Professional Documents

Culture Documents

Daily FX Update: Eur Limited by Fibo Levels

Uploaded by

Basil Baby-PisharathuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily FX Update: Eur Limited by Fibo Levels

Uploaded by

Basil Baby-PisharathuCopyright:

Available Formats

GLOBALFXSTRATEGY

DAILYFXUPDATE

Tuesday,July8,2014

CAMILLASUTTON,CFA,CMT

ChiefFXStrategist,ManagingDirector

T.416.866.5470

camilla.suon@scoabank.com

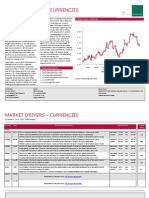

EURLIMITEDBYFIBOLEVELS

USD is mixed with a familiar paern of weak Europeans and strong

growthcurrencies.Limiteddatatodaybutahawk&adovespeak.

CAD is at but yesterdays weakness warns that market is growing

nervous;fundamentalsdontsupportfurthersustainedstrength.

EURisso;butimmateriallysoaersoGermantradedata.

EUR nearterm range trade between 1.35 1.37; medterm techni

calsturnbearishwithbreakoftrend&50daycrossingbelow200day.

CHFissoinaonfallsbackintodeaontyinghandsofSNB.

GBPissoaerdisappoinngindustrial&manuproducon.

JPYisrangeboundtradedecitnarrowsbutexportssllaconcern.

AUD is up, having now retraced half of Gov Stevens induced weak

ness;signalsarebearishunlessAUDmanagestocloseabove0.9443.

CNYisatleadingintotheCPIrelease,9:30pmEST&cons:2.4%y/y.

FX Market Update MarketsarequietleadingintotheNAsessionthat

will kick o earnings season with the release of Alcoas earnings. The

majors are relavely quiet with some weakness from GBP and EUR on

so data and strong growth currencies leading into Chinas CPI report

latertoday(9:30pmEST).Thehighlighttodayislikelytocomefromthe

twoFedspeakerswithLacker(nonvonghawk)at1pmESTwhointhe

spring saw the rst rate hike in early 2015; and Kocherlakota (vong

dove) who could update his April comments that the Fed was under

shoongonbothmandates.Accordinglythetwospeakerscouldbalance

eachother.C.S.

USDCAD (1.0685) CADisattoyesterdayscloseaerrelavelyquiet

Asian and European sessions. Yesterdays weakness was driven by a

concerning Ivey PMI, which came in well under expectaons at 46.9;

however this is a volale series and markets dont tend to react as

strongly to it; suggesng that traders are nervous with USDCADs cur

rentlevels.TheBoCOutlookSurveyhadfewmaterialchangessincethe

spring; with respondents nong only a modest improvement in past

sales but posive expectaons for future sales and a gradual rming in

exports.Intermsofinaon,therewasessenallynochange;withover

90% expecng inaon with the BoC control band (1 to 3%) over the

nexttwoyears.ThereisnoCanadiandata.C.S.

USDCAD shortterm technicals: bearishhowever are irng with a

bullishturnastheMACD irtswithabreakandspothintsataboom

ing formaon. The market is nervous. We favour playing USDCAD from

the long side. Support lies at the recent low of 1.0621 while resistance

liesat1.0720.C.S.

EURUSD (1.3595) EURissobutslltradingwithinyesterdaysrange.

Aerasoindustrialproduconprintyesterday;todaysGermantrade

surplus was wider than expected at 17.8bn, but both exports and im

portsdisappointed,falling1.1%m/mand3.4%m/m,respecvely.ECB

memberLindesuggestedthatCPIisexpectedtoremainfarfromthe2%

targetbutthatSpanishindicatorssuggestaposivetrend.C.S.

BOCSURVEYSUGGESTCONTAINEDINFLATION

UKINDUSTRIALANDMANUPRODUCTION

EURTRADINGINFIBORANGE1.3520TO1.3701

Source:TheBankofCanada

Source:Bloomberg&ScoabankFXStrategy

Source:Bloomberg&ScoabankFXStrategy

Industrialproducony/y

Manufacturingproducony/y

%

Overthenext2yrsexpectaononannualCPI

Tuesday,July08,2014

2

GLOBALFXSTRATEGY

SuggestedReading

Welcometoeverythingboom,ormaybetheeverythingbubble,N.Irwin,NYT(July8,2014)Aroundtheworld,nearlyeveryassetclassis

expensivebyhistoricalstandards.Thephenomenonisrootedintwointerrelatedforces:savingsandcentralbankpolicy.

