Professional Documents

Culture Documents

Supplement: Theory and Measurement in The Macroeconomy

Uploaded by

eroxoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supplement: Theory and Measurement in The Macroeconomy

Uploaded by

eroxoCopyright:

Available Formats

5

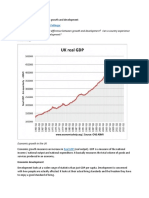

Theory and measurement in the macroeconomy

Theory and measurement in

the macroeconomy

Supplement

Self-assessment task 5.7 (page 191)

Which of the following should be included in measuring GDP by the income method:

government subsidies to farmers

the pay of civil servants

the pay of nurses

supernormal prots

state pensions?

The pay of civil servants, the pay of nurses and supernormal prots should be included in measuring

GDP by the income method. These are all payments received in return for providing a good or service.

Government subsidies to farmers and state pensions are transfer payments.

Self-assessment task 5.8 (page 192)

In 2008 a countrys GDP is $1000 billion. In 2009 nominal GDP rises to $1092 billion and the price index

increases by 4%. Calculate:

a real GDP

real GDP = money GDP

So $1092 bn

price index in base year

price index in current year

100

= $1050 bn

104

b the percentage increase in real GDP.

The percentage increase in real GDP is $50 bn/$1000 bn = 5%.

Self-assessment task 5.9 (page 194)

1 Explain what is meant by sustainable economic growth.

Sustainable growth is growth which can be maintained year after year and generation after

generation. In the short term this means that both aggregate demand and aggregate supply increase

in line with each other so that an output gap does not develop. In the longer term it means that

growth is achieved in a way that will not endanger future generations ability to experience economic

growth. For example, a rapid depletion of oil reserves may harm the growth prospects of many

countries, unless sufcient progress is made in developing alternative sources of fuel.

2 What evidence is provided in the feature to suggest that Ghanas economic growth is not sustainable?

The extract indicates that Ghana is destroying its forests at too rapid a rate. Farmers, timber merchants

and loggers are cutting down trees and digging up forest areas at a such a rate that they cannot be

replaced. This means that they are threatening the future viability of two of the countries main

industries, logging and tourism.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

Self-assessment task 5.10 (page 199)

1 Explain what is meant by purchasing power parity.

Purchasing power parity involves adjusting exchange rates to reect price levels in different countries.

For example, the actual exchange rate between Bangladeshs taka and the US$ may be 70 taka = $1. If,

however, the same basket of goods costs 12 000 taka in Bangladesh and $200 in the US, the exchange

rate based on purchasing power parity would be 60 taka = $1.

2 Explain what effect using an undervalued exchange rate for the Polish zloty would have when comparing

the GDP of the Poland with that of the USA.

An undervalued exchange rate for the Polish zloty would result in Polands GDP seeming relatively low

when compared to the GDP of the USA. For instance, the true value of the zloty may be 3Zl per $1 but

the actual rate may be 5Zl per $1. This would mean that if Polands GDP is $1 200 billion, it would be

converted into $240 billion using the actual exchange rate whereas the true exchange rate would give

a value of $400 billion.

3 Explain how information on the purchasing power parity of wage rates can be used to draw conclusions about

the cost of living in different countries.

Information on the purchasing power parity of wage rates indicates how much the wages can

purchase. If the purchasing power is high, it would suggest relatively high living standards.

Self-assessment task 5.11 (page 201)

1 Use Figure 5.16 to compare the difference between HDI and HPI-1.

HDI

DIMENSION

INDICATOR

A long and

healthy life

Knowledge

A decent standard

of living

Life expectancy

at birth

Adult literacy rate Gross enrolment ratio

(GER)

GDP per capita

(PPP US$)

Adult literacy index

DIMENSION

INDEX

GER index

Education index

Life expectancy index

GDP index

Human development index (HDI)

HPI-1

DIMENSION

A long and

healthy life

INDICATOR

Probability at birth

of not surviving

to age 40

Knowledge

Adult illiteracy rate

A decent standard of living

Percentage of population

not using an improved

water source

Percentage of children

under weight-for-age

Deprivation in

a decent standard of living

Human poverty index

for developing countries (HPI-1)

Figure 5.16 Calculating the HDI and HPI-1

The HDI essentially concentrates on what people have whereas the HPI examines what they lack.

