Professional Documents

Culture Documents

Manhattan PDF

Uploaded by

Anonymous Feglbx5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manhattan PDF

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

MANHATTAN

Office Market Report

August 2015

Market Starts to Heat Up in July

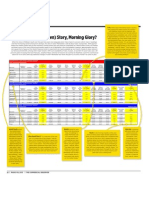

MARKET TRACKER (all classes; month-over-month)

Manhattan Market Snapshot

Availability: 9.4%

Net Absorption: 464,826 SF

Asking Rent:

$70.69 PSF

Deliveries:

0 SF

Overall Availability

MANHATTAN

10.25%

10.00%

The Manhattan office market heated

up in July, much like the sweltering

temperatures outside. Manhattan posted

its sixth consecutive month of positive

absorption after 464,826 square feet was

absorbed in July. This coincides with the

strong job numbers through midyear, as

office-using employment added 30,700

jobs in New York City over the past 12

months. Although availability only fell 10

basis points to 9.4 percent, this is the first

month in 2015 where all three Manhattan

markets contributed to the decline in

available space. In addition, 13 of the 17

submarkets posted a decline in the

available supply. Class A asking rents

increased $0.25 per square foot to

$77.43, while Class B asking rents jumped

$1.42 per square foot to $61.81 because of

an increase in demand in the Midtown

South market.

9.75%

Midtown Stability Continues

9.50%

9.25%

9.00%

8.75%

8.50%

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Asking Rents

MANHATTAN

$80

Class A

$75

$70

$65

Class B

$60

$55

$50

$45

Jul-14

Oct-14

Jan-15

Apr-15

Jul-15

Midtown posted another solid month with

seven of the nine submarkets having

positive absorption with 256,895 square

feet coming off the market. This brought

Midtowns 2015 absorption totals to

positive 342,353 square feet. The

availability rate decreased another 10

basis points to 9.5 percent, as the direct

available supply dropped to just under 20

million square feet for the first time since

December 2008. A total of 23 deals

greater than 100,000 square feet have

been signed through July, compared to 17

through the first seven months of 2014.

This demand has caused the availabe

large blocks in Midtown to drop from 51 to

46 in the past 12 months. Class A asking

rents increased $0.46 per square foot to

$86.12, mainly from the Fifth/Madison

asking rents increasing $0.73 per square

foot to $128.20. Class B asking rents

continue to rise, increasing $0.75 per

square foot to $62.10.

Midtown South Bounces Back

Midtown South continues to be

Manhattans hottest market with four of

the five submarkets having availability

rates below 7.0 percent. Availability

dropped 20 basis points in July to 6.7

percent. Midtown South posted positive

152,642 square feet this month, bringing

its year-to-date total to positive 222,873

square feet. Demand from the TAMI

(technology, advertising, media and

information services) sector continues to

drive the market, as it comprises 60

percent of Midtown Souths leasing

volume. Both Class A and Class B asking

rents jumped significantly throughout July,

as Class A asking rents are up by $4.94 to

$77.73 per square footthis is primarily

due to the high asking rental prices at

11 Madison Avenue. Class B asking rents

surpassed $70.00 per square foot for the

first time in history and are up $3.13 per

square foot to $71.27.

Downtown Steadies

Downtown continues to slowly chip away

at the 1.6 million square feet of space

added to the market in the first quarter.

Even with 298,655 square feet of space

added to the market at 200 Vesey Street

American Express plans to vacate a

portion of their spaceDowntown still

posted 55,289 square feet of positive

absorption which caused availability to

drop 10 basis points to 12.0 percent.

Downtown inked its two largest

relocations this year from Midtown and

Midtown South during the month of July

with Gucci and Sandbox Studio leasing a

combined 155,224 square feet. Class A

asking rents increased $0.17 per square

foot to $62.41. Class B asking rents

remained flat in July, increasing a mere

$0.07 to $44.25 per square foot, but still

increased 8.1 percent over the past 12

months.

MANHATTAN

Office Market Report

August 2015 | Statistical Data as of July 29, 2015

SUBMARKET

INVENTORY

AVAILABLE

SF

SF

AVAILABILITY

ABSORPTION

MONTHLY

UNDER

YEAR-TO-DATE CONSTRUCTION SF

AVERAGE ASKING RENT

CLASS A

CLASS B

OVERALL

$68.09

$57.18

$66.16

MIDTOWN

20,842,455

1,307,282

Fashion District

33,081,198

3,280,930

Fifth/Madison

25,192,308

2,921,398

Grand Central

50,084,883

5,817,194

11.6%

East Side/UN

6.3%

(92,393)

198,905

9.9%

6,217

(767,062)

$69.75

$55.72

$54.13

11.6%

(78,917)