EurosreserveappealfadesasECBpromptsdecline,C.Zachariahs,Bloomberg(July8,2014)TheECBsunprecedentedsmulusmeasures

arestarngtodimtheeurosallureamongthekeepersofforeignexchangereserves.

ECBunderpressuretotacklecrazyeuro,M.Stothard,FT(July8,2014)PressureismounngontheECBtotakeaconagainstapersistently

strongeurowithaleadingindustrialistcallingonFrankfurttotacklethecrazystrengthofthecurrency.

FearsgrowoverlongtermhittoIraqoiloutput,A.Raval,FT(July8,2014)ConcernsoverIraqsabilitytosupplyoilincludeweakinfrastruc

ture,waterissues&labourshortages.Recentviolencecompoundstheseproblemsdrivingquesonsovertheworlds2ndbiggestproducer.

Yellendidntruleoutmonetarypolicytocombatbubbles,J.Yellen,WSJ(July8,2014)ChairYellencausedasrwhensheappearedtorule

outraisinginterestratestotamenancialbubbles.Butaclosereadingsuggestsshewenttogreatlengthstoleaveheroponsopen.

eral Reserve Bank of NY (in yesterdays

morning document and link here) high

lighted the disappoinng performance

of trade, given the expected export

benets of a weak yen are being oset

by the cost of imporng fuel. USDJPY

connues to trade within a narrow

range, showing remarkable stability

with the 50, 100 and 200day moving

averages all within 50 points of one

another. The catalyst for a break in the

rangeislikelytocomefromfundamen

tal data that would change the risk of

Japanesemonetarypolicy.C.S.

USDJPY shortterm technicals: mixed

with all studies suggesng that USDJPY

istradingwithinarelavelysmallmedi

umterm range. In this environment,

technicals are providing few clues for

nearterm direcon. Support lies at the

recent low of 101.24 while resistance

liesat100dayMAat102.18.C.S.

EURUSD shortterm technicals: bullish but studies are fading and momentum has evaporated.

EURislikelytotradewithinarange1.3500to1.3700unlthereisastrongercatalyst.Theseare

alsoclosetoitsFibolevelsfromtheJuly2013toMay2014rallywiththe23.6%retracementat

1.3701andthe38.2%at1.3520seechart.ThenegavepressmenonsofEURappearstohave

increased, pung addional pressure on EUR. While longerterm technicals have shied to an

increasingly bearish stance, with the breaking of the upward trend and the 50day MA crossing

below the 200day MAsee chart. The above menoned Fibo levels can be used as support/

resistance.C.S.

GBPUSD (1.7115) GBP is weak, down 0.1%, having touched a sixsession low. Soer than ex

pectedindustrialandmanufacturingproducon,unexpectedlyfalling0.7%m/mand1.3%m/m

werethemaindriver.Thedeceleraonisaconcern(seechart),howeveritisunlikelytoshithe

BoEpolicystance.Wedonotexpectanychangeatthisweeksmeeng;butdoexpectthatGov

ernor Carney connues to highlight that interest rate hikes are likely to come sooner than the

marketexpectsbutproveslowandgradual.Intheneartermthisshouldconnuetosupportan

elevatedGBP.C.S.

GBPUSD shortterm technicals: bullishhowever momentum is fading and studies are shiing

towards more neutral and even sell signals. Accordingly, the nearterm outlook for GBP is cau

ous;abreakandclosebelowlastTuesdaysopenat1.7106wouldshisignalstowardsamore

bearishoutlook.Supportlies at1.7106,followedby1.7080;resistanceliesattherecenthighof

1.7180.C.S.

USDJPY (101.75) JPY is up 0.1%, during a relavely unevenul Asian and European sessions.

Japanscurrentaccountsurpluswidenedto523bnwhilethetradedecitnarrowedto676bn.

ThepathofexportsremainsanimportantconcernforJPYtraders.YesterdaysarclebytheFed

TECHNICALS:BUY/SELLSIGNALSANDPIVOTLEVELS

30Day

Hi stVol

Spot MACD

9&21

dayMA

DMI RSI

Pi vot1st

Support

Pi vot1st

Resi st.