Whereas the HDI measures how long people live on average, the HPI considers what proportion of

people will not survive until aged 40. The HDI measures adult literacy. In contrast, the HPI calculates

adult illiteracy. The third component of the HDI is GDP per capita whereas the HPI measures the

deprivation of a decent standard of living but taking into account the proportion of the population

not using an improved water source and the proportion of children underweight for their age.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

2 Table 5.7 shows that Russia has a higher GDP per head than Malaysia, but a lower HDI value. How might

this be explained?

Rank

Country

Life

expectancy at

birth

Adult

literacy

rate

Combined primary,

secondary, tertiary

enrolment

GDP

per head,

PPPUS$

HDI

value

Very high

1

Norway

80.5

99.0

98.6

53 433

0.971

Ireland

79.7

99.0

97.6

44 613

0.965

13

USA

79.1

99.0

92.4

45 592

0.956

23

Singapore

80.2

94.4

n.a.

49 704

0.944

High

43

Hungary

73.3

98.9

90.2

18 755

0.879

66

Malaysia

74.1

91.9

71.5

13 518

0.829

71

Russia

66.2

99.5

81.9

14 690

0.817

81

Mauritius

72.1

87.4

76.9

11 296

0.804

Medium

92

China

72.9

93.3

68.7

5 383

0.772

95

Maldives

71.1

97.0

71.3

5 196

0.771

102

Sri Lanka

74.0

90.8

68.7

4 243

0.759

141

Pakistan

66.2

54.2

39.3

2 496

0.522

Low

176

DR Congo

47.6

67.2

48.2

298

0.389

179

CAR

46.7

48.6

28.6

713

0.369

180

S. Leone

47.3

38.1

44.6

679

0.365

182

Niger

50.8

28.7

27.2

627

0.340

Table 5.7

Human Development Index, 2007

Russia has a higher GDP per head but a lower HDI value because it has a lower life expectancy at birth,

a lower adult literacy rate and a lower school enrolment rate.

3 Make a few notes on how the information produced by the HDI and HPI-1 might be used by UN

policy makers.

The information produced by the HDI and the HPI-1 may be used by the UN to assess living

standards in different countries and to make recommendations on how countries can increase their

development.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

Self-assessment task 5.12 (page 203)

1 Explain why China has found it necessary to increase its budget decit in 2009.

China found it necessary to increase its budget decit in 2009 for a number of reasons. One was

the downturn in economic activity which reduced tax revenue and raised government spending

automatic stabilisers. Other reasons included the Chinese governments attempt to stimulate economic

activity (discretionary scal policy), to cope with a drought and to improve medical care.

2 What are the consequences of successive budget decits for an economy?

Successive budget decits for an economy would increase government borrowing and build up

national debt.

Self-assessment task 5.13 (page 208)

1 How and why is Singapore an open economy?

Singapore is an open economy in the sense that it engages in international trade. Indeed, it is very

heavily involved in international trade with its net exports generating a high proportion of its

aggregate demand, usually around 40%.

2 Explain how Singapores real growth rate is susceptible to external events in the global economy.

As Singapore is such an open economy, its real growth rate is susceptible to external events in the

global economy. If other countries experience a recession, demand for Singapores exports will decline

as Singapore relies on export-led growth.

3 Discuss two factors which could increase another component of Singapores aggregate expenditure.

A cut in income tax and a cut in the rate of interest would both be likely to cause an increase in

consumption. A lower rate of income tax would increase consumers disposable income, enabling

them to spend more. A lower interest rate would tend to encourage spending as it would be cheaper to

borrow and less rewarding to save.

