Professional Documents

Culture Documents

Indian Banking: The New Landscape : K. C. Chakrabarty

Uploaded by

rgovindan1230 ratings0% found this document useful (0 votes)

23 views6 pagesThis document discusses the changing landscape of the Indian banking industry and key challenges and process changes needed to adapt. It addresses 5 questions: 1) Is the industry prepared for more competition from new entrants? 2) Is it properly adapting to global regulatory changes and financial risks? 3) Is it improving credit appraisal to address asset quality concerns? 4) Is it leveraging technology effectively? 5) Is it improving customer service as demands increase? The document argues that true competition requires the largest players competing with each other to improve prices and quality for customers. Financial innovations must support real sector growth rather than run ahead of it.

Original Description:

BULU

Original Title

01SP_BUL10022014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses the changing landscape of the Indian banking industry and key challenges and process changes needed to adapt. It addresses 5 questions: 1) Is the industry prepared for more competition from new entrants? 2) Is it properly adapting to global regulatory changes and financial risks? 3) Is it improving credit appraisal to address asset quality concerns? 4) Is it leveraging technology effectively? 5) Is it improving customer service as demands increase? The document argues that true competition requires the largest players competing with each other to improve prices and quality for customers. Financial innovations must support real sector growth rather than run ahead of it.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views6 pagesIndian Banking: The New Landscape : K. C. Chakrabarty

Uploaded by

rgovindan123This document discusses the changing landscape of the Indian banking industry and key challenges and process changes needed to adapt. It addresses 5 questions: 1) Is the industry prepared for more competition from new entrants? 2) Is it properly adapting to global regulatory changes and financial risks? 3) Is it improving credit appraisal to address asset quality concerns? 4) Is it leveraging technology effectively? 5) Is it improving customer service as demands increase? The document argues that true competition requires the largest players competing with each other to improve prices and quality for customers. Financial innovations must support real sector growth rather than run ahead of it.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

SPEECH

RBI Monthly Bulletin February 2014

53

Indian Banking: the New Landscape

of this would come later. Sufce to say that Inclusion

agenda will dominate the new landscape of the Indian

banking in the coming days.

Five Questions on processes amidst changing

business environment

2. I know that you all will be keen to debate issues

of emerging new banking structure with its building

blocks in the form of new bank licenses, more liberal

entry of foreign banks, mergers and acquisitions,

required capital infusion to meet Basel III requirements,

etc. Yes, these are important issues. But I intend to start

my keynote address on the theme of new landscape

for Indian banking with a little broader sweep. There

is a need to bring about signicant changes in the

banking processes in this country so that the banks of

today can remain relevant in the days ahead. In my talk

today, I intend to focus on the key challenges in the

business environment facing the Indian banking

industry and ve important process changes that would

be needed to meet these impending challenges.

3. First, with bringing down of the barriers to entry

in the banking industry, are we geared for a more

competitive banking industry that is likely to

emerge? Second, a paradigm shift is taking place in

global banking activity and its regulation with greater

emphasis on managing nancial risks. Are we adapting

to it in right measure, without getting carried away by

being overzealous in copying the regulatory changes,

importing them in a CKD form or are we going to the

other extreme of being obstinate and refusing to accept

global norms and standards? A corollary to this is the

penchant for financial innovations and financial

engineering. Are we captive to it or are we using this

for the benet of the real sector that produces goods

and services, consumes them, saves some and invests

the surplus. Third, fear is the worst substitute for

courage, though some dose of it may be necessary to

stimulate defences. A question I would like to ask is,

in view of the current asset quality concerns, are we

making efforts to improve our credit appraisal systems?

An important consideration in this regard would be to

appreciate the need for sustainable development and

Sukumar and Tamal, thank you very much, for

this invite. I am happy to note that you and your paper-

the Mint, have been focussing on the process of change

for the Indian banking that is presently underway. I

see that in many of its writings. By organising this

discussion on Indian Banking: The New Landscape,

it will further spur thoughts and debates in this area.