USDCAD 3.9 1.0683 sel l sel l sel l 37 1.0645 1.0708

EURUSD 3.6 1.3594 buy buy sel l 45 1.3577 1.3611

GBPUSD 3.9 1.7106 buy buy buy 62 1.7071 1.7156

USDCHF 4.4 0.8940 sel l sel l buy 52 0.8927 0.8956

USDJPY 3.8 101.73 buy sel l sel l 47 101.55 102.06

AUDUSD 7.2 0.9392 sel l buy buy 52 0.9354 0.9417

USDMXN 6.2 13.00 sel l sel l buy 52 12.96 13.03

DXY(USDi ndex) 3.1 80.27 sel l na buy 51 80.19 80.36

EURCAD 5.0 1.4523 buy sel l sel l 36 1.4467 1.4564

GBPCAD 4.9 1.8275 buy sel l sel l 47 1.8206 1.8333

AUDCAD 6.6 1.0034 sel l sel l sel l 44 0.9980 1.0066

CADMXN 5.5 12.17 buy buy buy 65 12.15 12.20

BoCNoonRate 1.0662 Source:Scotiabank&Bloomberg

Jul08,2014

Tuesday,July08,2014

GLOBALFXSTRATEGY

IMPORTANTNOTICEandDISCLAIMER:

ThispublicaonhasbeenpreparedbyTheBankofNovaScoa(Scoabank)forinformaonalandmarkengpurposesonly.Opinions,esmatesandprojeconscontainedhereinareourownasofthe

datehereofandaresubjecttochangewithoutnoce.Theinformaonandopinionscontainedhereinhavebeencompiledorarrivedatfromsourcesbelievedreliable,butnorepresentaonorwarran

ty, express or implied, is made as to their accuracy or completeness and neither the informaon nor the forecast shall be taken as a representaon for which Scoabank, its aliates or any of their

employeesincuranyresponsibility.NeitherScoabanknoritsaliatesacceptanyliabilitywhatsoeverforanylossarisingfromanyuseofthisinformaon.Thispublicaonisnot,andisnotconstructed

as,anoertosellorsolicitaonofanyoertobuyanyofthecurrenciesreferredtoherein,norshallthispublicaonbeconstruedasanopinionastowhetheryoushouldenterintoanyswaportrading

strategyinvolvingaswaporanyothertransacon.Thegeneraltransacon,nancial,educaonalandmarketinformaoncontainedhereinisnotintendedtobe,anddoesnotconstute,arecommen

daonofaswaportradingstrategyinvolvingaswapwithinthemeaningofU.S.CommodityFuturesTradingCommissionRegulaon23.434andAppendixAthereto.Thismaterialisnotintendedtobe

individuallytailoredtoyourneedsorcharacteriscsandshouldnotbeviewedasacalltoaconorsuggesonthatyouenterintoaswaportradingstrategyinvolvingaswaporanyothertransac

on.Youshouldnotethatthemannerinwhichyouimplementanyofthestrategiessetoutinthispublicaonmayexposeyoutosignicantriskandyoushouldcarefullyconsideryourabilitytobear

suchrisksthroughconsultaonwithyourownindependentnancial,legal,accounng,taxandotherprofessionaladvisors.Scoabank,itsaliatesand/ortheirrespecveocers,directorsoremploy

eesmayfrommetometakeposionsinthecurrenciesmenonedhereinasprincipaloragent,andmayhavereceivedremuneraonasnancialadvisorand/orunderwriterforcertainofthecorpo

raonsmenonedherein.Directors,ocersoremployeesofScoabankanditsaliatesmayserveasdirectorsofcorporaonsreferredtoherein.AllScoabankproductsandservicesaresubjectto

thetermsofapplicableagreementsandlocalregulaons.Thispublicaonandallinformaon,opinionsandconclusionscontainedinitareprotectedbycopyright.Thisinformaonmaynotberepro

ducedinwholeorinpart,orreferredtoinanymannerwhatsoevernormaytheinformaon,opinionsandconclusionscontainedinitbereferredtowithoutthepriorexpresswrienconsentofScoa

bank.

