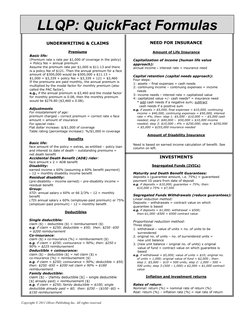

LLQP: QuickFact Formulas

UNDERWRITING & CLAIMS

NEED FOR INSURANCE

Premiums

Amount of Life Insurance

Basic life:

(Premium rate x rate per $1,000 of coverage in the policy)

+ Policy fee = annual premium

Assume the premium rate per $1,000 is $11.13 and there

is a policy fee of $121. Then the annual premium for a face

amount of $300,000 would be $300,000 x $11.13

$1,000 = $3,339 + policy fee = $3,339 + 121 = $3,460

If the premiums are paid monthly, the annual premium is

multiplied by the modal factor for monthly premium (also

called the PAC factor).

e.g., if the annual premium is $3,460 and the modal factor

for monthly premium is 0.08, then the monthly premium

would be $276.80 ($3,460 x 0.08).

Capitalization of income (human life value

approach):

Adjustments

e.g. if assets = $5,000, final expenses = $10,000, continuing

income = $40,000, continuing expenses = $50,000, interest

rate = 4%; then: step 1: $5,000 - $10,000 = $5,000 cash

needed; step 2: $40,000 $50,000 = $10,000 income

needed; step 3: $10,000 4% = $250,000; step 4: $250,000

+ $5,000 = $255,000 insurance needed

For misstatement of age:

premium charged correct premium = correct rate x face

amount = amount of insurance

For special risks:

Flat dollar increase: $/$1,000 of coverage

Table rating (percentage increase): %/$1,000 in coverage

Basic life:

Benefits

face amount of the policy + extras, as entitled policy loan

and interest to date of death outstanding premiums =

net death benefit

Accidental Death Benefit (ADB) rider:

face amount x 2 = ADB benefit

earned income x 60% (assuming a 60% benefit payment)

12 = monthly disability income benefit

(pre-disability income earned)

residual benefit

interest rate = insurance need

Capital retention (capital needs approach):

Four steps:

1: assets final expenses = cash needs

2: continuing income continuing expenses = income

needs

3: income needs interest rate = capitalized value

4: capitalized value +/- cash needs* = insurance need

* add cash needs if a negative sum; subtract

cash needs if a positive sum

Amount of Disability Insurance

Need is based on earned income calculation of benefit. See

column on left.

INVESTMENTS

Segregated Funds (IVICs)

Disability:

Residual disability:

annual income

pre-disability income =

Group:

STD: annual salary x 60% or 66 2/3% 12 = monthly

benefit

LTD: annual salary x 60% (employee-paid premium) or 75%

(employer-paid premium) 12 = monthly benefit

Deductibles

Single deductible:

claim ($) deductible ($) = reimbursement ($)

e.g. if claim = $250; deductible = $50; then: $250 -$50

= $200 reimbursement

Co-insurance:

claim ($) x co-insurance (%) = reimbursement ($)

e.g. if claim = $250; coinsurance = 90%; then: $250 x

90% = $225 reimbursement

Deductible + coinsurance:

claim ($) deductible ($) = net claim ($) x

co-insurance (%) = reimbursement ($)

e.g. if claim = $250; coinsurance = 90%; deductible = $50;

then: $250 -$50 = $200 net claim x 90% = $180

reimbursement

Family deductible:

claim ($) (family deductible [$] single deductible

[$] already paid) = reimbursement ($)

e.g. if claim = $250; family deductible = $100; single

deductible already paid = $0; then: $250 ($100 -$0) =

$150 reimbursement

Copyright 2011 Oliver Publishing Inc. All rights reserved.

Maturity and Death Benefit Guarantees:

deposits x (guarantee amount, i.e. 75%) = guaranteed

payment 10 years from date of deposit

e.g. if deposits = $10,000, guarantee = 75%; then:

$10,000 x 75% = $7,500

Segregated Funds Withdrawals (reduce guarantees):

Linear reduction method:

Deposits withdrawals = contract value on which

guarantee is based

e.g. if deposits = $1,000; withdrawal = $500;

then:$1,000 -$500 = $500 contract value

Proportional reduction method:

Three steps:

1. withdrawal value of units = no. of units to be

surrendered

2. original no. of units no. of surrendered units =

new unit balance

3. (new unit balance original no. of units) x original

value of fund = contract value on which guarantee is

based

e.g. if withdrawal = $5,000; value of units = $10; original no.