That this discussion has drawn several doyens of the

Indian banking, is a testimony to the importance of the

issues we face as a banking community. I welcome all

the listed speakers, Smt. Arundhati Bhattacharya,

Chairman, State Bank of India; Smt. Chanda Kocchar,

MD and CEO, ICICI Bank Limited; Shri Aditya Puri, MD,

HDFC Bank Limited; Shri S. S. Mundra, CMD, Bank of

Baroda; Shri Pramit Jhaveri, CEO, Citibank-India; Shri

Sunil Kaushal, Regional Chief Executive, India & South

Asia, Standard Chartered Bank as also exclusive

audience here comprising of senior members of the

nancial services industry, members of the print and

electronic media; ladies and gentlemen! Let me begin

by stating that an exclusive audience cannot be a

substitute for inclusive banking. Through this process

of change, we have to move on faster to serve all in our

society. The customer has to be the king and the banks

have to shift their attention away from the exclusive

club of corporates and High Networth Individuals

(HNIs) to those who still fear to tread through the

banks glass doors and feel hesitant to sit on its sofas

or approach the counters. Bankers should serve them

with a smile and leave them with a feeling that they

are as welcome and exclusive as any other and also that

the banks can understand their needs and offer them

structured products as per their requirements. More

*

Keynote address by Dr. K. C. Chakrabarty, Deputy Governor, Reserve Bank

of India at the Mints Annual Banking Conference, 2014 for Bank Chairmen

discussion on Indian Banking: The New Landscape on January 30, 2014.

Assistance provided by Dr. Mridul Saggar is gratefully acknowledged.

Indian Banking: The New

Landscape*

K. C. Chakrabarty

SPEECH

RBI Monthly Bulletin February 2014

54

Indian Banking: the New Landscape

hence, incorporating assessment of impact that the

projects financed by the banks may have on the

environment and the society. Fourth, technological

change is affecting banks as well as other industries.

In fact, technology has entered all facets of our lives.

It can pose threat as well as throws opportunities for

banks. The key point is whether we doing enough to

leverage technology to our advantage. Fifth, with

increasing competitiveness and information, the

customer is becoming more demanding than before.

So how are banks gearing up to improve customer

service, commoditise products amidst more diversied

demand for banking services and consequently, to offer

wider menu choices.

Gearing up for competition

4. One inevitable outcome of the changing banking

structure will be that the industry would have more

players but simply bringing in more players would not

make the banking industry more competitive. It is not

as if there is lot of concentration in our banking

industry. In fact, India scores over many of its peers as

well as several advanced countries when it comes to

concentration within the industry. Concentration

measured by top three banks in total banking assets is

just under 30 per cent. This compares well with other

countries. For Germany and Japan, it exceeds 75 per

cent, while that for China, Brazil, UK and France it

exceeds 50 per cent and for the United States it is just

over 35 per cent. Herfindahl index, a measure of

concentration ratio, shows that concentration is low

and the index normalised to a range of zero to unity

reads 0.040 for March 2013, down from 0.065 in March

2000. Apart from concentration, on several other

parameters the sector appears fairly competitive.

Interest rates, both on deposit and lending side are

essentially deregulated. Branch licensing has now been

freed subject to certain well-founded interventions to

ensure that under-banked rural areas are not neglected.

Foreign banks can seek licenses on tap. We plan to move

in similar direction for private sector banks with

passage of time after seeing the outcomes of the current

initiative.

5. However, even with these developments, the

banking industr y cannot be considered truly

competitive. The reason for that is the major players

have not really started competing with each other. It is

only when the dominant players in any business

segment start to compete against each other that the

consumer truly benets in terms of prices and quality

of service. This sadly is not the case in our banking

sector. In my opinion, the bigger and stronger players

would not be averse to competition as the new banks

are not likely to threaten their position at least in the

medium term. The stronger players would rather use

this opportunity to further consolidate their position

by innovating and improving their internal systems

and processes. As I said before, if the customer

experience in terms of quality of service and charges

has to improve in this country, it can only happen

through competition amongst the bigger banks.

Therefore, I would request the doyens of the industry

present here, who represent the top public, private and

foreign sector banks in the country, to begin a healthy

competition amongst them.

6. It is not that the regulators support monopolistic

tendencies in the Indian banking system. It must be

remembered that banking is a tightly regulated sector

across the globe and there are stiff entry barriers for

obvious reasons. Banks do their business by using

depositors money and it is incumbent upon the

regulators and supervisors to ensure their safety. But,

we do need more banks in the country for more than

one reason. The Net Interest Margins (NIMs) in India

have not suffered much despite the pronounced

downturn. At around 2.8 per cent at the system level,

they suggest that banks can withstand more competition.

At the system level, NIMs are closer to 1 per cent for

banks in Japan, UK, France and they are even lower in

the case of Germany. At the same time, NIMs in India

are less than those in Brazil and Russia. Our primary

motive for allowing new banks, however, is to increase

banking penetration in the country. More banks are

needed because we need to take banking across the

geography and to all income classes of the population.