TrademarkofTheBankofNovaScoa.Usedunderlicense,whereapplicable.Scoabank,togetherwithGlobalBankingandMarkets,isamarkengnamefortheglobalcorporateandinvestment

bankingandcapitalmarketsbusinessesofTheBankofNovaScoaandcertainofitsaliatesinthecountrieswheretheyoperate,allmembersoftheScoabankgroupandauthorizedusersofthe

mark.TheBankofNovaScoaisincorporatedinCanadawithlimitedliabilityandisauthorisedandregulatedbytheOceoftheSuperintendentofFinancialInstuonsCanada.TheBankofNova

ScoaandScoabankEuropeplcareauthorisedbytheUKPrudenalRegulaonAuthority.TheBankofNovaScoaissubjecttoregulaonbytheUKFinancialConductAuthorityandlimitedregulaon

bytheUKPrudenalRegulaonAuthority.ScoabankEuropeplcisauthorisedbytheUKPrudenalRegulaonAuthorityandregulatedbytheUKFinancialConductAuthorityandtheUKPrudenal

RegulaonAuthority.DetailsabouttheextentofTheBankofNovaScoa'sregulaonbytheUKPrudenalRegulaonAuthorityareavailableonrequest.ScoabankInverlat,S.A.,ScoaInverlatCasade

Bolsa,S.A.deC.V.,andScoaInverlatDerivados,S.A.deC.V.,areeachauthorizedandregulatedbytheMexicannancialauthories.Notallproductsandservicesareoeredinalljurisdicons.Services

describedareavailableinjurisdiconswherepermiedbylaw.

CONTACTSGLOBALFXSTRATEGY

Pleasecontactauthorsdirectlytobeaddedtodistribuonlists

CamillaSuon,CFA,CMT

ChiefFXStrategist,ManagingDirector

T.416.866.5470

camilla.suon@scoabank.com

EricTheoret

FXStrategist(G10),AssociateDirector

T.416.863.7030

eric.theoret@scoabank.com

EduardoSuarez

SeniorFXStrategist(LATAM),Director

T.416.945.4538

eduardo.suarez@scoabank.com

SachaTihanyi

SeniorFXStrategist(ASIAexJapan),Director

T.852.2861.4770

sacha.hanyi@scoabank.com

TODAY'SRELEASES&SPEAKERS

Ti me

(EST)

Country Rel ease Peri od Consensus Last Si gni fi cance

10:00 UK NIESRGDPEsti mate Jun 0.9% med

10:00 US JOLTSJobOpeni ngs May 4350 4455 med

13:00 US Fed'sLacker(nonvoti nghawk)speaksoneconomi coutl ook;Q&A medhi gh

13:45 US Fed'sKocherl akota(voti ngdove)speaksonmonetarypol i cy;Q&A medhi gh

15:00 US ConsumerCredi t May $20.000B $26.847B l ow

15:00 NZ RBNZGov.Wheel erspeakstoapri vateaudi ence l ow

19:01 UK BRCShopPri ceIndexYoY Jun 1.4% med

21:30 CH PPIYoY Jun 1.0% 1.4% HIGH

21:30 CH CPIYoY Jun 2.4% 2.5% HIGH

02:00 SW PESUnempl oymentRate Jun 4.3% 3.9% medhi gh

02:00 JN Machi neTool OrdersYoY JunP 24.1% med

02:10 EC ECB'sCoeureparti ci patesi npanel di scussi ononGreece med

03:00 EC ECB'sPraetspeaksongrowth;Q&Aunknown med

You might also like

- Inside the Currency Market: Mechanics, Valuation and StrategiesFrom EverandInside the Currency Market: Mechanics, Valuation and StrategiesNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Daily FX Update: Europe Provides Offset To Worrisome China PmiDocument3 pagesDaily FX Update: Europe Provides Offset To Worrisome China PmiMohd Sofian YusoffNo ratings yet

- BNP FX WeeklyDocument22 pagesBNP FX WeeklyPhillip HsiaNo ratings yet

- Global FX StrategyDocument4 pagesGlobal FX StrategyllaryNo ratings yet

- 2011 12 02 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 02 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- 12 Mars 2010Document29 pages12 Mars 2010api-25889552No ratings yet

