Professional Documents

Culture Documents

Background

Background

Uploaded by

abhiktCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Background

Background

Uploaded by

abhiktCopyright:

Available Formats

Company Background: Ultratech Cements Limited

UltraTech Cement Ltd. is part of the Aditya Birla Group. With an installed capacity of 62

Million Tonnes Per Annum (MTPA), it is one of the leading manufacturers of cement in

the country.

The company manufactures and markets Ordinary Portland Cement, Portland Blast

Furnace Slag Cement and Portland Pozzalana Cement. They also manufacture ready mix

concrete. They are having 12 composite plants, one white cement plant, 16 grinding

units and six bulk terminals - five in India and one in Sri Lanka. The company's

subsidiaries are Dakshin Cements Ltd, UltraTech Cement Lanka Pvt Ltd and UltraTech

Cement Middle East Investments Ltd.

The foundation stone of UltraTech was laid in mid 1980s with the establishment of its

first cement plant at Jawad in Madhya Pradesh. To increase its presence in the sector,

Grasim acquired a stake in L&T cement ltd. in 2001. The stake was further increased to

a majority stake in 2003 thereby giving Grasim a pan-India presence and an increased

market share. In 2004, Grasim acquired a controlling stake in the company and L&T

cement was demerged. Henceforth the companys name was change to UltraTech

Cement Ltd. In July 2010, the other cement business of Grasim, grouped under

Samrudhi cement limited were amalgamated with UltraTech. In September 2010,

UltraTech Cement put itself on a global map as UltraTech Cement Middle East

Investments Limited acquired management control of ETA Star Cement Company along

with its operation in the UAE, Bahrain and Bangaldesh.

Source: Capitaline, Ultratechcement.com

Cement industry outlook

With nearly 300 million tonnes (MT) of cement production capacity, India is the second

largest cement producer in the world. It is expected to reach the production of 550 Mt

by 2020. The sector is dominated by private players including UltraTech, Ambuja, ACC,

Prism and Shree Cement Ltd. Of the total capacity, 98 per cent lies with the private

sector and the rest with public sector. A major part of the production is consumed by

housing sector, accounting for about 64% of the total consumption. The other major

consumers of cement include infrastructure (17%), commercial construction (13%) and

industrial construction (6%).

Cement production in India increased at a compound annual growth rate (CAGR) of 9.7

per cent to 272 MT over FY 0613. As per the 12th Five Year Plan, production is

expected to reach 407 MT by FY 2017. Currently, India has 185 large cement plants

spread across all states with an installed capacity of more than 350 million tonnes per

annum which is estimated to touch 550 MT in FY 20. Andhra Pradesh is the leading

state with 37 large cement plants, followed by Rajasthan and Tamil Nadu with 21 and

19 plants, respectively.

Infrastructure projects such as new and upgraded airports, more black top roads

connectivity in the country will further drive construction activity and with it the

demand of cement in the market will go up. All this brings about a tremendous scope for

the cement industry in the country.

Source: India Brand Equity Foundation (www.ibef.org)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Legal EncyclopediaDocument292 pagesLegal EncyclopediaprincelegerNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Modelling Prices of In-Play Football Betting MarketsDocument24 pagesModelling Prices of In-Play Football Betting MarketsBosttoncicoNo ratings yet

- TQMDocument160 pagesTQMEzekiel Eljay MacatangayNo ratings yet

- Literature ReviewDocument4 pagesLiterature ReviewMuhammad Irfan Dogar100% (1)

- Chapter4 141022095335 Conversion Gate02Document40 pagesChapter4 141022095335 Conversion Gate02NarenBistaNo ratings yet

- Broiler Entreprenuership Project For MeDocument20 pagesBroiler Entreprenuership Project For Mellyoyd takawiraNo ratings yet

- Case Study Ocean CarriersDocument5 pagesCase Study Ocean Carriersmetzor100% (4)

- AutoUFOs User Guide TView v1Document18 pagesAutoUFOs User Guide TView v1AllenNo ratings yet

- Business Foundations Crossword - AnswersDocument2 pagesBusiness Foundations Crossword - Answersdanieljames1023No ratings yet

- Vinitt Bawri - Shillong BiodataDocument2 pagesVinitt Bawri - Shillong BiodataManisha KaseraNo ratings yet

- Initial Public OfferingDocument9 pagesInitial Public OfferingAnji UpparaNo ratings yet

- Philippine Electronics & Communication Institute of TechnologyDocument3 pagesPhilippine Electronics & Communication Institute of TechnologyAngela MontonNo ratings yet

- Micro Finance in EgyptDocument40 pagesMicro Finance in EgyptdinamadkourNo ratings yet

- 8 - Closing Negotiation PDFDocument25 pages8 - Closing Negotiation PDFaishwarya sahai100% (1)

- Long Run Analysis of ProductionDocument51 pagesLong Run Analysis of ProductionPathumi NavodyaNo ratings yet

- 4section I PDFDocument3 pages4section I PDFYohannes GebreNo ratings yet

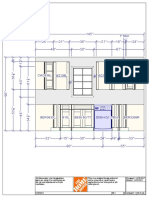

- Kitchen Floorplan ElevationsDocument4 pagesKitchen Floorplan ElevationsaudioxtraNo ratings yet

- Swarajya PresskitDocument29 pagesSwarajya Presskitanirudh100% (1)

- Problem (Orange Peel & Dented)Document2 pagesProblem (Orange Peel & Dented)Marketing TanajawaNo ratings yet

- How To Pretest and Pilot A Survey Questionnaire PDFDocument7 pagesHow To Pretest and Pilot A Survey Questionnaire PDFsaimaNo ratings yet

- 27 08 19Document6 pages27 08 19Sangram ShindeNo ratings yet

- Smith - Matthew, ResumeDocument1 pageSmith - Matthew, Resumesmithm13No ratings yet

- Code of ConductDocument5 pagesCode of ConductAyaz MeerNo ratings yet

- Od 224189092682635000Document1 pageOd 224189092682635000Mental DadaNo ratings yet

- Pioneers Vs Late ArrivalsDocument17 pagesPioneers Vs Late ArrivalsPragya BiraniNo ratings yet

- Chapter 2-An Introduction To Linear Programming: Multiple ChoiceDocument20 pagesChapter 2-An Introduction To Linear Programming: Multiple ChoiceMayuresh Kulkarni100% (1)

- Oracle User Productivity Kit (UPK)Document20 pagesOracle User Productivity Kit (UPK)Nauman KhalidNo ratings yet

- PART 5 CHUẨN NHẤT PDFDocument380 pagesPART 5 CHUẨN NHẤT PDFTùng Dương ThanhNo ratings yet

- Performance Measurement, Compensation, and Multinational ConsiderationsDocument32 pagesPerformance Measurement, Compensation, and Multinational ConsiderationsSugim Winata EinsteinNo ratings yet

- Ba 8Document2 pagesBa 8issrihari_629088783No ratings yet