Professional Documents

Culture Documents

BDO: Statement of Condition

Uploaded by

BusinessWorldOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BDO: Statement of Condition

Uploaded by

BusinessWorldCopyright:

Available Formats

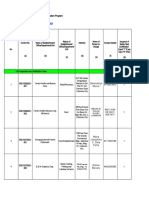

BDO UNIBANK, INC.

As of December 31, 2014

BALANCE SHEET

CONSOLIDATED BALANCE SHEET

(Head Office and Branches)

(Bank and Financial Subsidiaries)

AMOUNT

Current Quarter

Previous Quarter

ASSETS

AMOUNT

Current Quarter

Previous Quarter

ASSETS

Cash and Cash Items

P

44,642,979,015.56 P

24,224,983,569.08

Due from Bangko Sentral ng Pilipinas

258,411,694,664.76

249,435,658,996.32

Due from Other Banks

43,098,466,998.13

43,164,358,978.73

Financial Assets at Fair Value through Profit or Loss

5,059,631,346.45

4,411,489,305.63

Available-for-Sale Financial Assets-Net

187,716,920,814.23

168,689,538,850.43

Held-to-Maturity Financial Assets-Net

0.00

0.00

Unquoted Debt Securities Classified as Loans-Net

6,492,035,700.18

7,807,669,709.26

Investments in Non-Marketable Equity Security-Net

319,535,179.88

302,351,001.30

Loans and Receivables-Net

1,102,460,638,106.85

1,160,435,162,986.35

Loans to Bangko Sentral ng Pilipinas

0.00

0.00

Interbank Loans Receivable

39,212,951,216.98

28,204,321,712.48

Loans and Receivables-Others

991,293,559,045.48

1,048,830,749,614.32

Loans and Receivables Arising from RA/CA/PR/SLB

86,054,000,000.00

96,061,000,000.00

General Loan Loss Provision

13,662,537,844.95

13,098,242,651.11

Other Financial Assets

8,649,356,957.65

9,340,104,108.16

Equity Investment in Subsidiaries, Associates and Joint Ventures-Net

23,765,101,199.90

23,125,142,708.81

Bank Premises, Furniture, Fixtures and Equipment-Net

22,425,972,180.99

19,300,684,003.71

Real and Other Properties Acquired-Net

6,388,697,653.28

6,821,359,968.09

Non-Current Assets Held for Sale

781,745,943.62

376,548,572.19

Other Assets-Net

43,892,221,363.72

43,700,670,170.32

Net Due from Head Office/Branches/Agencies, if any (Philippine branch of a foreign bank)

0.00

0.00

P 1,812,863,626,079.19 P 1,702,377,093,974.39

TOTAL ASSETS

P

Cash and Cash Items

24,331,822,892.96

44,747,198,670.48 P

Due from Bangko Sentral ng Pilipinas

269,536,139,817.61

263,049,163,095.79

Due from Other Banks

45,909,910,571.66

46,813,957,710.19

Financial Assets at Fair Value through Profit or Loss

7,756,425,876.50

7,848,781,508.85

Available-for-Sale Financial Assets-Net

209,888,832,263.59

184,247,855,987.59

Held-to-Maturity Financial Assets-Net

0.00

0.00

Unquoted Debt Securities Classified as Loans-Net

7,807,669,709.26

6,492,035,700.18

Investments in Non-Marketable Equity Security-Net

332,201,874.88

315,017,696.30

Loans and Receivables-Net

1,182,503,323,567.90

1,129,806,818,530.28

Loans to Bangko Sentral ng Pilipinas

0.00

0.00

Interbank Loans Receivable

39,212,951,216.98

28,204,321,712.48

Loans and Receivables-Others

1,071,261,873,509.41

1,013,732,822,383.59

Loans and Receivables Arising from RA/CA/PR/SLB

101,303,000,000.00

86,054,000,000.00

General Loan Loss Provision

14,025,501,158.49

13,433,325,565.79

Other Financial Assets

10,646,184,181.22

9,558,159,308.23

Equity Investment in Subsidiaries, Associates and Joint Ventures-Net

5,562,920,954.63

5,761,156,183.83

Bank Premises, Furniture, Fixtures and Equipment-Net

24,575,940,923.82

21,180,111,699.13

Real and Other Properties Acquired-Net

7,122,632,904.98

6,495,886,221.70

Non-Current Assets Held for Sale

388,131,328.11

1,004,430,362.98

Other Assets-Net

57,600,537,210.96

55,773,999,998.53

Net Due from Head Office/Branches/Agencies, if any (Philippine branch of a foreign bank)

