Professional Documents

Culture Documents

Med 1

Uploaded by

api-259279833Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Med 1

Uploaded by

api-259279833Copyright:

Available Formats

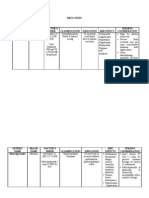

Form MED 1 Health Expenses - Claim for Relief

You can claim for Health Expenses via the Internet using PAYE Anytime.

For further information please visit www.revenue.ie

Receipts (and Form Med 2 if your claim includes non-routine dental expenses) should not be submitted with this claim but should be retained

by you - See Receipts section on Page 3

Name and Address

Return Address - If the address of your Revenue offce is not shown below, please

check any correspondence you have received from Revenue to locate the address

to which you should submit this form, or visit www.revenue.ie and enter your PPS

number into Revenues contact locator.

Year for which claim is being made

PPS Number

The PPS number can be obtained from any correspondence

you have received from Revenue. If you are married or in

a civil partnership and are taxed under Joint Assessment

please quote the PPS number of the assessable spouse or

nominated civil partner.

Notes

Please read the notes on Pages 3 & 4 before completing

this form.

Individuals for whom you wish to claim

Declaration

Please complete in all cases the names of the persons on whose behalf you paid or incurred health expenses

Name

Address

In the case of a claim for an individual whom you maintain in a nursing home, please state their PPS number and date of birth.

I declare that:

s all particulars stated on this form, including income received from all sources, are complete, true and correct

s I have paid all expenses claimed and I hold receipts for all expenses which are available for inspection

s in respect of expenses claimed on this form, all refunds received to date from any source are shown and I agree

to notify the Revenue Commissioners of any such refunds received in the future

s to the best of my knowledge no part of these expenses will be voluntarily reimbursed to me.

Signature Tel. No.

Page 1

Date D D M M Y Y

PPS Number

PPS Number

Date of Birth D D M M Y Y

RPC002669_EN_WB_L_9

Please supply your bank account details for Revenue to transfer your refund to your Irish bank account.

(It is not possible to make a refund directly to a foreign bank account.)

Note: Any subsequent Revenue refunds will be made to this bank account until otherwise notifed.

Sort Code Account Number

Routine Health Expenses (see Qualifying Medical Expenses section on Page 3)

Income Details of Claimant PPS No.

Please enter details of Income that was subject to PAYE in the year of claim. If you, your spouse or civil partner had more then one

employment or Pension (Non Department of Social Protection) please list the total taxable Pay & Tax deducted and Gross Pay for

USC & USC deducted for each employment or pension on a separate sheet. Alternatively include your P60 for each employment

or P45 if not already submitted. In the absence of P60(s), the relevant details may be obtained from your employer.

Name of Employer or Pension Provider

Total Taxable Pay

Maintenance or treatment in an approved nursing home (see Nursing Home section on Page 3)

Nursing Home

Name and Address

(a) Services of a doctor or consultant

(b) Total outlay on prescribed drugs or medicines for the year

(c) Educational Psychological Assessment for a dependent child

(see note on Page 3)

(d) Speech and Language Therapy for a dependent child

(see note overleaf)

(e) Orthoptic or similar treatment

(on referral from a doctor or other qualifying practitioner)

(f) Diagnostic procedures (X-rays, etc.)

(g) Physiotherapy or similar treatment

(on referral from a doctor or other qualifying practitioner)

(i) Maintenance or treatment in a hospital

(h) Expenses incurred on any medical, surgical or nursing appliance

Non-Routine Dental Treatment (per Med 2) (see Receipts section on Page 3)

(1)

(2)

(j) Other Qualifying Expenses (provide brief details below)

Total (a) to (j)

TOTAL HEALTH EXPENSES

(1 + 2 + 3)

(3)

Deductions - (if none write NONE)

(i) from any public or local authority, e.g. Health Service Executive

(iii) other, e.g. compensation claim

(ii) under any policy of insurance, e.g. VHI, Laya Healthcare, Aviva Healthcare, etc.

