Professional Documents

Culture Documents

SDRL Seadrill LTD Xnyssdrl Stock

Uploaded by

miscrandomOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SDRL Seadrill LTD Xnyssdrl Stock

Uploaded by

miscrandomCopyright:

Available Formats

SDRL Seadrill Ltd XNYS:SDRL Stock Quote Price News

1 of 2

http://library.morningstar.com.remote.scccld.lib.mo.us:8080/Stock/quote...

End Session

Provided by St Charles City-County Library

Home

Companies

Funds

ETFs

Markets

Articles & Videos

Portfolio

Help & Education

Enter a Ticker or Name

Newsletters

Seadrill Ltd SDRL

Quote

Chart

Stock Analysis

Overview

Company Profile

Last Price

Day Change

PDF Report

Performance

Key Ratios

Financials

Insiders

0.06 | 0.28

After Hours : 21.78 0.01| 0.05%

As of Fri 11/07/2014 5:19 PM EST | USD

Transcripts

Filings

Bonds

Open Price

Day Range

52-Week Range

Yield

Market Cap

$ 21.42

21.42-22.14

20.21-47.03

18.10%

10.2 bil

Volume

Avg Vol.

Forward P/E

Price/Book Price/Sales

Price/Cash Flow

7.4 mil

7.6 mil

8.4

1.0

5.6

More...

Stock Price SDRL

10/07/2014

Shareholders

Industry Peers

21.77

Valuation

Zoom:1D

- 11/06/2014

5D 1M

3M

YTD

1Y

3Y

5Y

10Y

Maximum

XNYS:SDRL:-3.13|-12.60%

2.1

More...

Dividends SDRL

Declared Date

08/27/2014

Ex-Dividend Date

09/04/2014

Latest Indicated Dividend Amount

1.0000

Yield

18.10%

Projected Yield

18.42%

Recent Dividends

Date

Type

Amount

09/04/2014

Cash Dividends

1.0000

06/10/2014

Cash Dividends

1.0000

03/04/2014

Cash Dividends

0.9800

12/03/2013

Cash Dividends

0.9500

Purchase Options

Volume

10/14/2014

10/20/2014

10/26/2014

11/01/2014

Direct Investment

No

Dividend Reinvestment Plan

No

11/06/2014

Competitors SDRL

Name

More...

Morningstar's Take SDRL

Seadrill is a maverick offshore driller. In an industry where many of the top

management teams survived a 20-year downturn and a strong balance sheet is

prized, Seadrill is almost recklessly...

Read full Analyst Report

Fair Value Estimate

Consider Buying

Consider Selling

$ 32.00

$ 16.00

$ 56.00

Fair Value Uncertainty

Economic Moat

Stewardship

Very High

None

Exemplary

Price

Company Profile SDRL

Profitability

% Chg

$21.77

0.28

5,192

Omv AG ADR

$30.75

-1.01

49,997

Omv AG

$30.35

-1.46

49,997

Transocean Ltd

$29.71

-0.70

9,603

Ensco PLC Class A

$41.31

2.00

5,181

Helmerich & Payne Inc

$86.70

1.14

3,599

Ownership SDRL

Fund Owners

More ...

Insiders

% Shares

Held

% Total

Assets

Morningstar Credit Rating

Vanguard Windsor II Inv

3.04

1.12

VA CollegeAmerica Cap Inc

Bldr 529E

1.43

0.20

Vanguard Selected Value

Inv

0.79

1.50

American Beacon Lg Cap

Value Inst

0.41

0.56

Vanguard Total Intl Stock

Index Inv

0.46

0.04

More...

What Does This Company Do?

Seadrill Ltd provides drilling & well services to the offshore industry. It has a fleet of

TTM Sales

$ mil

Seadrill Ltd

Name

Growth

More...

Star Rating

11/7/2014 4:44 PM

SDRL Seadrill Ltd XNYS:SDRL Stock Quote Price News

2 of 2

http://library.morningstar.com.remote.scccld.lib.mo.us:8080/Stock/quote...

drilling units that is outfitted to operate in shallow water, mid-water and deepwater

areas, in benign & harsh environments.