SPEECH

RBI Monthly Bulletin February 2014

55

Indian Banking: the New Landscape

Deploying nancial innovations to support growth

7. A stark trend in banking leading up to the global

nancial crisis was rapid nancial innovation and

nancial engineering. The pre-crisis period witnessed

efforts by nancial engineers to nd solutions to real

sector problems in the nancial sector. A very key

reality was lost sight of which is, nancial sector exists

to subserve the real sector and it should not be allowed

to run ahead of the real sector.A number of regulatory

reforms have been ushered in since, which has slowed

down the pace of nancial innovations and the extent

of nancial engineering. The Dodd-Frank Act in the US

and other regulatory changes in the euro zone and the

UK have changed the face of banking. Through the crisis

and after the crisis, Indian banking industry faced a

more stable regulatory environment that allowed

changes and transformation to occur with due

cognisance of the international standards and codes,

but India neither retracted on the nancial deregulation

nor did it discourage new innovations within the ambit

of its regulatory system and genuine market needs.

Consequently, we have seen introduction of several

new financial products that include credit default

swaps, new cash-settled interest rate futures, ination

indexed bonds and certicates, etc.

8. Once the global nancial crisis is behind us and

banking reforms in its aftermath completed, the pace

of nancial innovations can pick-up again. But we need

to ponder if our nancial innovations are growth-

supportive or create mere notional nancial gains and

losses. Financial innovations bridge the missing

markets to provide complete markets, reduce agency

costs, facilitate risk sharing and improve efciency and

economic growth. However, they can lead to weaker

nancial and credit discipline, encourage excessive

risk-taking, add to market volatility and fuel asset price-

led or credit-led boom-bust cycles risks. All these evils

will mitigate if we, as bankers, focus on financial

innovations to support economic growth. The

innovations must lead to affordability. The innovation

has to be what Dr. R. A. Mashelkar calls inclusive.

Innovations must be aimed at serving the needs of the

society. The benets of innovations must reach the

masses in form of cheaper prices and accessibility.

Where do we stand on this today? Have there been any

efforts to provide suitable banking products to those

whose access to nance is restricted? Are there products

that can meet the needs of a street hawker or the

seasonal needs of an agrarian labourer? Why have our

efforts at nancial inclusion been so supply-driven and

not demand-led? As I mentioned earlier, eliminating

nancial exclusion in all its manifestations would have

to be one of the underlying missions for the banks.

Globalisation of Regulation

9. An important fallout of the nancial crisis has

been internationalisation of bank regulations. More

and more bank regulations are emerging out of shared

understanding amongst the members of the Basel

Committee on Bank Supervision, Financial Stability

Board, the IMF, the World Bank etc., primarily with the

objective of ensuring nancial stability in a highly

interconnected global nancial system. As a member

of the BCBS and FSB, India too is committed to

implementing the regulatory, supervisory and other

nancial sector policies which these global standard-

setting bodies decide upon. In fact, the implementation

of the regulations would be reviewed by peer regulators.

Therefore, the Indian banks have to be ready to expect

the unexpected and prepare to live with more and

more stringent regulations. It is high time our banks

start adopting the international best practices in their

operations and stopped seeking regulatory forbearance

at the earliest sign of distress.

Strengthening credit appraisal system to address asset

quality issues

10. With each quarterly corporate results season, we

see some market nervousness surrounding asset quality

for the banks. Some of the concerns are genuine

responses to the deterioration in the asset quality.

However, there also needs to be a recognition that NPA

cycles do take a turn with changing business cycle

conditions. With the economy slowing down, gross

NPAs of the public sector banks have increased from

SPEECH

RBI Monthly Bulletin February 2014

56

Indian Banking: the New Landscape

2.3 per cent in March 2011 to 4.8 per cent in September

2013. In net term, their ratio went up from 1.0 per cent

to 2.8 per cent over the same period.

Moreover restructured standard advances to gross

advances rose to 6.6 per cent by September 2013.

Undeniably, these are signs of deterioration. Yet one

needs to consider that restructuring is a legitimate

banking activity so long as it is practiced with due

diligence and does not become a conduit to nancial

indiscipline. There are silver linings too. Slippage ratio

of public sector banks has improved, coming down from

3.1 per cent at end-March 2013 to 2.1 per cent at end-

September 2013. There is some hope that the NPA cycle

might bottom out ahead, especially if economic

recovery sets in and investment activity picks up.

