Professional Documents

Culture Documents

BKAL 1013 - 16ogos10

Uploaded by

mypinklady0 ratings0% found this document useful (0 votes)

198 views40 pagescontoh soalan

Original Title

BKAL 1013 -16Ogos10

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcontoh soalan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

198 views40 pagesBKAL 1013 - 16ogos10

Uploaded by

mypinkladycontoh soalan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 40

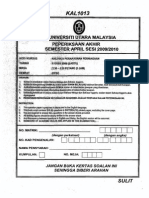

SULIT BKAL 1013

UNIVERSITI UTARA MALAYSIA

PEPERIKSAAN AKHIR SEMESTER

PLK SEMESTER APRIL SESI 2010/2011

KODINAMA KURSUS BKAL1013 / PERAKAUNAN PERNIAGAAN

TARIKH : 16 OGOS 2010

MASA : 2.30 - 5.30 PETANG

TEMPAT DTSO

ARAHAN

1 Buku soalan ini mengandungi LAPAN PULUH (80) soalan aneka pilihan dalam TIGA

PULUH SEMBILAN (39) halaman bercetak tidak termasuk kulit hadapan.

2. Sila jawab SEMUA soaian.

3. Sekiranya terdapat sebarang kekeliruan di antara versi Bahasa Inggeris dan Bahasa

Melayu, versi Bahasa Inggeris akan diterima pakai,

INSTRUCTION:

1. This book script contains EIGHTY (80) multiple choice question in THIRTY NINE (39)

printed pages excluding the cover page.

2. Answer ALL the questions.

3. _ Incase of any discrepancies between English and Bahasa Melayu versions, the English

version would prevail

NO. MATRIK :

(dengan perkataan ) (dengan angka )

NO. KAD PENGENALAN : [

NAMA PENSYARAH :

KUMPULAN : NOMBOR MEJA :

JANGAN BUKA KERTAS SOALAN INI

SEHINGGA DIBERI ARAHAN

BKALI013 PERAKAUNAN PERNIAGAAN

The main purpose of accounting information is to:

(a) Provide information that is useful for decision making

(b) Provide information about an enterprise's assets, liabilities, and capital

(©) Provide information about an enterprise's financial performance during a period

(d) Provide information that allows owners to assess management's performance

(©) None of all above

Below are the accounting processes EXCEPT:

(a) Communication of financial information to users

(b) Recording transaction of economic events

(0) Identifying economies events that are relevant to the business

(@) Recording non-transaction of economic events

(©) Nore of all above

Which of the following is NOT TRUE about the users of accounting information?

(a) Company’s Board of Director (BOD) is an intemal user

(b) Inland Revenue Board (IRB) is an external user

(c) Creditor is an external user

(d) Security commission is an extemal user

(@) Shareholder is an external user

Which of the following is the best to explain the purpose of accounting?

(a) To provide information for top manager to determine the best strategy of the

business

(b) To provide useful financial information for users to make appropriate decision

making

(©) To provide information for manager of the business in controlling business

operation

(d) To provide information for the creditor, in deciding upon giving loan to the

‘business

(©) None of all above

Under section 169, Companies Act 1965, a company should include the following

items in the annual report EXCEPT:

(a) Shareholder’s Statement

(b) Auditor’s Report

(©) Director's Statement

(@) Director’s Report

(©) Notes to account

10,

‘BKALIOI3 PERAKAUNAN PERNIAGAAN

Which of the following is NOT an external user of accounting information?

(a) Marketing manager

(b) Regulatory agency

(©) Labor union

(@) Tax authority

(©) None of all above

Which of the following is NOT an internal user of accounting information?

(a) Marketing manager

(b) Regulatory agency

(©) Board of directors

(@) Shareholders

(©) None of all above

The economic entity assumption requires that the activities

(a) Of different entities can be combined if all the entities are corporations

(b) Must be reported to the accounting professional bodies

(©) OF a sole proprietorship cannot be distinguished from the personal economic

events of its owners

(4) Of an entity be kept separate from the activities o

(©) None of all above

owner

On 9 June 2009, Jamal delivered the product worth of RM4,000 to his customer, but

his customer promised to pay Jamal in August 2009. The accounting principle that

should be applied by Jamal to record this transaction is

(a) Matching principle

(b) Revenue recognition principle

(©) Historical cost principle

(@) Full disclosure principle

(©) None of all above

In applying revenue recognition principle, revenue is considered earned_

(a) At the end of the month

(b) At the end of the year

(©) When the service is performed

(4) When cash is received

(@) None of ali above

BKALIO13 PERAKAUNAN PERNIAGAAN

11. Which of the following account example is part of liabilities?

(a) Prepaid insurance

(b) Insurance expenses

(c) Cash

(@) Uneamed revenues

(e) None of all above

12, Which of the following account example is part of owner's capital?

(a) Salary payable

(b) Service revenue

(©) Motor vehicle

(d) Account payable

(e) None of all above

13. Which of the following credit account balance would signify an error?

(a) Capital

(b) Inventory.

(©) Accumulated depreciation

(4) Notes payable

(e) None of all above

14, A statement that discloses company’s assets, liabilities and owner’s equity at a point

in time is known as

(a) Balance sheet

(b) Income statement

(c) Trial balance

(d) Statement of cash flows

(e) None of all above

15. A statement that lists company’s revenues, expenses and operating result is known as:

(a) Balance sheet

(b) Income statement

(©) Trial balance

(d) Statement of cash flows

(e) None of all above

16. A list that summarize the account balances at a specific date is known as

(a) Balance sheets

(b) Journal

(©) Ledger

BKALIOI3 PERAKAUNAN PERNIAGAAN

(d) Trial balance

(©) None of all above

17. Which of the following accounting equation is true?

Owner's drawings — Revenue ~ Expenses

~ Owner's drawings + Revenues —

(a) Assets = Liabilities + Owner's equ

(b) Assets = Liabilities + Owner's eq

Expenses

(c) Assets = Owner's equity + Revenues — Liabilities - Owner's drawings — Expenses

(d) Assets = Revenues + Expenses ~ Liabilities

(©) None of all above

18, Mr. Muhammad has started a photocopy service business in July 2009. Initially, Mr.

Muhammad intended to contribute RM20,000 cash to start the business but eventually

he managed to only give off RM6,400 cash and contributes his personal motor

vehicle worth RM7,000. Based on the transaction analysis, what would be the effect

of this transaction towards the accounting equation?

(a) RM33,400 Increase in Asset, RM33,400 Increase in Owner's Equity

(b) RM33,400 Increase in Asset, RM33,400 Increase in Liability

(©) RM27,000 Increase in Asset, RM27,000 Increase in Liability

(@) RM13,400 Increase in Asset, RM13,400 Increase in Owner's Equity

(©) None of all above

19. If total asset increased RM20,000 and total liabilities increased RM12,000 during the

same period, what is the effect in total owner's equity?

(a) RM8,000 decrease

(b) RM32,000 decrease

(©) RMB8,000 increase

(@) RM32,000 increase

(©) None of alll above

20. The sequence of steps in the accounting recording process is

(a) Joumalize transactions, posts to the ledger and analyze business events.

(b) Post to the ledger, journalize transactions and prepare trial balance

(©) Analyze business events, journalize transactions and post to the accounts

(d) Analyze business events, journalize transactions and prepare trial balance

(©) None of all above

21. Ayu company purchased office supplies for RM10,000. The company paid RM8,000

in cash and signed a note for the balance. The company should debit the Office

Supplies Account, credit Cash Account and

(a) Debit Ayu’s capital account for RM10,000

22.

BKALIOI3 PERAKAUNAN PERNIAGAAN

(b) Credit an Account Receivable for RM2,000

(c) Credit an Notes Payable for RM2,000,

(@) Debit Notes Payable for RM2,000

(©) None of all above.

