presence of Tier II

cement players

Use of alternate fuels to lower

production costs and emissions

FY12

Production

capacity:

247 million

tonnes

FY20E

Production

capacity:

407 million

tonnes

Advantage

India

Source: Cement Manufacturers Association (CMA),Planning Commission, Aranca Research

Note: mtpa - Million Tonnes Per Annum, * FY12 data

Cement Industry

(FY13)

Mini And White Cement Plants Large Cement Plants

Cement plants: 185

Installed capacity: 339.5 mtpa

Cement production: 168.3 mtpa*

Cement plants: 365

Installed capacity: 11.1 mtpa

Cement production: 6.0 mtpa*

Top Cement Consumers in 2011 (million

tonnes)

Source: International Cement Review, Aranca Research

India is the 2

nd

largest cement producer as well as consumer in the world led by the enormous growth in the infrastructure

and construction sector for the last two decades

Top Cement Producer in 2011 (million

tonnes)

2,048

229

72 65 58 56 56 50 49 48

C

h

i

n

a

I

n

d

i

a

U

S

A

B

r

a

z

i

l

R

u

s

s

i

a

I

r

a

n

T

u

r

k

e

y

E

g

y

p

t

V

i

e

t

n

a

m

I

n

d

o

n

e

s

i

a

2,058

222

66 66 64 63 56 56 52 49

C

h

i

n

a

I

n

d

i

a

I

r

a

n

U

S

A

B

r

a

z

i

l

T

u

r

k

e

y

J

a

p

a

n

R

u

s

s

i

a

V

i

e

t

n

a

m

I

n

d

o

n

e

s

i

a

Production of Cement (million tonnes)

Source: Department of Industrial Policy and Promotion,

Working group for 12

th

Five Year Plan, Aranca Research

Notes: E - Estimate, CAGR - Compound Annual Growth Rate

Cement production increased at a CAGR of 9.7 per cent to

272 million tonnes over FY0613

As per the 12

th

Five Year Plan, production is expected to

reach 407 million tonnes by FY17

142

156 168

182

207

229

247

272

300

332

368

407

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

F

Y

1

1

F

Y

1

2

F

Y

1

3

E

F

Y

1

4

E

F

Y

1

5

E

F

Y

1

6

E

F

Y

1

7

E

CAGR:10.0%

Domestic Cement Consumption (million tonnes)

Source: Working group for 12

th

Five Year Plan, Aranca Research

Notes: E Estimate, CAGR - Compound Annual Growth Rate

Domestic cement consumption is expected to reach 265

million tonnes in FY13 from 222 million tonnes in FY11

The consumption is further expected to increase at a CAGR

of 10.2 per cent during FY11-17 and reach 398 million

tonnes

222

242

265

293

324

359

398

FY11 FY12 FY13E FY14E FY15E FY16E FY17E

CAGR:10.2%

323

336

350

373

405

441

479

FY11 FY12 FY13E FY14E FY15E FY16E FY17E

Cement Production Capacity (million tonnes)

Source: Working group for 12

th

Five Year Plan, Aranca Research

Notes: E - Estimate, CAGR - Compound Annual Growth Rate

Cement production capacity reached 350 million tonnes in

FY13 from 323 million tonnes in FY11

Production capacity is expected to increase at a CAGR of

6.8 per cent during FY11-17 and reach 479 million tonnes

CAGR:6.8%

Cement capacity (million tonnes) and utilisation

rate (%)

Source: Working group for 12

th

Five Year Plan, Aranca Research

Notes: E - Estimate, CAGR - Compound Annual Growth Rate

Cement capacity utilisation rate is expected to touch around

78 per cent in FY13 from 71 per cent in FY11

The utilisation rate is expected to further reach 85 per cent

by FY17

60%

65%

70%

75%

80%

85%

90%

150

200

250

300

350

400

450

500

FY11 FY12 FY13E FY14E FY15E FY16E FY17E

Capacity -LHS Production-LHS Utilisation rate (%)