0.00

0.00

P 1,873,353,006,708.07 P 1,763,704,240,044.07

TOTAL ASSETS

LIABILITIES

Financial Liabilities at Fair Value through Profit or Loss

Deposit Liabilities

Due to Other Banks

Bills Payable

a) BSP (Rediscounting and Other Advances)

b) Interbank Loans Payable

c) Other Deposit Substitutes

d) Others

Bonds Payable-Net

Unsecured Subordinated Debt-Net

Redeemable Preferred Shares

Special Time Deposit

Due to Bangko Sentral ng Pilipinas

Other Financial Liabilities

Other Liabilities

Net Due to Head Office/Branches/Agencies (Philippine branch of a foreign bank)

LIABILITIES

Financial Liabilities at Fair Value through Profit or Loss

Deposit Liabilities

Due to Other Banks

Bills Payable

a) BSP (Rediscounting and Other Advances)

b) Interbank Loans Payable

c) Other Deposit Substitutes

d) Others

Bonds Payable-Net

Unsecured Subordinated Debt-Net

Redeemable Preferred Shares

Special Time Deposit

Due to Bangko Sentral ng Pilipinas

Other Financial Liabilities

Other Liabilities

Net Due to Head Office/Branches/Agencies (Philippine branch of a foreign bank)

TOTAL LIABILITIES

Capital Stock

Other Capital Accounts

Retained Earnings

Assigned Capital

STOCKHOLDERS' EQUITY

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

CONTINGENT ACCOUNTS

Guarantees Issued

Financial Standby Letters of Credit

Performance Standby Letters of Credit

Commercial Letters of Credit

Trade Related Guarantees

Commitments

Spot Foreign Exchange Contracts

Securities Held Under Custodianship by Bank Proper

Trust Department Accounts

a) Trust and Other Fiduciary Accounts

b) Agency Accounts

c) Advisory/Consultancy

Derivatives

Others

TOTAL CONTINGENT ACCOUNTS

600,977,139.95

2,592,265,685.74

1,462,686,977,720.64

1,392,244,927,775.77

634,386.41

635,790.31

57,901,314,153.35

42,352,328,529.85

50,551,488.00

21,540,000.00

21,331,440,000.00

17,712,162,500.00

22,765,397,988.50

9,096,724,559.38

13,753,924,676.85

15,521,901,470.47

26,784,474,702.77

26,871,534,844.86

10,000,000,000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

16,874,591,359.67

13,575,766,411.96

58,954,799,486.98

52,335,632,220.86

0.00

0.00

P 1,633,803,768,949.77 P 1,529,973,091,259.35

P

104,846,759,334.26

23,089,443,495.79

51,123,654,299.37

0.00

104,846,759,334.26

16,408,237,956.46

51,149,005,424.32

0.00

P 179,059,857,129.42 P

172,404,002,715.04

P 1,812,863,626,079.19 P 1,702,377,093,974.39

P

19,605,678.40 P

0.00

33,735,035,300.62

20,373,687,654.02

3,666,864,733.46

121,574,532,967.79

10,096,983,453.12

0.00

597,536,976,646.04

441,391,030,821.98

156,145,945,824.06

0.00

245,926,718,521.05

11,434,042,750.24

19,649,065.80

0.00

22,595,485,479.46

26,096,374,091.56

1,818,861,131.25

127,246,185,973.17

23,323,989,297.20

0.00

611,132,495,577.11

459,462,536,110.65

151,669,959,466.46

0.00

327,868,096,691.82

12,780,986,125.70

P 1,044,364,447,704.74 P 1,152,882,123,433.07

1,591,103,420.77 P

3,570,740,402.16

1,491,836,966,892.14

1,424,582,818,623.12

634,386.41

635,790.31

73,177,064,157.91

57,156,003,529.85

50,551,488.00

21,540,000.00

21,331,440,000.00

17,712,162,500.00

22,765,397,988.50

9,096,724,559.38

29,029,674,681.41

30,325,576,470.47

26,784,474,702.77

26,871,534,844.86

10,000,000,000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

17,956,173,106.45

14,405,009,958.89

72,330,880,263.70

64,208,878,199.68

0.00