Self-assessment task 5.14 (page 212)

In an economy, mps is 0.1, mrt is 0.1 and mpm is 0.2. GDP is $300 billion. The government raises its spending

by $6 billion in a bid to close a deationary gap of $20 billion. Calculate:

a the value of the multiplier

The multiplier is:

1

1

=

0.1 + 0.1 + 0.2 0.4

= 2.5

b the increase in GDP

GDP will increase by $6 billion 2 = $15 billion.

c whether the injection of extra government spending is sufcient, too high or too low to close the

deationary gap.

The injection is not sufcient. It is too low, by $5 billion, to close the deationary gap.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

Self-assessment task 5.15 (page 212)

1 Calculate the value of the tourism multiplier for the Caribbean, Thailand and India.

The value of the tourism multiplier for the Caribbean is 1/0.8 = 1.25, for Thailand it is 1/0.7 = 1.43

and for India it is 1/0.4 = 2.5.

2 Explain the likely reasons for the differences in the values you have calculated.

The values are different because different proportions of the money spent by tourists leak out of the

economy. For instance, tourists may stay in foreign hotels and eat food brought in from outside the country.

3 Discuss how governments in developing economies might introduce policies to make international tourism

more benecial than seems to be the case.

There is a range of policies developing economies might introduce to make tourism more benecial.

These include setting up their own airlines, subsidising the building of holiday resorts in their

countries and running courses on travel and tourism in state run schools and universities.

Self-assessment task 5.16 (page 216)

A bank keeps a liquidity ratio of 5%. It receives additional cash deposits of $20 000. Calculate:

a the credit multiplier

The credit multiplier is 100/5 = 20.

b the potential increase in total liabilities (deposits)

The potential increase in total liabilities is 20 $20 000 = $400 000.

c the potential increase in bank lending.

The potential increase in bank lending is $400 000 $20 000 = $380 000.

Self-assessment task 5.17 (page 219)

1 Dene liquidity.

Liquidity is the ability to turn an asset into cash quickly without loss. The most liquid asset is

obviously cash.

2 Explain why ooding the markets with liquidity would be expected to keep interest rates low.

Increasing the money supply will raise the money balances households and rms hold. They will use

some of these extra balances to buy government bonds. The extra demand for government bonds will

raise their price and so push down the rate of interest.

3 Discuss the possible effect that the rise in Japanese corporate lending rates may have on investment.

The rise in Japanese corporate lending rates would be expected to reduce investment. Higher interest

rates will increase the opportunity cost of using retained prots to buy capital goods and would reduce

rms expectations of high consumer demand.

4 Explain why cutting interest rates can be as useless as pushing on a string .

Cutting interest rates can be as useless as pushing on a string as if entrepreneurs are

pessimistic about the future lowering interest rates will not encourage them to invest.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

Specimen exam questions (page 220)

1 a

Road building is often undertaken by the government rather than the private sector for a

number of reasons. These include the public nature of some roads, the large capital outlay often

needed, the signicant externalities that can be involved and the impact that road building can

have on a countrys macroeconomic objectives.

Roads which have many entry and exit points and which are relatively empty may be both

non-excludable and non-rival. An inability to exclude free riders may discourage private sector rms

from building and maintaining roads. In practice, however, some roads are operating privately using

tolls. It is also becoming easier to charge for the use of roads with advances in technology such as

smart cards which can be tted into cars to record when and where they are driven.

A more signicant reason in many countries for the involvement of the government in road

building is the high capital expenditure needed. Road building can be very expensive and the

private sector may lack the funds. A government may have larger funds and if it does not it may

be able to borrow from international organisations such as the World Bank.

Private sector rms also base their decisions just on private costs and benets. The

construction and use of roads can generate signicant externalities. Air, noise and visual pollution

may be created, there may be environmental damage and there may be an adverse effect on the

income of railways if they follow a similar route. On the other hand, roads can link communities

and can increase economic activity. A government can undertake a costbenet analysis to nd out

if the social benets arising from constructing the road exceed the social costs.

By building roads to productive rural areas, a government will make it easier and cheaper to

transport agricultural products from rural areas to the cities and capital equipment and other products

from the cities to the rural areas. As a result, incomes should rise in both the rural and urban areas.

