Professional Documents

Culture Documents

Unit - 2

Uploaded by

Bas RamuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit - 2

Uploaded by

Bas RamuCopyright:

Available Formats

Unit -2

2.1 CAPITAL ANALYSIS OF APPRAISAL TECHNIQUES

2.1.1 CAPITAL INVESTMENT ANALYSIS

INTRODUCTION

A budgeting procedure that companies and government agencies use to assess the potential

profitability of a long-term investment. Capital investment analysis assesses long-term

investments, which might include fixed assets like equipment, machinery or real estate. The goal

of this process is to pinpoint the option that is most likely to be the most profitable for the

business. usinesses may use techniques such as discounted cash flow analysis, risk-return

analysis, risk-neutral valuation and utility theory in a capital investment analysis.

Capital investments are risky because they involve large, up-front expenditures on assets

intended for many years of service and that will take a long time to pay for themselves. !f a

capital investment is financed, it must earn an even greater return, to compensate for the interest

the company must pay on the financed funds. "urthermore, a poor investment decision may not

be reversible. "or all of these reasons, it is crucial that a company perform a capital investment

analysis before making any high-stakes capital investment decision

2.1.2 COMPREHENSIVE CAPITAL ANALYSIS AND REVIEW

The Comprehensive Capital Analysis and #eview $CCA#% is an annual exercise by the "ederal

#eserve to ensure that institutions have robust, forward-looking capital planning processes that

account for their unique risks and sufficient capital to continue operations throughout times of

economic and financial stress. As part of the CCA#, the "ederal #eserve evaluates institutions&

capital adequacy, internal capital adequacy assessment processes, and their plans to make capital

distributions, such as dividend payments or stock repurchases. The CCA# includes a supervisory

stress test to support the "ederal #eserve&s analysis of the adequacy of the firms& capital. oards

of directors of the institutions are required each year to review and approve capital plans before

submitting them to the "ederal #eserve.

Comparison of the sums to be invested in a pro'ect with the earnings expected over the period of

the investment, expressed usually as return-on-investment $#(!% percentage per accounting

period.

2.1.3 OVERVIEW OF APPRAISAL TECHNIQUES

The basic purpose of systematic appraisal is to achieve better spending decisions for capital and

current expenditure on schemes, pro'ects and programmes. This document provides an overview

of the main analytical methods and techniques which should be used in the appraisal process.

These techniques can also be used in the evaluation process.

1

An understanding of discounting and )et *resent +alue $)*+% calculations is fundamental to

proper appraisal of pro'ects and programmes. A good understanding of Cost enefit Analysis

$CA%, !nternal #ate of #eturn $!##%, ,ulti Criteria Analysis $,CA% and Cost -ffectiveness

Analysis $C-A% is also essential for economic appraisal purposes.

Analti!al "#t$%&'

The recommended analytical methods for appraisal are generally discounted cash flow

techniques which take into account the time value of money. *eople generally prefer to receive

benefits as early as possible while paying costs as late as possible. Costs and benefits occur at

different points in the life of the pro'ect so the valuation of costs and benefits must take into

account the time at which they occur. This concept of time preference is fundamental to proper

appraisal and so it is necessary to calculate the present values of all costs and benefits.

N#t P(#'#nt Val)# M#t$%& *NPV+

!n the )*+ method, the revenues and costs of a pro'ect are estimated and then are discounted

and compared with the initial investment. The preferred option is that with the highest positive

net present value. *ro'ects with negative )*+ values should be re'ected because the present

value of the stream of benefits is insufficient to recover the cost of the pro'ect.

Compared to other investment appraisal techniques such as the !## and the discounted payback

period, the )*+ is viewed as the most reliable technique to support investment appraisal

decisions. There are some disadvantages with the )*+ approach. !f there are several independent

and mutually exclusive pro'ects, the )*+ method will rank pro'ects in order of descending )*+

values. .owever, a smaller pro'ect with a lower )*+ may be more attractive due to a higher

ratio of discounted benefits to costs $see C# below%, particularly if there affordability

constraints.

/sing different evaluation techniques for the same basic data may yield conflicting conclusions.

!n choosing between options A and , the )*+ method may suggest that option A is preferable,

while the !## method may suggest that option is preferable. .owever in such cases, the results

indicated by the )*+ method are more reliable. The )*+ method should be always be used

where money values over time need to be appraised. )evertheless, the other techniques also

yield useful additional information and may be worth using.

The key determinants of the )*+ calculation are the appraisal hori0on, the discount rate and the

accuracy of estimates for costs and benefits.

2

Di'!%)nt (at#

The discount rate is a concept related to the )*+ method. The discount rate is used to convert

costs and benefits to present values to reflect the principle of time preference. The calculation of

the discount rate can be based on a number of approaches including, among others1

The social rate of time preference

The opportunity cost of capital

2eighted average method

The same basic discount rate $usually called the test discount rate or T3#% should be used in all

cost-benefit and cost-effectiveness analyses of public sector pro'ects.

The current recommended T3# is 45. .owever, given the recent changes in economic

circumstances, the current discount rate needs to be updated. This task will be undertaken by the

C--/ and the revised discount rate will be published in section - of the code 6#eference and

*arameter +alues.

.owever, if a commercial 7tate 7ponsored ody is discounting pro'ected cash flows for

commercial pro'ects, the cost of capital should be used or even a pro'ect-specific rate.

Int#(nal Rat# %, R#t)(n *IRR+

The !## is the discount rate which, when applied to net revenues of a pro'ect sets them equal to

the initial investment. The preferred option is that with the !## greatest in excess of a specified

rate of return. An !## of 895 means that with a discount rate of 895, the pro'ect breaks even.

The !## approach is usually associated with a hurdle cost of capital:discount rate, against which

the !## is compared. The hurdle rate corresponds to the opportunity cost of capital. !n the case

of public pro'ects, the hurdle rate is the T3#. !f the !## exceeds the hurdle rate, the pro'ect is

accepted.

There are disadvantages associated with the !## as a performance indicator. !t is not suitable for

the ranking of competing pro'ects. !t is possible for two pro'ects to have the same !## but have

different )*+ values due to differences in the timing of costs and benefits. !n addition, applying

different appraisal techniques to the same basic data may yield contradictory conclusions.

-#n#,it . C%'t (ati% *-CR+

3

The C# is the discounted net revenues divided by the initial investment. The preferred option is

that with the ratio greatest in excess of 8. !n any event, a pro'ect with a benefit cost ratio of less

than one should generally not proceed. The advantage of this method is its simplicity.

/sing the C# to rank pro'ects can lead to suboptimal decisions as a pro'ect with a slightly

higher C# ratio will be selected over a pro'ect with a lower C# even though the latter pro'ect

has the capacity to generate much greater economic benefits because it has a higher )*+ value

and involves greater scale.

Pa/a!0 an& Di'!%)nt#& 1a/a!0

The payback period is commonly used as an investment appraisal technique in the private sector

and measures the length of time that it takes to recover the initial investment. .owever this

method presents obvious drawbacks which prevent the ranking of pro'ects. The method takes no

account of the time value of money and neither does it take account of the earnings after the

initial investment is recouped.

A variant of the payback method is the discounted payback period. The discounted payback

period is the amount of time that it takes to cover the cost of a pro'ect, by adding the net positive

discounted cashflows arising from the pro'ect. !t should never be the sole appraisal method used

to assess a pro'ect but is a useful performance indicator to contextualise the pro'ect;s anticipated

performance.

