Professional Documents

Culture Documents

Credit Spreads A Fixed Income Investor's Must-Know Guide

Uploaded by

TroemsolOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Spreads A Fixed Income Investor's Must-Know Guide

Uploaded by

TroemsolCopyright:

Available Formats

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

Credit

spreads: A fixed income investor's must-know guide

Credit spreads: A fixed income investor's must-know guide (Part 1 of 6)

Credit spreads: A fixed income investors must-know guide

By Surbhi Jain - Disclosure Mar 24, 2014 3:56 pm EDT

Credit spreads

Credit spreads are the difference in yield between U.S. Treasuries and corporate bonds of the same maturity. Corporate bonds yield more than

Treasury bonds, as they carry a risk of default. The difference in yields between a corporate bond and a Treasury of the same maturity is actually the

premium that investors require for undertaking the additional credit risk associated with the corporate bond.

U.S. Treasury bonds are considered the safest, as theyre issued and guaranteed by the government of United States.

Calculating credit spreads

The credit spread between a ten-year corporate bond yielding 5% and the ten-year Treasury bond yielding 2% would be 3%.

The current bond yield for a five-year Exxon Mobil (XOM) bond is 1.82%. The corresponding five-year Treasury bond yield stands at 1.73%. So the

credit spread for the Exxon Mobil bond would be 0.09%, or 9 basis points.

At the same time, a five-year JP Morgan Chase (JPM) bond yields 6.3%. Here, the credit spread is much wider, at 4.57% or 457 basis points, than

Exxon Mobils, where the spread is tighter or narrower. This shows that the JPM bond carries more credit risk than the XOM bond.

Credit spreads for a category of bonds

In addition to looking at credit spreads for individual bonds, investors may also want to look at the credit spread of different categories of bonds.

For example, by comparing a group of corporate bonds (like high-yield bonds) versus Treasuries, you can get a picture of where the average highyield bond credit spread currently stands.

There are various indices available that enable this comparison. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which tracks the

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

1/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

iBoxx $ Liquid High Yield Index, and the SPDR Barclays Capital High Yield Bond ETF (JNK), which tracks the Barclays Capital High Yield Very

Liquid Index, are popular ETFs tracking indices in the high-yield bonds category.

Similarly, in the leveraged loans category, the S&P/LSTA U.S. Leveraged Loan 100 Index (SPBDLL) is a popular measure that tracks the marketweighted performance of the largest institutional leveraged loans. The PowerShares Senior Loan Portfolio Fund (BKLN), with companies like H.J.

Heinz Company (HNZ) and Fortescue Metals Group (FMG) in its portfolio, tracks this index.

To find out more about the relationship between interest rates and credit spreads, read on to the next part of this series.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

2/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

Credit spreads: A fixed income investor's must-know guide (Part 2 of 6)

The relationship between interest rates and credit spreads

By Surbhi Jain - Disclosure Mar 25, 2014 9:00 am EDT

Interest rates and credit spreads

Interest rates for different types of bonds normally dont change by the same degree together. When theres a lot of uncertainty in the market,

investors tend to park their money in super-safe U.S. Treasuries, causing their yields to drop and prices to rise. On the other hand, in times of

uncertainty, investors expect higher returns from high-yield bonds to compensate for the increased risk, causing their yields to rise and the prices to

drop. So even though Treasury yields are falling, the credit spread for high-yield bonds is getting wider.

Accordingly, examining credit spreads gives investors an idea of how cheap (a wide credit spread) or expensive (a narrow credit spread) the

market for a particular bond category or a particular bond is.

Credit spreads as an economic indicator

Credit spreads also give investors an idea as to where the economy is heading.

Improved economic conditions are signaled by improvements in company profitability and lower corporate default rates. This causes investors to

view investment-grade and high-yield corporate bonds more favorably, which causes the credit spread to contract. Moreover, improvement in the

economy prompts the Fed to hike interest rates in order to ward off inflationary pressure. This increase in interest rates causes Treasury yields to

spike, in turn tightening credit spreads.

The reverse happens in the case of an economic slowdown.

Market behavior

Bond investors try to anticipate changes in the fundamentals of the economy and the individual bond issuers they follow. Because of this trend,

credit spreads often move ahead of the economy, offering the intelligent investor some predictive power they can use to profit and avoid losses.

