Professional Documents

Culture Documents

Application For PartialWithdrawalSurrenderJun5

Uploaded by

Raghunath DayalaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application For PartialWithdrawalSurrenderJun5

Uploaded by

Raghunath DayalaCopyright:

Available Formats

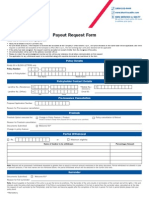

APPLICATION FOR PARTIAL WITHDRAWAL OF UNITS

Policy Number

Date

D D

M M

Y Y Y Y

Name of Proposer

Mr./Ms./Mrs.

First Name

Middle Name

Surname

Address

Landmark

Contact Numbers

PIN Code

STD

Residence

STD

Office

Ext.

Mobile

E-Mail ID

PARTIAL WITHDRAWAL

I wish to apply for Partial Withdrawal of the amount indicated below from the units credited to my policy, in the proportion given below.

I understand that I must withdraw at least Rs.2,000.00 worth of units.

Percentage

Name of the Fund

Amount (Rs.)

Flexi Growth

Flexi Balanced

Maximiser*

Multiplier

Balancer

Preserver

Protector

R.I.C.H.**

*Maximiser shall not be available for investment to policyholders whose application is received at the Companys office after February 22, 2008.

** R.I.C.H. is available only for new ULIP products,starting from U37, except for Lifetime Super (U39) and InvestShield (U46 & U47)

Amount in words:

For any mismatch in amount mentioned, the amount that is mentioned in words would be considered for processing the request

ELECTRONIC PAYOUT METHODS

Please tick one of the options

National Electronic Fund Transfer (NEFT)

Electronic Clearing System (ECS)

Direct Credit (select banks)

If none of the above options are selected, the default option will be Cheque. Please attach a cancelled copy of your cheque if any of the above payout

option is selected.

Name of Account Holder

First Name

Mr./Ms./Mrs.

Middle Name

Surname

Bank Name _______________________________________________________________________________________________________________________________________

Branch Name _______________________________________________________________________________________________________________________________________

A/c Type

Current

Savings

Please strike off unfilled cells wherever applicable.

Bank Account No.

MICR Code

(Only mandatory for ECS mode)

(You can get this code from your cheque book)

IFSC Code

(Only mandatory for NEFT Mode

( You can get this code from your bank)

The Payout mode selected in this form would be used by the Company to make all subsequent payout(s) to the Proposer. Payouts would be in

accordance and subject to the terms and conditions of the policy.

I would not hold ICICI Prudential Life Insurance Co. Ltd responsible in cases of non-credit to my bank account or if the transaction is delayed or not

effected at all for reasons of incomplete/incorrect information. Further, the Company reserves the right to use any alternative payout option including a

demand draft/payable at par cheque inspite of opting for Electronic payout Method. Responsibilty of providing IFSC code lies with the customer. Please

note that IFSC code for RTGS & IFSC code for NEFT may be different.

* To be filled in case a cancelled copy of your cheque is not attached:

Bank Account No.

I hereby take the sole responsibility for the correctness of my Bank Account number and other details of this form. I undertake that I will not hold the

Company responsible in any manner for any transactions effected by the Company due to incorrect Bank A/C No. or other details stated by me.

_______________________________________________________________________________________________________________________________________

Time Stamp

Proposers Signature

ACKNOWLEDGEMENT OF APPLICATION FOR PARTIAL WITHDRAWAL OF UNITS

Proposal/ Policy No.:

Name of Policy Holder:

Branch Name:

Stamp / Time Stamp

Date

D D

M M

Y Y Y Y

Received by:

_______________________________________________________________________________________________________________________________________

Note: Please save this acknowledgement till the transaction is complete. The application will be effected on receipt of this form at an ICICI Prudential

authorized centre, subject to terms and conditions mentioned in the policy document.

Page 2...

APPLICATION FOR PARTIAL WITHDRAWAL OF UNITS

Note:

All the required details in the form should be completed in order to avoid decline of application.

Once requested, the partial withdrawal transaction cannot be cancelled.

There is no tax deduction in Partial Withdrawal.

Partial withdrawals are not applicable on pension plans.

Please note that in case your Policy has been assigned, the Partial Withdrawal request would be accepted if the consent from the Assignee of the

Policy is received.

As per the new IRDA guidelines, the cut off timings for NAV application in respect of allocation and redemption of units stands revised to 3.00 pm

with effect from June 1st07. This implies that if the application for Partial Withdrawal is received up to 3.00 p.m. on a weekday (Mon Fri), the same

days unit value will be applicable. However, if the application for Partial Withdrawal is received after 3.00 p.m. on a weekday, then the next working

days unit value will be applicable (when the applicable day is not a valuation day, NAV of the next immediate valuation day would be considered).