S#n'iti2it anal'i'

An important feature of a comprehensive CA is the inclusion of a risk assessment. The use of

sensitivity analysis allows users of the CA methodology to challenge the robustness of the

results to changes in the assumptions made $i.e. discount rate, time hori0on, estimated value of

costs and benefits, etc%. !n doing so, it is possible to identify those parameters and assumptions to

which the outcome of the analysis is most sensitive and therefore, allows the user to determine

which assumptions and parameters may need to be re-examined and clarified.

7ensitivity analysis is the process of establishing the outcomes of the cost benefit analysis which

is sensitive to the assumed values used in the analysis. This form of analysis should also be part

of the appraisal for large pro'ects. !f an option is very sensitive to variations in a particular

variable $e.g. passenger demand%, then it should probably not be undertaken. !f the relative merits

of options change with the assumed values of variables, those values should be examined to see

4

whether they can be made more reliable. !t can be useful to attach probabilities to a range of

values to help pick the best option.

7ensitivity analysis requires a degree of exploratory analysis to ascertain the most sensitive

variables and should lead to a risk management strategy involving risk mitigation measures to

ensure the most pessimistic values for key variables do not materialise or can be managed

appropriately if they do materialise.

!t is important to take into account the level of disaggregation of pro'ect inputs and benefits 6

sensitivity analysis based on a mix of highly aggregated and disaggregated variables may be

misleading.

S!#na(i% anal'i'

The scenario analysis technique is related to sensitivity analysis. 2hereas the sensitivity analysis

is based on a variable by variable approach, scenario analysis recognises that the various factors

impacting upon the stream of costs and benefits are inter-independent. !n other words, this

approach assumes that that altering individual variables whilst holding the remainder constant is

unrealistic $i.e. for a tourism pro'ect, it is unlikely that ticket sales and caf<-souvenir sales are

independent%. #ather, scenario analysis uses a range of scenarios $or variations on the option

under examination% where all of the various factors can be reviewed and ad'usted within a

consistent framework.

A number of scenarios are formulated 6 best case, worst case, etc 6 and for each scenario

identified, a range of potential values is assigned for each cost and benefit variable. 2hen

formulating these scenarios, it is important that appropriate consideration is given to the sources

of uncertainty about the future $i.e. technical, political, etc%. (nce the values within each scenario

have been reviewed, the )*+ of each scenario can then be recalculated.

S3it!$in4 2al)#'

This process of substituting new values on a variable-by-variable basis can be referred to as the

calculation of switching values. These can provide interesting insights such as what change$s%

would make the )*+ equal 0ero or alternatively, by how much must costs or benefits fall or rise,

respectively, in order to make a pro'ect worthwhile. The switching value is usually presented as a

5 i.e. a =95 increase in investment costs reduces pro'ect )*+ to 9.

5

This is very useful information and should be afforded a prominent place in any decision-making

process. ,oreover, given the importance of this information the switching values chosen should

be carefully considered and should be realistic and 'ustifiable. "or example, for capital pro'ects

requiring an -xchequer commitment over the medium to long-term, operating and maintenance

costs should always be examined. 7imilarly, any pro'ect reliant upon user charges should always

examine the impact of changes in volumes and the level of charges.

"inally, the -uropean Commission have suggested that when undertaking a sensitivity analysis a

useful determinant of the most critical variables is those for which a 8 per cent variation $>:-%

produces a corresponding variation of ? per cent or more in the )*+.

Di't(i/)ti%nal Anal'i'

The calculation of )*+;s makes no allowance for the distribution of costs and benefits among

members of society. This is an important drawback if the intended ob'ectives of a

programme:pro'ect aimed at specific income groups. 3ifferential impact may arise because of

income, gender, ethnicity, age, geographical location or disability and any distributional effects

should be explicit and quantified where appropriate. A common approach to take account of

distributional issues is to divide the relevant population into different income groups and analyse

the impact of the programme:pro'ect on these groups. 2eights can be attached to the different

groups to reflect @overnment policy. Carrying out a distributional analysis can be a difficult task

because costs and benefits are redistributed in unintended ways.

2.1.5 ECONOMIC APPRAISAL TECHNIQUES

-conomic analysis aims to assess the desirability of a pro'ect from the societal perspective. This

form of appraisal differs from financial appraisal because financial appraisal is generally done

from the perspective of a particular stakeholder e.g. an investor. 7ponsoring Authority or the

-xchequer. -conomic analysis also considers non-market impacts such as externalities.

C-A

The general principle of cost benefit analysis is to assess whether or not the social and economic

benefits associated with a pro'ect are greater than its social and economic costs. To this end, a

pro'ect is deemed to be desirable where the benefits exceed the costs. .owever, should the

benefits exceed the costs, this does not necessarily imply that a pro'ects will proceed as other

pro'ects with a higher net present value $)*+% may be in competition for the same scarce

resources. !n addition, there are affordability constraints which mean that pro'ects should not

proceed even if the )*+ is positive.

6

!n cost-benefit analysis all of the relevant costs and benefits, including indirect costs and

benefits, are taken into account. Cash values, based on market prices $or shadow prices, where

no appropriate market price exists% are placed on all costs and benefits and the time at which

these costs:benefits occur is identified. The analytic techniques outlined above $i.e. )*+ method,

!## method, etc.% are applied using the T3#. The general principle of cost-benefit analysis is

that a pro'ect is desirable if the economic and social benefits are greater than economic and

social costs. !t is vital that cost-benefit analysis is ob'ective. !ts conclusions should not be

pre'udged. !t should not be used as a device to 'ustify a case already favoured for or against a

proposal. "actors of questionable or dubious relevance to a pro'ect should not be introduced into

an analysis in order to affect the result in a preferred direction.

A more detailed guide on how to carry out a CA is set out in *ublic 7pending Code 3.9A 6

@uide to -conomic Appraisal1 Carrying out a CA.

C%'t E,,#!ti2#n#'' Anal'i' *CEA+

!t is difficult to measure the value to society of public investment in social infrastructure because

the outputs may be difficult to specify accurately and to quantify, and are not frequently

marketed. !n cases like these, the cost of the various alternative options should be first

determined in monetary terms. A choice can then be made as to which of the options $if they all

achieve the same effects% is preferable. C-A is not a basis for deciding whether or not a pro'ect

should be undertaken. #ather, it is concerned with the relative costs of the various options

available for achieving a particular ob'ective. C-A will assist in the determination of the least

cost way of determining the capital pro'ect ob'ective. A choice can then be made as to which of

these options is preferable.

-valuating options in C-A is best done by applying the principles of the )*+ method to the

stream of cash outflows or costs. The recurring costs of using facilities as well as the capital

costs of creating them should be taken into account, particularly if they differ between alternative

options. /sually, the aim will be to select the option which minimises the net present cost.

There is a particular need for consistency in the assumptions and parameters adopted for CA

and C-A appraisals. C-A is most applicable to healthcare, scientific and educational pro'ects

where benefits can be difficult to evaluate.

C%'t Utilit Anal'i' *CUA+

C/A is a variant of C-A that measures the relative effectiveness of alternative interventions in

achieving two or more ob'ectives. !t is often used in health appraisals. !n a C/A, costs are

expressed in monetary terms and outcomes: benefits are expressed in utility terms e.g. outcomes

7

are often defined in quality ad'usted life years $BACDs%. This outcome measure is a combination

of duration of life and health related quality of life. 2hereas in a CA, there is a requirement to

attempt to place a monetary value on all benefits, C/A allows for a comparison of the benefits of

health interventions without having to place a financial value on health states.

M)lti C(it#(ia Anal'i' *MCA+

,ulti-criteria analysis $,CA% establishes preferences between pro'ect options by reference to an

explicit set of criteria and ob'ectives. These would normally reflect policy:programme ob'ectives

and pro'ect ob'ectives and other considerations as appropriate, such as value for money, costs,

social, environmental, equality, etc. ,CA is often used as an alternative to appraisal techniques

because it incorporates multiple criteria and does not focus solely on monetary values.