More...

Wall St. Recommendations SDRL

Visit Company Website

Current

Sector

Industry

Stock Type

Energy

Oil & Gas Drilling

Employees

Fiscal Year Ends

Stock Style

8,965

2014-12-31

2.7

Total Analysts : 7

5.0

Buy

Beta

More...

Stock

Ind Avg

Price/Earnings TTM

2.6

8.2

Price/Book

1.0

0.9

Price/Sales TTM

2.1

1.5

Rev Growth (3 Yr Avg)

9.1

14.0

33.4

19.4

Net Income Growth (3 Yr Avg)

Operating Margin % TTM

46.3

28.3

Net Margin % TTM

80.7

17.8

ROA TTM

17.3

5.5

ROE TTM

47.8

11.2

1.1

0.7

Debt/Equity

1.0

Sell

Market Data SDRL

Large Value

Key Stats SDRL

3.0

Hold

Relative to Industry

1.36

Below 52-Week High

-53.84%

50-Day Moving Average

27.10

200-Day Moving Average

34.11

Short Interest SDRL

Shares Outstanding

468.89 Mil

Float

353.32 Mil

Shares Short (as of 10/15/2014)

28.53 Mil

Short % of Float

8.08%

Short Ratio

2.75

Shares Short Chg. (from 09/30/2014)

Avg

10.85%

+

More ...

Filings SDRL

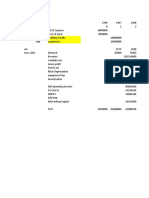

Financials SDRL

More...

Annual

Financials

Announcements

Ownership

Proxy

Registration

Insider Activities

Quarterly

2013-12

2012-12

2011-12

2014-06

2013-06

Revenue

5,282

4,478

4,214

1,222

1,268

Operating Income

2,098

1,791

1,774

476

507

Net Income

2,653

1,108

1,401

605

1,727

5.47

2.34

2.96

1.24

3.53

492

471

488

493

469

2,834

2,354

1,967

3,185

2,978

Income Statement

Earnings Per Share

Diluted Average Shares

Balance Sheet

Current Assets

Non Current Assets

23,466

17,278

16,337

23,419

18,823

Total Assets

26,300

19,632

18,304

26,604

21,801

Current Liabilities

Total Liabilities

Stockholders' Equity

3,825

3,613

2,771

4,103

4,397

18,788

14,129

12,327

16,472

14,386

7,512

5,503

5,977

10,132

7,415

Cash Flow

Cash From Operations

1,695

1,590

1,816

225

248

Capital Expenditures

-4,273

-1,557

-2,543

-568

-1,332

Free Cash Flow

-2,578

33

-727

-343

-1,084

In millions except "EPS". Currency in USD.

S&P 500 index data: S&P 500 Copyright 2014

All data supplied by Morningstar Real-Time Data. U.S. intraday real-time exchange quotes are sourced from BATS

when available. End-of-day quotes for Nasdaq, NYSE, and Amex securities will appear 15 minutes after close.

Graph times are Eastern Standard. Copyright 2014 Morningstar, Inc .

Contact us. Please read our User's Agreement and Troubleshooting documents.

2014 Morningstar, Inc. All rights reserved.

11/7/2014 4:44 PM

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Akuntansi, DavidDocument11 pagesAkuntansi, DavidTema Exaudi DaeliNo ratings yet

- Share and Share CapitalDocument63 pagesShare and Share Capitaldolly bhati100% (4)

- Nike's Calculation For Cost of CapitalDocument2 pagesNike's Calculation For Cost of CapitalDiandra Aditya Kusumawardhani100% (1)

- E-Procurement ToolsDocument39 pagesE-Procurement Toolsthảo nguyễnNo ratings yet

- International Accounting Standards: # Name IssuedDocument44 pagesInternational Accounting Standards: # Name IssuedWasim Arif HashmiNo ratings yet

