Professional Documents

Culture Documents

Half-Year Results 2014

Uploaded by

IcadeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Half-Year Results 2014

Uploaded by

IcadeCopyright:

Available Formats

Half-year results

2014

July 24

th

, 2014

Future Veolia head office (Aubervilliers, 93)

2

This presentation is not an offer or a request for an offer to sell or exchange securities,

or a recommendation to subscribe, buy or sell Icade securities. Distribution of this document may be limited

in certain countries by legislation or regulations.

As a result, any person who comes into possession of this document is required to familiarise themselves

and comply with such restrictions. To the extent permitted by the applicable laws, Icade excludes all liability

and makes no representation regarding the violation of any such restrictions by any person whatsoever.

July 24

th

, 2014 Half-year results 2014

Disclaimer

3

1. Resilient results

2. Pro-active management of liabilities

3. A unique property investment company

4. Useful diversification

5. Outlook

Appendices

July 24

th

, 2014 Half-year results 2014

Contents

1. Resilient results

Future Veolia head office (Aubervilliers, 93)

5 July 24

th

, 2014 Half-year results 2014

Resilient results in a market that remains under pressure

1. RESILIENT RESULTS

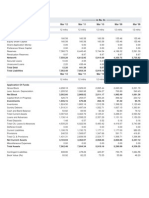

(m)

30/06/2013

a

30/06/2014 Change

Rental income 187 275 +47.0%

EBITDA 158 228 +44.4%

Profit on disposals 39 2 (93.9)%

Operating profit 95 90 (4.8)%

Net financial items -(54) (82) (51.0)%

Profit from other activities 16 12 (27.8)%

Net profit (Group share) 45 6 (87.4)%

EPRA Earnings from Property Investment 82 130

+58.3%

EPRA Earnings from Property Investment per share

1.58 1.76

+11.1%

Net current cash flow

b

100 147

+46.4%

Net current cash flow per share

b

1.94 1.99

+2.8%

EPRA NNNAV

c

5,704 5,419 (5.0)%

EPRA NNNAV per share

c

77.3 73.2 (5.3)%

LTV

c

37.5% 40.3% +2.8pt

a

Restated in accordance with the application from 1 January 2014

of the new IFRS 11 standard relating to joint-venture partnerships

b

Adjusted for Icade Sant minority interests

c

Data at 31 December for 2013

6 6

187

275

+97

(10)

+1

0

July 24

th

, 2014 Half-year results 2014

Growth in rental income: +47%

Acquisition of Silic: +89m

Other acquisitions (incl. clinics): +8m

Asset disposals: -10m

Indexation: +1m (0.4% on average)

Like-for-like growth: +0.2%

Improvement in net rental rate: +3.0pt

Net rental rate: 90.6%

Effect of acquisition of Silic

1. RESILIENT RESULTS

Growth in rental income

Like-for-like

+0.2%

Change in the scope of consolidation

+47%

30/06/2013 Acquisitions Disposals

& restructuring

Indexing Rental

activity

30/06/2014

7 July 24

th

, 2014 Half-year results 2014

Positioning in phase with demand

In the most promising areas (inner Paris rim)

In resilient areas (La Dfense)

Targeting major clients

Veolia

French Ministry of Justice

KPMG

Asset management teams with the ability

to tackle vacancies

Vacancy rates in line with, or below, the market average

Pro-active marketing strategy applied to former Silic parks

Alternative strategies to deal with structural vacancy

Disposals

Conversion to housing

1. RESILIENT RESULTS

Key strengths to withstand market

conditions

Trends in takeup

102

32

143

191

62

180

H1 2013 H1 2014

Vacancy rate

12.0%

9.5%

17.6%

12.8%

7.5%

Sources: MBE Conseil / Immostat

La Dfense &

surrounding area

Paris inner rimh

North

Paris outer rim

+87%

+97%

+26%

La Dfense

& surrounding area

Paris inner rim

North

Paris outer rim

South

Market vacancy rate

Icade vacancy rate (excl. EQHO)

14.7%

8 8 July 24

th

, 2014 Half-year results 2014

Major contracts in 1

st

half 2014

1. RESILIENT RESULTS

Notable commercial successes

94

leases

67,500m

14m

in rental

income

Additions / losses

+5

years

9m

in rental

income

41,400m

28

leases

Renewals

EQHO (La Dfense, 92)

40,500m

KPMG

Tour Initiale (La Dfense, 92)

5,600m

Tarkett

Saint-Quentin Fallavier Warehouse (38)

6,500m

Findis

Millnaire 2 (Paris, 75)

2,500m

Agence Rgionale de Sant

Europen (Evry, 91)

2,500m

La Direccte

+28m

in rental

income

+85,500m

+50

leases

9 July 24

th

, 2014 Half-year results 2014

1. RESILIENT RESULTS

Change in EPRA Earnings from Property Investment

(/share)