,CAs often include Escoring and weightingF of the relevant criteria reflecting their relative

importance to the ob'ectives of the pro'ect. Care should be taken to try and minimise the

sub'ectivity of decision making in an ,CA as this is a common problem with carrying out

,CA;s. The relative importance of ob'ectives and criteria to achievement of the pro'ect will vary

from sector to sector. The 7ponsoring Agency should agree these with the 7anctioning Authority.

!n constructing a multi criteria analysis scorecard and determining the weightings to be given to

criteria the aim should be to achieve an ob'ective appraisal of pro'ect options and consistency in

decision making. Gudgments regarding the scoring of investment options should be based on

ob'ective, factual information. The 'ustification for scoring and weighting decisions must be

documented in detail. !n this regard, the system should be capable of producing similar results if

the selection criteria were applied by different decision makers.

The main steps in the ,CA process include1

8. !dentify the performance criteria for assessing the pro'ect

=. 3evise a scoring scheme for marking a pro'ect under each criterion heading

A. 3evise a weighting mechanism to reflect the relative importance of each criterion

4. Allocate scores to each investment option for each of the criteria

?. 3ocument the rationale for the scoring results for each option

H. Calculate overall results and test for robustness

I. #eport and interpret the findings

The importance of explaining the weights and scores fully, and interpreting the results carefully,

cannot be over-stressed.

8

2.2 SI6NIFICANCE OF THE INFORMATION RE6ARDIN6 CAPITAL ANALYSIS

Capital investment appraisal involves the decision making process with respect to investment in

fixed assets specifically.

!t helps the manager to determining the long term ob'ective of the company business

The successful administration of capital investment appraisal involves

@eneration of investment proposal

7election of pro'ect budget

-xecution of pro'ect budget

-stimation of cash flow

!t help assist manager to improve and adopt strategies to reduce loss of capital in the

business operation.

!t ensure reliable methods of keeping records.

Capital investment decision implies taking decisions concerning big amount of capital

outlay.

!t also involves planning for improved performance.

@ood capital budgeting demands a comprehensive integrated and co-ordinate plan which

can provide guidelines for improved performance.

A firm;s decision to invest n long 6 term assets has a decision influence on the rate and

direction of growth. A wrong decision on investment adversely affects the progress of the

firm.

"uture events are assessed and these events are difficult to predict. Truly it is a complex

problem to correctly estimate future cash flow;s of an investment.

9

The cash flow;s uncertainly is caused by economic, political social and technological

forces. !nvestment in capital assets might course firm to suffer for many years whole their

analysis is not properly done. enefit would accrue to a firm where investment in capital

has been properly analy0ed.

!t is therefore properly analy0ed budgeting process have to be well articulated for a firm

to derive good benefit from it.

2.3 PRO7ECT SELECTION

INTRODUCTION8

*ro'ect selection is the process of choosing a pro'ect or set of pro'ects to be implemented by the

organi0ation. 7ince pro'ects in general require a substantial investment in terms of money and

resources, both of which are limited, it is of vital importance that the pro'ects that an

organi0ation selects provide good returns on the resources and capital invested. This requirement

must be balanced with the need for an organi0ation to move forward and develop. The high level

of uncertainty in the modern business environment has made this area of pro'ect management

crucial to the continued success of an organi0ation with the difference between choosing good

pro'ects and poor pro'ects literally representing the difference between operational life and death.

ecause a successful model must capture every critical aspect of the decision, more complex

decisions typically require more sophisticated models.

*ro'ect 7election is a process to assess each pro'ect idea and select the pro'ect with the highest

priority. *ro'ects are still 'ust suggestions at this stage, so the selection is often made based on

only brief descriptions of the pro'ect. As some pro'ects will only be ideas, you may need to write

a brief description of each pro'ect before conducting the selection process.

7election of pro'ects is based on1

-#n#,it'8

A measure of the positive outcomes of the pro'ect. These are often described as Jthe reasons why

you are undertaking the pro'ectJ. The types of benefits of eradication pro'ects include1

o iodiversity

o -conomic

o 7ocial and cultural

o "ulfilling commitments made as part of national, regional or international plans

and agreements.

F#a'i/ilit8

10

A measure of the likelihood of the pro'ect being a success, i.e. achieving its ob'ectives. *ro'ects

vary greatly in complexity and risk. y considering feasibility when selecting pro'ects it means

the easiest pro'ects with the greatest benefits are given priority.

W$ &% 3# 1lan 1(%9#!t:

(ften you will have a number of suggested pro'ects but not enough resources, money or time to

undertake all of the pro'ects. The ideas for eradication pro'ects may have come from many

sources including1 the community, funders, local and national governments and )on-

@overnmental (rgani0ations $)@(s%. Dou will therefore need a way of deciding on a priority

order and choosing a pro'ect.

!f your organisation has limited experience in conducting eradications then it is recommended to

concentrate on a small number of pro'ects, ideally one pro'ect at a time, until the people in your

organisation have developed the skills and experience. @row capacity and build up to

undertaking multiple pro'ects at any one time. 3o the easy pro'ects first. 2ork towards the most

difficult and rewarding pro'ects. /se the easy pro'ects to help answer questions:solve issues for

the more difficult pro'ects. /se the best opportunities to learn.

Dou may have a mix of straight forward and difficult eradication pro'ects and do not know where

to start. The *ro'ect 7election 7tage will assist you by providing a process to compare the

importance of the pro'ects and select the most suitable pro'ect to undertake.

y following the *ro'ect 7election 7tage you will follow a step by step ob'ective method for

prioriti0ing pro'ects - this can be used to explain to stakeholders the reasoning behind why you

selected a particular pro'ect.

The benefits of completing the *ro'ect 7election are1

a transparent and documented record of why a particular pro'ect was selected

a priority order for pro'ects, that takes into account their importance and how achievable

the pro'ect is.

W$#n t% &%:

/ndertake a *ro'ect 7election when you have more ideas than the number of pro'ects you can

undertake and need to select the pro'ect that should be given priority.

N%t#8 !f you only have 8 pro'ect, it may still be useful to score the pro'ect against a set of criteria

to identify the strengths and weaknesses of the pro'ect. The results may be useful later in the

"easibility 7tudy 7tage.

W$% '$%)l& /# in2%l2#&:

A4#n! Mana4#"#nt8

7et selection criteria to ensure the selection process aligns with agency strategies.

7election processes are often run as a management initiative before the implementing

*ro'ect ,anager is assigned.

11

Sta0#$%l&#('8

7takeholder participation at the start of a pro'ect creates strong community ownership and

support, and increases the chances of a successful outcome.

7takeholder input should be included at the ideas stageK consult widely as you are

developing the ideas for pro'ects as the community will be the source of many of the best

pro'ect ideas.

7takeholders must be informed of the outcome of the *ro'ect 7election 7tage.

P(%9#!t Mana4#(8

!nvolving the *ro'ect ,anager in the *ro'ect 7election process will help build ownership in the

pro'ect and support a successful pro'ect in the long run.

There are various pro'ect selection methods practiced by the modern business organi0ations.

These methods have different features and characteristics. Therefore, each selection method is

best for different organi0ations.

Although there are many differences between these pro'ect selection methods, usually the

underlying concepts and principles are the same.

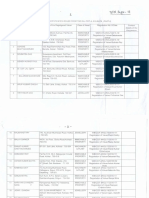

"ollowing is an illustration of two of such methods $enefit ,easurement and Constrained

(ptimi0ation methods%.

12

As the value of one pro'ect would need to be compared against the other pro'ects, you could use

the benefit measurement methods. This could include various techniques, of which the following

are the most common.