Source: Working group for 12

th

Five Year Plan, Aranca Research

Currently, India has 185 large cement plants spread across

all states

Andhra Pradesh is the leading state with 37 large cement

plants, followed by Rajasthan and Tamil Nadu having 21

and 19 plants, respectively

37

19

21

11

12

11

10

10

11

5

5

4

8

3

3

5

3

2

2

1

1

1

Source: Department of Industrial Policy and Promotion, Aranca Research

Note: mtpa - Million Tonnes Per Annum

Cement

Industry

South

North

East

West

Central

126.9 mtpa

66.4 mtpa

43.5 mtpa

44.1 mtpa

37.3 mtpa

Tamil Nadu, Andhra

Pradesh and Karnataka

Rajasthan, Punjab,

Haryana and the NCR

West Bengal,

Chhattisgarh, Orissa and

Jharkhand

West Bengal,

Chhattisgarh, Orissa and

Jharkhand

Uttar Pradesh, Madhya

Pradesh

Installed capacity (2011) Key markets

Shares in Total Capacity in Northern

Region (2011)

Source: International Cement Review, Aranca Research

Rajasthan has the highest installed capacity in North India, accounting for a 66.5 per cent share in capacity in the region in

2011

Chhattisgarh leads the Eastern region with a share of 32.6 per cent of total installed capacity in the region in 2011

Shares in Total Capacity in Eastern Region

(2011)

66.5%

14.2%

7.2%

6.0%

4.5%

0.8%

0.8%

Rajasthan

Himachal Pradesh

Punjab

Uttarakhand

Haryana

Jammu & Kashmir

Delhi

0.5%

7.5%

2.3%

19.5%

20.8%

16.8%

32.6%

Assam

Meghalaya

Bihar

Jharkhand

Orissa

West Bengal

Chhattisgard

Shares in total capacity

in Southern region (2011)

Source: International Cement Review, Aranca Research

Andhra Pradesh has the highest installed capacity in South India (53.5 per cent share of total installed capacity)

Madhya Pradesh leads the Central region in installed capacity, while Gujarat leads the West

53.5%

28.0%

18.0%

0.5%

Andhra Pradesh Tamil Nadu

Karnataka Kerala

34.4%

65.6%

Uttar Pradesh Madhya Pradesh

55.0%

45.0%

Gujarat Maharashtra

Shares in total capacity

in Central region (2011)

Shares in total capacity

in Western region (2011)

All India (million tonnes)

Source: International Cement Review, Aranca Research

Total demand for cement is expected to grow at a CAGR of 10.2 per cent to 265.9 million tonnes during FY08-13

Cement demand from the Eastern and Central regions during FY08-13 is expected to grow at a CAGR of 13.5 per cent

and 12.1 per cent, respectively.

Central (million tonnes) East (million tonnes)

163.4

177.5

196.4

210.2

236.3

265.9

FY08 FY09 FY10 FY11F FY12F FY13F

23.8

26.2

30.8

34.3

38.2

42.0

FY08 FY09 FY10 FY11F FY12F FY13F

24.7

28.0

33.0

37.3

41.7

46.6

FY08 FY09 FY10 FY11F FY12F FY13F

CAGR: 10.2% CAGR: 12.1%

CAGR: 13.5%

32.7

34.5

38.8

41.4

45.4

49.8

FY08 FY09 FY10 FY11F FY12F FY13F

33.6

35.1

38.3

40.8

48.6

51.0

FY08 FY09 FY10 FY11F FY12F FY13F

48.6

53.8

55.5

56.4

62.1

63.9

FY08 FY09 FY10 FY11F FY12F FY13F

South (million tonnes)

Source: International Cement Review, Aranca Research

Cement demand from Western, Northern and Southern regions is expected to grow at a CAGR of 8.8, 8.7 and 5.6 per

cent, respectively, during FY08-13

North (million tonnes) West (million tonnes)