‘A customer sent his car to Kim Sin Workshop for a car repair on 31 August. Kim Sin

has completed the repair on the same day. The service charge was RMI,000. The

customer picked up the car on 1 September but managed to pay only half of the

service charge on 5 September and the remaining on 10 September. By applying the

revenue recognition principle, when should Kim Sin recognise the revenue and how

much?

(a) August 31 and RM1,000

(b) September 1 and RM1,000

(c) September 5 and RMS00

(d) September 10 and RMS00

(e) None of all above

Which of the following account has normal credit balance?

(a) Accumulated depreciation

(b) Depreciation expenses

(c) Inventory

(d) Prepaid rent

(©) None of all above

24. In October, an audit firm received RM4,000 cash for consultation services to be

25.

rendered on the month of December. The full amount of RM4,000 was credited to the

Unearned Consultation Fees Account. If the consultation services have been rendered

in December and no adjusting entry was made, this would cause

(a) Expenses to be overstated.

(b) Net income to be overstated.

(©) Liabilities to be understated.

(@) Revenues to be understated

(©) None of all above

‘An owner paid his personal utility expenses amounted RM300. The cost was paid

from company’s cash account. Which ONE of the followings is the CORRECT

journal entry to show the above transaction:

(a) Debit Utility expenses RM300, Credit Cash RM300

(b) Debit Owner’s equity RM300, Credit Cash RM300.

(©) Debit Drawings RM300, Credit Cash RM300

(d) Debit Drawing expenses RM300, Credit Cash RM300

(©) None of all above

BKALIOI3 PERAKAUNAN PERNIAGAAN

CASH |

Balance

Date_ Item Dr. [cr | (RM)

1-Jan | Capital 20,000 20,000

3-tan | Office Equipment 2,300 17,700

10-Jan | Office Supplies 260) 17,440

12-Jan | Service Revenues | 7,200 24,640

26-Jan | Salary expenses 1,800 | 22,840

TOTAL 27,200 4,360

For the above cash ledger, itis required that one of the amounts recorded to be posted

to trial balance. Which ONE of the following amounts should appear in the trial

balance:

(a) RM22,840

(b) RM4,360

(©) RM27,200

(@) RM20,000

(e) RM7,200

Question 27 and 28 is based on the following information:

Below is the summary of accounts balance as at 30 June 2009 for Syarikat Boon

Consulting.

Cash

Office supplies

| Supplies expenses

Office equipment

‘Accumulated depreciation ~ office equipment

‘Account payable

‘Account receivable

Drawing

Fee revenued

[Accrued fees

‘Salary expenses

[Utilities expenses

[Depreciation expenses

Capital

27. What is total expenses amount for unadjusted trial balance above?

(a) RM106,000

28.

30,

31.

32.

BKALIOI3 PERAKAUNAN PERNIAGAAN

(b) RM286,450

(©) RM306,450

(4) Incomplete information to determine the unadjusted trial balance amount

(©) None of all above

What is asset amount should be reported in balance sheets?

(a) RM1S1,500

(b) RM171,500

(c) RM160,100

(4) RM180,100

(©) None of all above

. Which of the followings is THE BKST to explain about a merchandise business?

(a) A business that involved in manufacturing finished goods from raw materials.

(b) A business that involved in buying finished goods from the supplier and sell them

to the customers.

(©) A business that involved in providing services to the customer and earns income

such as rental.

(d) A business that uses raw materials, direct labour and factory overhead to operate

the business.

(©) None of all above.

Gross profit for a merchandise business is equal to:

(a) Sales ~ Cost of good sold (COGS)

(b) Sales ~ [Cost of good sold (COGS) + Operating expenses]

(c) Sales ~ Operating expenses

(d) Service revenues — Cost of good sold (COGS)

(e) None of all above.

In dealing with trade discounts received, a company should:

(a) Debit Purchase discount, Credit Inventory

(b) Debit Account Payable, Credit Inventory

(c) Debit Sales Discount, Credit Account Receivable

(d) Not perform any journal entry

(e) None of all above

When a discount term states 2/20, n/30, it indicates that:

(a) If buyer settles the amount due within 2 days, a discount of 20% would be

received.

(b) If buyer settles the amount due within 30 days, a discount of 2% would be

received,

BKALIO13 PERAKAUNAN PERNIAGAAN

(©) If buyer settles the amount due within 20 days, a discount of 2% would be

received.

(d) The amount due should be settled after 20" day but before 30" day in order to get

the 2% discount.

(©) None of all above.

33. On 4 January 2009, Beli Company purchased 200 units of merchandise inventory on

account, RM10,000 from Jual Company. As per agreement, this amount was subject

to a discount term stated as 2.4/10, n/eom. Should Beli Company settle the amount by

10 January 2009, how much is the amount that the company is required to pay?

(a) RM9,760

(b) RM7,600

(©) RM9,976

(@) RM10,000

(€) None of all above,

34. When a company made a cash sales, it should be treated as:

(a) Debit Cash, Credit Sales

(b) Debit Account receivable, Credit Sales

(©) Debit Cash, Credit Account receivable

(@) Debit Inventory , Credit Sales

(©) None of all above.

Questions 35-36 are based on the following diagram:

=

Ownership changed to buyer at

* point

35. The above diagram indicates a method of transportation cost applied in a merchandise

business. It is:

(a) FOB shipping point

(b) FOB destination

(©) FOB purchase point

(@) FOB manufacturing point

(©) None of all above

BKALIOI3 PERAKAUNAN PERNIAGAAN

36. If company applies the above transportation method, the cost would be paid by the:

(a) Transportation Company

(b) Both parties

(c) Seller

(d) Buyer

(©) None of all above.

37. Under the perpetual inventory system, purchase of inventory should be treated as:

(a) Debit Purchase, Credit Cash

(b) Debit Purchase, Credit Cash or Account payable

(©) Debit Inventory, Credit Cash or Account payable

(d) Debit Inventory, Credit Cash or Account receivable

(©) None of all above

38. Which of the following is a relevant journal entry when a company made a cash sale?

(a) Debit Inventory, Credit Sales

(b) Debit Account payable, Credit Sales

(c) Debit Inventory, Credit Account payable

(d) Debit Cost of good sold, Credit Inventory

(©) None of all above,

39, When a company received goods from the customer as a result of sales return, the

company should treat this as:

(a) Debit Sales return & allowances, Credit Cash

(b) Debit Sales return & allowances, Credit Cash AND Debit Inventory, Credit

Account Receivable

(c) Debit Sales return & allowances, Credit Cash/Account payable AND Debit

Inventory, Credit COGS

(d) Debit Sales return & allowances, Credit Cash/Account receivable AND Debit

Inventory, Credit COGS

(©) Trade discounts.

40. Users of the financial statement includes:

(a) The company management

(b) Existing and Potential shareholders

(©) Creditors, customers and general public

(@) All above

(©) None of all above

BKALIOI3 PERAKAUNAN PERNIAGAAN

41, Which of the following statement is INCORRECT regarding ratio analysis?

(@) Liquidity ratios measure the ability of company to meet short-term obligations.

(b) Profitability ratios measure company’s ability to generate profit

(c) Solvency ratios measure company’s ability to survive over a long period of time.

(@ Efficiency ratios measure company’s ability in managing its resources efficently.

(¢) Liquidity ratio is also known as debt ratio

42. In a vertical analysis of the balance sheet, each item is stated as a percentage of

(a) Total equities

(b) Total liabilities

(©) Total assets

(@) Total non-current assets

(©) None of all above.

43. Profit margin, gross profit margin, earnings per share, dividend per share and return

on equity are examples of analysis.

(a) Solvency

(b) Profitability

(©) Efficiency

(d) Solvency and efficiency

(©) None of all above

44, Accounts receivable turnover, number of day’s sales in receivable and number of

day's sales in inventory are examples of. analysis measurement.