1.58

1.76

+0.01

+0.03

+0.09

+0.04

30/06/2013 Property Investment Operating property

depreciation

Financial result Income tax 30/06/2014

+11.1%

10 July 24

th

, 2014 Half-year results 2014

1. RESILIENT RESULTS

1.94

1.99

+0.01

(0.16) (0.03)

+0.02

+0.10

+0.11

30/06/2013 Property

Investment

Property

Development

Services Inter-division Financial

result

Income tax 30/06/2014

+2.8%

a

Adjusted for Icade Sant minority interests

Change in net current cash flow

a

(/share)

11 July 24

th

, 2014 Half-year results 2014

Change in EPRA NNNAV

(/share)

1. RESILIENT RESULTS

77.3

(3.7)

+0.1

+0.4

+0.1

(0.9)

(0.1)

31/12/2013 Dividend 2014 Consolidated

net income

Change

in unrealised gains

on property assets

Change

in unrealised gains

on property development

and services

Change

in fair value

of derivatives and

fixed-rate debt

Other 30/06/2014

73.2

12 July 24

th

, 2014 Half-year results 2014

Change in yields

1. RESILIENT RESULTS

a

Impact on appraisal value of revision of capitalisation and discount rates applied by property appraisers

b

Impact on appraisal value of revised assumptions in building business plans (e.g. rent index, lease renegotiation, adjustment of market rental value, change in vacancy rate, change in construction plans and unbillable expenses, etc.)

c

Annualised net rent from rented space plus potential net rent from vacant space at market rental value, divided by appraisal value excluding transfer duties of rentable space

d

Icade Sant share

Appraisal value (excluding transfer duties)

on a like-for-like basis

Average yield

(excluding transfer duties)

c

30/06/2014 Change in H1

of which

discount rate

effect

a

of which

business

plan effect

b

30/06/2014 Change in H1

Offices, France 3,526 (1.5)% (1.2)% (0.3)% 7.1% +12bp

Business parks 4,062 (0.4)% +0.8% (1.2)% 8.0% +14bp

Total Strategic 7,588 (0.9)% (0.1)% (0.8)% 7.5% +13bp

Healthcare

d

1,114 (0.4)% +0.2% (0.6)% 6.9% +4bp

Non-strategic 168 (4.2)% (0.6)% (3.6)% 10.2% +126bp

Commercial property 8,870 (0.9)% (0.1)% (0.8)% 7.5% +11bp

2. Pro-active management

of liabilities

Vert & O (Aubervilliers, 93)

14 July 24

th

, 2014 Half-year results 2014

Optimised debt

2. PRO-ACTIVE MANAGEMENT OF LIABILITIES

Reduction in average cost Longer average term

4.1%

3.8%

3.8% 3.8%

3.3%

30/06/2012 31/12/2012 30/06/2013 31/12/2013 30/06/2014

3.6

4.3

4.3

4.6

4.6

30/06/2012 31/12/2012 30/06/2013 31/12/2013 30/06/2014

Anticipated

reduction by

40-60bp

a

Loan to value = (Net debt including fair value of derivatives) / (Portfolio value excluding transfer taxes + Value of Service and Development companies)

b

Bank covenant limit

c

Restated in accordance with IFRS 11

d

Interest Coverage Ratio = EBITDA (operating profit adjusted

for depreciation) / Cost of net debt

LTV in line with guidance

a

Solid ICR

d

37.0% 36.7%

36.2%

37.5%

c

40.3%

30/06/2012 31/12/2012 30/06/2013 31/12/2013 30/06/2014

4.5x

3.5x

3.3x

4.0x

c

3.6x

30/06/2012 31/12/2012 30/06/2013 31/12/2013 30/06/2014

2.0

b

52.0%

b

15

591

440

546 543

378

576

124

650

787

118

H2 2014 2015 2016 2017 2018 2019 2020 2021 2022 and

beyond

Debts

Ornane

July 24

th

, 2014 Half-year results 2014

Secure and stable resources

2. PRO-ACTIVE MANAGEMENT OF LIABILITIES

a

Excluding debt relating to equity investments and bank overdraft facilities

b

Debts including bank loans, finance leases, mortgage loans, bonds

and private placements

Drawn debt maturity schedule

a

(m)

b

Undrawn facilities

1,280m

Cash

700m

Hedging ratio

93%

16 July 24

th

, 2014 Half-year results 2014

Increasing diversification

2. PRO-ACTIVE MANAGEMENT OF LIABILITIES

a

Including 200m secured private placement

30/06/2014

Corporate loans

and finance leases

50.0%

2010

Mortgage

loans

12.9%

Bonds

30.0%

Private placements

a

6.1%

Other liabilities

1.0%

Corporate loans

and finance leases

83.3%

Mortgage

loans

14.2%

Other liabilities

2.5%

Total debt as at 30/06/2014

4,792m

3. A unique property

investment company

Monet (Saint-Denis, 93)