9,955

$128.20

$79.29

$113.95

41,786

277,650

$73.27

$58.85

$69.19

Midtown West/Columbus Circle

21,385,133

2,155,235

10.1%

88,746

193,758

$76.58

$51.63

$71.73

Park Avenue

30,089,432

2,344,787

7.8%

76,895

570,274

$97.11

$83.69

$96.62

Penn Plaza/Hudson Yards

14,585,528

955,798

6.6%

15,988

120,603

3,204,950

$63.16

$62.35

$60.18

Sixth Avenue/Rock Center

45,141,080

3,995,995

8.9%

167,698

(338,273)

472,535

$82.43

$72.55

$80.60

Times Square

17,965,613

1,883,875

10.5%

30,875

76,543

$88.92

$63.26

$80.16

258,367,630

24,662,494

9.5%

256,895

342,353

3,677,485

$86.12

$62.10

$77.46

114,000

$54.51

MIDTOWN TOTALS

MIDTOWN SOUTH

Chelsea/Meatpacking

19,575,179

1,247,968

6.4%

9,520

213,613

$79.00

$59.99

Flatiron/Union Square

15,045,451

1,423,960

9.5%

1,485

(217,538)

$85.00

$76.48

$75.67

Hudson Square/TriBeCa

19,575,219

1,164,278

5.9%

84,746

151,406

$73.00

$72.64

$70.87

Madison Square/Park Avenue S

26,225,012

1,805,086

6.9%

69,930

(31,420)

$76.72

$65.68

$67.16

7,238,360

256,155

3.5%

(13,039)

106,812

$72.06

$72.06

87,659,221

5,897,447

6.7%

152,642

222,873

$77.73

$71.27

$67.53

4,963,218

439,403

8.9%

44,828

13,264

$48.44

$46.95

$46.13

SoHo/NoHo/Village

MIDTOWN SOUTH TOTALS

114,000

DOWNTOWN

City Hall/Insurance

Financial

53,064,463

5,607,015

10.6%

258,048

(297,201)

$53.93

$44.79

$51.20

World Trade Center

31,043,427

4,652,634

15.0%

(247,587)

(827,347)

2,861,402

$69.62

$41.25

$66.83

DOWNTOWN TOTALS

89,071,108

10,699,052

12.0%

55,289

(1,111,284)

2,861,402

$62.10

$44.25

$58.18

MANHATTAN TOTALS

435,097,959

41,258,993

9.5%

464,826

(546,058)

6,652,887

$77.43

$61.81

$70.69

Office asking rents converted to Full Service

Key Lease Transactions July 2015

PROPERTY

SF

TENANT

TRANSACTION TYPE SUBMARKET

Richard Persichetti

237 Park Avenue

270,000

J Walter Thompson

Renewal/Expansion

Park Avenue

Vice President, Research, Marketing and Consulting

Email: Richard.Persichetti@dtz.com

350 Fifth Avenue

120,000

Expansion

Madison Square/Park Avenue

Lauren Hale

28 Liberty Street

101,958

Ironshore Insurance

New Lease

Financial

Research Manager

Email: Lauren.Hale@dtz.com

888 Seventh Avenue

99,948

TPG Capital

Renewal/Expansion

Midtown West/Columbus Circle

195 Broadway

83,694

Gucci

New Lease

World Trade Center

55 Water Street

68,260

Sandbox Studio

New Lease

Financial

115 Broadway

62,624

PANYNJ

Renewal

Financial

About DTZ

DTZ is a global leader in commercial real estate services providing occupiers, tenants and investors around the world with a full

spectrum of property solutions. Our core capabilities include agency leasing, tenant representation, corporate and global occupier

services, property management, facilities management, facilities services, capital markets, investment and asset management,

valuation, building consultancy, research, consulting, and project and development management. DTZ manages 3.3 billion square

feet and $63 billion in transaction volume globally on behalf of institutional, corporate, government and private clients. Our more

than 28,000 employees operate across more than 260 offices in more than 50 countries and proudly represent DTZs culture of

excellence, client advocacy, integrity and collaboration. For further information, visit: www.DTZ.com or follow us on Twitter @DTZ.

277 Park Avenue

New York, NY 10172

Tel: 212.758.0800

The information contained within this report is gathered from

multiple sources considered to be reliable. The information may

contain errors or omissions and is presented without any warranty

or representations as to its accuracy.

Copyright 2015 DTZ.