(a) Solvency

(b) Efficiency

(©) Profitability

(a) Efficiency and profitability

(c) None of all above

BKALIOI3 PERAKAUNAN PERNIAGAAN

Questions 45 to 50 are based on the following balance sheet of PETDAG Berhad:

ASSETS

Proper an ard equpen: 3 amen 232005

Iearmentinsezacier 3 aa eae

Prpaitaaspaymente ‘ mo un

Conant 7 25399 40

{TOTAL NOW-CORRENT ASSETS a5 755 39.018

ovenores a wag mas

Tre ane er rceatae > amma 30120

oar and csr equates 2 staan

[TOTAL CURRENT ASSETS Tess

TWTALASSETS sma zie

eoury

‘Shae capi ” sass

Ruserves arene

‘ikalequiyanrintabie te storable ofthe Cmpany eae

Minor inert 8 rs

{oTALCOUTY aanaay anu

w ed was

6 24a 2m

Finance less abies a an -

TOTAL NON-CORRENT UABILTIES wacerr az

Trae and eter payable Cr rc)

Teor 559 9307

Faceless ates 6 ‘ae

eras cunnoer LABILTIS Benes at

TaALaBILTES ZINA

TOTAL EOUTY AND LABIUTIES| 0 08

45. The current ratio for PETDAG Berhad in 2009 is:

(a) 1.2131

() 0.4121

(©) 0.82:1

@ 14:1

(©) None of all above.

46. The quick ratio for PETDAG Berhad in 2009 is:

(a) 121-1

(b) 1.0121

(©) 0.82:1

(@ Lt

(e) None of all above.

u

BKALIOI3 PERAKAUNAN PERNIAGAAN

47. If PETDAG Berhad reported a net profit (before finance cost) of RM470,000,000 in

2009, the company’s return on asset would be:

(@) 7.14%

(b) 5.46%

(©) 6.19%

@ 12.13%

(e) None of all above.

48. What is the company’s inventory turnover ratio should PETDAG Berhad reported

the cost of good sold of RM9,000,000,000 in 2009:

(a) 20.27 times

(b) 8.36 times

(©) 5.92 times

(@ 11.83 times

(e) None of all above.

49. PETDAG?’s debt ratio for 2009 is:

(a) 36.4%

(b) 63.6%

(©) 61.3%

(@) 38.7%

(© None of alt above.

50. PETDAG’s equity ratio for 2009 is:

(a) 36.4%

(b) 63.6%

(©) 61.3%

(¢) 38.7%

(©) None of all above.

51. Company A and B reported a current ratio of 10:1 and 8:1 respectively. The

followings are TRUE regarding the analysis of performance for both companies

EXCEPT:

(2) Company A is able to meet its short term obtigation by 10 times of its current

assets.

(b) Company B is able to meet its short term obligation by 8 times of its current,

assets

(©) Both companies have a higher value in current assets as compared to their current

liabilities.

(@) In term of liquidity performance, Company B performed better than Company A.

BKALIO13 PERAKAUNAN PERNIAGAAN

(e) Both companies have a lower value in current liabilities as compared to their

current assets.

52. In calculating a quick ratio, the following items should be taken into account

EXCEPT:

(a) Cash

() Account Receivable

(c) Marketable Securities

(d) Inventory

(©) None of all above

53. The following statements are TRUE in relation to the Management Accounting

report EXCEPT:

(a) Users for management accounting information are internal users.

(b) A content of the report prepared is flexible and subject to the management needs.

(©) The purpose of the report is not according to the generally accepted accounting

principles but subject to the decision to be made.

(d) The report is subject to the independent verification,

(@) None of all above.

54, Office salaries and office equipment depreciation expenses are two examples of

(a) Direct labor cost

(b) Factory overhead

(©) Product cost

(@) Period cost

(©) None of all above

55. In a manufacturing process, prime cost is equal to___cost plus cost.

(a) Direct material, factory overhead

(b) Direct labour, factory overhead

(©) Direct material, direct labour

(@) Sel\ing, administrative

(©) Direct materia}, selling

56. A product cost includes:

(a) Direct materials only

(b) Direct materials and labours only

(©) Direct materials, direct labours and manufacturing overhead only

(d) Direct materials, direct labours, manufacturing overhead & selling/administrative

costs.

(e) None of all above

BKALIO13 PERAKAUNAN PERNIAGAAN

57. Ina manufacturing process, conversion cost is equal to cost plus cost.

(a) Direct material, factory overhead

(b) Direct labour, factory overhead

(©) Direct material, direct labour

(@) Selling, administrative

(©) Direct material, selling

58. The following costs are part of manufacturing overhead EXCEPT:

(a) Indirect material

(b) Indirect labor

(0) Production supervisor's salary

(@) Utility for factory

(©) Salary of human resource manager

Question 59 to 60 is based on the following manufacturing data:

[ Beginning Ending | RM

(RM) (RM)

Direct material inventory 90,000 110,000

(Work-in progress inventory 180,000 120,000

Finished goods inventory 300,000 | 400,000

Purchased direct material Z 300,000

Direct labor 170,000

Factory overhead 190,000

Net sales 1,000,000

Period cost 280,000

59. Prime cost is:

(2) RM450,000

(b) RM320,000

(©) RM100,000

(4) RMS00,000

(e) None of all above

60. Conversion cost is:

(2) RM450,000

(b) RM360,000

(©) RM470,000

(@) RM490,000

(©) None of all above

14

‘BKALIOI3 PERAKAUNAN PERNIAGAAN

61. Which of the following statements describes variable cost?

(a) This cost increases in direct proportion to increases in volume

(b) This cost decreases in direct proportion to increases in volume

(©) This cost is the combined amount of all the other costs

(4) This cost remains constant overall volume levels within the productive capacity

for the planning period

(©) None of all above

62. Which of the following statement is NOT TRUE about the fixed cost?

(a) The total fixed costs are remain same regardless the number of products are

produced.

(b) The fixed costs per unit produced are increase when more products are produced.

(©) Depreciation of factory equipment expense is one of the examples of fixed costs.

(@) Fixed cost would not increase in direct proportion to increase in unit produced

(e) None of all above

63. What is contribution margin?

(a) The excess of sales revenues over fixed cost

(b) The excess of variables cost over sales revenues

(c) The excess of sales revenues over variables cost,

(d) The ratio of sales revenues over variables cost

(e) None of all above

64, Contribution margin per unit is calculated as:

(a) Selling price per unit — fixed cost per unit

(b) Selling price per unit ~ selling expense per unit

(©) Selling price per unit ~ variable cost per unit

(@) Variable cost per unit — fixed cost per unit

(e) None of all above

65. Contribution margin ratio is calculated as:

(a) (Selling price per unit ~ fixed cost per unit] / selling price per unit

(b) [Selling price per unit — selling expense per unit] / selling price per unit

(©) [Variable cost per unit - fixed cost per unit] / selling price per unit

(@) [Selling price per unit — variable cost per unit] / selling price per unit

(e) None of all above

BKALIO13 PERAKAUNAN PERNIAGAAN

66. Which of the followings is TRUE in relation to the concept of break-even point

(BEP):

(a) At BEP, total contribution margin is equal to total fixed cost

(b) A company would make profit at BEP

(©) A company would make loss at BEP

(d) BEP will not always result in zero profivloss

(©) None of all above

67. Which of the followings is THE BEST to indicate the technique available in doing

Cost volume profit analysis (CVP)

(a) Contribution margin approach is the best technique in calculating BEP.

(b) Mathematical equation approach is the best technique in calculating BEP.

(©) Graphical approach is the best technique in calculating BEP.

(@) In calculating BEP, there are number of techniques available namely Centribution

margin approach, Mathematical equation approach and Graphical approach.

{e) None of all above.

Question 68-71 are based on the following data:

Optimus Prime Bethad manufactures and sells external hard disk model i-Bee. The detail

information is extracted from their records show as below:

Selling price per RM200

RM100

RM180,000

Production capacity 6,500 unit

68. What is the break-even-point (BEP) in units?

(2) 1,700 units

(b) 1,750 units

(©) 1,800 units

(@ 1,850 units

(©) None of all above

69. It is expected that the variable cost will be increased by RM3 per unit. However,

management decides to remain the Break-Even-Point (BEP) and selling price. What

is the new fixed cost per unit at Break-Even-Point (BEP)?