- Bpme2043 Group 9Document34 pagesBpme2043 Group 9maulana anjasmaraNo ratings yet

- Gitman Im Ch07Document11 pagesGitman Im Ch07Nor Diana NordinNo ratings yet

- SHAREHOLDERS EQUITY - ProblemsDocument3 pagesSHAREHOLDERS EQUITY - ProblemsGlen Javellana0% (2)

- Pengendalian Persediaan Bahan Baku Terhadap Proses Produksi (Studi Kasus Di PERUSAHAAN SURABAYA)Document16 pagesPengendalian Persediaan Bahan Baku Terhadap Proses Produksi (Studi Kasus Di PERUSAHAAN SURABAYA)Melyan LhyandNo ratings yet

- Working Capital Management - IFFCO - Kalol UnitDocument64 pagesWorking Capital Management - IFFCO - Kalol UnitVijay Kumbhar100% (1)

- India Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableDocument4 pagesIndia Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableKishan PatelNo ratings yet

- Materi Ke 11Document37 pagesMateri Ke 11Rahma YantiNo ratings yet

- Solutions of Revision Session by AMK Sept 2020 AttemptDocument13 pagesSolutions of Revision Session by AMK Sept 2020 AttemptShehrozSTNo ratings yet

- Latygina Bazovy Kurs Ekonomiki Na AnglDocument388 pagesLatygina Bazovy Kurs Ekonomiki Na AnglЛідіяNo ratings yet

- 010-Reducing Agent SwitchingDocument91 pages010-Reducing Agent Switchingasri nurulNo ratings yet

- Stock Market Intermediaries For FinanceDocument54 pagesStock Market Intermediaries For FinancePRIYA PAULNo ratings yet

- Understanding Bond Valuation and Key ConceptsDocument59 pagesUnderstanding Bond Valuation and Key ConceptsHawraa AlabbasNo ratings yet

- Chapter 8 Part 4 (B)Document26 pagesChapter 8 Part 4 (B)zulhairiNo ratings yet

- Depreciation Expense 120,000 - 20,000 / 5 Years 20,000/12 1,667 Monthly Depreciation ExpenseDocument2 pagesDepreciation Expense 120,000 - 20,000 / 5 Years 20,000/12 1,667 Monthly Depreciation ExpenseGarp BarrocaNo ratings yet

- MBGN 4001/FM 4001/in 4001Document3 pagesMBGN 4001/FM 4001/in 4001ashanNo ratings yet

- Industrial Diesel Quotation LetterDocument1 pageIndustrial Diesel Quotation LetterLIOE JINNo ratings yet

- Đề thi thử KPMG TaxDocument53 pagesĐề thi thử KPMG TaxĐặng Trần Huyền TrâmNo ratings yet

- Model Grace CorporationDocument9 pagesModel Grace CorporationEhtisham AkhtarNo ratings yet

- Goldman Sachs May 5 UBSDocument6 pagesGoldman Sachs May 5 UBSZerohedgeNo ratings yet

- ACW366 Advanced Financial Reporting: Semester 1, 2020/2021Document31 pagesACW366 Advanced Financial Reporting: Semester 1, 2020/2021MERINANo ratings yet

- Ind Nifty ItDocument2 pagesInd Nifty ItRaghavendraNo ratings yet

- Jamille Cummins Transworld Group - Capital RaisingDocument34 pagesJamille Cummins Transworld Group - Capital RaisingSteve Cummins, Transworld GroupNo ratings yet

- Confirmation LetterDocument3 pagesConfirmation Letter0506sheltonNo ratings yet

- Chapter 1 - Test Bank Advanced Accounting BakerDocument12 pagesChapter 1 - Test Bank Advanced Accounting Bakergilli1tr100% (4)

- NCERT SOLUTIONS CLASS-12 ACCOUNTANCY PART-2 CHAPTER-1Document42 pagesNCERT SOLUTIONS CLASS-12 ACCOUNTANCY PART-2 CHAPTER-1cchendrimadaNo ratings yet