Professional Documents

Culture Documents

Tax - Assignment

Uploaded by

jai_thakker7659Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax - Assignment

Uploaded by

jai_thakker7659Copyright:

Available Formats

1

Chapter 1: INTRODUCTION

The Income-tax Act, 1961 is the charging Statute of Income Tax in India. It provides for levy,

administration, collection and recovery of Income Tax. Recently the Government of India has

brought out a draft statute called the "Direct Taxes Code" intended to replace the Income Tax

Act,1961 and the Wealth Tax Act, 1956. Public Commentary has been called for the Draft Bill.

The redrafted bill is supposed to be made public soon.

The Central Government has been empowered by Entry 82 of the Union List of Schedule VII of the

Constitution of India to levy tax on all income other than agricultural income (subject to Section

10(1)).[1] The Income Tax Law comprises The Income Tax Act 1961, Income Tax Rules 1962,

Notifications and Circulars issued by Central Board of Direct Taxes (CBDT), Annual Finance Acts

and Judicial pronouncements by Supreme Court and High Courts.

The government of India imposes an income tax on taxable income of all persons including

individuals, Hindu Undivided Families (HUFs), companies, firms, association of persons, body of

individuals, local authority and any other artificial judicial person. Levy of tax is separate on each of

the persons. The levy is governed by the Indian Income Tax Act, 1961. The Indian Income Tax

Department is governed by CBDT and is part of the Department of Revenue under the Ministry of

Finance, Govt. of India. Income tax is a key source of funds that the government uses to fund its

activities and serve the public.

The Income Tax Department is the biggest revenue mobilizer for the Government. The total tax

revenues of the Central Government increased from 1392.26 billion in 1997-98 to 5889.09

billion in 2007-08.

HISTORY

Income tax was introduced in 1860, abolished in 1873 and reintroduced in 1886. Income tax levels

in India were very high during 1950-1980, in 1970-71 there were 11 tax slabs with highest tax rate

being 93.5% including surcharges. In 1973-74 highest rate was 97.75%. But to reduce tax evasion

tax rates were reduced later on, by 1992-93 maximum tax rates were reduced to 40%.

2

Chapter 2: ASSESSMENT PROCEDURE

(SECTION 139 TO 160 of the Income Tax Act, 1961)

The term Assessment has not been defined anywhere under the Income Tax Act, 1961. It

basically means a process of quantifying the Income and Tax on such income. Procedure to carry

out of such process is called as Assessment Procedure. This entire procedure involves participation

of Assessee and Income Tax Department. This chapter can be understood in a better way, if it is

divided into two parts, viz. (a.) What assessee is supposed to do and (b.) What Department will do in

response thereto?

Assessee is supposed to furnish his Return of Income, apply for Permanent Account

No.(PANo.), Pay his taxes, etc.. On the other hand, department is supposed to process the Return

filed by assessee, issue notices, ensure compliance of provisions of the Income Tax Act, etc.

Lets begin with what assessee is supposed to do:-

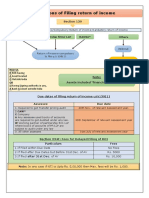

[1] Section 139(1): Filing of Return of Income (ROI):

Every person being:-

a) a Company,

b) a Partnership Firm,

c) Resident Person having Asset Outside India or Signing Authority in an Account Outside

India

d) every other person other than a company or a firm, whose total income, before claiming

deduction u/s. 10A, 10B, 10BA or under chapter VIA has exceeded the basic exemption

limit, (but after claiming exemption U/S 10 and after claiming set off of brought forward

losses) will be required to furnish the ROI within the due dates as follows:

Assessee Due date

i) Company

ii) Every person whose Books of accounts are required to be

audited under any law 30th Sept.

iii) Every person who is a working partner of a firm, where of the A.Y.

firms Books of accounts are required to be audited under

any law.

iv) For every other person other than the above. 31

st

July of the A.Y.

3

How to File the Returns?

- Return should be filed in prescribed forms Return can be filed manually or electronically.

However, as put forth in Section 139 (1B), in case of following assesses, e-filing is mandatory:

1) Companies

2) Tax Audit Assessees

3) Resident Person having Asset Outside India or Signing Authority in an Account Outside

India

4) Any person whose Net Taxable Income is more than Rs. 5 Lacs

[2] Section 139(1A): Filing of Bulk ROI: Salaried assessee can furnish their returns to

their employers and then employer shall furnish all such returns in bulk, within the due date as

above. It is completely at the option of the employee to do so.

[3] Section 139(1B): E-Filing Return: Mandatory for Company and those Partnership

Firms, whose Books of Accounts are required to be audited u/s 44AB of the Act, for others it is

optional to furnish their Return of Income electronically on a computer readable media.

[4] Section 139(3): Loss Return:

If assessee has sustained / suffered a loss for any P.Y. and claims carry forward of such loss

u/s. 72, 73, 74 or 74A, then as per sec. 80, such loss return has to be filed within the due dates

given in sec. 139(1), otherwise such loss will not be allowed to be carried forward.

The condition enumerated in sec. 80 does not apply to following losses:

a) loss under the head House Property Sec. 71B

b) loss due to Unabsorbed Depreciation Sec. 32(2)

c) loss due to Capital Expenditure on Scientific Research

d) loss due to Capital Expenditure on promotion of Family Planning amongst employees.

The above-mentioned losses can be carried forward without filing ROI in time.

Note The condition stipulated / enumerated in sec. 80 applies only for the year in which the

loss was sustained / incurred. It does not apply to the ROI of the year in which carried forward

is claimed.

4

[5] Section 139(4): Belated ROI:

If ROI could not be furnished within the due dates enumerated u/s. 139(1), then it can still be

filed at any time:

a) within a period of one year from the end of the relevant A.Y.

or

b) before completion of assessment,

whichever is earlier.

Note ROI filed belatedly u/s. 139(4) cannot be considered as a return filed u/s. 139(1).

[6] Section 139(5): Revised Return:

Any person who after filing ROI u/s. 139(1) or ROI in response to a notice u/s. 142(1), if

discovers any omission or a wrong statement in such ROI filed earlier, then such person can

file a revised return u/s 139(5) at any time:

a) within a period of one year from the end of the relevant A.Y.

or

b) before completion of assessment

whichever is earlier.

Revised return replaces the original return in all aspects, except to the date of filing of ROI. As

far as the date of filing the ROI is concerned, the date of filing of original ROI only will be

taken into account.

If assessee discovers any wrong statement or omission in such revised return, then he

can revise such revised return also and so on. There are no restrictions on the number of times

assessee can file revised return, therefore, assessee can file as many number of revised returns

as he wants to. But all such revised returns must be filed within the overall time limit allowed

u/s 139(5) as given above.

Note:

1) What can be revised is a ROI filed u/s. 139(1) or ROI filed in response to a notice u/s.

142(1).

Therefore, a belated return filed u/s. 139(4) cannot be revised, as ROI filed u/s.

139(4) is not considered as ROI filed u/s.139(1).

2) A return can be revised even after receiving refund u/s. 143(1) as sec. 143(1) is not

completion of assessment.

5

3) Goetze (India)Ltd. v/s CIT (SC)(2006): Revising the original return can be done only by

way of filing a revised return u/s 139(5) and not by way of filing a plain letter for the same.

[7] Section 139(4A): ROI by Trust:

Every person who is in receipt of an income from property held under trust for charitable or

religious purposes in India, shall be required to furnish a ROI on behalf of trust on or before

the due dates specified in sec. 139(1), if the income of the trust exceeds the basic exemption

limit (B. E. limit) before giving effect to exemption available to it u/s.11. (Due date for filing

return of trust would be either 31

st

July or 30

th

September, depending upon whether Books of

accounts of the trust are required to be audited or not)

Note:

Penalty u/s. 272A(2) @ Rs. 100/- per day of default, will be attracted if ROI is not filed within

due date.