Page 2

TOTAL DEDUCTIONS

AMOUNT ON WHICH TAX RELIEF IS CLAIMED

(Total Health Expenses less Total Deductions)

Self

Sums received or receivable in respect of any of the above expenses

Spouse or Civil Partner

Total Income from other sources not subject to PAYE (see section

on other income on Page 4 )

Details of Claim

Total Tax deducted

Gross Pay for USC

Total USC deducted

Individuals for whom tax relief may be claimed

You may claim a refund of tax in respect of medical expenses paid or incurred by you:

s On your own behalf

s For the year 2009 and subsequent years on behalf of any other person (no restrictions).

A personal representative of a deceased person can claim for medical expenses incurred by the deceased. Such expenses

are treated as if they were paid immediately before the death of the deceased person and form part of the estate. However,

if another individual has paid expenses on behalf of the deceased individual that individual can claim relief on the basis of

when the expense was incurred subject to the time limits listed below.

Qualifying Medical Expenses

The headings under which expenses qualify are listed on Page 2 of this form. You must have paid or incurred the amounts

claimed on treatment prescribed by or on the advice of a qualifying practitioner. Drugs and medicines can only be claimed

where supplied on the prescription of a qualifying practitioner.

Nursing Homes

If the claim relates to the year 2010 and subsequent years of assessment the nursing home in question must provide

qualifed nursing care on-site on a 24 hour per day basis.

Note for the year 2009 or previous years the nursing home must be on the Revenue list of approved hospitals and nursing

homes, viewable on www.revenue.ie

Maternity Care

The cost of providing routine health care in respect of pregnancy is allowable.

In Vitro Fertilisation (IVF)

IVF may be regarded as treatment in respect of infertility and relief may be allowed in respect of the cost of this treatment

where the treatment is carried out by a qualifying practitioner.

Educational Psychological Assessment for a dependent child

Must be carried out by an educational psychologist who is entered on a register maintained by the Minister for Education and

Skills for the purposes of this relief in accordance with guidelines set down by that Minister.

Speech and Language Therapy for a dependent child

Must be carried out by a speech and language therapist who is approved for the purposes of this relief by the Minister for

Health in accordance with guidelines set down by that Minister.

Consumable products

Relief can be claimed for the costs incurred on products manufactured specifcally for coeliacs and diabetics where this

expenditure is incurred on the advice of a qualifying medical practitioner.

Non-Routine Dental Expenses

You must hold a completed Form Med 2 (Dental), signed and certifed by the dental practitioner when making a claim for

non-routine dental expenses. A full list of qualifying treatments is listed on the reverse of the Form Med 2 (Dental) which is

available from your Dental practitioner or from www.revenue.ie

Expenses that do not qualify

s The cost of sight testing and the provision and maintenance of spectacles and contact lenses.

s Routine dental treatment which is defned as the extraction, scaling and flling of teeth and the provision and repair

of artifcial teeth and dentures.

s Cosmetic surgery unless the surgery or procedure is necessary as a result of a physical deformity arising from, or

directly related to a congenital abnormality, personal injury or a disfguring disease.

Receipts for expenses claimed

Please ensure that you only claim for amounts for which you hold receipts (and Form Med 2 if the claim includes non-routine

dental expenses). Please do not send in the receipts (or Form Med 2) to Revenue with your claim. However, you must

keep the receipts (including Form Med 2) for a period of 6 years as you may be asked to send them in if your claim is

chosen for a detailed examination.

Deductions for sums received or receivable in respect of Health Expenses

You cannot claim relief in respect of refunds already received or due to be received from:

s Any public or local authority, e.g. Health Service Executive

s Any Policy of Insurance

s Any other source, e.g. Compensation claim.

You must give details of such amounts and deduct them from the amount claimed on the claim form.

Page 3

Drugs & Medicines: From 01/01/12 you can claim tax relief for expenditure of amounts up to 132 per calendar month

for prescribed medication. Expenditure in excess of 132 per month is recoverable from the Health Service Executive under

the Drugs Payment Scheme. The amounts recoverable for dates prior to 01/01/12 are as follows:

s 01/01/09 - 31/12/09 - 100 s 01/01/10 - 31/12/10 - 120 s 01/01/11 - 31/12/11 - 120

Where an individual has been prescribed drugs or medication which are outside the Drugs Payment Scheme these should

be claimed in addition to the 132 monthly threshold. In circumstances where an individual is claiming for another person,

other than their spouse, civil partner or children, that other individuals personal threshold of 132 per month should also be

applied to any amounts of related expenditure.

