Professional Documents

Culture Documents

Break-Even Analysis: Instructions

Uploaded by

Anurag Somani0 ratings0% found this document useful (0 votes)

19 views1 pagebreakeven for honda showroom

Original Title

breakeven

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbreakeven for honda showroom

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 pageBreak-Even Analysis: Instructions

Uploaded by

Anurag Somanibreakeven for honda showroom

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

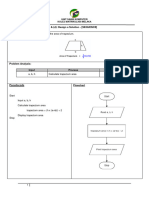

Break-Even Analysis

Enter your company name here

Cost Description Fixed Costs ($) Variable Expenses (%)

Inventory or Materials 0.00 0.0

Direct labor (includes payroll taxes) 0.00 0.0

Other expenses 0.00 0.0

Other expenses 0.00 0.0

Salaries (includes payroll taxes) 200,000.00 0.0

Supplies 0.00 0.0

Repairs & maintenance 5,000.00 0.0

Advertising 50,000.00 0.0

Car, delivery and travel 10,000.00 0.0

Accounting and legal 0.00 0.0

Rent 200,000.00 0.0

Telephone 2,000.00 0.0

Utilities 0.00 0.0

Insurance 0.00 0.0

Taxes (Real estate, etc.) 0.00 0.0

Interest 50,000.00 0.0

Depreciation 0.00 0.0

Other (specify) 0.00 0.0

Other (specify) 0.00 0.0

Miscellaneous expenses 0.00 0.0

Principal portion of debt payment 0.00 0.0

Owner's draw 0.00 0.0

Total Fixed Expenses 517,000.00

Total Variable Expenses 0.0

Breakeven Sales level = 517,000.00

Instructions

Note: You may want to print

this information to use as

reference later. To delete

these instructions, click the

border of this text box and

then press the DELETE key.

Using figures from your

Profit and Loss Projection,

enter expected annual fixed

and variable costs.

Fixed costs are those that

remain the same regardless

of your sales volume. They

are expressed in dollars.

Rent, insurance and real

estate taxes, for example,

are usually fixed.

Variable costs are those

which change as your

volume of business

changes. They are

expressed as a percent of

sales. Inventory, raw

materials and direct

production labor, for

example, are usually

variable costs.

Under the variable expenses

column, use whole numbers

as a percentage, not

decimal numbers. For

example, use 45%, rather

than .45%.

For your business, each

category of expense may

either be fixed or variable,

but not both.

Suggestions

Note: You may want to print this information to use as reference later. To delete

these instructions, click the border of this text box and then press the DELETE

key.

The categories of expense shown above are just suggestions. Change the labels

to reflect your own accounting systems and type of business. Breakeven is a "big

picture" kind of tool; we recommend that you combine expense categories to stay

within the 22 lines that this template allows.

One of the best uses of breakeven analysis is to play with various scenarios. For

instance, if you add another person to the payroll, how many extra sales dollars

will be needed to recover the extra salary expense? If you borrow, how much will

be needed to cover the increased principal and interest payments? Many owners,

especially retailers, like to calculate a daily breakdown. This gives everyone a

target to shoot at for the day.

You might also like

- Break EvenAnalysisDocument1 pageBreak EvenAnalysisr.jeyashankar9550No ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name HereKamrul HasanNo ratings yet

- Break Even Analysis1Document1 pageBreak Even Analysis1JoãoMiguelRamosCorreiaNo ratings yet

- Breakeven Analysis: Enter Your Company Name HereDocument1 pageBreakeven Analysis: Enter Your Company Name Hereiamsudiro7674No ratings yet

- Profit and Loss Statement TemplateDocument8 pagesProfit and Loss Statement TemplateJerarudo BoknoyNo ratings yet

- How To Write A Traditional Business Plan: Step 1Document5 pagesHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanNo ratings yet

- TEMPLATE Financial Projections WorkbookDocument22 pagesTEMPLATE Financial Projections WorkbookFrancois ChampenoisNo ratings yet