Dou and your team could come up with certain criteria that you want your ideal pro'ect

ob'ectives to meet. Dou could then give each pro'ect scores based on how they rate in each of

these criteria, and then choose the pro'ect with the highest score.

2hen it comes to the 3iscounted Cash flow method, the future value of a pro'ect is

ascertained by considering the present value and the interest earned on the money. The higher the

present value of the pro'ect, the better it would be for your organi0ation.

The rate of return received from the money is what is known as the !##. .ere again, you

need to be looking for a high rate of return from the pro'ect.

The mathematical approach is commonly used for larger pro'ects. The constrained optimi0ation

methods require several calculations in order to decide on whether or not a pro'ect should be

re'ected.

Cost-benefit analysis is used by several organi0ations to assist them to make their selections.

@oing by this method, you would have to consider all the positive aspects of the pro'ect, which is

the benefits, and then deduct the negative aspects $or the costs% from the benefits. ased on the

results you receive for different pro'ects, you could choose which option would be the most

viable and financially rewarding.

These benefits and costs need to be carefully considered and quantified in order to arrive at a

proper conclusion. Buestions that you may want to consider asking are in the selection process

are1

2ould this decision help me to increase organi0ational value in the long runL

13

.ow long will the equipment last forL

2ould ! be able to cut down on costs as ! go alongL

!n addition to these methods, you could also consider Choosing based on opportunity cost -

2hen choosing any pro'ect, you would need to keep in mind the profits that you would make if

you do decide to go ahead with the pro'ect.

*rofit optimi0ation is therefore the ultimate goal. Dou need to consider the difference between

the profits of the pro'ect you are primarily interested in, and the next best alternative.

I"1l#"#ntati%n %, t$# C$%'#n M#t$%&8

The methods mentioned above can be carried out in various combinations. !t is best that you try

out different methods, as in this way you would be able to make the best decision for your

organi0ation considering a wide range of factors rather than concentrating on 'ust a few. Careful

consideration would therefore need to be given to each pro'ect.

2.5 PRO7ECT DECISIONS

EThere is a simple solution to every complex problemK unfortunately, it is wrongF. This reality

creates a ma'or challenge for tool designers. *ro'ect decisions are often high-stakes, dynamic

decisions with complex technical issuesMprecisely the kinds of decisions that are most difficult

to model1

N *ro'ect selection decisions are high-stakes because of their strategic implications. The pro'ects

a company chooses can define the products it supplies, the work it does, and the direction it takes

in the marketplace. Thus, pro'ect decisions can impact every business stakeholder, including

customers, employees, partners, regulators, and shareholders. A sophisticated model may be

needed to capture strategic implications.

N *ro'ect decisions are dynamic because a pro'ect may be conducted over several budgeting

cycles, with repeated opportunities to slow, accelerate, re-scale, or terminate the pro'ect. Also, a

successful pro'ect may produce new assets or products that create time-varying financial returns

and other impacts over many years. A more sophisticated model is needed to address dynamic

impacts.

N *ro'ect decisions typically produce many different types of impacts on the organi0ation.

"or example, a pro'ect might increase revenue or reduce future costs. !t might impact how

customers or investors perceive the organi0ation. !t might provide new capability or learning,

important to future success. ,aking good choices requires not 'ust estimating the financial return

on investmentK it requires understanding all of the ways that pro'ects add value. A more

sophisticated model is needed to account for all of the different types of potential impacts that

pro'ect selection decisions can create.

14

*ro'ect decisions often entail risk and uncertainty. The significance of a pro'ect risk depends on

the nature of that risk and on the other risks that the organi0ation is taking. A more sophisticated

model is needed to correctly deal with risk and uncertainty.

*ro'ect selection is the process of evaluating individual pro'ects or groups of pro'ects, and then

choosing to implement some set of them so that the ob'ectives of the parent organi0ation will be

achieved. This same systematic process can be applied to any area of the organi0ation;s business

in which choices must be made between competing alternatives. "or example1

A manufacturing firm can use evaluation:selection techniques to choose which machine

to adopt in a part-fabrication process.

A television station can select which of several syndicated comedy shows to rerun in its

I1A9 p.m. weekday time-slot

A construction firm can select the best subset of a large group of potential pro'ects on

which to bid

A hospital can find the best mix of psychiatric, orthopedic, obstetric, and other beds for a

new wing.

-ach pro'ect will have different costs, benefits, and risks. #arely are these known with certainty.

!n the face of such differences, the selection of one pro'ect out of a set is a difficult task.

Choosing a number of different pro'ects, a portfolio, is even more complex.

!n the following sections, we discuss several techniques that can be used to help senior managers

select pro'ects. *ro'ect selection is only one of many decisions associated with pro'ect

management. To deal with all of these problems, we use decision aiding models. 2e need such

models because they abstract the relevant issues about a problem from the plethora of detail in

which the problem is embedded. #eality is far too complex to deal with in its entirety. An

EidealistF is needed to strip away almost all the reality from a problem, leaving only the aspects

of the ErealF situation with which he or she wishes to deal. This process of carving away the

unwanted reality from the bones of a problem is called modeling the problem.

The ideali0ed version of the problem that results is called a model. The model represents the

problem;s structure, its form. -very problem has a form, though often we may not understand a

problem well enough to describe its structure. 2e will use many models in this bookMgraphs,

analogies, diagrams, as well as flow graph and network models to help solve scheduling

problems, and symbolic $mathematical% models for a number of purposes.

A model is an ob'ect or concept, which attempts to capture certain aspects of the real world. The

purpose of models can vary widely, they can be used to test ideas, to help teach or explain new

concepts to people or simply as decorations. 7ince the uses that models can be put are so many it

is difficult to find a definition that is both clear and conveys all the meanings of the word. !n the

context of pro'ect selection the following definition is useful1

EA model is an explicit statement of our image of reality. !t is a representation of the relevant

aspects of the decision with which we are concerned. !t represents the decision area by

15

structuring and formali0ing the information we possess about the decision and, in doing so,

presents reality in a simplified organi0ed form. A model, therefore, provides us with an

abstraction of a more complex realityF.

2hen pro'ect selection models are seen from this perspective it is clear that the need for them

arises from the fact that it is impossible to consider the environment, within which a pro'ect will

be implemented, in its entirety. The challenge for a good pro'ect selection model is therefore

clear. !t must balance the need to keep enough information from the real world to make a good

choice with the need to simplify the situation sufficiently to make it possible to come to a

conclusion in a reasonable length of time.

2.5.1 CRITERIA FOR CHOOSIN6 PRO7ECT MODEL8

8. #ealism1

=. Capability1

A. "lexibility1

4. -ase of /se1

?. Cost1

H. -asy Computeri0ation1

2.5.2 THE NATURE OF PRO7ECT SELECTION MODELS8

There are two basic types of pro'ect selection models, numeric and nonnumeric. oth are widely

used. ,any organi0ations use both at the same time, or they use models that are combinations of

the two. )onnumeric models, as the name implies, do not use numbers as inputs. )umeric

models do, but the criteria being measured may be either ob'ective or sub'ective. !t is important

to remember that the qualities of a pro'ect may be represented by numbers, and

that sub'ective measures are not necessarily less useful or reliable than ob'ective measures.

efore examining specific kinds of models within the two basic types, let us consider 'ust what

we wish the model to do for us, never forgetting two critically important, but often overlooked

facts.

N ,odels do not make decisionsMpeople do. The manager, not the model, bears responsibility

for the decision. The manager may EdelegateF the task of making the decision to a model, but the

responsibility cannot be abdicated.

N All models, however sophisticated, are only partial representations of the reality they are meant

to reflect. #eality is far too complex for us to capture more than a small fraction of it in any

model. Therefore, no model can yield an optimal decision except within its own, possibly

inadequate, framework.