Income from other sources not subject to PAYE

Income derived from all sources must be declared (e.g. Taxable payments received from the Department of Social

Protection (DSP), Investment/Foreign Income or Foreign Pensions received. Please list details of this income on a separate

sheet).

Year for which you claim

Relief is normally claimed for expenses paid in each tax year (1 January to 31 December). However, you may elect to

claim in respect of expenses incurred in the tax year even though they may be paid later. If you so elect, all amounts

claimed for the year must relate to amounts incurred in the year.

If your subscription year for medical insurance (VHI, Laya Healthcare, Aviva Healthcare, etc.) does not coincide with the tax

year you may submit Form Med 1 for the subscription year. However, claims for subsequent tax years must also be based

on your subscription year.

Calculation of relief

Relief due for Nursing Home fees is granted at your highest rate of Income Tax.

From 01/01/09 relief for all other expenses is granted at the Standard Rate of Income Tax.

Where to send your claim form

Completed claim forms should be sent to your Revenue offce. Use any envelope and write FREEPOST above the

address.

Can I have my claim dealt with in a different Revenue offce for confdentiality reasons?

Yes, if you do not wish your local Revenue offce to know the nature of your medical condition you have the option of having

the claim examined by a Revenue offce other than your local Revenue offce. Please submit your claim in a separate sealed

envelope attaching your request clearly stating that for reasons of confdentiality you wish to have the claim processed in a

different offce. Your local Revenue offce will refer the claim to the appropriate area and advise you of the contact details for

your records. Alternatively, you may call in person to any of Revenues information offces, details available at

www.revenue.ie and request the case be processed in an area other than your local area.

Penalties

Any person who knowingly makes a false statement for the purpose of obtaining a repayment of Income Tax is liable to heavy

penalties.

Tax Refunds

Tax refunds can be paid by transfer to your Irish bank account. It is not possible to make a refund directly to a foreign bank

account.

Time Limit

A claim for tax relief must be made within 4 years after the end of the tax year to which the claim relates.

Further information

Customers can get further information by visiting Revenues website www.revenue.ie or alternatively PAYE customers can

contact their Regional Revenue LoCall Service (within ROI only).

s Border Midlands West Region 1890 777 425 s East & South East Region 1890 444 425

Cavan, Donegal, Galway, Leitrim, Carlow, Kildare, Kilkenny, Laois,

Longford, Louth, Mayo, Monaghan, Meath, Tipperary, Waterford,

Offaly, Roscommon, Sligo, Westmeath Wexford, Wicklow

s Dublin Region 1890 333 425 s South West Region 1890 222 425

Dublin (City and County) Clare, Cork, Kerry, Limerick

Please note that the rates charged for the use of 1890 (LoCall) numbers may vary among different service providers.

If you are calling from outside the Republic of Ireland, please telephone + 353 1 702 3011.

Accessibility - If you are a person with a disability and require this form in an alternative format the Revenue Access Offcer

can be contacted at accessoffcer@revenue.ie

Page 4

You might also like

- Klein (1963) On The Sense of LonelinessDocument7 pagesKlein (1963) On The Sense of LonelinessTyler BishopNo ratings yet

- Anal Fissure Treatment OptionsDocument17 pagesAnal Fissure Treatment OptionsZoe Anna0% (1)

- 4 Step Ho'oponopono Healing ProcessDocument3 pages4 Step Ho'oponopono Healing ProcessHugo F. Garcia ChavarinNo ratings yet

- Dencover ClaimformDocument4 pagesDencover Claimformd763106No ratings yet

- CLAIM FORMDocument2 pagesCLAIM FORMEleftheria AggeleaNo ratings yet

- Laya Claim FormDocument2 pagesLaya Claim FormManolo0% (1)

