Professional Documents

Culture Documents

A Snapshot of Legislative Changes Proposed in The Budget

Uploaded by

architectprasyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Snapshot of Legislative Changes Proposed in The Budget

Uploaded by

architectprasyCopyright:

Available Formats

A snapshot of legislative changes proposed in the Budget

From laws to contain circulation of black money to a newbankruptcy code that will make it easier for entrepreneurs to exit unviable

businesses the Union Budget has proposed a series of wide-ranging legislative changes. Here is a snapshot of the nine laws and

their impact:

Bankruptcy code

The proposed legislation is going to make it easier for corporates and entrepreneurs to exit unviable ventures. The code will replace

the Sick Industrial companies Act (SICA) as well as the Board for Industrial and Finance reconstruction (BIFR) Act.

Comprehensive law to deal with black money parked abroad

The proposed law provides for prosecution and rigorous imprisonment up to 10 years for those concealing income and assets, and

evading tax on foreign assets. It also provides for prosecution of those not filing returns on, or filing returns with inadequate

disclosure of foreign assets. The owner or beneficiary of foreign assets will have to mandatorily file returns, even if there is no taxable

income. Those abetting offenders whether individuals, entities, banks or financial institutions will be liable for prosecution and a

penalty.

Benami Transactions (Prohibition) Bill

The new legislation will enable confiscation of benami properties and provide for prosecution. The move is aimed at checking

circulation of black money in the domestic economy. Income Tax act too is proposed to be amended to prohibit acceptance or

payment of an advance of Rs. 20,000 or more in cash for purchase of immovable property.

Public Contracts (resolution of disputes) Bill

The new law is expected to streamline the process for resolving disputes arising in public contracts. A quick resolution of disputes is

expected to ease the cash flow stress of companies involved in public contracts.

India Financial Code

As suggested by the Financial Sector Legislative Reforms Commission (FSLRC), India Financial Code lays out clear objectives for

financial regulations. Under the proposed legislation, a unified financial authority (UFA) will be constituted as a regulator. It proposes

to set up a financial redress agency (FRA) for resolving consumer complaints.

Regulatory reform Bill

It is expected to bring about a cogency of approach across various sectors of infrastructure. The move is seen to be creating an

enabling environment for smooth roll out of Public Private Partnership (PPP) projects. The proposed law is expected to bring about

consistency of regulators entrusted with tariff decisions in various sectors.

Procurement law

Aimed at containing malfeasance in public procurement. A similar Public Procurement Bill, 2012 was introduced in the 15 th Lok

Sabha. The bill had advocated open competitive bidding as the preferred method for procurement and specified the conditions under

which procurement methods could be used and the procedure to be followed.

Amendment to RBI Act to help constitute a Monetary Policy Committee

The committee will guide the central banks policy stance and help in inflation targeting. As per monetary policy framework

agreement signed between the finance ministry and the Reserve Bank, the Committee will seek to keep Consumer Price Index-based

inflation below six per cent by January 2016 and four per cent from 2016-17, with a band of plus/minus two per cent. The move is

seen as an attempt to bring better coordination between the ministry and the central bank.

Public Debt Management Agency

The new agency thus created will manage both external and domestic debt.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Associate Professor Sharan Desai's ExpertiseDocument1 pageAssociate Professor Sharan Desai's ExpertisearchitectprasyNo ratings yet

- Timetable Insights Self Study Upsc Mains 2015 Online Timetable 10Document7 pagesTimetable Insights Self Study Upsc Mains 2015 Online Timetable 10architectprasyNo ratings yet

- UD131 MagazineDocument52 pagesUD131 MagazinearchitectprasyNo ratings yet

- Structure of Thesis TopicsDocument4 pagesStructure of Thesis TopicsarchitectprasyNo ratings yet

- PIBDocument19 pagesPIBarchitectprasyNo ratings yet

- Land ReformsDocument3 pagesLand ReformsarchitectprasyNo ratings yet

- Astronomy-Sphere of Influence, Mars Mission, OrbitDocument16 pagesAstronomy-Sphere of Influence, Mars Mission, Orbitcrackmains2014No ratings yet

- Akhila Bharatiya Hindu MahasabhaDocument3 pagesAkhila Bharatiya Hindu MahasabhaarchitectprasyNo ratings yet

- Agriculture - Some Challenges in Modern IndiaDocument6 pagesAgriculture - Some Challenges in Modern IndiaRavikanth ReddyNo ratings yet

- Agriculture - Some Challenges in Modern IndiaDocument6 pagesAgriculture - Some Challenges in Modern IndiaRavikanth ReddyNo ratings yet

- Grammar of Gender Relations in IndiaDocument10 pagesGrammar of Gender Relations in IndiaarchitectprasyNo ratings yet

- 12th Five Year PlanDocument146 pages12th Five Year PlanKajal RaiNo ratings yet

- Critically Endangered Animal Species of India PDFDocument26 pagesCritically Endangered Animal Species of India PDFUtkarsh RajNo ratings yet

