Professional Documents

Culture Documents

Rewards Gold 1.9 For 10

Uploaded by

learn345Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rewards Gold 1.9 For 10

Uploaded by

learn345Copyright:

Available Formats

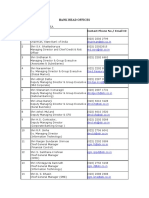

RBC Rewards Visa Gold Information Box (subject to change)

Annual Interest Rate

Purchases: 19.99%

Cash advances: 21.99% after introductory interest rate expires.

Introductory Interest Rate on cash advances: 1.9% for 10 full monthly statement periods.

You will lose this rate and your standard rate for cash advances will apply (subject to any

further increase as set out below), if you miss making any minimum payment by the payment

due date and you have not paid it by the date we prepare your next statement. This will take

effect in the third statement period following the missed payment.

These interest rates are in effect on the date your credit card account is opened (whether or

not your card is activated).

Your interest rate will increase to 24.99% on purchases and 26.99% on cash advances for

at least 6 months if you do not make your minimum payment by the payment due date and

you have not paid it by the date we prepare your next statement 2 or more times in any 12

month period. This will take effect in the third statement period following the missed payment

that caused the rate to increase.

Interest-free Grace Period

You will benefit from an interest-free period of at least 21 days for new purchases and fees if

you pay your statement balance in full by the payment due date shown on your statement.

If you do not pay your statement balance in full by the payment due date, you must then pay

interest on all purchases and fees shown on that months statement from the transaction date

until we receive your payment for the total amount you owe.

There is no interest-free period for cash advances. Cash withdrawals, balance transfers, use

of RBC Royal Bank credit card cheques, certain bill payments and cash-like transactions are

all cash advances. Interest is charged from the day the cash advance is made until we receive

your payment for the total amount you owe.

Minimum Payment

$10 plus interest and fees, or your full statement balance if it is less than the sum of

$10 plus interest and fees. Any previously unpaid minimum payments will also be included.

Foreign Currency Conversion

Transactions in a foreign currency are converted to Canadian dollars no later than the date

we post the transaction to your credit card account at an exchange rate that is 2.5% over a

benchmark rate Royal Bank of Canada pays on the date of conversion.

Annual Fee

No annual fee.

Other Fees

Cash Advance Fees: $3.50 for (i) cash withdrawals or cash-like transactions, in Canada, or (ii)

bill payments or balance transfers made at an introductory interest rate offered to you at account

opening or at your standard interest rate. $5.00 if cash withdrawal or cash-like transaction occurs

outside Canada. No fee on credit card cheques at your standard or introductory interest rate.

Promotional Rate Fee: Up to 3% of the transaction amount when you take advantage of a

promotional interest rate offered to you after account opening, by writing a credit card cheque

or making a balance transfer during the promotional period. The exact Promotional Rate Fee

will be disclosed at the time the offer is made to you.

Cash Advance and Promotional Rate fees are charged within 3 business days from when the

transaction is posted to your account.

Dishonoured Payment: $40 charged on the date the payment reversal is posted for a payment

to your credit card account returned for any reason.

Overlimit: $25 charged on the date your statement is prepared if your statement balance

exceeds your credit limit.

Additional copies: $5 for monthly statement charged within 3 business days from when the

copy was requested.

$1.50 charged within 3 business days from each statement update at an ATM or branch.

$2 for transaction receipt that does not relate to the current statement. Fee is charged each

time the situation occurs.

/ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

All other trademarks are the property of their respective owner(s).

498759PROMO (06/2013)

Introductory Interest Rate on Cash Advances Important Information

The introductory interest rate offer is applicable to all cash advances. You can also take advantage of this offer if you transfer a balance

by calling 1-800 ROYAL 1-2 (1-800-769-2512) or visiting RBC Online Banking at rbcroyalbank.com/online during the offer period.

All other account activities are subject to the annual interest rate(s) indicated on your monthly statement.

Interest is charged from the day the cash advance or the balance transfer is made, until we receive your payment for the total amount

you owe.

The introductory interest rate on cash advances remains in effect through the first 10 full monthly statement periods (approximately

10 months from account open date). The Interest Rate Chart on your monthly statement will indicate the date on which the introductory

interest rate expires, as long as you have a remaining balance associated with your introductory interest rate. If we do not process

statements on the expiry date (for example, if it falls on a holiday or weekend), you will continue to benefit from that introductory interest

rate until your statement is prepared, the next processing day. At the expiration of the offer, (i) all cash advances, including any cheques

processed to your credit card account; and (ii) any remaining balance(s), which were subject to the introductory interest rate under this

offer, will be subject to the cash advances interest rate indicated on your monthly statement.

In general, if your credit card account consists of balances with different interest rates, such as purchases at the standard interest rate

and cash advances at an introductory or promotional interest rate (e.g. a special lower rate credit card cheque or balance transfer, or a

temporary lower rate on all cash advances), any payment that exceeds the minimum payment due will be allocated to those balances in

a proportionate manner. Your payment will not be applied to the balance(s) of your choice, such as the balance(s) with the highest interest

rate, or to any category of balance(s) following a specific order. For example, if your purchases balance at the standard interest rate is $800

and you have a cash advances balance of $200 at one promotional interest rate, proportionate allocation means that 80% of your payment

will be allocated to your purchases balance and 20% will be allocated to your cash advances balance.