- Global FX StrategyDocument3 pagesGlobal FX StrategyrockieballNo ratings yet

- 2011 12 06 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 06 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- Barclays FX Weekly Brief 20100902Document18 pagesBarclays FX Weekly Brief 20100902aaronandmosesllcNo ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Barclays Capital - The - W - Ides of MarchDocument59 pagesBarclays Capital - The - W - Ides of MarchjonnathannNo ratings yet

- Jun-10-DJ Asia Daily Forex OutlookDocument3 pagesJun-10-DJ Asia Daily Forex OutlookMiir ViirNo ratings yet

- Forex Market Insight 10 June 2011Document3 pagesForex Market Insight 10 June 2011International Business Times AUNo ratings yet

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocument25 pagesFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburNo ratings yet

- 2011 12 05 Migbank Daily Technical Analysis ReportDocument15 pages2011 12 05 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- Sep 16Document12 pagesSep 16kn0qNo ratings yet

- ScotiaBank AUG 06 Daily FX UpdateDocument3 pagesScotiaBank AUG 06 Daily FX UpdateMiir ViirNo ratings yet

- ScotiaBank AUG 09 Daily FX UpdateDocument3 pagesScotiaBank AUG 09 Daily FX UpdateMiir ViirNo ratings yet

- 2012 01 06 Migbank Daily Technical Analysis ReportDocument15 pages2012 01 06 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- Global FX StrategyDocument3 pagesGlobal FX Strategyashish pandeyNo ratings yet

- Daily I Forex Report 23 Sep 2013Document15 pagesDaily I Forex Report 23 Sep 2013epicresearch4No ratings yet

- Daily I Forex Report: 8 February 2013Document15 pagesDaily I Forex Report: 8 February 2013EpicresearchNo ratings yet

- FX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingDocument5 pagesFX Weekly Commentary - Sep 25 - Sep 30 2011 Elite Global TradingJames PutraNo ratings yet

- Daily FX Update: Cad Outperforming Into Na OpenDocument3 pagesDaily FX Update: Cad Outperforming Into Na OpenbabbabeuNo ratings yet

- ScotiaBank AUG 04 Daily FX UpdateDocument3 pagesScotiaBank AUG 04 Daily FX UpdateMiir ViirNo ratings yet

- Weakening of Yen Continued Yesterday: Morning ReportDocument3 pagesWeakening of Yen Continued Yesterday: Morning Reportnaudaslietas_lvNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument5 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Daily FX Update: Eur Limited Above 1.40 As Draghi Lays Out PlansDocument3 pagesDaily FX Update: Eur Limited Above 1.40 As Draghi Lays Out Planspathanfor786No ratings yet

- Global FX Insights - 8 August 2016Document12 pagesGlobal FX Insights - 8 August 2016BBand TraderNo ratings yet

- Daily FX Update: Usd Looks To Chair YellenDocument3 pagesDaily FX Update: Usd Looks To Chair Yellenpathanfor786No ratings yet

- Daily I Forex Report 16 Sep 2013Document15 pagesDaily I Forex Report 16 Sep 2013epicresearch4No ratings yet

- Risk Event For This Week September 5-9-2016 2Document5 pagesRisk Event For This Week September 5-9-2016 2randz8No ratings yet

- Daily-i-Forex-report-1 by EPIC RESEARCH 27 MAY 2013Document15 pagesDaily-i-Forex-report-1 by EPIC RESEARCH 27 MAY 2013EpicresearchNo ratings yet

- 2011 07 13 Migbank Daily Technical Analysis ReportDocument15 pages2011 07 13 Migbank Daily Technical Analysis ReportmigbankNo ratings yet

- Jul-14-Dj Asia Daily Forex OutlookDocument4 pagesJul-14-Dj Asia Daily Forex OutlookMiir ViirNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- ScotiaBank AUG 03 Daily FX UpdateDocument3 pagesScotiaBank AUG 03 Daily FX UpdateMiir ViirNo ratings yet

- Forex Market Insight 15 June 2011Document3 pagesForex Market Insight 15 June 2011International Business Times AUNo ratings yet

- ScotiaBank JUL 27 Daily FX UpdateDocument3 pagesScotiaBank JUL 27 Daily FX UpdateMiir ViirNo ratings yet

