Professional Documents

Culture Documents

Accounting Assessment

Uploaded by

PhenixChuanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Assessment

Uploaded by

PhenixChuanCopyright:

Available Formats

TEAM 6 - ACCOUNTING

ACCT5602 Accounting

Team based exercise number

Team name!!!!!TEAM 06!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

You have been given summary data for Woodside and Santos from the Morning Star

data base. Using primarily this data and other information you can access compare

the two companies and answer the six questions listed below. Be sure to clearly

explain your assessment and indicate which company you believe has performed

better or is in a preferred position.

" In terms o# $ro#itabi%it& '(ic( com$an& (as $er#ormed better in recent

&ears) *(&)

a+ ,es$onse

!he following ratios have been considered in arriving at our decision regarding

which company is performing better in recent years

-INANCIA. ,ATIO/

20 202 201

*2. /ANTO/ *2. /ANTO/ *2. /ANTO/

"et #rofit Margin $%& '(.() *+.', '-.(+ *'.*( -..+- *'..(

/eturn on 0quity $/10& % *'.,+ 2.,2 *'.)* (.)* **.*. (.3'

/eturn of 4ssets $/14& % +.23 '.', ..3) -.+. +.3) -.))

4sset !urnover ,.-* ,.*+ ,.-) ,.*3 ,.-2 ,.*.

1!50/

0arnings per share $0#S&

after 4bnormals *.+.(' .(.2, '2-.2. 2(.*, -'+.2 2'.*

b+ Net 2ro#it Margin3

6rom the figures presented above7 it is clear that the "et #rofit Margin $"#M& for W#8

is higher than Santos for the following reasons

!he net profit for W#8 is higher with respect to sales over three years

compared to Santos7 in which means W#8 has better performance.

!he high ratio for W#8 shows that its management of expenses7 including

taxes7 depreciation and interest are controlled better comparing with Santos9

0ven though W#8 has higher profit margins compared to Santos7 the trend

of its profit margin is declining9

* of +

TEAM 6 - ACCOUNTING

!he margins indicate that for W#87 the company:s sales revenue is

increasing as indicating from the financial statement.

c+ ,eturn On E4uit&

6rom the figures7 it is also clear that this benchmar; for assessing

profitability ratios between the two companies is higher for W#8 compared to

Santos. !he high ratio for W#8 indicates that the company uses its assets

well to generate income. !his means that W#8 has a higher level of

management performance in this case compared to Santos9

!he high net income is driving the high ratio that we have observed in W#8.

<n this case7 the average total shareholders: equity remains stable7 and the

net income drives the ratio margin.

d+ ,eturn On Assets

4verage total assets are similar for both companies7 therefore the /14 is

being driven by a higher net income generated by W#8 compared to Santos.

1ver the last three years7 the average total assets for W#8 was =-(7-.-.) m

compared to Santos average of =*+7.*3.', m. 5owever7 the average net

income for the last three years in W#8 is =-7*(..* m and for Santos is

=232m. 6rom this7 it is clear that the net income is driving the high ratio in

W#89

e+ Asset Turno5er

!he average net sales for W#8 for the last three years is =)*2(.(m and

='7'.+.)m for Santos. !he net sales for W#8 are almost twice the net sales

for Santos7 yet the asset values for both are almost similar. >onsequently7

W#8 will have a better 4sset !urnover compared to Santos9

#+ E$s A#ter Abnorma%s

Since the 0#S measures earnings in relation to every share7 the 0#S values

are more valuable compared to the Santos7 which may well be a good

indication of the profitability of W#8 relative to Santos.

2" *(ic( com$an& (as better managed in5entories and debtors) *(&)

a+ In5entor& Turno5er

6rom the table below7 it is clear that W#8 has a better management of

inventories since the turnover is considerably higher compared to Santos.

!his may means that Santos has on average a more unsold inventory

- of +

TEAM 6 - ACCOUNTING

compared to W#8.

b+ Assets Turno5er

Since asset turnover is an indicator of the efficiency of using assets7 W#8

has a slight edge over Santos7 although the ratios are not significantly

different.

c+ NET 6E7T 0 C-

6rom the figures in the table below7 the "et ?ebt of Santos is better than

W#8. !his may well be due to the si@e of the W#8 compared to Santos7 or it

may well be due to Santos managing its better. <n the last of our analysis

$-,*-A*'&7 we see that Santos had more debt and reduced cash flow

compared to W#8

-INANCIA. ,ATIO/

20 202 201

*2. /ANTO/ *2. /ANTO/ *2. /ANTO/

<nventory !urnover -(.)' 3.-2 -).'( *,.-( ',..) ..)3

4sset !urnover ,.-* ,.*+ ,.-) ,.*3 ,.-2 ,.*.