18 July 24

th

, 2014 Half-year results 2014

Generating recurring cash flow,

secured over the long term

3. A UNIQUE PROPERTY INVESTMENT COMPANY

OFFICES

LIQUID ASSETS

GENERATING

SECURE REVENUE

BUSINESS PARKS

ASSETS WITH

VERY SIGNIFICANT POTENTIAL

FOR VALUE CREATION

CASH FLOW

RECURRENT

AND SECURE

OVER THE LONG TERM

19 July 24

th

, 2014 Half-year results 2014

3. A UNIQUE PROPERTY INVESTMENT COMPANY

Management tailored to each segment

Business parks

Substantial land

reserves providing

a reservoir of value

creation for the long

term: increase in

commercial property,

density and

diversification

Offices

Maximising asset

value through

dynamic asset

management and

medium-term asset

turnover

Healthcare

Leader in an

attractive sector

Non-strategic

Non-strategic assets

due to be sold

gradually (housing,

retail, warehouses)

20 July 24

th

, 2014 Half-year results 2014

A refocused portfolio

3. A UNIQUE PROPERTY INVESTMENT COMPANY

Total portfolio value at 30/06/2014

9,044m (Group share)

Alternative

12%

Non-strategic

4%

Paris

Inner rim

22%

La Dfense &

surrounding area

26%

French provinces

1%

Paris

Outer rim

23%

Other western

crescent

12%

Paris

16%

Strategic

84%

20

21 21 July 24

th

, 2014 Half-year results 2014

Warehouses, office and retail property

a shopping centre in Montpellier

land at the Portes de Paris business park

Offices, Germany

2 office buildings in Munich and Hamburg

2 parcels of land in Berlin

Residential

48 individual units sold

3. A UNIQUE PROPERTY INVESTMENT COMPANY

Active rotation of the portfolio

MILLNAIRE 5&6 (Paris 19

e

)

Acquisition of 50% of the offices owned by Klepierre

38m acquisition in January 2014013

MILLNAIRE 3 (Paris 19

e

)

Completion of 32,000 m expected in 2015,

fully let to the Ministry of Justice

27m of investment in H1 2014

HEALTHCARE

Acquisition of 3 clinics from the Mdiple Sud Sant Group

for 71m

Signature of agreement with Capio to acquire a further

7 clinics

SISLEY (Saint-Denis, 93)

Completion in April 2014

11m of investment in H1 2014

Disposals: 153m Investments: 257m

TGV stations

Existing

Proposed

Launch date

of Grand Paris Express

Airport

Before 2030

Beyond 2030

PARIS - SAINT-DENIS - AUBERVILLIERS

PARIS - LA DFENSE - NANTERRE

ROISSY - PARIS NORD 2

PARIS ORLY - RUNGIS

Icades portfolio

in the Paris region

Business parks Offices

July 24

th

, 2014 Half-year results 2014

3. A UNIQUE PROPERTY INVESTMENT COMPANY

A key positioning in Grand Paris

22

July 24

th

, 2014 Half-year results 2014

3. A UNIQUE PROPERTY INVESTMENT COMPANY

A well-served portfolio

23

PARIS - SAINT-DENIS - AUBERVILLIERS

PARIS - ORLY - RUNGIS

4. Useful diversification

Le Garance (Paris 20

e

)

July 24

th

, 2014 Half-year results 2014

Working with Frances major cities

4. USEFUL DIVERSIFICATION

25

Le Garance (Paris 20

e

)

Offices, creche and college

Space: 30,000m

2

Architects: Brigitte Mtra et associs

Lyon Confluence (lot A3)

Housing, offices and retail property

Space: 26,400m

Architects: Herzog & de Meuron /

Atelier AFAA

Les Docks de Strasbourg

Mixed commercial and residential

development (45 eco-active homes),

restaurants, spaces dedicated to

education, art and culture

Space: Net usable floor area of 11,600m

Architects: Georges Heint /

Anne-Sophie Kehr

26 July 24

th

, 2014 Half-year results 2014

Stability in profits from other activities

4. USEFUL DIVERSIFICATION

Property Development

Services Inter-division TOTAL

(m) 30/06/2013

a

30/06/2014 30/06/2013 30/06/2014 30/06/2013

a

30/06/2014 30/06/2013 30/06/2014

Revenues 425 465 23 21 (14) (10) 434 476

EBITDA 14 16 1 (1) (2) 0 13 15

EBITDA margin (EBITDA/revenue)

3.4% 3.5% 3.0% (5.1)% 15.0% 2.1% 3.0% 3.1%

Operating profit 25 23 0 (1) 0 (3) 25 18

Net financial items 1 2 0 0 0 0 1 2

Tax (10) (9) 0 0 0 0 (10) (9)

Net profit 16 15 0 (1) 0 (3) 16 12

Enterprise value

b

484 529 37 39 n.a. n.a. 520 568

a

Restated in accordance with the application from 1 January 2014

of the new IFRS 11 standard relating to joint-venture partnerships

b

Inclusive of enterprise value of subsidiaries accounted for

on an equity basis

27

62 establishments / 2.0bn excl. transfer taxes

9 operators-partners

In progress: +7 Capio Sant clinics

July 24

th

, 2014 Half-year results 2014

4. USEFUL DIVERSIFICATION

Icade Sant: controlled risks

Breakdown by operator

(% of total portfolio value)