[8] Section 139(4B): ROI by Political Parties:

C.E.O. of the Political Party will be responsible to furnish a ROI on behalf of the Political

Party, if the income of Political Party exceeds the basic exemption limit before giving effect to

exemption available to it u/s. 13A. (Due date for filing ROI by a Political Party will always be

30

th

September, as audit of Books of accounts is mandatory for Political Party)

[9] Section 139(4C): ROI by certain Association/Institutions/Funds:

The following Associations/Institutions will be required to furnish their ROI within the due

dates given u/s. 139(1), if their income exceeds the basic exemption limit before giving effect

to exemption u/s.10.

a) Scientific Research Association as referred to in sec. 10(21)

b) News Agency as referred to in sec. 10(22B)

c) Certain Institution / Association as referred to in sec. 10(23A) / 10(23B)

d) Certain Institution / Funds or University or an Educational Institution or a Hospital or a

Medical Institution as referred to in sec. 10(23C) (iiiad) / (iiiae) / (iv) / (v) /(vi) / (via)

e) Trade Union / Association as referred to in sec. 10(24)

Note: Non-filing of return shall attract a Penalty u/s. 272(A)(2) @ Rs. 100/- per

day of default.

6

[10] Section 139(4D): Those Colleges, University or Educational Institutions, which are

approved u/s. 35 of the Act, and which were not required to furnish their ROI under earlier

provisions, will now have to furnish their ROI mandatorily w.e.f. A.Y. 07-08.

[11] Section 139(9): Defective return: A Return of Income could be treated as defective if it

was not accompanied by certain Books of accounts, documents or certificates. This section has

become redundant due to introduction of Annexure-less ROI, w.e.f. A.Y. 2008-2009.

[12] Section 139A: Permanent Account Number(PANo.) (read with Rule No.

114):

Following persons shall be mandatorily required to apply for PANo. in Form 49A:-

a) Every person who is assessable to tax in respect of his own income or in respect of income

of any other person.

b) Every person who is carrying on business or profession and gross receipts or turnover from

such business or profession has exceeded or is likely to exceed Rs. 5,00,000 for the

relevant P. Y.

c) Every person who is required to furnish ROI u/s. 139(4A) (Trust)

d) Every person who is required to furnish a return of FBT u/s. 115WD

e) Every person who is required to register himself under the Central Sales Tax Act, 1956 or

under General Sales Tax Act of any state or who is required to apply for Import Export

Code or a person who is an assessee for Service Tax, Excise or Customs Act.

Such PANo. is required to be quoted in every financial transaction as is referred to in Rule 114B.

[13] Section 139B: Tax Return Preparer (TRP):

1) Sec. 139B enables / empowers CBDT to frame a scheme whereby a specified class of

persons can file their ROI through a TRP.

2) Specified class of persons means any person who is required to file ROI, other than the

following persons:

a) a Company,

b) any other person whose Books of accounts are required to be audited u/s. 44AB or under

any other law.

7

3) A TRP means an Individual who is authorized to act as TRP by CBDT, other than following

persons:-

a) a Chartered Accountant,

b) a Legal Practitioner,

c) an Officer of a Scheduled Bank with which assessee maintains an account.

4) The scheme formed by CBDT for TRP shall provide for the following:-

a) Educational and other qualifications which a TRP shall possess,

b) The training and other conditions which a TRP shall fulfill,

c) Code of conduct for TRP,

d) The manner in which TRP may be authorized,

e) The period for which the TRP may be authorized,

f) The duties and obligations of TRP,

g) The circumstances under which the authorization granted to TRP may be withdrawn.

[14] Section 139C: Annexure-less ROI: (w.e.f. A.Y. 2007-08):

Empowers CBDT to make rules providing for a class or classes of persons who shall not be required

to furnish any Certificate, Audit Report, any Document or a Receipt etc. along with their ROI.

However, the relief provided under this section shall be subject to applicability of provisions of

section 139D, which empowers the AO to demand for production of such Books of accounts,

documents, etc. which were otherwise not required to be produced along with ROI.

[15] Section 139D

Empowers CBDT to make rules for the following :-

a) a class person or classes of person who shall be required to furnish their ROI mandatorily on a

computer readable media. (E-filing of ROI)

b) The terms and the manner in which such ROIs can be filed electronically.

c) CBDT may require the persons who are not required to attach any documents along with ROI,

to furnish such documents whenever required by an A.O.

[16] Section 140: Signing of Return of Income (ROI) or Return of FBT:

The following persons can sign the return:-

In case of:- Who can sign the return

8

(1.) (a.)An Individual.

(b.) If that Individual is not present

in India

(c.) If that Individual is mentally

incapacitated..

That Individual himself.

Any person who is competent to sign on

behalf of such Individual, duly authorized

by such Individual in writing in this behalf

can sign the return.

(2.) (a.)A HUF

(b.) If Karta is not present in India..

(c.) If Karta or Manager is mentally

incapacitated

Karta or Manager of such HUF.

Any other adult member of such HUF.

(3.) (a.) A Partnership Firm

(b.) If there is no such Managing

Partner.

Managing Partner.

Any Adult Partner of such Firm.

(4.) (a.) A Company..

(b.)If Company has no Managing

Director

(c.) If it is a Foreign Company

(d.) If Companys Management is

taken over by Govt..

(e.)Company is under Liquidation..

Managing Director of such Company.

Any other Director of the Company.

Any person who holds a valid Power of

Attorney from the Company.

Court Receiver appointed by Govt.

Liquidator appointed by High Court.

(5.) Local Authority. Principal Officer of such Local Authority.

(6.) A.O.P. / B.O.I Principal Member of such A.O.P./ B.O.I.

(7.) Any Other person.. Either that person himself or any person,

who is competent to sign on behalf of such

person.

Note: A Return of Income or FBT, which is unsigned is not a return at all.

[17] Section 140A : Self Assessment Tax (S.A. Tax):

Every person who is required furnish ROI or return of FBT, shall, before filing such return, compute

the tax payable by him after considering the followings:

a) taxes already paid, including Advance Tax,

b) TDS / TCS,

9

c) MAT credit,

d) DTAA relief,

e) Any other rebate or relief,

and pay the same along with interest u/s. 234A / 234B / 234C if any, before filing such return.

Note: Non-payment of Self - Assessment Tax results in assessee being treated as an assessee

deemed to be in default.

If the amount paid by assessee as SA Tax falls short of the amount of tax + interest, then the amount

paid by assessee shall be first adjusted towards interest and balance if any shall be against the

amount of tax (so that the shortfall will reflect the amount of tax and interest will keep accruing on

the same.)

Section 142: Enquiry before Assessment:

[18] Section 142(1): Notice:

A notice under this section can be issued by A.O. to any person without any time limit whether ROI

has been furnished by such person or not, requiring him any of the following three things:

a) To furnish his ROI, if it was not furnished within the due dates given u/s. 139(1),

b) to produce Books of accounts and documents (for a maximum period of 3 years prior to the

relevant P.Y.) (However, he can call for Books of accounts or documents for a period of more

than 3 years by virtue of powers available u/s.131)

c) to furnish information on the points or matters required by A.O., including furnishing of list of

assets and liabilities. (However, a prior approval of JCIT shall be required for requiring the

assessee to furnish a list of those assets and liabilities, which are not included in the Books of

accounts.)

Note:-

There is no time limit to issue / serve notice u/s. 142(1).

[19] Section 142(2): Cross Inquiry:

Any inquiry can be made by AO from any person in order to enable him to complete the assessment.

[20] Section 142(2A): Special Audit:

i) A.O. may at any stage of proceedings, require the assessee to get his Books of accounts

specially audited under this section.