CAGR: 5.6%

CAGR: 8.7%

CAGR: 8.8%

All India

Source: International Cement Review, Aranca Research

UltraTech Cement, a major player in India, accounted for 15.0 per cent of the total market share in terms of installed

capacity in 2011

It is a leading player in the Southern and Eastern regions, accounting for 50.6 and 52.1 per cent of total market share,

respectively, in terms of installed capacity in 2011

South East

10.2%

5.9%

9.9%

8.3%

7.1%

8.0%

50.6%

India Cement Madras Cement

Ultratech Cement Chettinad Cement

Dalmia Cement ACC

Others

14.2%

6.2%

12.1%

9.8%

5.5%

52.1%

Lafarge India ACC

Ultratech OCL India Ltd

Ambuja Cement Others

10.0%

7.5%

15.0%

1.4%

66.1%

Ambuja Cement ACC

Ultratech Cement Jaypee Cement

Others

North

Source: International Cement Review, Aranca Research

Jaypee Cement led the Central region in terms of installed capacity, with 33.5 per cent of the market share; the Western

region was dominated by UltraTech cement with 29.0 per cent of market share in 2011

Ambuja Cements accounted for 28.9 per cent of the total market share in terms of installed capacity in the Northern region

in 2011

Central West

28.9%

16.6%

14.2%

13.8%

11.1%

7.3%

5.5%

2.5%

Ambuja Cement Shree Cement

Others Ultratech Cement

J K Cement ACC

Jaypee Cement Birla Cement

33.5%

12.3%

12.1%

42.1%

Jaypee Cement Ultratech Cement

ACC Others

29.0%

10.9%

12.5%

47.6%

Ultratech Cement Jaypee Cement

Ambuja Cement Others

Increasing presence of

small and mid-size

cement players

Presence of small and mid-size cement players across regions is increasing, which helps

to diminish market concentration of industry leaders

Small and mid-size players have been constantly increasing their installed capacity to

cater to increasing cement demand

Cost reduction through

the use of alternate

fuels **

Major cement manufacturers in India are increasingly using alternate fuels, especially

bioenergy, to fire their kilns

This is not only helping to reduce production costs of cement companies, but is also

proving effective in reducing emissions

Increasing sale of

blended cement

The proportionate sales of blended varieties of cementPortland Pozzolana Cement

(PPC) and Portland Blast Furnace Slag Cement (PBFC)has risen over the years

During 2011, blended cement accounted for 75 per cent of total cement production in the

country

Notes: ** The Success Stories section includes cases of successful employment

of alternate fuels in cement production to reduce production costs

ACC

Holcim, a Switzerland-based major cement company has plans for capacity expansion in

India through its subsidiary ACC cement

The construction of the companys new plant at Jamul, Chhattisgarh is under process.

This plant will increase ACCs capacity to 35 million tonnes per annum (mtpa) from 30

mtpa in a phased manner by 2015

Ambuja Cements

Ambuja Cements is targeting an investment of USD370.4 million for capacity expansion in

Rajasthan and Northern India

The proposed project in Rajasthan is expected to add 5 million tonnes (MT) to Ambuja

Cements existing production capacity

Dalmia Cement

Dalmia Cement is planning an investment of USD333.3 million to ramp up its

manufacturing capacity to 21 mtpa from the existing 17 mtpa over the next two years.

Dalmia has plans to set up a 2.5 million tonne (MT) greenfield unit at Belgaum in

Karnataka. It also plans to scale up its two plants in North-East India for a total value of

USD239 million and USD9.2 million, respectively

Source: Aranca Research

Heidelberg Cement

Heidelberg Cement, a Germany-based cement manufacturer has commissioned Phase-I

of its Jhansi grinding unit

The company has undertaken an investment worth USD 259.4 million for expanding its

capacity to 2.7 million tonnes (MT)

Heidelberg aims to ramp up the operational capacity to 6 MT at its Damoh plant in Madhya

Pradesh

Vicat Group

Vicat Group, a France-based company plans to sell 4.5 MT of cement in India in FY 2013

The company has recently commissioned a joint venture cement plant Vicat Sagar

Cement at Chattrasal, Karnataka, for a total value of USD333.3 million

Vicat Sagar will have a 2.8 MT of capacity in the first phase

Amrit Cement

Amrit Cement India Ltd (ACIL) has announced the launch of Amrit Cement in the North-

Eastern market.

