Professional Documents

Culture Documents

New York State Comptroller's Office Report On Sales Tax Collection

Uploaded by

Ryan DeffenbaughOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New York State Comptroller's Office Report On Sales Tax Collection

Uploaded by

Ryan DeffenbaughCopyright:

Available Formats

Local Government Snapshot

N E W YO R K S TAT E O F F I C E O F T H E S TAT E CO M P T R O L L E R

Thomas P. DiNapoli State Comptroller

February 2015

Local Sales Tax Collection Growth Slows to 3 Percent in 2014;

Slowest Growth Since 2009

Statewide Trends

Total local sales tax collections in New York State grew by $439 million, or 3.0 percent, from 2013 to 2014.1

This was less than the 2012 to 2013 growth of 5.2 percent, and the slowest annual growth since the end of

the 2008-09 recession.

About 69 percent of the dollar growth in local

sales tax collections took place in New York

City. The Citys sales tax collections grew by

$304 million, or 4.8 percent from 2013 to 2014.

Although this was less than the 6.8 percent

growth seen in 2013, it continued the pattern of

strong sales tax performance in the City since

the end of the recession.

The increase in county sales tax collections,

excluding all cities, was 1.3 percent from 2013

to 2014 significantly lower than the 3.8 percent

growth experienced from 2012 to 2013.

Percentage Change in Total Local Sales Tax Collections

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

9.9%

5.2%

Average Annual

Increase

1999 to 2014:

4.2%

3.0%

Recessions

-6.0%

Source: Department of Taxation and Finance; additional calculations by the Office of the State

Comptroller. Numbers not adjusted for tax rate or tax law changes. Includes New York City.

Importance of Local Sales Tax Revenue

The sales tax is a major revenue source for New

York City and the 57 counties outside of the

City, which collectively receive 92 percent of all

local sales tax collections.2

Sales tax made up 33.2 percent of county

revenues in 2013, the largest single county

revenue source.3 Almost one-quarter of these

sales tax revenues were distributed by the

counties to other local governments, including

cities, towns, villages and school districts.

County Revenue Mix, FY 2013

Other Local

Revenues

21.0%

Property Tax

24.0%

Sales Tax

Distributions

7.5%

State and

Federal Aid

21.8%

Sales Tax for

County Purposes

25.7%

Total Sales Tax: 33.2%

Source: Office of the State Comptroller. Excludes New York City.

Division of Local Government and School Accountability

Local Government Snapshot

Total Local Sales Tax Collections Regional Trends

In the Long Island region, sales tax collections

declined by 1.4 percent from 2013 to 2014. This

was due in part to the wind-down of the rebuilding

efforts that followed Superstorm Sandy in late

2012. Storm-related spending pushed Long

Island sales taxes to grow by 6.9 percent in 2013,

and the 2014 decline may largely reflect a return

to more normal long-term collection levels.

Change in Local Sales Tax Collections by Region, 2013 to 2014

Year-Over-Year Change

The strongest 2014 sales tax performance was

in the North Country, where collections grew

7.7 percent.4 Much of this improvement can be

explained by increases in sales tax rates in three

North Country counties that took effect in late

2013, but were in place for all of 2014. Essex

and Lewis counties increased their tax rates from

3.75 percent to 4 percent, while the St. Lawrence

County rate increased from 3 to 4 percent.5

10%

7.7%

8%

6%

4%

2%

3.5%

4.8%

2.6%

0.9%

3.0%

2.1%

3.0%

1.9%

0%

-2%

-1.4%

Capital Central Finger Mohawk North Southern Western Long

Mid-

New

District

NY

Lakes Valley Country Tier

NY

Island Hudson York

City

Upstate

Downstate

Source: New York State Department of Taxation and Finance; additional calculations by

the Office of the State Comptroller. Numbers not adjusted for tax rate or tax law changes.

Includes city and county general sales taxes.

