Professional Documents

Culture Documents

Glossary - TCC

Uploaded by

rubbtuna0 ratings0% found this document useful (0 votes)

149 views2 pagesGlossary on Tax Terms

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGlossary on Tax Terms

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

149 views2 pagesGlossary - TCC

Uploaded by

rubbtunaGlossary on Tax Terms

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

-C-

Cargo Manifest. A shipping document

used by customs personnel reviewing a

particular transport vehicle's intended trip

that summarizes all bills of lading that have

been issued by the carrier or its

representative for that particular shipment.

For example, a cargo manifest might be

used for shipments made by sea, air or land,

and will generally show the shipment's

cosigner and consignee, as well as listing

product details such as number, value,

origin and destination.

Coastwise Port. Such domestic ports as

are open to the coastwise trade only. These

include all ports, harbors and places not

ports of entry. [Sec. 3514, TCC]

Coastwise Trade. Trade between ports

and places in the Philippines.

Commercial Invoice. Document required

by customs to determine true value of the

imported goods, for assessment of duties

and taxes. A commercial invoice (in addition

to other information), must identify the

buyer and seller, and clearly indicate the (1)

date and terms of sale, (2) quantity, weight

and/or volume of the shipment, (3) type of

packaging, (4) complete description of

goods, (5) unit value and total value, and (6)

insurance, shipping and other charges (as

applicable).

Contraband. Goods whose import or

export is forbidden in a country.

Countervailing Duty. A special duty

levied, in addition to the regular duty and

other charges, by an importing country on

its imports which have been found to be

subsidized in the country of origin or

exportation. It is equal to the ascertained

amount of subsidy, calculated in terms of

subsidy per unit of the subsidized exported

product. It is imposed following an

affirmative final determination.

Customs. Government agency entrusted

with enforcement of laws and regulations to

collect and protect import-revenues, and to

regulate and document the flow of goods in

and out of the country.

Customhouse. A building where customs

and duties are paid or collected and where

vessels are entered and cleared.

Customs Broker. Person who is licensed

by the Bureau of Customs, after passing an

examination that covers a broad range of

knowledge including customs law, customs

classification, customs tariff schedule,

import and export regulations, shipping

procedures, trade documentation, etc. He or

she acts as a professional-agent for an

importer or exporter, prepares and submits

all documents for clearing goods through

customs, and is paid customs-brokerage.

Customs Duty. A tax levied on imports

(and, sometimes, on exports) by the

customs authorities of a country to raise

state revenue, and/or to protect domestic

industries from more efficient or predatory

competitors from abroad.

-D-

Declared Weight. Gross weight as

declared in the manifest or bill of lading.

Derelict. A ship or her cargo which is

abandoned and deserted at sea by those who

were in charge of it, without any hope of

recovering it (sine spe recuperandi), or

without any intention of returning to it (sine

animo revertendi). [Erlanger and Galinger

vs The Swedish East (1916)]

Domestic Industry. Refers to the

domestic producers, as a whole, of the like

product or to those producers of such like

product whose collective output of the

product constitutes a major proportion of

the total domestic production of that

product. However, when producers are

related to the foreign exporters or importers

or are themselves importers of the allegedly

subsidized product, the term domestic

industry may be interpreted as referring to

the rest of the producers.

Dumping. Exporting goods at prices lower

than the home-market prices. In price-to-

price dumping, the exporter uses higher

home-prices to supplement the reduced

revenue from lower export prices. In price-

cost dumping, the exporter is subsidized by

the local government with duty drawbacks,

cash incentives, etc. Dumping is legal under

WTO rules unless its injurious effect on the

importing country's producers can be

established. If injury is established, WTO

rules allow imposition of anti-dumping duty

equal to the difference between the

exporter's home-market price and the

importer's FOB price.

Drawback. A refund that can be obtained

when an import fee has already been paid

for a good, but the good is then

subsequently exported. In order to obtain a

duty drawback, a business does not have to

have paid the import duty, nor do they have

had to perform the product's exportation,

they only need to be assigned the drawback

from those to whom it would typically be

due.

You might also like

- Kiok Loy Vs NLRCDocument2 pagesKiok Loy Vs NLRCrubbtunaNo ratings yet

- Liberty Union Vs Liberty CottonDocument2 pagesLiberty Union Vs Liberty Cottonrubbtuna100% (1)

- Songco Vs NLRCDocument2 pagesSongco Vs NLRCrubbtuna100% (1)

- In Pari Delicto Exception for Void ContractsDocument4 pagesIn Pari Delicto Exception for Void ContractsrubbtunaNo ratings yet

- Court rules on Manila business tax disputeDocument16 pagesCourt rules on Manila business tax disputerubbtunaNo ratings yet

- Glossary - VATDocument3 pagesGlossary - VATrubbtunaNo ratings yet

- Atlanta Industries Vs SebolinoDocument2 pagesAtlanta Industries Vs Sebolinorubbtuna33% (3)

- Glossary - Transfer TaxesDocument1 pageGlossary - Transfer TaxesrubbtunaNo ratings yet

- Glossary - Business TaxesDocument4 pagesGlossary - Business TaxesrubbtunaNo ratings yet

- Ocampo Vs Potenciano DigestDocument2 pagesOcampo Vs Potenciano Digestrubbtuna100% (1)

