Professional Documents

Culture Documents

Corporate Governance in The Area of Finance - ECIL

Uploaded by

saiyuvatechOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Governance in The Area of Finance - ECIL

Uploaded by

saiyuvatechCopyright:

Available Formats

1

CHAPTER I

INTRODUCTION

1.1 INTRODUCTION OF THE STUDY

Corporate governance is the set of processes, customs, policies, laws, and

institutions affecting the way a corporation (or company) is directed, administered or

controlled. Corporate governance also includes the relationships among the many

stakeholders involved and the goals for which the corporation is governed. In simpler

terms it means the extent to which companies are run in an open & honest manner.

Corporate governance has three key constituents namely: the Shareholders, the Board

of Directors & the Management. Other stakeholders include employees, customers,

creditors, suppliers, regulators, and the community at large.

DEFINITION:

The manner in which the stakeholders in a corporation relate to one another.

Corporate governance has a positive connotation and a company with "good" corporate

governance is said to be a company in which all stakeholders relate to each other in a

positive way. Good corporate governance is considered an important quality of

sustainable growth for a company; that is, if the shareholders, management, and

employees all fulfill their fiduciary responsibilities to one another, the corporation is

thought to have a greater likelihood of success. Corporate governance is laid out in the

corporation's charter and other applicable documents.

The frame work of rules and practices by which a board of directors ensures

accountability, fairness, and transparency in a company's relationship with its all

stakeholders (financiers, customers, management, employees, government, and the

community). The corporate governance framework consists of (1) explicit and implicit

contracts between the company and the stakeholders for distribution of responsibilities,

rights, and rewards, (2) procedures for reconciling the sometimes conflicting interests of

stakeholders in accordance with their duties, privileges, and roles, and (3) procedures for

proper supervision, control, and information-flows to serve as a system of checks-and-

balances.

2

The concept of corporate governance identifies their roles & responsibilities as well

as their rights in the context of the company. It emphasizes accountability, transparency

& fairness in the management of a company by its Board, so as to achieve sustained

prosperity for all the stakeholders. Corporate governance is a synonym for sound

management, transparency & disclosure. Transparency refers to creation of an

environment whereby decisions & actions of the corporate are made visible, accessible &

understandable.

In the light of originating competition and liberation Corporate Governance has

assumed significance in the public sector undertaking (PSUS)

The various groups in the ECIL Company are as follows.

Workers union

Officers Association

Other agency including Government representatives

Need for Transparency is invested in public sector undertaking

Tax payers money is invested in public sector undertaking

It is also to be noted that accounts are placed in parliament through the parent department

of Atomic Energy for discussion.

In the light of above, it is felt that the project on Corporate Government can be

appropriately under taken for ECIL.

1.2 OBJECTIVES OF THE STUDY

To study the Corporate Governance practices at ECIL.

To analyze the impact of Corporate Governance at ECIL.

To identify the various problems of Corporate Governance.

To draw proper conclusion from the project study.

To make suggestion for improvements.

3

1.3 SCOPE OF THE STUDY

A study of Corporate Governance involves the process and structure used to direct and

manage the business and affairs of the business enterprise with the objective of enhancing

long term value for the shareholders and the financial viability of the business.

The scope of the study is confined to the Corporate Governance practices in ECIL for

3years and encompasses analysis followed by conclusions and suggestions.

1.4 RESEARCH METHODOLOGY

Data relating to ECIL has been collected through.

Primary sources:

Detailed discussions with Mr.J.S.Anand, (G.M-FAG, Finance and Accounts ECIL,

Hyderabad).

Discussions with Finance manager and the other members of the Finance department at

ECIL.

Secondary sources:

Data is collected from the Published Annual reports of the ECIL Company.

It is collected through the internet (web), and newspapers.

Sample size-3 years data.

1.5 LIMITATIONS OF THE STUDY

Employees had not responded in time due to heavy work

Division-wise practices are not covered due to limited time of the study.

Time limit to do in depth study.

Since ECIL is public sector unit, confidentiality maintained to certain issues which may

not cover under project work.

4

CHAPTER II

LITERATURE REVIEW

2.1 OVERVIEW OF CORPORATE GOVERNANCE

INTRODUCTION:

Corporate governance refers to the set of systems, principles and processes by

which a company is governed. They provide the guidelines as to how the company can be

directed or controlled such that it can fulfill its goals and objectives in a manner that adds

to the value of the company and is also beneficial for all stakeholders in the long term.

Stakeholders in this case would include everyone ranging from the board of directors,

management, shareholders to customers, employees and society. The management of the

company hence assumes the role of a trustee for all the others.

Corporate governance is a process, not a state.The field is continually evolving, as

the review explains. Its initial focus was on the way in which individual corporations are

directed and controlled. This led to the introduction of national codes of best practice. As

the wider economic and social significance of corporate governance became apparent,

international guidelines were published to advance its cause more broadly. These

guidelines reflected the part which good governance can play in promoting economic

growth and business integrity. The way ahead lies in ensuring that the fruits of good

governance, its ability to add value, are widely and wisely shared, thus playing a positive

part in the goal of the developed and developing world to alleviate poverty.

Definition of Corporate Governance

Corporate Governance is the relationship between corporate managers, directors

and the providers of equity, people and institutions who save and invest their capital to

earn a return .It ensures that the Board of Directors is accountable for the pursuit of

corporate objectives and that the corporation itself conforms to the law and regulations.

The frame work of rules and practices by which a board of directors ensures

accountability, fairness, and transparency in a company's relationship with its all

5

stakeholders (financiers, customers, management, employees, government, and the

community).The corporate governance framework consists of (1) explicit and implicit

contracts between the company and the stakeholders for distribution of responsibilities,

rights, and rewards, (2) procedures for reconciling the sometimes conflicting interests of

stakeholders in accordance with their duties, privileges, and roles, and (3) procedures for

proper supervision, control, and information-flows to serve as a system of checks-and-

balances.

Corporate Governance is the relationship among various participants in determining

the direction and performance of corporations. The primary participants are:

shareholders; company management; and the Board of Directors.

Why do we need corporate governance

With increased global competitiveness, the growing market in Bahrain is faced

with the challenge of attracting and retaining investment in order to participate more fully

in the global economy and address mounting demographic concerns. Increasing

awareness and implementation of good corporate governance practices can improve the

investment climate and promote the development of a vibrant private sector and capital

market.

2.2 Objectives

The Core Objective of Corporate Governance can be defined as under:

Strategic Focus

Predictability

Transparency

Participation

Accountability

Efficiency & Effectiveness

Stakeholder Satisfaction.

The Strategy Focus defines the direction the organization should take to meet its

goals and to ensure Stakeholder satisfaction.

6

The Strategic focus should be based on predictability as the evolution of strategies

has to consider the dynamic environment within which it has to operate and hence the

challenges from the environment need to be anticipated.

A well-designed process to evolve and deploy strategy has to have Transparency for

all stakeholders so that there is a commitment and an understanding of the result expected

from the operations.

For proper execution of any processes aimed at achieving the desired end result,

Participation of all stakeholder is important and actually necessary.

The participation should have a clear goal of Efficiency and Effectiveness of the

organization as a whole and this where Accountability is the key.

All stakeholders have to have a clear understanding of their accountability for the

most effective operations of any Organization.