Date

D D

M M

Y Y Y Y

_______________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________________

Signature of Proposer/

Policy Owner

Signature of Assignee

(Required in case of Absolute

assignment of policy)

National Electronic Fund Transfer (NEFT) is a funds transfer from one bank branch to another provided these bank-branches are participating in

the network system. Indian Financial System Code (IFSC code) for NEFT will be available from the bank branch where you hold your account.

Electronic Clearing System (ECS) is a method of funds transfer where funds are processed through Clearing Houses created by RBI. MICR code

can be obtained from the cheque leaf. The credit received will depend on the customers ECS location.

Direct Credit is a method of funds transfer from one bank to another bank (destination bank) provided ICICI Prudential has a tie-up with the

destination bank.

Please contact any of our touch points to know more about any of the Payouts Mode mentioned above.

Customer Service Helpline

Call Center timings: 9.00 A.M. to 9.00 P.M. Monday to Saturday (except national holidays)

Location

Location

Andhra Pradesh

Assam

Bihar

Chattisgarh

Delhi

Goa

Gujarat

Haryana (Karnal)

Haryana (Faridabad)

Karnataka

Kerala

Madhya Pradesh

Number

Number

98495-77766

99540-77766

99313-77766

98931-27766

98181-77766

98904-47766

98982-77766

98961-77766

98181-77766

98455-77766

98954-77766

98931-27766

Location

Location

Maharashtra (Mumbai)

Maharashtra (Rest)

Orissa

Punjab

Rajasthan

Tamil Nadu (Chennai)

Tamil Nadu (Rest)

Uttar Pradesh (Agra, Bareilly, Meerut, Varanasi)

Uttar Pradesh (Kanpur, Lucknow)

Uttaranchal

West Bengal (Kolkatta)

West Bengal (Rest)

Number

Number

98925-77766

98904-47766

99377-77766

98159-77766

98292-77766

98408-77766

98944-77766

98973-07766

99352-77766

98973-07766

98313-77766

99330-77766

For other cities, kindly call our Customer Service Toll Free Number 1-800-22-2020 from your MTNL or BSNL line

Communication Address

ICICI Prudential Life Insurance Company Ltd., Vinod Silk Mills Compound, Chakravarthy Ashok Road, Ashok Nagar, Kandivali ( E ), Mumbai 400 101.

You might also like

- Policy Surrender Form PDFDocument2 pagesPolicy Surrender Form PDF1012804201No ratings yet

- Welcome LetterDocument4 pagesWelcome Letterchelladuraik25% (4)

- Welcome Letter 193521762Document3 pagesWelcome Letter 193521762Deeptej Singh MatharuNo ratings yet

- Welcome Letter 131706428Document3 pagesWelcome Letter 131706428rupesh.gunjan90823No ratings yet

- Full Surrender: Direct Transfer To My Account (Not Applicable For NRE A/c)Document2 pagesFull Surrender: Direct Transfer To My Account (Not Applicable For NRE A/c)L.BISHORJIT MEITEINo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- ECS Direct Debit Mandate FormDocument3 pagesECS Direct Debit Mandate FormManish KumarNo ratings yet

- Link ClickDocument2 pagesLink ClickSukh BrarNo ratings yet

- Policy Cancellation Form NewDocument2 pagesPolicy Cancellation Form Newteja_praveenNo ratings yet

- Neft FormatDocument2 pagesNeft FormatVinay Kumar100% (1)

- Superannuation FormDocument8 pagesSuperannuation FormShatvik MishraNo ratings yet

- Welcome Letter 33875975Document3 pagesWelcome Letter 33875975Raj KumarNo ratings yet

- Neft Mandate Form Format For LICDocument2 pagesNeft Mandate Form Format For LICksbbsNo ratings yet

- MetlifeDocument2 pagesMetlifeShantu ShirurmathNo ratings yet

- Lic Ecs Mandate Form EnglishDocument3 pagesLic Ecs Mandate Form EnglishpajipitarNo ratings yet

- Ecs New Form LicDocument4 pagesEcs New Form LicAtul Thakur0% (1)

- Partial Full Withdrawal Surrender Request Form Ver 2 6Document5 pagesPartial Full Withdrawal Surrender Request Form Ver 2 6Sandeep SharmaNo ratings yet

- WLC LTRDocument6 pagesWLC LTRraghu INo ratings yet

- Welcome Letter 162032006Document6 pagesWelcome Letter 162032006faizalkapadia737No ratings yet