10

ii) A.O. can direct special audit, having regard to the following two things:-

a) the nature and complexities involved in the Books of accounts

b) and if it is in the interest of Revenue.

iii) Prior approval of CCIT or CIT, shall be required to be obtained by A.O. before directing the

assessee for Special Audit.

iv) Special Audit will have to be carried out by a Chartered Accountant nominated by CCIT or

CIT.

v) Fees for Special Audit shall be determined by CCIT or CIT, but will be paid by Central Govt.

vi) Special Audit Report has to be submitted to the A.O. within the time allowed in the direction

u/s. 142(2A), which can be extended on an application made by assessee, in such a way that

the total time allowed to the assessee does not exceed - 180 days. (Upto A.Y. 2008-09, the time

limit for submission of Audit Report could be extended only on an application made by

assessee, however, now w.e.f. A.Y. 2009-2010, the time limit can be extended by AO on his own

motion also.)

vii) An opportunity of being heard must be given to the assessee before directing Special Audit.

viii) Books of accounts will have to audited under this section even if they are already audited

u/s.44AB or under any other law or even if Books of accounts are not required to be audited.

ix) Special Audit could be directed only if the Books of accounts are found to be complex. Now,

what is complex has not been clarified anywhere under the Act. What may seem to be

complex to someone, may not necessarily seem to be complex to others.-- Rajesh kumar and

others v/s Deputy CIT (2006) (SC).

x) Failure to get the Books of accounts audited under this section or failure to furnish the audit

report within the time allowed will lead to Best Judgement Assessment u/s.144 and it also

attracts a penalty of Rs. 10,000/- u/s. 271(1)(B).

[21] Section142(3):

An opportunity of being heard shall be given to the assessee, before making use of any material

gathered by A.O.

[22] Section 142A: Reference to Valuation Officer (VO):

For the purpose of making an assessment or re-assessment of an income of the assessee, if any

investment as referred to in Sec. 69 or Sec. 69B or any money, building, jewellery as referred to in

11

Sec. 69A or Sec. 69B is required to be valued, then AO shall refer the matter to an officer of the

department, called as Valuation Officer.

V.O. shall issue a notice to the assessee, giving him reasonable opportunity of being heard.

After hearing the assessee and evidence furnished by him, V.O. shall value these assets by way of

passing his valuation report and furnish one copy of his valuation report to the concerned A.O. and

another copy to the assessee.

A.O. shall be bound to adopt the report of V.O. while making such assessment or re-assessment. As

far as AO is concerned, he has no power to challenge the validity of VOs report. Assessee also

cannot challenge it directly, but he may do so by way of filing an appeal against the Assessment

order of AO, which will be based on report of VO.

V.O. shall have all the powers, which are available to him u/s. 38A of the Wealth Tax Act, 1957.

[23] Section 143(1): Intimation / Deemed Intimation:

(Popularly called as Summary Assessment)

Though it is called as Summary Assessment, it is not an assessment. Under this section, the ROI

filed by assessee will not be scrutinized. Whatever, is claimed by assessee in his ROI will be

accepted by A.O. after confirming arithmetical accuracy.

The following 3 things may happen under this section:-

a) Based on ROI filed by assessee, if refund is found due to him, then cheque of refund, along

with the intimation u/s. 143(1) will be issued to the assessee.

b) Based on ROI filed by assessee, if tax is found payable by him, then intimation to that effect

will be issued to him u/s. 143(1), which shall be treated as Demand Notice u/s. 156.

c) Based on ROI filed by assessee, if no tax is found payable by assessee nor is any refund found

due to the assessee (i.e. NIL return) and no adjustments have been made in such ROI, then no

intimation will be issued to the assessee to that effect. The acknowledgement of the ROI filed

shall be deemed to be the intimation in such cases. (Popularly called as deemed intimation.)

Note:

1) No such intimation can be issued after the expiry of 1 year from the end of the Financial

Year in which the ROI was filed by the assessee.

2) Even though Section 143(1) is called as Summary Assessment, it is not an assessment in real

sense. Therefore, assessee can file a revised return u/s. 139(5), even after receiving a refund

u/s. 143(1), provided the other time limit given in sec. 139(5) has not yet expired.

12

3) With effect from A.Y. 2009-10, the following adjustments can be made under this section,

without hearing the assessee:-

(a.) Arithmetical errors in the return can be rectified,

(b.) Any incorrect claim of the assessee in the ROI, may be disallowed.

Incorrect Claim means the following claims:-

An item in the ROI, which is inconsistent with another entry in the ROI,

A claim of the assessee in the ROI, which is not supported by any required

information in that regard (For e.g.: TDS claim),

A deduction claimed by the assessee, which exceeds the specified statutory limit.

(For e.g.: Deduction u/s 80C exceeding Rs. 1,00,000/-)

Scrutiny Assessment

[24] Section 143(3): Regular Assessment / Scrutiny Assessment:

In most of the cases, normally there will be intimation or deemed intimation u/s. 143(1) i.e.

Summary Assessment. However, in some cases if A.O. finds it necessary to ensure that assessee has

not

a) understated his income, or

b) claimed excessive loss, depreciation allowance etc. or

c) has not underpaid the taxes in any manner,

take up the case for regular assessment u/s. 143(3) by way of serving a notice u/s. 143(2).

Based on materials and evidences furnished by assessee in response to notice u/s 1432(2) or gathered

by A.O., A.O. shall determine the income or loss of the assessee, by way of passing an order in

writing along with determination of tax payable by or refundable to assessee u/s. 143(3). Such order

is to be called as Assessment Order.

[25] Section 143(2): Notice:

A notice u/s. 143(2) has to be served to the assessee in order to take up the case for a regular

assessment u/s. 143(3). This notice will require the assessee to furnish necessary evidences and

materials, supporting his claim in the ROI.

No notice u/s. 143(2) can be served after the expiry of 1 year from the end of the month in which

ROI was filed.

13

However, w.e.f. A.Y. 2009-2010, this time limit has been amended. Now, Notice under this section

has to be served within a period of six months, from the end of the Financial Year, in which the

ROI was filed.

Notes:

(1.) Notice u/s 143(2) can be issued to the assessee even after issuing an intimation u/s.

143(1). However, vice-versa situation, i.e. issue of an intimation u/s. 143(1) after

issue of notice u/s 143(2) for scrutiny was held to be invalid in law.

(2.) Issue of notice for scrutiny u/s 143(2) is not completion of assessment, it is just the

beginning of the assessment. Therefore, assessee can still file a Revised Return u/s

139(5), even after receiving a notice u/s 143(2), provided the other time limit given

in section 139(5) has not yet expired.

(3.) Difference between notice u/s. 142(1) & u/s. 143(2):

Notice u/s 142(1) Notice u/s 143(2)

1) There is no time limit for issue or

service of this notice.

This notice has to be served within a period of 6

mths. from the end of the year in which ROI was

filed.

2) This notice can be issued irrespective of

whether ROI was filed by assessee or

not.

This notice can be issued only if ROI was filed

by assessee.

3) Assessee will be required to furnish

those information or documents, as are

specifically demanded in the notice u/s.

142(1)

Assessee can furnish any information or

documents or evidences, which he finds

necessary in response to notice u/s. 143(2) as per

his own choice.

4) Can be issued, even after completion of

the Assessment.

Cannot be issued after completion of

Assessment.

[26] Section 143(4):

If refund was granted to the assessee u/s. 143(1), later on as a result of completion of regular

assessment u/s. 143(3), if it is found that either there is no refund due to the assessee or the amount

14

refunded to the assessee exceeds the amount of refund due to him, then excess amount so refunded

shall be deemed to be the tax payable by the assessee along with interest u/s. 234D.