- Teamster UPS Hardship FormDocument19 pagesTeamster UPS Hardship Formmnharris1550% (2)

- Form MED 1 Health Expenses - Claim ReliefDocument4 pagesForm MED 1 Health Expenses - Claim ReliefAndy O'MahoneyNo ratings yet

- Your SayDocument8 pagesYour SayphpfoxgNo ratings yet

- Reg 2-Primary Care Claim Form-31 Oct 2008Document2 pagesReg 2-Primary Care Claim Form-31 Oct 2008Pradeep KhubchandaniNo ratings yet

- Medical Card GP Visit Card Application FormDocument12 pagesMedical Card GP Visit Card Application FormGeorgiana GattinaNo ratings yet

- Claim Form en Nov 08Document4 pagesClaim Form en Nov 08Juju FernsNo ratings yet

- OVHC Claim Form 102017 PDFDocument3 pagesOVHC Claim Form 102017 PDFtarmudiNo ratings yet

- f10 Claim FormDocument2 pagesf10 Claim Formiceslurpie100% (1)

- US Internal Revenue Service: p502 - 1995Document20 pagesUS Internal Revenue Service: p502 - 1995IRSNo ratings yet

- Alberta Accident Benefits Initial Claims Process: AB-1 (2006/01) Page 1 of 5Document5 pagesAlberta Accident Benefits Initial Claims Process: AB-1 (2006/01) Page 1 of 5Patrick Maguire100% (1)

- Claim FormDocument3 pagesClaim FormInvestor ProtegeNo ratings yet

- Registering As A Dentist With The General Dental Council (Overseas Qualified)Document18 pagesRegistering As A Dentist With The General Dental Council (Overseas Qualified)zahra seraj0% (1)

- GMHP Claim Form - Online PDFDocument4 pagesGMHP Claim Form - Online PDFSalem AmraneNo ratings yet

- Claim Dental Care Expenses 19110ADocument2 pagesClaim Dental Care Expenses 19110Alizita777No ratings yet

- Application For Membership Form: Application No.: Effectivity Date: Contract No.Document2 pagesApplication For Membership Form: Application No.: Effectivity Date: Contract No.Lizeth QuerubinNo ratings yet

- YSA Claim Form (NPC) 11.12.2010Document2 pagesYSA Claim Form (NPC) 11.12.2010Joanna ClarkNo ratings yet

- Disability Advisory Council BookletDocument36 pagesDisability Advisory Council BookletBernewsAdminNo ratings yet

- NTUC Claim FormDocument5 pagesNTUC Claim FormHihiNo ratings yet

- Registering As A Dentist With The General Dental Council (EU/EEA/Switzerland)Document14 pagesRegistering As A Dentist With The General Dental Council (EU/EEA/Switzerland)Georgia SkopelitiNo ratings yet

- How Do You Claim Health ExpensesDocument1 pageHow Do You Claim Health Expensesjanegibney6No ratings yet

- Baroda Health Mediclaim Insurance PolicyDocument13 pagesBaroda Health Mediclaim Insurance Policyabdulyunus_amirNo ratings yet

- I 1040 ScaDocument15 pagesI 1040 Scaapi-173610472No ratings yet

- Put Your LOGO & SLOGAN Here: A. Policyholder - Insured DetailsDocument3 pagesPut Your LOGO & SLOGAN Here: A. Policyholder - Insured DetailsTHÍCH XEM XENo ratings yet

- NOW HEALTH Claim - Form - Uae - RsaDocument2 pagesNOW HEALTH Claim - Form - Uae - RsaWilliam IsaacNo ratings yet

- Claim FormDocument4 pagesClaim Formmuhammad haroonNo ratings yet

- Dentist Registration Form (EU EEA Switzerland)Document12 pagesDentist Registration Form (EU EEA Switzerland)Manuel José RésNo ratings yet

- Understanding My Benefits: Pre - Auth@Document2 pagesUnderstanding My Benefits: Pre - Auth@Jonelle Morris-DawkinsNo ratings yet