Changes in interest rates affect investor behavior to a great extent. Certain exchange-traded funds (or ETFs) like the ProShares Investment GradeInterest Rate Hedged ETF (IGHG), which has its major holdings in companies like Citigroup Inc. (C) and JP Morgan Chase & Co. (JPM), the

Vanguard Short Term Corporate Debt ETF (VCSH), and the PowerShares Senior Loan Fund (BKLN) are designed to protect the investors against

interest rate risk caused by inflation.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

3/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

To see how credit spreads change over time, read on to the next part of this series.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

4/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

Credit spreads: A fixed income investor's must-know guide (Part 3 of 6)

How credit spreads change with economic conditions

By Surbhi Jain - Disclosure Mar 25, 2014 1:00 pm EDT

Credit spreads change

As we reasoned in Part 2 of this series, credit spreads tighten with improvements in economic conditions and widen with deteriorating economic

conditions. You can see good evidence of these trends in spreads behavior during the credit crisis of 20082009.

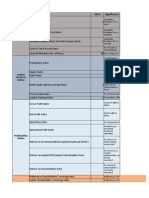

The chart above shows how the Bank of America Merrill Lynch U.S. Corporate 3-5 Year Option-Adjusted Spread rose from 2008 through 2009.

This was a time when the sub-prime crisis had adversely affected the U.S. economy. The BofA Merrill Lynch US Corporate 3-5 Year Option

Adjusted Spread Index measures the credit spread between the average corporate bond with a maturity of three to five years and the average

Treasury of the same maturity range.

The three-to-five year corporate bond spread was below 1% until middle-to-late 2007, when the market started to get nervous leading up to the

financial crisis. The credit spread skyrocketed, reaching a high of about 7% at the height of the financial crisis. This was when Lehman Brothers

went bankrupt, in September 2008. After heavy government and Federal Reserve intervention, the markets stabilizedalthough spreads still

remained much higher than they were before the financial crisis, as weakness in the economy persisted.

For investors in ETFs, the performances of popular exchange-traded funds like the SPDR S&P 500 ETF (SPY), the iShares Core S&P 500 ETF

(IVV), and the iShares S&P 100 ETF (OEF)which track large-cap equities of companies like Apple Inc. (AAPL) and Exxon Mobil Corp. (XOM)

serve as a good indicator of the course the U.S. economy is taking.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

5/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

Credit spreads: A fixed income investor's must-know guide (Part 4 of 6)

Must-know: Do credit spreads only represent credit risk?

By Surbhi Jain - Disclosure Mar 25, 2014 5:00 pm EDT

Credit risk

While credit spreads do give you a good picture of the credit risk of one bond compared to another, its not the only factor they represent.

The spread is basically the premium that an investor in a bond expects over a benchmark bond (like a U.S. Treasury) for the additional credit (or

default) risk attached to it. However, there are other factors too that go into determining the premium that an investor in a bond demands over a

higher-grade benchmark bond. There are several other factors that combine with credit risk to make up the spread premium.

Municipal bonds

Take the case of municipal bonds. Municipal bonds are generally considered risk-free as Treasuriesand they often enjoy favorable tax treatment.

This results in most of them actually trading at a yield below the Treasury yield. This means the spread is negative.

The chart above shows the price performance of the iShares National AMT-Free Muni Bond (MUB), which tracks the performance of the investment

grade segment of the U.S. municipal bond market, against the iShares U.S. Treasury Bond (GOVT), which tracks the performance of public

obligations of the U.S. Treasury that have a remaining maturity of one year or more.

Corporate bonds

Similarly, many corporate bonds are illiquid, meaning it can be difficult to sell the bond once youve bought it because theres no active market for

the bond. Investors will therefore require a higher premium over and above credit risk premium to compensate for the liquidity risk associated with

the bond. The premium is known as liquidity risk premium. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) tracks the

performance of 600 highly liquid investment grade corporate bonds of companies like Verizon Communications (VZ) and General Electric (GE).

Other factors that affect credit spreads, in addition to credit risk, include the following.

The bonds duration: The higher the duration, the higher the perceived risk, and the higher the spread.

Embedded options such as callability: Investors require a premium for accommodating such options, increasing spreads.

Event risk (natural disasters, regulatory changes, et cetera): A negative event warrants a higher premium, and consequently a higher spread.

Liquidity: As we mentioned, the spread is directly proportional to the illiquidity of the bond.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

6/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

Credit spreads: A fixed income investor's must-know guide (Part 5 of 6)

Assessing high yield bond credit spreads so far in 2014

By Surbhi Jain - Disclosure Mar 26, 2014 9:00 am EDT

High yield bond credit spreads

As we discussed in parts 2 and 3 of this series, credit spreads tighten with improvements in economic conditions. The U.S. economy is recovering

from the 2009 recession, and macroeconomic indicators are positive as far as the countrys economic growth. Investor confidence, which had

plummeted, is regaining.