16

2.5.3 TYPES OF PRO7ECT SELECTION MODELS8

(f the two basic types of selection models $numeric and nonnumeric%, nonnumeric models are

older and simpler and have only a few subtypes to consider. 2e examine them first.

N%n-N)"#(i! M%&#l'8

These include the following1

8. The 7acred Cow1

=. The (perating )ecessity1

A. The Competitive )ecessity1

4. The *roduct Cine -xtension1

?. Comparative enefit ,odel1

2.5.5 INVESTMENT DECISIONS

!nvestment decisions are made by investors and investment managers.

!nvestors commonly perform investment analysis by making use of fundamental analysis,

technical analysis and gut feel.

!nvestment decisions are often supported by decision tools. The portfolio theory is often applied

to help the investor achieve a satisfactory return compared to the risk taken.

(ne of the most important long term decisions for any business relates to investment. !nvestment

is the purchase or creation of assets with the ob'ective of making gains in the future. Typically

investment involves using financial resources to purchase a machine: building or other asset,

which will then yield returns to an organisation over a period of time.

Oey considerations in making investment decisions are1

8. 2hat is the scale of the investment - can the company afford itL

=. .ow long will it be before the investment starts to yield returnsL

A. .ow long will it take to pay back the investmentL

4. 2hat are the expected profits from the investmentL

?. Could the money that is being ploughed into the investment yield higher returns elsewhereL

DEFINITION OF INVESTMENT DECISION

17

A determination made by directors and:or management as to how, when, where and how much

capital will be spent on investment opportunities. The decision often follows research to

determine costs and returns for each option

Capital investments are funds invested in a firm or enterprise for the purposes of furthering its

business ob'ectives. Capital investment may also refer to a firm&s acquisition of capital assets or

fixed assets such as manufacturing plants and machinery that are expected to be productive over

many years. 7ources of capital investment are manifold and can include equity investors, banks,

financial institutions, venture capital and angel investors. 2hile capital investment is usually

earmarked for capital or long-life assets, a portion may also be used for working capital

purposes.

Capital investment encompasses a wide variety of funding options. 2hile funding for capital

investment is generally in the form of common or preferred equity issuance, it may also be

through straight or convertible debt. "unding may range from an amount of less than P899,999 in

seed financing for a start-up to amounts in the hundreds of millions for massive pro'ects in

capital-intensive sectors like mining, utilities and infrastructure.

To what extent do fnancing frictions constrain investments that frms woud

otherwise ma!e" This #uestion is argua$% one of the most im&ortant in

cor&orate fnance' and one a$out

which there continues to $e signifcant de$ate( )ince *a++ari'

,u$$ard' and -eterson .1988/ frst estimated the sensitivit% of investment to

interna cash 0ow generation' the iterature has argued a$out whether their

fnding that greater interna ca&ita corres&onds to greater investment was

driven $% the reaxing of fnancing constraints ena$ing investment that

woud otherwise have $een forgone or whether the higher interna cash 0ow

mere% &roxied for im&rovements in investment o&&ortunities $e%ond the

contros in their s&ecifcation .1a&an and 2ingaes' 2000' and 3ric!son and

4hited' 2000/(

*inance theor% &redicts' however' that frms with unfettered access to the

ca&ita mar!ets woud aread% $e o&timi+ing their investment( 5n other words'

a crucia and unstated assum&tion under%ing the 6ct is that frms were

una$e to raise su7cient funds from externa mar!ets at

reasona$e &rices and were not generating su7cient interna domestic funds

to fnance a avaia$e domestic investment o&&ortunities( 5f a frm can

access externa ca&ita or generate su7cient interna domestic ca&ita to

fu% fund their domestic investments' we woud not ex&ect the 6ct to have

an% e8ect on the frm9s investment(

Ca'$ in,l%3

Dou can see from the illustration above that the cumulative net cash inflow will pay back the

investment at the end of the fourth year. *ro'ects with the shortest payback periods are preferred

18

as longer payback periods increase the risk of unforeseen circumstances arising. .owever, the

problem of payback is that it gives no indication of the profitability of the pro'ect. An alternative

method that can be employed therefore to weigh up the investment is the Accounting rate of

return method.

2.; CAPITAL RATIONIN6

2.;.1 INTRODUCTION

Capital rationing is

N -normity of funds requirements

N Cimited availability of funds

N Capital rationing resorted to by firms who are not able to generate additional funds

N Ceiling is set on capital spendingMconsider only pro'ects with high )*+s

W$at i' !a1ital (ati%nin4:

Capital rationing has to do with the acquisition of new investments. ,ore to the point, it is all

about getting investments based on such factors as the recent performance of other capital

investments, the amount of disposable resources that are free to acquire a new asset, and the

anticipated performance of the asset. !n short, it&s a strategy employed by companies to make

investments based on the current relevant circumstances of the company.

@enerally, capital rationing is used as a means of putting a limit or cap on the portion of the

existing budget that may be used in acquiring a new asset. As part of this process, the investor

will also want to consider the use of a high cost of capital when thinking in terms of the outcome

of the act of acquiring a particular asset. Any responsible company will likely choose to employ

strategies that support the productive use of disposable funds built within a capital budget, but at

the same time, it is important to understand what benefits can reasonably be expected from

owing the asset in question.

7ince this strategy is all about setting criteria that any investment opportunity must meet before

the company will seriously entertain the purchase, many businesses choose it as their guiding

process for any acquisitions. /sing the basic principles of the technique, a company can develop

a list of standards that must be addressed before any capital purchase. !f the standards are drafted

in a manner that accurately reflects the current condition of the company, then there is a good

chance the right types of investments will be considered.

7ome of the more important factors to consider as part of a productive capital rationing approach

are the financial condition of the company, the long and short term goals of the business, and

proper attention to daily operations. (ne of the benefits of the strategy is that the approach helps

19

to ensure that funds for basic operations are not diverted in order to take advantage of a so-called

Ecan;t failF opportunity, which helps to maintain the stability of the business.

D#,initi%n %, Ca1ital Rati%nin4

The act of placing restrictions on the amount of new investments or pro'ects undertaken by a

company. This is accomplished by imposing a higher cost of capital for investment consideration

or by setting a ceiling on the specific sections of the budget.

Companies may want to implement capital rationing in situations where past returns of

investment were lower than expected.

"or example, suppose AC Corp. has a cost of capital of 895 but that the company has

undertaken too many pro'ects, many of which are incomplete. This causes the company&s actual

return on investment to drop well below the 895 level. As a result, management decides to place

a cap on the number of new pro'ects by raising the cost of capital for these new pro'ects to 8?5.

7tarting fewer new pro'ects would give the company more time and resources to complete

existing pro'ects.

2.;.1.1 W$ !a1ital (ati%nin4:

< E=t#(nal (#a'%n'

- (ccurs when firm has many options for investment but is unable to take them up either

because of insufficient funds or because capital markets are not favourable

- Cack of standing in the marketMcannot raise funds due to the credibility issues 6 .igh

floatation costs

Capital rationing is the process of selecting the most valuable pro'ects to invest available funds.

!n this process, managers use a number of capital budgeting methods such as cash payback

period method $C**,%, accounting rate of return $A##% method, net present value $)*+%

method and internal rate of return $!##% method.