[27] Section 144: Best Judgement Assessment: (EX-PARTE ASSESSMENT):

Whenever, there is any one of the following 4 defaults on the part of the assessee, then A.O. has to

mandatorily complete the assessment u/s.144 to the best of his knowledge or experience:

1) Failure to furnish ROI u/s. 139(1), or 139(4) or 139(5),

2) Failure to comply with the terms of notice u/s. 142(1), requiring the assessee to either furnish

his ROI or to produce relevant Books of accounts / documents or furnish information called

upon,

3) Failure to comply with the terms of direction issued u/s. 142(2A) or failure to furnish special

audit report within time.

4) Failure to comply with the terms of notice u/s. 143(2), requiring the assessee to either remain

present or furnish evidences in support of his claim in the ROI.

Note:

1) Best Judgement Assessment u/s. 144 can be taken up only after issuing a show cause notice to

the assessee u/s. 144, without any time limit.

2) No refund can be issued by A.O. u/s.144.

3) An-order passed u/s.144 can be appealed against at CIT (A) level.

4) According to section 2(40), Best Judgement Assessment u/s. 144 is also a Regular

Assessment.

5) No Opportunity of being heard is required to be given to the assessee in a case, where there

is a failure on the part of the assessee to comply with the terms of notice u/s 142(1).

6) Since, assessment u/s. 144 takes place without co-operation of the assessee, it is called a s

Ex-Parte Assessment, which means excluding the party concerned.

[28] Protective Assessment: (There is no section governing this provision):

Income of one person can be assessed to tax in the hands of that person only, unless there are

specific provisions under the Income Tax Act (like Clubbing Provisions) whereby income of one

person can be assessed to tax in the hands of some other person. However, under no circumstances

the same income can be assessed in the hands of both such person. However, when the ownership of

the income is in dispute or is a matter of doubt, then A.O. can assess such income in the hands of the

person who is liable to tax, as well as include the same income, in the hands of some other person

15

also on protective basis. Such assessment in the hands of such other person is called as protective

Assessment. The assessment in the hands of first mentioned person would be called as

Substantive Assessment.

The objective of Protective Assessment is to protect the interest of Revenue. By the time the dispute

regarding the ownership of the income is resolved, the assessment of such income should not get

time barred. When the dispute is finally settled in an appeal or otherwise, any one of the assessment

will stand and the other assessment will be cancelled accordingly. It would be worth to note here that

I.T. dept. cannot recover tax from both the persons as a result of protective assessment. Similarly,

the Protective Assessment cannot be the reason for levy of penalty.

[29] Section 144A: Powers of JCIT to issue directions to A.O.:

JCIT may on his own motion or on an application made by assessee or on reference being made by

A.O., can call for and examine the records of any proceedings, in which assessment is pending and

having regard to the nature of the case and the amount involved and for any other reason, JCIT may

issue such directions to A.O. as he deems fit. Such directions are issued by JCIT as guidance for the

A.O. to enable him to complete the assessment. Such directions are binding on A.O., A.O. cannot

challenge such directions. Even assessee also cannot challenge such directions, but assessee can

challenge the assessment order, which would be based on such directions of JCIT.

No such directions, which are pre-judicial to the interest of the assessee can be issued by JCIT,

unless an opportunity of being heard was given to the assessee. However, if a direction is issued by

JCIT on the lines of investigation to be made by A.O., then such directions cannot be considered as

pre-judicial to the interest of the assessee and can be issued by JCIT without hearing the assessee.

For e.g.: If JCIT issues a direction requiring the A.O. to reject the claim of the assessee, then such

direction is pre-judicial to interest of assessee and cannot be issued without hearing the assessee.

However, if JCIT issues a direction requiring the A.O. to investigate into the genuineness of the

claim made by assessee, then such directions are on the lines of investigation to be made by AO and

cannot be considered as prejudicial to the interest of assessee and such directions can be issued

without hearing the assessee.

[30] Section 145 : Method of Accounting:

For PGBP & IFOS Either Cash or Mercantile system of Accounting at the option of the

assessee.

16

For Salary, H.P. & C.G. Method of accounting plays no role.These incomes are taxable as

per specific rules applicable to them.

[31] Section 145(2): Income Tax Accounting Standards (ITAS):

Central Govt. has been empowered to notify Accounting Standards to be followed by those assessee,

who are following Mercantile system of accounting. Such Accounting Standards are to be called as

Income Tax Accounting Standards (ITAS).

Central Government has delegated this power to CBDT and till now CBDT has issued the following

2 ITAS

a) ITAS -I Disclosure of Accounting Policies (same as AS-1)

b) ITAS -II Prior Period Items, Extraordinary Items and Changes in Accounting

Policies. (same as AS-5)

[32] Section 145(2): Discretionary Best Judgement Assessment:

In the following circumstances A.O. may take up the case and complete the assessment in the

manner provided in Sec. 144:

a) A.O. is not satisfied about the completeness or correctness of the Books of accounts and

documents of the assessee.

b) Correct Method of Accounting, was not regularly followed by the assessee.

c) ITAS notified by Central Govt. u/s. 145(2), have not been regularly followed by assessee.

In all the above-mentioned circumstances, AO may (or may not) take up the case in and

complete it in the manner provided in section 144.

[33] Section 145(3): Power of A.O. to reject the Books of accounts:

If A.O. is not satisfied about the correctness or completeness of the Books of accounts of the

assessee, then he has a power to reject the Books of accounts and estimate the profits.

Once, such profit is estimated by A.O., then thereafter no further disallowances can be made by A.O.

to this estimated profits, as such estimated profit encompasses all the disallowances within itself. For

e.g.: If AO rejects the Books of accounts and estimates the profit at 10% of the turnover, then he

cannot make further addition to the income by way of disallowing cash payment made in excess of

Rs. 20,000/- u/s 40A(3).

17

[34] Section 145A: Method of Accounting in certain cases:

Generally, for Business income assessee is allowed to follow either Cash or Mercantile system of

accounting. The valuation of Purchase, Sales and Inventory of Goods shall be:

a) in accordance with the method of accounting regularly followed by assessee.

b) Such valuation shall be further adjusted to include the amount of any Tax, Duty, Cess, Fees, by

whatever name called as, whether paid by assessee or incurred but not paid by assessee to bring

the goods to its present location and condition.

This gives rise to two different methods, viz.:

(i.) Inclusive Method and

(ii.) Exclusive Method

According to section 145A, only Inclusive Method is to be followed while valuing Purchase,

Sales and Inventory of Goods.

[35] Section 147: Assessment / Reassessment / Recomputation of Income escaping

Assessment: (Reopening of the case):

Whenever A.O. has a reason to believe that the income chargeable to tax has escaped assessment for

any Assessment Year, then he may assess, reassess or recompute the income, loss, depreciation or

any other allowances etc. for that Assessment Year, by issuing a notice to the assessee u/s. 148

within the time allowed u/s.149 and with the prior approval of higher authorities as required u/s. 151.

Scope of Sec. 147:

Scope of sec. 147 is very wide. Once, the case is re-opened u/s.147 then everything stands reopened

to the A.O. Once the case is taken up u/s 147 for a particular income, any other income which has

escaped assessment and which comes to the knowledge of A.O. subsequently, can also be included

within the same proceeding, without reissuing any notice already issued to the assessee. However,

w.e.f. A.Y. 2009-2010, the scope of this section has been slightly curtailed down. Now w.e.f. 01

st

April, 2008, AO can take up a case u/s 147, only in respect of those matters, which have not been

considered and decided in an Appeal, Revision or Reference.

Explanation 2 to section 147:

18

Circumstances under which an income can be considered as having escaped assessment:

1) In a case, where ROI has not been furnished, inspite of having income above the basic

exemption limit.

2) In a case, where ROI has been furnished, but no assessment was made and assessee is found to

have understated his income or claimed excessive loss, deprecation, allowance etc. in such ROI.

3) Assessment has been made but in such assessment,

a) Income has been under assessed, or

b) Income has been assessed at too low a rate, or

c) Excessive relief was granted to the assessee in such assessment, or

d) Excessive loss, depreciation, allowance etc. was allowed to the assessee.