A road development programme can have a major impact on an economy. The spending on

the programme will be an injection into the circular ow of income. National income will

increase by a multiple amount. The diagram below shows real GDP rising from Y to Y1.

LRAS

AD1

Price level

AD

P1

P

AD1

AD

Y1

Real GDP

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

If, for example, the government spends $10 billion on a road development programme and the

multiplier is 3, real GDP will rise by $30 billion.

People will be employed in the road building programme and the extra income generated will

create jobs for workers in other industries.

The lower transport costs which should arise from the road building programme should

increase the international competitiveness of the countrys products. This, in turn, should increase

the countrys exports. Higher exports will further increase aggregate demand and will reduce any

current account decit.

Lower transport costs will reduce prices or reduce the increase in prices of a wide range of

products. This will reduce inationary pressure.

Improved transport links may also encourage multinational companies to set up in the country.

These companies may create more jobs and contribute to the countrys employment, real GDP and

exports.

Of course, the impact of a road development programme will depend on a number of factors

including the size of the scheme, whether it is built in the most productive areas and how it is

nanced. A larger programme which links previously remote but highly productive rural areas to

urban areas, airports and docks will obviously have more of an impact than a small programme

which builds roads to places which already have reasonable transport links. If the money for the

programme is diverted from educational and health care programmes, the effect on the country

will be less benecial than if the money is extra spending. If the government has borrowed the

money from, for instance, the World Bank it may experience difculties repaying it unless it uses

wisely the extra tax revenue which the scheme should generate through raising real GDP.

2 a An increase in taxation may cause a multiple fall in national income. A rise in income tax, for

instance, would reduce disposable income and so peoples ability to spend. A rise in sales tax may also

reduce consumer expenditure. Lower spending would result in a multiple fall in aggregate demand.

The diagram below shows aggregate demand moving to the left from AD to AD1, causing real

GDP to fall from Y to Y1.

AS

AD

Price level

AD1

P

P1

AD

AD1

Y1

Real GDP

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

If corporation tax is raised, investment may decline which may reduce aggregate demand and

aggregate supply, which in turn would reduce real GDP as shown in the diagram below.

AS1

AD

AS

Price level

AD1

AD

AD1

0

Y1

Real GDP

A rise in tax rates, however, increase the marginal rate of tax which would reduce the size of the

multiplier. As a result, the fall in aggregate demand would be reduced.

Whilst a rise in taxes would be expected to reduce national income, this may not necessarily be

the case. If aggregate demand is rising beyond full employment, higher taxes may have more of an

impact on ination than on real national income.

The effect of higher taxes on national income also depends on how much taxes are increased

by, which taxes are increased, how consumers respond and what happens to the other components

of aggregate demand. A large rise in taxes will obviously have more of an impact than a small rise.

A rise in regressive taxes would be expected to have more of an impact on aggregate demand and

so on national income than a rise in progressive taxes. This is because the poor spend a higher

proportion of their disposable income. A relatively high proportion of the tax taken from the rich,

in contrast, may have been saved rather than spent. The impact of increasing indirect taxes on a

range of products will be inuenced by the price elasticity of demand for the products. Indeed, it is

possible that consumers may avoid paying extra tax by switching their purchases to other products

which have not experienced a rise in taxes. Higher taxes matched by an increase in government

spending may lead to a rise in national income. This will occur if the extra government spending

raises the disposable income of those who have a higher marginal propensity to consume than

those who pay the higher taxes.

b A fall in the level of national income might be expected to result in a decline in the standard of

living in the country as it indicates that there is a reduction in goods and services available, This,

however, may not be the case. If population has fallen by more than national income, there may

be more products available per person. It is also important to consider real national income. If the

general price level has fallen, national output of products may have increased despite a fall in

money national income. So it is important to assess real national income per head when assessing

living standards.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

Even if real national income per head falls, it does not necessarily mean that living standards

have fallen. Income may have become more evenly distributed. This may mean that whilst a

number of people may have experienced a fall in living standards, the majority of the population

may have enjoyed more goods and services. It is also possible that whilst the quantity of products

produced may have fallen, the quality of products may have improved or the composition of output

may have changed. For instance, if a country produces fewer weapons but more consumer products,

people may feel better off.