All rights reserved.

www.dtz.com | 2

You might also like

- House Rental Agreement FormatDocument4 pagesHouse Rental Agreement FormatArul Thangam Kirupagaran54% (37)

- The Registration Act 1908Document26 pagesThe Registration Act 1908Asif Masood RajaNo ratings yet

- Land Lease AgreementDocument8 pagesLand Lease AgreementRavi KumarNo ratings yet

- CANONS 1 and 2 Digests EthicsDocument19 pagesCANONS 1 and 2 Digests EthicsNestNo ratings yet

- Appraisal of Lease InterestsDocument55 pagesAppraisal of Lease InterestsLuningning CariosNo ratings yet

- Progress Ventures Newsletter 3Q2018Document18 pagesProgress Ventures Newsletter 3Q2018Anonymous Feglbx5No ratings yet

- Supply GSTDocument16 pagesSupply GSTMehak Kaushikk100% (1)

- Ang Yu Asuncion Vs CADocument2 pagesAng Yu Asuncion Vs CAAnonymous gHx4tm9qmNo ratings yet

- RERA in India - All You Need To KnowDocument75 pagesRERA in India - All You Need To KnowAbhishekNo ratings yet

- Exclusive Commercial Property Management AuthorityDocument11 pagesExclusive Commercial Property Management AuthorityKatharina Sumantri0% (2)

- International Valuation Standards - 2020 MCQ PDFDocument18 pagesInternational Valuation Standards - 2020 MCQ PDFNikhil TidkeNo ratings yet

- Monetizing Your Data: A Guide to Turning Data into Profit-Driving Strategies and SolutionsFrom EverandMonetizing Your Data: A Guide to Turning Data into Profit-Driving Strategies and SolutionsNo ratings yet

- TALA REALTY v. BANCO FILIPINODocument1 pageTALA REALTY v. BANCO FILIPINOKingNo ratings yet

- Drop in Leasing Volume While Asking Rents Reach New Record: News ReleaseDocument5 pagesDrop in Leasing Volume While Asking Rents Reach New Record: News ReleaseAnonymous 28PDvu8No ratings yet

- JLL Pulse NYC 08Document4 pagesJLL Pulse NYC 08Anonymous Feglbx5No ratings yet

- CompStak Effective Rent ReportDocument2 pagesCompStak Effective Rent ReportCRE ConsoleNo ratings yet

- 1CO2200A1008Document1 page1CO2200A1008jotham_sederstr7655No ratings yet

- Omr PDFDocument4 pagesOmr PDFAnonymous Feglbx5No ratings yet

- Atlanta Office Market Report Q3 2011Document2 pagesAtlanta Office Market Report Q3 2011Anonymous Feglbx5No ratings yet

- September2011ManhattanNewsletter (101011)Document2 pagesSeptember2011ManhattanNewsletter (101011)Anonymous Feglbx5No ratings yet

- 1CO1900A0716Document1 page1CO1900A0716jotham_sederstr7655No ratings yet

- Manhattan Beach Real Estate Market Conditions - June 2015Document15 pagesManhattan Beach Real Estate Market Conditions - June 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- What's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013Document1 pageWhat's The (Downtown) Story, Morning Glory?: Downtown New York Office Market-February 2013jotham_sederstr7655No ratings yet

- Howard County 3Q11Document3 pagesHoward County 3Q11William HarrisNo ratings yet

- Cushman & Wakefield's MarketBeat - Industrial U.S. 3Q 2013Document0 pagesCushman & Wakefield's MarketBeat - Industrial U.S. 3Q 2013Angie BrennanNo ratings yet

- For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailDocument4 pagesFor Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailAnonymous Feglbx5No ratings yet

- Palm Beach County Office MarketView Q1 2016Document4 pagesPalm Beach County Office MarketView Q1 2016William HarrisNo ratings yet

- Manhattan Beach Real Estate Market Conditions - May 2015Document15 pagesManhattan Beach Real Estate Market Conditions - May 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- 1CO1800A1016Document1 page1CO1800A1016Jotham SederstromNo ratings yet

- Marketbeat: Office SnapshotDocument1 pageMarketbeat: Office Snapshotapi-150283085No ratings yet

- Manhattan Beach Real Estate Market Conditions - July 2015Document15 pagesManhattan Beach Real Estate Market Conditions - July 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Manhattan Beach Real Estate Market Conditions - March 2015Document15 pagesManhattan Beach Real Estate Market Conditions - March 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Q3 2012 OfficeSnapshotDocument2 pagesQ3 2012 OfficeSnapshotAnonymous Feglbx5No ratings yet

- SanFran 4Q11AptDocument4 pagesSanFran 4Q11AptGen ShibayamaNo ratings yet

- CW DC 3Q15 SnapshotDocument2 pagesCW DC 3Q15 SnapshotWilliam HarrisNo ratings yet

- Commercial Power 2013Document103 pagesCommercial Power 2013NewYorkObserverNo ratings yet