26.9%

Mdi-Partenaires

+ Mdiple Sud Sant

29.6%

Gnrale

de Sant

+ Ramsay

Vedici

28.7%

6 regional

groups

14.8%

a

MSO: Medicine, surgery, obstetrics

b

FRC: Follow-up and rehabilitation care

c

MHE: Mental health establishment

49 MSO clinics

a

13 FRC

b

and MHE

c

7 clinics currently being acquired

(Capio)

28 July 24

th

, 2014 Half-year results 2014

Diversification generating dynamic

and secure cash flow

Long leases: residual maturity as at 30 June 2014 of nearly 9 years

Triple net indexed rents

Net current cash flow: +12%

Attractive yields

Average yield of 6.9%

a

Multiple options for financing development

Further capital increases

Partnership

Initial Public Offering

4. USEFUL DIVERSIFICATION

Icade Sant: a clear leader

a

Annualised net rent from rented space plus potential net rent from vacant space at market rental value,

divided by appraisal value excluding transfer duties of rentable space

Source: Jones Lang LaSalle Expertises

Recurrent

annualised

rental income

19

45

56

86

114

130

135

536

661

829

1,317

1,725

1,887

1,971

2008 2009 2010 2011 2012 2013 H1 2014

Portfolio

value

(m) 30/06/2013 31/12/2013 30/06/2014

Net rental income 58.9 122.4 64.8

EBITDA 55.4 115.0 60.9

Operating profit 28.9 60.5 32.7

Net current cash flow 44.6 92.7 49.9

Asset value 1,844.9 1,886.8 1,971.4

Net debt 684.8 676.1 781.2

NAV 1,151.0 1,205.7 1,182.6

LTV 37.2% 35.9% 39.6%

5. Outlook

Nanterre Prfecture (92)

30

435m of investment

141,000 m, of which 90% pre-let

July 24

th

, 2014 Half-year results 2014

5. OUTLOOK

A value-creating secured pipeline

269

118

49

2014 2015 2016

2014

2015

2016

BRAHMS

(Colombes, 92)

8,700m

Main tenant: Alcatel

Rent: 2.6m

Lease term: 9 years

Yield: 8.2%

SISLEY

(Saint-Denis, 93)

18,700m

Main tenant: Siemens

Rent: 6.4m

Lease term: 9 years

Yield: 6.8%

QUBEC

(Rungis, 94)

12,000m

Rent: 3.4m

Yield: 7.2%

MONET

(Saint-Denis, 93)

20,600m

Main tenant: SNCF

Rent: 6.3m

Lease term: 9 years

Yield: 7.1%

MILLNAIRE 3

(Paris 19

e

)

32,000m

Main tenant: Ministry

of Justice

Rent: 11.6m

Lease term: 12 years

Yield: 7.7%

VEOLIA

(Aubervilliers, 93)

45,000m

Main tenant: Veolia

Rent: 16.5m

Lease term: 9 years

Yield: 7.4%

31 July 24

th

, 2014 Half-year results 2014

An additional pipeline primed for economic recovery

5. OUTLOOK

a

Total amount of works excluding land costs

6 projects in hand

186,000 m

680m

a

of investment

Project launches seeing satisfactory

pre-marketing conditions

LOT E (Saint-Denis, 93)

28,300m

Rent: 9.1m

Completion: 30 months

after launch

MILLNAIRE 4 (Paris 19

e

)

24,600m

Rent: 8.7m

Completion: 24 months

after launch

CAMPUS DFENSE (Nanterre, 92)

79,200m

Rent: 29.1m

Completion: 36 months

after launch

OTTAWA (Rungis, 94)

14,000m

Rent: 3.9m

Completion: 24 months

after launch

VANCOUVER (Rungis, 94)

7,000m

Rent: 1.6m

Completion: 17 months

after launch

VAUBAN (Rungis, 94)

33,000m

Rent: 7.6m

Completion: 34 months

after launch

32

3.5

4.0

5.2

(0.1)

+0.3

+0.1

+0.2

+0.8

(0.1)

+0.5

Estimated EPRA

Earnings

31/12/2014

Disposals

under

contract

Projects launched

and pre-let

Clinics

(acquisitions

under contract)

Additional

secured rents

(Tour EQHO,

Tour Initiale)