Ofcial real national income gures may also not accurately represent the total amount

produced in a country. Real national income may fall but if the size of the informal economy has

increased, the country may actually be producing more goods and services.

The standard of living in a country is also inuenced not only by the quantity of products

but also by a range of other factors. For example, living standards may rise if working conditions

improve and the number of hours worked decline. People may prefer to have safe working

conditions and more leisure time rather than more products. Improvements in environmental

conditions can also improve the quality of peoples lives. For example, the closure of chemical

plants may reduce real national income, but improve may the quality of peoples lives.

A number of composite measures of living standards recognise that living standards are

inuenced not only by national income but also by other factors. The Human Development Index

takes into account education, as measured by the adult literacy rate and school enrolment ratios,

and health care, as indicated by life expectancy as well as GDP per head. Cuba, for example, has

a lower GDP per head than Saudi Arabia but a higher HDI value. Cuba has a very high tertiary

enrolment rate with the country spending a high proportion of its GDP on education and its

people, on average, live longer than people in Saudi Arabia.

The Index of Sustainable Economic Welfare starts with GDP per head and then adjusts it to take

account of other factors that affect peoples quality of life. It considers that, for instance, inequality,

pollution and depletion of resources reduce welfare and so are given negative gures in the index.

In contrast, the value of domestically produced services such as childcare are thought to add to

welfare and so are given positive gures.

A fall in the level of national income may indicate a decline in the standard of living in the

country. This, however, is not always the case and to assess what is happening to living standards

in a country, other measures, which take into account more than income, may be examined.

Original material Cambridge University Press 2010

Theory and measurement in the macroeconomy

KEY TERMS

Denitions of key terms can be found in the glossary.

accelerator

active balances

aggregate demand

aggregate expenditure

aggregate supply

autonomous investment

average propensity to consume/

save

balanced budget

broad money

capital-output ratio

circular ow of income

closed economy

credit multiplier

deationary gap

dissaving

Gross Domestic Product (GDP)

GDP deator

Gross National Product (GNP)

idle balances

induced investment

inationary gap

injections

Keynesian approach

leakages

Original material Cambridge University Press 2010

liquidity preference

liquidity trap

loanable funds theory

marginal propensity to consume/

save

Monetarist approach

money supply

multiplier

narrow money (supply)

national income

Net Domestic Product (NDP)

Net National Product (NNP)

net property income from abroad

open economy

paradox of thrift

precautionary motive/demand for

money

saving

speculative motive/demand for

money

total currency ow

transactions motive/demand for

money

withdrawals

10

You might also like

- Economic Development Activity #1Document5 pagesEconomic Development Activity #1Jeraldine DejanNo ratings yet

- LO3-4 Chap4Document17 pagesLO3-4 Chap4Dương Thu HàNo ratings yet

- Chapter TwoDocument9 pagesChapter Twoyassin eshetuNo ratings yet

- Macro Unit 2 6EC02 Revision Notes 2011Document58 pagesMacro Unit 2 6EC02 Revision Notes 2011TheMagicCarpetNo ratings yet

- IGCSE Economics Self Assessment Chapter 25 AnswersDocument2 pagesIGCSE Economics Self Assessment Chapter 25 AnswersDesreNo ratings yet

- Solution Manual For Economics Principles For A Changing World 5th Edition Eric Chiang Full DownloadDocument5 pagesSolution Manual For Economics Principles For A Changing World 5th Edition Eric Chiang Full Downloadsarahgibbsixgtenodba100% (40)

- Macroeconomics Principles Applications and Tools 8th Edition Osullivan Solutions ManualDocument15 pagesMacroeconomics Principles Applications and Tools 8th Edition Osullivan Solutions Manualcharleshoansgb3y100% (32)

