Professional Documents

Culture Documents

Accounting Standards 40

Uploaded by

Khundrakpam SatyabartaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Standards 40

Uploaded by

Khundrakpam SatyabartaCopyright:

Available Formats

Indian Accounting Standard (Ind AS) 40

Investment Property

Contents

Paragraphs

OBJECTIVE 1

SCOPE !4

"E#I$ITIO$S %!1%

&ECO'$ITIO$ 1(!1)

*EAS+&E*E$T AT &ECO'$ITIO$ 0,)

*EAS+&E*E$T A#TE& &ECO'$ITIO$ -0,%(

Accounting po.ic/ -0,-C

#air 0a.ue deter1ination --,%%

Inability to determine fair value reliably 53-55

Cost 1ode. %(

T&A$S#E&S %2!(%

"ISPOSA3S ((!2-

"ISC3OS+&E 24!2)

APPE$"ICES

A 4 &e5erences to 1atters contained in other Indian

Accounting Standards

1 Co1parison 6ith IAS 407 Investment Property

1

Indian Accounting Standard (Ind AS) 40

Investment Property

(This Indian Accounting Standard includes paragraphs set in bold type and plain type,

which have equal authority. Paragraphs in bold type indicate the main principles.)

O89ecti0e

1 The objective of this Standard is to prescribe the accounting treatment for

investment property and related disclosure requirements.

Scope

This Standard sha.. 8e app.ied in the recognition7 1easure1ent and

disc.osure o5 in0est1ent propert/:

3 mong other things! this Standard applies to the measurement in a lessee"s

financial statements of investment property interests held under a lease accounted

for as a finance lease and to the measurement in a lessor"s financial statements of

investment property provided to a lessee under an operating lease. This Standard

does not deal #ith matters covered in Ind S 1$ Leases! including%

&a' classification of leases as finance leases or operating leases(

&b' recognition of lease income from investment property &see also Ind S

1) evenue'(

&c' measurement in a lessee"s financial statements of property interests

held under a lease accounted for as an operating lease(

&d' measurement in a lessor"s financial statements of its net investment in a

finance lease(

&e' accounting for sale and leasebac* transactions( and

&f' disclosure about finance leases and operating leases.

+ This Standard does not apply to%

&a' biological assets related to agricultural activity &see Ind S +1

Agriculture

!

)( and

&b' mineral rights and mineral reserves such as oil! natural gas and similar

non-regenerative resources.

1

Ind AS 41 Agriculture is under formulation.

2

"e5initions

% The 5o..o6ing ter1s are used in this Standard 6ith the 1eanings speci5ied4

"arrying amount is the a1ount at 6hich an asset is recognised in the 8a.ance

sheet:

"ost is the a1ount o5 cash or cash e;ui0a.ents paid or the 5air 0a.ue o5 other

consideration gi0en to ac;uire an asset at the ti1e o5 its ac;uisition or

construction or7 6here app.ica8.e7 the a1ount attri8uted to that asset 6hen

initia../ recognised in accordance 6ith the speci5ic re;uire1ents o5 other

Indian Accounting Standards7 eg Ind AS 10 Share-based Payment:

#air value is the a1ount 5or 6hich an asset cou.d 8e e<changed 8et6een

=no6.edgea8.e7 6i..ing parties in an ar1>s .ength transaction:

Investment property is propert/ (.and or a 8ui.ding?or part o5 a 8ui.ding?or

8oth) he.d (8/ the o6ner or 8/ the .essee under a 5inance .ease) to earn

renta.s or 5or capita. appreciation or 8oth7 rather than 5or4

(a) use in the production or supp./ o5 goods or ser0ices or 5or

ad1inistrati0e purposes@ or

(8) sa.e in the ordinar/ course o5 8usiness:

$wner%occupied property is propert/ he.d (8/ the o6ner or 8/ the .essee under

a 5inance .ease) 5or use in the production or supp./ o5 goods or ser0ices or

5or ad1inistrati0e purposes:

( A&e5er to Appendi< 1B

$ Investment property is held to earn rentals or for capital appreciation or both.

Therefore! an investment property generates cash flo#s largely independently of

the other assets held by an entity. This distinguishes investment property from

o#ner-occupied property. The production or supply of goods or services &or the

use of property for administrative purposes' generates cash flo#s that are

attributable not only to property! but also to other assets used in the production or

supply process. Ind S 1, Property, Plant and &quipment applies to o#ner-

occupied property.

) The follo#ing are e-amples of investment property%

&a' land held for long-term capital appreciation rather than for short-term

sale in the ordinary course of business.

&b' land held for a currently undetermined future use. &If an entity has not

determined that it #ill use the land as o#ner-occupied property or for

short-term sale in the ordinary course of business! the land is regarded

as held for capital appreciation.'

3

&c' a building o#ned by the entity &or held by the entity under a finance

lease' and leased out under one or more operating leases.

&d' a building that is vacant but is held to be leased out under one or more

operating leases.

&e' property that is being constructed or developed for future use as

investment property.

. The follo#ing are e-amples of items that are not investment property and are

therefore outside the scope of this Standard%

&a' property intended for sale in the ordinary course of business or in the

process of construction or development for such sale &see Ind S /

Inventories'! for e-ample! property acquired e-clusively #ith a vie# to

subsequent disposal in the near future or for development and resale.