The company plans to achieve a production level of 5 million tonnes per annum by 2015

16 through capacity expansion in North-Eastern Bihar and Nepal

Source: Aranca Research

Source : Aranca Research

High Huge capital investments required

present substantial barriers to entry and

achieving economies of scale

Moderate Cement players have

to depend on the railways for

carriage outward and local coal

companies for fuel, although

diversification of freight options

and fuel sources is diminishing

the suppliers power

Low Substantial market

concentration among large

players ensures low bargaining

power of buyers

Low Cement, practically,

has no substitutes

Low The Indian cement market

is oligopolistic in nature,

characterised by tacit collusion,

where large players partially

control supply for better price

discipline

Positive

Neutral

Positive Positive

Positive

Market

Attractiveness

Source: McKinsey Quarterly Report, Aranca Research

Housing Growth Infrastructure Growth

Commercial Real Estate

Growth

The Housing segment accounts for

a major portion of the total domestic

demand for cement in India

Real estate market is expected to

grow at a CAGR of 17.2 per cent

over 201115 to USD126 billion

Growing urbanisation, an increasing

number of households and higher

employment are primarily driving the

demand for housing

Initiatives by the government are

expected to provide an impetus to

construction activity in rural and

semi-urban areas through large

infrastructure and housing

development projects respectively

The government is strongly focused

on infrastructure development to

boost economic growth

It plans to increase investment in

infrastructure to USD1 trillion in the

12

th

Five Year Plan (201217),

compared with USD514 billion

under the 11

th

Five Year Plan

(200712)

Infrastructure projects such as

Dedicated Freight Corridors as well

as new and upgraded airports and

ports are expected to further drive

construction activity

The government intends to expand

the capacity of the railways and the

facilities for handling and storage to

ease the transportation of cement

and reduce transportation costs

The demand for Commercial Real

Estate segments, comprising retail

space, office space and hotels, as

well as civic facilities including

hospitals, multiplexes and schools,

has been rising due to the growth in

economy

The demand for office space in

India is being driven by the

increasing number of multinational

companies and the growth of the

services sector

Strong growth in tourism, including

both business and leisure travel,

has boosted the construction of

hotels in the country

Estimated demand by real estate

segment between 2010 and 2014:

Office (240 million sq ft), Retail (55

million sq ft), Hospitality (78 million

room nights)

Major cement demand drivers (FY12)

Source: Aranca Research

Demand for cement is highly correlated with cyclical

activities like construction and development

Housing sector accounts for 64 per cent of the total cement

demand

Real estate market is expected to grow at a CAGR of 17.2

per cent during 201115 to USD126 billion

The rapidly increasing real estate industry in India is

expected to push the demand for cement

Residential real estate demand is driven by rising

population and growing urbanisation

Rising income levels are leading to higher demand

for luxury projects

Demand for affordable housing is growing in order to

meet the demand from lower income groups

Commercial real estate demand will be driven by growth in

IT/ITeS sector and organised retail

64%

17%

13%

6%

Housing sector

Infrastructure

Commercial &

Institutional

Industrial

Infrastructure Spending As % Of GDP

Source: Working group for 12

th

Five Year Plan

Notes: Additional capacity creation estimates are based on increase in base lines, roads, housing and fiscal support

Investment in infrastructure is the main growth driver for the cement industry

The Planning Commission estimates total infrastructure spending to be about of 10 per cent of the GDP during the 12

th

Five-Year Plan (201217), up from 7.6 per cent during the previous five-year plan (200712)