- (Input Company Name) Income Statement Projection: RevenueDocument1 page(Input Company Name) Income Statement Projection: RevenueAshimNo ratings yet

- Service CompanyDocument6 pagesService CompanyMaria Crisol OliciaNo ratings yet

- Damodaran's Optimal Capital StructureDocument17 pagesDamodaran's Optimal Capital StructureRajaram IyengarNo ratings yet

- Developing Financial ProjectionsDocument14 pagesDeveloping Financial ProjectionsIngrid AtaydeNo ratings yet

- Annual Profit BudgetDocument4 pagesAnnual Profit BudgetPaul Julius de PioNo ratings yet

- Financial Projections TemplateDocument26 pagesFinancial Projections TemplateTerungwa Joe UjohNo ratings yet

- Financial Projections TemplateDocument31 pagesFinancial Projections TemplateJayesh NairNo ratings yet

- Objective Before You Start Inputs Units Income Inputs: Preliminary Stuff and InputsDocument28 pagesObjective Before You Start Inputs Units Income Inputs: Preliminary Stuff and InputsPhuongwater Le Thanh PhuongNo ratings yet

- Evaluating Your Business Idea: January 6, 2010Document22 pagesEvaluating Your Business Idea: January 6, 2010race egrNo ratings yet

- 12 Month Profit and Loss ProjectionDocument2 pages12 Month Profit and Loss ProjectionPeter JonesNo ratings yet

- Objective Before You Start Inputs Units Income Inputs: Preliminary Stuff and InputsDocument21 pagesObjective Before You Start Inputs Units Income Inputs: Preliminary Stuff and InputsAdigas UdupiNo ratings yet

- Bussines PlanDocument38 pagesBussines Planmicheale gebrehansNo ratings yet

- Cost of Project & Break-Even AnalysisDocument28 pagesCost of Project & Break-Even AnalysisRs rsNo ratings yet

- Jul-13 Company Name Facebook Numbers From Your Base Year Below (In Consistent Units) This Year Last Year ImportantDocument62 pagesJul-13 Company Name Facebook Numbers From Your Base Year Below (In Consistent Units) This Year Last Year ImportantsomilNo ratings yet

- Assignment 1Document11 pagesAssignment 1Hai NinhNo ratings yet

- CapstruDocument28 pagesCapstruRiyan RismayanaNo ratings yet

- Financial Ratio & LeverageDocument25 pagesFinancial Ratio & Leverageankushrasam700No ratings yet

- Preliminary Stuff and InputsDocument17 pagesPreliminary Stuff and InputsMehmet IsbilenNo ratings yet

- Breakeven PointDocument6 pagesBreakeven PointMuhammad Faran KhanNo ratings yet

- Ratio AnalysisDocument32 pagesRatio AnalysisVignesh NarayananNo ratings yet

- Break Even AnalysisDocument14 pagesBreak Even AnalysisBabacar Tall100% (1)

- Terms of Share MarketDocument6 pagesTerms of Share Marketsearchanirban6474No ratings yet

- 12 Month Profit and Loss ProjectionDocument3 pages12 Month Profit and Loss ProjectionBadoiu LiviuNo ratings yet

- Profit and Loss Projection 1yr 0Document1 pageProfit and Loss Projection 1yr 0Suraj RathiNo ratings yet

- 12 Month Profit and Loss ProjectionDocument2 pages12 Month Profit and Loss Projectiontofahmi100% (1)

- Cash Flow ProjectionDocument8 pagesCash Flow ProjectionSuhailNo ratings yet

- SAP SD Pricing FundamentalsDocument14 pagesSAP SD Pricing FundamentalsThiagoHanuschNo ratings yet

- C CC C CCDocument3 pagesC CC C CCTushar BhaipNo ratings yet

- How To Calculate Markup PercentageDocument8 pagesHow To Calculate Markup PercentageGilbert AranaNo ratings yet