Total Local Sales Tax Collections Quarterly Trends

Change in Local Sales Tax Collections by Quarter, 2013 to 2014

Year-Over-Year Change

Local sales tax collections grew by just 1.2

percent in the first quarter of 2014 over the first

quarter of 2013. While some of this weak growth

may be due to reduced spending as post storm

rebuilding entered its second year, slow growth

was considerably more widespread than the

effects of the storm and reflect a slowdown in the

national economy in that quarter (GDP declining

by 2.1 percent). In the second, third and fourth

quarters sales tax growth improved to 3.5 and

3.6 percent. This was still slower, however, than

the 15-year sales tax trend of 4.2 percent yearover-year growth.

4%

3.5%

3.5%

2nd Quarter

3rd Quarter

3.6%

3%

2%

1%

0%

1.2%

1st Quarter

4th Quarter

Source: Department of Taxation and Finance; additional calculation by the Office of

the State Comptroller. Numbers not adjusted for tax rate or tax law changes.

N e w Yo r k S t a t e O f f i c e o f t h e S t a t e C o m p t r o l l e r

Local Government Snapshot

County Sales Tax County-by-County Trends

Sales tax collections grew in 52 of the 57 counties outside of New York City from 2013 to 2014. The strongest

growth was in St. Lawrence County, where an increase in the sales tax rate from 3 to 4 percent helped spur

a 30 percent jump in collections. Hamilton County also increased its sales tax rate from 3 to 4 percent and

derived 25.7 percent growth. Lewis County saw 12.9 percent growth, helped by a 0.25 percent increase in its

sales tax rate. However, while Essex County also increased its rate by 0.25 percent, it only experienced a 6.2

percent increase in collections.

Only five counties experienced

a decline in their sales tax

collections from 2013 to 2014.

The sharpest decline was in

Nassau County (4.3 percent),

which was the center for

the effects of Superstorm

Sandy. The other counties

with collection declines were

Clinton (0.2 percent), Genesee

(0.2 percent), Oneida (0.1

percent) and Seneca (1.4

percent). Although some of

these declines were due to

technical adjustments by the

Department of Taxation and

Finance to these counties

sales tax distributions, much of

the slowdown was the result of

weaker retail sales.

Change in Sales Tax Collections from 2013 to 2014

Clinton

Franklin

St. Lawrence

Essex

Jefferson

Lewis

Hamilton

Warren

Oswego

Niagara

Orleans

Monroe

Genesee

Erie

Madison

Allegany

Rensselaer

Otsego

Cortland

Schuyler

Cattaraugus

Montgomery

Schenectady

Seneca Cayuga

Tompkins

Schoharie

Chenango

Steuben

Chemung

Tioga

Saratoga

Fulton

Herkimer

Onondaga

Ontario

Wyoming Livingston

Yates

Chautauqua

Washington

Oneida

Wayne

Broome

Delaware

Counties selection

Percentage Change

Decline

Increase less than 3 percent

Albany

Greene

Columbia

Ulster

Dutchess

Sullivan

Orange

Putnam

RocklandWestchester

Increase between 3 and 6 percent

Increase between 6 and 12 percent

Suffolk

New York City

Nassau

Increase more than 12 percent

Sales tax collections data from New York State Department of Taxation and Finance. Local sales taxes are those imposed for entities other than

the State.

The remaining 8 percent of local sales tax collections are distributed to other cities, certain school districts, the Metropolitan Transportation

Authority (MTA) and other designated entities.

3

4

County revenue data is from the Office of the State Comptroller. 2013 is the latest year for which revenue data is available.

Regional sales tax collections include counties and cities with a general sales tax, but exclude cities with a segmented sales tax, school districts,

the MTA and other entities.

The local rate is combined with the State rate of 4 percent to determine the overall sales tax rate for each jurisdiction.