- Municipality of San Pedro Vs Castillo DigestDocument2 pagesMunicipality of San Pedro Vs Castillo DigestrubbtunaNo ratings yet

- Ocampo Vs Potenciano DigestDocument2 pagesOcampo Vs Potenciano Digestrubbtuna100% (1)

- Go-Tan vs. Sps. Tan: Parents-in-law covered by RA 9262Document3 pagesGo-Tan vs. Sps. Tan: Parents-in-law covered by RA 9262rubbtuna80% (5)

- Civil Code of the Philippines outlines human relationsDocument328 pagesCivil Code of the Philippines outlines human relationsrubbtunaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Credito Document A RioDocument2 pagesCredito Document A RioFrancescoHernándetzNo ratings yet

- Payroll Accounting 2015 25th Edition Bieg Solutions Manual 1Document36 pagesPayroll Accounting 2015 25th Edition Bieg Solutions Manual 1dorothy100% (51)

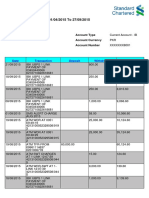

- Account Statement SummaryDocument2 pagesAccount Statement SummaryMohammed Al-DawoudiNo ratings yet

- Bengaluru To Jaipur Lurkmv: Air Asia I5-1576Document3 pagesBengaluru To Jaipur Lurkmv: Air Asia I5-1576maneeshNo ratings yet

- Jan-19 PDFDocument2 pagesJan-19 PDFPriya Gujar100% (1)

- Account Statement 010123 280223Document49 pagesAccount Statement 010123 280223Boby RajNo ratings yet

- Complaint Against Kansas Attorney Sean Allen McElwain - April 4th, 2018Document20 pagesComplaint Against Kansas Attorney Sean Allen McElwain - April 4th, 2018Conflict GateNo ratings yet

- Department of Education Region III Schools Division of Zambales Municipality of Sta. CruzDocument5 pagesDepartment of Education Region III Schools Division of Zambales Municipality of Sta. CruzNhatz Gallosa MarticioNo ratings yet

- MR - Duvvuri IjakDocument4 pagesMR - Duvvuri IjakGirish GilluNo ratings yet

- BIT - Integrated Time Ticket: How Much Does It Cost?Document2 pagesBIT - Integrated Time Ticket: How Much Does It Cost?FabianNo ratings yet

- Trinidad & Tobago TaxDocument26 pagesTrinidad & Tobago TaxHaydn Dunn100% (4)

- Tibetan Grill: Jacob SheridanDocument23 pagesTibetan Grill: Jacob SheridanJacob Sheridan100% (1)

- Iesha Indi June Statement 2021Document1 pageIesha Indi June Statement 2021Sharon JonesNo ratings yet

- Comprehensive Mobility Plan For Jodhpur PDFDocument194 pagesComprehensive Mobility Plan For Jodhpur PDFPayalJoshi100% (1)

- Shri Ramswaroop Memorial University Lucknow: Presented byDocument12 pagesShri Ramswaroop Memorial University Lucknow: Presented byShailesh KumarNo ratings yet

- Unifi - Invoice Bulan 2020Document25 pagesUnifi - Invoice Bulan 2020Mich SpikeNo ratings yet

- Chapter 11Document87 pagesChapter 11Sandeep PanNo ratings yet

- Fine Art - Direct and Indirect Taxation Aspects: A Masterwork of ComplexityDocument12 pagesFine Art - Direct and Indirect Taxation Aspects: A Masterwork of ComplexityMark KubanNo ratings yet

- Laundry InvoiceDocument1 pageLaundry InvoiceprashantkgargNo ratings yet

- Accounting Paper 1 Dec 2015Document11 pagesAccounting Paper 1 Dec 2015Sudhan NairNo ratings yet

- Uzor, Blessing Amarachukwu: Trans. Date Reference Value Date Debit Credit Balance RemarksDocument5 pagesUzor, Blessing Amarachukwu: Trans. Date Reference Value Date Debit Credit Balance RemarksThank GodNo ratings yet

- Your Banking Relationship With Us.: Personal Banking Terms and ConditionsDocument24 pagesYour Banking Relationship With Us.: Personal Banking Terms and ConditionsCosmin GBNo ratings yet

- Sarath Salary SlipDocument5 pagesSarath Salary Slipbindu mathaiNo ratings yet

- Handout on ADC Products, GST, and Regenerating Transaction PasswordsDocument45 pagesHandout on ADC Products, GST, and Regenerating Transaction PasswordsSiddhartha100% (1)

- Retail Invoice for MedicinesDocument1 pageRetail Invoice for MedicinesSapat DasNo ratings yet

- VAT (As Amended by TRAIN)Document60 pagesVAT (As Amended by TRAIN)Katrina CoscolluelaNo ratings yet

- Account Transactions FDocument7 pagesAccount Transactions FZeeshan_Akram01No ratings yet

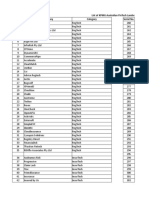

- List of KPMG Australian Fintech LandscapeDocument12 pagesList of KPMG Australian Fintech LandscapeFaysal Bank Strategy TeamNo ratings yet

- F 8288 ADocument5 pagesF 8288 AIRSNo ratings yet

- XII ScienceDocument1 pageXII ScienceShahzaib MughalNo ratings yet