11. However, the question we need to ask ourselves

is whether the fall in slippages comes out of good luck

or good policies by the bank boards. Have banks learned

some lessons from this cycle of asset quality

deterioration? The cycle has certain distinctive features

in that apart from cyclical slowdown, structural and

sector-specic issues have worsened the asset quality

of the banks. Several investment projects, especially in

infrastructure space, have got stuck for want of

environmental or forest clearances or due to constraints

on the resources front. Banks clearly lacked expertise

in evaluating these projects. There was no contingency

planning. No exit route was thought of. Going forward,

a key consideration for the banks and more specically

for public sector banks, would be to make a demonstrable

improvement in their credit appraisal system. Some of

you might have gone through my presentation in

BANCON 2013 titled Two Decades of Credit

Management in Indian Banks: Looking Back and Moving

Ahead. A very disturbing fact which hits us is the

quality of equity that has been brought in by the

promoters. The banks, to put it mildly, have been very

lackadaisical in the credit appraisals. Most of the time

it is debt raised elsewhere by the promoter, either in

the holding company or in a SPV, which is used to fund

their portion of the equity. Effectively, promoters do

not have any skin in the game and they are least

bothered whether or not the projects see the light of

the day. The source and quality of equity brought in

by the promoters is a major element which the banks

would have to carefully examine in their credit

appraisal going forward.

12. Let me now come to another common lacuna in

the banks credit appraisal process. We know that banks

and nancial institutions are leveraged entities but the

leverage witnessed in some of the corporate groups

dramatically overshadow the leverage of the banks.

Evidence suggests that the banks were not taking

adequate cognisance of the build-up of leverage while

sanctioning or renewing limits. In fact, banks credit

appraisal processes failed to differentiate between

promoters debt and equity and over time, promoters

equity contribution signicantly declined and leverage

increased. In particular, there has been a signicant

increase in the indebtedness of large business groups

in recent years. A study of ten large corporate groups

has revealed that the share of these groups in total

banking sector credit more than doubled between 2007

and 2013 even while, the overall debt of these groups

rose six times (from under Rs. one trillion to over Rs.

six trillion). Hence, this is an area where the banks need

to focus more closely in future.

13. At the same time, banks cannot ignore their own

capital requirement for supporting the projected growth

of their balance sheet. They must closely look at the

state of the economy, expected credit expansion,

requirements of provision for loan losses and other

present and future liabilities and model them into their

capital requirement.

14. As I mentioned earlier, another area where the

banks need to be sensitive about in their appraisal is

the environment. Banks as the nancing agent of the

economic and developmental activities have an

important role in promoting overall sustainable

development. It is in this respect that the concept of

green banking has emerged and is recognised as an

important strategy to address sustainable development

concerns and creating awareness among people about

SPEECH

RBI Monthly Bulletin February 2014

57

Indian Banking: the New Landscape

environmental responsibility. Promoting Green banking

has to be the way forward for banks across the globe.

Green Banking entails banks to encourage environment

friendly investments and give lending priority to those

industries which have already turned green or are trying

to go green and, thereby, help to restore the natural

environment.

15. As a part of the Corporate Social Responsibility,

the companies are required to integrate social and

environmental concerns in their business operations

and in their interactions with their stakeholders on a

voluntary basis. The banks/nancial institutions would

also need to keep themselves abreast of the latest

developments in this area and help build a sustainable

environment through good banking practices. This is

important for ensuring that the banks remain socially

relevant.

16. The banks need to beef up their market intelligence

and economic analysis, so that they can catch demand-

supply gaps, such as those in minerals and mining

space, better than they have. Only then can the

deterioration in asset quality be turned around. Have

the banks sufciently moved in this direction? I would

rather wait for your introspection rather than the

answer.

Know Your Customer, his business and business risks

17. Let me now turn to a related issue, which is KYC.

This is to my mind one of the most misunderstood

concepts in banking parlance. KYC to a certain extent

can be considered as a necessary evil. But, KYC goes

much more beyond a simple proof of identify and proof

of address for the banks. KYC is a critical component

of a banks risk management framework. A customer-

centric business needs to know its customer, the nature

of his business and the inflows/outflows into the

accounts, if it is to provide customised business

products and solutions. This, I call as KYC-B. The banks

further need to understand the risks associated with

customers business to manage risks arising from

potential delinquency, fraud and consequent losses as

also legal and reputational risks arising from exposure

to customers having links to Multi level Marketing

(MLM) business/terrorist activities/hawala transactions,

etc. , which is another manifestation of KYC and may

be termed as KYC BR. The Know Your Customer (KYC),

Know Your Customers Business (KYC-B) and Know Your

Customers Business Risks (KYC-BR) should be ingrained

in the DNA of the banks business. It should be

understood that it is not just procedural compliance,

but that good KYC and KYC-BR compliance are important

for the banks business.

Leveraging Technology and making Technical Progress

18. A wave of technology change has already occurred

as banks adopted core banking technology to enhance

customer relationships and expand the market for

banking services. These technologies could enable

banks to go-to-customers and enable door-step

banking through virtual banking. For instance, cloud

computing and big data technologies can reap both scale

and scope economies. What is important is not the

name of the technologies, but what they do eventually.