- Claim FormDocument2 pagesClaim Formmrraj69No ratings yet

- Frequently Asked Questions: Claims and BenefitsDocument4 pagesFrequently Asked Questions: Claims and BenefitsjaimeelynpNo ratings yet

- AXA Non Death Claim FormDocument4 pagesAXA Non Death Claim FormKenji ChinNo ratings yet

- Laya ClaimDocument2 pagesLaya ClaimManoloNo ratings yet

- Medical Claim Reimbursement Form EnglishDocument2 pagesMedical Claim Reimbursement Form EnglishHananAhmedNo ratings yet

- CLAIM FORM Maternity MEAF RSA 69041 3Document5 pagesCLAIM FORM Maternity MEAF RSA 69041 3Arindam ChangdarNo ratings yet

- Your Policy ExplainedDocument29 pagesYour Policy ExplaineddeonptNo ratings yet

- Supplementary Health Benefits Claim Form: Drug ExpensesDocument2 pagesSupplementary Health Benefits Claim Form: Drug ExpensesKaitlinMSNo ratings yet

- Company Your Policy ExplainedDocument34 pagesCompany Your Policy ExplaineddeonptNo ratings yet

- Claim Form NewDocument4 pagesClaim Form Newparvazahmed03191No ratings yet

- SGP Generic Claim FormDocument5 pagesSGP Generic Claim FormSanny HamdaniNo ratings yet

- Claim Form: Patient's Details - To Be Completed by The Person Undergoing TreatmentDocument4 pagesClaim Form: Patient's Details - To Be Completed by The Person Undergoing Treatmentpier_roNo ratings yet

- Prescription Reimb Claim FormDocument2 pagesPrescription Reimb Claim FormimthedciNo ratings yet

- TCS Helath Insurance - Domiciliary Claim Reimbursement GuidelinesDocument1 pageTCS Helath Insurance - Domiciliary Claim Reimbursement GuidelinesMohd Ahmad RazaNo ratings yet

- Claim FormDocument4 pagesClaim FormRohit UtrejaNo ratings yet

- Use Office OnlyDocument7 pagesUse Office OnlyAdina CiuraruNo ratings yet

- Dental and Vision Enrollment FormDocument3 pagesDental and Vision Enrollment Formsatnam_25No ratings yet

- Star Health Insurance Proposal FormDocument2 pagesStar Health Insurance Proposal FormBhaktha SinghNo ratings yet

- HIS Claim Guide Lines - 0.3Document3 pagesHIS Claim Guide Lines - 0.3Chirag Kumar VegadNo ratings yet

- Important:: CIGNA Group InsuranceDocument2 pagesImportant:: CIGNA Group InsuranceLoganBohannonNo ratings yet

- Cigna TTK Lifestyle Protection Group Policy - Health InsuranceDocument4 pagesCigna TTK Lifestyle Protection Group Policy - Health InsuranceChrissy CattonNo ratings yet

- BCBSTX Halliburton Intl Claim FormDocument2 pagesBCBSTX Halliburton Intl Claim FormLoganBohannonNo ratings yet

- Dentist EEA EU Switzerland FormDocument5 pagesDentist EEA EU Switzerland FormDaniel ColesnicNo ratings yet

- Health Suraksha Claim FormDocument2 pagesHealth Suraksha Claim FormAnna MalaiNo ratings yet

- BIN Claim Form 1611v11 D PDFDocument5 pagesBIN Claim Form 1611v11 D PDFAnonymous BZF0QIjDNo ratings yet

- Medicaid Provider Distribution InstructionsDocument10 pagesMedicaid Provider Distribution InstructionsDiego12001No ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- Cross-Training: The Medical Assistant WorkbookFrom EverandCross-Training: The Medical Assistant WorkbookNo ratings yet

- A Guide for Medical Case Managers: Stop Loss Insurance for Medical ProfessionalsFrom EverandA Guide for Medical Case Managers: Stop Loss Insurance for Medical ProfessionalsNo ratings yet

- CB 1Document16 pagesCB 1api-259279833No ratings yet

- Declaration Form ADocument3 pagesDeclaration Form Aapi-259279833No ratings yet

- Prawo JazdyDocument2 pagesPrawo Jazdyapi-259279833No ratings yet

- Med 2Document2 pagesMed 2api-259279833No ratings yet

- Maternity Benefit FormDocument12 pagesMaternity Benefit Formapi-259279833No ratings yet