&b' property being constructed or developed on behalf of third parties &see

Ind S 11 "onstruction "ontracts'.

&c' o#ner-occupied property &see Ind S 1,'! including &among other

things' property held for future use as o#ner-occupied property!

property held for future development and subsequent use as o#ner-

occupied property! property occupied by employees &#hether or not the

employees pay rent at mar*et rates' and o#ner-occupied property

a#aiting disposal.

&d' 01efer to ppendi- 12

&e' property that is leased to another entity under a finance lease.

13 Some properties comprise a portion that is held to earn rentals or for capital

appreciation and another portion that is held for use in the production or supply of

goods or services or for administrative purposes. If these portions could be sold

separately &or leased out separately under a finance lease'! an entity accounts for

the portions separately. If the portions could not be sold separately! the property is

investment property only if an insignificant portion is held for use in the production

or supply of goods or services or for administrative purposes.

11 In some cases! an entity provides ancillary services to the occupants of a property it

holds. n entity treats such a property as investment property if the services are

insignificant to the arrangement as a #hole. n e-ample is #hen the o#ner of an

office building provides security and maintenance services to the lessees #ho

occupy the building.

1/ In other cases! the services provided are significant. 4or e-ample! if an entity o#ns

and manages a hotel! services provided to guests are significant to the

arrangement as a #hole. Therefore! an o#ner-managed hotel is o#ner-occupied

property! rather than investment property.

4

13 It may be difficult to determine #hether ancillary services are so significant that a

property does not qualify as investment property. 4or e-ample! the o#ner of a

hotel sometimes transfers some responsibilities to third parties under a

management contract. The terms of such contracts vary #idely. t one end of the

spectrum! the o#ner"s position may! in substance! be that of a passive investor. t

the other end of the spectrum! the o#ner may simply have outsourced day-to-day

functions #hile retaining significant e-posure to variation in the cash flo#s

generated by the operations of the hotel.

1+ 5udgement is needed to determine #hether a property qualifies as investment

property. n entity develops criteria so that it can e-ercise that judgement

consistently in accordance #ith the definition of investment property and #ith the

related guidance in paragraphs $613. 7aragraph $5&c' requires an entity to

disclose these criteria #hen classification is difficult.

15 In some cases! an entity o#ns property that is leased to! and occupied by! its parent

or another subsidiary. The property does not qualify as investment property in the

consolidated financial statements! because the property is o#ner-occupied from

the perspective of the group. 8o#ever! from the perspective of the entity that o#ns

it! the property is investment property if it meets the definition in paragraph 5.

Therefore! the lessor treats the property as investment property in its individual

financial statements.

&ecognition

1( In0est1ent propert/ sha.. 8e recognised as an asset 6hen7 and on./ 6hen4

(a) it is pro8a8.e that the 5uture econo1ic 8ene5its that are associated

6ith the in0est1ent propert/ 6i.. 5.o6 to the entit/@ and

(8) the cost o5 the in0est1ent propert/ can 8e 1easured re.ia8./:

1$ n entity evaluates under this recognition principle all its investment property costs

at the time they are incurred. These costs include costs incurred initially to acquire

an investment property and costs incurred subsequently to add to! replace part of!

or service a property.

1) 9nder the recognition principle in paragraph 1,! an entity does not recognise in the

carrying amount of an investment property the costs of the day-to-day servicing of

such a property. 1ather! these costs are recognised in profit or loss as incurred.

:osts of day-to-day servicing are primarily the cost of labour and consumables!

and may include the cost of minor parts. The purpose of these e-penditures is

often described as for the ;repairs and maintenance" of the property.

1. 7arts of investment properties may have been acquired through replacement. 4or

e-ample! the interior #alls may be replacements of original #alls. 9nder the

recognition principle! an entity recognises in the carrying amount of an investment

property the cost of replacing part of an e-isting investment property at the time

that cost is incurred if the recognition criteria are met. The carrying amount of

those parts that are replaced is derecognised in accordance #ith the derecognition

provisions of this Standard.

5

*easure1ent at recognition

0 An in0est1ent propert/ sha.. 8e 1easured initia../ at its cost: Transaction

costs sha.. 8e inc.uded in the initia. 1easure1ent:

/1 The cost of a purchased investment property comprises its purchase price and any

directly attributable e-penditure. <irectly attributable e-penditure includes! for

e-ample! professional fees for legal services! property transfer ta-es and other

transaction costs.

// 01efer to ppendi- 12

/3 The cost of an investment property is not increased by%

&a' start-up costs &unless they are necessary to bring the property to the

condition necessary for it to be capable of operating in the manner

intended by management'!

&b' operating losses incurred before the investment property achieves the

planned level of occupancy! or

&c' abnormal amounts of #asted material! labour or other resources

incurred in constructing or developing the property.

/+ If payment for an investment property is deferred! its cost is the cash price

equivalent. The difference bet#een this amount and the total payments is

recognised as interest e-pense over the period of credit.