So credit spreads are tightening for corporate bonds, as the economy is showing signs of improvement, and the macroeconomic outlook is

positive. To read more about the U.S. macro-economic outlook for 2014, read the Market Realist series Must-know 2014 US macro outlook: The

crack in the debt ceiling.

The iShares S&P 100 ETF (OEF), which tracks the large-cap equities of companies like Apple Inc. (AAPL) and Exxon Mobil Corp. (XOM), serves

as a good indicator of the course the U.S. economy is taking.

Credit spreads for high-yield bonds have shown a declining trend.

The chart above depicts how credit spreads for ten-year BBB-rated high yield bonds have evolved since the beginning of the year. The ten-year

BBB spread is the premium (or excess return) that a ten-year BBB-rated bond pays over the ten-year Treasury bond yield.

Quantitative easing, the massive bond-buying program by the Fedthrough which the government invests substantial funds in purchasing its own

Treasury securitieshas led Treasury rates to an all-time low.

The capital market has become yield-thirsty on account of Treasury yields being at an all-time low. So investors are diverting their investments

towards high-yield bonds in search of better risk-adjusted yields.

Through the recent tapering initiatives, through which the Feds gradually reducing the amount of Treasury bonds and mortgage-backed-securities it

buys, yields on Treasury bonds should show an uptick. The taper is an indication of improvement in the economy, raising expectations for corporate

profitability. This is precisely why the high yield bond spread curve (in the chart above) was reversing its trend in early March.

The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and the SPDR Barclays Capital High Yield Bond ETF (JNK) are popular ETFs in the

high yield bond category.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

7/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

Credit spreads: A fixed income investor's must-know guide (Part 6 of 6)

Assessing leveraged loan credit spreads so far in 2014

By Surbhi Jain - Disclosure Mar 26, 2014 1:00 pm EDT

Leveraged loan credit spreads

While changes in interest rates may not prompt long-term investors in safe companies like Apple Inc. (AAPL) and Exxon Mobil (XOM) to react,

investors holding stocks of highly leveraged companies may want to evaluate their holdings.

Leveraged loans have also experienced an increase in fund flows as investors moved their funds from low-yielding Treasuries elsewhere. Since

both high-yield bonds and leveraged loans offer high interest rates, investors are primarily divided between the two on the basis of the risk theyre

willing to take. Investors demand higher yields from high-yield bonds vis--vis leveraged loans, as high-yield bonds are unsecured, whereas

leveraged loans are secured by a charge on the issuers assets. Consequently, the credit risk attached to high yield bonds is greater.

However, leveraged loans are loans issued to individuals or corporations with a considerable amount of existing debt, and they also have to

compensate for the default or credit risk associated with repayment by paying higher yields.

The chart above shows how credit spreads for leveraged loans have evolved since the beginning of the year. The leveraged loan spread measured

here is the difference between the S&P/LSTA U.S. Leveraged Loan 100 Index return and LIBOR1, which serves as a benchmark for most

leveraged loans.

The PowerShares Senior Loan Portfolio Fund (BKLN) is a popular ETF tracking the S&P/LSTA U.S. Leveraged Loan 100 Index. The

Highland/iBoxx Senior Loan ETF (SNLN) and the First Trust Senior Loan ETF (FTSL) are other popular ETFs in the leveraged loans category.

The Fed funds rate has been zero on the lower bound for quite some time now. The Fed has deliberately kept the Fed funds rate at near zero so

that its unconventional monetary policy, consisting of quantitative easing, is effective. This has also resulted in the LIBOR rate maintaining its low

figure.

For more on the Fed funds rate being zero-lower-bound, read the Market Realist article Why a zero lower bound is constraining the Fed funds rate.

More than one factor have led to funds diverting toward the leveraged loan market.

The capital market has become yield-thirsty on account of Treasury bond yields also being at an all-time low. Investors are therefore diverting their

investments towards leveraged loans in search of better yields.

With investor expectations of an interest rate rise, leveraged loans seem to be a safer bet, as they offer floating interest rates. Floating interest rate securities

are preferable in a rising rate environment, as their return rises with the market. Theyre effective in negating the effect of inflation or interest rate risk.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

8/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

However, as leveraged loans are based on LIBOR, and LIBOR has been low for a while now, the yield on leveraged loans was also low. In a low

interest rate environment, investors preference shifts towards fixed-rate high yield bonds. The outflow from leveraged loans has increased the

liquidity risk attached to them, leading to an increase in the risk premium commanded by these securities. The increased risk premium has led to

an uptick in yields, while LIBOR remains low. Consequently, spreads have risen since January.

To learn more about investing in fixed income securities, see the Market Realist series Tapering and Treasury yields: Important takeaways.