"et ?ebt A >ash 6low -.*3 B,.,) ,.), *.-, ,.2* '.(2

' of +

TEAM 6 - ACCOUNTING

1"

Comment on and com$are t(e s(ort term %i4uidit& $ositions o# bot( com$anies+

!he table below shows the ratios that we have used to explain short term liquidity

positions for the two companies.

a+ Current ,atio

4s the current ratio indicates the firm:s ability to pay debt7 the table shows

Santos: current ratio is better than W#8 in -,**A*-7 however lower in -,*'7

although the trend is moving downwards. <n contrast7 W#8:s current ratio is

trending upwards7 with the highest ratio being achieved in -,*-.

b+ 8uic9 ,atio

4s the quic; ratio is an indication of the firm:s ability to use quic; assets to

pay its current liabilities7 Santos appears to have a better quic; ratio for the

first - years $-,**A*-& compared to W#87 although in the last year $-,*'&7

W#8:s quic; ratio was better than Santos.

6or both ratios7 figures provided $not shown in the table&7 indicate that the total current

assets for Santos have shown a downward while its current liabilities have gone up. 1n

the other hand7 W#8:s current assets have gone up while the liabilities have relatively

stable.

<n addition7 W#8:s ?ays /eceivables and <nventories and ta;es less time compared to

Santos.

-INANCIA. ,ATIO/

20 202 201

*2. /ANTO/ *2. /ANTO/ *2. /ANTO/

>urrent /atio ,.(- '.*- *.'3 -.(3 *.-- *.-,

Cuic; /atio ,.'( -.3' *.-3 -.-( *.*( ,.3)

:" Comment on and com$are t(e %ong term %i4uidit& $ositions o# bot( com$anies+

!he table below provides ratios that have been used to explain the long term

liquidity positions.

-INANCIA. ,ATIO/

20 202 201

*2. /ANTO/ *2. /ANTO/ *2. /ANTO/

6inancial 8everage *.+* *.+) *.2+ *..- *.(3 -.,-

( of +

TEAM 6 - ACCOUNTING

"et <nterest >over 3,.++ B..(3 -,.+3 B3.'+ *'.3- 2,.-3

a+ -inancia% .e5erage

4s the financial leverage is an indicator of the company:s ability to hold

assets relative to its equity7 the figures below indicate that W#8 is marginally

better compared to Santos. !his indicates that Santos is reliant on debt

compared to W#8.

b+ Net Interest Co5er

4s the "et <nterest >over is the ratio of net profit before tax plus interest over

interest expenses7 the figures above indicate that W#8 is far better than

Santos to meet interest expenses on debt using profits. Santos7 on the other

hand7 had an initial low interest coverage7 although the -,*' financial year

shows some mar;ed improvement.

5" Ex$%ain '(& t(e ,OE #or bot( com$anies dec%ined s(ar$%& in 200;)

a+ Ex$%anations3

!he /10 figures for -,,. was '*.(-% while it was *'.3% in -,,3 for W#89

similarly7 the /10 for Santos in -,,. was *'.)% which dropped to '.22% in

-,,3. We see that the -,,3 figures dropped significantly for both

companies.

1ne possible explanation for these drops could be due to external factors

outside both companies: control. 4s we recall7 this is the period when the

Dlobal 6inancial >risis $D6>& was in full swing7 which may have impacted on

the net incomes for both companies7 resulting in low generated revenues.

4s the /10 is a ratio between the "et <ncome and the average

shareholder:s equity7 a decrease in the net income will have a spiralling

effect on the /10 ratio7 resulting in its reduced value7 which is clearly shown

by these values.

6" *(& do &ou t(in9 t(e 2rice Earnings ratios are so muc( (ig(er #or /antos in recent

&ears)

4s the price earnings ratio is calculated based on the share price divided by

the earnings per share7 it is clear from the table below that the increase in

2 of +

TEAM 6 - ACCOUNTING

the ratio is due to better sales price earnings by Santos from -,** onwards.

!his could be due to better company performance and financial positions.