Banking technology is poised to make a big leap in the

near term towards integrating customer data across

banking platforms, facilitating trading in a more secure

manner, developing virtual desktops and private clouds

to centralise information across desktops by making

them available to different employees on need-basis,

enable speedier transaction processing and faster

settlements.

19. Technology should not, however, be acquired for

the sake of it. Unless, it is employed gainfully and helps

enhance procedural and cost efciency, technology

adoption cannot be considered meaningful. The

technology ought to help the banks achieve cost-

effective scalability in the services they render. Such

technology should contribute to enhancing productivity,

especially through total factor productivity growth in

the banking industry. I, however, see statements

suggesting that the cost of service delivery has escalated

post adoption of technology and bankers are

contemplating levying charges on their own customers

for using their ATMs. I nd the position quite amusing

SPEECH

RBI Monthly Bulletin February 2014

58

Indian Banking: the New Landscape

actually. Have we made a comparative assessment of

the expenses of delivering services at the branch and

the ATM? I urge my banker friends to take a holistic

view of things and harness the technology to its

optimum rather than blaming the technology itself.

Commoditising Banking Products Amidst Wider Menu

Choices

20. Two emerging trends in the banking space are

greater competition and a more discerning customer,

who is aided by less information asymmetry and more

knowledge in the world where ICT revolution has

occurred and where media and internet penetration

has empowered him. In this world, what strategy could

work best for the banks? Actually they need to realise

that customer wants wider menu choice and more

tailored products to meet their needs. At a time when

banks are facing increasing competition amongst

themselves, as also from non-banking intermediaries,

they are left with little choice but to adapt themselves

to meeting the customer needs or else risk losing their

clients. At the same time, more competition also means

that they need to reap economies of scale and scope

more fully. For reaping these, banks need to commoditise

their products and produce them in large scale so as to

bring down the average and the marginal cost of

producing them. The banking in that sense has to

traverse from being class to mass. This is quite a

challenging job.

21. The solution perhaps lies in banks turning

themselves into mega stores, with a wide array of

services that it can offer, leveraging on technology. They

can then offer customised web pages for individuals

based on their prole and the need. This alone can

ensure cost-effective delivery of products and services

right at customers door steps.

22. Talking of customers let me remind you that

consumer protection and fair market conduct are two

themes which are at the forefront of regulators agenda

and would continue to engage their attention going

forward. The growing regularly activism is evident in

the frequency and quantum of penalties being levied

on banks worldwide. Whether, it is the European

Commission slapping record nes on major banks and

financial institutions for making undue profits or

masking their problems by fraudulently rigging the

rates or whether it is the US Fed putting nes on the

banks in America for selling bad loans to government-

controlled companies Fannie Mae and Freddie Mac, the

trend of activism has emerged. An outcome of these

developments has been creation of new regulatory

bodies to focus exclusively on consumer protection and

nancial market conduct. We are also witnessing a lot

of mis-selling by the banks, not only of the banking

products but also the non-banking nancial products

that they sell at their braches, especially insurance. The

purpose of allowing banks to sell the non-nancial

products is not to create an avenue for generating non-

interest income and to facilitate customers diverse

needs. So the banks must not aim only at the former

and they should, in fact, link their sales to the needs

of their banking customers. The insurance products

that the banks sell must be low premium with the

income for banks staggered over the entire life of the

product. Believe me, unless we mend our ways quickly,

we must be prepared for more intrusive regulation in

this area with a signicant bearing on your compliance

cost.

23. I would conclude by saying that rather than

worrying about the new landscape that the banks would

have to encounter, the brilliant minds assembled here

must deliberate on the actions that they need to take

to prepare the banking sector to face the upcoming

challenges. I believe that the panel discussion would

throw up some actionable ideas. These are some of my

thoughts that I want to leave with you in the twilight

of my career as a banker and bank regulator. However,

as I see the tectonic shifts occurring in the banking

space ahead, I cannot afford to rest. As they say, age

wrinkles the body, quitting wrinkles the soul. So I can

go on and on, but in the interest of time, let me close

by wishing you all a fruitful deliberation.