of units = 1,000; original value of fund = $2,000 ; then:

step 1: $5,000

$10 = 500 units; step 2: 1,000 500 =

500 units; step 3:(500 1,000) x $2,000 = $1,000 contract

value

Inflation and investment returns

Rates of return:

Nominal: return (%) = nominal rate of return (%)

Real: return (%) inflation rate (%) = real rate of return

�LLQP: QuickFact Formulas

Adjusted cost basis (ACB)

TAXATION

Before December 2, 1982

Premiums dividends* = adjusted cost basis (ACB)

After December 2, 1982

Premiums net cost of pure insurance (NCPI)

dividends* = adjusted cost basis (ACB)

e.g. if premiums = $5,000; NCPI = $3,000; dividends = $100;

then: $5,000 -$3,000 -$100 = $1,900 adjusted cost basis

*if applicable

Taxation of Cash Surrender Value (CSV)

Before December 2, 1982

CSV (premiums dividends*) = taxable gain

After December 2, 1982

CSV (premiums - net cost of pure insurance [NCPI]

dividends*) = taxable gain

e.g. if CSV = $10,000; premiums = $5,000; NCPI = $3,000;

dividends = $500; then: $10,000 ($1,500) = $8,500 taxable

gain *if applicable

Policy Loans and Taxation of Policy Loans

Loan: CSV x 90% = max. policy loan

e.g. if CSV = $6,000; then: $6,000 x 90% = $5,400 max. loan

Tax on loan: loan adjusted cost basis (ACB) =

taxable portion of loan

e.g. if loan = $5,400; ACB = $4,000; then: $5,400 - $4,000 =

$1,400 of the loan is taxable under certain conditions

Tax Deferral

RRSP Contributions:

Basic: earned income x 18% = contribution limit to a

maximum dollar limit for the year (2014 = $24,740;

2013 = $23,820)

With Pension Adjustment (PA): basic contribution

pension adjustment for previous year

Taxation of Investments

Interest:

interest income x investors marginal tax rate (MTR) =

tax on interest income

e.g. if $1,000 earned in interest and a marginal tax rage of 26%;

then: $1,000 x 26% = $260 owed in interest

Capital gains/loss:

market value of capital property cost of capital property

= capital gain or capital loss on capital property

e.g. if $6,500 selling price - $500(cost) = $6,000 capital gain;

if $6,500 selling price - $8,000 (cost) = ($1,500) capital loss

Capital gains tax:

market value of capital property cost of capital

property = capital gain x .5 = taxable portion of gain x

investors marginal tax rate = capital gains tax

e.g. if $6,000 sale and a marginal tax rate of 26%: then:

$6,000 x .5 =$3,000 x 26% = $780 owed in capital

gains tax

Stock Dividends:

The dividend tax credit and the dividend gross-up

amount are changing each year as of 2010. For

this reason, the calculation of taxation on stock

dividends is no longer being tested.

Segregated Funds (tax consequence of withdrawal):

Three steps:

1. amount of withdrawal fair market value of contract =

percentage of disposition

2. fair market value of contract adjusted cost basis =

basis for taxation

3. basis for taxation x percentage of disposition =

capital gain

e.g. if withdrawal = $1,000; fair market value of contract =

$5,000; adjusted cost basis = $2,500; then: step 1: $1,000

$5,000 = 20% of contract being disposed; step 2: $5,000

$2,500 = $2,500 basis for taxation; step 3: $2,500 x 20% =

$500 capital gain

With Past Service Pension Adjustment (PSPA):

basic contribution PSPA for current year

MORE INVESTMENT FORMULAS

Present Value

present value (PV) = future value (FV) (1 + interest

rate [i])n

e.g., if future value is $50,000; interest rate is 3.1%;

and n (number of compounding periods [typically the

number of years]) is 3; then:

PV = 50,000 (1 + .031)3; PV = 50,000 (1.031) 3;

PV = 50,000 (1.031 x 1.031 x 1.031)*;

PV = 50,000 1.096; PV = $45,620.44

*(remember to solve the calculation in the brackets first)

Copyright 2011 Oliver Publishing Inc. All rights reserved.

Future Value

future value (FV) = present value (PV) x (1 +

interest rate [i])n

e.g., if present value is $50,000; interest rate is 3.1%;

and n (number of compounding periods [typically the

number of years]) is 3; then:

FV = 50,000 x (1 + .031)3; FV = 50,000 x (1.031)3;

FV = 50,000 x (1.031 x 1.031 x 1.031)*;

FV = 50,000 x 1.096; FV = $54,800

*(remember to solve the calculation in the brackets first)