[36] Section 148: Notice for R-opening the case:

1) Whenever, the case is to be taken up u/s.147, then A.O. has to issue a notice u/s. 148 to the

assessee after recording his reasons in writing for the same. [and assessee can demand for a copy of

reasons for the same, as was held by Supreme Court, in case of GKN Driveshafts (India) Ltd.]

2) Such notice has to be issued within the time limit given is sec. 149 and with the prior approval of

higher authorities as required u/s. 151.

3) Notice u/s. 148 shall require the assessee to furnish a fresh ROI in response thereto, within the

time allowed in such notice.

4) A single notice can be issued for more than one Assessment Year.

5) Assessee is expected to furnish a fresh ROI in response to such notice, even if the ROI was

already furnished earlier.

6) Failure on the part of the assessee to furnish a fresh ROI in response to notice u/s148, within the

time limit allowed, can lead to Best Judgement Assessment u/s147, in the manner provided in

section 144.

[37] Section 149: Time limit to issue notice u/s. 148: Generally, the time limit to issue a

notice u/s. 148 is 4 years from the end of the relevant assessment year. However, in the following

circumstances, a notice u/s. 148 can be issued beyond 4 years but within 6 years from the end of the

relevant A.Y.:-

1) In a case where the income chargeable to tax which has escaped assessment amounts to or

likely to amount to Rs. 1 lac or more for each such A.Y. (Similarly, under Wealth Tax Act, 1957, the

19

time limit will be 6 years, if the wealth escaping assessment, amounts to is likely to amount to Rs. 10

Lacs or more for each such A.Y.)

OR

2) There is a failure on the part of the assessee:-

a) to furnish ROI u/s. 139 or in response to a notice 142(1) or notice u/s.148.

b) to disclose truly and fully all the material facts.

Explanation 1 to section 147:

Mere production of books of accounts or documents, from which material facts or evidence could

have been discovered by A.O. by due diligence, will not necessarily amount to disclosure on the part

assessee.

[38] Section 149(3): Time limit to issue notice u/s. 148 to an Agent of Non-

Resident:

No notice u/s. 148 can be issued to an Agent of Non-Resident in his capacity as an Agent after the

expiry of 2 years from the end of relevant assessment year, irrespective of the amount of income

escaping assessment.

In other words, the regular time limit of 4 years or 6 years will not apply in such cases, where the

notice is to be issued to an Agent of the Non-Resident. However, this time limit applies only to the

Agent and not to the Non-Resident himself. Secondly, this time limit applies to such agent in his

capacity as an agent and not in his personal capacity.

Other Provisions applicable for Reassessment / Recomputation:

[39] Section 152(1): The income escaping assessment, which is now assessed to tax will be taxed

at that rate at which it would have other-wise been taxable, had there been no escapement of income.

[40] Section 152(2): Proceedings once initiated u/s. 147, may be dropped by A.O., if assessee

satisfies him that:-

a) there will be no impact or no effect on his tax liability, even after taking into account the

income escaping assessment

AND

20

b) He has not gone in an Appeal, Revision or Reference, against any part of the original

Assessment order.

[41] Section 150(1): Notwithstanding anything contained in section 149, a notice u/s. 148 can be

issued at any time, if it is to be issued in consequence of or to give effect to an order passed by:

a) Any Authority in an Appeal, Revision or Reference,

or

b) Any Court under any other law for time being in force in India.

[42] Section 150(2): However, no notice u/s. 148 can be issued by taking advantage of section

150(1), in a case where at the time of passing of the order, which was subject matter of Appeal,

Revision or Reference, if the time limit to issue notice u/s. 148 had already expired. [This section

does not come in a way where, the notice us/ 148 is to be issued beyond 6 years in consequence of or

to give effect to an order passed by any Court under any other law in India.]

[43] Section 153: Time limit to complete the Assessment and pass Assessment

Order:

Section Particulars Time Limit

153(1) To pass Assessment Order u/s. 143(3)

or u/s.144

21 months from the end of relevant A.Y.

However, w.e.f. 01/06/2007, i.e. A.Y.

08-09 if reference was made to Transfer

Pricing Officer (T.P.O.) u/s. 92CA, then

the time limit applicable will be 33

months from the end of the relevant A.Y.

153(2) To pass an Assessment Order or a Re-

Assessment Order u/s. 147

9 months from the end of F.Y. in which

the notice u/s. 148 was served.

However, w.e.f. 01/06/2007, i.e. A.Y.

08-09 if reference was made to Transfer

Pricing Officer (T.P.O.) u/s. 92CA, for

21

the purpose of such assessment or

reassessment u/s 147, then the time limit

available will be 21 months from the end

of F.Y. in which the notice u/s. 148 was

served.

153(2A) a) Time limit to pass a Fresh

Assessment Order in pursuance

of an order of ITAT u/s. 254

canceling or setting aside the

original Assessment Order and

directing a Fresh Assessment

9 months from the end of the F.Y. in

which a copy of order of ITAT is

received by CIT.

b) Time limit to pass a Fresh

Assessment Order in pursuance

of a Revisional Order passed by

CIT u/s 263 or 264, canceling or

setting aside the original

Assessment Order and directing

for a Fresh Assessment

9 months from the end of the F.Y. in

which CIT passes his Revisional Order

u/s. 263 or 264.

However, w.e.f. 01/06/2007, for (a) and

(b) both, if a reference was being made

to a Transfer Pricing Officer u/s. 92CA,

for the purpose of carrying out such fresh

Assessment, then the time limit available

will be 21 months instead of 9 months as

above

Note: (1.) The above-mentioned time limits are for completing and passing the Assessment or

Reassessment order and not the time limits for issue or service of Assessment or Reassessment

order. Assessment will be deemed to have been completed on that date on which the Income and

the Tax payable on such income is determined.

(2.) If an application of the assessee before ITSC is rejected and the case is sent back to AO, then the

time available with AO to complete the assessment in such cases shall be minimum one year.

22

[44] Section 153(3): Exception to the above time limit:

The time limits given in section 153(1) and section 153(2), to pass an Assessment Order u/s 143(3)

or u/s 144 or a Reassessment Order or u/s 147 shall not apply in a case if it is to be passed in

consequence of or to give effect to any finding or direction contained in an order passed by any

authority or any court in an Appeal, Revision or Reference. (i.e. unlimited time will be available to

pass an Assessment Order, as compared to the time limits given above, if such Assessment Order is

to be passed to give effect to an order passed by any higher authority or any court)

Explanation 1 to section 153: Exclusion of time:

While computing the above-mentioned time limits, the time of AO lost in followings, shall be

excluded:-

(a.) Time lost in giving an opportunity of being reheard to the assessee u/s 129,

(b.) Time lost due to Stay Order of Court,

(c.) Time lost in intimating Central Govt. about the contravention by Institution or Association

referred to section 10(21) / 10(22B) / 10(23A) / 10(23B) / 10(23C), i.e. those Institutions or

Associations covered by section 139(4C),

(d.) Time lost in requiring the assessee to get his Books of Accounts audited u/s 142(2A),

(e.) Time lost in following the procedure for avoiding Repetitive Appeals u/s 158A,

(f.) Time lost in making an application to Income Tax Settlement Commission (ITSC) and ITSC

rejecting such application,

(g.) Time lost in a making a successful application to Authority for Advance Ruling (AAR).

Proviso to Explanation 1: After excluding the above-mentioned time, if the time period available to

AO to complete the assessment is less than 60 days, then it shall be increased to 60 days.

ASSESSMENT OF SEARCH CASES

[45] Section 153A: Assessment or Reassessment of Search cases:

1) Whenever a Search is conducted u/s 132 or a Requisition is made u/s. 132A, in respect of any

person, the assessment of such person will be governed by section 153A.