You might also like

- Banking Retail ProductsDocument7 pagesBanking Retail ProductsaadisssNo ratings yet

- Prabhat Project Report RETAIL BANKINGDocument70 pagesPrabhat Project Report RETAIL BANKINGAnshu Rajput100% (1)

- Indian Banking Sector Towards The Next OrbitDocument17 pagesIndian Banking Sector Towards The Next OrbitKalyan Raman VadlamaniNo ratings yet

- Indian Retail Banking Industry: An AnalysisDocument13 pagesIndian Retail Banking Industry: An AnalysisAman SaxenaNo ratings yet

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaNo ratings yet

- The World and The Indian Banking Industry: Munich Personal Repec ArchiveDocument10 pagesThe World and The Indian Banking Industry: Munich Personal Repec ArchivesravanthhhhNo ratings yet

- Banking Sector in India - Challenges and OpportunitiesDocument6 pagesBanking Sector in India - Challenges and OpportunitiesDeepika SanthanakrishnanNo ratings yet

- Retail BankingDocument15 pagesRetail BankingjazzrulzNo ratings yet

- Indian Financial SystemDocument8 pagesIndian Financial SystemRajeev ChinnappaNo ratings yet

- Retail BankingDocument56 pagesRetail BankingAnand RoseNo ratings yet

- Vandana SinghDocument104 pagesVandana SinghDeepak SinghalNo ratings yet

- Report On Banking Industry of BangladeshDocument38 pagesReport On Banking Industry of BangladeshZim-Ud -Daula67% (9)

- Chapter No Page NoDocument55 pagesChapter No Page NoAnand RoseNo ratings yet

- Challenges Faced by Indian BaksDocument2 pagesChallenges Faced by Indian BaksAlex FrancisNo ratings yet

- Being Five Star in ProductivityDocument48 pagesBeing Five Star in ProductivityfaemozNo ratings yet

- Banking IndustryDocument30 pagesBanking IndustrySagar Damani100% (1)

- Name: Jay Ketanbhai Changela Enrollment No.: 20fomba11508 For The Submission Of: SeeDocument26 pagesName: Jay Ketanbhai Changela Enrollment No.: 20fomba11508 For The Submission Of: SeeMAANNo ratings yet

- BANKING2Document21 pagesBANKING2Ansh JunejaNo ratings yet

- 2015iciee - India3 Challenges PDFDocument7 pages2015iciee - India3 Challenges PDFVishakha RathodNo ratings yet

- Inclusive Growth Means Affordable Finance BUsiness Standard, September 10, 2010Document1 pageInclusive Growth Means Affordable Finance BUsiness Standard, September 10, 2010Dr Vidya S SharmaNo ratings yet

- Sector Project 1Document5 pagesSector Project 12k20dmba102 RiyaGoelNo ratings yet

- Study On Retail Banking in IndiaDocument12 pagesStudy On Retail Banking in IndiashwethaNo ratings yet

- Indian Banking SectorDocument16 pagesIndian Banking SectorDr.K.BaranidharanNo ratings yet

- Introduction To The IndustryDocument18 pagesIntroduction To The Industrynikunjsih sodhaNo ratings yet

- 69038Document4 pages69038inamdar_amitNo ratings yet

- Porter's Five Forces Analysis For The Indian Banking SectorDocument4 pagesPorter's Five Forces Analysis For The Indian Banking SectorVinayak Arun Sahi86% (7)

- Retail Banking An Introduction Research Methodology: Title of Project Statement of The Problem Objective of The StudyDocument9 pagesRetail Banking An Introduction Research Methodology: Title of Project Statement of The Problem Objective of The StudySandeep KumarNo ratings yet

- BC 15120113 SPDocument8 pagesBC 15120113 SPKnowledge GuruNo ratings yet

- Banking Module 1Document26 pagesBanking Module 1mansisharma8301No ratings yet

- Merger and Acqusitions ProjectDocument9 pagesMerger and Acqusitions ProjectOmshyam PhogatNo ratings yet

- Research Paper On Banking IndustryDocument7 pagesResearch Paper On Banking Industryjsmyxkvkg100% (1)

- Study On Retail BankingDocument47 pagesStudy On Retail Bankingzaru1121No ratings yet

- Research Project Report: To Study The Retial Banking in Present ScenarioDocument94 pagesResearch Project Report: To Study The Retial Banking in Present Scenariodiwakar0000000No ratings yet

- Summer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala CityDocument104 pagesSummer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala Cityjs60564No ratings yet

- Credit AppraisalDocument9 pagesCredit Appraisalyogi2416No ratings yet

- Success in SME FinancingDocument33 pagesSuccess in SME FinancingSachin GuptaNo ratings yet

- Project On Credit Appraisal For Sme SectorDocument33 pagesProject On Credit Appraisal For Sme Sectoranish_10677953No ratings yet

- Retail BakingDocument29 pagesRetail BakingdarshpujNo ratings yet

- Banking Sector - Backing On Demographic DividendDocument13 pagesBanking Sector - Backing On Demographic DividendJanardhan Rao NeelamNo ratings yet

