100% found this document useful (1 vote)

256 views16 pagesUnderstanding Annuities: Types and Benefits

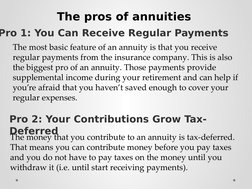

(1) Annuities provide a series of fixed payments over a fixed period that are either paid by or to the annuity owner.

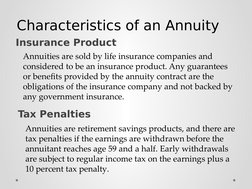

(2) Annuities have tax advantages like tax-deferred growth but also tax penalties for early withdrawals. They also have withdrawal fees in the first 5-7 years.

(3) Annuities offer guaranteed income in retirement through various payout options and can help protect against outliving savings. However, they also have high fees that can reduce returns over time.

Uploaded by

PraveenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

256 views16 pagesUnderstanding Annuities: Types and Benefits

(1) Annuities provide a series of fixed payments over a fixed period that are either paid by or to the annuity owner.

(2) Annuities have tax advantages like tax-deferred growth but also tax penalties for early withdrawals. They also have withdrawal fees in the first 5-7 years.

(3) Annuities offer guaranteed income in retirement through various payout options and can help protect against outliving savings. However, they also have high fees that can reduce returns over time.

Uploaded by

PraveenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

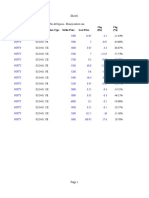

![Calculation of PV and FV

of Ordinary Annuity

Mathematically,

PV of ordinary annuity=C*[{(1+r)^n-

1}/r(1+r)^n]

FV](https://screenshots.scribd.com/Scribd/252_100_85/189/452736646/8.jpeg)

![Calculation of PV and FV

of Annuity due

Mathematically,

PV of

an Annuity due: C*[{(1+r)^n-

1}/r(1+r)^n]*(1](https://screenshots.scribd.com/Scribd/252_100_85/189/452736646/9.jpeg)