1. The London Inter-bank Offered Rate is the average interest rate paid by banks to borrow overnight from each other. Its estimated by the British Bankers Association, which

comprises the leading banks in London.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

9/10

9-8-2014

Credit spreads: A fixed income investor's must-know guide Market Realist

2013 Market Realist, Inc.

http://marketrealist.com/2014/03/credit-spreads-fixed-income-investors-must-know-guide/

10/10

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Spellbound: The Only 2-Tier Affiliate Product That Lasts A Lifetime!Document12 pagesSpellbound: The Only 2-Tier Affiliate Product That Lasts A Lifetime!JimNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Private Placement Trade Programs ExplainedDocument18 pagesPrivate Placement Trade Programs ExplainedMike Weiner100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ratio AnalysisDocument26 pagesRatio AnalysisDeep KrishnaNo ratings yet

- BS & Income Statement ReformulationDocument30 pagesBS & Income Statement ReformulationAbhishek Singh RanaNo ratings yet

- 2015 Evaluating Multiple Classifiers For Stock Price Direction PredictionDocument11 pages2015 Evaluating Multiple Classifiers For Stock Price Direction PredictionhnavastNo ratings yet

- Project Manager Inc. Real Estate DevelopmentDocument13 pagesProject Manager Inc. Real Estate DevelopmentinventionjournalsNo ratings yet

- A Major Project Report On A Study of Awareness and Knowledge About Wealth Management Among IndividualsDocument51 pagesA Major Project Report On A Study of Awareness and Knowledge About Wealth Management Among IndividualsGaurav Solanki50% (2)

- Cambridge Assessment International Education: Business 9609/13 May/June 2019Document12 pagesCambridge Assessment International Education: Business 9609/13 May/June 2019AbdulBasitBilalSheikhNo ratings yet

- Financial Performance Analysis of Janata Bank LimitedDocument68 pagesFinancial Performance Analysis of Janata Bank Limitedsumaiya sumaNo ratings yet

- 5484Document11 pages5484mairaj08No ratings yet

- 2017-Annual Report Groep N.V PDFDocument356 pages2017-Annual Report Groep N.V PDFWilliam WatterstonNo ratings yet

- Full Download Corporate Finance 11th Edition Ross Test BankDocument35 pagesFull Download Corporate Finance 11th Edition Ross Test Bankdhinzlantzp100% (29)

- Beximco Accounting ProjectDocument44 pagesBeximco Accounting ProjectAmeer FerdousNo ratings yet

- CiiiDocument19 pagesCiiimikelNo ratings yet

- Capital Structure TheoryDocument22 pagesCapital Structure TheorySigei LeonardNo ratings yet

- Capital Structure and Financial Performance: Evidence From IndiaDocument17 pagesCapital Structure and Financial Performance: Evidence From IndiaanirbanccimNo ratings yet

- Comm 103 NotesDocument76 pagesComm 103 NotesKanak NageeNo ratings yet

- JNUG Factsheet PDFDocument2 pagesJNUG Factsheet PDFCho CuteNo ratings yet

- FPI-Disposal of Shares by FPM in ABDocument4 pagesFPI-Disposal of Shares by FPM in ABShungchau WongNo ratings yet

- Major Assignment Comparative Financial Statement Analysis of Kabul Based Corporations MBA Non-BusinessDocument2 pagesMajor Assignment Comparative Financial Statement Analysis of Kabul Based Corporations MBA Non-BusinessMasoud AfzaliNo ratings yet

- Lecture5 6 Ratio Analysis 13Document39 pagesLecture5 6 Ratio Analysis 13Cristina IonescuNo ratings yet

- Finama Sir MarayaDocument16 pagesFinama Sir MarayaYander Marl BautistaNo ratings yet

- Key Success Facotr GeneralDocument3 pagesKey Success Facotr GeneralprashantNo ratings yet

- Corporate Finance Case StudyDocument26 pagesCorporate Finance Case StudyJimy ArangoNo ratings yet

- Thesis Group IVDocument14 pagesThesis Group IVAldrene KyuNo ratings yet

- New ProjectDocument10 pagesNew Projectvishal soniNo ratings yet

- Business and Management HL P1Document18 pagesBusiness and Management HL P1FarrukhsgNo ratings yet

- 2020 Q 4 ReleaseDocument18 pages2020 Q 4 ReleasentNo ratings yet

- Terms and Conditions v4 1 NBRB Capital ComDocument42 pagesTerms and Conditions v4 1 NBRB Capital ComMaria ReyesNo ratings yet

- Syndicated Loan Vs BondDocument37 pagesSyndicated Loan Vs BondAli Attarwala100% (2)