(@) RM67

(b) RM77

(©) RM87

(d) Insufficient information to calculate the fixed cost per unit at BEP

(©) None of all above

16

‘BKAL1013 PERAKAUNAN PERNIAGAAN

70. How much the amount of net profit or net loss if 3,500 units are sold?

(a) Net profit of RM170,000

(b) Net loss of RM170,000

(c) Net profit of RM175,000

(a) Net loss of RM175,000

(e) None of all above

71. How many units should be sold to generate a profit of RM450,000?

(@) 3,300 units

(b) 3,600 units

(©) 5,300 units

(A) 6,300 units,

(©) None of all above

Questions 72 to 75 are based on the following data:

Syarikat Kumar produces drinking water. The detail information is extracted from their

records show as follows:

"M Rat

72. Variable cost per unit is:

(a) RM0.80

(b) RMS5.00

(©) RM1.20

(4) RM2.00

(© None of all above.

73. Contribution margin per ut

(a) RM0.80

(b) RM5.00

(©) RM1.20

(a) RM2.00

(©) None ofall above.

74, What is break-even point in unit?

(a) 24,000

() 100,000

(©) 150,000

7

BKALIO13 PERAKAUNAN PERNIAGAAN

(4) 60,000

(©) None of all above.

75. BEI

in RM:

(a) RM48,000

(b) RM200,000

(©) RM120,000

(@) RM300,000

(©) None of all above.

76. A budgeted sales figure is calculated by:

(a) Multiplying a estimated sales price per unit with budgeted sales in unit

(b) Multiplying a estimated sales cost per unit with budgeted sales in unit

(©) Multiplying a estimated variable cost per unit with budgeted sales in unit

(@ Multiplying a estimated fixed cost per unit with budgeted sales in unit

(ce) None of all above

77. The followings are part of operating budget EXCEPT:

(a) Sales budget

(b) Cost of good sold budget

(©) Purchase budget

(d) Income statement budget

(©) Cash budget

78. Which of the following is part of the financial budget?

{a) Sales budget

(b) Cost of good sold budget

(©) Purchase budget

(a) Income statement budget

(©) Balance sheet budget

Questions 79 and 80 are based on the following data:

Syarikat Ahad reported the following sales budget for month of January and February:

naan Budgeted Sales

(unit)

January 10,000

February 12,200

79. If selling price per unit is estimated to be RM2.00, what would be the budgeted sales

figure in January?

18

80.

(a) RM10,000

(b) RM4,000

(c) RM24,000

(a) RM44,000

(e) RM20,000

BKALIOI3 PERAKAUNAN PERNIAGAAN

Assuming that all sales are credit sales, how much Syarikat Ahad will collect the cash

in February if itis expected that only 20% of the current month sales would be

collected in the month sold and the remaining would be in the following month?

(a) RM4,800

(b) RM4,000

(c) RM20,800

(4) RM23,200,

(© RM8,800

19

BKAL1013 PERAKAUNAN PERNIAGAAN

Tujuan wtama maklumat perakaunan adalah untuk:

(a) Menyediakan maklumat yang berguna di dalam pembuatan keputusan.

(6) Menyediakan maklumat mengenai aset, liabiliti dan modal perniagaan

(©) Menyediakan maklumat mengenai prestasi kewangan perniagaan bagi sesuatu

tempoh

(d) Menyediakan maklumat yang membolehkan pemilk perniagaan menilai prestasi

‘pengurusan

(e) Tiada satu di atas

Di bawah adalah proses-proses perakaunan KECUALI:

(a) Komunikasi maklumat kewangan kepada pihak pengguna

(2) Merekod transaksi dari urusniaga ekonomi

(¢) Mengenalpasti urusniaga ekonomi yang relevan kepada perniagaan

(&) Merekod urusniaga ekonomi bukan transaksi

(e) Tiada satu di atas

Manakah antara berikut TIDAK BENAR tentang pengguna maklumat perakaunan?

(a) Lembaga pengarah syarikat adalah pengguna dalaman

(b) Lembaga Hasil Dalam Negeri (LHDN) adalah pengguna luaran

(c) Pemiutang adalah pengguna luaran

(d) Suruhanjaya sekuriti adalah pengguna luaran

(e) Pemegang saham adalah pengguna luaran

Manakah yang berikut yang terbaik untuk menerangkan iujuan perakaunan?

(a) Untuk menyediakan maklumat kepada pengurus atasan untuk _menentukan

strategi perniagaan yang terbaik

(b) Untuk menyediakan maklumat kewangan kepada pengguna untuk membuat

keputusan

(6) Untuk menyediakan maklumat kepada pengurus untuk mengawal operasi

perniagaan

(a) Untuk menyediakan maklumat kepada kreditor untuk membuat keputusan

pinjaman perniagaan

(@) Tiada satu di atas

Di bawah seksyen 196, Akta Syarikat 1965, sesebuah syarikat mestilah menyertakan

perkara berikut di dalam laporan tahunan syarikat KECUALI-

(a) Pernyataan pemegang saham

(b) Laporan juruaudit

(©) Pernyataan pengarah

(d) Laporan pengarah

(©) Nota kepada akaun

20

‘BKALIO13 PERAKAUNAN PERNIAGAAN

6. Manakah yang berikut bukan pengguna luaran maklumat perakaunan?

(a) Pengurus pemasaran

(b) Agensi penguatkuasa undang-undang

(©) Kesatuan sekerja

(@) Pihak berkuasa cukai

(e) Tiada satu di atas

7. Manakah yang berikut bukan pengeuna dalaman maklumat perakaunan?

(a) Pengurus pemasaran

(b) Agensi penguatkuasa undang-undang

(c) Ahli lembaga pengarah

(d) Pemegang saham

(@) Tiada satu di atas

8. Andaian entiti ekonomi mengkehendaki setiap aktiiviti

(a) Entiti yang berbeza boleh digabungkan jika kaitan semua entiti yang tersebuit

adalah syarikat

(6) Mestilah dilaporkan kepada badan professional perakaunan

(©) Perniagaan tunggal tidak boleh dibezakan daripada urusniaga persendirian

pemiliknya

(@ Entiti_mestilah merekod urusniaganya secara berasingan daripada aktiviti

pemiliknya

(@) Tiada satu di atas

9. Pada 9 Jun 2009, Jamal telah menghantar produk yang bernilai RM4,000 kepada

pelanggannya, tetapi pelanggannya berjanji untuk membayar kepada Jamal dalam

bulan Ogos 2009. Prinsip perakaunan yang perlu digunakan oleh Jamal untuk

merekod urusniaga ini ialah

(a) Prinsip pemadanan

(b) Prinsip pengiktirafan hasil

(©) Prinsip kos sejarah

(d) Prinsip pendedahan penuh

(e) Tiada satu di atas

10. Dalam mengaplikasikan prinsip pengiktirafan hasil, hasil akan terperoleh

(a) Pada setiap akhir bulan

(6) Pada setiap akhir tahun

(c) Apabila perkhidmatan telah diberikan

(@) Apabila tunai diterima

(e) Tiada satu di atas

2

BKALIOI3 PERAKAUNAN PERNIAGAAN

11, Manakah contoh akaun berikut adalah sebahagian daripada liabiliti?

(@) Insurans prabayar

(2) Belanja insurans

(c) Tunai

(d) Hasil belum terperoleh

(@) Tiada satu di atas

12, Manakah contoh akaun berikut adalah sebahagian daripada modal pemilik?