- 2011 08 08 Migbank Daily Technical Analysis Report+Document15 pages2011 08 08 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- Daily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?Document2 pagesDaily FX Strategy: ECB Preview: EUR To Take Fright From QE-lite?GlobalStrategyNo ratings yet

- 2011 08 05 Migbank Daily Technical Analysis Report+Document15 pages2011 08 05 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- FX Talking: Ing'S View On The Major Bullish and Bearish Currency ThemesDocument20 pagesFX Talking: Ing'S View On The Major Bullish and Bearish Currency ThemesCiocoiu Vlad AndreiNo ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily I Forex Report 1 by EPIC RESEARCH 08.04.13Document15 pagesDaily I Forex Report 1 by EPIC RESEARCH 08.04.13EpicresearchNo ratings yet

- Daily Currency Update: Market SummaryDocument3 pagesDaily Currency Update: Market Summarysilviu_catrinaNo ratings yet

- 2011 08 01 Migbank Daily Technical Analysis Report+Document15 pages2011 08 01 Migbank Daily Technical Analysis Report+migbankNo ratings yet

- Daily Markets UpdateDocument32 pagesDaily Markets Updateapi-25889552No ratings yet

- MCB Market Update - 18th October 2016 - tcm12-12829Document2 pagesMCB Market Update - 18th October 2016 - tcm12-12829sharktale2828No ratings yet

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470No ratings yet

- FX Weekly Commentary - Nov 06 - Nov 12 2011Document5 pagesFX Weekly Commentary - Nov 06 - Nov 12 2011James PutraNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/CHFDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/CHFMiir ViirNo ratings yet

- Daily-i-Forex-report-1 by EPIC RESEARCH 20 MAY 2013Document16 pagesDaily-i-Forex-report-1 by EPIC RESEARCH 20 MAY 2013EpicresearchNo ratings yet

- Daily I Forex Report 24 Sep 2013Document13 pagesDaily I Forex Report 24 Sep 2013epicresearch4No ratings yet

- Global FX StrategyDocument3 pagesGlobal FX StrategylavdiotisNo ratings yet

- Foreign Exchange OutlookDocument17 pagesForeign Exchange Outlookdey.parijat209No ratings yet

- SEB Report: Investors To Move Away From Dollar, EuroDocument44 pagesSEB Report: Investors To Move Away From Dollar, EuroSEB GroupNo ratings yet

- Daily Technical Analysis Report 23/october/2015Document14 pagesDaily Technical Analysis Report 23/october/2015Seven Star FX LimitedNo ratings yet

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocument3 pagesRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470No ratings yet

- Yaser Mozaffari Jouybari, Abbas Akbarpour NikghalbDocument8 pagesYaser Mozaffari Jouybari, Abbas Akbarpour NikghalbBasil Baby-PisharathuNo ratings yet

- Performance Based Analysis of RC Building Consisting Shear Wall and Varying Infill PercentageDocument21 pagesPerformance Based Analysis of RC Building Consisting Shear Wall and Varying Infill PercentageBasil Baby-PisharathuNo ratings yet

- IJISET - Call For Paper Vol 1 Issue 6Document2 pagesIJISET - Call For Paper Vol 1 Issue 6Basil Baby-PisharathuNo ratings yet

- Notification KSHB Asst Engineer PostsDocument1 pageNotification KSHB Asst Engineer PostsBasil Baby-PisharathuNo ratings yet

- Published Papers: Publishing Place Publishing Date Title of The Paper NoDocument6 pagesPublished Papers: Publishing Place Publishing Date Title of The Paper NoBasil Baby-PisharathuNo ratings yet

- AIR QUALITY FORECAST FOR Wednesday, July 9, 2014: Yesterday Today Tomorrow ExtendedDocument4 pagesAIR QUALITY FORECAST FOR Wednesday, July 9, 2014: Yesterday Today Tomorrow ExtendedBasil Baby-PisharathuNo ratings yet

- Latest eDocument39 pagesLatest eBasil Baby-PisharathuNo ratings yet

- Extended AbstractDocument11 pagesExtended AbstractBasil Baby-PisharathuNo ratings yet

- Federal Register / Vol. 79, No. 130 / Tuesday, July 8, 2014 / NoticesDocument2 pagesFederal Register / Vol. 79, No. 130 / Tuesday, July 8, 2014 / NoticesBasil Baby-PisharathuNo ratings yet