% The initia. cost o5 a propert/ interest he.d under a .ease and c.assi5ied as an

in0est1ent propert/ sha.. 8e as prescri8ed 5or a 5inance .ease 8/ paragraph

0 o5 Ind AS 127 ie the asset sha.. 8e recognised at the .o6er o5 the 5air 0a.ue

o5 the propert/ and the present 0a.ue o5 the 1ini1u1 .ease pa/1ents: An

e;ui0a.ent a1ount sha.. 8e recognised as a .ia8i.it/ in accordance 6ith that

sa1e paragraph:

/, ny premium paid for a lease is treated as part of the minimum lease payments for

this purpose! and is therefore included in the cost of the asset! but is e-cluded

from the liability. If a property interest held under a lease is classified as

investment property! the item accounted for at fair value is that interest and not the

underlying property. =uidance on determining the fair value of a property interest

is set out in paragraphs 3365/. That guidance is also relevant to the determination

of fair value #hen that value is used as cost for initial recognition purposes.

/$ >ne or more investment properties may be acquired in e-change for a non-

monetary asset or assets! or a combination of monetary and non-monetary assets.

The follo#ing discussion refers to an e-change of one non-monetary asset for

another! but it also applies to all e-changes described in the preceding sentence.

The cost of such an investment property is measured at fair value unless &a' the

e-change transaction lac*s commercial substance or &b' the fair value of neither

the asset received nor the asset given up is reliably measurable. The acquired

asset is measured in this #ay even if an entity cannot immediately derecognise

6

the asset given up. If the acquired asset is not measured at fair value! its cost is

measured at the carrying amount of the asset given up.

/) n entity determines #hether an e-change transaction has commercial substance

by considering the e-tent to #hich its future cash flo#s are e-pected to change as

a result of the transaction. n e-change transaction has commercial substance if%

&a' the configuration &ris*! timing and amount' of the cash flo#s of the asset

received differs from the configuration of the cash flo#s of the asset

transferred! or

&b' the entity-specific value of the portion of the entity"s operations affected

by the transaction changes as a result of the e-change! and

&c' the difference in &a' or &b' is significant relative to the fair value of the

assets e-changed.

4or the purpose of determining #hether an e-change transaction has commercial

substance! the entity-specific value of the portion of the entity"s operations affected

by the transaction shall reflect post-ta- cash flo#s. The result of these analyses

may be clear #ithout an entity having to perform detailed calculations.

/. The fair value of an asset for #hich comparable mar*et transactions do not e-ist is

reliably measurable if &a' the variability in the range of reasonable fair value

estimates is not significant for that asset or &b' the probabilities of the various

estimates #ithin the range can be reasonably assessed and used in estimating fair

value. If the entity is able to determine reliably the fair value of either the asset

received or the asset given up! then the fair value of the asset given up is used to

measure cost unless the fair value of the asset received is more clearly evident.

*easure1ent a5ter recognition

Accounting po.ic/

-0 An entit/ sha.. adopt as its accounting po.ic/ the cost 1ode. prescri8ed in

paragraph %( to a.. o5 its in0est1ent propert/:

31 01efer to ppendi- 12

3/ This Standard requires all entities to determine the fair value of investment property

for the purpose of disclosure even though they are required to follo# the cost

model. n entity is encouraged! but not required! to determine the fair value of

investment property on the basis of a valuation by an independent valuer #ho

holds a recognised and relevant professional qualification and has recent

e-perience in the location and category of the investment property being valued.

-A,-C A&e5er to Appendi< 1B

#air 0a.ue deter1ination

7

--,-% A&e5er to Appendi< 1B

3, The fair value of investment property is the price at #hich the property could be

e-changed bet#een *no#ledgeable! #illing parties in an arm"s length transaction

&see paragraph 5'. 4air value specifically e-cludes an estimated price inflated or

deflated by special terms or circumstances such as atypical financing! sale and

leasebac* arrangements! special considerations or concessions granted by

anyone associated #ith the sale.

3$ n entity determines fair value #ithout any deduction for transaction costs it may

incur on sale or other disposal.

-C The 5air 0a.ue o5 in0est1ent propert/ sha.. re5.ect 1ar=et conditions at the

end o5 the reporting period:

3. 4air value is time-specific as of a given date. ?ecause mar*et conditions may

change! the amount reported as fair value may be incorrect or inappropriate if

estimated as of another time. The definition of fair value also assumes

simultaneous e-change and completion of the contract for sale #ithout any

variation in price that might be made in an arm"s length transaction bet#een

*no#ledgeable! #illing parties if e-change and completion are not simultaneous.

+3 The fair value of investment property reflects! among other things! rental income

from current leases and reasonable and supportable assumptions that represent

#hat *no#ledgeable! #illing parties #ould assume about rental income from future

leases in the light of current conditions. It also reflects! on a similar basis! any cash

outflo#s &including rental payments and other outflo#s' that could be e-pected in

respect of the property. Some of those outflo#s are reflected in the liability

#hereas others relate to outflo#s that are not recognised in the financial

statements until a later date &eg periodic payments such as contingent rents'.

+1 01efer to ppendi- 12

+/ The definition of fair value refers to ;*no#ledgeable! #illing parties". In this conte-t!

;*no#ledgeable" means that both the #illing buyer and the #illing seller are

reasonably informed about the nature and characteristics of the investment

property! its actual and potential uses! and mar*et conditions at the end of the

reporting period. #illing buyer is motivated! but not compelled! to buy. This buyer

is neither over-eager nor determined to buy at any price. The assumed buyer

#ould not pay a higher price than a mar*et comprising *no#ledgeable! #illing

buyers and sellers #ould require.

