Professional Documents

Culture Documents

MF0012

Uploaded by

Rajesh SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MF0012

Uploaded by

Rajesh SinghCopyright:

Available Formats

Get Answers on www.smuHelp.

com

G

e

t

A

n

s

w

e

r

s

o

n

w

w

w

.

s

m

u

H

e

l

p

.

c

o

m

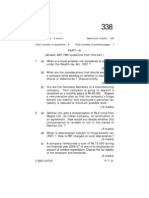

ASSIGNMENT

DRIVE FALL 2014

PROGRAM MBADS (SEM 3/SEM 5)

MBAFLEX/ MBA (SEM 3)

PGDFMN (SEM 1)

SUBJECT CODE &

NAME

MF0012 &

TAXATION MANAGEMENT

BK ID B1760

CREDITS 4

MARKS 60

Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400

words. Each question is followed by evaluation scheme.

Q.No Questions Marks Total

Marks

1 Explain the objectives of tax planning. Discuss the factors to be considered in tax

planning.

Objectives of tax planning

Factors in tax planning

5

5

10

2 Explain the categories in Capital assets.

Mr. C acquired a plot of land on 15th June, 1993 for 10,00,000 and sold it on 5th

January, 2010 for 41,00,000. The expenses of transfer were 1,00,000.

Mr. C made the following investments on 4th February, 2010 from the proceeds of the

plot.

a) Bonds of Rural Electrification Corporation redeemable after a period of three years,

12,00,000

b) Deposits under Capital Gain Scheme for purchase of a residential house 8,00,000 (he

does not own any house)

Compute the capital gain chargeable to tax for the AY2010-11.

Explanation of categories of capital assets

Calculation of indexed cost of acquisition

Calculation of long term capital gain

Calculation of taxable long term capital gain

4

2

2

2

10

Get Answers on www.smuHelp.com

G

e

t

A

n

s

w

e

r

s

o

n

w

w

w

.

s

m

u

H

e

l

p

.

c

o

m

3 Explain major considerations in capital structure planning. Write about the dividend

policy and factors affecting dividend decisions.

Explanation of factors of capital structure planning

Explanation of dividend policy

Factors affecting dividend decisions

6

2

2

10

4 X Ltd. has Unit C which is not functioning satisfactorily. The following are the details

of its fixed assets:

Asset

Date of

acquisition

Book value (`

lakh)

Land

Goodwill (raised in books on 31

st

March,

2005)

Machinery

Plant

10

th

February,

2003

5

th

April, 1999

12

th

April, 2004

30

10

40

20

The written down value (WDV) is ` 25 lakh for the machinery, and

15 lakh for the plant. The liabilities on this Unit on 31

st

March, 2011 are

35 lakh.

The following are two options as on 31

st

March, 2011:

Option 1: Slump sale to Y Ltd for a consideration of 85 lakh.

Option 2: Individual sale of assets as follows: Land ` 48 lakh, goodwill ` 20 lakh,

machinery 32 lakh, Plant 17 lakh.

The other units derive taxable income and there is no carry forward of loss or

depreciation for the company as a whole. Unit C was started on 1st January, 2005.

Which option would you choose, and why?

Computation of capital gain for both the options

Computation of tax liability for both the options

Conclusion

4

4

2

10

5 Explain the Service Tax Law in I ndia and concept of negative list. Write about the

exemptions and rebates in Service Tax Law.

Explanation of Service Tax Law in India

Explanation of concept of negative list

Explanation of exemptions and rebates in Service Tax Law

5

2

3

10

Get Answers on www.smuHelp.com

G

e

t

A

n

s

w

e

r

s

o

n

w

w

w

.

s

m

u

H

e

l

p

.

c

o

m

6 What do you understand by customs duty? Explain the taxable events for imported,

warehoused and exported goods. List down the types of duties in customs.

An importer imports goods for subsequent sale in India at $10,000 on assessable value

basis. Relevant exchange rate and rate of duty are as follows:

Particulars Date

Exchange

Rate Declared

by CBE&C

Rate of

Basic

Customs

Duty

Date of submission

of bill of entry

25

th

February, 2010 ` 45/$ 8%

Date of entry

inwards granted to

the vessel

5

th

March, 2010 ` 49/$ 10%

Calculate assessable value and customs duty.

Meaning and explanation of customs duty

Explanation of taxable events for imported, warehoused and

exported goods

Listing of duties in customs

Calculation of assessable value and customs duty.