-,** -,*- -,*'

Sales per share $=& -.3( '.(' '.+2

#0/ /atio -(.,. -(.)2 -..-*

<" *(ic( com$an& 'ou%d &ou recommend to $otentia% in5estors) *(&)

a+ ,ecommendations3

!he company that we recommend is Woodside based on the following reasons

o !he net profit margin for W#8 is better than Santos by a factor of almost -9

o !he /10 ratio of W#8 is almost ' times that of Santos9

o !he /14 ratio of W#8 is almost -.2 times that of Santos9

o !he 4sset !urnover for W#8 is slightly better than Santos9

<n addition the following factors have been considered

*2. /antos

7enc(mar9 20 202 201 20 202 201

Mar;et >ap $=m& -(7))3.)) -+73*(.,3 '-7,2,.*- **72),.'* *,7))3.*( *(7--*.)2

Share #rice $=& ',.)- ''... '..3 *-.-( **.* *(.)'

1perating /evenues $=m& (+-..-( )**'.-2 ))--.+* -)*3 '-.+ ')(*

#0/ /atio *(... *'.3* *)..' -(.,. -(.)2 -..-*

<t is clear from the table above that all benchmar;s for enticing investments are in W#8:s

favour7 thus ma;ing it a potential target for investment.

1ther factors considered are the ?ebt to 0quity ratio for both W#8 and Santos shown in the

table below

*2. /antos

7enc(mar9 20 202 201 20 202 201

Dross Dearing $?A0 /atio& '..(2 -+.(- -'.23 ').'. '3.22 2).2*

4s the table above shows7 with the exception of -,**7 W#8:s ?A0 /atio is lower7 indicating

that W#8 has a better capital structure and may be less reliant on borrowings or

shareholder:s capital to fund its assets and activities.

CONC.U/ION

<n conclusion7 we can confidently say that W#8 is a better company for potential investment7

) of +

TEAM 6 - ACCOUNTING

and !eam ) feels that it is one company that is worthy recommending to prospective

investors.

MA,=ING /C>E6U.E

Cuestions #oor 4verage Dood 0xcellent Mar;

* A-,

- A*,

' A*,

( A*,

2 A2

) A2

+ of +

TEAM 6 - ACCOUNTING

+

A*2

!otal A+2

. of +

You might also like

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- UST Debt Policy and Capital Structure AnalysisDocument10 pagesUST Debt Policy and Capital Structure AnalysisIrfan MohdNo ratings yet

- Financial ForecastingDocument23 pagesFinancial ForecastingRajesh ChowdaryNo ratings yet

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- Unit - 2 - Financial Statement and RatioDocument37 pagesUnit - 2 - Financial Statement and Ratiodangthanhhd7967% (6)

- Solution For The Analysis and Use of Financial Statements (White.G) ch03Document50 pagesSolution For The Analysis and Use of Financial Statements (White.G) ch03Hoàng Thảo Lê69% (13)

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains Solution01dynamic33% (3)

- CXC Principles of Accounts Past Paper Jan 2009Document8 pagesCXC Principles of Accounts Past Paper Jan 2009ArcherAcs83% (6)

- Nykaa Powerpoint PresentationDocument12 pagesNykaa Powerpoint PresentationPragya Singh100% (2)

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroNo ratings yet

- Financial Management & Control FinalDocument25 pagesFinancial Management & Control FinalAnees Ur RehmanNo ratings yet

- This Page Is Designed For The Sole Purpose of Teaching Someone How To Read Financial StatementsDocument77 pagesThis Page Is Designed For The Sole Purpose of Teaching Someone How To Read Financial StatementsAhmad Fauzi MehatNo ratings yet

- Bar Chart: Turn-Over in Rupees Hundred Lakhs in A Certain YearDocument3 pagesBar Chart: Turn-Over in Rupees Hundred Lakhs in A Certain YearSushobhan SanyalNo ratings yet

- Analyzing financial statements of Kingston, IncDocument5 pagesAnalyzing financial statements of Kingston, Inclucano350% (1)

- Warren Buffet Shareholder Letter Year 2000Document31 pagesWarren Buffet Shareholder Letter Year 2000nirajpp100% (1)

- FINANCIAL ACCOUNTING: Review QuestionsDocument2 pagesFINANCIAL ACCOUNTING: Review QuestionsSyed Muhammad Junaid HassanNo ratings yet

- Data analysis and company ratiosDocument31 pagesData analysis and company ratiosAnonymous nTxB1EPvNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementskheymiNo ratings yet

- FIN621 Final solved MCQs under 40 charsDocument23 pagesFIN621 Final solved MCQs under 40 charshaider_shah882267No ratings yet

- Final Accounts of Joint Stock Companies: Selling and Distribution ExpensesDocument6 pagesFinal Accounts of Joint Stock Companies: Selling and Distribution ExpensesbhsujanNo ratings yet