Int#(nal (#a'%n'

- (ccur when the firm has self imposed restrictions on funds allocated for fresh

investmentsN Availability of funds or have the ability to procure funds from markets, but

they do not do so

- /se retained earnings to foster growth

- !mplies firms do not want to grow

2.;.2 St#1' in !a1ital (ati%nin48

#anking of different investment proposals

7election of most profitable proposal based on the ranks or highest )*+s

20

An effective capital rationing usually consists of the following steps1

St#1 18

"irst of all, the alternative pro'ects are screened using payback period and accounting rate of

return methods. ,anagement sets maximum desired payback period or minimum desired

accounting rate of return for all competing alternative pro'ects. The payback period or

accounting rate of return of various alternatives is then computed and compared to the

management;s desired payback period and accounting rate of return. $To know how payback

period and accounting rate of return are computed,

7tep =1

The pro'ects that pass the initial test in step 8 are further analy0ed using net present value and

internal rate of return methods. $To know how net present value $)*+% and internal rate of return

$!##% are computed,.

St#1 38

The pro'ects that survive in step = are ranked using a predetermined criteria and compared with

the available funds. "inally, the pro'ects are selected for funding.

The pro'ects that remain unfunded may be reconsidered on the availability of funds.

!n addition to quantitative techniques, management should also consider the qualitative factors

related to all pro'ects. "or example, the purchase of a new machine can increase customer

satisfaction by improving the quality of the product, reduce cost by eliminating several 'obs but

lower employee moral.

21

2.;.2.1 Ri'0 anal'i'

N #isk refers to the uncertain conditions under which a firm performs

N -xist because of the inability to forecast future situations

N "orecasts not done with precision

2.;.2.2 W$at i' Ri'0 Mana4#"#nt:

22

N #isk ,anagement is the logical and systematic method of identifying, analysing, treating and

monitoring the risks involved in any activity or process.

E2#nt' a,,#!tin4 in2#'t"#nt ,%(#!a't'- t$(## !at#4%(i#'

6 @eneral economic conditions

Mpolitical changes, monetary policies, taxation policies, lending conditions, social conditions

6 !ndustry factorsMspurt in employment and construction industry

6 Company factorsMchange in management, strike or lock out

T1#' %, (i'0'

N *ro'ect specific riskMwrong estimates, considering high discount rates, wrong estimates about

material and labour

N Competition riskMactions of competitors, price wars

N !ndustry specific riskMchanges in technology, changes in laws like change in service tax rates,

bringing in new services into the net

N !nternational riskMincrease:decrease in foreign currency, political connections

N ,arket riskMinflation, general economic conditions, change in bank lending rates

T#!$ni>)#' %, in!%(1%(ati%n %, (i'0 ,a!t%( in !a1ital /)&4#tin4 &#!i'i%n'

N Conventional techniques 6 *ayback method 6 #isk ad'usted discount rate 6 Certainty

equivalents 6 7ensitivity analysisN 7tatistical techniques 6 *robability distribution approach

6 3ecision tree approach

2.;.2.3 T1#' %, !a1ital (ati%nin4

Ha(& !a1ital (ati%nin4

An absolute limit on the amount of finance available is imposed by the lending institutions.

S%,t !a1ital (ati%nin4

A company may impose its own rationing on capital. This is contrary to the rational view of

shareholder wealth maximi0ation.

2.;.2.5 R#a'%n' ,%( !a1ital (ati%nin4

23

2.;.2.; M)lti 1#(i%& !a1ital (ati%nin4

Capital rationing can apply to a single period, or to multiple periods. 7ingle-period capital

rationing occurs when there is a shortage of funds for one period only. ,ulti-period capital

rationing is where there will be a shortage of funds in more than one period.

2.;.2.? D#alin4 3it$ 'in4l#-1#(i%& !a1ital (ati%nin4

1. Di2i'i/l# 1(%9#!t

2here potential pro'ects are able to be divided, ie any fraction of the pro'ect may be undertaken

and the returns from the pro'ect are expected to be generated in exact proportion to the amount of

investment undertaken, a calculation known as the profitability index $*!% is used. This a

variation on key factor analysis and the aim when managing capital rationing is to maximise

the )*+ earned per P8 invested in pro'ects.

This is done by1

$8%calculating a *! for each pro'ect $see below%

$=%ranking the pro'ects according to their *!

$A%allocating funds according to the pro'ects; rankings until they are used up.

The formula is1

24

!ndivisible pro'ects

!f pro'ects are indivisible it must be done in its entirety or not at all. To determine the optimum

use of capital investment, a t(ial an& #((%( approach must be used.

,utually excusive pro'ects

7ometimes the taking on of pro'ects will preclude the taking on of another, e.g. they may both

require use of the same asset.

!n these circumstances, each combination of investments is tried to identify which earns the

higher level of returns.

2.;.2.? D#alin4 3it$ ")lti-1#(i%& !a1ital (ati%nin4

Lin#a( 1(%4(a""in4

A solution to a multi-period capital rationing problem cannot be found using *!s. This method

can only deal with one limiting factor $i.e. one period of shortage%. .ere there are a number of

limiting factors $i.e. a number of periods of shortage% and linear programming techniques must

therefore be applied.

(b'ective function

The linear programming method can be applied to a multi-period capital rationing problem in

one of two ways. The ob'ective of the solution can be either1

to maximise the total )*+ from the investment in available pro'ects

to maximise the present value of cash flow available for dividends.

oth techniques result in the same pro'ect selections.

3ual values

The dual price is1

the amount by which one additional unit of scarce resource would increase the value of

the ob'ective function, or alternatively

the amount by which one fewer unit of scarce resource would decrease the value of the

ob'ective function.

25

!n capital rationing, the scarce resource is available funds, so the dual value expresses the

increase in the ob'ective function gained if one more dollar became available, or the reduction if

one less dollar were invested.

The amount of the dual value varies depending on which method is used to formulate the linear

programme1

)*+ method - the dual equals the change in )*+ earned if P8 more or less is available.

*+ of dividends method - the dual equals the change in the *+ of cash available to pay

dividends if P8 more or less is available.

2.;.2.@ H%3 t% S%l2# C%n,li!t' In2%l2in4 Ca1ital Rati%nin4:

Capital rationing is a method companies use to weigh different investment options. All firms

have money set aside for new investments. !f a firm is presented with more profitable pro'ects

than it has money to finance, a method must be used to decide where the available funds will go.

!n general, rationing uses the internal rate of return to decide this. The internal rate of return is a

figure that reflects the Etime valueF or Epresent valueF of proposed pro'ect funds over a period of

time. This method is used to solve most conflicts in rationing available capital funds.

7tep 8

3ecide what an acceptable rate of return is. This is the primary step because it is the basic

criterion by which an investment is seen as Erational.F !f different officers in the firm are arguing

over the proper investments for the company&s limited budget, the way to solve this problem is to

see which investments are likely to reach the desired rate or return the quickest.

7tep =

Consider the length of time it will take to see this expected or desired return. !nternal rate of

return calculations are really about the time value of money, or the actual worth of available

capital funds today. ,ore specifically, internal rate of return deals with the actual value of the

available capital as if it were already invested and came to its profitable maturity. !f conflicts are

about the amount of time that firm money will be tied up in a specific pro'ect, then this will solve

the conflict. !n other words, if the company needs money fast, using a short time frame to reach

the expected return rate would be the best option. The main variable used to solve the conflict

would therefore be those investments that would show the proper rate of return in the shortest

amount of time. These might not show the highest overall profit, but the profits they do make

will be seen very early.

7tep A

*erform the basic internal rate of return calculation for each investment option. The calculation is

simple1 divide the initial outlay of investment money by the cash flow expected from the

investment. This simple equation will give you the time value or present value of the current

investment funds earmarked for specific pro'ects.

26

7tep 4

!nclude the amount of time the money will be tied up in investments. This can be done in the

equation by including the factor of how many times the expected cash flow will be generated. !f

the funds will be tied up for two years and the cash flow is generated monthly, then you will use

the factor of =4 to come to the cash flow figure. Therefore, the cash flow variable used in the

equation should be the monthly cash flow figure multiplied by =4.