Secured EPRA

Earnings

Rental

optimisation

Disposal of

non-strategic

assets

Non-committed

projects

Potential EPRA

Earnings

July 24

th

, 2014 Half-year results 2014

Potential change in EPRA Earnings from Property Investment

over 5 years

5. OUTLOOK

a

b

a

Corresponds to potential rental income from vacant space as at 30 June 2014

plus vacancy cost (recovery of expenses)

b

Corresponds to the following projects: lot E, Millnaire 4, Qubec,

Campus Dfense, Vauban, Ottawa, Vancouver

per share

33 July 24

th

, 2014 Half-year results 2014

5. OUTLOOK

Priority: Energy and carbon footprints

Signature of the Pelletier Charter for

Sustainable Building and participation

in market reporting

Introduction of a methodology for monitoring

regulated green leases

and extension to certified buildings

Systematic environmental certification of

all new buildings: at least HQE Excellent

Continuing to build Icades expertise in

renovation of commercial property targeting

the highest levels of certification

and labelling

Reduction in consumption

in the major commercial

buildings owned by Icade

through to 2020

Reduction in greenhouse gases

linked to operational energy use

on the basis of 2011

emissions

CONTINUATION OF ENVIRONMENTAL

CERTIFICATION PROCESS

8

8

,

0

0

0

1

8

7

,

0

0

0

2

1

8

,

0

0

0

2

3

8

,

0

0

0

3

8

8

,

4

9

7

4

3

0

,

4

9

7

4

8

4

,

2

6

3

5

8

3

,

3

9

6

2009 2010 2011 2012 2013 2014e 2015e 2016e

Floor space of HQE certified

assets

(m

2

)

EQHO

80,000 m

START

30,000 m

BEAUVAISIS

a

14,000 m

and

a

First BBC Rnovation certified building in Paris

and

LONG-TERM

PUBLIC COMMITMENTS

2%

per m

2

/year

18%

relative to

2011

3%

/year

1/4

of emissions

by 2020

STRONG MANAGEMENT ACTION

TO REDUCE ENERGY & CARBON

FOOTPRINTS IN THE SHORT TERM

34

5. OUTLOOK

Priority: sustainable city

July 24

th

, 2014 Half-year results 2014

Veolia Environnement HQ, is one of the five

pilot companies for the testing and

development of the proposed Biodivercity

label

Experimental research with Ecole Normale

Suprieure into urban green roofs

Progress plan based on 4 key challenges

relating to the CDC Energy and Ecology

Transition programme

The diversity of Icades residential clients

shows a very balanced view of the city.

These figures confirm its position as

a unique operator in France promoting

sustainable cities and social diversity

CONNECTED BUILDINGS

Production of a sustainability assessment

tool for urban projects looking

at planning/mobility integration

Creation of an information platform

for business park accessibility

Car-sharing and electric vehicles

in residential projects

Arbitrage of development and land projects

using a connectivity indicator

GREATER FUNCTIONAL

AND SOCIAL MIXITY

COMMITMENT TO

BIODIVERSITY

ECO-MOBILITE effinergie

Type of client 2013

Tax-efficient investment 21%

Social housing 25%

First-time buyers 30%

Second-time buyers 8%

Investment without tax breaks 12%

Other 4%

Total 100%

35

Maintenance of 2014 guidance of consolidation in EPRA Earnings from Property Investment per share,

thanks to:

increased marketing efforts across the entire portfolio in order to bring the financial occupancy rate above 90%

the development of major projects at business parks under secure conditions allowing for improvement in cash flow

control of operating expenses, primarily as a result of cost synergies from the merger with Silic

maintaining the LTV ratio at around 40% and further reduction in the average cost of debt by means of increased financial

disintermediation

As of 2015, Icade should see significant improvement in EPRA Earnings from Property Investment thanks

to the full letting of EQHO and the completion of secure development projects (Monet and Millnaire 3

due to be completed in 2015, Veolia in 2016)

July 24

th

, 2014 Half-year results 2014

5. OUTLOOK

Guidance

Q&A

Appendices

Les Closbilles (Cergy, 95)

38 July 24

th

, 2014 Half-year results 2014

Calculation of EPRA Earnings from Property Investment

APPENDICES

(m)

30/06/2013 30/06/2014 Change

Net profit 52 16 (70)%

Profit from other activities (16) (12) (28)%

Profit from property income (a) 36 4 (89)%

Change in value of investment property and depreciation (96) (129) +35%

Gains on disposals of fixed assets 36 (4) (111)%

Tax on profits relating to disposals and impairment losses 1 0 NA

Change in fair value of financial instruments 2 (10) NA

Adjustments for affiliates (6) (3) (47)%

Minority interests (Icade Sant) 17 22 +25%

Total restatements (b) (46) (126) +174%

EPRA Earnings from Property Investment (a b) 82 130 +58%

EPRA Earnings from Property Investment (/share) 1.58 1.76 +1%

39 July 24

th

, 2014 Half-year results 2014

EPRA Net Asset Value

APPENDICES

(Group share, in m)

30/06/2013 31/12/2013 30/06/2014

Change over

6 months

(%)

Change over

one year

(%)

EPRA NAV 4,226 5,822 5,610 (3.6)% +32.7%

EPRA NNNAV 4,079 5,703 5,419 (5.0)% +32.8%

Number of shares, fully diluted (million) 51.7 73.8 74.0

EPRA NAV per share 81.7 78.9 75.8 (3.9)% (7.3)%

EPRA NNNAV per share 78.9 77.3 73.2 (5.3)% (7.2)%

40 July 24

th

, 2014 Half-year results 2014

EPRA NNNAV

APPENDICES

(m)

(12) (15) (16)