+3 #illing seller is neither an over-eager nor a forced seller! prepared to sell at any

price! nor one prepared to hold out for a price not considered reasonable in current

mar*et conditions. The #illing seller is motivated to sell the investment property at

mar*et terms for the best price obtainable. The factual circumstances of the actual

investment property o#ner are not a part of this consideration because the #illing

seller is a hypothetical o#ner &eg a #illing seller #ould not ta*e into account the

particular ta- circumstances of the actual investment property o#ner'.

8

++ The definition of fair value refers to an arm"s length transaction. n arm"s length

transaction is one bet#een parties that do not have a particular or special

relationship that ma*es prices of transactions uncharacteristic of mar*et

conditions. The transaction is presumed to be bet#een unrelated parties! each

acting independently.

+5 The best evidence of fair value is given by current prices in an active mar*et for

similar property in the same location and condition and subject to similar lease and

other contracts. n entity ta*es care to identify any differences in the nature!

location or condition of the property! or in the contractual terms of the leases and

other contracts relating to the property.

+, In the absence of current prices in an active mar*et of the *ind described in

paragraph +5! an entity considers information from a variety of sources! including%

&a' current prices in an active mar*et for properties of different nature!

condition or location &or subject to different lease or other contracts'!

adjusted to reflect those differences(

&b' recent prices of similar properties on less active mar*ets! #ith

adjustments to reflect any changes in economic conditions since the

date of the transactions that occurred at those prices( and

&c' discounted cash flo# projections based on reliable estimates of future

cash flo#s! supported by the terms of any e-isting lease and other

contracts and &#hen possible' by e-ternal evidence such as current

mar*et rents for similar properties in the same location and condition!

and using discount rates that reflect current mar*et assessments of the

uncertainty in the amount and timing of the cash flo#s.

+$ In some cases! the various sources listed in the previous paragraph may suggest

different conclusions about the fair value of an investment property. n entity

considers the reasons for those differences! in order to arrive at the most reliable

estimate of fair value #ithin a range of reasonable fair value estimates.

+) In e-ceptional cases! there is clear evidence #hen an entity first acquires an

investment property &or #hen an e-isting property first becomes investment

property after a change in use' that the variability in the range of reasonable fair

value estimates #ill be so great! and the probabilities of the various outcomes so

difficult to assess! that the usefulness of a single estimate of fair value is negated.

This may indicate that the fair value of the property #ill not be reliably

determinable on a continuing basis &see paragraph 53'.

+. 4air value differs from value in use! as defined in Ind S 3, Impairment o' Assets.

4air value reflects the *no#ledge and estimates of *no#ledgeable! #illing buyers

and sellers. In contrast! value in use reflects the entity"s estimates! including the

effects of factors that may be specific to the entity and not applicable to entities in

general. 4or e-ample! fair value does not reflect any of the follo#ing factors to the

e-tent that they #ould not be generally available to *no#ledgeable! #illing buyers

and sellers%

9

&a' additional value derived from the creation of a portfolio of properties in

different locations(

&b' synergies bet#een investment property and other assets(

&c' legal rights or legal restrictions that are specific only to the current

o#ner( and

&d' ta- benefits or ta- burdens that are specific to the current o#ner.

53 01efer to ppendi- 12

51 The fair value of investment property does not reflect future capital e-penditure that

#ill improve or enhance the property and does not reflect the related future

benefits from this future e-penditure.

5/ 01efer to ppendi- 12

Ina8i.it/ to deter1ine 5air 0a.ue re.ia8./

%- There is a re8utta8.e presu1ption that an entit/ can re.ia8./ deter1ine the 5air

0a.ue o5 an in0est1ent propert/ on a continuing 8asis: Do6e0er7 in

e<ceptiona. cases7 there is c.ear e0idence 6hen an entit/ 5irst ac;uires an

in0est1ent propert/ (or 6hen an e<isting propert/ 5irst 8eco1es in0est1ent

propert/ a5ter a change in use) that the 5air 0a.ue o5 the in0est1ent propert/

is not re.ia8./ deter1ina8.e on a continuing 8asis: This arises 6hen7 and

on./ 6hen7 co1para8.e 1ar=et transactions are in5re;uent and a.ternati0e

re.ia8.e esti1ates o5 5air 0a.ue (5or e<a1p.e7 8ased on discounted cash 5.o6

pro9ections) are not a0ai.a8.e: I5 an entit/ deter1ines that the 5air 0a.ue o5 an

in0est1ent propert/ under construction is not re.ia8./ deter1ina8.e 8ut

e<pects the 5air 0a.ue o5 the propert/ to 8e re.ia8./ deter1ina8.e 6hen

construction is co1p.ete7 it sha.. deter1ine the 5air 0a.ue o5 that in0est1ent

propert/ either 6hen its 5air 0a.ue 8eco1es re.ia8./ deter1ina8.e or

construction is co1p.eted (6hiche0er is ear.ier): I5 an entit/ deter1ines that

the 5air 0a.ue o5 an in0est1ent propert/ (other than an in0est1ent propert/

under construction) is not re.ia8./ deter1ina8.e on a continuing 8asis7 the

entit/ sha.. 1a=e the disc.osures re;uired 8/ paragraphs 2)(e)(i)7 (ii) and (iii):

53 >nce an entity becomes able to measure reliably the fair value of an investment

property under construction for #hich the fair value #as not previously determined!

it shall determine the fair value of that property. >nce construction of that property

is complete! it is presumed that fair value can be measured reliably. If this is not

the case! in accordance #ith paragraph 53! the entity shall ma*e the disclosures

required by paragraphs $.&e'&i'! &ii' and &iii'.