0.00

P 1,693,677,296,930.15 P 1,590,795,621,348.87

TOTAL LIABILITIES

STOCKHOLDERS' EQUITY

Capital Stock

Other Capital Accounts

Retained Earnings

Assigned Capital

Minority Interest In Subsidiaries

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

CONTINGENT ACCOUNTS

Guarantees Issued

Financial Standby Letters of Credit

Performance Standby Letters of Credit

Commercial Letters of Credit

Trade Related Guarantees

Commitments

Spot Foreign Exchange Contracts

Securities Held Under Custodianship by Bank Proper

Trust Department Accounts

a) Trust and Other Fiduciary Accounts

b) Agency Accounts

c) Advisory/Consultancy

Derivatives

Others

TOTAL CONTINGENT ACCOUNTS

104,846,759,334.26 P

23,109,194,766.58

51,118,426,848.96

0.00

601,328,828.12

104,846,759,334.26

16,412,473,469.93

51,063,677,093.69

0.00

585,708,797.32

P 179,675,709,777.92 P 172,908,618,695.20

P 1,873,353,006,708.07 P 1,763,704,240,044.07

P

19,605,678.40 P

0.00

33,735,035,300.62

20,373,687,654.02

3,666,864,733.46

121,793,508,682.64

10,110,361,852.91

0.00

817,481,848,312.31

633,670,375,995.00

183,811,472,317.31

0.00

294,587,428,467.63

11,434,110,883.24

19,649,065.80

0.00

22,595,485,479.46

26,096,374,091.56

1,818,861,131.25

127,642,997,759.37

24,751,011,811.23

0.00

824,213,964,266.22

650,733,825,755.08

173,480,138,511.14

0.00

375,102,927,177.24

12,781,054,774.70

P 1,313,202,451,565.23 P 1,415,022,325,556.83

ADDITIONAL INFORMATION

Gross total loan portfolio (TLP)

P 1,188,874,963,688.27 P 1,131,601,542,674.93

Specific allowance for credit losses on the TLP

14,777,262,856.97

16,042,661,916.97

Non-Performing Loans (NPLs)

a. Gross NPLs

15,898,690,558.16

16,992,547,843.11

b. Ratio of gross NPLs to gross TLP (%)

1.34%

1.50%

c. Net NPLs

1,121,427,701.19

949,885,926.14

d. Ratio of Net NPLs to gross TLP (%)

0.09%

0.08%

Classified Loans and Other Risk Assets, gross of allowance for credit losses

57,717,404,126.37

64,248,551,365.70

DOSRI loans and receivables, gross of allowance for credit losses

47,690,886,034.45

57,541,655,916.07

Ratio of DOSRI loans and receivables, gross of allowance for credit losses, to gross TLP (%)

4.01%

5.08%

Gross non-performing DOSRI loans and receivables

563,116.77

649,245.18

Ratio of gross non-performing DOSRI loans and receivables to gross TLP (%)

0.00%

0.00%

Percent Compliance with Magna Carta (%)

a. 8% for Micro and Small Enterprises

2.22%

2.37%

b. 2% for Medium Enterprises

3.50%

3.07%

Return on Equity (ROE) (%)

13.29%

13.28%

Capital Adequacy Ratio (CAR) on Solo Basis, as prescribed under existing regulations

a. Total CAR (%)

13.26%

12.75%

b. Tier 1 Ratio (%)

11.45%

11.76%

c. Common Equity Tier 1 Ratio (%)

11.02%

11.30%

Deferred Charges not yet Written Down

67,771,718.95

86,254,914.97

Unbooked Allowance for Credit Losses on Financial Instruments Received

0.00

0.00

ADDITIONAL INFORMATION

1. List of Bank's Financial Allied Subsidiaries (Excluding Subsidiary Insurance Companies)

a. Banco De Oro Savings Bank, Inc.

b. BDO Capital & Investment Corporation

c. BDO Elite Savings Bank, Inc.

d. BDO Leasing and Finance, Inc.

e. BDO Private Bank, Inc.

f. BDO Remit (Japan) Ltd.

g. BDO Remit (USA), Inc.

h. BDO Strategic Holdings, Inc.

i. BDORO Europe Ltd.

j. Express Padala Frankfurt GmbH

k. Express Padala (Hongkong) Limited

l. PCIB Europe SPA

m. PCIB Securities, Inc.