If you miss making any minimum payment by the payment due date and if you have not paid it before the date we prepare your next

monthly statement, and/or if you change your actual RBC Royal Bank credit card for another type of card before the expiration of the offer,

you will lose the benefit of this introductory interest rate offer and any remaining balance(s) which were subject to the introductory interest

rate under this offer will be subject to the cash advances interest rate indicated on your monthly statement, beginning on the first day of

the third statement period after the missed payment.

If the use of a credit card cheque or a balance transfer exceeds your credit card accounts available credit limit, it will be declined.

As with any cash advance, the use of a credit card cheque or a balance transfer does not qualify for RBC Rewards points, partner rewards

or cash back credits if your credit card is a type that earns rewards.

Credit card cheques and balance transfers cannot be used to pay any RBC Royal Bank credit card account or used for pre-authorized

payments.

Please call customer service for up-to-date information on your credit card account. Your RBC Royal Bank Credit Card Agreement

explains the terms under which you use your RBC Royal Bank credit card. Please refer to it for full details.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sample - Gap Analysis IndonesiaDocument101 pagesSample - Gap Analysis IndonesiapalmkodokNo ratings yet

- Citigroup - A Case Study in Managerial and Regulatory FailuresDocument70 pagesCitigroup - A Case Study in Managerial and Regulatory FailuresJulius NatividadNo ratings yet

- Backup of Master Card VPC Integration G0uide MR 25Document59 pagesBackup of Master Card VPC Integration G0uide MR 25unknown2iNo ratings yet

- Money and CreditDocument7 pagesMoney and CreditSunil Sharma100% (1)

- 25 Important Model IBPS Banking Awareness QuestionsDocument5 pages25 Important Model IBPS Banking Awareness Questionsjaved alamNo ratings yet

- Sample Brgy Resolution 7Document1 pageSample Brgy Resolution 7san nicolas 2nd betis guagua pampangaNo ratings yet

- GCL PresentationDocument18 pagesGCL PresentationKunal ChawlaNo ratings yet

- Telugu Net BankingDocument75 pagesTelugu Net BankingSudarson SharmaNo ratings yet

- Your Money My Idea Venture Capital: Nandana - Bhat Jalauk - UjalambkarDocument13 pagesYour Money My Idea Venture Capital: Nandana - Bhat Jalauk - UjalambkarArun KumarNo ratings yet

- Banks in CbeDocument28 pagesBanks in Cbemanu_9040100% (1)

- Barangay Sambag BHERNDocument4 pagesBarangay Sambag BHERNCoffee CoxNo ratings yet

- Chapter6E2010 PDFDocument12 pagesChapter6E2010 PDFutcm77No ratings yet

- 1st Year Assignments 2019-20 (English)Document8 pages1st Year Assignments 2019-20 (English)NarasimhaNo ratings yet

- Subject: Official Dispute of Transactions.: Date Amount CurrencyDocument3 pagesSubject: Official Dispute of Transactions.: Date Amount CurrencyVirgil HalunajanNo ratings yet

- Banking SystemDocument4 pagesBanking SystemKhaishen LamNo ratings yet

- Non Fund Based Activities of BankDocument53 pagesNon Fund Based Activities of BankAKSHAT MAHENDRANo ratings yet

- Ceo Letter To Shareholders 2023Document60 pagesCeo Letter To Shareholders 2023TanayNo ratings yet

- Ecs2605 - Study Unit 1Document4 pagesEcs2605 - Study Unit 1Rico BartmanNo ratings yet

- KCCDocument3 pagesKCCRahul ChoudharyNo ratings yet

- History and Evolution of BanksDocument10 pagesHistory and Evolution of BanksDr-Shefali GargNo ratings yet

- Murray V ThompsonDocument2 pagesMurray V ThompsonCristelle Elaine ColleraNo ratings yet

- Handout 2Document5 pagesHandout 2Lian MagatNo ratings yet

- IFM PresentationDocument12 pagesIFM PresentationRunail harisNo ratings yet

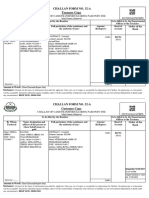

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into Theآرنولڈ دا فینNo ratings yet

- Exim Bank Claim FormDocument9 pagesExim Bank Claim Formmufaddal.pittalwala513No ratings yet

- Tally Sample Exercise - 4Document7 pagesTally Sample Exercise - 4Velu SNo ratings yet

- SRS Atm FinalDocument4 pagesSRS Atm FinalArmaanNo ratings yet

- Conclusion: Project Survey of Branch Accounting in Commercial Bank in EthiopiaDocument19 pagesConclusion: Project Survey of Branch Accounting in Commercial Bank in Ethiopia1990fitsum100% (1)

- Suco BankDocument20 pagesSuco BankRavi Kumar SPNo ratings yet

- Banking and Financial InstitutionsDocument6 pagesBanking and Financial InstitutionsCristell BiñasNo ratings yet