Importance

Fundamentally, there is a level of confidence that is associated with a company

that is known to have good corporate governance. The presence of an active group of

independent directors on the board contributes a great deal towards ensuring confidence

in the market. Corporate governance is known to be one of the criteria that foreign

institutional investors are increasingly depending on when deciding on which companies

to invest in. It is also known to have a positive influence on the share price of the

company. Having a clean image on the corporate governance front could also make it

easier for companies to source capital at more reasonable costs. Unfortunately, corporate

governance often becomes the centre of discussion only after the exposure of a large

scam.

Impact of Corporate Governance

The positive effect of good corporate governance on different stakeholders

ultimately is a strengthened economy, and hence good corporate governance is a tool for

socio-economic development.

Parties to corporate governance

The most influential parties involved in corporate governance include government

agencies and authorities, stock exchanges, management (including the board of directors

and its chair, the Chief Executive Officer or the equivalent, other executives and line

7

management, shareholders and auditors). Other influential stakeholders may include

lenders, suppliers, employees, creditors, customers and the community at large.

The agency view of the corporation posits that the shareholder forgoes decision

rights (control) and entrusts the manager to act in the shareholders' best (joint) interests.

Partly as a result of this separation between the two investors and managers, corporate

governance mechanisms include a system of controls intended to help align managers'

incentives with those of shareholders. Agency concerns (risk) are necessarily lower for a

controlling shareholder.

A board of directors is expected to play a key role in corporate governance. The

board has the responsibility of endorsing the organization's strategy, developing

directional policy, appointing, supervising and remunerating senior executives, and

ensuring accountability of the organization to its investors and authorities.

All parties to corporate governance have an interest, whether direct or indirect, in

the financial performance of the corporation. Directors, workers and management receive

salaries, benefits and reputation, while investors expect to receive financial returns. For

lenders, it is specified interest payments, while returns to equity investors arise from

dividend distributions or capital gains on their stock. Customers are concerned with the

certainty of the provision of goods and services of an appropriate quality; suppliers are

concerned with compensation for their goods or services, and possible continued trading

relationships. These parties provide value to the corporation in the form of financial,

physical, human and other forms of capital. Many parties may also be concerned with

corporate social performance.

2.3 Principles:

Key elements of good corporate governance principles include honesty, trust and

integrity, openness, performance orientation, responsibility and accountability, mutual

respect, and commitment to the organization.

Commonly accepted principles of corporate governance include:

Rights and equitable treatment of shareholders :

Organizations should respect the rights of shareholders and help shareholders to

exercise those rights. They can help shareholders exercise their rights by openly and

8

effectively communicating information and by encouraging shareholders to participate in

general meetings.

Interests of other stakeholders :

Organizations should recognize that they have legal, contractual, social, and market

driven obligations to non-shareholder stakeholders, including employees, investors,

creditors, suppliers, local communities, customers, and policy makers.

Role and responsibilities of the board :

The board needs sufficient relevant skills and understanding to review and challenge

management performance. It also needs adequate size and appropriate levels of

independence and commitment

Integrity and ethical behavior :

Integrity should be a fundamental requirement in choosing corporate officers and

board members. Organizations should develop a code of conduct for their directors and

executives that promotes ethical and responsible decision making.

Disclosure and transparency :

Organizations should clarify and make publicly known the roles and responsibilities of

board and management to provide stakeholders with a level of accountability. They

should also implement procedures to independently verify and safeguard the integrity of

the company's financial reporting. Disclosure of material matters concerning the

organization should be timely and balanced to ensure that all investors have access to

clear, factual information

Issues involving corporate governance principles include:

Internal controls and the independence of the entity's auditors

Oversight and management of risk

Oversight of the preparation of the entity's financial statements

Review of the compensation arrangements for the chief executive

Officer and other senior executives

There sources made available to directors in carrying out their duties

The way in which individuals are nominated for positions on the board

Dividend policy

9

"Corporate Governance" despite some feeble attempts from various quarters has

remained ambiguous and often misunderstood phrase. For quite some time it was

confined to only corporate management. It is not so. It is something much broader for it

must include a fair, efficient and transparent administration to meet certain well defined

objectives. Corporate governance also must go beyond law. The quantity, quality and

frequency of financial and managerial disclosure, the degree and extent to which the

board of Director (BOD) exercise their trustee responsibilities and the commitment to run

transparent organization- these should evolve due to interplay of many factors and the

role played by more progressive elements within the corporate sector. In India, a strident

demand for evolving a code of good practices by the corporate themselves is emerging.

2.4 Mechanisms and controls:

Corporate governance mechanisms and controls are designed to reduce the

inefficiencies that arise from moral hazard and adverse selection. There are both internal

monitoring systems and external monitoring systems.Internal monitoring can be done, for

example, by one (or a few) large shareholder(s) in the case of privately held companies or

a firm belonging to a business group. Furthermore, the various board mechanisms

provide for internal monitoring. External monitoring of managers' behaviour occurs when

an independent third party (e.g. the external auditor) attests the accuracy of information

provided by management to investors. Stock analysts and debt holders may also conduct

such external monitoring. An ideal monitoring and control system should regulate both

motivation and ability, while providing incentive alignment toward corporate goals and

objectives.

Internal corporate governance controls:

Internal corporate governance controls monitor activities and then take corrective

action to accomplish organizational goals. Examples include:

Monitoring by the board of directors: The board of directors, with its legal authority

to hire, fire and compensate top management, safeguards invested capital. Regular board

meetings allow potential problems to be identified, discussed and avoided. Whilst non-

executive directors are thought to be more independent, they may not always result in

more effective corporate governance and may not increase performance. Different board

10

structures are optimal for different firms. Moreover, the ability of the board to monitor

the firm's executives is a function of its access to information. Executive directors

possess superior knowledge of the decision-making process and therefore evaluate top

management on the basis of the quality of its decisions that lead to financial performance

outcomes, ex ante. It could be argued, therefore, that executive directors look beyond the

financial criteria.

Internal control procedures and internal auditors: Internal control procedures are

policies implemented by an entity's board of directors, audit committee, management,

and other personnel to provide reasonable assurance of the entity achieving its objectives

related to reliable financial reporting, operating efficiency, and compliance with laws and

regulations. Internal auditors are personnel within an organization who test the design

and implementation of the entity's internal control procedures and the reliability of its

financial reporting.

Balance of power: The simplest balance of power is very common; require that the

President be a different person from the Treasurer. This application of separation of

power is further developed in companies where separate divisions check and balance

each other's actions. One group may propose company-wide administrative changes,

another group review and can veto the changes, and a third group check that the interests

of people (customers, shareholders, employees) outside the three groups are being met.

Remuneration: Performance-based remuneration is designed to relate some proportion

of salary to individual performance. It may be in the form of cash or non-cash payments

such as shares and share options, superannuation or other benefits. Such incentive

schemes, however, are reactive in the sense that they provide no mechanism for

preventing mistakes or opportunistic behavior, and can elicit myopic behavior.

External corporate governance controls :

External corporate governance controls encompass the controls external

stakeholders exercise over the organization.

Examples include:

Competition

Debt covenants

11

Demand for and assessment of performance information (especially financial

statements)

Government regulations

Managerial labour market

Media pressure

Takeovers

Role of the accountant

Financial reporting is a crucial element necessary for the corporate governance

system to function effectively. Accountants and auditors are the primary providers of

information to capital market participants. The directors of the company should be

entitled to expect that management prepare the financial information in compliance with

statutory and ethical obligations, and rely on auditors' competence.