2,547

4,168

3,850

1,500

1,492

1,521

44

58

64

30/06/13 31/12/13 30/06/14

Unrealised gains on property assets

net of transfer duties

Unrealised gains

on Property Development / Services

Shareholders equity

(+FMV of debt

and impact of dilution)

Tax on property assets

and companies

5,703

or 77.3 per share

4,079

or 78.9 per share

5,419

or 73.2 per share

41 July 24

th

, 2014 Half-year results 2014

Income statement by asset type

a

APPENDICES

Strategic

assets

Alternative

assets

Non-strategic

assets

Other

(Head office costs,

intra-group items) TOTAL

(m, share of total) June 2013 June 2014 June 2013 June 2014 June 2013 June 2014 June 2013 June 2014 June 2013 June 2014

Rental income 103 193 60 66 27 19 (3) (3) 187 275

Net rental income 90 174 59 65 18 13 (3) (2) 164 249

Rental margin 87.0% 90.0% 98.8% 98.9% 66.9% 65.9% NA NA 87.6% 90.6%

EBITDA 84 161 55 61 17 11 2 (4) 158 228

Operating profit 17 61 29 33 48 3 0 (6) 95 90

a

Restated in accordance with the application from 1 January 2014

of the new IFRS 11 standard relating to joint-venture partnerships

42 July 24

th

, 2014 Half-year results 2014

Portfolio indicators

APPENDICES

Figures at

30 June 2014

a

Portfolio

value

excluding

transfer duties

(m)

Rentable space

(m)

EPRA vacancy

rate

(%)

IFRS rental

income,

annualised

(m)

Remaining

committed

lease

term

(years)

Offices, France 3,526 592,609 14.9%

b

180.3

4.6

Business parks 4,062 1,468,789 13.4% 222.3 3.1

Total Strategic 7,588 2,061,398 14.1% 402.6 3.8

Alternative

a

1,114 507,867 0.0% 76.4 8.8

Non-strategic 168 320,176 4.0% 15.1 5.9

COMMERCIAL PROPERTY 8,870 2,889,440 11.9% 494.2 4.6

a

Icade Sant share

b

Adjusted for lettings at Tour EQHO and Tour Initiale, the EPRA vacancy rate is 7.5%

for offices in France

43 July 24

th

, 2014 Half-year results 2014

Yield

a

APPENDICES

a

Annualised net rent from rented space plus potential net rent from vacant space

at market rental value, divided by appraisal value excluding transfer duties of rentable space

6

.

8

%

7

.

7

%

6

.

9

%

8

.

0

%

7

.

3

%

6

.

8

%

7

.

3

%

6

.

8

%

8

.

2

%

7

.

1

%

6

.

7

%

7

.

6

%

6

.

9

%

9

.

0

%

7

.

3

%

6

.

8

%

7

.

6

%

6

.

9

%

8

.

1

%

7

.

2

%

6

.

9

%

7

.

9

%

6

.

9

%

8

.

9

%

7

.

4

%

7

.

1

%

8

.

0

%

6

.

9

%

1

0

.

2

%

7

.

5

%

Offices, France Business parks Healthcare Non-strategic commercial TOTAL COMMERCIAL

PROPERTY

31/12/2010 31/12/2011 31/12/2012 30/06/2013 31/12/2013 30/06/2014

44 July 24

th

, 2014 Half-year results 2014

French commercial property market

APPENDICES

a

Source: CBRE

b

Source: Banque de France

0

5

10

15

20

25

30

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

H1 H2

15.5

10.7

0%

1%

2%

3%

4%

5%

6%

7%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 H1

2014

Yield on "prime" Paris CBD offices

OAT TEC 10

4.00%

0.21%

1.63%

699

467

294

200

400

600

800

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 H1 2014

PrimeParis Centre West PrimeLa Dfense Average Greater Paris

Commercial property commitments

in France by half-year period

a

(bn)

Rental values in the Paris region

between 2000 and H1 2013

a

/ m / year, excluding VAT and charges

Comparison of yields (at end of period)

b

Vacancy rates in the Paris region

a

30/06/2013 30/06/2014

West Central Paris 5.6% 5.6%

South Paris 3.3% 3.9%

Northeast Paris 3.6% 4.1%

Paris average 4.5% 4.8%

La Dfense 7.6% 12.1%

Western Crescent 11.5% 11.8%

Inner rim, North 10.3% 9.4%

Inner rim, East 7.5% 7.6%

Inner rim, South 7.9% 9.4%

Outer rim 5.5% 5.4%

Total Paris region 6.7% 7.0%

45 July 24

th

, 2014 Half-year results 2014

Residential Property Development market

APPENDICES

459

512

460

555

435

697

463

359

458

326

355

H1 2009 H2 2009 H1 2010 H2 2010 H1 2011 H2 2011 H1 2012 H2 2012 H1 2013 H2 2013 H1 2014

650

811

1,028

1,082

1,012

909

31/12/2009 31/12/2010 31/12/2011 31/12/2012 31/12/2013 30/06/2014

9.2%

13.4%

12.7%

7.8%

6.6%

6.1%

31/12/2009 31/12/2010 31/12/2011 31/12/2012 31/12/2013 30/06/2014

40

33

16

21 21

22

31/12/2009 31/12/2010 31/12/2011 31/12/2012 31/12/2013 30/06/2014

(22.4)%

(10.1)%

(7.6)%

+6.2%

Most residential developments have NF Logement and BBC certification

Housing reservations - Value

(m)

