Professional Documents

Culture Documents

Oracle Stock Analysis Report

Uploaded by

InvestingSidekickCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oracle Stock Analysis Report

Uploaded by

InvestingSidekickCopyright:

Available Formats

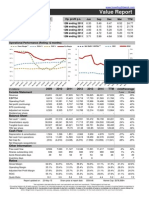

Oracle Corp.

www.InvestingSidekick.com

ORCL

Value Report

I.S.Q. Score: 7/10

TTM EPS:

Next year EPS estimate:

Net cash* / (debt) p.s:

Net debt EBITDA:

Net debt Equity:

2.48

3.01

2.64

-

Op. profit p.s.

May

Aug

Nov

Feb

TTM

12M ending 2015

12M ending 2014

12M ending 2013

12M ending 2012

12M ending 2011

1.10

1.08

0.94

0.86

0.66

0.67

0.63

0.60

0.53

0.38

0.81

0.76

0.73

0.62

0.55

0.77

0.80

0.71

0.67

0.59

3.35

3.26

2.97

2.68

2.18

Operational Performance (Rolling 12 months)

Gross Margin**

SG&A %

R&D %

Net Debt / EBITDA**

Op Margin

45%

84%

ROE

ROIC

45%

1.2

40%

40%

82%

1.0

35%

35%

80%

30%

78%

30%

0.8

25%

25%

0.6

20%

20%

76%

15%

15%

0.4

74%

10%

10%

0.2

72%

5%

5%

0%

70%

2009

$ millions

2010

2011

0%

2012

2013

2014

TTM

Income Statement

Revenue

CAGR/average

5 year

10 year

23,252

10,245

8,321

5,593

1.12

5,771

0.05

26,820

11,241

9,062

6,135

1.22

6,921

0.20

35,622

14,949

12,033

8,547

1.69

9,159

0.21

37,121

16,532

13,706

9,981

2.03

10,325

0.24

37,180

17,501

14,684

10,925

2.35

10,881

0.30

38,275

17,361

14,759

10,955

2.45

11,155

0.48

38,841

17,448

14,797

10,827

2.48

11,074

0.48

10%

11%

12%

14%

17%

14%

57%

14%

16%

14%

15%

17%

15%

#DIV/0!

2,386

25,090

(1,021)

(0.20)

3,814

30,798

1,052

0.21

12,926

39,776

10,363

2.04

14,202

43,688

10,670

2.18

13,722

44,648

10,665

2.30

14,644

46,878

11,089

2.48

11,520

48,095

6,925

1.59

44%

13%

-261%

-265%

6%

19%

3%

5%

1,976

8,255

(529)

-

2,271

8,681

(230)

-

2,796

11,214

(345)

-

2,916

13,743

(648)

-

2,931

14,224

(650)

-

2,908

14,921

(580)

-

2,868

8%

14,509

13%

(948)

2%

(6,232) #DIV/0!

29%

17%

4%

#DIV/0!

7,673

5,005

70

8,392

5,026

76

16

10,804

5,068

68

13

12,932

4,905

63

7

13,543

4,646

59

12

14,313

4,464

58

10

13,365

4,367

39

15

13%

-2%

65

12

17%

-1%

72

12

Gross Margin

79.4%

78.5%

76.4%

78.8%

80.9%

81.1%

82.2%

79.1%

78.5%

Operating Margin

35.8%

33.8%

33.8%

36.9%

39.5%

38.6%

38.1%

36.5%

35.3%

Adjusted Net Profit Margin

24.8%

25.8%

25.7%

27.8%

29.3%

29.1%

28.5%

27.5%

26.1%

ROIC

25.7%

24.1%

33.1%

34.8%

36.2%

35.0%

30.8%

32.6%

29.5%

2.5

2.0

EBITDA

Operating Profit

Net profit (continuing)

EPS (continuing)

Adjusted net income

Dividend per share

Balance Sheet

Net cash* / (debt)

Shareholders equity

Tangible book value

TBV per share

Cash Flow

Depreciation & amortization

Net cash from operations

Net Cap Ex

Net Disposals (acquisitions)

Other Information

Free cash flow

Shares outstanding (mil)