- Rashi PundirDocument95 pagesRashi PundirDeepak SinghalNo ratings yet

- Social Media in Banking - ProjectDocument29 pagesSocial Media in Banking - ProjectHiraj KotianNo ratings yet

- Indian Bank - CompanyAnalysis7687888989Document17 pagesIndian Bank - CompanyAnalysis7687888989yaiyajieNo ratings yet

- Content PagesDocument59 pagesContent PagesSuraj PatilNo ratings yet

- ChapterDocument16 pagesChapterAjay YadavNo ratings yet

- What, Why and How of Retail (Mass) Banking: Issues and ChallengesDocument10 pagesWhat, Why and How of Retail (Mass) Banking: Issues and Challengesrgovindan123No ratings yet

- A Study On Contemporary Challenges and Opportunities of Retail Banking in IndiaDocument12 pagesA Study On Contemporary Challenges and Opportunities of Retail Banking in IndiakokoNo ratings yet

- KPMG CII Indian BankingDocument32 pagesKPMG CII Indian BankingMukesh Pareek100% (1)

- Recent Mergers and Acquisition in Indian Banking Sector-A StudyDocument9 pagesRecent Mergers and Acquisition in Indian Banking Sector-A StudyAjith AjithNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Challenges Faced by Indian Banking IndustryDocument5 pagesChallenges Faced by Indian Banking IndustryPooja Sakru100% (1)

- BANKING Sector India and Swot AnalysisDocument16 pagesBANKING Sector India and Swot AnalysisPrateek Rastogi93% (14)

- Thesis On Banking in IndiaDocument4 pagesThesis On Banking in Indiamichellebojorqueznorwalk100% (2)

- Banking: Industries in IndiaDocument41 pagesBanking: Industries in IndiaManavNo ratings yet

- The Evolution of Neobanks in India - 1Document34 pagesThe Evolution of Neobanks in India - 1Ravi BabuNo ratings yet

- Thesis On Indian BanksDocument4 pagesThesis On Indian Bankslizbrowncapecoral100% (2)

- Final Project of Indusind BankDocument104 pagesFinal Project of Indusind Banknikhil chikhaleNo ratings yet

- Banking 2020: Transform yourself in the new era of financial servicesFrom EverandBanking 2020: Transform yourself in the new era of financial servicesNo ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Toward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyFrom EverandToward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyNo ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- Calculation (Formula) : Current LiabilitiesDocument1 pageCalculation (Formula) : Current Liabilitiesrgovindan123No ratings yet

- Analysys Mason Microsoft Nokia Deal Sept2013 RDMM0Document2 pagesAnalysys Mason Microsoft Nokia Deal Sept2013 RDMM0rgovindan123No ratings yet

- 1Q14 Fact SheetDocument1 page1Q14 Fact Sheetrgovindan123No ratings yet

- Etc Venues 155 Bishopsgate Local HotelsDocument1 pageEtc Venues 155 Bishopsgate Local Hotelsrgovindan123No ratings yet

- February 2014 Occupancy Publication RevisedDocument3 pagesFebruary 2014 Occupancy Publication Revisedrgovindan123No ratings yet

- Cassidy Sept 5 2005 VersionDocument8 pagesCassidy Sept 5 2005 Versionrgovindan123No ratings yet

- Li-Wen Hsieh, National Taipei University Tracy L. Wisdom, USA Field HockeyDocument1 pageLi-Wen Hsieh, National Taipei University Tracy L. Wisdom, USA Field Hockeyrgovindan123No ratings yet

- Hotel List 2014Document2 pagesHotel List 2014rgovindan123No ratings yet

- Implementation of A Dossier-Based Submission Process in A Senior Design Project CourseDocument2 pagesImplementation of A Dossier-Based Submission Process in A Senior Design Project Coursergovindan123No ratings yet

- 2009 North American Society For Sport Management Conference (NASSM 2009) Dimensions of General Market Demand Associated With Professional Team Sports: Development of A ScaleDocument2 pages2009 North American Society For Sport Management Conference (NASSM 2009) Dimensions of General Market Demand Associated With Professional Team Sports: Development of A Scalergovindan123No ratings yet

- Aiello Donvito Godey Pederzoli Wiedmann Hennigs SiebelsDocument37 pagesAiello Donvito Godey Pederzoli Wiedmann Hennigs Siebelsrgovindan123No ratings yet

- Case1 1Document3 pagesCase1 1rgovindan123No ratings yet

- Personal Statement GuideDocument4 pagesPersonal Statement Guidergovindan123No ratings yet

- Outline Writing GuideDocument1 pageOutline Writing Guidergovindan123No ratings yet