53? The presumption that the fair value of investment property under construction can

be measured reliably can be rebutted only on initial recognition. n entity that has

determined the fair value of an item of investment property under construction may

not conclude that the fair value of the completed investment property cannot be

determined reliably.

10

5+ In the e-ceptional cases #hen an entity is compelled! for the reason given in

paragraph 53! to ma*e the disclosures required by paragraphs $.&e'&i'! &ii' and

&iii'! it shall determine the fair value of all its other investment property! including

investment property under construction. In these cases! although an entity may

ma*e the disclosures required by paragraphs $.&e'&i'! &ii' and &iii' for one

investment property! the entity shall continue to determine the fair value of each of

the remaining properties for disclosure required by paragraph $.&e'.

%% I5 an entit/ has pre0ious./ deter1ined the 5air 0a.ue o5 an in0est1ent

propert/7 it sha.. continue to deter1ine the 5air 0a.ue o5 that propert/ unti.

disposa. (or unti. the propert/ 8eco1es o6ner,occupied propert/ or the

entit/ 8egins to de0e.op the propert/ 5or su8se;uent sa.e in the ordinar/

course o5 8usiness) e0en i5 co1para8.e 1ar=et transactions 8eco1e .ess

5re;uent or 1ar=et prices 8eco1e .ess readi./ a0ai.a8.e:

Cost 1ode.

%( A5ter initia. recognition7 an entit/ sha.. 1easure a.. o5 its in0est1ent

properties in accordance 6ith Ind AS 1(>s re;uire1ents 5or cost 1ode.7

other than those that 1eet the criteria to 8e c.assi5ied as he.d 5or sa.e (or are

inc.uded in a disposa. group that is c.assi5ied as he.d 5or sa.e) in accordance

6ith Ind AS 10% Non-current Assets Held for Sale and Discontinued

Operations: In0est1ent properties that 1eet the criteria to 8e c.assi5ied as

he.d 5or sa.e (or are inc.uded in a disposa. group that is c.assi5ied as he.d 5or

sa.e) sha.. 8e 1easured in accordance 6ith Ind AS 10%:

Trans5ers

%2 Trans5ers to7 or 5ro17 in0est1ent propert/ sha.. 8e 1ade 6hen7 and on./

6hen7 there is a change in use7 e0idenced 8/4

(a) co11ence1ent o5 o6ner,occupation7 5or a trans5er 5ro1

in0est1ent propert/ to o6ner,occupied propert/@

(8) co11ence1ent o5 de0e.op1ent 6ith a 0ie6 to sa.e7 5or a trans5er

5ro1 in0est1ent propert/ to in0entories@

(c) end o5 o6ner,occupation7 5or a trans5er 5ro1 o6ner,occupied

propert/ to in0est1ent propert/@ or

(d) co11ence1ent o5 an operating .ease to another part/7 5or a

trans5er 5ro1 in0entories to in0est1ent propert/:

(e) A&e5er to Appendi< 1B

5) 7aragraph 5$&b' requires an entity to transfer a property from investment property

to inventories #hen! and only #hen! there is a change in use! evidenced by

commencement of development #ith a vie# to sale. @hen an entity decides to

dispose of an investment property #ithout development! it continues to treat the

property as an investment property until it is derecognised &eliminated from the

balance sheet' and does not treat it as inventory. Similarly! if an entity begins to

11

redevelop an e-isting investment property for continued future use as investment

property! the property remains an investment property and is not reclassified as

o#ner-occupied property during the redevelopment.

5. Transfers bet#een investment property! o#ner-occupied property and inventories

do not change the carrying amount of the property transferred and they do not

change the cost of that property for measurement or disclosure purposes.

(0,(% A&e5er to Appendi< 1B

"isposa.s

(( An in0est1ent propert/ sha.. 8e derecognised (e.i1inated 5ro1 the 8a.ance

sheet) on disposa. or 6hen the in0est1ent propert/ is per1anent./

6ithdra6n 5ro1 use and no 5uture econo1ic 8ene5its are e<pected 5ro1 its

disposa.:

,$ The disposal of an investment property may be achieved by sale or by entering into

a finance lease. In determining the date of disposal for investment property! an

entity applies the criteria in Ind S 1) for recognising revenue from the sale of

goods and considers the related guidance in the ppendi- A to Ind S 1). Ind S

1$ applies to a disposal effected by entering into a finance lease and to a sale and

leasebac*.

,) If! in accordance #ith the recognition principle in paragraph 1,! an entity recognises

in the carrying amount of an asset the cost of a replacement for part of an

investment property! it derecognises the carrying amount of the replaced part.

replaced part may not be a part that #as depreciated separately. If it is not

practicable for an entity to determine the carrying amount of the replaced part! it

may use the cost of the replacement as an indication of #hat the cost of the

replaced part #as at the time it #as acquired or constructed.