- Chapter08 KGWDocument24 pagesChapter08 KGWMir Zain Ul HassanNo ratings yet

- Premier Bank's Financial Performance AnalysisDocument8 pagesPremier Bank's Financial Performance Analysistoxictouch100% (1)

- Short-term debt securities markets introduction overview agency relationship corporate forms business organization present valueDocument3 pagesShort-term debt securities markets introduction overview agency relationship corporate forms business organization present valueGrad Student100% (1)

- Exam 1 KeyFinanceDocument7 pagesExam 1 KeyFinancepoojasoni06No ratings yet

- Financial Statement Analysis of Square PharmaceuticalsDocument15 pagesFinancial Statement Analysis of Square PharmaceuticalsAushru HasanNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- FM11 CH 16 Mini-Case Cap Structure DecDocument11 pagesFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNo ratings yet

- Independent Auditor ReportDocument3 pagesIndependent Auditor Reportpathan1990No ratings yet

- Accounting For Business II PM Xii Chapter4Document6 pagesAccounting For Business II PM Xii Chapter4akbar2jNo ratings yet

- Long-Term Financial Planning and Corporate Growth: Chapter OutlineDocument9 pagesLong-Term Financial Planning and Corporate Growth: Chapter Outline1t4No ratings yet

- Financial Ratios for Capital Structure and Risk AssessmentDocument17 pagesFinancial Ratios for Capital Structure and Risk Assessmentsamuel_dwumfourNo ratings yet

- Berkshire Hathaway's 1998 Annual Letter to ShareholdersDocument23 pagesBerkshire Hathaway's 1998 Annual Letter to ShareholdersnirajppNo ratings yet

- Player Contracts: Italy's Serie B Salary Cap: AnalysisDocument2 pagesPlayer Contracts: Italy's Serie B Salary Cap: AnalysisLuca FerrariNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- A Few Practice Questions From Chapters 1-5: D) Capital StructureDocument4 pagesA Few Practice Questions From Chapters 1-5: D) Capital StructureMichaelFraserNo ratings yet

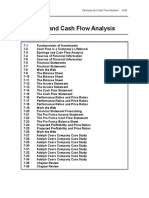

- Earnings and Cash Flow Analysis: SlidesDocument6 pagesEarnings and Cash Flow Analysis: Slidestahera aqeelNo ratings yet

- Unit VI Part 1 General Journal, General Ledger, Trial BalanceDocument20 pagesUnit VI Part 1 General Journal, General Ledger, Trial BalancePatrick BernilNo ratings yet

- Mutual FundsDocument4 pagesMutual FundsSelva KumarNo ratings yet

- Chapter 7 Long Term Debt Paying Ability SolutionsDocument35 pagesChapter 7 Long Term Debt Paying Ability SolutionsRox310% (1)

- Fubuki Case Assignment FINALDocument4 pagesFubuki Case Assignment FINALnowgamiNo ratings yet

- Mutual Fund Analysis and Stock Portfolio ReviewDocument5 pagesMutual Fund Analysis and Stock Portfolio Reviewaklank_218105No ratings yet

- SAP Helpful Financial ReportsDocument18 pagesSAP Helpful Financial ReportsotchmarzNo ratings yet

- Sap Helpful Reports ListDocument18 pagesSap Helpful Reports ListupendersheriNo ratings yet

- David Ruiz Tarea 12-13Document33 pagesDavid Ruiz Tarea 12-131006110950No ratings yet

- FMM Acct For Business Ch1Document99 pagesFMM Acct For Business Ch1Rubi JangraNo ratings yet

- S - ALR - 87012284 - Financial Statements & Trial BalanceDocument9 pagesS - ALR - 87012284 - Financial Statements & Trial Balancessrinivas64No ratings yet

- Dividends and Dividend Policy (Answer Key To Problems inDocument8 pagesDividends and Dividend Policy (Answer Key To Problems inkevinnleeeNo ratings yet

- Concept Questions: NPV and Capital BudgetingDocument23 pagesConcept Questions: NPV and Capital BudgetingGianni Stifano P.No ratings yet

- Amity AssignmentDocument16 pagesAmity AssignmentAnkita SrivastavNo ratings yet

- Financial Record Example-NEWDocument2 pagesFinancial Record Example-NEWAshley MorganNo ratings yet

- iSoftStone 3Q13 ResultsDocument26 pagesiSoftStone 3Q13 Resultsslash4kNo ratings yet

- Discussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortDocument32 pagesDiscussion Questions: Foundations of Fin. Mgt. 6/E Cdn. - Block, Hirt, ShortElvis169No ratings yet