Indias investment in infrastructure is estimated to double to about USD1 trillion during the 12

th

plan (201217) compared

to the previous plan

Infrastructure Spending in % during 11

th

And 12

th

Five-year Plan

75.7

69.4

89.5

101.6 101.9

157.4

181.2

206.0

233.5

264.4

F

Y

0

8

F

Y

0

9

F

Y

1

0

F

Y

1

1

F

Y

1

2

F

Y

1

3

E

F

Y

1

4

E

F

Y

1

5

E

F

Y

1

6

E

F

Y

1

7

E

5.2%

6.4%

7.2%

7.5%

7.9%

8.4%

7.6%

10.0%

10th Five year plan

FY08

FY09

FY10

FY11

FY12

11th Five year plan

12th Five year plan

12

th

Plan

11

th

Plan

North

Source: CMA, Kotak Institutional Equities, Aranca Research

Note: F- Forecast

South

82%

84%

88%

FY11F FY12F FY13F

67% 68%

73%

FY11F FY12F FY13F

81%

87%

91%

FY11F FY12F FY13F

East

West Central All India

79%

77%

80%

FY11F FY12F FY13F

90%

85%

87%

FY11F FY12F FY13F

78%

77%

82%

FY11F FY12F FY13F

12.8

13.5

23.6

31.9

35.5

38.7

FY12 FY13E FY14E FY15E FY16E FY17E

Capacity creation as per the 12

th

Five Year Plan

(million tonnes)

Source: Working group for 12

th

Five Year Plan

Notes: Additional capacity creation estimates are based on

increase in base lines, roads, housing and fiscal support,

E - Estimates

Total capacity of 336 million tonnes is estimated to have

been generated in FY12

The strong momentum in capacity addition is not surprising

given the sharp growth in construction, infrastructure and

real estate in Indian economy

Hence, the 12

th

Five Year Plan is estimated to have an

additional capacity requirement of 156.0 million tonnes by

FY17

Strategy Benefits Company/Plant

Madras Cement's

Alathiyur plant

India Cements Ltd's

Dalavoi plant

UltraTech's Gujarat

Cement Works

Lafarge's Arasmeta

plant

Use bioenergy through

burning of coffee husk

and cashew nut shells

Use Low Sulphur Heavy

Stock (LSHS) sludge as

alternate fuel

Use tyre chips and

rubber dust as alternate

fuel

Substitute 10% of coal

used in kilns with rice

husk

Annual cost savings of USD1.7 million

Annual savings of USD6500 approx

Reduction of about 30,000 tonnes of

carbon emissions annually

Higher energy savings and lower

carbon emissions

Source: CMA, Aranca Research

Revenue and Profit after Tax (PAT) in USD billion

Source: Company Website (www.grasim.com, Aranca Research

Notes: RMC Ready-Mix Concrete

UltraTech is India's largest exporter of cement clinker

spanning export markets in countries across the Indian

Ocean, Africa, Europe and the Middle East

UltraTech and its subsidiaries have a presence in five

countries through 11 integrated plants, one white cement

plant, one clinkerisation plant, 15 grinding units, two rail and

three coastal terminals, and 101 RMC plants

It has an annual capacity of 52 MT

Projects: Mumbai Metro, Bangalore Metro Rail, Kolkata

Metro Rail, Monorail, Coastal Gujarat Power

MILESTONES

2004 Acquisition of L&Ts Cement Business: UltraTech

Cement Ltd

2006 Narmada Cement Company Limited amalgamated

with UltraTech

2010 Samruddhi Cement Limited amalgamated with

UltraTech Cement Limited

2012 Acquisition of Adhunik Cements Meghalaya plant

1.1

1.4

1.4

1.5

3.0

4.0

3.9

0.2

0.3

0.2 0.2

0.3

0.5

0.5

FY07 FY08 FY09 FY10 FY11 FY12 FY13

CAGR: 23.5%

1.4

1.4

1.5

1.6

1.8

1.8

FY07 FY08 FY09 FY10 FY11 FY12

Revenue (USD billion)

Source: Company Website, Aranca Research

Note: mtpa Million Tonnes Per Annum

Ambuja Cements Ltd (ACL) is one of the leading cement

manufacturing companies in India.