- Extended AbstractDocument11 pagesExtended AbstractBasil Baby-PisharathuNo ratings yet

- Balance Sheet and Statement of Cash FlowsDocument8 pagesBalance Sheet and Statement of Cash FlowsAntonios FahedNo ratings yet

- Overview of Self Employed Segment-SES: XP ND RningDocument582 pagesOverview of Self Employed Segment-SES: XP ND RningJeetin KumarNo ratings yet

- Akash Yadav 2Document66 pagesAkash Yadav 2deewakar dubeyNo ratings yet

- Credit Risk ManagementDocument17 pagesCredit Risk Managementarefayne wodajoNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Bill 00000000000000000000826433Document2 pagesBill 00000000000000000000826433Mohammad WaseemNo ratings yet

- Edexcel IGCSE May 2012 AccountingDocument20 pagesEdexcel IGCSE May 2012 AccountingJonayed Ahmed 96No ratings yet

- Test On Cashbook and Petty CashbookDocument5 pagesTest On Cashbook and Petty Cashbookshamawail hassanNo ratings yet

- Final SLP Accounting For ReceivablesDocument26 pagesFinal SLP Accounting For ReceivablesLovely Joy SantiagoNo ratings yet

- Maths ExamDocument17 pagesMaths ExamBenjamin GeorgeNo ratings yet

- Ranchi Municipal Corporation Pay.Document2 pagesRanchi Municipal Corporation Pay.Adarsh JhaNo ratings yet

- Santiago Golf Resort 01102007 FaqDocument8 pagesSantiago Golf Resort 01102007 FaqdiffsoftNo ratings yet

- Money and Banking ObjectiveDocument5 pagesMoney and Banking Objectivebhivanshu mukhijaNo ratings yet

- Types of Transaction: Being Name of Person's Cheque Returned ChequeDocument2 pagesTypes of Transaction: Being Name of Person's Cheque Returned ChequeDipendra GiriNo ratings yet

- Sem 5th Project On HDFC Vansh...Document84 pagesSem 5th Project On HDFC Vansh...ktaneja073No ratings yet

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheZahoorNabiNo ratings yet

- 6 Months HDFC Current Ac - From Aug 1st 2023 To Jan 2024Document62 pages6 Months HDFC Current Ac - From Aug 1st 2023 To Jan 2024Subramanyam JonnaNo ratings yet

- An Case Study On Exley Chemical CompanyDocument12 pagesAn Case Study On Exley Chemical CompanyChristian JimmyNo ratings yet

- An Analysis of Volatility in Stock Market (With Reference To 100 Scripts of NSE & BSE From Jan 1999 To June 2009)Document98 pagesAn Analysis of Volatility in Stock Market (With Reference To 100 Scripts of NSE & BSE From Jan 1999 To June 2009)Vikash BhanwalaNo ratings yet

- Soal Bhs Inggris Kelas XiDocument7 pagesSoal Bhs Inggris Kelas Xinadhiva guraysNo ratings yet

- Blank Finance Budgets and Net WorthDocument24 pagesBlank Finance Budgets and Net WorthAdam100% (6)

- SLTF FormDocument7 pagesSLTF FormFelix MaccarthyNo ratings yet

- Eight Days A Week PDFDocument439 pagesEight Days A Week PDFRita D'HaeneNo ratings yet

- Department of Accountancy: Bank Reconciliation and Proof of CashDocument3 pagesDepartment of Accountancy: Bank Reconciliation and Proof of CashAsterism LoneNo ratings yet

- Receipt 8585870553 April16Document1 pageReceipt 8585870553 April16Nishikant MeshramNo ratings yet

- Online Banking - Bank LoginDocument16 pagesOnline Banking - Bank LoginonliebankingNo ratings yet

- ACF AssignmentDocument27 pagesACF AssignmentAmod GargNo ratings yet

- Accounting For Managers - Unit 2Document161 pagesAccounting For Managers - Unit 2Chirag JainNo ratings yet

- 5010 Ohada Fin Reporting p2Document12 pages5010 Ohada Fin Reporting p2serge folegweNo ratings yet

- Quiz 2 Partnership OperationsDocument4 pagesQuiz 2 Partnership OperationsChelit LadylieGirl FernandezNo ratings yet