2

3

2

3

10

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesApproximately of 400 Words. Each Question Is Followed by Evaluation SchemeBadder DanbadNo ratings yet

- TaxationDocument3 pagesTaxationKavish BablaNo ratings yet

- MBA Taxation Assignment on Objectives of Tax Planning and Factors to ConsiderDocument8 pagesMBA Taxation Assignment on Objectives of Tax Planning and Factors to Considersambha86No ratings yet

- TaxationDocument4 pagesTaxationshreya chhajerNo ratings yet

- Fin 303 PDFDocument4 pagesFin 303 PDFSimanta KalitaNo ratings yet

- Malawi Taxation Exam QuestionsDocument15 pagesMalawi Taxation Exam QuestionsCean Mhango100% (1)

- Requirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Document5 pagesRequirements:: Taxation-Ii Time Allowed - 3 Hours Total Marks - 100Srikrishna DharNo ratings yet

- Taxation EMDocument2 pagesTaxation EMtadepalli patanjaliNo ratings yet

- Students' Companion: The Chartered Institute of Taxation of NigeriaDocument24 pagesStudents' Companion: The Chartered Institute of Taxation of Nigeriadejioyinloye2004No ratings yet

- Test Papers: FoundationDocument23 pagesTest Papers: FoundationUmesh TurankarNo ratings yet

- Higher Level Paper 2 2010Document8 pagesHigher Level Paper 2 2010Mark MoloneyNo ratings yet

- Executive MBA Power Accounting AssignmentDocument5 pagesExecutive MBA Power Accounting AssignmentSai Phanindra Kumar MuddamNo ratings yet

- Accounting I.com 2Document4 pagesAccounting I.com 2Saqlain KazmiNo ratings yet

- F1 May 2011Document20 pagesF1 May 2011Shamra KassimNo ratings yet

- Nov 06Document24 pagesNov 06Vascilly TerentievNo ratings yet

- Alhamd Taxation Tests and SolutionDocument35 pagesAlhamd Taxation Tests and Solutionshahnawaz243No ratings yet

- Where Success Follows Brilliance: Accounting and Bookkeeping QuestionsDocument6 pagesWhere Success Follows Brilliance: Accounting and Bookkeeping QuestionsAtul Kumar100% (1)

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- Accounting Test Paper 1: Key ConceptsDocument30 pagesAccounting Test Paper 1: Key ConceptsSatyajit PandaNo ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Intermediate Exam Question Compilation for ICWAI Syllabus 2002Document30 pagesIntermediate Exam Question Compilation for ICWAI Syllabus 2002Reshma RajNo ratings yet

- Actuarial Society of India: ExaminationsDocument9 pagesActuarial Society of India: ExaminationsAmitNo ratings yet

- Introduction to Taxation and IncomeDocument7 pagesIntroduction to Taxation and IncomeMonirul Islam MoniirrNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- F AccountDocument39 pagesF AccountChandra Prakash SoniNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- ACCT 504 Midterm Exam 2Document7 pagesACCT 504 Midterm Exam 2DeVryHelpNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- 1mba FM 042mbaDocument3 pages1mba FM 042mbaAtindra ShahiNo ratings yet

- Financial Accounting 250 Final Exam Revision QuestionsDocument7 pagesFinancial Accounting 250 Final Exam Revision QuestionsKen ChenNo ratings yet

- Ms 4Document2 pagesMs 4Dickie SangmaNo ratings yet

- Acct1511 2013s2c2 Handout 2 PDFDocument19 pagesAcct1511 2013s2c2 Handout 2 PDFcelopurpleNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- ICMA Fall 2013 Exam Business Taxation QuestionsDocument4 pagesICMA Fall 2013 Exam Business Taxation Questionsmuhzahid786No ratings yet

- Taxation ManagementDocument11 pagesTaxation Managementshreya chhajerNo ratings yet

- F1 - Financial OperationsDocument20 pagesF1 - Financial OperationsMarcin MichalakNo ratings yet

- Question Papers Supplementary Exam 2007Document24 pagesQuestion Papers Supplementary Exam 2007ce1978No ratings yet

- Institute of Actuaries of India: ExaminationsDocument8 pagesInstitute of Actuaries of India: ExaminationsRushikesh AravkarNo ratings yet

- Accounting For Managers GTU Question PaperDocument3 pagesAccounting For Managers GTU Question PaperbhfunNo ratings yet

- Advanced Taxation Final ExamDocument4 pagesAdvanced Taxation Final ExamAhmed Raza MirNo ratings yet

- Caf-6 TaxDocument4 pagesCaf-6 TaxaskermanNo ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7india1965No ratings yet

- Advanced Accounting ExamDocument6 pagesAdvanced Accounting ExamMozam MushtaqNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- March 09 TaxDocument4 pagesMarch 09 TaxmimriyathNo ratings yet