- Financial Accounting: Salal Durrani 2020Document12 pagesFinancial Accounting: Salal Durrani 2020Rahat BatoolNo ratings yet

- SBV Financial StatementsDocument17 pagesSBV Financial Statementsbhundofcbm0% (1)

- Neo PriceDocument11 pagesNeo Pricelaxave8817No ratings yet

- J.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2012: Your Complete Guide to a Better Bottom LineNo ratings yet

- Fundamentals of SAP SD PricingDocument13 pagesFundamentals of SAP SD Pricingrajendrakumarsahu100% (3)

- Cost of Goods Sold and Operating ExpensesDocument4 pagesCost of Goods Sold and Operating ExpensesAna Mae CatubesNo ratings yet

- SBV Financial StatementsDocument18 pagesSBV Financial StatementsAmsalu WalelignNo ratings yet

- What Is Cost of Goods SoldDocument19 pagesWhat Is Cost of Goods SoldRanaNo ratings yet

- Will Your Business Start To Make A Profit.: What Is Break-Even?Document12 pagesWill Your Business Start To Make A Profit.: What Is Break-Even?zahida kayaniNo ratings yet

- Bomay Dieng ReportsDocument22 pagesBomay Dieng ReportsR SreenuNo ratings yet

- Weak Leaner ActivityDocument5 pagesWeak Leaner ActivityAshwini shenolkarNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisRacheel SollezaNo ratings yet

- Ultimate Financial ModelDocument36 pagesUltimate Financial ModelTom BookNo ratings yet

- EBITDADocument1 pageEBITDAMenu Harry GandhiNo ratings yet

- Use Financial Terms To Get Management To Take Notice of Your Quality MessageDocument12 pagesUse Financial Terms To Get Management To Take Notice of Your Quality MessageAnahii KampanithaNo ratings yet

- COST-VOLUME-PROFIT RELATIONSHIPS (KEY TERMS & CONCEPTS TO KNOW) (ACC102-Chapter5new PDFDocument21 pagesCOST-VOLUME-PROFIT RELATIONSHIPS (KEY TERMS & CONCEPTS TO KNOW) (ACC102-Chapter5new PDFBarbie GarzaNo ratings yet

- All Ears - Financial - Analysis For QualityDocument10 pagesAll Ears - Financial - Analysis For QualitysamebcNo ratings yet

- New Model 2009 - Frame ConfirmationDocument1 pageNew Model 2009 - Frame ConfirmationAnurag SomaniNo ratings yet

- IIM K SelectionDocument1 pageIIM K SelectionShoutik ChakrabartiNo ratings yet

- Assignment No. 9: Problem Definition: Implementation of Email Security Using PGP/GPG (CreateDocument3 pagesAssignment No. 9: Problem Definition: Implementation of Email Security Using PGP/GPG (CreateAnurag SomaniNo ratings yet

- LOR Final Ext GuideDocument1 pageLOR Final Ext GuideAnurag SomaniNo ratings yet

- Contrast StretchingDocument17 pagesContrast StretchingAnurag SomaniNo ratings yet

- Certificateprjreport 1Document1 pageCertificateprjreport 1Anurag SomaniNo ratings yet

- 1Document1 page1Anurag SomaniNo ratings yet

- Quotation Kanematsu 2401027784Document3 pagesQuotation Kanematsu 2401027784sofianro.sitepuNo ratings yet

- Coca Cola (KO) Financial RatiosDocument4 pagesCoca Cola (KO) Financial RatiosKhmao SrosNo ratings yet

- Difference Between Vertical and Horizontal MarketDocument3 pagesDifference Between Vertical and Horizontal Marketkristoffer_dawisNo ratings yet

- Texas Vehicle Bill of SaleDocument3 pagesTexas Vehicle Bill of SaleDiana ReynaNo ratings yet

- Resume by Shannon Jocson July 2022Document5 pagesResume by Shannon Jocson July 2022Shannon JocsonNo ratings yet