() 'ains or .osses arising 5ro1 the retire1ent or disposa. o5 in0est1ent propert/

sha.. 8e deter1ined as the di55erence 8et6een the net disposa. proceeds and

the carr/ing a1ount o5 the asset and sha.. 8e recognised in pro5it or .oss

(un.ess Ind AS 12 re;uires other6ise on a sa.e and .ease8ac=) in the period

o5 the retire1ent or disposa.:

$3 The consideration receivable on disposal of an investment property is recognised

initially at fair value. In particular! if payment for an investment property is deferred!

the consideration received is recognised initially at the cash price equivalent. The

difference bet#een the nominal amount of the consideration and the cash price

equivalent is recognised as interest revenue in accordance #ith Ind S 1) using

the effective interest method.

$1 n entity applies Ind S 3$ or other Standards! as appropriate! to any liabilities that

it retains after disposal of an investment property.

12

2 Co1pensation 5ro1 third parties 5or in0est1ent propert/ that 6as i1paired7

.ost or gi0en up sha.. 8e recognised in pro5it or .oss 6hen the co1pensation

8eco1es recei0a8.e:

$3 Impairments or losses of investment property! related claims for or payments of

compensation from third parties and any subsequent purchase or construction of

replacement assets are separate economic events and are accounted for

separately as follo#s%

&a' impairments of investment property are recognised in accordance #ith

Ind S 3,(

&b' retirements or disposals of investment property are recognised in

accordance #ith paragraphs ,,6$1 of this Standard(

&c' compensation from third parties for investment property that #as

impaired! lost or given up is recognised in profit or loss #hen it becomes

receivable( and

&d' the cost of assets restored! purchased or constructed as replacements

is determined in accordance #ith paragraphs /36/. of this Standard.

"isc.osure

$+ The disclosures belo# apply in addition to those in Ind S 1$. In accordance #ith

Ind S 1$! the o#ner of an investment property provides lessors" disclosures

about leases into #hich it has entered. n entity that holds an investment property

under a finance lease provides lessees" disclosures for finance leases and lessors"

disclosures for any operating leases into #hich it has entered.

2% An entit/ sha.. disc.ose4

(a) its accounting po.ic/ 5or 1easure1ent o5 in0est1ent propert/:

(8) A&e5er to Appendi< 1B

(c) 6hen c.assi5ication is di55icu.t (see paragraph 14)7 the criteria it

uses to distinguish in0est1ent propert/ 5ro1 o6ner,occupied

propert/ and 5ro1 propert/ he.d 5or sa.e in the ordinar/ course o5

8usiness:

(d) the 1ethods and signi5icant assu1ptions app.ied in deter1ining

the 5air 0a.ue o5 in0est1ent propert/7 inc.uding a state1ent

6hether the deter1ination o5 5air 0a.ue 6as supported 8/ 1ar=et

e0idence or 6as 1ore hea0i./ 8ased on other 5actors (6hich the

entit/ sha.. disc.ose) 8ecause o5 the nature o5 the propert/ and

.ac= o5 co1para8.e 1ar=et data:

13

(e) the e<tent to 6hich the 5air 0a.ue o5 in0est1ent propert/ (as

1easured or disc.osed in the 5inancia. state1ents) is 8ased on a

0a.uation 8/ an independent 0a.uer 6ho ho.ds a recognised and

re.e0ant pro5essiona. ;ua.i5ication and has recent e<perience in

the .ocation and categor/ o5 the in0est1ent propert/ 8eing 0a.ued:

I5 there has 8een no such 0a.uation7 that 5act sha.. 8e disc.osed:

(5) the a1ounts recognised in pro5it or .oss 5or4

(i) renta. inco1e 5ro1 in0est1ent propert/@

(ii) direct operating e<penses (inc.uding repairs and

1aintenance) arising 5ro1 in0est1ent propert/ that

generated renta. inco1e during the period@ and

(iii) direct operating e<penses (inc.uding repairs and

1aintenance) arising 5ro1 in0est1ent propert/ that did not

generate renta. inco1e during the period:

(i0) A&e5er to Appendi< 1B

(g) the e<istence and a1ounts o5 restrictions on the rea.isa8i.it/ o5

in0est1ent propert/ or the re1ittance o5 inco1e and proceeds o5

disposa.:

(h) contractua. o8.igations to purchase7 construct or de0e.op

in0est1ent propert/ or 5or repairs7 1aintenance or

enhance1ents:

2(,2C A&e5er to Appendi< 1B

2) In addition to the disc.osures re;uired 8/ paragraph 2%7 an entit/ sha..

disc.ose4

(a) the depreciation 1ethods used@

(8) the use5u. .i0es or the depreciation rates used@

(c) the gross carr/ing a1ount and the accu1u.ated depreciation

(aggregated 6ith accu1u.ated i1pair1ent .osses) at the 8eginning

and end o5 the period@

(d) a reconci.iation o5 the carr/ing a1ount o5 in0est1ent propert/ at

the 8eginning and end o5 the period7 sho6ing the 5o..o6ing4

(i) additions7 disc.osing separate./ those additions resu.ting

5ro1 ac;uisitions and those resu.ting 5ro1 su8se;uent

e<penditure recognised as an asset@

(ii) additions resu.ting 5ro1 ac;uisitions through 8usiness

co18inations@

14

(iii) assets c.assi5ied as he.d 5or sa.e or inc.uded in a disposa.