Backlog

(m)

Disposal rate of marketable stock Unsold homes value

(m)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- PR - Icade Santé Purchased The Buildings of 7 Clinis Held by Capio SantéDocument1 pagePR - Icade Santé Purchased The Buildings of 7 Clinis Held by Capio SantéIcadeNo ratings yet

- PR - Icade Will Build The New TGV Station in MontpellierDocument2 pagesPR - Icade Will Build The New TGV Station in MontpellierIcadeNo ratings yet

- PR - Icade Signs Lease With The French Ministry of The InteriorDocument1 pagePR - Icade Signs Lease With The French Ministry of The InteriorIcadeNo ratings yet

- PR - Icade Signs A Substantial Lease Agreement On EQHODocument1 pagePR - Icade Signs A Substantial Lease Agreement On EQHOIcadeNo ratings yet

- PR - 2014 Half-Year Results Resilient Cash-Flows in A Still-Strained MarketDocument11 pagesPR - 2014 Half-Year Results Resilient Cash-Flows in A Still-Strained MarketIcadeNo ratings yet

- PR - Icade - Bond - Issue - VUKDocument1 pagePR - Icade - Bond - Issue - VUKIcadeNo ratings yet

- PR - Icade Santé Wins The Tender Bid Launched by Capio SantéDocument1 pagePR - Icade Santé Wins The Tender Bid Launched by Capio SantéIcadeNo ratings yet

- Half Year Financial Report - June 2014Document84 pagesHalf Year Financial Report - June 2014IcadeNo ratings yet

- PR - Icade Takes A Significant Step Towards Complete Withdrawal From GermanyDocument1 pagePR - Icade Takes A Significant Step Towards Complete Withdrawal From GermanyIcadeNo ratings yet

- PR - Icade Santé Acquires 3 ClinicsDocument1 pagePR - Icade Santé Acquires 3 ClinicsIcadeNo ratings yet

- PR - Icade - Q1 - 2014 ActivityDocument9 pagesPR - Icade - Q1 - 2014 ActivityIcadeNo ratings yet

- PR - EQHO: Icade and KPMG Sign A LeaseDocument1 pagePR - EQHO: Icade and KPMG Sign A LeaseIcadeNo ratings yet

- Icade Annual Report - Reference Document 2012Document368 pagesIcade Annual Report - Reference Document 2012IcadeNo ratings yet

- PR - Livraison - Parc - Zoologique - ParisDocument2 pagesPR - Livraison - Parc - Zoologique - ParisIcadeNo ratings yet

- PR - Résultats Annuels 2013Document54 pagesPR - Résultats Annuels 2013IcadeNo ratings yet

- PR - EpraDocument1 pagePR - EpraIcadeNo ratings yet

- PR - Icade Enters A New Chapter of Its History enDocument2 pagesPR - Icade Enters A New Chapter of Its History enIcadeNo ratings yet

- CP - Icade - NominationDocument1 pageCP - Icade - NominationIcadeNo ratings yet

- PR - Icade Will Construct A New "Bridge Building"Document1 pagePR - Icade Will Construct A New "Bridge Building"IcadeNo ratings yet

- PR - Icade Klepierre Odysseum VUKDocument2 pagesPR - Icade Klepierre Odysseum VUKIcadeNo ratings yet

- PR - Bond Issue - IcadeDocument1 pagePR - Bond Issue - IcadeIcadeNo ratings yet

- PR - Icade Merger - Buyout Offer Exception Granted PDFDocument1 pagePR - Icade Merger - Buyout Offer Exception Granted PDFIcadeNo ratings yet

- Presentation of The Half-Year Results 2013 Icade - VUKDocument76 pagesPresentation of The Half-Year Results 2013 Icade - VUKIcadeNo ratings yet

- RP - Icade Le BeauvaisisDocument1 pageRP - Icade Le BeauvaisisIcadeNo ratings yet

- PR - Update To The Icade Reference DocumentDocument1 pagePR - Update To The Icade Reference DocumentIcadeNo ratings yet

- PR - Icade Santé Acquires The Hôpital de La Loire in Saint EtienneDocument1 pagePR - Icade Santé Acquires The Hôpital de La Loire in Saint EtienneIcadeNo ratings yet

- PR - Merger of Silic Into Icade PDFDocument2 pagesPR - Merger of Silic Into Icade PDFIcadeNo ratings yet

- PR - Icades First Half Results 2013 PDFDocument63 pagesPR - Icades First Half Results 2013 PDFIcadeNo ratings yet