(a) Goji belum bayar

(®) Hasil perkhidmatan

(©) Kenderaan bermotor

(@ Akaun belum bayar

(e) Tiada satu di atas

13. Manakah baki debit akaun yang berikut adalah salah?

(a) Modal

(b) Inventori

(0) Susutnilai terkumpul

@ Nota belum bayar

(@) Tiada satu di atas

14, Penyata yang mendedahkan kedudukan aset, liabiliti dan ekuiti pemilik syarikat bagi

satu titik masa tertentu dikenali sebagai

(a) Lembaran imbangan

(b) Penyata pendapatan

(c) Imbangan duga

(d) Penyata aliran tunai

(@) Tiada satu di atas

15, Penyata yang menyenaraikan hasil, belanja dan keputusan operasi syarikat dikenali

sebagai.

(a) Lembaran imbangan

() Penyata pendapatan

(©) Imbangan duga

(@ Penyata aliran tunai

(©) Tiada satu di atas

16, Satu senarai yang meringkaskan baki akaun-akaun pada tarikh iertentu dikenali

sebagai

(@) Lembaran imbangan

18.

19.

20.

BKALIOI3 PERAKAUNAN PERNIAGAAN

(b) Jurnal

(©) Lejar

(d) Imbangan duga

(e) Tiada satu di atas

7. Manakah persamaan perakaunan yang berikut adalah benar?

(a) Aset = Liabiliti + Ekuiti pemilik + Ambilan pemilik — Hasil + Belanja

(b) Aset = Liabiliti + Ekuiti pemilik + Ambilan pemilik + Hasil — Belanja

(€) Aset = Ekuiti pemilik + Hasil — Liabiliti - Ambilan pemilik - Belanja

(d) Aset = Hasil + Belanja - Liabiliti

(@) Tiada satu di atas

En. Muhammad telah memulakan perniagaan perkhidmatan fotokopi pada Julai

2009. Pada mulanya, En. Muhammad berhasrat untuk menyumbang RM20,000 tunai

bagi memulakan perniagaannya tetapi akhirnya dia hanya mengeluarkan tunai

RM6,400 dan menyumbang kenderaan peribadinya yang bernilai RM7,000.

Berdasarkan analisa transaksi, apakah kesan urusniaga ini ke alas persamaan

perakaunan?

(a) Aset meningkat RM33,400, Ekuiti Pemilik meningkat RM33,400

(b) Aset meningkat RM33,400, Liabititi meningkat RM33,400

(c) Aset meningkat RM27,000, Liabiliti meningkat RM27,000

(d) Aset meningkat RMI3,400, Ekuiti Pemilik meningkat RM13,400

(@) Tiada satupun di atas.

Jika jumlah aset meningkat RM 20,000 dan jumlah liabiliti juga meningkat RM

12,000 dalam tempoh yang sama, apakah kesan ke atas jumlah ekuiti pemilik?

(a) RMB8,000 menurun

(6) RM32,000 menurun

(c) RMB,000 meningkat

(d) RM32,000 meningkat

(@) Tiada satu di atas

Urutan langkah di dalam proses perekodan perakaunan adalah

(a) Membuat catatan jurnal, pos ke lejar dan menganalisis aktiviti perniagaan

(b) Pos ke lejar, membuat catatan jurnal dan menyediakan imbangan duga

(c) Menganalisis aktiviti perniagaan, membuat catatan jurnal dan pos ke lejar

(@) Menganalisis aktiviti perniagaan, membuat catatan jurnal dan menyediakan

imbangan duga

(@) Tiada satu di atas

BKALIOI3 PERAKAUNAN PERNIAGAAN

21. Syarikat Ayu membeli bekalan pejabat pada harga RM10,000. Syarikat membayar

RM8,000 secara tunai dan menandatangani nota untuk bakinya. Syarikat seharusnya

mendebitkan Akaun Bekalan Pejabat, Mengkreditkan Akaun Tunai dan

(a) Mendebitkan Akaun Modal Ayu pada nilai RM10,000

(b) Mengkreditkan Akaun Belum Terima pada nilai RM2,000

(c) Mengkreditkan Nota Belum Bayar pada nilai RM2,000

(a) Mendebitkan Nota Belum Bayar pada nilai RM2,000

(e) Tiada satu di atas

22, Seorang pelanggan telah menghantar keretanya kepada Bengkel Kim Sin untuk

tujuan pembaikan pada 31 Ogos. Kim Sin telah menyelesaikan kerja pembaikan

tersebut pada hari yang sama. Caj perkhidmatan pembaikan adalah RMI,000.

Pelanggan tersebut telah mengambil keretanya pada | September tetapi hanya

membayar separuh dari caj perkhidmatan pada 5 September dan bakinya pada 10

September. Dengan mengaplikasikan prinsip pengiktirafan hasil, bilakah Kim Sin

perlu mengiktiraf hasil tersebut dan berapakah amaunnya?

(@) 31 Ogos dan RM1,000

(B) 1 September dan RM},000

(©) 5 September dan RMS500

(d) 10 September dan RMSOO

(©) Tiada satu di atas

23, Manakah antara akaun berikut lazimnya mempunyai baki kredit?

(@) Susutnilai terkumpul

(6) Belanja susutnilat

(0) Inventori

(@) Sewa terdahulu

(@) Tiada satu di atas

24. Dalam bulan Oktober, sebuah firma audit menerima RM4,000 tunai bagi khidmat

perundingan yang akan diberikan dalam bulan Disember. Amaun penuh sebanyak

RM4,000 dikreditkan ke Akaun Hasil Perundingan Belum Terperoleh. Sekiranya

khidmat perundingan telah dilaksanakan pada bulan Disember dan tiada catatan

pelarasan dilakukan, ini akan menyebabkan

(a) Perbelanjaan terlebih nyata

(®) Pendapatan bersih terlebih nyata

(c) Liabiliti terkurang nyata

(@) Hasil terkurang nyata

(e) Tiada satu di atas

24

BKALI013 PERAKAUNAN PERNIAGAAN

25. Seorang pemilik telah membayar belanja utiliti peribadinya berjumlah RM300. Kos

tersebut telah dibayar menggunakan akaun tunai syarikat. Mana SATUkah antara

berikut merupakan catatan jurnal yang BETUL bagi menunjukkan urusniaga di atas:

(@) Debit Belanja utiliti RM300, Kredit Tunai RM300

(b) Debit Ekuiti pemilik RM300, Kredit Tuna RM300

(c) Debit Pengeluaran RM300, Kredit Tunai RM300

(d) Debit Belanja pengeluaran RM300, Kredit Tunai RM300

() Tiada satupun di atas

26.

TUNAL

Baki

Tarikh | Item Dt_|_xt._| (RM)

Jan | Modal 20,000 20,000

3-Jan | Peralatan Pejabat 2,300| 17,700

10-Jan | Bekalan Pejabat 260| 17,440

42-Jan | Hasil Perkhidmatan | 7,200 24,640

26-Jan | Belanja Goji 22,840

JUMLAH

Bagi lejar tunai di atas, ianya memerlukan salah satu dari amaun yang direkodkan

untuk diposkan ke imbangan duga. Mana SATUkah antara yang berikut merupakan

amaun yang perlu berada di dalam imbangan duga.

(a) RM22,840

(b) RM4,360

(©) RM27,200

(@) RM20,000

fe} RM7.200

Soalan 27 dan 28 berdasarkan maklumat berikut:

Di bawah ini ringkasan baki akaun-akaun pada 30 Jun 2009 Syarikat Boon Consulting,

RM.

Tunai_ - 21,000 |

Bekalan pejabat = 18,500

[Belanja bekalan 3,000

| Kelengkapan pejabat __ 80,600

([Susutnilai terkumpul — Kelengkapan pejabat 600

(Akaun belum bayar 12,000

terima _____ 40,000

— 350

‘Hasil yuran [750,000

Yuran terakru _ 20,000 |

BKALIO13 PERAKAUNAN PERNIAGAAN

Belanja Gaji 81,400

Belanja uiliti 13,000

‘Belanja susutnilat 8,600

‘Modal 735,850.