- Macroeconomics Principles Applications and Tools 8th Edition Osullivan Solutions Manual Full Chapter PDFDocument36 pagesMacroeconomics Principles Applications and Tools 8th Edition Osullivan Solutions Manual Full Chapter PDFStevenCookexjrp100% (10)

- A Lev Econ 01Document11 pagesA Lev Econ 01maailaaNo ratings yet

- Chapter 8 SolutionsDocument4 pagesChapter 8 SolutionsNikulNo ratings yet

- 7 Production GrowthDocument27 pages7 Production GrowthRuman MahmoodNo ratings yet

- How Reliable Are The Leading Indicators of GDPDocument2 pagesHow Reliable Are The Leading Indicators of GDPVishal JoshiNo ratings yet

- 7 Production GrowthDocument27 pages7 Production GrowthFARHAN KAMALNo ratings yet

- Indicators of Successful EconomyDocument9 pagesIndicators of Successful EconomyAli Zafar0% (1)

- Overview of Developing CountriesDocument44 pagesOverview of Developing CountriesresourcesficNo ratings yet

- Mini Exam 3Document17 pagesMini Exam 3course101No ratings yet

- Answer Tutorial MacroeconomicsDocument6 pagesAnswer Tutorial MacroeconomicsAinaasyahirah RosidanNo ratings yet

- CH # 7 Human Resources and Economic Development P IIDocument36 pagesCH # 7 Human Resources and Economic Development P II097 - Kashif MustafaNo ratings yet

- GDP and PPPDocument24 pagesGDP and PPPrahul negiNo ratings yet

- Economics 1st Edition Acemoglu Solutions ManualDocument16 pagesEconomics 1st Edition Acemoglu Solutions ManualKimCoffeyjndf100% (33)

- Chapter 9BDocument30 pagesChapter 9BMandarin English CentreNo ratings yet

- Figure 2.3 Relationships Between Latitude and Income Per CapitaDocument6 pagesFigure 2.3 Relationships Between Latitude and Income Per CapitaMuhammad IbadNo ratings yet

- Problem Set 01-QuestionsDocument9 pagesProblem Set 01-QuestionsYI CHENNo ratings yet

- Readers Question: What Is The Difference Between Growth and Development? Can A Country Experience Economic Growth Without Development?Document5 pagesReaders Question: What Is The Difference Between Growth and Development? Can A Country Experience Economic Growth Without Development?abdulNo ratings yet

- Topic 5 - Our EconomyDocument83 pagesTopic 5 - Our EconomyDK01No ratings yet

- D.B (Econ) U-1,2 J DV (C)Document10 pagesD.B (Econ) U-1,2 J DV (C)Satakshi NandyNo ratings yet

- B) National Income StatisticsDocument4 pagesB) National Income StatisticsNaveed WattoNo ratings yet

- CSQ Question 1: 2017 H2 Economics Preliminary Exams Paper 1 - Suggested AnswersDocument7 pagesCSQ Question 1: 2017 H2 Economics Preliminary Exams Paper 1 - Suggested AnswersRonald McdonaldNo ratings yet

- Tutorial 3 - Production and GrowthDocument2 pagesTutorial 3 - Production and GrowthQuý DioNo ratings yet

- Rineesh Uog - Essay Project - EditedDocument9 pagesRineesh Uog - Essay Project - EditedJiya BajajNo ratings yet

- Macroeconomics: by Michael J. Buckle, PHD, James Seaton, PHD, and Stephen Thomas, PHDDocument24 pagesMacroeconomics: by Michael J. Buckle, PHD, James Seaton, PHD, and Stephen Thomas, PHDDouglas ZimunyaNo ratings yet

- Section Nine Factors That Determine A Country's Standard of LivingDocument9 pagesSection Nine Factors That Determine A Country's Standard of LivingMattew HydenNo ratings yet

- Macroeconomics QuestionsDocument3 pagesMacroeconomics Questionsdongxuan0120No ratings yet

- Difference Between Economic Growth and DevelopmentssDocument5 pagesDifference Between Economic Growth and DevelopmentssabdulNo ratings yet