7tep ?

*rioriti0e the rationing of investment funds based on this conclusion. !f different officers in the

company are at odds over the use of company funds, then the internal rate of return should be

able to solve these conflicts with the use of reason. 7hareholders and employees will be satisfied

since the conflicts over the use of investment money will be based on time and profit

calculations, not personal interest.

2.? PORTFOLIO MANA6EMENT

INTRODUCTION

*ortfolio management is a process encompassing many activities of investment in assets and

securities. !t is dynamic and flexible concept and involves continuous and systematic analysis,

'udgement and operations. The ob'ective of this service is to help the novices and initiali0ed

investors with the expertise of professionals in portfolio management.

"irstly, it involves construction of a portfolio based upon the fact sheet of the investor giving out

his ob'ectives, constraints, preferences for risk and return and his tax liability.

7econdly, the portfolio is reviewed and ad'usted from time to time in tune with the market

conditions. The ad'ustment is done through the changes in the weighting pattern of the securities

and asset classes in the portfolio. The shifting of assets and securities will take advantage of

changes in market conditions and in prices in the securities and assets in the portfolio.

Thirdly, the evaluation of portfolio performances is to be done by the manager in terms of targets

set for risk and return and charges in the portfolio are to be affected to meet the changing

conditions.

2.?.1 ELEMENTS OF PORTFOLIO MANA6EMENT8

*ortfolio management is an on-going involving the following basic tasks.

8. !dentifications of the investor ob'ectives constraints and preferences which will help

formulate the investment policy

=. 7trategies to be developed and implemented in tune with the investment policy

formulated. This will help selection of asset classes and securities in each class depending

upon their risk-return attributed.

27

A. #eview and monitoring of the performance of the portfolio by continuous overview of

the market conditions, companies; performance and investors circumstances.

4. "inally, the evaluation of the portfolio for the results to compare with the targets and

needed ad'ustments have to be made in the portfolio to the emerging conditions and to

makeup for any shortfalls in achievement vis-Q-vis targets.

The collection of data on the investors; preferences ob'ectives etc. is the foundation of portfolio

management. This gives an idea of channels of investment in terms of asset classes to be selected

and securities to be chosen based upon the liquidity requirements, time hori0on, taxes, asset

preferences of investors, etc. these are the building blocks for construction of a portfolio.

According to these ob'ectives and constraints, the investment policy can be formulated. This

policy will lay down the weights to be given to different assets classes of investment such as

equity shares, preference shares, debentures, company deposits etc. and the proportion of funds

to be invested the investment strategy for a time hori0on for income and capital appreciation and

for level of risk tolerance.

The investment strategies developed by the portfolio managers have to be correlated with their

expectation of the capital market and the individual sectors of the country.

Then a particular combination of assets is chosen on the basis of investment strategy and

managers expectations of the market.

2.?.1.2 EAECUTION OF STRATE6Y8

The next stage, namely, implementation and execution of this investment strategy, is the most

critical process in the portfolio management. .ere the research, analysis and the 'udgment of the

manager are very essential inputs in the process his initiative, innovation and 'udgment would on

the basis of his success structuring of portfolios to improve the performance to make it optimal

and efficient. The changes in investor;s conditions and into eh conditions and in industry

performance are taken into account in the portfolio management.

The portfolio thus contractures may relate to the needs of a given level of income, a provision for

contingencies and a preference for fixed income, etc. of the investor. 7ome investors while a few

would prefer risk less investments in *7/ bonds-short term or long-term government securities,

etc. Certain risk-takers may prefer investment in high-yielding growth and venture equities.

M%nit%(in48

,onitoring of these portfolios is a continuous upgrading and changes in asset composition to

take advantage of the conditions and economic performance. *ortfolio monitoring is a

continuous assessment of the current portfolio to the goals, changes in investors; preferences,

capital market conditions and expectations. The monitoring requires a periodic meeting with

investors to know the changes in the conditions, continuous review of the investment policy

relative to investors; preference.

28

The current investment strategy reflects the capital market conditions and expectation and

changes in them will bring out the changes in optimal conditions in the portfolio. The portfolio is

thus sub'ected to the original review and assessment to change the composition of portfolio in

tune with the changing conditions in the market and of the investor.

To give specific examples, !f market conditions change and the prospects of the cement industry

are likely to be better in the coming year, as 'udged by the government policy changes vis-Q-vis

the steel industry, then the investor preferences can be better satisfied by shifting from steel

shares to cement shares.

esides, within the cement industry, a manager may shift from a poorly performing company

like orient. Cement to be better performing company like #asi cement.

7imilarly changes can take place as between different asset classes such as moving from

debentures to equities and vice versa or from income stocks to growth stock etc.

Thus portfolio changes can be about by the changes in market expectations and from the half6

yearly results or yearly results of the companies, along with changes in industry and economy.

PORTFOLIO ANALYSIS CHART

29

)&ecifcation

and

#uantifcation

of investor:s

o$;ectives'

constraints'

-ortfoio

&oicies and

strategies

<onitoring

investor =

reated in&ut

factors

-ortfoio seection'

construction' revision'

evauation' asset aocation'

&ortfoio o&timi+ation'

securit% seection'

6ttainment of

investor

o$;ectives

These ad'ustments of the portfolio may also be initiated due to changes in the managers;

expectations of the company and market or asset classes. Certain changes in asset classes may

have a time limit as a critical input. Thus purchases and sales of equity shares on the stock

market are to be well 6 timed based upon the assessment of the market technical position. This

requires technical analysis in addition to fundamental analysis. !n fact, any shift of the

investment from one type of asset to another requires a careful analysis of time, risk return and

host of other factors.

An important characteristic of the portfolio is risk reduction, which can be achieved by

diversification of the portfolio into the various asset classes and securities within the asset class.

Changes in security prices or market expectations of the manager may have necessitated changes

in the asset composition. The efficient frontier in terms of modern portfolio theory may itself

change the composition of the portfolio due to the change in the eta value in the longer time

hori0on. The composition has to be changed to being portfolio back to the optimal conditions and

back to the efficient frontier line.

2.?.1.3 THE INVESTMENT ALTERNATIVES FOR PORTFOLIO MANA6EMENT ARE

SET OUT -ELOW.

8% Asset classes1

a. -quity new issues

b. -quity old issues

c. *reference shares

d. 3ebentures

e. *7/ bonds

f. @overnment securities

g. Company deposits

=% !ndustry groups

a. Textiles

b. Cement

30

>a&ita

mar!et

ex&ectations

?eevant

economic'

socia' &oitica'

sectors' and

securit%

<onitoring economic

and mar!et in&ut

factors

c. Aluminum

d. *etrochemicals

e. "ertili0ers

f. *aper

A% .igh income yielding securities1 lue chips and growth stock. #egular dividend paying

companies at a stable rate are income yielding shares the blue chips are not only dividend

paying regularly but their performance is above the averages and the dividend

distributions may increase over time. The growth stocks are shares with a large scope for

capital appreciation in addition to good dividends.

4% Companies with export orientation and those with only domestic demand

?% Companies based on location as those in the west, south, east and north of !ndia.

H% Type of management, vi0, family type, professional type etc.

2.?.2 FACT SHEET-CLIENTSB DATA -ASE8

The following preferences of the investor are to be noted first in investment decisions. These will

constitute the data base of the investor or client..

8. !ncome and saving decisions-how much income can be saved for contingencies and for

transactions the present positions of wealth, income and savings of the investor.

=. Asset preferences profile-preferences for risk less assets like bank deposits or for risky

stock market investment1

a. the degree of risk the investor is capable of taking and willing to takeK

b. the risk aversion and preferences for safety and certaintyK

c. requirements of regular incomeK

d. ob'ective of capital appreciationK

e. (b'ectives of speculative gains.