27. Berapakah amaun jumlah belanja bagi imbangan duga tidak terselaras di atas?

(@) RM106,000

(6) RM286,450

(o) RM206,450

(@) Makiumat tidak lengkap untuk menentukan amaun imbangan duga tidak

terselaras

(e) Tiada satu di atas

28. Berapakah amaun aset yang perlu dilaporkan dalam lembaran imbangan?

(a) RMIS1,500

() RMI60,100

(©) RMI171,500

(@) RM180,100

(@) Tiada satu di atas

29, Manakah antara berikut yang PALING BAIK bagi menerangkan tentang sebuah

‘perniagaan perdagangan?

(@) Sebuah perniagaan yang melibatkan penghasilan barangan akhir dengan

menggunakan bahan mentah

(b) Sebuah perniagaan yang melibatkan pembelian barangan akhir dari pembekal dan

‘menjualkanaya kepada pelanggan.

(c) Sebuah perniagaan yang melibatkan penyediaan perkhidmatan kepada pelanggan

dan menghasilkan pendapatan seperti hasil sewaan.

(@) Sebuah perniagaan yang menggunakan bahan mentah, buruh langsung dan

overhead perkilangan untuk beroperast.

(@) Tiada satupun di atas.

30. Untung kasar bagi perniagaan perdagangan adalah bersamaan dengan.

(a) Jualan— Kos barang di jual (KBDJ)

(b) Jualan -{ Kos barang di jual (KBDJ) + Belanja operasi]

(c) Juatan ~ Belanja operasi

(d) Hasil perkhidmatan - Kos barang di jual (KBDJ)

(@) Tiada satupun di atas.

26

BKALIOI3 PERAKAUNAN PERNIAGAAN

31. Apabila sesebuah syarikat menerima diskaun perniagaan, syarikat seharusnya.

(a) Debit Diskaun belian, Kredit Inventori

(b) Debit Akaun belum bayar, Kredit Inventori

(c) Debit Diskaun Jualan, Kredit Akaun belum terima

(d) Tidak membuat sebarang catatan jurnal

(e) Tiada satupun di atas.

32. Apabila sesuatu terma diskaun mencatatkan 2/20, n/30, ianya menunjukkan:

(a) Sekiranya pembeli menyelesaikan hutang dalam tempoh 2 hari, diskaun 20% akan

diterima.

(®) Sekiranya pembeli menyelesaikan hutang dalam tempoh 30 hari, diskaun 2% akan

diterima.

(c) Sekiranya hutang dalam tempoh 20 hari, diskaun 2% akan diterima.

(@) Hutang tersebut perlu diselesaikan selepas hari ke-20 tetapi sebelum hari ke-30

bagi memperoleh 2% diskaun tersebut.

(e) Tiada satupun di atas.

33. Pada 4 Januari 2009, Beli Company telah membeli 200 unit barangan inventori

ssecara hutang, RM10,000 dari Jual Company. Termaktub di dalam perjanjian

bahawa jumlah ini tertakluk kepada terma diskaun 2.4/10, weom. Sekiranya Beli

Company menyelesaikan jumlah tersebut pada 10 Januari 2009, berapakah jumlah

yang perlu di bayar oleh syarikat?

(a) RM9,760

() RM?,600

(c) RM9,976

(d) RM10,000

(e) Tiada satupun di atas.

34. Apabila sesebuah syarikat membuat jualan tunai, ia perlu dilayan sebagai.

(a) Debit Tunai, Kredit Jualan

(6) Debit Akaun belum terima, Kredit Jualan

(c) Debit Tunai, Kredit Akaun belum terima

(d) Debit Inventori, Kredit Jualan

(e) Tiada satupun di atas.

Soalan 35-36 berdasarkan gambarajah di bawah:

= =

Pemilikan berubah ke tangan pembeli

pada titik ini

aoe

BKALIO13 PERAKAUNAN PERNIAGAAN

35. Diagram di atas menunjukkan sejenis kaedah kos pengangkutan yang diamalkan oleh

sesebuah syarikat perdagangan. la adalah:

(@) FOB titik perkapalan

(®) FOB destinsi

(0) FOB titik pembelian

(@) FOB titik pengeluaran

(©) Tiada satupun di atas

36, Sekiranya sesebuah syarikat mengamalkan kaedah pengangkutan di atas, kos akan

dibayar oleh:

(a) Syarikat pengangkutan

(6) Kedua-dua pihak

(©) Penjual

(d) Pembeli

(@) Tiada satupun di atas

37. Di bawah system inventori berterusan, pembelian inventori perlu dilayan sebagai.

(a) Debit Belian, Kredit Tunai

(®) Debit Belian, Kredit Akaun belum bayar

(c) Debit Inventori, Kredit Tunai atav Akaun belum bayar

(d) Debit Inventori, Kredit Tunai atau Akaun belum terima

(@) Tiada satupun di atas

38. Manakah antara berikut merupakan catatan jurnal yang releven apabila sesebuah

syarikat membuat jualan tunai?

(a) Debit Inventori, Kredit Jualan

(b) Debit Akaun belum bayar, Kredit Jualan

(c) Debit Inventori, Kredit Akaun belum bayar

(@) Debit Kos barang dijual, Kredit Inventori

(@) Tiada satupun di atas

39, Apabila syarikat menerima barangan disebabkan pulangan yang dibuat oleh

pelanggan, syarikat perlu melayan ia sebagai

(a) Debit Pulangan & Elaun Jualan, Kredit Tunai

(®) Debit Pulangan & Elaun Juatan, Kredit Tunai DAN Debit Inventori, Kredit Akaun

belum terima

(©) Debit Pulangan & Elaun Juatan, Kredit Tunai/Akaun belum bayar DAN Debit

Inveniori, Kredit COGS

(@) Debit Pulangan & Elaun Jualan, Kredit Tunai/Akaun belum terima DAN Debit

Inventori, Kredit COGS

(@) Diskaun perdagangan

28

BKALI013 PERAKAUNAN PERNIAGAAN

40. Pengguna penyata kewangan termasuklah:

(a) Pengurusan syarikat

(b) Pemegang saham sedia ada dan bakal

(c) Pemiutang, pelanggan dan orang awam

(d) Semua di atas

(e) Tiada satupun di atas

41. Manakah kenyataan yang berikut adalah SALAH berkenaan analisis nisbah?

(a) Nisbah kecairan mengukur kemampuan syarikat memenuhi obligasi jangka

pendek

(b) Nisbah keberuntungan mengukur kebolehan syarikat di dalam menjana

keuntungan

(©) Nisbah solvensi mengukur kemampuan syarikat untuk bertahan dalam jangka

panjang

(d) Nisbah keefisyenan mengukur kemampuan syarikat menguruskan sumbernya

secara efisyen.

(e) Nisbah kecairan juga dikenali sebagai nisbah hutang.