- Payout FormDocument5 pagesPayout FormMMayoor1984No ratings yet

- Systematic Investment Plan: Investo Solutions ARN - 73827Document2 pagesSystematic Investment Plan: Investo Solutions ARN - 73827mbaiifpbatch2No ratings yet

- 5062 Policy Payout FormDocument2 pages5062 Policy Payout Formbpd21No ratings yet

- Welcome Letter - 160548927Document6 pagesWelcome Letter - 160548927MD AZHARNo ratings yet

- Welcome Letter - 203319753 PDFDocument6 pagesWelcome Letter - 203319753 PDFRITIK DESHBHRATARNo ratings yet

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- Partial Withdrawal FormDocument2 pagesPartial Withdrawal FormPinkys Venkat100% (1)

- Claim FormDocument4 pagesClaim FormthamaraikannanNo ratings yet

- Opd English Claim FormDocument2 pagesOpd English Claim Formpriyapj1911No ratings yet

- Sbi New Ecs FormDocument1 pageSbi New Ecs FormzampakNo ratings yet

- Payout Request FormDocument2 pagesPayout Request FormSATHISHLATEST2005100% (11)

- Welcome Letter 111306743Document6 pagesWelcome Letter 111306743Tabe alamNo ratings yet

- Neft Format 1Document3 pagesNeft Format 1hitesh_tilalaNo ratings yet

- Comm Training MatDocument8 pagesComm Training MatVadivel NattarayanNo ratings yet

- 5 Cashback TNCDocument5 pages5 Cashback TNCamitd010No ratings yet

- Conversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountDocument2 pagesConversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountIlyas SafiNo ratings yet

- MITC Commercial Credit Card v12 September 2021Document22 pagesMITC Commercial Credit Card v12 September 2021Anjalidevi TNo ratings yet

- EMI APPLICATION FORM New PDFDocument2 pagesEMI APPLICATION FORM New PDFakibNo ratings yet

- Opening Bank Account Unit 4Document30 pagesOpening Bank Account Unit 4ShaifaliChauhanNo ratings yet

- Stay Connected Address Change FormDocument2 pagesStay Connected Address Change Formनित्यानंद पाटीलNo ratings yet

- Services 432Document22 pagesServices 432Bhisham Pal RajoraNo ratings yet

- Payout FormDocument3 pagesPayout FormavisekgNo ratings yet

- SIP Registration RenewalForm Dec15Document2 pagesSIP Registration RenewalForm Dec15singenaadamNo ratings yet

- Evaluation Form: Reasons For SurrenderDocument2 pagesEvaluation Form: Reasons For Surrendersarwar shamsNo ratings yet

- Health Check Up Claim Form 16 MarchDocument2 pagesHealth Check Up Claim Form 16 MarchAmar Deep GoyalNo ratings yet

- Most Important Terms & ConditionsDocument6 pagesMost Important Terms & ConditionsshanmarsNo ratings yet

- Mandate Form For Auto Debit HDFC ElifeDocument2 pagesMandate Form For Auto Debit HDFC ElifeRaj Herg100% (1)

- Meaning of National AnthemDocument1 pageMeaning of National Anthemmanishchaudhry73No ratings yet

- IDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Document7 pagesIDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Sarath KumarNo ratings yet

- 88643200593Document2 pages88643200593infoNo ratings yet

- HDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Document5 pagesHDFC Fixed Deposits Individual Application Form Contact Wealth Advisor Anandaraman at 944-529-6519Mutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Final Application Form - Restructuring 2.0 - RevisedDocument5 pagesFinal Application Form - Restructuring 2.0 - RevisedShabin ShabiNo ratings yet

- NEFT Mandate FormDocument2 pagesNEFT Mandate FormSupriya KandukuriNo ratings yet

- Welcome Letter PDFDocument4 pagesWelcome Letter PDFVinay KumarNo ratings yet

- Smart Pay Appllication FormDocument2 pagesSmart Pay Appllication FormTony M.TomyNo ratings yet

- NEFT FormDocument2 pagesNEFT Formanilmavi100% (1)

- IDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Document7 pagesIDFC FIRST Bank Limited (Formerly IDFC Bank Limited)Sarath KumarNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Java SerializationDocument7 pagesJava SerializationRaghunath DayalaNo ratings yet

- Gupta Temple Architecture in India - Art and Culture PDFDocument15 pagesGupta Temple Architecture in India - Art and Culture PDFRaghunath Dayala100% (1)

- Java Exception HandlingDocument8 pagesJava Exception HandlingRaghunath DayalaNo ratings yet