Republic of the Philippines )

Makati City

) S.S.

Republic of the Philippines )

Makati City

) S.S.

We, LUCY CO DY and NESTOR V. TAN of the above-mentioned bank do solemnly swear that all matters set forth in the above balance

sheet are true and correct to the best of my/our knowledge and belief.

We, LUCY CO DY and NESTOR V. TAN of the above-mentioned bank do solemnly swear that all matters set forth in the above balance

sheet are true and correct to the best of my/our knowledge and belief.

LUCY CO DY

Executive Vice President & Comptroller

(Signature Over Printed Name)

3. Capital Adequacy Ratio (CAR) on Consolidated Basis, as prescribed under existing regulations

a. Total CAR (%)

b. Tier 1 Ratio (%)

c. Common Equity Tier 1 Ratio (%)

NESTOR V. TAN

President

(Signature Over Printed Name)

SUBSCRIBED AND SWORN to before me this Jan. 30, 2015 at Makati City, affiant exhibiting his/her/their Community Tax Certificate No.

2254646, issued at Makati City on February 10, 2014 and Community Tax Certificate No. 2254577, issued at Makati City on February 10, 2014

Doc. No. 329

Page No. 67

Book No. I

Series of 2015

2. List of Subsidiary Insurance Companies

a. BDO Insurance Brokers, Inc.

Atty. Jaclyn B. Gonzales

Appointment No. M-306

Notary Public until 31 December 2015

Roll No. 54168

IBP No. 944178; PTR No. 4230777

LUCY CO DY

Executive Vice President & Comptroller

(Signature Over Printed Name)

14.56%

12.79%

12.39%

14.14%

13.16%

12.73%

NESTOR V. TAN

President

(Signature Over Printed Name)

SUBSCRIBED AND SWORN to before me this Jan. 30, 2015 at Makati City, affiant exhibiting his/her/their Community Tax Certificate No.

2254646, issued at Makati City on February 10, 2014 and Community Tax Certificate No. 2254577, issued at Makati City on February 10, 2014

Doc. No. 303

Page No. 62

Book No. 1

Series of 2015

Atty. Millicent Dorel M. Marcelo

Appointment No. M-447

Notary Public until 31 December 2015

Roll No. 47289

IBP No. 944183; PTR No. 4230770

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Affidavit of DisclosureDocument1 pageAffidavit of DisclosureNatura Manila91% (11)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assessment 1 Written Critique Amb374Document15 pagesAssessment 1 Written Critique Amb374api-336586977No ratings yet

- Nation at A Glance - (12/20/18)Document1 pageNation at A Glance - (12/20/18)BusinessWorldNo ratings yet

- Nation at A Glance - (12/11/18)Document1 pageNation at A Glance - (12/11/18)BusinessWorldNo ratings yet

- Nation at A Glance - (12/04/18)Document1 pageNation at A Glance - (12/04/18)BusinessWorldNo ratings yet

- Nation at A Glance - (12/07/18)Document1 pageNation at A Glance - (12/07/18)BusinessWorldNo ratings yet

- Nation at A Glance - (12/06/18)Document1 pageNation at A Glance - (12/06/18)BusinessWorldNo ratings yet

- Nation at A Glance - (12/18/18)Document1 pageNation at A Glance - (12/18/18)BusinessWorldNo ratings yet

- Nation at A Glance - (12/21/18)Document1 pageNation at A Glance - (12/21/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/30/18)Document1 pageNation at A Glance - (11/30/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/23/18)Document1 pageNation at A Glance - (11/23/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/21/18)Document1 pageNation at A Glance - (11/21/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/29/18)Document1 pageNation at A Glance - (11/29/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/22/18)Document1 pageNation at A Glance - (11/22/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/27/18)Document1 pageNation at A Glance - (11/27/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/16/18)Document1 pageNation at A Glance - (11/16/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/06/18)Document1 pageNation at A Glance - (11/06/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/20/18)Document1 pageNation at A Glance - (11/20/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/13/18)Document1 pageNation at A Glance - (11/13/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/09/18)Document1 pageNation at A Glance - (11/09/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/25/18)Document1 pageNation at A Glance - (10/25/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/14/18)Document1 pageNation at A Glance - (11/14/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/08/18)Document1 pageNation at A Glance - (11/08/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/30/18)Document1 pageNation at A Glance - (10/30/18)BusinessWorldNo ratings yet