A. !nvestor;s ob'ectives, constraints and financial commitmentsK

4. Tax brackets into which the investor fails and his preference for planning the tax liabilityK

?. Time hori0on in which investments should fructify or results expected.

These and other factors constitute the Efact sheetF of the investor on the basis of which the

individual portfolio is to be structured, constructed and managed.

The motives for saving are varied depending on the individuals. "or ex, provision for insurance,

contingencies contribution of *", pension funds etc., which are mostly contractual obligations,

provisions for future income etc. are some of the motives. 7ome of the savers are influenced by

interest return or stable income while others are by speculative gains or get-rich quick motive.

O/9#!ti2#' %, in2#'t%('8

The investors; ob'ectives are to be specified in the first place. The ob'ective may be income,

capital appreciation or a future provision for contingencies such as marriage, death, birth, etc.

provision for retirement and accident and accident could be covered by contractual obligations

like insurance and contributions to *" and pension funds. A certain amount of savings has to be

kept as cash with themselves or in deposit with banks or post offices to facilitate daily

31

transactions for purchase and sale. 2hile cash earns no interest, savings deposit with banks,

cooperatives and *(s would earn 4.?-H5 on account. ut when inflation is prevalent in the

economy at the rate of 895 this return 4.?5 will provide only a net negative return to savers.

7o the amounts kept in the form of cash and deposit with banks, etc. should normally be the bare

minimum. The rest of the amount has to spread in various investment avenues earning higher

returns than the normal inflation rate of R-895. These investment avenues are discussed in the

previous chapter.

2.?.2.1 MOTIVES FOR INVESTMENT8

The investor has to set out his priorities of investment keeping the following motives in mind.

All investors would like to haveK

8. capital appreciation

=. income

A. liquidity or marketability

4. safety or security

?. hedge against inflation

The investor gets his income from the dividend or yield or interest. There will be capital

appreciation also in the case of equities. The liquidity and safety of an investment will depend

upon the marketability and the credit rating of the borrower, namely, the company or the issuer of

the securities.

These securities vary between assets and securities. An investor is also concerned in having a tax

plan to reduce his tax commitments so as to maximi0e the take home income. "or this purpose,

etc. investor should specify his income bracket, his liabilities and his preference for tax planning.

The investment avenues have certain characteristics of risk and return and also of some tax

concessions attached to them. These tax provisions as such can influence the investors in a very

big way as these provisions will alter risk return scenario of investment alternatives. !t is,

therefore necessary that all these avenues should be assessed in terms of yields, capital

appreciation, liquidity safety and tax implications. The investment strategy should be based on

the above ob'ectives after a through study of the goals of the investor, in the background of

characteristics of the investment avenues.

Ta= 1(%2i'i%n'8

!t is apt to start with the tax-exempt incomes of the securities in which the investment can be

made. The income by way of interest on *7/ code bonds, ).7. certificates, securities of the

central government and those deposits specified by the central government are exempted from

income tax sub'ect to certain limits and conditions. The *.(. deposits, certificates and other

claims operated by the *(s are exempted from income-tax up to a limit. This exemption is,

32

however not applicable to !ndra +ikas *atra, Oisan +ikas *atra and )7C +!!! !ssue. 3eposits in

**" and )77 are exempted from taxes in the year of deposits sub'ect to some limits in the year

of withdrawal except in the case of )77, which is, however, taxable in the year of withdrawal.

/nder the category of insurance, in addition to C!C policies, the /C!* of $/T!% en'oys popularity

due to the tax shelters.

2ealth tax exemption for all investments in shares and debentures along with other

eligible investment.

.

!ncome-tax exemption up to #s.8=999 aggregate income from bank deposits, shares, /T!

units, *.( deposits, ,utual "unds and other specified categories of investment, including

dividends. 7ince 8SSI-SR, dividends from equity of the companies are tax exempt in the

hands of the investors.

Ca1ital 4ain'8

Capital gains refer to profits earned on the transfer of capital assets, sale or exchange, etc. these

gains are long-term gains, if they are held for more than AH months for all assets except shares of

the company for which the period is 8= months. Cong-term capital gains are taxable at a lower

rate of =95. /nder 7ections ?4- and ?4" of the !ncome-tax Act, the long-term capital gains are

exempt, !f these funds are invested in central government securities, /T!s and C@! 7chemes and

other specified bonds of semi-government bodies.

!ncome from interest on debentures and on company deposits is tax deductible at source, if it

exceeds #s.=?99 p.a. the exemption available from income tax for )77 deposits up to #s.49999

was since withdrawn in 8SS=-SA. Tax exemption is also available in respect of income from

government securities, semi-government bonds, bank deposits, income from mutual funds, etc.

!n the budget for 8SS9-S8, a new scheme called -quity linked 7aving 7cheme was announced by

the government under 7ection RRA of !ncome Tax Act to provide a tax rebate of =95 of the

investment made in the eligible assets new issues, or eligible ,." 7cheme up to #s.89,999.

2.?.2.2 PORTFOLIO SELECTION8

The selection of portfolio depends on the various ob'ectives of the investors. The selections of

portfolio under different ob'ectives are dealt subsequently.

O/9#!ti2#' an& a''#t' "i=8

!f the main ob'ective is getting adequate amount of current income. 7ixty per cent of the

investment is made on debts and 49 per cent on equities. The proportions of investments on debt

and equity differ according to the individual;s performance. ,oney is invested in short term debt

and fixed income securities.

33

6(%3t$ %, in!%"# an& a''#t' "i=8

The investor requires a certain percentage of growth in the income received from his investment.

The investor;s portfolio may consist of sixty per cent to hundred per cent equities and 0ero to

fourty per cent debt instruments. The debt portion of the portfolio may consist of concession

regarding tax exemption. Appreciation of principles amount is given third priority.

Ca1ital a11(#!iati%n an& a''#t' "i=8

Capital appreciation means that the value of the original investment increases over the years.

!nvestment in real estate;s like land and house may provide a faster rate of capital appreciation

but they lake liquidity. !n the capital market, the values of the shares are much higher than their

original issue prices.

Sa,#t %, 1(in!i1al an& a''#t' "i=8

According to the life cycle theory, people in the third stage of life also give more importance to

the safety of the principal. All the investors have this ob'ective in their mind. )o one likes to lose

his money invested in different assets. ut, the degree may differ. The investor;s portfolio may

consist more of debts instruments and within the debt portfolio more would be on short term

debts.

Di2#('i,i!ati%n8

(nce the asset mix is identified and the risk and return are analysed, the final step is the

diversification of portfolio. "inancial risk can be minimi0ed by commitments to top-quality

bonds, but these securities offer poor resistance to inflation. 7tocks provide better inflation

protection than bonds but are more vulnerable to financial risk. @ood quality convertible may

balance the financial risk and purchasing power risk. According to the investor;s need for income

and risk tolerance level of portfolio is diversified.

2.?.3 PORTFOLIO CONSTRUCTION8

*ortfolio construction refers to the allocation of funds among a variety of financial assets open

for investment. *ortfolio theory concerns itself with the principles governing such allocation.

The ob'ective of the theory is to elaborate the principles in which is the risk can be minimi0ed,

sub'ect to desired level of return on the portfolio or maximum the return, sub'ect to the

constraint of a tolerable level of risk.

Thus, the basic ob'ective of *ortfolio management is to maximi0e yield and minimi0e risk. The

other ancillary ob'ectives are as per the needs of investors, namelyK

8. regular income or stable return

=. safety of investment

A. minimi0ing of tax liability

34

4. appreciation of capital

?. marketability and liquidity