- ICAB Last Year Question (Knowledge Level)Document5 pagesICAB Last Year Question (Knowledge Level)Fatema KanizNo ratings yet

- Great Zimbabwe University Faculty of CommerceDocument5 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- Advanced Financial ReportingDocument5 pagesAdvanced Financial ReportingShravan Subramanian BNo ratings yet

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument20 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTang Swee ChanNo ratings yet

- FPDocument20 pagesFPRadhika ParekhNo ratings yet

- Question 1 (40marks - 48 Minutes)Document8 pagesQuestion 1 (40marks - 48 Minutes)dianimNo ratings yet

- Sy Bcom Oct2011Document83 pagesSy Bcom Oct2011Anonymous l0j1IwcPDNo ratings yet

- Accounting concepts and principles in financial statementsDocument6 pagesAccounting concepts and principles in financial statementskartikbhaiNo ratings yet

- MB0043Document1 pageMB0043Rajesh SinghNo ratings yet

- MBA106Document1 pageMBA106Rajesh SinghNo ratings yet

- MBA105Document1 pageMBA105Rajesh SinghNo ratings yet

- MBA104Document2 pagesMBA104Rajesh SinghNo ratings yet

- MBA101Document3 pagesMBA101Rajesh SinghNo ratings yet

- Smude Mba Project ReportsDocument8 pagesSmude Mba Project ReportsRajesh SinghNo ratings yet

- MBA Semester 2 MB0049Document3 pagesMBA Semester 2 MB0049Rajesh SinghNo ratings yet

- MBA103Document2 pagesMBA103Rajesh Singh0% (2)

- MB0043Document1 pageMB0043Rajesh SinghNo ratings yet

- Smude Mba Semester 3 Mb0051Document1 pageSmude Mba Semester 3 Mb0051Rajesh SinghNo ratings yet

- Smude Mba Semester 3 Spring 2015 Assignments MU0012Document1 pageSmude Mba Semester 3 Spring 2015 Assignments MU0012Rajesh SinghNo ratings yet

- Smude Mba Semester 3 Spring 2015 Assignments MU0011Document1 pageSmude Mba Semester 3 Spring 2015 Assignments MU0011Rajesh SinghNo ratings yet

- Answer:: Mf0010: Security Analysis and Portfolio ManagementDocument1 pageAnswer:: Mf0010: Security Analysis and Portfolio ManagementRajesh SinghNo ratings yet

- Smude Mba Semester 3 Spring 2015 assignmentsMF0011Document1 pageSmude Mba Semester 3 Spring 2015 assignmentsMF0011Rajesh SinghNo ratings yet

- Smude Mba Semester 3 Spring 2015 Assignments MF0013Document2 pagesSmude Mba Semester 3 Spring 2015 Assignments MF0013Rajesh SinghNo ratings yet

- Smude Mba Semester 3 Spring 2015 Assignments MF0012Document3 pagesSmude Mba Semester 3 Spring 2015 Assignments MF0012Rajesh SinghNo ratings yet

- Smude Mba Semester 3 Mb0050Document2 pagesSmude Mba Semester 3 Mb0050Rajesh SinghNo ratings yet

- Get Answers of Following Questions HereDocument2 pagesGet Answers of Following Questions HereRajesh SinghNo ratings yet

- Smude Mba Project ReportsDocument8 pagesSmude Mba Project ReportsRajesh SinghNo ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- Get Answers of Following Questions Here: MB0043 - Human Resource ManagementDocument2 pagesGet Answers of Following Questions Here: MB0043 - Human Resource ManagementRajesh SinghNo ratings yet

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDocument3 pagesMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereRajesh SinghNo ratings yet

- Get Answers of Following Questions Here: MB0043 - Human Resource ManagementDocument2 pagesGet Answers of Following Questions Here: MB0043 - Human Resource ManagementRajesh SinghNo ratings yet

- Get Answers of Following Questions HereDocument2 pagesGet Answers of Following Questions HereRajesh SinghNo ratings yet

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocument3 pagesGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghNo ratings yet

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDocument2 pagesMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereRajesh SinghNo ratings yet

- MB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereDocument2 pagesMB0038 - Management Process and Organizational Behaviour: Get Answers of Following Questions HereRajesh SinghNo ratings yet

- MB0050Document2 pagesMB0050Rajesh SinghNo ratings yet

- MBA Semester 1 Assignments With AnswerDocument8 pagesMBA Semester 1 Assignments With AnswerRajesh SinghNo ratings yet