The company, initially called Gujarat Ambuja Cements Ltd,

was founded by Narotam Sekhsaria in 1983

Ambuja Cements is the second largest cement

manufacturer in India, with nearly 10 per cent of the market

share of total installed capacity

It is the market leader in Northern India with 29 per cent of

the total installed capacity

MILESTONES

2010 Started cement plant at Nalagarh, Himachal

Pradesh and Dadri, Uttar Pradesh with a capacity

of 1.5 million tonnes

2011 Acquired 85 per cent stake in Nepal-based Dang

Cement

2012 Expansion of Sankrail Grinding Unit, thereby

increasing the capacity from 1.5 mtpa to 2.4 mtpa

CAGR: 5.2%

Source: Industry Sources, Aranca Research

Note: mtpa - Million Tonnes Per Annum

5.2

3.0

Estimated Demand Available Supply

NE India: Cement demand NE India: Cement supply

NE India: Cement demand-supply gap

Deficit of 2.2 mtpa

The North Eastern (NE) region has

consistently been in cement deficit for

several years

At present, cement demand in the NE is

about 5.2 mtpa

Cement manufactured locally is inadequate

to meet the local demand for cement

The deficit is met through cement

purchased from other parts of India

High transportation costs cause the landed

costs of cement to increase considerably

NE States Projected GDP Growth at

Constant Prices

The Government has approved a package of fiscal incentives and other concessions for the North Eastern Region, namely

the North East Industrial and Investment Policy, 2007, effective from 1 April, 2007

The major policy and fiscal initiatives are expected to catalyse infrastructure and industrial development in the region,

spurring the demand for cement

NE States Projected Per Capita Income

Growth

10.0%

13.7%

16.4%

XI 5-yr Plan XII 5-yr Plan XIII 5-yr Plan

8.6%

12.4%

15.2%

XI 5-yr Plan XII 5-yr Plan XIII 5-yr Plan

Cement Manufacturers' Association

CMA Tower, A-2E, Sector 24 NOIDA 201 301

Uttar Pradesh, India

Phone: 91-120-2411955, 2411957, 2411958

Fax: 91-120-2411956

E-mail: cmand@vsnl.com

Website: www.cmaindia.org/index.html

Indian Concrete Institute

Ocean Crest 79, Third Main Road, Gandhi Nagar, Adyar, Chennai 600 020

Phone: 91-44-24912602

Fax: 91-44-24455148

E-mail: ici3@vsnl.in, ici4@airtelmail.in, vj6314@gmail.com

Website: www.indianconcreteinstitute.org

National Council for Cement and Building Materials

34

th

Milestone, Delhi-Mathura Road, Ballabgarh 121 004 Haryana, India

Phone: 91-129-2242051/52/53/54/55/56; 4192222

Fax : 91-129-2242100; 2246175

E-mail: nccbm@vsnl.com; info@ncbindia.com

CMA: Cement Manufacturers' Association

GDP: Gross Domestic Product

GoI: Government of India

INR: Indian Rupee

MTPA: Million tonnes per annum

NE India: North-East India

FY: Indian financial year (April to March)

So FY10 implies April 2009 to March 2010

USD: US Dollar

Wherever applicable, numbers have been rounded off to the nearest whole number

Year INR equivalent of one USD

2004-05 44.95

2005-06 44.28

2006-07 45.28

2007-08 40.24

2008-09 45.91

2009-10 47.41

2010-11 45.57

2011-12 47.94

2012-13 54.31

Exchange Rates (Fiscal Year)

Year INR equivalent of one USD

2005 45.55

2006 44.34

2007 39.45

2008 49.21

2009 46.76

2010 45.32

2011 45.64

2012 54.69

2013 54.45

Exchange Rates (Calendar Year)

Average for the year

India Brand Equity Foundation (IBEF) engaged Aranca to prepare this presentation and the same has been prepared

by Aranca in consultation with IBEF.