- Problem Set 1Document7 pagesProblem Set 1Adela Casanovas RevillaNo ratings yet

- Aggregate Incomes: QuestionsDocument17 pagesAggregate Incomes: QuestionsZulham IdahNo ratings yet

- Chapter 4 MacroeconomicsDocument11 pagesChapter 4 MacroeconomicsEveNo ratings yet

- Readers Question: What Is The Difference Between Growth and Development? Can A Country Experience Economic Growth Without Development?Document4 pagesReaders Question: What Is The Difference Between Growth and Development? Can A Country Experience Economic Growth Without Development?abdulNo ratings yet

- Unit 2: Macroeconomic Performance and PolicyDocument22 pagesUnit 2: Macroeconomic Performance and PolicysnapNo ratings yet

- A2 Data Response 3Document3 pagesA2 Data Response 3SylvainNo ratings yet

- What Is GDP Per CapitaDocument9 pagesWhat Is GDP Per CapitaAnthonySilvaNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsCeren Gökçe KeskinNo ratings yet

- Problems Related To National inDocument3 pagesProblems Related To National inelysia lyNo ratings yet

- Math Project1Document3 pagesMath Project1api-256890869No ratings yet

- GDP and WelfareDocument23 pagesGDP and WelfareAshish SinghNo ratings yet

- Final Econ e PortfolioDocument7 pagesFinal Econ e Portfolioapi-317164511No ratings yet

- Macro Final Exams 2021Document11 pagesMacro Final Exams 2021Quỳnh Trang NguyễnNo ratings yet

- Libres Bsce 2-c Module4Document10 pagesLibres Bsce 2-c Module4Abegail Marie LibresNo ratings yet

- Study Guide Dev - Econ MohanDocument100 pagesStudy Guide Dev - Econ MohanMinh TranNo ratings yet

- Macroeconomics Canada in The Global Environment 10th Edition Parkin Solutions ManualDocument11 pagesMacroeconomics Canada in The Global Environment 10th Edition Parkin Solutions Manualdrusilladaisyvlz9a100% (13)

- Macroeconomics Canada in The Global Environment 10th Edition Parkin Solutions Manual Full Chapter PDFDocument32 pagesMacroeconomics Canada in The Global Environment 10th Edition Parkin Solutions Manual Full Chapter PDFdenmelioraqfj100% (13)

- CH 1 - Hillman - Prof. Levitchi - Sept 18thDocument25 pagesCH 1 - Hillman - Prof. Levitchi - Sept 18thLora LevitchiNo ratings yet

- Background Paper SMM MDGsDocument21 pagesBackground Paper SMM MDGsUnic JakartaNo ratings yet

- End of Chapter 2 List of ContentsDocument8 pagesEnd of Chapter 2 List of ContentsChaudhry Muhammad RazaNo ratings yet

- Name Class Assignment DateDocument6 pagesName Class Assignment Datehyna_khanNo ratings yet

- MC Exercise (Part 1)Document6 pagesMC Exercise (Part 1)xdivanxd100% (1)

- Economic Growth NotesDocument7 pagesEconomic Growth Notestatyanna weaverNo ratings yet

- Homework 3Document5 pagesHomework 3CHUA JO ENNo ratings yet

- Taxation Assignment Final DraftDocument4 pagesTaxation Assignment Final DraftMukhtaar Cabdala AadanNo ratings yet

- Milion - ProposalDocument34 pagesMilion - Proposalzelalem adaneNo ratings yet

- Punjab Skills Sector Plan 2018Document50 pagesPunjab Skills Sector Plan 2018arjmandquestNo ratings yet

- HL Master Prospectus 2017 FinalDocument173 pagesHL Master Prospectus 2017 FinalhlamycomNo ratings yet

- Causes ConsequencesDocument2 pagesCauses ConsequencesShrikant SadulNo ratings yet

- Oil and Gas IndustryDocument5 pagesOil and Gas Industryaravindan_arrNo ratings yet

- Aurangabad Development PlanDocument218 pagesAurangabad Development PlanNikhil Surekha Sudhir Bhalerao90% (21)