Current accounting practice allows a degree of choice of method in determining

the method of measurement, criteria for recognition, and even the definition of the

accounting entity. The exercise of this choice to improve apparent performance

(popularly known as creative accounting) imposes extra information costs on users. In the

extreme, it can involve non-disclosure of information.

One area of concern is whether the accounting firm acts as both the independent

auditor and management consultant to the firm they are auditing. This may result in a

conflict of interest which places the integrity of financial reports in doubt due to client

pressure to appease management. The power of the corporate client to initiate and

terminate management consulting services and, more fundamentally, to select and

dismiss accounting firms contradicts the concept of an independent auditor. Changes

enacted in the United States in the form of the Sarbanes-Oxley Act (in response to the

Enron situation as noted below) prohibit accounting firms from providing both auditing

and management consulting services. Similar provisions are in place under clause 49

of SEBI Act in India.

The Enron collapse is an example of misleading financial reporting. Enron

concealed huge losses by creating illusions that a third party was contractually obliged to

pay the amount of any losses. However, the third party was an entity in which Enron had

12

a substantial economic stake. In discussions of accounting practices with Arthur

Andersen, the partner in charge of auditing, views inevitably led to the client prevailing.

However, good financial reporting is not a sufficient condition for the

effectiveness of corporate governance if users don't process it, or if the informed user is

unable to exercise a monitoring role due to high costs.

Corporate governance models around the world

Although the US model of corporate governance is the most notorious, there is a

considerable variation in corporate governance models around the world. The intricated

shareholding structures of keiretsus in Japan, the heavy presence of banks in the equity of

German firms, the chaebols in South Korea and many others are examples of

arrangements which try to respond to the same corporate governance challenges as in the

US.

The World Business Council for Sustainable Development WBCSD has done

work on corporate governance, particularly on accountability and reporting, and in 2004

created an Issue Management Tool: Strategic challenges for business in the use of

corporate responsibility codes, standards, and frameworks. This document aims to

provide general information, a "snap-shot" of the landscape and a perspective from a

think-tank/professional association on a few key codes, standards and frameworks

relevant to the sustainability agenda.

Codes and guidelines

Corporate governance principles and codes have been developed in different

countries and issued from stock exchanges, corporations, institutional investors, or

associations (institutes) of directors and managers with the support of governments and

international organizations. As a rule, compliance with these governance

recommendations is not mandated by law, although the codes linked to stock exchange

listing requirements may have a coercive effect.

For example, companies quoted on the London, Toronto and Australian Stock

Exchanges formally need not follow the recommendations of their respective codes.

However, they must disclose whether they follow the recommendations in those

documents and, where not, they should provide explanations concerning divergent

13

practices. Such disclosure requirements exert a significant pressure on listed companies

for compliance.

One of the most influential guidelines has been the OECD Principles of Corporate

Governance published in 1999 and revised in 2004. The OECD guidelines are often

referenced by countries developing local codes or guidelines. Building on the work of the

OECD, other international organizations, private sector associations and more than 20

national corporate governance codes formed the United Nations Intergovernmental

Working Group of Experts on International Standards of Accounting and Reporting

(ISAR) to produce their Guidance on Good Practices in Corporate Governance

Disclosure.[32] This internationally agreed[33] benchmark consists of more than fifty

distinct disclosure items across five broad categories.

Auditing

Board and management structure and process

Corporate responsibility and compliance

Financial transparency and information disclosure

Ownership structure and exercise of control rights

The World Business Council for Sustainable Development (WBCSD) has done

work on corporate governance, particularly on accountability and reporting, and in 2004

released Issue Management Tool: Strategic challenges for business in the use of corporate

responsibility codes, standards, and frameworks. This document offers general

information and a perspective from a business association/think-tank on a few key codes,

standards and frameworks relevant to the sustainability agenda.

Corporate governance and firm performance

In its 'Global Investor Opinion Survey' of over 200 institutional investors first

undertaken in 2000 and updated in 2002, McKinsey found that 80% of the respondents

would pay a premium for well-governed companies. They defined a well-governed

company as one that had mostly out-side directors, who had no management ties,

undertook formal evaluation of its directors, and was responsive to investors' requests for

information on governance issues. The size of the premium varied by market, from 11%

14

for Canadian companies to around 40% for companies where the regulatory backdrop

was least certain (those Morocco, Egypt and Russia).

Other studies have linked broad perceptions of the quality of companies to

superior share price performance. In a study of five year cumulative returns of Fortune

Magazine's survey of 'most admired firms', Antunovich et al found that those "most

admired" had an average return of 125%, whilst the 'least admired' firms returned 80%. In

a separate study Business Week enlisted institutional investors and 'experts' to assist in

differentiating between boards with good and bad governance and found that companies

with the highest rankings had the highest financial returns.

On the other hand, research into the relationship between specific corporate

governance controls and firm performance has been mixed and often weak.

Board composition

Some researchers have found support for the relationship between frequency of

meetings and profitability. Others have found a negative relationship between the

proportion of external directors and firm performance, while others found no relationship

between external board membership and performance. In a recent paper Bagahat and

Black found that companies with more independent boards do not perform better than

other companies. It is unlikely that board composition has a direct impact on firm

performance.

SEBI committee on Corporate Governance

Report of SEBI committee on Corporate Governance defines corporate

governance as the acceptance by management of the inalienable rights of shareholders as

the true owners of the corporation and of their own role as trustees on behalf of the

shareholders. It is about commitment to values, about ethical business conduct and about

making a distinction between personal & corporate funds in the management of a

company.

Issues involving corporate governance principles include:

Internal controls and internal auditors.

The independence of the entity's external auditors and the quality of their audits.

Oversight of the preparation of the entity's financial statements.

15

Review of the compensation arrangements for the chief executive officer and other senior

executives. arch

To analyze corporate governance practice of BSE-30 companies for last five years with

reference of mandatory disclosure described by SEBI for Indian companies.

To find out importance of corporate governance in Indian companies from the view point

of the Company Secretary.

To find out the awareness of functioning of Corporate Governance amongst investors

who are fundamental analyst. To evaluate the importance of corporate governance as a

parameter for investor before investing.

2.5 There are four broad theories to explain and elucidate corporate governance.

These are:

Agency theory

Stewardship theory

Stakeholder theory

Sociological theory

Agency theory:

Recent thinking about strategic management and business policy has been

influenced by agency cost theory, though the roots of the theory can be traced back to

Adam Smith who identified an agency problem in the joint stock company. The

fundamental theoretical basis of corporate governance is agency costs. Shareholders are

the owners of any joint stock, limited liability Company, and are the principals of the

same. By virtue of their ownership, the principals define the objectives of the company.

The management, directly or indirectly selected by the shareholders to pursue such

objectives, are the agents. While the principals generally assume that the agents would

invariably carry out their objectives, it is often not so. In many instances, the objectives

of managers are at variance from those of the shareholders. Such mismatch of objectives

is called the agency problem; the cost inflicted by such dissonance is the agency cost. The

core of corporate governance is designing and putting in place disclosures, monitoring,

16

oversight and corrective systems that can align the objectives of the two sets of players as

closely as possible and hence minimize agency costs.

Stewardship theory:

The stewardship theory of corporate governance discounts the possible conflicts

between corporate management and owners and shows a preference for board of directors

made u primarily of corporate insiders. This theory assumes that managers are basically

trustworthy and attach significant value to their own personal reputations. The market for

managers with strong personal reputations serves as the primary mechanism to control

behavior, with more reputable managers being offered higher compensation packages.