All rights reserved. All copyright in this presentation and related works is solely and exclusively owned by IBEF. The

same may not be reproduced, wholly or in part in any material form (including photocopying or storing it in any medium

by electronic means and whether or not transiently or incidentally to some other use of this presentation), modified or in

any manner communicated to any third party except with the written approval of IBEF.

This presentation is for information purposes only. While due care has been taken during the compilation of this

presentation to ensure that the information is accurate to the best of Aranca and IBEFs knowledge and belief, the

content is not to be construed in any manner whatsoever as a substitute for professional advice.

Aranca and IBEF neither recommend nor endorse any specific products or services that may have been mentioned in

this presentation and nor do they assume any liability or responsibility for the outcome of decisions taken as a result of

any reliance placed on this presentation.

Neither Aranca nor IBEF shall be liable for any direct or indirect damages that may arise due to any act or omission on

the part of the user due to any reliance placed or guidance taken from any portion of this presentation.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SMART GRID - The Future of Electric Grid: Presented By: Group 7Document23 pagesSMART GRID - The Future of Electric Grid: Presented By: Group 7rahulverma9No ratings yet

- Airthread Connections Case (Work Sheet)Document66 pagesAirthread Connections Case (Work Sheet)bachandas75% (4)

- An Analysis On The Supply Chain of RiceDocument9 pagesAn Analysis On The Supply Chain of RiceGela Roxas50% (2)

- ThesisDocument55 pagesThesisJhona Paguntalan Junsay100% (2)

- 12 UP 04 Factors Affecting Demand For and Supply of Urban LandDocument9 pages12 UP 04 Factors Affecting Demand For and Supply of Urban LandKuldeepsinh J. Dodiya100% (3)

- Bs 302-Part3-1987 (Steel Wire Ropes-Specification For Zinc CoDocument11 pagesBs 302-Part3-1987 (Steel Wire Ropes-Specification For Zinc Cocelsocarvalh100% (1)

- Performance Management at Vitality HealthDocument7 pagesPerformance Management at Vitality HealthRachit Pradhan33% (3)

- Bottled Water Strategy in UKDocument19 pagesBottled Water Strategy in UKshibin21No ratings yet

- P&G LDLDocument6 pagesP&G LDLRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM049Document3 pagesPGP2 Nict 2013PGPM049Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM010Document3 pagesPGP2 Nict 2013PGPM010Rachit PradhanNo ratings yet

- Business Analytics Assignment Charles Book Club: by Group 5: Anand Chaurasia (16) Dhyani DoshiDocument4 pagesBusiness Analytics Assignment Charles Book Club: by Group 5: Anand Chaurasia (16) Dhyani DoshiRachit PradhanNo ratings yet

- GSDE Assignment: 1) Do You Think NICT Should Take Up PBI Offer?Document2 pagesGSDE Assignment: 1) Do You Think NICT Should Take Up PBI Offer?Rachit PradhanNo ratings yet

- To Diversify or To consolidate-NICT at Crossroads: Gsde AssignmentDocument3 pagesTo Diversify or To consolidate-NICT at Crossroads: Gsde AssignmentRachit PradhanNo ratings yet

- Case: Natureview Farm: Submitted byDocument3 pagesCase: Natureview Farm: Submitted byRachit PradhanNo ratings yet

- UGG - Valuation Stand Alone and With Synergies PDFDocument7 pagesUGG - Valuation Stand Alone and With Synergies PDFRachit PradhanNo ratings yet

- Submitted By: Vikrant Singh Pawar Roll No: 57.: Q1: According To Me Taking Up PBI Offer Had Following AdvantagesDocument2 pagesSubmitted By: Vikrant Singh Pawar Roll No: 57.: Q1: According To Me Taking Up PBI Offer Had Following AdvantagesRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM043Document2 pagesPGP2 Nict 2013PGPM043Rachit PradhanNo ratings yet

- Library - Due Date SlipDocument1 pageLibrary - Due Date SlipRachit PradhanNo ratings yet