Accts Receivable days

Inventory days

Ratios

Quick Ratio

1.9

Report updated on:

18-May-15

1.6

2.5

2.4

Share price at report date:

3.0

$43.94

3.1

3.5

Market Cap: $191,889m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments. **Plotted against Left hand axis

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Oracle Corp.

www.InvestingSidekick.com

ORCL

Value Report

EV/OP trading range

Conservative model value

Aggressive model value

Current EV/OP (TTM)

Current EV/OP 12.2

(Enterprise Value / Operating Profit)

Return on Invested Capital

21.7

Free Cash ROIC

32.6%

42.0%

(5 year average)

19.7

Free Cash Flow Operating Profit

90%

15 years

92%

10 years

93%

5 years

17.7

15.7

13.7

% spending of FCF on

0%

8%

46%

4%

39%

Net Acquisitions/(divestitures)

11.7

Dividends

Share buybacks / (issues)

9.7

Decrease/(increase) of net debt

7.7

Other spending/(asset sales)

(cumulative last 10 years)

P/B trading range

P/B = 1

Book value p.s. 11.01

Current P/B

10.9

Average annual change in

Book Value p.s.

TBV p.s.

21.8%

40.0%

15 years

15 years

21.6%

52.0%

10 years

10 years

16.2%

5 years

5 years

8.9

6.9

4.9

Compounded annual growth in

Book Value p.s.

TBV p.s.

17.1%

5.7%

15 years

15 years

19.5%

44.6%

10 years

10 years

14.4%

85.6%

5 years

5 years

0.9

Book Value per share

Quick Ratio (Acid test)

Accounts receivable days

16,000

12

14,000

10

12,000

10,000

8,000

4

6,000

4,000

2,000

-

Inventory days

450%

60.0

400%

50.0

350%

Quick Ratio

Free Cash Flow

Tangible Book Value per share

Book Value per share ($)

Operating Income

(2)

300%

40.0

250%

30.0

200%

150%

20.0

100%

10.0

50%

0%

0.0

Inventory/Accounts receivable days

2.9

Operating Profit / FCF ($mil)

1.59

0.23

2.64

Tangible Book (TBV) p.s.

Net Net Curr. Assets p.s.

Net cash* / (debt) p.s.

12.9

(Seasonally adjusted data)

Report updated on: 18-May-15

Share price at report date:

$43.94

Market Cap: $191,889m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments.

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

You might also like

- QuizDocument3 pagesQuizInvestingSidekickNo ratings yet

- Berkshire Hathaway Equity ResearchDocument2 pagesBerkshire Hathaway Equity ResearchInvestingSidekickNo ratings yet

- IBM Stock Analysis ReportDocument2 pagesIBM Stock Analysis ReportInvestingSidekick100% (1)

- Netflix Stock Analysis ReportDocument2 pagesNetflix Stock Analysis ReportInvestingSidekickNo ratings yet

- Cisco Stock Analysis ReportDocument2 pagesCisco Stock Analysis ReportInvestingSidekickNo ratings yet

- Apple Stock Analysis ReportDocument2 pagesApple Stock Analysis ReportInvestingSidekickNo ratings yet

- Johnson Johnson Stock Analysis ReportDocument2 pagesJohnson Johnson Stock Analysis ReportInvestingSidekickNo ratings yet

- Verizon Stock Analysis ReportDocument2 pagesVerizon Stock Analysis ReportInvestingSidekickNo ratings yet

- Microsoft Stock Analysis ReportDocument2 pagesMicrosoft Stock Analysis ReportInvestingSidekickNo ratings yet

- Google Stock Analysis ReportDocument2 pagesGoogle Stock Analysis ReportInvestingSidekickNo ratings yet

- Customer Solutions ModelDocument8 pagesCustomer Solutions ModelInvestingSidekick0% (1)

- Boeing Stock Analysis ReportDocument2 pagesBoeing Stock Analysis ReportInvestingSidekick100% (1)

- EAM Solar ProspectusDocument178 pagesEAM Solar ProspectusInvestingSidekickNo ratings yet

- House Buying Vs RentingDocument14 pagesHouse Buying Vs RentingInvestingSidekickNo ratings yet