2) A. O. shall issue a notice to such person u/s. 153A, requiring such person to furnish fresh ROI

for the last 6 previous years, immediately preceding the year of search. Such ROIs will have to

be furnished within the time allowed in such notice. (For e.g.: If a search is conducted on

23

01/01/2009 i.e. in P.Y. 2008-2009, then 6 year prior to the year of search will be P.Y. 2001-

2002 to 2007-2008 i.e. A.Y.2002-2003 to 2008-2009)

3) Assessee is required to furnish fresh ROI in respect of such last 6 previous years, even if such

ROIs were already filed earlier. (If assessee fails to furnish such ROI in respect of last 6

previous years, then AO shall complete the assessment or reassessment of such person u/s

153A, in a manner provided u/s 144)

4) ROI filed for the last 6 previous years in response to notice u/s. 153A cannot be revised.

5) There is no time limit to issue or to serve the notice u/s.153A.

6) The ROI for the year of search (i.e. the current year or the 7

th

year) will have to be furnished in

a regular course (and not in response to notice u/s 153A), which can be revised.

7) A.O. shall complete the assessment / reassessment for all the 7 years u/s. 153A, within the time

limit given in section 153B. (Though the ROI for the 7

th

year i.e. the year of search is not filed

in response to notice u/s 153A, then also the assessment of such current year will be made u/s

153A only)

8) Any assessment / reassessment, which is pending as on the date of initiation of search, in

relation to such last 6 previous years shall abate. (only assessment / reassessment shall abate.

Any other proceedings such as Appeals or Revision, which is pending, shall not abate.)

9) The Rate of Tax applicable to such income will be the rate of tax prevailing during each of

these last six assessment years and not the rate of tax prevailing in the year of search.

[46] Section 153B: Time limit to complete Assessment or Reassessment u/s. 153A:

1) The time limit to complete the assessment or reassessment for the last 6 previous years

immediately preceding the year of search, shall be 21months from the end of the Financial

Year, in which the Search was concluded u/s. 132 or Requisition was made u/s. 132A.

2) Time limit to complete the assessment for the year of search shall also be 21 months from the

end of the Financial Year, in which the Search was concluded u/s. 132 or Requisition was

made u/s. 132A.

3) However, if reference was made to Transfer Pricing Officer (TPO) u/s. 92CA for the purpose

of assessment / reassessment u/s. 153A, then the time limit will be 33 months instead of 21

months.

4) However, the time of A.O. lost in any of the following 5 shall be excluded, while calculating

the time limit of 21 months or 33 months as above:-

a) Time lost in giving an opportunity of being reheard to the assessee u/s 129,

24

b) Time lost due to Stay Order of Court,

c) Time lost in requiring the assessee to get his Books of Accounts audited u/s 142(2A),

d) Time lost in making an application to Income Tax Settlement Commission (ITSC) and

ITSC rejecting such application,

e) Time lost in a making a successful application to Authority for Advance Ruling (AAR).

After excluding the above-mentioned 5, if time left with A.O. to complete the assessment or

reassessment is less than 60 days, then it shall be extended to 60 days.

[47] Section 153C: Assessment or Reassessment of another person:

1) During the course of Search u/s 132, in the premises of an assessee, if Books of accounts,

documents or assets belonging to any other person are found, then A.O. shall seize such Books

of accounts, documents or assets and hand them over to the A.O. having jurisdiction over such

other person.

2) The case of such other person will also be governed by section 153A.

3) The A.O. having jurisdiction over such other person shall then issue a notice u/s. 153A

(without any time limit) requiring such person to furnish ROI for the last 6 previous years

immediately preceding the year of search (such ROI, for the last 6 previous years cannot be

revised).

4) ROI for the 7

th

year i.e. the year of search shall be furnished in regular course, which can be

revised.

5) Assessment or Reassessment of last 6 previous years + the year of search shall now be

governed by section 153A.

6) All the provision as discussed in section 153A shall apply to such other person.

7) Any Assessment or Reassessment for the last 6 previous years, which is pending as on the date

of receipt of Books of accounts or documents or assets by AO having jurisdiction over such

other person, shall abate. (only assessment / reassessment shall abate. Any other proceedings

such as Appeals or Revision, which is pending, shall not abate.)

8) The time limit to complete the Assessment / Reassessment in respect of such other person u/s.

153A for the last 6 previous years + the year of search shall be:-

a) 21 months from the end of the Financial Year, in which the Search was concluded u/s. 132

or Requisition was made u/s. 132A,

OR

25

b) 9 months from the end of the Financial Year, in which A.O. having jurisdiction over such

other person, receives the Books of accounts, documents or assets belonging to such other

person,

whichever is later.

However, if reference is made to a Transfer Pricing Officer (TPO) u/s. 92CA in respect

of such other person, by his AO, then both the above mentioned time limits shall be increased to 33

months and 21 months respectively.

[48] Section 153D: [w.e.f. A.Y. 2008-2009]: Assessment or Reassessment of Search cases,

u/s 153A or u/s 153C, shall not be made by an Income Tax Authority below the rank of Joint

Commissioner of Income Tax (JCIT), except with the prior approval of JCIT.

Note: Any Assessment or Reassessment in respect of last 6 previous years, which is pending, shall

abate, as discussed in section 153A and section 153C and the matter shall be governed by provisions

of section 153A only. However, later on if the assessment or reassessment made u/s 153A is annulled

in any appeal or any other legal proceeding, then abated assessment or reassessment shall stand

revived. In such cases the time limit available to complete such revived assessment or reassessment

shall be one year from the end of the month in which such abated assessment or reassessment is

revived or the time specified in section 153B, whichever is later.

However, if the order of annulment of assessment or reassessment u/s 153A is set aside or

cancelled, then such revived assessment or reassessment shall once again stand abated and the

matter will be governed by section 153A only. In such a case, the time of AO lost, starting from the

date of annulment of assessment or reassessment u/s 153A and ending on the date of receipt of a

copy of order setting aside such annulment order shall be excluded, while computing the time limit

given in section 153B.

[49] Section 156: Notice of Demand [Demand Notice]: Whenever, any Tax, Interest,

penalty or any other sum is found payable by assessee as a result of any order passed, then AO shall

be required to serve a notice to the assessee in this regard in a prescribed form, which shall be called

as Demand Notice. There is no time limit being prescribed anywhere in the Act for issue or service

of demand notice. Therefore, demand notice can be issued at anytime, even after expiry of time limit

to pass Assessment or Reassessment Order given in section 153.

Demand notice can only specify the sum payable, but cannot determine the amount payable.

Determination of sum payable shall be by way of an Assessment or Reassessment Order only. A

26

demand notice cannot determine the amount payable by assessee. Therefore, a demand notice u/s

156 cannot contain an amount, which was not specified in an order. For e.g.: If Assessment order is

silent about levy of Interest u/s 234A for late filing of ROI, then demand notice u/s 156 cannot talk

about such Interest. In simple words, Interest cannot be levied by way of specifying it in demand

notice, unless Assessment Order has determined such levy. CIT v/s Ranchi Club Ltd. (2001)(SC)

[50] Section 157: Intimation of Loss: During the course of assessment of total income of the

assessee, if it is established that he is eligible to carry forward a Loss, then AO shall intimate such

loss to the assessee, by an order in writing.

[51] Section 160: Representative Assessee: In case of certain assessee, the assessment may

be made on some other person. Such other persons are called as Representative Assessee. As per

this section, the following persons shall act as a Representative Assessee for other persons:

Persons Representative Assessee

(a.) Minor Child, Lunatic or an

Idiot.

Guardian or Manager

(b.) Non-

Resident...

Agent of such Non-Resident

(c.) Trust / Oral

Trust.