- SAPM Technical AnalysisDocument1 pageSAPM Technical AnalysisRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM039Document5 pagesPGP2 Nict 2013PGPM039Rachit PradhanNo ratings yet

- Barilla SpaDocument3 pagesBarilla SpaRachit PradhanNo ratings yet

- Sm-II Course Wrap UpDocument27 pagesSm-II Course Wrap UpRachit PradhanNo ratings yet

- A New Mandate For Human Resources: Article SummaryDocument7 pagesA New Mandate For Human Resources: Article SummaryRachit PradhanNo ratings yet

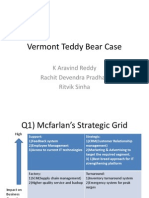

- Vermont Teddy Bear CaseDocument4 pagesVermont Teddy Bear CaseRachit Pradhan0% (1)

- 202004021910157508amar Tiwari ITS MARKETINGDocument5 pages202004021910157508amar Tiwari ITS MARKETINGJagannath SethiNo ratings yet

- Delamere Vineyard - Group06Document19 pagesDelamere Vineyard - Group06Geetha ChNo ratings yet

- Buyer Behaviour PDFDocument10 pagesBuyer Behaviour PDFKiran A.SNo ratings yet

- Consumer Trends For 2020 - BrandwatchDocument28 pagesConsumer Trends For 2020 - BrandwatchHafian FuadNo ratings yet

- Predatory Pricing: Abuse of DominanceDocument43 pagesPredatory Pricing: Abuse of DominanceChristina ShajuNo ratings yet

- CB Multible Choice Question BankDocument26 pagesCB Multible Choice Question BankSuresh Uchiha50% (2)

- Marketing Strategies by Reckitt Benckiser: Air Freshener (Airwick) Consumer Buying JourneyDocument5 pagesMarketing Strategies by Reckitt Benckiser: Air Freshener (Airwick) Consumer Buying JourneyGarimaBhandariNo ratings yet

- Consumer EquilibriumDocument31 pagesConsumer EquilibriumHassanRazaNo ratings yet

- Dissertation Report AnishDocument4 pagesDissertation Report Anishneeraj91132No ratings yet

- South Korea - LiptonDocument23 pagesSouth Korea - LiptonLalit Singh100% (1)

- 14000024catalagodedura-Tuff 20131218220037.631 XDocument18 pages14000024catalagodedura-Tuff 20131218220037.631 XCarlos Rudas RamirezNo ratings yet

- CH 5 St. Guide WordDocument4 pagesCH 5 St. Guide WordarsalmoinNo ratings yet

- Industry AnalysisDocument3 pagesIndustry AnalysisNaveen Dv100% (1)

- About Toy IndustryDocument7 pagesAbout Toy IndustryAnonymous HrtC0PHvNo ratings yet

- Louis Vuitton v. My Other Bag - Decision PDFDocument31 pagesLouis Vuitton v. My Other Bag - Decision PDFMark JaffeNo ratings yet

- The Winning StrategyDocument3 pagesThe Winning StrategyVarun KohliNo ratings yet

- Cases FinalDocument15 pagesCases FinalGlenPalmer100% (1)

- Medoc CompanyDocument2 pagesMedoc CompanyPriyanka Kelgandre67% (3)

- STP Analysissegmentation Targeting Positioning - PPTMDocument29 pagesSTP Analysissegmentation Targeting Positioning - PPTMZaid ChelseaNo ratings yet

- 6 Choosing Brand ElementsDocument53 pages6 Choosing Brand ElementsFaisal ChishtiNo ratings yet

- The Structure and Organization of The Travel and Tourism IndustryDocument2 pagesThe Structure and Organization of The Travel and Tourism IndustryAnonymous olkUZ9No ratings yet

- A SWOT Analysis of The BournvilleDocument4 pagesA SWOT Analysis of The BournvillePrawar JagnaniNo ratings yet

- Consumer BehaviourDocument13 pagesConsumer BehaviourPooja ShahNo ratings yet

- PDF NiveaDocument6 pagesPDF NiveaLucky MauryaNo ratings yet