- BofA - The EEMEA FX Strategist Higher Oil More EEMEA FX Weakness - 20230926Document19 pagesBofA - The EEMEA FX Strategist Higher Oil More EEMEA FX Weakness - 20230926Sofia Franco100% (1)

- Is The Budgeting Exercise of Any Use - Group DiscussionDocument7 pagesIs The Budgeting Exercise of Any Use - Group DiscussionRajeev KumarNo ratings yet

- Wang, Vanhaverbeke, Roijakkers. Exploring The Impact of Open Innovation On National Systems of Innovation - A Theoretical Analysis. 2012Document10 pagesWang, Vanhaverbeke, Roijakkers. Exploring The Impact of Open Innovation On National Systems of Innovation - A Theoretical Analysis. 2012VítorMacedoNo ratings yet

- UOB Economic PlaybookDocument16 pagesUOB Economic PlaybookMas WarisNo ratings yet

- Prospects of Renewable Energy Sources The Case Stu PDFDocument8 pagesProspects of Renewable Energy Sources The Case Stu PDFnaveen AnanthNo ratings yet

- Solow Model IntroductionDocument3 pagesSolow Model IntroductionAsaf AbramovichNo ratings yet

- Micro Small and Medium Enterprises in India Trends and ChallengesDocument15 pagesMicro Small and Medium Enterprises in India Trends and ChallengesBHARATHITHASAN S 20PHD0413No ratings yet

- 4 Economic Planning in PakistanDocument3 pages4 Economic Planning in PakistanMushtaq AnjumNo ratings yet

- Policy Narratives On Food and Nutrition SecurityDocument13 pagesPolicy Narratives On Food and Nutrition SecurityInstitute of Policy StudiesNo ratings yet

- MT (T) MaterialDocument305 pagesMT (T) MaterialVenkiDonNo ratings yet

- Kerala Niyamasabha Economic Review 2019Document584 pagesKerala Niyamasabha Economic Review 2019Mirash Moossa ValiyakathNo ratings yet

- SageOne Investor Memo May 2018Document10 pagesSageOne Investor Memo May 2018Akhil ParekhNo ratings yet

- Leading Through The Fourth Industrial Revolution: Putting People at The CentreDocument25 pagesLeading Through The Fourth Industrial Revolution: Putting People at The CentreMargareta KusumaningrumNo ratings yet

- Annual Report 2016-17Document120 pagesAnnual Report 2016-17Amandeep SinghNo ratings yet

- 1 Pakistan Renewable EnergyDocument21 pages1 Pakistan Renewable EnergyIram ShafiqNo ratings yet

- Final BPNG Strategic Plan 2016 2020Document20 pagesFinal BPNG Strategic Plan 2016 2020alfred jambiakweNo ratings yet

- Sustainable Housing Finance in Ghana 2Document14 pagesSustainable Housing Finance in Ghana 2Opensource projextsNo ratings yet

- 111 Struct1Document8 pages111 Struct1Tamar LaliashviliNo ratings yet

- Impact of Life Assurance On Poverty Alleviation in Kwara StateDocument62 pagesImpact of Life Assurance On Poverty Alleviation in Kwara StateDaniel ObasiNo ratings yet

- Growth and Trade: Multiple Choice QuestionsDocument20 pagesGrowth and Trade: Multiple Choice QuestionsMian NomiNo ratings yet

- South Africa Construction IndustryDocument13 pagesSouth Africa Construction IndustryShakeel AhmadNo ratings yet

- FMCGDocument39 pagesFMCGANKITA NAIRNo ratings yet

- Matthew P. Drennan-Income Inequality - Why It Matters and Why Most Economists Didn't Notice-Yale University Press (2015) PDFDocument168 pagesMatthew P. Drennan-Income Inequality - Why It Matters and Why Most Economists Didn't Notice-Yale University Press (2015) PDFvikas_psyNo ratings yet

- Bamboo White PaperDocument56 pagesBamboo White PaperAnonymous nTDFZGgCkVNo ratings yet