group c.assi5ied as he.d 5or sa.e in accordance 6ith Ind AS

10% and other disposa.s@

(i0) depreciation@

(0) the a1ount o5 i1pair1ent .osses recognised7 and the a1ount

o5 i1pair1ent .osses re0ersed7 during the period in

accordance 6ith Ind AS -(@

(0i) the net e<change di55erences arising on the trans.ation o5 the

5inancia. state1ents into a di55erent presentation currenc/7

and on trans.ation o5 a 5oreign operation into the presentation

currenc/ o5 the reporting entit/@

(0ii) trans5ers to and 5ro1 in0entories and o6ner,occupied

propert/@ and

(0iii) other changes@ and

(e) the 5air 0a.ue o5 in0est1ent propert/: In the e<ceptiona. cases

descri8ed in paragraph %-7 6hen an entit/ cannot deter1ine the

5air 0a.ue o5 the in0est1ent propert/ re.ia8./7 it sha.. disc.ose4

(i) a description o5 the in0est1ent propert/@

(ii) an e<p.anation o5 6h/ 5air 0a.ue cannot 8e deter1ined

re.ia8./@ and

(iii) i5 possi8.e7 the range o5 esti1ates 6ithin 6hich 5air 0a.ue is

high./ .i=e./ to .ie:

15

Appendi< A

&e5erences to 1atters contained in other Indian

Accounting Standards

This Appendi( is an integral part o' Indian Accounting Standard (Ind AS) )* Investment

Property .

1: Appendi< A Income Taxes-ecovery of evalued Non-Depreciable Assets

contained in Ind AS 17 Income Taxes 1a=es re5erence to this Standard a.so:

16

Appendi< 1

+ote, This Appendi( is not a part o' the Indian Accounting Standard. The purpose o' this

Appendi( is only to -ring out the di''erences, i' any, -etween Indian Accounting Standard

(Ind AS) )* and the corresponding International Accounting Standard (IAS) )*, Investment

Property.

Co1parison 6ith IAS 407 Investment Property

1 IS +3 permits both cost model and fair value model &e-cept in some situations' for

measurement of investment properties after initial recognition. Ind S +3 permits only the

cost model. The follo#ing paragraphs of IS +3 #hich deal #ith fair value model have been

deleted in Ind S +3. In order to maintain consistency #ith paragraph numbers of IS +3!

the paragraph numbers are retained in Ind S +3%

&i' 7aragraph ,

&ii' 7aragraph 31

&iii' 7aragraphs 3/-3/:

&iv' 7aragraphs 33-35

&v' 7aragraph +1

&vi' 7aragraph 53

&vii' 7aragraph 5/

&viii' 7aragraphs ,3-,5

&i-' 7aragraph $5&b'

&-' 7aragraph $5&f'&iv'

&-i' 7aragraphs $,-$)

/ The transitional provisions given in IS +3 have not been included in Ind S +3 since

all transitional provisions related to Ind Ss! #herever considered appropriate have been

included in Ind S 131! 4irst-time doption of Indian ccounting Standards corresponding

to I41S 1! 4irst-time doption of International 4inancial 1eporting Standards.

3 IS +3 requires disclosure of fair values of investment property #hen cost model is

used. Since this requirement is retained in Ind S +3! paragraphs 53! 53! 53?! 5+ and 55

and certain other paragraphs of IS +3 have been modified. The modifications include

substitution of fair value measurement #ith fair value determinationBdisclosure and deletion

of reference to use of cost model #hen fair value determination is unreliable.

+ IS +3 permits treatment of property interest held in an operating lease as investment

property! if the definition of investment property is other#ise met and fair value model is

17

applied. In such cases! the operating lease #ould be accounted as if it #ere a finance

lease. Since Ind S +3 prohibits the use of fair value model! this treatment is prohibited in

Ind S +3. s a result! paragraph , of IS +3 has been deleted in Ind S +3 &see point 1&i'

above'. In addition! the e-pression ;investment property under a finance or operating lease"

appearing in paragraph $+ of IS +3 has been modified as ;investment property under a

finance lease" in Ind S +3.

5 s a result of prohibition of use of fair value model in Ind S +3! there are some

modifications in the #ording of paragraph /, &removal of the #ords ;for the fair value

model"'! paragraphs 33 and 3/ &ccounting policy'! heading above paragraph 33 &;4air

value determination" instead of ;4air value model"'! paragraph 5, ! paragraph 5. &deletion

of portion relating to fair value model'! paragraph ,) &deletion of a portion dealing #ith fair

value model'! heading above paragraph $+ &deletion of the heading ;4air value model and

cost model"' and $5&a' &disclosure of accounting policy' as compared to the #ording used

in IS +3.

, <ifferent terminology is used in this Standard e.g.! the term Ebalance sheet" is used

instead of ;Statement of financial position".

