0% found this document useful (0 votes)

376 views1 pageLife Insurance Options and Benefits

Whole life, universal life, and variable life are types of permanent life insurance that provide coverage for the insured's entire life in exchange for fixed premium payments. Term life provides temporary coverage for a limited term and has lower premiums but no cash value component. When considering life insurance, factors to include are how long coverage is needed, existing debt levels, and the insured's age and life expectancy. The application process involves getting quotes, speaking with an agent, completing paperwork, and potentially a medical exam.

Uploaded by

Michelle StubbsCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

376 views1 pageLife Insurance Options and Benefits

Whole life, universal life, and variable life are types of permanent life insurance that provide coverage for the insured's entire life in exchange for fixed premium payments. Term life provides temporary coverage for a limited term and has lower premiums but no cash value component. When considering life insurance, factors to include are how long coverage is needed, existing debt levels, and the insured's age and life expectancy. The application process involves getting quotes, speaking with an agent, completing paperwork, and potentially a medical exam.

Uploaded by

Michelle StubbsCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

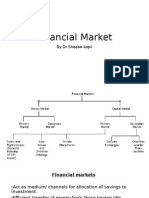

- Life Insurance Overview: Provides an overview of life insurance types and guidelines, including reasons to buy and how it functions.