Trustee o such Trust

(d.) Any person in respect of whom

Official Trustee / Court of Wards / Court

Receiver / Manager is appointed by the

Court

Such Official Trustee / Court of Wards /

Court Receiver / Manager appointed by

Court

27

Chapter 3: SUGGESTIONS, FINDINGS & CONCLUSION

What has been described above is to explain how the assessment procedure works in Income

Tax Law. There are also assessment procedures relating to cases under search / seizure. But that has

not been dealt here that would take up another article to write about.

As such, for any case that is undertaken for assessment by the department there are various

issues relating to date of issue / receipt of notice, assessee approaching CIT (Appeals) or filing writ

petition in High Court, changes happening in IT laws/ regulations through Court proceedings in

other similar cases, and various circumstantial ifs and buts. All these tend to complicate the

assessment proceedings. And that is apart from at times illegal gratification for satisfaction of

AO which at times happen (In one of the seminars, a popular Income Tax author commented that

the satisfaction of AO was more important than the correctness of accounts!). All these things tend

to influence a case under assessment. However, in matter of illegal demands by AO, I would say,

that in one of the case I saw (as trainee) u/s 143(3), the AO was asking for certain large amount.

The Assessee initially was ready to pay upto Rs. 5000 but refused to pay more. As no bargain

could be struck, the Assessee did not pay anything. And thereafter the assessee struck to his point

that he would not pay anything even telling the AO that he could do whatever assessment he

wished to do! Finally the assessment happened without any exchange of money and the assessment

order made tax demand of around Rs. 850 (only!). So if one is correct in his stand and has disclosed

his income properly then there is nothing to fear. Also, as such, there are honest officers in IT

Department. It is just another department of government (or just another organisation) having mix of

good and bad.

The assessment is feared by people who hide income, and it is they who try to bribe IT

officials to get a favourable assessment. Sometimes black-sheep AOs can also demand money

but then one should not pay up if one is correct. To be honest does cause some procedural

harassment but end result is usually in favour of the honest.

But in a nutshell, the Assessment Procedures followed in India, though tedious & lengthy to

understand, are very functional. However, the multi-level authorities, bestowed with unlimited

powers are a jerk in the smooth functioning of the collection of taxes & assessments. However, e-

governance, which is the latest development in taxation by the Central Government is proving & will

be a boon to the Authorities by which all taxation departments will be automated & hence will

regulated by a Single Authority with requirement of no multi-level checks & then there would be

complete transparency in our Income Tax Procedures.

28

29

Chapter 4: BIBLIOGRAPHY

http://www.incometaxindia.gov.in/pages/acts/income-tax-act.aspx

http://indiapoint.net/finance/2009/12/03/assessment-income-tax/#_pdf

https://www.wiziq.com/tutorial/143330-Assessment-Procedures-under-Income-Tax-Act

http://www.slideshare.net/patelameet/basics-of-income-tax-assessments-and-appeals

http://en.wikipedia.org/wiki/The_Income-tax_Act,_1961

http://taxguru.in/income-tax/income-tax-assessment-procedure-nutshell-part.html

http://www.udyogtax.com/documents/11367/0/Assessment+Procedures.

http://www.caclubindia.com/articles/common-income-tax-procedures-at-one-place-

17516.asp#.VCequfmSwcE

www.google.com

xa.yimg.com/kq/groups/19352903/319143123/name/23

http://cafinalstuff.blogspot.in/2013/11/short-notes-on-assessment-procedure.html

You might also like

- CTT January 18 ExamDocument5 pagesCTT January 18 ExamAie GeraldinoNo ratings yet

- Merchant Merchant Mobile S No Shop Name Shop Address City 83 Abhijeet Saha 99065620Document167 pagesMerchant Merchant Mobile S No Shop Name Shop Address City 83 Abhijeet Saha 99065620Delta PayNo ratings yet

- Provisions For Filing of Return of IncomeDocument17 pagesProvisions For Filing of Return of IncomeJoseph SalidoNo ratings yet

- Adjudication - Case (1) .Docx 1Document14 pagesAdjudication - Case (1) .Docx 1aliciag4342No ratings yet

- Assessment ProcedureDocument8 pagesAssessment ProcedureAbhishek SharmaNo ratings yet

- Direct Tax CS FinalDocument19 pagesDirect Tax CS FinalkapilNo ratings yet

- Roi 2Document5 pagesRoi 2Shankar SinghNo ratings yet

- 5.1-Module 5Document3 pages5.1-Module 5Arpita ArtaniNo ratings yet

- Itr Returns On Listed EntitiesDocument21 pagesItr Returns On Listed EntitiesShyam SultaniaNo ratings yet

- Filing of ReturnsDocument28 pagesFiling of ReturnsrpsinghsikarwarNo ratings yet

- Filing of ReturnsDocument10 pagesFiling of ReturnsSayudh SarkarNo ratings yet

- Submitted To Submitted by MR Mayank Shrivastava RachitaDocument6 pagesSubmitted To Submitted by MR Mayank Shrivastava RachitaRachita WaghadeNo ratings yet

- Section 139Document7 pagesSection 139dhanishta906No ratings yet

- Filing Return of IncomeDocument4 pagesFiling Return of IncomeEpari SarthakNo ratings yet

- Return of Income: Group 3Document17 pagesReturn of Income: Group 3Khushi SonarNo ratings yet

- Income Tax AsgmentDocument9 pagesIncome Tax AsgmentPARVATHA VARTHININo ratings yet

- Return of IncomeDocument6 pagesReturn of Incometoton33No ratings yet

- Instructions For Filling Out FORM ITR-2: Page 1 of 10Document10 pagesInstructions For Filling Out FORM ITR-2: Page 1 of 10mehtakvijayNo ratings yet

- Semester: VI Subject: Computerised Accounting and E-Filing of Tax Return Name of The Teacher: Dr. Sujit Kumar Roy (SKR) Lecture Note # 1Document4 pagesSemester: VI Subject: Computerised Accounting and E-Filing of Tax Return Name of The Teacher: Dr. Sujit Kumar Roy (SKR) Lecture Note # 1BenstarkNo ratings yet

- Chapter 6 - Return of Income and AssessmentsDocument22 pagesChapter 6 - Return of Income and AssessmentsBRYNA BHAVESH 2011346No ratings yet

- Return of IncomeDocument9 pagesReturn of Incomes4sahithNo ratings yet

- After The Previous Year ExpiryDocument4 pagesAfter The Previous Year ExpiryRaj JamadarNo ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- Filing of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaDocument13 pagesFiling of Returns (Section 139) : By-Mohan Patel Mba 3 Sem. MonirbaMohan PatelNo ratings yet

- Unit 18Document20 pagesUnit 18Raja SahilNo ratings yet

- Section 139 of Income TaxDocument4 pagesSection 139 of Income TaxMOUSOM ROYNo ratings yet

- 51178bos40861 Mod1init cp10 PDFDocument40 pages51178bos40861 Mod1init cp10 PDFNithish minnalNo ratings yet

- Chapter 10Document5 pagesChapter 10Amar SharmaNo ratings yet

- Taxation of Salaried Employees, Pensioners and Senior by IndiagovermentDocument88 pagesTaxation of Salaried Employees, Pensioners and Senior by IndiagovermentHarshala NileshNo ratings yet

- Assesment Procedure: By: Smriti KhannaDocument25 pagesAssesment Procedure: By: Smriti KhannaSmriti KhannaNo ratings yet

- Assessment ProcedureDocument58 pagesAssessment ProcedureDrop Singh MeenaNo ratings yet

- Offshore Tax Evasion (145Document23 pagesOffshore Tax Evasion (145eraraja390No ratings yet

- Semester: UG SEM - V Subject: Taxation - II Teacher: SKG Lecture No:I Module - I (Direct Tax) Chapter: Filing of ReturnDocument4 pagesSemester: UG SEM - V Subject: Taxation - II Teacher: SKG Lecture No:I Module - I (Direct Tax) Chapter: Filing of ReturnShanzaiNo ratings yet