$ The follo#ing paragraphs appear as ;<eleted" in IS +3. In order to maintain

consistency #ith paragraph numbers of IS +3! the paragraph numbers are retained in Ind

S +3%

&i' 7aragraph .&d'

&ii' 7aragraph //

&iii' 7aragraph 5$&e'

18

You might also like

- Manipur Bank Branches ListDocument17 pagesManipur Bank Branches ListKhundrakpam SatyabartaNo ratings yet

- Microsoft Word Shortcut KeysDocument9 pagesMicrosoft Word Shortcut KeysKhundrakpam Satyabarta100% (2)

- Mco-7 emDocument8 pagesMco-7 emKhundrakpam Satyabarta100% (3)

- Bakery Manufacturing ProcessesDocument26 pagesBakery Manufacturing ProcessesKhundrakpam Satyabarta50% (2)

- Mnemonics of AuditsDocument17 pagesMnemonics of AuditsKhundrakpam SatyabartaNo ratings yet

- Information System and Control Audit For Ca FinalDocument157 pagesInformation System and Control Audit For Ca FinalKhundrakpam SatyabartaNo ratings yet

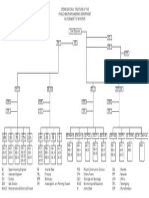

- Organisational ChartDocument1 pageOrganisational ChartKhundrakpam SatyabartaNo ratings yet

- North Eastern Region Vision 2020 The Vision StatementDocument360 pagesNorth Eastern Region Vision 2020 The Vision StatementKapil Arambam100% (1)

- 25 Company Law NotesDocument23 pages25 Company Law NotesKhundrakpam SatyabartaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pengaruh Ukuran Perusahaan Dan Leverage Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel InterveningDocument7 pagesPengaruh Ukuran Perusahaan Dan Leverage Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel InterveningREHANI ALIA PUTRINo ratings yet

- Prakas 741 On Rule and Procedure For CMT EngDocument6 pagesPrakas 741 On Rule and Procedure For CMT EngNak VanNo ratings yet

- Module 07.5 - Foreign Currency Accounting PSDocument5 pagesModule 07.5 - Foreign Currency Accounting PSFiona Morales100% (2)

- Solved A Building Was Constructed and Finished On January 1, 2014Document3 pagesSolved A Building Was Constructed and Finished On January 1, 2014JoffersonNo ratings yet

- Wayward Hedgefund v7Document144 pagesWayward Hedgefund v7Anonymous hEUpbtvNo ratings yet

- A Study On Fundamental Analysis of Top IT Companies in IndiaDocument14 pagesA Study On Fundamental Analysis of Top IT Companies in IndiaMuttavva mudenagudiNo ratings yet

- Miles CPA RoadmapDocument72 pagesMiles CPA RoadmapRoshan SNo ratings yet

- CPWA Code BriefDocument301 pagesCPWA Code BriefSamrat MukherjeeNo ratings yet

- M. Com. I Advanced Accountancy Paper-I AllDocument134 pagesM. Com. I Advanced Accountancy Paper-I Allसदानंद देशपांडेNo ratings yet

- Accounting For Governmental & Nonprofit 16e Solution Manual Chapter 17Document24 pagesAccounting For Governmental & Nonprofit 16e Solution Manual Chapter 17sellertbsm2014No ratings yet

- Personal Financial Planning Questionnaire / Data Gathering Sheet in ExcelDocument24 pagesPersonal Financial Planning Questionnaire / Data Gathering Sheet in ExcelSatish MistryNo ratings yet

- Chapter 21 Intangible AssetsDocument27 pagesChapter 21 Intangible Assetsshelou_domantayNo ratings yet

- CV Cale J Dunlap Us3Document1 pageCV Cale J Dunlap Us3api-312690447No ratings yet

- Muthoot Finance LTD 110912Document3 pagesMuthoot Finance LTD 110912Kannan SundaresanNo ratings yet

- Confirmation of Execution PDFDocument1 pageConfirmation of Execution PDFZsolt GyongyosiNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- Quick and Dirty Analysis Excel Spreadsheet 3 7Document3 pagesQuick and Dirty Analysis Excel Spreadsheet 3 7rishab mehraNo ratings yet

- Short Notes ABADDocument135 pagesShort Notes ABADsing jotNo ratings yet

- Currency Trader Magazine 2006-07Document43 pagesCurrency Trader Magazine 2006-07Keith GarayNo ratings yet

- Midterm Quiz in ACCTG2215Document17 pagesMidterm Quiz in ACCTG2215guess who100% (1)

- Campus 22 - Finance JDDocument2 pagesCampus 22 - Finance JDAryan MaheshwariNo ratings yet

- Sample Resume - FinanceDocument2 pagesSample Resume - FinanceNiraj DeobhankarNo ratings yet

- Mariel Princess TabilangonDocument2 pagesMariel Princess TabilangonMariel PrincessNo ratings yet

- Adtp Fee 2022 IntiDocument1 pageAdtp Fee 2022 IntiAsma AkterNo ratings yet

- Evidencia 8 Actividad 15Document10 pagesEvidencia 8 Actividad 15Angela Maria Galan NavasNo ratings yet

- ZS Associates - E-School Compensation Annexure - 2023-24Document2 pagesZS Associates - E-School Compensation Annexure - 2023-24manjot singhNo ratings yet

- 104 2022 218 BdoDocument29 pages104 2022 218 BdoJason BramwellNo ratings yet

- AnDocument5 pagesAnPritesh ChaudhariNo ratings yet

- Chartered AccountantDocument33 pagesChartered AccountantSandeep Soni0% (1)

- Warner Company Statement of Cash FlowsDocument2 pagesWarner Company Statement of Cash FlowsKailash KumarNo ratings yet