- 01 President Speech FinalDocument5 pages01 President Speech FinalAbinesh KumarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Global Divides The North and The South - Bryan OcierDocument17 pagesGlobal Divides The North and The South - Bryan OcierBRYAN D. OCIER, BSE - ENGLISH,No ratings yet

- China Pakistan Economic Corridoor: Prestented by Waleed Babar B-Com Part 2Document9 pagesChina Pakistan Economic Corridoor: Prestented by Waleed Babar B-Com Part 2Sana KhanNo ratings yet

- Top 10 Developments in India Over The Last 10 Years: 10. Rural DevelopmentDocument2 pagesTop 10 Developments in India Over The Last 10 Years: 10. Rural DevelopmentananyaNo ratings yet

- Economic Systems in EthiopiaDocument1 pageEconomic Systems in EthiopiaMeti GudaNo ratings yet

- VAT calculations and transactionsDocument2 pagesVAT calculations and transactionsKathreen Aya ExcondeNo ratings yet

- Globalization of world economics definedDocument15 pagesGlobalization of world economics definedysblnclNo ratings yet

- Economics PPT Module 6Document10 pagesEconomics PPT Module 6Sujo GeorgeNo ratings yet

- Devina Singh - EDPM 2023 Assignment 2Document11 pagesDevina Singh - EDPM 2023 Assignment 2Devina SinghNo ratings yet

- Protectionism-4 1 6Document41 pagesProtectionism-4 1 6Shafayet MirajNo ratings yet

- Fiscal PolicyDocument21 pagesFiscal PolicyAdityaNo ratings yet

- Chapter (10) : Economic Integration: Customs Unions and Free Trade AreasDocument8 pagesChapter (10) : Economic Integration: Customs Unions and Free Trade AreasMirna MansourNo ratings yet

- International Business and TradeDocument23 pagesInternational Business and TradeJv Manuel100% (2)

- Econ 90 - Chapter 9 ReportDocument11 pagesEcon 90 - Chapter 9 ReportAnn Marie Abadies PalahangNo ratings yet

- External Factor Evaluation (EFE) Matrix Weight (In %) Rate Weighted Scores OpportunitiesDocument1 pageExternal Factor Evaluation (EFE) Matrix Weight (In %) Rate Weighted Scores OpportunitiesNANDAKRISHNA SNo ratings yet

- Economics MeDocument11 pagesEconomics MePrateek Kumar PatelNo ratings yet

- Introducing Aggregate DemandDocument1 pageIntroducing Aggregate DemandMr Aycock100% (1)

- GDP, GNP and NI NotesDocument5 pagesGDP, GNP and NI NotesKhaleel KothdiwalaNo ratings yet

- KES Assigment 1Document7 pagesKES Assigment 1Vash PatniNo ratings yet

- Submit in Schoology Using " " 1.: Shirwin - Sandoval@olivarezcollege - Edu.phDocument2 pagesSubmit in Schoology Using " " 1.: Shirwin - Sandoval@olivarezcollege - Edu.phCherry MirabuenoNo ratings yet

- IB MCQsDocument4 pagesIB MCQsChau SaNo ratings yet

- M3.1.1 Customs BasicDocument14 pagesM3.1.1 Customs Basic5173 VARMA AARTINo ratings yet

- National Debt Crisis Instructor Directions PDFDocument1 pageNational Debt Crisis Instructor Directions PDFScott MartzNo ratings yet

- Chapter 6 - International TradeDocument31 pagesChapter 6 - International TradeWilliam DC RiveraNo ratings yet

- Delhi - Summary Asian IntegrationDocument72 pagesDelhi - Summary Asian IntegrationNiraj KumarNo ratings yet

- HP Capital Structure Case StudyDocument8 pagesHP Capital Structure Case StudyHarsimar NarulaNo ratings yet

- Green Pearl Ceylon Enters Maldives MarketDocument2 pagesGreen Pearl Ceylon Enters Maldives MarketAssignment DriveNo ratings yet

- "Increasing Global Competitiveness": Sarthak Shukla Roll No. 2038Document4 pages"Increasing Global Competitiveness": Sarthak Shukla Roll No. 2038Abhijeet KumarNo ratings yet

- Chapter 19 Multinational Cash Management Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument7 pagesChapter 19 Multinational Cash Management Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsBarakaNo ratings yet

- IShares Floating Rate Bond ETF FundDocument1,224 pagesIShares Floating Rate Bond ETF FundAdquisiciones DelinstitutoNo ratings yet

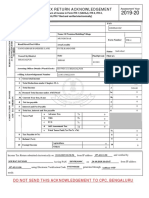

- Indian Income Tax Return Acknowledgement for AY 2019-20Document1 pageIndian Income Tax Return Acknowledgement for AY 2019-20Sourav KumarNo ratings yet