- Khalil, 2014Document6 pagesKhalil, 2014Ibro DanNo ratings yet

- EMERGENCY STROKE MANAGEMENT .... Enny Mulyatsih 2019Document47 pagesEMERGENCY STROKE MANAGEMENT .... Enny Mulyatsih 2019IndahNo ratings yet

- Neauvia New CatalogueDocument52 pagesNeauvia New CatalogueCristiana MariaNo ratings yet

- Engleza Oral 2011Document30 pagesEngleza Oral 2011Manuela DrobotăNo ratings yet

- Dental AnesthesiaDocument20 pagesDental AnesthesiaAnonymous gUjimJKNo ratings yet

- ECG Characteristics and Management of Cardiac RhythmsDocument6 pagesECG Characteristics and Management of Cardiac RhythmsJeffrey Viernes100% (1)

- Basic Anaestetic DrugsDocument1 pageBasic Anaestetic DrugsLuthfi AfiatNo ratings yet

- Acute Exacerbation of Congestive Heart Failure: History & ExamDocument76 pagesAcute Exacerbation of Congestive Heart Failure: History & ExamMicija CucuNo ratings yet

- Spineworks Conference 2016 ProlotherapyDocument66 pagesSpineworks Conference 2016 Prolotherapyesma bekirogluNo ratings yet

- Management of Alopecia Areata in ChildrenDocument22 pagesManagement of Alopecia Areata in ChildrenAnita MarakNo ratings yet

- Drug StudyDocument17 pagesDrug StudyChairperson Celine Abaya SiquianNo ratings yet

- Historical Contributions To The Human Toxicology of AtrompineDocument122 pagesHistorical Contributions To The Human Toxicology of AtrompineReid KirbyNo ratings yet

- Individuals Wellness Plan Packages and BenefitsDocument2 pagesIndividuals Wellness Plan Packages and BenefitsTony Peterz KurewaNo ratings yet

- Rotation PlansDocument25 pagesRotation PlansMevelle Laranjo AsuncionNo ratings yet

- Anita Atwal - Nurses Perceptions of Discharge Planning in Acute Health CareDocument9 pagesAnita Atwal - Nurses Perceptions of Discharge Planning in Acute Health CareHaryaman JustisiaNo ratings yet

- Case Presentation 1Document4 pagesCase Presentation 1api-448765847No ratings yet

- Institutionalized ElderlyDocument20 pagesInstitutionalized ElderlySourav DeyNo ratings yet

- Amsino 2018catalog FINAL PDFDocument64 pagesAmsino 2018catalog FINAL PDFIGD RS YARSI JAKARTANo ratings yet

- DR - Nidhi Shah (PT) : Career ObjectivesDocument2 pagesDR - Nidhi Shah (PT) : Career ObjectivesMayank mohantyNo ratings yet

- Jurnal Vitamin CDocument15 pagesJurnal Vitamin CbethjohNo ratings yet

- Home About Us Order Info FAQ Distributors Suppliers Feedback Contact Us View CartDocument5 pagesHome About Us Order Info FAQ Distributors Suppliers Feedback Contact Us View CartdpscribdzoneNo ratings yet

- The Economic Impact of Legalizing MarijuanaDocument36 pagesThe Economic Impact of Legalizing MarijuanaPrateek HerpersadNo ratings yet

- Hypoxia: Symptoms: Its Causes andDocument5 pagesHypoxia: Symptoms: Its Causes andRosihayati100% (1)

- Glasser'S Reality TherapyDocument5 pagesGlasser'S Reality Therapyana9311No ratings yet

- Rotator Cuff BookDocument37 pagesRotator Cuff BookAlexandra DimitrakouNo ratings yet

- Fundamentals of NursingDocument5 pagesFundamentals of NursingKaren Mae Santiago AlcantaraNo ratings yet

- SCDDocument56 pagesSCDdrvbonillaNo ratings yet