42, Di dalam analisis menegak bagi lembaran imbangan, setiap item dinyatakan sebagai

peratusan dari

(a) Jumtah ekuiti

(6) Jumlah liabiliti

(c) Jumlah aset

(d) Jumtah aset bukan semasa

(©) Tiada satu di atas

43, Margin keuntungan, margin keuntungan kasar, perolehan sesaham, dividen sesaham

dan pulangan ke atas ekuiti adalah contoh analisis _

(a) Solvensi

(b) Keberuntungan

(©) Kecekapan

(d) Solvensi dan kecekapan

(e) Tiada satu di atas

44. Pusing ganti akaun belumterima, bilangan hari akaun belum terima, bilangan hari

inventori dijual, dan nisbah jualan bersih ke atas jumlah aset adalah contoh-contoh

ukuran analisis

(@ Keupayaan bayar huang

(6) Kecekapan

(c) Keberuntungan

(d) Kecekapan dan keberuntungan

29

BKALIOI3 PERAKAUNAN PERNIAGAAN

(@) Tiada satu di atas

Soalan 45 hingga 50 berdasarkan kepada penyata kewangan beriku

Assers

Proper on ae equa: 2 amaato 2323206

Inmet seit 5 7 £42

Prpsitase ayes ‘ mo on

Saoerit 7 400

{TOTAL NOW-CURRENTASSETS Gansa35 __d9018

enoroe 2 wag apna

Trae ac ter acealee ee

Cae ad ae oquatels 2 sae S099

TOTAL CURRENTASSETS Zmesss aS

TorALASSETS asai2ik ase ate

Starecapial ” yrds, 388456

acervee awsm2 2723965

‘ia equy able te sharehelders eke Con pary a1.286——-api7Ai7

2 ur

amaze 37648

Ofer tala: “ tonsse 38

Prorsins % 26498 man

France lsc baie a or E

[orAL Hon-conaenT LABLTES ae0r7 ez

Trade and eter ayes aan

Tuaiee 559

Faece tose ilios % ae ~

[oTAL CURRENT LADILTES Baa7900 ASE

ToL UABIUTS Bans ASE

ToTaL EOUFTY AND LASITIES ase216 ase

45. Nisbah semasa PETDAG Berhad pada 2009 adalah:

(a) 1.21:1

() 04121

(©) 082:1

@ 11421

(@) Tiada satupun di atas

46. Nisbah cepat PETDAG Berhad pada 2009 adalah:

(@) 1.2131

(6) 101:

30

BKALIO13 PERAKAUNAN PERNIAGAAN

(©) 0.82: 1

@) 1.14:1

(e) Tiada satupun di atas

47. Sekiranya PETDAG Berhad melaporkan keuntungan bersih RM470,000,000 pada

2009, pulangan atas aset syarikat adalah:

(a) 7.14%

() 5.46%

(©) 6.19%

@) 12.13%

(©) Tiada satupun di atas

48, Apakah nisbah pusing ganti inventori syarikat sekiranya PETDAG Berhad

melaporkan kos barang dijual pada 2009 sebanvak RM9,000,000,000:

(a) 20.27 times

(©) 8.36 times

(©) 5.92 times

(d) 11.83 times

(©) Tiada satupun di atas

49. Nisbah hutang PETDAG bgi 2009 adalah

(@) 36.4%

(b) 63.6%

(©) 61.3%

(d) 38.7%

(@) Tiada satupun di atas

50, Nisbah ekuiti PETDAG bgi 2009 adalah.

(a) 36.4%

(b) 63.6%

(6) 61.3%

(4) 38.7%

(e) Tiada satupun di atas

51. Syarikat A dan B melaporkan nisbah semasa masing-msing adalah 10:1 dan 8:1.

Berikut adalah BENAR berkenaan analisa prestasi bagi kedua-dua syarikat

KUCULI:

(a) Syarikat A mampu memenuhi obligasi jangka pendek dengan aset semasanya

sebanyak 10 kali.

(6) Syarikat B mampu memenuhi obligasi jangka pendek dengan aset semasanya

sebanyak 8 kali

(0) Kedua-dua syarikat mempunyai nilai aset semasa yang melebihi liabiliti semasa

31

BKALJ013 PERAKAUNAN PERNIAGAAN

(@) Dari sudut prestasi kecairan, Syarikat B mempunyai prestasi yang lebih baik dari

Syarikat A

(©) Kedua-dua syarikat mempunyai nilai liabiliti semasa yang lebih rendah

berbanding aset semasa.

52. Bagi mengira nisbah cepat, item-item berikut perlu diambil kira KECUALI

(a) Tunai

(0) Akaun Belum terima

(©) Sekuriti boleh pasar

(d) Inventori

(©) Tiada satupun diatas

53. Berikut adalah BENAR berkenaan laporan Perakaunan Pengurusan KECUALI.

(a) Pengguna kepada laporan perakaunan pengurusan adalah pengguna-pengguna

dalaman.

(b) Kandungan laporan adalah fleksibel dan bergantung kepada kehendak

pengurusan

() Tujuan laporan adalah tidak mengikut prinsip-prinsip perakaunan diterima

unum tetapi bergantung kepada keputusan yang akan dibuat.

(@) Laporan tersebut memerlukan pemeriksaan bebas.

(e) Tiada satupun di atas.

54, Belanja gaji pejabat dan sustnilai kelengkapan pejabat adalah dua contoh

(a) Kos buruh langsung

(b) Overhed kilang

(©) Kos produk

(d) Kos tempoh

(@) Tiada satu di atas

55. Di dalam sesuatu proses pengeluaran, kos prima adalah bersamaan kos

campur kos

(a) Bahan langsung, overhead kilang

(6) Buruh langsung, averhead kilang

(c) Bahan langsung, buruh langsung

(@) Juatan, pentadbiran

(©) Bahan langsung, jualan

56. Sesuatu kos produk termasuklah:

(@) Bahan mentah langsung sahaja

(®) Bahan mentah langsung dan buruh langsung sahaja

(©) Bahan mentah langsung, buruh langsung dan overhead pengeluaran sahaja

32

BKALIO13 PERAKAUNAN PERNIAGAAN

(d) Bahan mentah langsung, buruh langsung, overhead pengeluaran & kos

jualan/pentadbiran

(e) Tiada satupun di atas.

57. Di dalam sesuatu proses pengeluaran, kos penukaran adalah bersamaan dengan

kos, campur kos.

(a) Bahan langsung, overhead kilang

(b) Buruh langsung, averhead kilang

(c) Bahan langsung, buruh langsung

(@) Juaian, pentadbiran

(e) Bahan langsung, jualan

58. Berikut adalah sebahagian dari kos-kos overhead pengilangan KECUALI:

(a) Bahan tak langsung

(®) Buruh tak langsung

(©) Gaji penyelia pengeluaran

(d) Utiliti untuk kilang

(e) Gaji pengurus sumber manusia

Soalan 59 hingga 60 berdasarkan data pengeluaran berikut:

Awal (RM) | Akhir (RM) RM

Tnventori bahan mentah 90,000 110,000

Inventori kerja dalam proses 180,000 120,000

Unventori barang siap 300.000 400,000

Belian bahan mentah 300,000

Buruh langsuns 170,000

Overhed kilang 190,000

Jualan bersih | 1,000,000

Kos tempoh 280,000

59. Kos prima ialah

(a) RM450,000

(b) RM320,000

(c) RM100,000

(d) RM500,000

(e) Tiada satupun di atas,

BKALIOI3 PERAKAUNAN PERNIAGAAN

60. Kos penukaran ialah:

(a) RMA50,000

(b) RM360,000

() RM470,000

(d) RM490,000

(e) Tiada satupun di atas.

61. Pernyatgan manakah yang menerangkan kos berubah?

(a) Kos ini bertambah seiring dengan kadar pertambahan unit pengeluaran

(b) Kos ini berkurang seiring dengan kadar pertambahan unit pengeluaran

(©) Kos ini adalah kombinasi keseluruhan kos yang terlibat di dalam sesebuah

pengeluaran

(d) Kos ini tetap kekal pada jumlah yang sama untuk semua volum pengeluaran pada

tahap kapasiti pengeluaran yang tertentu untuk suatu jangkamasa

(e) Tiada satu di atas

62. Manakah yang penyataan berikut TIDAK BENAR berkaitan dengan kos tetap?

(a) Total kos tetap ada malar atau sama tanpa mengira bilangan unit porduk yang

dikeluarkan

(8) Kos tetap seunit produk yang dihasitkan meningkat apabila lebih banyak produk

dikasilkan

(c) Belanja susutnilai kelengkapan kilang adalah salah satu contoh kos tetap

(@) Kos tetap tidak akan bergerak seiring dengan pertambahan unit pengeluaran

(e) Tiada satu di atas

63. Apakah yang dimaksudkan margin sumbangan?

(a) Lebihan hasil jualan ke atas kos tetap

(6) Lebihan kos berubah ke atas hasil jualan

(c) Lebihan hasil jualan ke atas kos berubah

(@) Nisbak hasil jualan ke atas kos berubah

(e) Tiada satu di atas

64, Margin sumbangan seunit dikira sebagai:

(a) Harga jualan seunit — kos tetap seunit

(b) Harga jualan seunit ~ belanja jualan seunit

(©) Harga jualan seunit — kos berubah seunit

(d) Kos berubah seunit ~ kos tetap seunit

(e) Tiada satupun di atas

BKALIOI3 PERAKAUNAN PERNIAGAAN

65. Nisbah margin sumbangan dikira sebagai:

(a) [Harga jualan seunit — kos tetap seunit] / Harga jualan seunit

(6) [Harga jualan seunit - belanja jualan seunit} / Harga jualan seunit

(©) [Kos berubah seunit — kos tetap seunit] / Harga jualan seunit

(d) [Harga jualan seunit — kos berubah seunit] / Harga jualan seunit

(e) Tiada satupun di atas

66. Manakah antara berikut BENAR berkenaan dengan konsep titik pulang modal

(IPM):

(a) Pada TPM, jumlah margin sumbangan adalah bersamaan dengan jumlah kos

tetap.