- Accessing Elements: Accessingelements - HTMLDocument2 pagesAccessing Elements: Accessingelements - HTMLRaghunath DayalaNo ratings yet

- Core JAVA Interview Questions and AnswersDocument62 pagesCore JAVA Interview Questions and AnswersRaghunath DayalaNo ratings yet

- Oracle Forms Interactive WorkbookDocument477 pagesOracle Forms Interactive WorkbookRaghunath Dayala100% (1)

- Example Transition Project Plan ExcelDocument65 pagesExample Transition Project Plan Excelஅனுஷ்யா சார்லஸ்100% (1)

- Sps. Tan V BanteguiDocument4 pagesSps. Tan V Banteguinazh100% (1)

- Introduction To Insurance IndustriesDocument37 pagesIntroduction To Insurance IndustriesNishaTambeNo ratings yet

- Social Policy Analysis and EvaluationDocument4 pagesSocial Policy Analysis and EvaluationTori SinananNo ratings yet

- 1Document31 pages1yippymeNo ratings yet

- Abans Electricals Annual ReportDocument52 pagesAbans Electricals Annual ReportYasasi Jayawardana100% (2)

- Definitions in PackageDocument1 pageDefinitions in Packagericetech100% (6)

- Great Depression and New Deal TestDocument10 pagesGreat Depression and New Deal TestLakshita SharmaNo ratings yet

- Accounting Revision Notes (0452)Document38 pagesAccounting Revision Notes (0452)MissAditi KNo ratings yet

- Tax 2 ExercisesDocument4 pagesTax 2 ExercisesDenmark CabadduNo ratings yet

- MarDocument1 pageMarDheeraj TippaniNo ratings yet

- Fornilda V RTCDocument2 pagesFornilda V RTCJustineNo ratings yet

- Reading 25 Non-Current (Long-Term) LiabilitiesDocument31 pagesReading 25 Non-Current (Long-Term) LiabilitiesNeerajNo ratings yet

- Natividad Vs SolidumDocument7 pagesNatividad Vs SolidumRose Ann CalanglangNo ratings yet

- BLT PRTC Final Pre-Board With AnsDocument8 pagesBLT PRTC Final Pre-Board With Ansrhea branzuelaNo ratings yet

- Assignment For Business Law - 1Document18 pagesAssignment For Business Law - 1Maruf AhmedNo ratings yet

- Osap Form To PrintDocument2 pagesOsap Form To Printglitch8No ratings yet

- Research Paper On Country Risk Analysis: by Ajinkya Yadav MBA - Executive Finance PRN - 19020348002Document18 pagesResearch Paper On Country Risk Analysis: by Ajinkya Yadav MBA - Executive Finance PRN - 19020348002Ajinkya YadavNo ratings yet

- Contract of BailmentDocument2 pagesContract of BailmentNisar KhanNo ratings yet

- A Layman's Guide To The U.S. Health Care System: OrganizationDocument19 pagesA Layman's Guide To The U.S. Health Care System: OrganizationFilip IonescuNo ratings yet

- Amit - Kanabar 2011002 PG13 Assignment Rights of Unpaid Seller V1Document7 pagesAmit - Kanabar 2011002 PG13 Assignment Rights of Unpaid Seller V1AmitNo ratings yet

- Personal Loan Agreement. BLANK FORMDocument2 pagesPersonal Loan Agreement. BLANK FORMAnonymous 1vPbQ3ML075% (4)

- CH 7 IntermediateDocument21 pagesCH 7 IntermediateArely ChapaNo ratings yet

- Cost Accounting Standards at A GlanceDocument10 pagesCost Accounting Standards at A GlancerajdeeppawarNo ratings yet

- Vol.10 Issue.2 Article44 Full TextDocument28 pagesVol.10 Issue.2 Article44 Full TextTopsun EnergyNo ratings yet

- Land Titles and Deeds CasesDocument6 pagesLand Titles and Deeds CasesAstrid Gopo BrissonNo ratings yet

- Uses of Funds: Lesson 4.4Document19 pagesUses of Funds: Lesson 4.4Tin CabosNo ratings yet

- CHAPTER 14 Bailment PledgeDocument13 pagesCHAPTER 14 Bailment PledgeRajesh BazadNo ratings yet

- Ent 600 FinanceDocument3 pagesEnt 600 FinanceDanial FahimNo ratings yet

- Module 4: Supervised Learning - I: Case StudyDocument3 pagesModule 4: Supervised Learning - I: Case StudyPriyadarshini AmarjeethNo ratings yet