- A Look at Key Issues and Emerging Solutions: Brand ArchitectureDocument2 pagesA Look at Key Issues and Emerging Solutions: Brand Architecturergovindan123No ratings yet

- The Link Between Standardization/Adaptation of International Marketing Strategy and Company PerformanceDocument12 pagesThe Link Between Standardization/Adaptation of International Marketing Strategy and Company Performancergovindan123No ratings yet

- 12th Commerce Book Keeping Accountancy SolutionsDocument21 pages12th Commerce Book Keeping Accountancy Solutionsvaibhav bhandari100% (4)

- Chapter 23 - Agg Expenditure - Equilibrium Output-TheKeynesianCrossDocument30 pagesChapter 23 - Agg Expenditure - Equilibrium Output-TheKeynesianCrossSanjana JaggiNo ratings yet

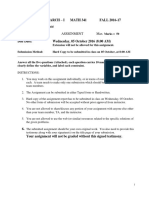

- Assign-01 (Math341) Fall 2016-17Document4 pagesAssign-01 (Math341) Fall 2016-17Rida Shah0% (1)

- IFRS 13 Fair Value MeasurementDocument14 pagesIFRS 13 Fair Value MeasurementQamar ZamanNo ratings yet

- Husk Power SystemsDocument19 pagesHusk Power SystemsSaurabh PalNo ratings yet

- A Study of Ponzi Scheme With Reference To Sharada Scam: Dr. Mini Amit Arrawatia, Mr. Vikram PandeDocument5 pagesA Study of Ponzi Scheme With Reference To Sharada Scam: Dr. Mini Amit Arrawatia, Mr. Vikram PandehimanshuNo ratings yet

- Cost Benefit Analysis MethodologyDocument10 pagesCost Benefit Analysis MethodologyRaphael Macha100% (5)

- (02a) Malacca Offer Document (Clean) PDFDocument334 pages(02a) Malacca Offer Document (Clean) PDFSiang ShengNo ratings yet

- GWSB Graduate Resume Template: Finance - Basic Format: EducationDocument1 pageGWSB Graduate Resume Template: Finance - Basic Format: Educationmikewang001No ratings yet

- Vodafone TakeoverDocument5 pagesVodafone TakeoverIamZakaNo ratings yet

- International Marketing LogisticsDocument8 pagesInternational Marketing LogisticsSammir MalhotraNo ratings yet

- Clearion Software v1 Group8Document23 pagesClearion Software v1 Group8Shivani Bhatia0% (1)

- AXA Art Market StudyDocument14 pagesAXA Art Market StudyGabriela GKNo ratings yet

- Maf5102 Fa Cat 2 2018Document4 pagesMaf5102 Fa Cat 2 2018Muya KihumbaNo ratings yet

- MF0015 B1759 Answer KeyDocument18 pagesMF0015 B1759 Answer Keyramuk100% (1)

- PLDT Audited FsDocument161 pagesPLDT Audited FsRomelyn PagulayanNo ratings yet

- OSFI - MCT Guidelines 2011Document46 pagesOSFI - MCT Guidelines 2011Roff AubNo ratings yet

- Deferra CV PDFDocument4 pagesDeferra CV PDFtorosterudNo ratings yet

- IT Policy 2057 2000Document8 pagesIT Policy 2057 2000hkhanalNo ratings yet

- Engineering Economics - Practice ProblemsDocument5 pagesEngineering Economics - Practice ProblemsSai Krish PotlapalliNo ratings yet

- Project 3Document22 pagesProject 3Cole FunNo ratings yet

- Finance Management SolutionsDocument10 pagesFinance Management Solutionsarwa_mukadam03No ratings yet

- Unit 4 Data ModelDocument34 pagesUnit 4 Data ModelgunifNo ratings yet

- Chapter 02Document15 pagesChapter 02sanket_yavalkarNo ratings yet

- Swot Analysis of The Indian Aviation IndustryDocument1 pageSwot Analysis of The Indian Aviation IndustryTejas Soni0% (1)

- EBook - Venture Capital & PE - DemoDocument161 pagesEBook - Venture Capital & PE - DemoRony JamesNo ratings yet

- Finance 350 Stock Case Write-UpDocument4 pagesFinance 350 Stock Case Write-Upapi-249016114No ratings yet

- Week 2 Solutions To ExercisesDocument5 pagesWeek 2 Solutions To ExercisesBerend van RoozendaalNo ratings yet

- Bikol Reporter September 3 - 9, 2017 IssueDocument8 pagesBikol Reporter September 3 - 9, 2017 IssueBikol ReporterNo ratings yet

- AdvisorShares AR 2011Document104 pagesAdvisorShares AR 2011mallikarjun1630No ratings yet