- Nation at A Glance - (11/07/18)Document1 pageNation at A Glance - (11/07/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/26/18)Document1 pageNation at A Glance - (10/26/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/22/18)Document1 pageNation at A Glance - (10/22/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/17/18)Document1 pageNation at A Glance - (10/17/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/23/18)Document1 pageNation at A Glance - (10/23/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/24/18)Document1 pageNation at A Glance - (10/24/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/18/18)Document1 pageNation at A Glance - (10/18/18)BusinessWorldNo ratings yet

- Nation at A Glance - (10/16/18)Document1 pageNation at A Glance - (10/16/18)BusinessWorldNo ratings yet

- PhiladelphiaBusinessJournal Sept. 8, 2017Document28 pagesPhiladelphiaBusinessJournal Sept. 8, 2017Craig EyNo ratings yet

- Atlas & Union Jute Press Co. LTD.: Chartered AccountantsDocument30 pagesAtlas & Union Jute Press Co. LTD.: Chartered Accountantsravibhartia1978No ratings yet

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 681Document19 pagesDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 681Justia.comNo ratings yet

- Exam 1Document17 pagesExam 1chel5353No ratings yet

- Uniform CostingDocument2 pagesUniform CostingSyed Mujtaba HassanNo ratings yet

- Wipro LimitedDocument6 pagesWipro LimitedRaghav KapoorNo ratings yet

- NadcapDocument21 pagesNadcapJHBernardoNo ratings yet

- Key Issues in IIRDocument3 pagesKey Issues in IIRSonia LawsonNo ratings yet

- 1 Series 1 MCQ (CIRP Regulations) Mandavi UpdatedDocument32 pages1 Series 1 MCQ (CIRP Regulations) Mandavi UpdatedAbhinay KumarNo ratings yet

- Absorption of OverheadDocument8 pagesAbsorption of OverheadRj NarineNo ratings yet

- Toyota Production SystemDocument32 pagesToyota Production SystemWawang SukmoroNo ratings yet

- Director de CineDocument2 pagesDirector de Cinealfonso nogueira100% (4)

- Global Financial Crisis and The Intellectual Capital Performance of UAE BanksDocument18 pagesGlobal Financial Crisis and The Intellectual Capital Performance of UAE BanksArchidHananAfifahNo ratings yet

- Drivers and Risks of OutsourcingDocument5 pagesDrivers and Risks of OutsourcinglpelessNo ratings yet

- Report-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Document4 pagesReport-on-Safety-Seal-Certification-2021 (October 21-27, 2021)Mecs NidNo ratings yet

- Mindanao Savings Vs WillkomDocument3 pagesMindanao Savings Vs WillkomLamara Del RosarioNo ratings yet

- Localization The Revolution SUMMARYDocument3 pagesLocalization The Revolution SUMMARYamatulmateennoorNo ratings yet

- First 10 Cases - CommrevDocument179 pagesFirst 10 Cases - CommrevStephen JacoboNo ratings yet

- Management de La Marque Cas NiveaDocument19 pagesManagement de La Marque Cas NiveaanissafmohamedNo ratings yet

- Green Management and Financial Performance: A Literature ReviewDocument22 pagesGreen Management and Financial Performance: A Literature ReviewNichole LalasNo ratings yet

- TitanDocument11 pagesTitanNitin GauravNo ratings yet

- Tony VanetikDocument5 pagesTony VanetiktvanetikNo ratings yet

- Presentasi Marketing NikeDocument11 pagesPresentasi Marketing NikeYaumil Arta HanifNo ratings yet

- Chapter13.Capital Budgeting & Revenue BudgetingDocument11 pagesChapter13.Capital Budgeting & Revenue BudgetingUdhaya SundariNo ratings yet

- Computerised Account Saving SystemDocument17 pagesComputerised Account Saving SystemUgoStan100% (1)

- Stock Subscription Agreement, Pre IncorporationDocument3 pagesStock Subscription Agreement, Pre IncorporationValdino WijayaNo ratings yet

- Leadership ProfileDocument3 pagesLeadership ProfileManjunathSulgadleNo ratings yet

- Craneandmatten3e ch09Document31 pagesCraneandmatten3e ch09Anup MysoreNo ratings yet