- PR Success of The Public Offer For Silic - Vuk PDFDocument2 pagesPR Success of The Public Offer For Silic - Vuk PDFIcadeNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RREEF The Future Size of The Global Real Estate Market (2007)Document22 pagesRREEF The Future Size of The Global Real Estate Market (2007)mr_mrsNo ratings yet

- Balance Sheet and P&L of CiplaDocument2 pagesBalance Sheet and P&L of CiplaPratik AhluwaliaNo ratings yet

- Mechanics of Futures Markets ExplainedDocument23 pagesMechanics of Futures Markets ExplainedaliNo ratings yet

- Far - First Preboard QuestionnaireDocument14 pagesFar - First Preboard QuestionnairewithyouidkNo ratings yet

- Sustainability 13 01933 v2Document15 pagesSustainability 13 01933 v2ronNo ratings yet

- Trendsetter Term SheetPPTDocument16 pagesTrendsetter Term SheetPPTMary Williams100% (2)

- Mining case nationality disputeDocument15 pagesMining case nationality disputeteryo expressNo ratings yet

- 101 Profit & Loss Type 1 BY 854×480@AsurReborn BotDocument7 pages101 Profit & Loss Type 1 BY 854×480@AsurReborn BotYash SharmaNo ratings yet

- Bloomberg Markets Magazine 2014-05.bakDocument130 pagesBloomberg Markets Magazine 2014-05.bakFeynman2014No ratings yet

- Conceptual QuestionsDocument5 pagesConceptual QuestionsSarwanti PurwandariNo ratings yet

- Corvex Capital - Restoring The Health To Commonwealth - 2013.02.26Document69 pagesCorvex Capital - Restoring The Health To Commonwealth - 2013.02.26Wall Street WanderlustNo ratings yet

- Paper 1 - Fundamentals of Securities and Futures RegulationDocument50 pagesPaper 1 - Fundamentals of Securities and Futures RegulationBogey Pretty100% (1)

- Homework 3: Pine Street Capital (Part I) : I Introduction and InstructionsDocument4 pagesHomework 3: Pine Street Capital (Part I) : I Introduction and Instructionslevan1225No ratings yet

- McDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaDocument12 pagesMcDonald's Stock Clearly Benefits From Its Large Buybacks - Here Is Why (NYSE - MCD) - Seeking AlphaWaleed TariqNo ratings yet

- 2 ACC5215 2020 M11 Associates and JV All SlidesDocument23 pages2 ACC5215 2020 M11 Associates and JV All SlidesDev GargNo ratings yet

- Soap Industry in Capital BudgetingDocument63 pagesSoap Industry in Capital BudgetingShivam Panday0% (1)

- Capital Budgeting Techniques for Investment EvaluationDocument5 pagesCapital Budgeting Techniques for Investment EvaluationUday Gowda0% (1)

- Questions Number One P LTD and Its Subsidiary Consolidated Income Statement For The Year Ended 31 December 2003Document29 pagesQuestions Number One P LTD and Its Subsidiary Consolidated Income Statement For The Year Ended 31 December 2003JOHN KAMANDANo ratings yet

- The Bankers Code Book PDFDocument202 pagesThe Bankers Code Book PDFOrdu Henry Onyebuchukwu100% (3)

- Direct Lenders First Real Test: Deloitte Alternative Lender Deal Tracker Spring 2020Document56 pagesDirect Lenders First Real Test: Deloitte Alternative Lender Deal Tracker Spring 2020fjdglf klfdNo ratings yet

- Audit of CFS Mind MapDocument1 pageAudit of CFS Mind Mapgovarthan1976No ratings yet

- Pricing Strategy: Midterm ExaminationDocument6 pagesPricing Strategy: Midterm ExaminationAndrea Jane M. BEDAÑONo ratings yet

- GL HOTELS LIMITED ("GL Hotels"/ "Target Company")Document1 pageGL HOTELS LIMITED ("GL Hotels"/ "Target Company")vridhiNo ratings yet

- Curso Forex Novato A Professional Más 60 Vídeos Explicativos PDFDocument5 pagesCurso Forex Novato A Professional Más 60 Vídeos Explicativos PDFLUISA SANCHEZNo ratings yet

- MIC ELECTRONICS LTD BUY OPPORTUNITYDocument17 pagesMIC ELECTRONICS LTD BUY OPPORTUNITYSudipta BoseNo ratings yet

- OTC Exchange of IndiaDocument17 pagesOTC Exchange of IndiaJigar_Dedhia_8946No ratings yet

- Problems On PPEDocument1 pageProblems On PPEimrul kaishNo ratings yet

- Post Qualification FormDocument25 pagesPost Qualification FormLalit Trivedi100% (1)

- TA112. BQA F.L Solution CMA September 2022 Exam.Document6 pagesTA112. BQA F.L Solution CMA September 2022 Exam.Mohammed Javed UddinNo ratings yet

- Virginia Key Marina RFP No 12-14-077 Presentation PDFDocument54 pagesVirginia Key Marina RFP No 12-14-077 Presentation PDFal_crespoNo ratings yet