N e w Yo r k S t a t e O f f i c e o f t h e S t a t e C o m p t r o l l e r

New York State Office of the State Comptroller

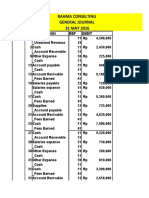

Local Sales Tax Collection Growth Slows to 3 Percent in 2014; Slowest

Growth Since 2009

Local Sales Tax Collections, 2013 to 2014

Albany

Allegany

Broome

Cattaraugus

Cayuga

Chautauqua

Chemung

Chenango

Clinton

Columbia

Cortland

Delaware

Dutchess

Erie

Essex

Franklin

Fulton

Genesee

Greene

Hamilton

Herkimer

Jefferson

Lewis

Livingston

Madison

Monroe

Montgomery

Nassau

Niagara

Oneida

Onondaga

Ontario

Orange

Orleans

Oswego

Otsego

Putnam

Rensselaer

Rockland

St. Lawrence

Saratoga

Schenectady

Schoharie

Schuyler

Seneca

Steuben

Suffolk

Sullivan

Tioga

Tompkins

Ulster

Warren

Washington

Wayne

Westchester

Wyoming

Yates

TOTAL COUNTY

2013

240,696,427

19,354,675

121,604,076

35,132,942

33,450,332

53,123,275

56,691,648

20,452,167

53,354,709

33,657,153

27,650,025

20,533,333

165,945,207

712,618,696

26,147,472

20,816,772

18,568,805

38,057,036

28,604,034

2,758,195

29,400,199

71,365,541

10,469,928

30,229,388

25,077,929

447,108,869

28,183,071

1,138,834,701

116,574,969

132,038,731

328,081,365

76,934,789

258,819,005

14,819,905

41,125,357

34,691,684

53,367,340

76,815,961

185,633,703

43,455,544

107,712,970

90,715,706

14,209,992

9,618,470

23,243,814

44,993,631

1,281,871,707

33,787,235

19,227,173

47,395,629

103,274,569

48,836,237

19,352,213

40,602,658

488,045,565

16,831,191

10,609,617

7,272,573,335

2014

251,043,069

19,938,424

121,885,268

36,324,141

34,969,534

54,739,518

58,839,279

20,964,900

53,253,846

35,690,081

28,933,985

21,656,372

174,154,357

724,858,170

27,758,244

21,794,349

19,329,489

37,994,929

28,941,513

3,466,570

30,017,997

71,951,035

11,824,281

31,128,489

25,653,812

449,842,017

29,173,148

1,089,890,346

118,345,190

131,930,956

335,533,340

78,452,837

260,772,530

15,703,363

41,724,500

35,796,293

55,885,996

78,940,487

194,634,392

56,476,979

110,791,247

94,275,742

14,974,531

10,106,417

22,914,096

47,009,909

1,298,023,398

35,846,930

20,244,765

49,648,449

103,489,188

49,404,038

19,689,092

41,230,933

503,802,272

16,853,447

10,925,943

7,369,444,422

2013-2014

Percent Change

4.3%

3.0%

0.2%

3.4%

4.5%

3.0%

3.8%

2.5%

-0.2%

6.0%

4.6%

5.5%

4.9%

1.7%

6.2%

4.7%

4.1%

-0.2%

1.2%

25.7%

2.1%

0.8%

12.9%

3.0%

2.3%

0.6%

3.5%

-4.3%

1.5%

-0.1%

2.3%

2.0%

0.8%

6.0%

1.5%

3.2%

4.7%

2.8%

4.8%

30.0%

2.9%

3.9%

5.4%

5.1%

-1.4%

4.5%

1.3%

6.1%

5.3%

4.8%

0.2%

1.2%

1.7%

1.5%

3.2%

0.1%

3.0%

1.3%

New York City

Other Local

6,349,043,149

1,244,139,445

6,652,693,276

1,283,042,562

4.8%

3.1%

TOTAL LOCAL

14,865,755,930

15,305,180,260

3.0%

Source: New York State Department of Taxation and Finance

County totals include only county collections. Other Local includes collections for school

districts, Metropolitan Commuter Transportation Districts, and pre-empting cities.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- T3-Sample Answers-Consideration PDFDocument10 pagesT3-Sample Answers-Consideration PDF--bolabolaNo ratings yet