Stakeholder theory:

The stakeholder theory is grounded in many normative, theoretical perspectives

including ethics of care, the ethics of fiduciary relationships, social contract theory,

theory of property rights, and so on. While it is possible to develop stakeholder analysis

from a variety of theoretical perspectives, in practice much of stakeholder analysis does

not firmly or explicitly root itself in a given theoretical tradition, but rather operates at the

level of individual principles and norms for which it provides little formal justification.

Stakeholder theory is often criticized, mainly because it is not applicable in practice by

corporations.

Sociological theory:

The sociological approach has focused mostly on board composition and

implications for power and wealth distribution in the society. Under this theory, board

composition, financial reporting, and disclosure and auditing are of utmost importance to

realize the socio-economic objectives of corporations.el

This is also known as unitary board model, in which all directors participate in a

single board comprising both executive and non-executive directors in varying

proportions. This approach to governance tends to be shareholder oriented. It is also

called the 'Anglo-Saxon' approach to corporate governance being the basis of corporate

17

governance in America, Britain, Canada, Australia and other Commonwealth law

countries including India.

The major features of this model are as follows:

The ownership of companies is more or less equally divided between individual

shareholders and institutional shareholders.

Directors are rarely independent of management.

Companies are typically run by professional managers who have negligible ownership

stake. There is a fairly clear separation of ownership and management.

A CASE STUDY ON INFOSYS

The case, 'Corporate Governance at Infosys talks about the corporate governance

practices at Infosys, one of India's largest software companies. Till late 1990s, corporate

governance did not have much significance in India. In 1999, two committees

(Confederation of Indian Industries, CII and the Kumar Mangalam Birla Committee)

were set up to recommend good governance norms. These committees came out with

several recommendations, which were made mandatory for the companies to adhere to by

2001. Infosys was one of the first companies in India which had complied with the

recommendations made by the committees. The case discusses in detail, the corporate

governance practices at Infosys, which complied with most of the recommendations

made by the committees.

By the late 1990s, Infosys Technologies Limited (Infosys)

1

had clearly emerged one

of the best managed companies in India. Its corporate governance practices seemed to be

better than those of many other companies in India.

Because of its good governance practices, Infosys was the recipient of many awards.

In 2001, Infosys was rated India's most respected company by Business World

2

. Infosys

was also ranked second in corporate governance among 495 emerging companies in a

survey conducted by Credit Lyonnais Securities Asia (CLSA) Emerging Markets. It was

voted India's best managed company five years in a row (1996-2000) by the Asiamoney

poll.

18

Code of Corporate Governance

In the late 1990s, the Confederation of Indian Industries (CII) published a code of

corporate governance (Refer Exhibit II for the highlights of the report). In 1999, the

Securities and Exchange Board of India (SEBI) appointed a committee under the

Chairmanship of Kumar Mangalam Birla

5

to recommend a code of corporate governance.

Corporate Governance-The Infosys Way

Infosys had accepted the recommendation of both the CII and the Kumar Mangalam

Birla Committee. This section provides an overview of corporate governance practices

followed by Infosys.

Infosys had an executive chairman and chief executive officer (CEO) and a managing

director, president and chief operating officer (COO). The CEO was responsible for

corporate strategy, brand equity, planning, external contacts, acquisitions, and board

matters. The COO was responsible for all day-to-day operational issues and achievement

of the annual targets in client satisfaction, sales, profits, quality, productivity, employee

empowerment and employee retention.

The CEO,COO, executive directors and the senior management made periodic

presentations to the board on their targets, responsibilities and performance.

Infosys-A Benchmark for Corporate Governance:

Some analysts felt that Infosys corporate governance practices offered many

lessons to corporate India. Infosys had shown that increasing shareholder wealth and

safeguarding the interests of other stakeholders was not incompatible. Infosys had given

its non-executive directors the mandate to pass judgement on the efficacy of its business

plans. Every non-executive director not only played an active role in decision making,

but also led or served on at least one of the three (Nomination, Compensation and Audit)

committees.

19

CHAPTER III

COMPANY PROFILE

3.1 INTRODUCTION

Electronics Corporation of India Limited (ECIL) is a wholly owned Government

of India enterprise under the Department of Atomic Energy. Established in 1967

primarily to meet the control and instrumentation requirements of Indias nuclear power

program, ECIL has played a pioneering role in spurring the growth of indigenous

electronics industry in the country. Spanning from miniature components to mammoth

systems and encompassing control, communication and computer technologies, ECIL,

today is a multi-product, multi-technology organization providing cutting-edge

technology solutions in the strategic areas of Atomic Energy, Defence, Aerospace,

Integrated Security and IT & e-Governance.

HISTORY:

Ayyagari Sambasiva Rao, the founder Managing Director of the Electronics

Corporation of India Limited (ECIL), died on Friday night at Nims after a prolonged

illness, family sources said. He was 89.He is survived by his wife, four sons and three

daughters. Rao, born in Mogallu in West Godavari district in 1914, obtained his

engineering degree from Stanford University in 1947 and joined the Department of

Atomic Energy as a nuclear physic is to work with the likes of HomiJBhabha. He was the

director of radiation health protection and electronics groups at Bhabha Atomic Research

Centre (Barc) and later played a key role in setting up ECIL in the city in 1967 when the

DAE decided to go commercial in its electronics research.

Performance in 2011-12:

During the year, the company posted a turnover of Rs. 1474 Crores which is 14%

higher than the turnover of the previous year. The major contribution of 48% came from

the e-Governance sector, 35% from the Defence sector, 12% from the nuclear sector and

balance 5% from supplies to other sectors in the Government domain. The company has

earned a Profit Before Tax of Rs. 55 Crores as compared to Rs.22 Crores during the

previous year.

20

The order book stood at Rs.2425 Crores at the beginning of 2012-13 as compared to

Rs.1150 Crores at the beginning of 2011-12.

Welfare Activities:

The employees were provided all benefits and facilities under the provisions of

Social Welfare and Industrial Acts. Some of the statutory measures were also extended to

the Contract Labour. The children of 30 workmen received merit scholarships under AP

Labour Welfare Fund 1987. Under the Workers.

Education Programme, 5 women workers were sponsored for Trainers Training

Course. 5 male workers were also sponsored to Worker Teachers programme under the

same scheme. Various social security insurance schemes were extended to the

employees viz., Janata Insurance Policy, Group Personal Accident Policy for the

employees proceeding on official tours. Under Group Savings Linked Insurance cum

Retirement Benefit Scheme, 23 employees who expired while in service were provided

with insurance amount of Rs. 1.00 lakh each and an additional payment of Rs.10,000/-

per employee from management side. As per the scheme of promoting small family

norms, 21 employees who have undergone Tubectomy/ Vasectomy operations were

given one increment as personal pay.

Research and Development:

In addition to in-house R&D activities, ECIL adopts the basic designs developed by

Bhabha Atomic Research Centre and Nuclear Power Corporation of India Limited and

engineers them into products and systems for industrial use. Recently, the company

signed a Strategic MoU with IGCAR (Indira Gandhi Centre for Atomic Research) to

meet the C&I requirements for Fast Reactors, Fuel Cycle Projects etc. and also for High

Performance Computer Systems and Security. Technology Planning, Identification of

Projects/Projects/Solutions, Funding and Project Monitoring happen through Technology

Development Council (TDC), an institutional mechanism to promote actionable R&D

and timely product ionization to support the ambitious programmes and expansion plans

of the Department of Atomic Energy.