(b) Sesebuah syarikat akan mendapat keuntungan pada TPM.

(c) Sesebzeah syarikat akan mendapat kerugian pada TPM.

(d) TPM tidak semestinya akan menghasilkan untung/rugi sifar.

(e) Tiada satupun di atas.

67. Manakah antara berikut PALING BAIK bagi menggambarkan teknik-teknik yang

boleh didapati bagi membuat analisa keuntungan kos volume:

(a) Pendekatan margin sumbangan adalah teknik terbaik bagi mengira TPM.

(b) Pendekatan persamaan matematik adalah teknik terbaik bagi mengira TPM.

(©) Pendekatan graf adalah teknik terbaik bagi mengira TPM.

(@ Di dalam mengira TPM, terdapat beberapa teknik yng boleh dilakukan, ianya

adalah Pendekatan margin sumbangan, Pendekatan persamaan marematik dan

Pendekatan graf,

(@) Tiada satypun di atas.

Soalan 68 hingga 7] adalah berdasarkan data dibawah:

Optimus Prime Berhad mengeluar dan menjual pemacu keras model i-Bee. Perincian

‘maklumat diperolehi dari rekod-rekodnya menunjukkan perkara berikut:

‘Hargajualanseunit_ | __RM200

Kos berubah seunit RMIO0

Total kos tetay RMI180,000

‘Kapasiti pengeluaran 6,500 unit

68, Berapakah titik pulang modal (TPM) dalam unit?

fa) 2,700 unit

(®) 1,750 unit

(©) 1,800 unit

(d) 1,850 unit

(@) Tiada satu di atas

35

‘BKALIO13 PERAKAUNAN PERNIAGAAN

69. Syarikat menjangkakan kos berubah akan meningkat sebanyak RM3 seunit. Walaw

bagaimanapun, syarikat tetap memutuskan untuk mengekatkan titik pulang modal

dan harga jualannya. Berapakah kos tetap seunit yang baru pada titik pulang

‘modalnya?

(a) RM67

(®) RM77

(c) RM87

(@) Maklumat tidak mencukupi untuk mengira kos tetap seunit pada titik pulang

modal

(@) Tiada sam di ass

70. Berapakah amaun untung atau rugi bersih jika 3,500 unit dijual?

(a) Untung bersih RM170,000

(b) Rugi bersih RM170,000

(0) Untung bersih RMI75,000

(d) Rugi bersih RMI75,000

(e) Tiada satu di atas

71. Berapakah bilangan unit yang perlu dijual untuk menghasilkan keuntungan sebanyak

RM450,000?

(0) 3,300 unit

(8) 3,600 unit

(©) 5,300 unit

(d) 6,300 unit

(e) Tiada satu di atas

Soalan 72 hingga 75 adalah berdasarkan data berikut:

Syarikat Kumar mengeluarkan air minuman. Perincian maklumat diperolehi dari rekod-

rekodiya menunjukkan perkara berikut:

[Harga jualan seuni ____ RM2.00

Nisbah margin ‘margin sumbangan 40% |

Jumiak kos tetap __RM120,000|

72, Kos berubah seunit ialah:

(@) RMO.80

(b) RM3.00

() RM1.20

(d) RM2.00

(©) Tiada satu di atas

36

BKALIOI3 PERAKAUNAN PERNIAGAAN

73. Margin sumbangan seunit ialah,

(a) RM0.80

(b) RMS.00

(©) RMI.20

(d) RM2.00

(e) Tiada satu di atas

74, Apakah titik pulang modal dalam unit?

(a) 24,000

(®) 100,000

(©) 150,009

(@) 66,000

(e) Tiada satu di atas

75. TPM dalam RM:

(a) RM48,000

(®) RM200,000

() RM120,000

(@) RM300,000

(¢) Tiada satu di atas

76. Satu angka belanjawan jualan adalah dikira dengan:

(@) Mendarabkan angggaran harga jualan seunit dengan belanjawan jualan dalam

unit

(6) Mendarabkan angggaran kos jualan seunit dengan belanjawan jualan dalam unit

(©) Mendarabkan angggaran kos berubah seunit dengan belanjawan jualan dalam

unit

(@) Mendarabkan angggaran kos tetap seunit dengan belanjawan jualan dalam unit

(e) None of all above

77. Berikut adalah sebahagian dari belanjawan operasi KECUALI-

(@ Belanjawan jualan

(b) Belanjawan Kos Barang di jual

(©) Belanjawan Belian

(@) Belanjawan Penyata pendapatan

(e) Belanjawan Tunai

78. Manakah antara berikut adalah sebahagian dari belanjawan kewangan?

(a) Belanjawan jualan

(6) Belanjawan Kos Barang di jual

37

BKALI013 PERAKAUNAN PERNIAGAAN

(©) Belanjawan Belian

(d) Belanjawan Penyata pendapatan

(e) Belanjawan Lembaran imbangan

Soalan 79 dan 80 adalah berdasarkan data berikut:

Syarikat Ahad reported the following sales budget for month of January and February:

ie Belanjawan jualan

79. Sekiranya harga jualan seunit dianggarkan RM2.00, apakah angka bagi belanjawan

Jjualan dalam Januari?

(@) RM10,000

(6) RM4,000

(©) RM24,000

(a) RM44,000

(e) RM20,000

80. Diandaikan bahawa semua jualan adalah secara hutang, berapakah Syarikat Ahad

akan membuat kutipan tunai ds dalam Februari sekiranya dijangkakan hanya 20%

dari jualan bulan semasa berjaya dikutip pada bulan ianya dijual dan selebihnya

akan dikutip pada bulan berikutnya?

(a) RM4,800

(b) RM4,000

(©) RM20,800

(d) RM23,200

(e) RMB,800

38

APPENDIX

CURRENT RATIO = Current assets / current liabilities

QUICK RATIO. = Quick assets / current liabilities

RETURN ON ASSET = Net profit (before int.) / average total assets

INVENTORY TURNOVER = COGS / Average inventory

DEBT RATIO = Total liabilities / total assets

EQUITY RATIO = Total equity / total assets

END OF QUESTION

KERTAS SOALAN TAMAT

39

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assignment Subprime MortgageDocument6 pagesAssignment Subprime MortgagemypinkladyNo ratings yet

- ELC590 Persuasive SpeechDocument5 pagesELC590 Persuasive SpeechmypinkladyNo ratings yet

- Senarai Pusat Jagaan Orang TuaDocument6 pagesSenarai Pusat Jagaan Orang TuamypinkladyNo ratings yet

- Assignment 2 Fin536Document6 pagesAssignment 2 Fin536mypinkladyNo ratings yet

- KAL 1013 - 8 Ogos09Document18 pagesKAL 1013 - 8 Ogos09mypinkladyNo ratings yet

- Design BannerDocument1 pageDesign BannermypinkladyNo ratings yet