- Inside Job Movie ReviewDocument4 pagesInside Job Movie ReviewThomas Cornelius AfableNo ratings yet

- Tugas P2-1A Dan P2-2A Peng - AkuntansiDocument5 pagesTugas P2-1A Dan P2-2A Peng - AkuntansiAlche MistNo ratings yet

- Landfill ReportDocument6 pagesLandfill ReportRyan DeffenbaughNo ratings yet

- Southern Cayuga ResponseDocument1 pageSouthern Cayuga ResponseRyan DeffenbaughNo ratings yet

- Town of Elbridge Resolution - Auburn Transmission ProjectDocument1 pageTown of Elbridge Resolution - Auburn Transmission ProjectRyan DeffenbaughNo ratings yet

- NYSEG's FilingDocument20 pagesNYSEG's FilingJeffrey SteinNo ratings yet

- Emerson Park Master Plan 2015 DraftDocument93 pagesEmerson Park Master Plan 2015 DraftRyan DeffenbaughNo ratings yet

- Nucor Steel To PSC Feb. 2014Document2 pagesNucor Steel To PSC Feb. 2014Ryan DeffenbaughNo ratings yet

- Cayuga Nation Halftown Appeal - Feb. 20Document46 pagesCayuga Nation Halftown Appeal - Feb. 20Ryan DeffenbaughNo ratings yet

- Letter From The National Coalition Against Racism in Sports and Media To The Southern Cayuga Central School DistrictDocument5 pagesLetter From The National Coalition Against Racism in Sports and Media To The Southern Cayuga Central School DistrictRyan DeffenbaughNo ratings yet

- BIA Cayuga Nation Decision 2/20Document9 pagesBIA Cayuga Nation Decision 2/20Ryan DeffenbaughNo ratings yet

- Power Plant's FilingDocument50 pagesPower Plant's FilingJeffrey SteinNo ratings yet

- NY Sen. Michael Nozzolio Auburn TransmissionDocument10 pagesNY Sen. Michael Nozzolio Auburn TransmissionRyan DeffenbaughNo ratings yet

- NYS Sen. John DeFrancisco Auburn TransmissionDocument3 pagesNYS Sen. John DeFrancisco Auburn TransmissionRyan DeffenbaughNo ratings yet

- Brutus NysegDocument2 pagesBrutus NysegRyan DeffenbaughNo ratings yet

- Scott and Dana EstelleDocument5 pagesScott and Dana EstelleRyan DeffenbaughNo ratings yet

- New York State Farm Bureau LetterDocument3 pagesNew York State Farm Bureau LetterRyan DeffenbaughNo ratings yet

- Localsalestaxcollectionstable0215 PDFDocument1 pageLocalsalestaxcollectionstable0215 PDFRyan DeffenbaughNo ratings yet

- Brutus NysegDocument2 pagesBrutus NysegRyan DeffenbaughNo ratings yet

- 2015 Cayuga County Economic Forecast PresentationDocument20 pages2015 Cayuga County Economic Forecast PresentationRyan DeffenbaughNo ratings yet

- Localsalestaxcollections0215 PDFDocument3 pagesLocalsalestaxcollections0215 PDFjspectorNo ratings yet

- 2015 NYSAC Legislative PrioritiesDocument2 pages2015 NYSAC Legislative PrioritiesRyan DeffenbaughNo ratings yet

- Cayuga County 2015 Adopted BudgetDocument259 pagesCayuga County 2015 Adopted BudgetRyan DeffenbaughNo ratings yet

- Spouses Aggabao V. Parulan, Jr. and Parulan G.R. No. 165803, (September 1, 2010) Doctrine (S)Document9 pagesSpouses Aggabao V. Parulan, Jr. and Parulan G.R. No. 165803, (September 1, 2010) Doctrine (S)RJNo ratings yet