21

Research and Development holds the key to the future business and

competitiveness of the company. The management has devoted focused attention on

R&D activities which has resulted in a number of new products being introduced apart

from adding features to existing products.

3.2 Products and Services

ECIL supplied hard wired relay logic systems for older power generating plants

like those in Rajasthan and Tamilnadu. As newer technologies became available, ECIL

graduated to supply partly computerized systems for plants at Narora and Kakrapara.

ECIL provides Programmable Logic Controller and Computer based Control and

Information systems for the newer power generating units at Tarapur, Kaiga and

Rawatbhata, Rajasthan.

ECIL manufactures and supplies a wide range of equipment which include:

1. Control Room Panels

2. Operator Information Systems

3. Programmable Controllers

4. Operator Training Simulators

5. Dual Processor Hot Standby Systems (DPHS) and many more.

Products:

Present product range of ECIL includes:

Nuclear sector : Control and instrumentation products for nuclear power plants;

Integrated security systems for nuclear installations; Radiation monitoring instruments;

Secured network of all Department of Atomic Energy (India) units via satellite.

Defence Sector : Various types of fuses; V/UHF Radio communication equipment;

Electronics warfare systems and derivatives; Thermal batteries and special components

for missile projects; Precision servo components like gyros; Missile support control and

command systems; Training simulators; Stabilized antenna and tracking for Light

Combat Aircraft; Detection and pre-detonation of explosive devices; Jammers with

direction finding abilities.

22

Commercial Sector: Electronic voting machines; Wireless local loop (WLL) systems;

Antenna products; Electronic Energy Meters or Electricity Meter; X-Ray baggage

inspection system for airports; Computer hardware, software and services; Computer

education services.

Corporate Governance

The company continues to take several measures to enhance the openness and

transparency of all its operations.

Joint venture:

The Joint Venture, ECIL- Rapiscan Limited registered a total income of Rs.30.20

crore during 2005-06 by way of supply of Multi-energy X-Ray machines etc. to Indian

Airlines, Ship Building Centre, Police Department & Prison of various States, Tihar Jail,

Cochin International Airport, etc. JV have supplied computer hardware to ECIL for their

Maharashtra State Government E-governance Project worth about Rs.3.00 crore and

earned around Rs.10 crore from maintenance income during the year.

The total income has increased by 24% as compared to the previous year due to

receipt of good orders. Provisional profit before tax for the year is Rs.6 crore, the profit

before tax has gone up by Rs.1.00 crore, a growth of 20% over the previous year. The

income target set for the year 2006-07 is Rs.35 crore and the JV Company is confident of

achieving it considering the requirement of security products in the country due to threat

from terrorists and introduction of large cargo scanning machines.

Financials:

The company has a turnover of around 14 billion (US$254.8 million) and

overall profit of around 220 million (US$4 million) for the financial year 201011.

23

INDUSRY PROFILE

ECIL is a multi-product and multi-disciplinary organization providing key

technology inputs, system integration and system solutions in the areas of Information

Technology, Strategic Electronics, Communications, Control and Automation,

Instrumentation and Components

The Telecommunications Industry produces technologies and services that are used

to facilitate people's communication. Major products include cell phones, chipsets,

wireless and landline infrastructure equipment, digital subscriber-line (DSL) and cable

modems, and networking devices, such as routers and switches. The industry's customer

base is highly diversified, including multi-national corporations, telephone companies,

governments, universities, institutions, commercial businesses and consumers.

Competitive Landscape:

Competition among companies in this industry can be intense. Most products are

technologically advanced, entailing significant research and development. This, and the

need for great economy-of-scale and international distribution facilities, creates a high

barrier to entry.

Market Influences:

Telecom services companies still depend on landline business for cash flow.

When economic times are tough, customers tend to disconnect these lines and rely more

on wireless and broadband communications. Also, consumers will gravitate to the most

economical voice and Internet plans.

Financial Considerations:

The Telecom Equipment Industry is fairly cyclical, conforming to the multiyear

boom and bust swings of the economy. Typical network infrastructure contracts, though,

are long-term, thereby lending stability to operating results. The degree to which its

products are technically advanced determines an equipment maker's pricing power. Hi-

tech offerings allow for higher prices and improved cost absorption.

24

Electronics Industry Analysis:

The Electronics Industry in India took off around 1965 with an orientation

towards space and defence technologies. This was rigidly controlled and initiated by the

government. This was followed by developments in consumer electronics mainly with

transistor radios, Black & White TV, Calculators and other audio products.1985 saw the

advent of Computers and Telephone exchanges, which were succeeded by Digital

Exchanges in 1988.In1997 the ITA agreement, was signed at the WTO where India

committed it self to total elimination of all customs duties on IT hardware by 2005. In the

subsequent years, a number of companies turned sick and had to be closed down.

Current Scenario:

In recent years the electronic industry is growing at a brisk pace. It is currently

worth US$ 32Billion and according to industry estimates it has the potential to reach US$

150 billion by 2010. The electronic industry in India constitutes just 0.7 per cent of the

global electronic industry. Hence it is miniscule by international comparison. However

the demand in the Indian market is growing rapidly and investments are flowing in to

augment manufacturing capacity. The output of the Electronic Hardware Industry in India

is worth US$11.6 Billion at present.

Electronic Manufacturing Services:

India is well-known for its software prowess. But on the hardware front, the

progress is rather slow. However, the country has been making gains in this sector also.

Already, 50 Electronics Manufacturing Services (EMS)/Original Design Manufacturers

(ODMs) providers are operating in India, ranging from global players including

Flextronics and Solectron to indigenous firms including Deltron, TVS Electronics and

Sahasra. Indias contract-manufacturing business is expected to nearly triple in revenue

over the next five years, a development that will present both opportunities and potential

pitfalls for the worldwide electronics supply chain. Revenue generated by Electronics

Manufacturing Services (EMS) providers and Original Design Manufacturers (ODMs) in

India will expand to $2.03 billion in 2009, rising at a CAGR of 21per cent from $774

million in 2004. Indian EMS/ODM revenue grew by 20.8 per cent to reach $935 million

in 2005.

25

CHAPTER IV

DATA ANALYSIS AND INTETPRETATION

Corporate Governance practices at ECIL are reflected through the annual

directors comments and replies and accounting policies.

4.1 ANNUAL REPORT FOR THE YEAR 2009-2010

The company continues to take several measures to enhance the openness and

transparency of all its operations.

Board of Directors

In terms of Sec 617 of the Companies Act, 1956, ECIL is a Government

company. The entire paid up capital of the company is held by the President of India,

including the 3 shares held by his nominees.

The Board, as on date comprised of seven Directors - Chairman & Managing

Director, one Whole-time Director and five Non-Executive Directors. The Board meets at

regular intervals and is responsible for the proper direction and management of the

Company.

During the financial year, six Board Meetings were held on 21.04.2009,

28.05.2009, 04.07.2009, 18.09.2009, 14.12.2009, and 02.03.2010. The composition of the

Directors, their attendance at the Board Meetings during the financial year and at the last

Annual General Meeting , etc.,

The remuneration

The remuneration of whole-time Directors is fixed by the Government of India.