- MB0051Document2 pagesMB0051Rajesh SinghNo ratings yet

- WEG Low Voltage Motor Control Center ccm03 50044030 Brochure English PDFDocument12 pagesWEG Low Voltage Motor Control Center ccm03 50044030 Brochure English PDFRitaban222No ratings yet

- Robert K Boscarato and Matthew Skaggs Corprate Credit Book Draft 1.Document70 pagesRobert K Boscarato and Matthew Skaggs Corprate Credit Book Draft 1.Robert BoscaratoNo ratings yet

- Jun 2005 - AnsDocument13 pagesJun 2005 - AnsHubbak Khan100% (1)

- Vernacular Terms in Philippine ConstructionDocument3 pagesVernacular Terms in Philippine ConstructionFelix Albit Ogabang IiiNo ratings yet

- Mordaunt Short ms907w User ManualDocument12 pagesMordaunt Short ms907w User ManualiksspotNo ratings yet

- Sajid Bhuiya CVDocument3 pagesSajid Bhuiya CVapi-612088476No ratings yet

- The 9 Building Blocks of Business ModelsDocument3 pagesThe 9 Building Blocks of Business ModelsTobeFrankNo ratings yet

- African in The Modern WorldDocument18 pagesAfrican in The Modern WorldSally AnkomaahNo ratings yet

- Report-Teaching English Ministery of EduDocument21 pagesReport-Teaching English Ministery of EduSohrab KhanNo ratings yet

- Educ 580 - Edpuzzle PD HandoutDocument3 pagesEduc 580 - Edpuzzle PD Handoutapi-548868233No ratings yet

- Piano: Grade 2: PiecesDocument4 pagesPiano: Grade 2: PiecesnolozeNo ratings yet

- Microbiology - Prokaryotic Cell Biology: Bacterial Surface Structures Bacterial Cell Wall StructureDocument5 pagesMicrobiology - Prokaryotic Cell Biology: Bacterial Surface Structures Bacterial Cell Wall StructureDani AnyikaNo ratings yet

- Burkert General Catalogue Rev2Document44 pagesBurkert General Catalogue Rev2cuongNo ratings yet

- Cardiopulmonary Physiotherapy in Trauma An Evidence-Based ApproachDocument3 pagesCardiopulmonary Physiotherapy in Trauma An Evidence-Based ApproachGme RpNo ratings yet

- PariharaDocument2 pagesPariharahrvNo ratings yet

- Self-test on the COSO ERM frameworkDocument6 pagesSelf-test on the COSO ERM frameworkLady BirdNo ratings yet

- WEEK 7 ICPS - and - ICSSDocument31 pagesWEEK 7 ICPS - and - ICSScikguhafidzuddinNo ratings yet

- Hatsun Supplier Registration RequestDocument4 pagesHatsun Supplier Registration Requestsan dipNo ratings yet

- Bismillah Skripsi Herlina Rozaaaa-1Document57 pagesBismillah Skripsi Herlina Rozaaaa-1Saidi NetNo ratings yet

- List of Blade MaterialsDocument19 pagesList of Blade MaterialsAnie Ummu Alif & SyifaNo ratings yet

- CPA Review Module on Accounting Standards and RegulationDocument13 pagesCPA Review Module on Accounting Standards and RegulationLuiNo ratings yet

- About WELDA Anchor PlateDocument1 pageAbout WELDA Anchor PlateFircijevi KurajberiNo ratings yet

- K&J Quotation For Geotechnical - OLEODocument4 pagesK&J Quotation For Geotechnical - OLEORamakrishnaNo ratings yet

- Metal Expansion Joint 2020 v2 20MBDocument116 pagesMetal Expansion Joint 2020 v2 20MBanni trejoNo ratings yet

- 6 Thinking Hats Detailed Model - UpdatedDocument32 pages6 Thinking Hats Detailed Model - Updatedgeetanshi mittalNo ratings yet

- Filed & Entered: SBN 143271 SBN 165797 SBN 259014Document8 pagesFiled & Entered: SBN 143271 SBN 165797 SBN 259014Chapter 11 DocketsNo ratings yet

- Inv 069 1701757527Document1 pageInv 069 1701757527neetu9414576916No ratings yet

- Roof Beam Layout - r1Document1 pageRoof Beam Layout - r1Niraj ShindeNo ratings yet

- Arpèges de Trois Notes: Arpeggios in TripletsDocument3 pagesArpèges de Trois Notes: Arpeggios in TripletspanapapakNo ratings yet

- Labcir - Marwa - FinalDocument119 pagesLabcir - Marwa - FinalMashavia AhmadNo ratings yet