- Direct Tax Final Suggestion: For Offline Admission Call / Whatsapp - +91 70031 65955Document9 pagesDirect Tax Final Suggestion: For Offline Admission Call / Whatsapp - +91 70031 65955AhiaanNo ratings yet

- Assessment ProcedureDocument47 pagesAssessment ProcedureHoor FatimaNo ratings yet

- Instructions For Filling Out FORM ITR-2Document7 pagesInstructions For Filling Out FORM ITR-2Harminder Singh DhamNo ratings yet

- Chapter 12 MCQs On Assessment ProcedureDocument21 pagesChapter 12 MCQs On Assessment ProcedureJashaswee MishraNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Final DTL Chapter 3Document33 pagesFinal DTL Chapter 3Raja NarayananNo ratings yet

- Set of or Carry-11Document11 pagesSet of or Carry-11s4sahithNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Instructions For Filling Out FORM ITR-2Document8 pagesInstructions For Filling Out FORM ITR-2Ganesh KumarNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30No ratings yet

- 30851ipcc May Nov14 It Vol1 CP 9.unlockedDocument43 pages30851ipcc May Nov14 It Vol1 CP 9.unlockedavesatanas13No ratings yet

- Return of Income: (Date in Connection With Assessment Order Is Ignored From All Sections)Document6 pagesReturn of Income: (Date in Connection With Assessment Order Is Ignored From All Sections)omar zohorianNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- IT NotesDocument58 pagesIT NotesIshitaNo ratings yet

- Asses MentDocument4 pagesAsses MentEngr. Md. Ishtiak HossainNo ratings yet

- Assessment ProcedureDocument7 pagesAssessment ProcedureVachanamrutha R.VNo ratings yet

- Nadeem Butt (FCA) Chartered AccountantDocument47 pagesNadeem Butt (FCA) Chartered AccountantMuhammad RamzanNo ratings yet

- Return of Income & AssessmentDocument3 pagesReturn of Income & AssessmentABC 123No ratings yet

- DT 4Document29 pagesDT 4Charu JagetiaNo ratings yet

- Ranjan Sir Lecture - Details - UnlockedDocument77 pagesRanjan Sir Lecture - Details - UnlockedTumpakuri67% (6)

- Computerised Accounting and e Filing of Tax ReturnsDocument8 pagesComputerised Accounting and e Filing of Tax ReturnsBishal BhandariNo ratings yet

- Volume 1 - 50 Pages MN23Document52 pagesVolume 1 - 50 Pages MN23Kajal KanduNo ratings yet

- CA Final DT Amendments For May 2022 Exam - Part 2Document23 pagesCA Final DT Amendments For May 2022 Exam - Part 2Bhuvanesh RavichandranNo ratings yet

- Income Tax Part 1 (Theory + MCQ)Document200 pagesIncome Tax Part 1 (Theory + MCQ)Neha SharmaNo ratings yet

- Assessment ProcedureDocument7 pagesAssessment Procedurebabajan_4No ratings yet

- Return of IncomeDocument13 pagesReturn of IncomeParth UpadhyayNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document7 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document6 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Calling TTDocument84 pagesCalling TTrahul0% (1)

- Recruitment in Clerical Cadre in Associate Banks of State Bank of IndiaDocument5 pagesRecruitment in Clerical Cadre in Associate Banks of State Bank of Indiap4ukumarNo ratings yet

- Taxation - Questions Sepr 2012Document17 pagesTaxation - Questions Sepr 2012kannadhassNo ratings yet

- Frequently Asked QuestionsDocument42 pagesFrequently Asked QuestionsRajiv Bajpai100% (4)

- 6 Accounting Concepts and PrinciplesDocument25 pages6 Accounting Concepts and Principlesapi-26702351283% (6)

- Double Entry Book Keeping SystemDocument14 pagesDouble Entry Book Keeping SystemVisakh Vignesh100% (1)

- NG GAN ZEE, Plaintiff-Appellee, vs. ASIAN CRUSADER LIFE ASSURANCE CORPORATION, Defendant-AppellantDocument2 pagesNG GAN ZEE, Plaintiff-Appellee, vs. ASIAN CRUSADER LIFE ASSURANCE CORPORATION, Defendant-AppellantTiff DizonNo ratings yet

- Statement of Additional Information Aug30 2012Document78 pagesStatement of Additional Information Aug30 2012Gaurav PultamkarNo ratings yet

- Sbi-Bank - Effectiveness of Customer Relationship Management Programme in State Bank of IndiaDocument71 pagesSbi-Bank - Effectiveness of Customer Relationship Management Programme in State Bank of IndiaVrinda Priya60% (5)

- Term Net Premium Reserve (NPR) Calculation: by Tim Cardinal, FSA, CERA, MAAA Principal, Actuarial CompassDocument6 pagesTerm Net Premium Reserve (NPR) Calculation: by Tim Cardinal, FSA, CERA, MAAA Principal, Actuarial Compassswatisin93No ratings yet

- Bangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsDocument17 pagesBangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsMichelle GoNo ratings yet

- Statement - EUR - 2020 08 01 - 2020 11 02 PDFDocument4 pagesStatement - EUR - 2020 08 01 - 2020 11 02 PDFhenryNo ratings yet

- BDO 2009 AR SupplementDocument136 pagesBDO 2009 AR SupplementStychri AlindayoNo ratings yet

- Ujjivan Updated Company ListDocument8,941 pagesUjjivan Updated Company ListArvind HarikrishnanNo ratings yet

- Mock 01 001Document28 pagesMock 01 001masud khanNo ratings yet

- Sr. No. Description Allied Rate of Charges PL Category (T24)Document2 pagesSr. No. Description Allied Rate of Charges PL Category (T24)Textro VertNo ratings yet

- The Risk and Term Structure of Interest RateDocument7 pagesThe Risk and Term Structure of Interest RatestixNo ratings yet

- How To Use Atm MachineDocument1 pageHow To Use Atm MachineHazrahNo ratings yet

- Prudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines Inc, G.R. No. 151890 June 20, 2006 (Full Text and Digest)Document14 pagesPrudential Guarantee and Assurance Inc., vs. Trans-Asia Shipping Lines Inc, G.R. No. 151890 June 20, 2006 (Full Text and Digest)RhoddickMagrataNo ratings yet

- Company Isin Description in NSDLDocument156 pagesCompany Isin Description in NSDLDhananjayan Gopinathan0% (1)

- Copia de Default of Credit Card ClientsDocument2,196 pagesCopia de Default of Credit Card Clientsricardipineda80No ratings yet

- CFDIDocument53 pagesCFDIBrando Castro CamposNo ratings yet

- F - Zakir Chaudhary - M XUV 500 - KA 04 MQ 1856Document7 pagesF - Zakir Chaudhary - M XUV 500 - KA 04 MQ 1856ASFAN CHAUDHARYNo ratings yet

- Account Statement From 12 May 2019 To 12 Nov 2019Document13 pagesAccount Statement From 12 May 2019 To 12 Nov 2019MukeshChauhanNo ratings yet

- Synopsis ON "Role and Need of Merchant Bankers in Ipo: M.Rajashekar (REG NO. 11SLCMA104)Document7 pagesSynopsis ON "Role and Need of Merchant Bankers in Ipo: M.Rajashekar (REG NO. 11SLCMA104)shiva7363No ratings yet

- Reward Current Account 31 March 2022 To 30 April 2022: Your Account Arranged Overdraft Limit 1,000Document4 pagesReward Current Account 31 March 2022 To 30 April 2022: Your Account Arranged Overdraft Limit 1,000ITNo ratings yet

- Ifcb2009 68Document734 pagesIfcb2009 68हर्षितझाझङियाNo ratings yet