Dr M J Zarabi is an Independent Director and is paid Rs 3,000 as sitting fee per

attendance. All other Part-time Directors on Board are officials from Government / other

PSUs and therefore, are not paid any sitting fees for the meetings attended.

Audit Committee

The Audit Committee comprises of Shri Umesh Chandra, Shri V R Sadasivam

and Shri Y S Mayya, Director (T) (up to 30.4.2009). Shri J K Ghai, Director (Finance),

26

NPCIL is a special invitee for all the meetings. Shri Umesh Chandra is the Chairman of

the Committee. During the year, five meetings were held on 21.04.09, 03.07.09,

18.09.09, 30.12.09 and 02.03.10. The Audit Committee reviewed the implementation of

Accounting Standards and Audit Programmes and Internal Audit Reports. The

Committee perused the Annual Financial Statements and interacted with the Statutory

Auditors for improvement in the system for maintaining financial records as well as the

data under Cost Accounting Record Rules.

Corporate Management Committee

The Corporate Management Committee is a high level policy making body at the

Corporate level which is headed by the Chairman & Managing Director. The Committee

consists of all Functional Directors, Executive Directors, General Managers and Heads of

Divisions. The Committee meets regularly and deliberates upon the major policy issues

including performance of the Company. The President and General Secretary of ECEU

and President and Secretary of ECOA are the special invitees.

General Body Meetings

The details of the last three Annual General Meetings of the Company are given

below:

Year Date Time Venue

2006-07

2007-08

2008-09

26.9.2007

29.9.2008

18.9.2009

14.00 hrs

12.00 hrs

14.00 hrs

Registered ofce:

ECIL Post Ofce ,

Hyderabad

500062

The Company has obtained a Compliance Certificate from M/s K K Rao &

Associates Company Secretaries.

27

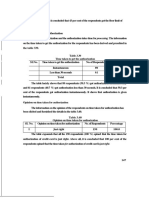

4.1.2 AUDITORS REPORTS AND COMPANY REPLIES ON ECIL

AUDITORS REPORT

COMPANYS REPLIES

To

The Members of

Electronics Corporation of India Limited

Hyderabad.

We have audited the attached Balance

Sheet of Electronics Corporation of India

Limited (ECIL), Hyderabad, as at 31st

March, 2010 and the related Profit & Loss

Account and the Cash Flow Statement for the

year ended on that date annexed thereto.

These financial statements are the

responsibility of the Companys

management. Our responsibility is to express

an opinion on these financial statements

based on our audit.

A) We conducted our audit in accordance

with the auditing standards generally

accepted in India. These standards require

that we plan and perform the audit to obtain

reasonable assurance about whether the

financial statements are free of material

misstatement. An audit includes examining,

on a test basis, evidence supporting the

amounts and disclosures in the financial

statements. An audit also includes assessing

the accounting principles used and significant

28

estimates made by the management, as well

as evaluating the overall financial statement

presentation. We believe that our audit

provides a reasonable basis for our opinion.

B) As required by the Companies (Auditors

Report) Order,2003 issued by the Central

Government of India in terms of Section

227(4A) of the Companies Act, 1956 and on

the basis of such checks as we considered

appropriate and according to the information

and explanations given to us, we annex hereto

a statement on the matters specified in

paragraphs 4 and 5 of the said order.

Further to our comments in the annexure

referred to in paragraph (B) above, attention

is invited to the following:

i) Note No: 2 in Schedule Q During the year

the company has changed Accounting Policy

on liquidated damages which has resulted in

increase of contingent liabilities by

Rs.1222.59 Lakhs and thereby increase in

Profit by the same amount.

ii) Note No: 9 In Schedule Q regarding

Recognition of Revenue on provisional basis

/ pending recommendation of the final price

by the Price Review Committee in respect of

Electronic Voting Machines at Rs.8670 per

unit for supplies.

iii) Note no.10 in Schedule Q regarding

reclassification of expenditure of Rs.2091.66

Lakhs from primary heads to functional heads

The Company has been receiving in

full the amount of revenue recognized.

R&D expenditure has been identified

and reclassified and the practice is

being followed consistently.

29

under in house R&D expenditure. We have

relied on the information given by the

management and accepted the same for the

disclosure purpose.

iv) Note No 15 (i) in Schedule Q regarding

Deposit of Rs.128.64 Lakhs received from

NFC for the purpose of Investment in

APGPCL. Pending settlement of issues

between NFC and the Company with

reference to investment in shares and its

ownership, the amount deposited has been

exhibited under Current Liabilities.

v) Note No 5 in Schedule Q regarding

deviations from the Guidance Note issued by

Institute of Chartered Accountants of India

for VAT accounting.

D)Our comments on the Financial

Statements 2009-10 are as under :

1. Accounting Policy A on Revenue

Recognition

a) Refer Note No 8(i), the Company has the

practice of recognizing the sales on

retention basis which is retained at the

request of the customer in the custody of

the company, the Risk & Rewards for

which are not passed to the customer. The

same in our opinion is not in accordance

with the Accounting Standard (AS)-9 and

by which the revenue and debtors are

overstated by Rs 918.96 Lakhs,

expenditure and liabilities are overstated

by Rs 98.42 Lakhs, inventory is

The note referred to by the Statutory

Auditors is factual and self-

explanatory.

The note referred is self-explanatory. It

has no financial impact on the results

for the year.

All the items were customer specific

and inspected wherever pre-inspection

clause is applicable and ready for

delivery. They were retained on

customers specific requests. Since the

customer has specifically requested for

retention, it amounts to transfer of

significant risks and rewards to the

buyer. Further, as these are produced

against specific orders, there is no

uncertainty in taking delivery by the

customer. As on date, out of the total

30

understated by Rs 676.71 Lakhs.

Consequential increase of PBT by Rs

143.83 Lakhs.

The company is having the stock in its

custody which are sold on retention basis for

financial year 2002-03 (Rs 1517.40 Lakhs);

2003-04 (Rs 1040.92 Lakhs); 2004-05 (Rs

344.88 Lakhs); 2007-08 (Rs.200.80 Lakhs)

2008-09 (Rs.191.90 Lakhs)- aggregating to

Rs. 3295.90 Lakhs,awaiting dispatch as on

31.03.2010.

b) The company bifurcated the work orders

received into construction contracts (AS7)

and supply of products/ services (AS9), We

have relied on the percentage completion of

the projects under AS-7 as certified by the

management.

2. The balances appearing under Sundry

Debtors, Sundry Creditors, Advances to

Suppliers, Advances from Customers, EMDs

and Security Deposits, claims recoverable

and other amounts paid/ received are long

pending and subject to confirmation and

reconciliation and consequential adjustments.

In view of same we are unable to comment

on the recoverability/ liability on account of

same and the impact of the same on the profit

and Loss statement.

3. Refer Note No. 15(vi) of schedule

Qregarding disclosure as per section 22 of

the Micro, Small and Medium Enterprises

retention sales recognized, an amount

of Rs.953 lakhs have already been

dispatched.

The Company has a practice of issuing

letters for confirmation of balances of

Sundry Debtors. There is a review

mechanism in place for outstanding

Sundry Debtors, Creditors and

Liquidated Damages etc. and necessary

actions have been taken. During the

year, apart from the confirmation

letters to Sundry Debtors, letters for

confirmation of balances in respect of

Sundry Creditors, Advances paid to

suppliers and Advances received from

Customers were sent with a request to

31

Development Act, 2006, we have relied on

the information given by the management and

accepted the same for the disclosure purpose.