- Laporan Keuangan PT Duta Intidaya TBK (Watsons) Tahun 2018Document49 pagesLaporan Keuangan PT Duta Intidaya TBK (Watsons) Tahun 2018rahmaNo ratings yet

- Duty Free v1Document76 pagesDuty Free v1Vasu SrinivasNo ratings yet

- 95085951Document50 pages95085951ANKITA LUTHRA EPGDIB 2018-20No ratings yet

- Abaya vs. EbdaneDocument30 pagesAbaya vs. Ebdanealexandra recimoNo ratings yet

- FS FactoringDocument17 pagesFS FactoringJai DeepNo ratings yet

- Total For Reimbursements: Transportation Reimbursements Date Transpo To BITSI March 23 To May 5, 2022Document4 pagesTotal For Reimbursements: Transportation Reimbursements Date Transpo To BITSI March 23 To May 5, 2022IANNo ratings yet

- Fabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Document19 pagesFabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Janna Gunio0% (1)

- Dianne FeinsteinDocument5 pagesDianne Feinsteinapi-311780148No ratings yet

- Federal ReserveDocument21 pagesFederal ReserveMsKhan0078No ratings yet

- Financial Analysis - Marketing - Circa Lynnwood 100% (2023 - 10 - 31 10 - 38 - 56 UTC)Document13 pagesFinancial Analysis - Marketing - Circa Lynnwood 100% (2023 - 10 - 31 10 - 38 - 56 UTC)SiyabongaNo ratings yet

- Unit 3Document23 pagesUnit 3Nigussie BerhanuNo ratings yet

- Role of Derivatives in Economic Growth and DevelopmentDocument22 pagesRole of Derivatives in Economic Growth and DevelopmentKanika AnejaNo ratings yet

- Income Declaration FormDocument1 pageIncome Declaration Formavi_3107No ratings yet

- Principle of Halal PurchasingDocument13 pagesPrinciple of Halal Purchasing680105100% (1)

- 1532407706ceb Long Term Generation Expansion Plan 2018-2037 PDFDocument230 pages1532407706ceb Long Term Generation Expansion Plan 2018-2037 PDFTirantha BandaraNo ratings yet

- LIC Jeevan Anand Plan PPT Nitin 359Document11 pagesLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeNo ratings yet

- DeudaPublica BalanzaPagosDocument21 pagesDeudaPublica BalanzaPagosMartin VallejosNo ratings yet

- MilmaDocument50 pagesMilmaPhilip G Geoji50% (2)

- FBL Annual Report 2019Document130 pagesFBL Annual Report 2019Fuaad DodooNo ratings yet

- IDirect Zomato IPOReviewDocument13 pagesIDirect Zomato IPOReviewSnehashree SahooNo ratings yet

- Rahma ConsutingDocument6 pagesRahma ConsutingEko Firdausta TariganNo ratings yet

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420No ratings yet

- Chapter 6Document17 pagesChapter 6MM M83% (6)

- Low Cost Housing Options for Bhutanese RefugeesDocument21 pagesLow Cost Housing Options for Bhutanese RefugeesBala ChandarNo ratings yet

- DataQuick® Signed Purchase Agreement To Acquire Wells Fargo's ATI Title Companies, Dba Rels Title (Wells Fargo's Entity Oversight FFIEC - GOV and ATI and RELS TITLE SERVICES LLCDocument12 pagesDataQuick® Signed Purchase Agreement To Acquire Wells Fargo's ATI Title Companies, Dba Rels Title (Wells Fargo's Entity Oversight FFIEC - GOV and ATI and RELS TITLE SERVICES LLCMaryEllenCochraneNo ratings yet

- P4 Taxation New Suggested CA Inter May 18Document27 pagesP4 Taxation New Suggested CA Inter May 18Durgadevi BaskaranNo ratings yet