- Sporting Goods Division:: RequiredDocument3 pagesSporting Goods Division:: RequiredAmy HurleyNo ratings yet

- MFAAssessment IDocument10 pagesMFAAssessment IManoj PNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryFrom EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- Framing Contractors World Summary: Market Values & Financials by CountryFrom EverandFraming Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- Concrete Contractors World Summary: Market Values & Financials by CountryFrom EverandConcrete Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Radio & Television Broadcasting Revenues World Summary: Market Values & Financials by CountryFrom EverandRadio & Television Broadcasting Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Marketing plan for coffee shop workshopDocument3 pagesMarketing plan for coffee shop workshopAnish DalmiaNo ratings yet

- Market Research Chapter 1 2 CompletedDocument22 pagesMarket Research Chapter 1 2 CompletedJerson PepinoNo ratings yet

- 10 Classc10 Full SyllabusDocument2 pages10 Classc10 Full SyllabusKhushnuma Shafi Shah100% (1)

- RiskCalc 3.1 WhitepaperDocument36 pagesRiskCalc 3.1 WhitepaperOri ZeNo ratings yet

- Marketing Management Concepts & PhilosophiesDocument22 pagesMarketing Management Concepts & PhilosophiesAshish GangwalNo ratings yet

- Brand Audit - Toyota Motor Corporation PDFDocument88 pagesBrand Audit - Toyota Motor Corporation PDFsabarinathNo ratings yet

- Marketing Group ProjectDocument45 pagesMarketing Group ProjectasalNo ratings yet

- CAPITAL BUDGETING REPORTDocument86 pagesCAPITAL BUDGETING REPORTtulasinad123No ratings yet

- Soap Production Concept Note - KOEEDODocument5 pagesSoap Production Concept Note - KOEEDORobinson Stanley ObadhaNo ratings yet

- Pandora's Freemium Model SuccessDocument3 pagesPandora's Freemium Model SuccessAbdullah RamayNo ratings yet

- IISP 2020 - B K RoyDocument37 pagesIISP 2020 - B K RoyHimangshu DekaNo ratings yet

- Box Truck Business Plan ExampleDocument37 pagesBox Truck Business Plan ExampleJoseph QuillNo ratings yet

- Media PlanningDocument3 pagesMedia PlanningSuvamDharNo ratings yet

- Business Oxford Unit 1Document36 pagesBusiness Oxford Unit 1remaselshazly76No ratings yet

- Boston Condo InfoDocument7 pagesBoston Condo InfoDaisy MaryNo ratings yet

- The Production ProcessDocument84 pagesThe Production ProcessRafi UllahNo ratings yet

- AmSpa Financials 150222Document59 pagesAmSpa Financials 150222Amelia SmithNo ratings yet

- C Accomplishment Report Service Credits - TeachersDocument7 pagesC Accomplishment Report Service Credits - TeachersCamelle MedinaNo ratings yet

- Audit and Assurance June 2009 Past Paper Answers (ACCA)Document15 pagesAudit and Assurance June 2009 Past Paper Answers (ACCA)Serena JainarainNo ratings yet

- A Conceptual Model of Customer Behavioral IntentioDocument6 pagesA Conceptual Model of Customer Behavioral IntentioHannah Marie NadumaNo ratings yet

- Project 2 - Securities Law 1Document16 pagesProject 2 - Securities Law 1Zaii ZaiNo ratings yet

- BM Faculties & CoursesDocument3 pagesBM Faculties & CoursesleylianNo ratings yet

- Ebm 3Document38 pagesEbm 3Mehak AsimNo ratings yet

- Meaning/Definition and Nature of Consumer BehaviourDocument8 pagesMeaning/Definition and Nature of Consumer BehaviourThe Mentals ProfessionNo ratings yet

- ACCP303 Accounting for Special Transactions Prefinals ReviewDocument9 pagesACCP303 Accounting for Special Transactions Prefinals ReviewAngelica RubiosNo ratings yet

- 1 Seminar Business PlanDocument35 pages1 Seminar Business PlanAashishAcharyaNo ratings yet

- Synchronous Manufacturing and The Theory of ConstraintsDocument27 pagesSynchronous Manufacturing and The Theory of ConstraintsAristianto ZXNo ratings yet

- Loreal Master ThesisDocument6 pagesLoreal Master ThesisMonique Anderson100% (2)

- Strategic Management: Porter's Five Forces Model and The Competitive Profile Matrix (CPM) - of Competitive AdvantageDocument62 pagesStrategic Management: Porter's Five Forces Model and The Competitive Profile Matrix (CPM) - of Competitive AdvantageMURALI PNo ratings yet