4. Considering the substantial amounts

involved in disputes at different levels

particularly relating to Income Tax, Sales

Tax, excise, service tax, etc, we are not in a

position to comment on the ultimate liability

that may devolve on the company and as such

the treatment given by the company showing

Contingent Liability has been relied upon by

us, as the issues are sub-judice.

E) Subject to our above comments, we

report that:

a. We have obtained all the information and

explanations which to the best of our

knowledge and belief were necessary for the

purposes of our audit;

b. In our opinion, proper books of account as

required by law have been kept by the

Company, so far as appears from our

examination of those books;

c. The Balance Sheet, the Profit & Loss

account and Cash Flow statement dealt with

by this report are in agreement with the books

of account;

d. In our opinion, the Balance Sheet, the

Profit and Loss Account and the Cash Flow

statement dealt with by this report comply

with the Accounting Standards referred to in

sub-section 3C of Section 211 of the

send the confirmations directly to the

statutory auditors. Replies received

have been properly dealt with.

32

Companies Act, 1956 except to the extent of

the deviations expressed in paragraphs C and

D above in so far as they relate to changes in

accounting policies, AS-9 on Revenue

Recognition.

e. As per circular No.8/2002, dated

22.03.2002 issued by the Ministry of Law,

Justice & Company Affairs, the provisions of

section 274 (1)(g) of the Companies Act,

1956 are not applicable to the Company, as it

is a Government Company.

f. According to our information, the Central

Government has not issued any Notification

for the purpose of levy and collection of cess

under section 441A of the Companies Act,

1956.

g. We report that without considering items 2,

3 and 4 of Para-D above, the impact of which

could not be determined or where we have

relied on the information given by the

management, had the other observations

made by us under 1 of Para-D above been

considered;

The gross sales would have been

Rs.117821.28 Lakhs instead of Rs.118740.24

Lakhs;

Total expenditure would have been

Rs.108623.12 Lakhs instead of Rs.108721.54

Lakhs;

Profit before tax for the year would have

been Rs.5297.97 Lakhs instead of Rs.5441.80

33

Lakhs;

Sundry Debtors would have been

Rs.140825.91Lakhs as against Rs.141744.87

Lakhs;

Current liabilities would have been

Rs.128623.91 Lakhs as against Rs.128722.33

Lakhs;

Inventories on 31.03.2010 would have been

Rs.20144.58 Lakhs instead of Rs.19467.87

Lakhs.

h) In our opinion and to the best of our

opinion and according to the explanations

given to us, the said accounts read together

with the accounting policies and notes

forming part of accounts, further, read with

our comments in the Annexure referred to in

paragraph B and subject to our comments

given in paragraph D and the cumulative

consequent effect thereof on the accounts to

the extent quantified, as stated in paragraph

E(g) above, give the information as required

by the Companies Act, 1956 in the manner so

required and give a true and fair view in

conformity with the accounting principles

generally accepted in India: a) In the case of

the Balance Sheet, of the state of affairs of

the Company as at 31.03.2010.

b) In case of the Profit and Loss Account, of

the profit for the year ended on that date; and

c) In the case of the Cash Flow Statement, of

the cash flows for the year ended on that date.

34

4.1.3 COMMENTS OF THE COMPTROLLER AND AUDITOR GENERAL OF INDIA

UNDER SECTION 619(4) OF THE COMPANIES ACT 1956 ON THE ACCOUNTS OF

ELECTRONICS CORPORATION OF INDIA LIMITED,HYDERABAD FOR THE YEAR

ENDED 31 MARCH 2010.

The preparation of financial statements of Electronics Corporation of India

Limited, Hyderabad for the year ended on 31 March 2010 in accordance with the

financial reporting framework prescribed under the Companies Act, 1956 is the

responsibility of the management of the Company. The statutory auditor appointed by the

Comptroller and Auditor General of India under Section 619(2) of the Companies Act,

1956 is responsible for expressing opinion on these financial statements under Section

227 of the Companies Act,1956 based on the independent audit in accordance with the

auditing and assurance standards prescribed by their professional body, the Institute of

Chartered Accountants of India. This is stated to have been done by them vide their Audit

Report dated 29 June 2010.

I, on the behalf of the Comptroller and Auditor General of India, have conducted

a supplementary audit under Section 619(3)(b) of the Companies Act, 1956 of the

financial statements of Electronics Corporation of India Limited, Hyderabad for the year

ended on 31 March 2010. This supplementary audit has been carried out independently

without access to the working papers of the statutory auditors and is limited primarily to

inquiries of the statutory auditor and company personnel and a selective examination of

some of the accounting records. On the basis of my audit, nothing significant has come to

my knowledge, which would give rise to any comment upon or supplement to Statutory

Auditor's report under Section 619(4) of the Companies Act, 1956.

35

4.2 ANNUAL REPORT FOR THE YEAR 2010-2011

The company continues to take several measures to enhance the openness and

transparency of all its operations.

Board of Directors:

In terms of Sec 617 of the Companies Act, 1956, ECIL is a Government company.

The entire paid up capital of the company is held by the President of India, including the

3 shares held by his nominees.

The board as on date, comprises of ten - Directors, Chairman & Managing

Director three whole-time Directors and 6 (Six) Non- Executive Directors. The Board

meets at regular intervals and is responsible for the proper direction and management of

the Company.

During the nancial year, 8 (eight) Board Meetings were held on 24th May,

2010, 9th June, 2010, 13th August, 2010, 27th September, 2010, 8th November,2010,

28th January, 2011, 1st March, 2011 and 14th March, 2011. The composition of

Directors, their attendance at the Board Meetings during the nancial year and at the

last Annual General Meetings etc.

The remuneration:

The remuneration of whole-time Directors is fixed by the Government of India as

the company is a Government company in terms of section 617of the Companies Act,

1956. At present, all the part time Directors except Dr. M J Zarabi , are Government

officials from other PSUs and therefore, are eligible for sitting fee for the meetings

attended by them. Dr. MJ Zarabi, who is an Independent Director, is being paid Rs. 2500

as sitting fee per attendance.

Audit Committee:

A three-member Audit Committee was constituted by the board in March

2001comprising of two Non-Executive Directors and a whole time Director. With

regard to terms of reference, powers and functions of the committee, the Board suggested

36

that the provisions in Clause 49 of Listing Agreement prescribed by SEBI as applicable

to listed Companies are to be followed as guidelines.

The Audit Committee presently comprises of two Non-Executive Directors, Sri

Rahul Asthana, (up to 26.03.2007) and Sri Umesh Chandra and one whole time Director

(Technical) of the company, Sri G.N.V. Satyanarayana. Sri Rahul Asthana is the

chairman of the committee. During the year, four meetings of the committees were held

on 09.02.2006, 27.07.2006, 08.11.2006 and 01.03.2007.

The Audit committee reviewed the implementation of Accounting Standards and

Audit Programmes. The committee reviewed the Internal Audit Reports and also the

report on Fixed Assets Physical Verification. The committee pursued the Annual

Financial Statements and interacted with the Statutory Auditors for improvement in the

system for maintaining financial records as well as the data under Cost Accounts Record

Rules.

Boards Sub-Committee on Capital Projects:

The Board reconstituted the sub-committee on Capital Projects on

29.3.2003consisting of Sri V.P.Raja, Non-Executive Director, Sri A .Murugesan,

Director (Finance) and Sri.G.N.V.Satyanarayana, Director (Technical) to scrutinize the

capital proposals and recommend to the Board for its approval.