- Gencorp Annual Report 2013Document177 pagesGencorp Annual Report 2013InvestingSidekickNo ratings yet

- EAM Solar ProspectusDocument178 pagesEAM Solar ProspectusInvestingSidekickNo ratings yet

- The Washington Post Company 1971 Annual ReportDocument33 pagesThe Washington Post Company 1971 Annual ReportInvestingSidekickNo ratings yet

- IBM 10 Year FinancialsDocument1 pageIBM 10 Year FinancialsInvestingSidekickNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- NYIF Accounting Module 10 Excercise With AnswersssDocument3 pagesNYIF Accounting Module 10 Excercise With AnswersssShahd OkashaNo ratings yet

- Executive Finance and Strategy Tiffin en 23071Document5 pagesExecutive Finance and Strategy Tiffin en 23071EdgarAnchondoNo ratings yet

- 0-Tugas-Corporate Finance Confronting Theory-Reading TaskDocument44 pages0-Tugas-Corporate Finance Confronting Theory-Reading TaskFirman DariyansyahNo ratings yet

- Dana Dairy Products 2010 Financial AnalysisDocument15 pagesDana Dairy Products 2010 Financial AnalysisNick GavalekNo ratings yet

- Adani ENterpriseDocument1 pageAdani ENterprisedheeraj tanejaNo ratings yet

- Hamriyah Free Zone - E Office Proposal-2012Document4 pagesHamriyah Free Zone - E Office Proposal-2012Jitendra MishraNo ratings yet

- BramDocument2 pagesBramIshidaUryuuNo ratings yet

- Financial Accounting and Reporting Ii Final Quiz 2/3Document7 pagesFinancial Accounting and Reporting Ii Final Quiz 2/3Patrick Ferdinand Alvarez50% (2)

- Venture Capital Opportunities in PakistanDocument7 pagesVenture Capital Opportunities in Pakistanstylishman11100% (1)

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- ITI Multi-Cap Fund HighlightsDocument48 pagesITI Multi-Cap Fund HighlightsRAHULNo ratings yet

- Capital MArket Ni JerrylDocument36 pagesCapital MArket Ni JerrylLyn AmbrayNo ratings yet

- 8.1. Introduction of Rural MarketingDocument7 pages8.1. Introduction of Rural MarketingAR Ananth Rohith BhatNo ratings yet

- IPSAS in Your Pocket April 2017 PDFDocument63 pagesIPSAS in Your Pocket April 2017 PDFMuhamad Riza El HakimNo ratings yet

- Chapter 07 Stocks and Stock ValuationDocument36 pagesChapter 07 Stocks and Stock ValuationAai NurrNo ratings yet

- Ar 2010Document115 pagesAr 2010pipiNo ratings yet

- Tying Free Cash Flows To Market Valuation - Robert Howell - Financial ExecutiveDocument4 pagesTying Free Cash Flows To Market Valuation - Robert Howell - Financial Executivetatsrus1No ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- Chap4 PDFDocument45 pagesChap4 PDFFathurNo ratings yet

- Hero Honda Demerger SynopsisDocument4 pagesHero Honda Demerger SynopsisYuktesh PawarNo ratings yet

- Chapter 1-Introduction To Financial Accounting (Acc106)Document17 pagesChapter 1-Introduction To Financial Accounting (Acc106)Syahirah AzlyzanNo ratings yet

- Toshiba Fraud Case ExposedDocument23 pagesToshiba Fraud Case ExposedShashank Varma100% (1)

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Bvps and EpsDocument30 pagesBvps and EpsRenzo Melliza100% (1)

- Anderson and Zinder, P.C., CpasDocument3 pagesAnderson and Zinder, P.C., CpasJack BurtonNo ratings yet

- Risk Management L SFM L Revision by CA Mayank KothariDocument103 pagesRisk Management L SFM L Revision by CA Mayank KothariPraveen Kumar100% (1)

- Product of EdelweissDocument5 pagesProduct of EdelweissNavneet Singh100% (1)

- SSRN Id1696151Document9 pagesSSRN Id1696151Nurma Listyana AyuNo ratings yet

- SP Case Study PDFDocument4 pagesSP Case Study PDFTanya SinghNo ratings yet