- Additional Funds Needed - Exercises - QuestionsDocument2 pagesAdditional Funds Needed - Exercises - QuestionsDANE MATTHEW PILAPILNo ratings yet

- Ibm NotesDocument183 pagesIbm NotesHarihara PuthiranNo ratings yet

- Projected Profit Rates Feb 2023Document14 pagesProjected Profit Rates Feb 2023adeelNo ratings yet

- Chapter 3 Feasibility PlanningDocument31 pagesChapter 3 Feasibility Planningrathnakotari63% (8)

- Pulman Steel Guide PDFDocument29 pagesPulman Steel Guide PDFNaveenNo ratings yet

- Intel Technology Philippines Inc. v. CIR (2007)Document37 pagesIntel Technology Philippines Inc. v. CIR (2007)Ramon EldonoNo ratings yet

- Microsoft Buys SkypeDocument3 pagesMicrosoft Buys SkypePuffyTeddyNo ratings yet

- Exercise Workbook 26Document41 pagesExercise Workbook 26RuzuiNo ratings yet

- Place of Receipt (收货地) Port Of Discharge (卸货港) Place of Delivery (目的港)Document1 pagePlace of Receipt (收货地) Port Of Discharge (卸货港) Place of Delivery (目的港)Cambridge PakistanNo ratings yet

- Cau Hoi Unit1Document3 pagesCau Hoi Unit1Hiền HiềnNo ratings yet

- PCG Credential Ver2.0 - GeneralDocument26 pagesPCG Credential Ver2.0 - GeneralDimas CindarbumiNo ratings yet

- Letter of TransmittalDocument8 pagesLetter of TransmittalAsif Rajian Khan AponNo ratings yet

- Youtube: The Answer Is YoutubeDocument1 pageYoutube: The Answer Is YoutubenisaNo ratings yet

- Answers Chapter 5 Quiz.s13Document3 pagesAnswers Chapter 5 Quiz.s13Aurcus JumskieNo ratings yet

- Soa 102021Document2 pagesSoa 102021Jethro VillahermosaNo ratings yet

- Airport Master PlanningDocument2 pagesAirport Master PlanningSumera RehanNo ratings yet

- P9-1 Polly and Subsidiaries: Sea's BooksDocument9 pagesP9-1 Polly and Subsidiaries: Sea's BooksFarrell DmNo ratings yet

- ABCR2103 Principles of Corporate Communication - Emay23 (CS)Document183 pagesABCR2103 Principles of Corporate Communication - Emay23 (CS)Joanne IsabellNo ratings yet

- Role of HRM in Corporate Social ResponsibilityDocument23 pagesRole of HRM in Corporate Social ResponsibilityAanshi PriyaNo ratings yet

- Management CH 1 Part 1 - Ahmed Yehia - ' Cairo University FCES (Cairo & Zayed) MKTBT NouR - Studocu 2Document1 pageManagement CH 1 Part 1 - Ahmed Yehia - ' Cairo University FCES (Cairo & Zayed) MKTBT NouR - Studocu 2Ahmed FawzyNo ratings yet

- 2 1 B & D TUTORIAL QUESTION Design A Solution ANSWER SCHEMEDocument45 pages2 1 B & D TUTORIAL QUESTION Design A Solution ANSWER SCHEME2022461692No ratings yet

- Issue Priority MatrixDocument1 pageIssue Priority MatrixGaurav Sharma0% (1)

- Quiz - Chapter 1 - Overview of Government AccountingDocument2 pagesQuiz - Chapter 1 - Overview of Government AccountingRoselyn Mangaron SagcalNo ratings yet

- Perhaps The Has Already Been Born.: Real India'Document210 pagesPerhaps The Has Already Been Born.: Real India'SudhanshuNo ratings yet

- New Heritage Doll - SolutionDocument4 pagesNew Heritage Doll - Solutionrath347775% (4)