Investments Committee:

The Board constituted an Investment Committee on 17.12.2003 consisting

of Chairman & Managing Director, Director (Finance), General Manager (Accounts) and

are preventative from Corporate Planning and Projects Monitoring Division. This

committee will consider the proposals for investment of surplus funds in nationalized

banks or sound rated scheduled banks at the highest and competitive rates as per DPE

guidelines.

Corporate Management Committee:

The Corporate Management Committee is a high level policy making body at the

Corporate level which is headed by the Chairman & Managing Director. The Committee

consists of all Functional Directors, Executive Directors, General Manager and Heads

37

of Divisions. The Committee meets deliberates on the major policy issues

including performance of the company. The President and General Secretary of ECEU

and President and Secretary of ECOA are the special invitees.

Apex Committee:

The Apex Committee is constituted under the scheme of Workers Participation in

Management. The Committee is headed by Chairman & Managing Director and

other members include Functional Directors on the Board, Executive Directors, General

Manager (HR), President and General Secretary of ECEU and President and Secretary of

ECOA.

General Body Meetings:

The details of the last three Annual General Meetings of the Company are given

below:

Year Date Time Venue

2007-08

2008-09

2009-10

29.09.2008

18.09.2009

13.08.2010

12.00 hrs

14.00 hrs

14.00 hrs

Registered ofce, ECIL Post

Ofce , Hyderabad do-

500062

38

4.2.1 AUDITORS REPORTS AND COMPANY REPLIES ON ECIL

AUDITORS REPORT

COMPANYS REPLIES TO AUDITORS

To

The Members of

Electronics Corporation of India Limited

Hyderabad.

We have audited the attached Balance Sheet

of Electronics Corporation of India Limited

(ECIL), Hyderabad, as at March, 2011 and

the related Prot & Loss Account and the

Cash Flow Statement for the year ended on

that date annexed thereto. These nancial

statements are the responsibility of the

Companys management. Our responsibility

is to express an opinion on these nancial

statements based on our audit.

A)We conducted our audit in accordance with

the auditing standards generally accepted in

India. These standards require that we plan

and perform the audit to obtain reasonable

assurance about whether the nancial

statements are free of material misstatement.

An audit includes examining, on a test

basis, evidence supporting the amounts and

disclosures in the nancial statements. An

audit also includes assessing the accounting

principles used and signicant estimates made

by the management, as well as evaluating the

39

overall nancial statement presentation.We

believe that our audit provides a reasonable

basis for our opinion.

B) As required by the Companies

(Auditors Report) Order, 2003 issued by the

Central Government of India in terms of

Section 227(4A) of the Companies Act, 1956

and on the basis of such checks as we

considered appropriate and according to the

information and explanations given to us,

we annex hereto a statement on the matters

specied in paragraphs 4 and 5 of the said

order.

C) Further to our comments in the

annexure referred to in paragraph (B)

above, attention is invited to the following

1) Note No:7 In Schedule Q regarding

Recognition of Revenue on provisional

basis / pending recommendation of the

nal price by the Price Review Committee in

respect of Electronic Voting Machines at

Rs.8670 per unit for supplies.

2) Note no. 8 in Schedule Q regarding re

classication of expenditure of Rs.2696.85

Lakhs from primary heads to functional

heads under in-house R&D expenditure. We

have relied on the information given by

the management and accepted the same for

The Company has been receiving in full the

amount of revenue recognized.

R&D expenditure has been identied and

reclassied and the practice is being followed

consistently.

40

the disclosure purpose.

3) Note No 13 (i) in Schedule Q regarding

Deposit of Rs.128.64 Lakhs received from

NFC for the purpose of Investment in

APGPCL.Pending settlement of issues

between NFC and the Company with

reference to investment in shares and its

ownership, the amount deposited has been

exhibited under Current Liabilities.

4) Note No 3 in Schedule Q regarding

deviations from the Guidance Note issued by

Institute of Chartered Accountants of India

for VAT accounting.

5) 5) Note No. 6: The company is having the

stock in its custody which are sold on

retention basis for nancial year 2002-03

(Rs 1517.40 Lakhs); 2003-04 (Rs 1040.92

Lakhs); 2004-05 (Rs 344.88 Lakhs); 2009-10

(Rs.143.12 Lakhs) 2010-11 (Rs.641.38

Lakhs)- aggregating to Rs.3687.70Lakhs,

awaiting dispatch as on 31.03.2011

(Accounting Policy A on Revenue

Recognition)

6) 6) The company bifurcated the work orders

received into construction contracts (AS-7)

and supply of products/ services (AS-9), we

have relied on the percentage completion of

the projects under AS-7 as certied by the

management.

The note referred to by the Statutory Auditors is

factual and self-explanatory.

The note referred is self-explanatory. It has no

nancial impact on the results for the year.

All the items were customer specic and

inspected wherever pre-inspection clause is

applicable and ready for delivery. They were

retained on customers specic requests. As on

date,out of the total retention sales recognized,

an amount of Rs.641.38 lakhs have already

been dispatched.

41

7) 7) The balances appearing under Sundry

Debtors, Sundry Creditors, Advances to

Suppliers, Advances from Customers, EMDs

and Security Deposits, claims recoverable and

other amounts paid/ received are long

pending. We are unable to comment on the

recoverability/ liability and the impact of the

same on the prot and Loss statement.

8) 8) Refer Not e No. 13(vi) of schedule

Q regarding disclosure as per section 22

of the Micro, Small and Medium Enterprises

Development Act, 2006, we have relied on the

information given by the management and

accepted the same for the disclosure purpose.

9) 9) Considering the substantial amounts

involved in disputes at different levels

particularly relating to Income Tax, Sales

Tax, excise, service tax, etc, we are not in a

position to comment on the ultimate liability

that may devolve on the company and as

such the treatment given by the company

showing Contingent Liability has been relied

upon by us, as the issues are sub-judice.

D) D) Further to the above, our comments

on the Financial Statements of 2010-11 are

as under.

1. 1.Note No: 2(B)(i) in Schedule Q The

Company has charged an amount of

Rs.26.80 Crores only against the total

gratuity liability amount of Rs.133.99

The Company has developed a review

mechanism for outstanding dues and periodical

review is taken up with all the heads and

marketing In-charges of the Divisions for

review, conrmation and collection of

outstanding dues.

Consequent to the amendment to The Payment

of Gratuity Act, 1972 increasing the ceiling

limit from Rs. 3.5 lakhs to Rs. 10 lakhs with

effect from 24

th

May, 2010, the total amount

chargeable to Prot & Loss Account, as per

actuarial valuation, as on 31

st

March, 2011 is

42

Crores to be provided as per the

Accounting Standard 15 (Employee

Benets) issued by ICAI. Had the entire

amount been charged to the Prot and

Loss Account, the prot before tax of

Rs.22.36 Crores would have become a

Loss of Rs.84.83 Crores.

E) Subject to our above comments, we

report that:

a. We have obtained all the information and

explanations which to the best of our

knowledge and belief were necessary for the

purposes of our audit;

b. b. In our opinion, proper books of account

as required by law have been kept by the

Company, so far as appears from our

examination of those books,

c. c. The Balance Sheet, the Prot & Loss

account and Cash Flow statement dealt with

by this report are in agreement with the

books of account;