- Office OverviewDocument22 pagesOffice OverviewAnonymous Feglbx5No ratings yet

- Miami-Dade LAR 3Q16Document4 pagesMiami-Dade LAR 3Q16Anonymous Feglbx5No ratings yet

- JLL PDFDocument3 pagesJLL PDFAnonymous Feglbx5No ratings yet

- Ims PDFDocument4 pagesIms PDFAnonymous Feglbx5No ratings yet

- Manhattan Beach Real Estate Market Conditions - January 2016Document15 pagesManhattan Beach Real Estate Market Conditions - January 2016Mother & Son South Bay Real Estate AgentsNo ratings yet

- WashingtonDocument2 pagesWashingtonAnonymous Feglbx5No ratings yet

- Hermosa Beach Real Estate Market Conditions - May 2015Document15 pagesHermosa Beach Real Estate Market Conditions - May 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Miami Retail Marketview Q1 2016Document3 pagesMiami Retail Marketview Q1 2016William HarrisNo ratings yet

- The First Quarter Continues Positive Trends Seen in 2014: ResearchDocument6 pagesThe First Quarter Continues Positive Trends Seen in 2014: ResearchAnonymous Feglbx5No ratings yet

- Marketbeat: Office SnapshotDocument1 pageMarketbeat: Office Snapshotapi-150283085No ratings yet

- Retail: ResearchDocument4 pagesRetail: ResearchAnonymous Feglbx5No ratings yet

- Elliman 1Q2016Document4 pagesElliman 1Q2016wardavisNo ratings yet

- Office Market Snapshot: Suburban Maryland Fourth Quarter 2013Document2 pagesOffice Market Snapshot: Suburban Maryland Fourth Quarter 2013Anonymous Feglbx5No ratings yet

- Office Market - Panama City: Quick Stats (Class A)Document4 pagesOffice Market - Panama City: Quick Stats (Class A)Fernando Rivas CortesNo ratings yet

- NorthernVA IND 3Q11Document2 pagesNorthernVA IND 3Q11Anonymous Feglbx5No ratings yet

- Highlights: U.S. Office Space Market Posts Weakest Quarter Since Q3 2001Document7 pagesHighlights: U.S. Office Space Market Posts Weakest Quarter Since Q3 2001FooNo ratings yet

- BDS - 2010 - CBRE - Toan Canh Thi Truong HA NOI (En) Q2 2010 - 06 07 2010Document28 pagesBDS - 2010 - CBRE - Toan Canh Thi Truong HA NOI (En) Q2 2010 - 06 07 2010ac2000No ratings yet

- Manhattan Beach Real Estate Market Conditions - September 2015Document15 pagesManhattan Beach Real Estate Market Conditions - September 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- ArielPA MFMIR: NYC Dec 2011Document16 pagesArielPA MFMIR: NYC Dec 2011Ariel Property AdvisorsNo ratings yet

- Cleveland Office 2nd Quarter 2011Document2 pagesCleveland Office 2nd Quarter 2011julie_lynch5049No ratings yet

- The Real Report Q3 Ending 2011, Bridge Commercial PropertiesDocument6 pagesThe Real Report Q3 Ending 2011, Bridge Commercial PropertiesScott W JohnstoneNo ratings yet

- Tenant Report 3Q 2011 DC - FINAL-LetterDocument4 pagesTenant Report 3Q 2011 DC - FINAL-LetterAnonymous Feglbx5No ratings yet

- Manhattan Beach Real Estate Market Conditions - April 2015Document15 pagesManhattan Beach Real Estate Market Conditions - April 2015Mother & Son South Bay Real Estate AgentsNo ratings yet

- Manhattan Americas MarketBeat Office Q42019Document4 pagesManhattan Americas MarketBeat Office Q42019Zara SabriNo ratings yet

- San Antonio Commercial Real Estate Market Overview: Ernest L. Brown IV, CCIMDocument35 pagesSan Antonio Commercial Real Estate Market Overview: Ernest L. Brown IV, CCIMBusiness Bank of Texas, N.A.No ratings yet

- Miami Office Insight Q3 2013Document4 pagesMiami Office Insight Q3 2013Bea LorinczNo ratings yet

- Philadelphia 3Q11 RetDocument4 pagesPhiladelphia 3Q11 RetAnonymous Feglbx5No ratings yet

- MD Market ReportDocument24 pagesMD Market ReportWilliam HarrisNo ratings yet

- 1CO2000A1106Document1 page1CO2000A1106Jotham SederstromNo ratings yet

- Manhattan Monthly Snapshot - Oct 2021Document2 pagesManhattan Monthly Snapshot - Oct 2021Kevin ParkerNo ratings yet

- 1 PDFDocument6 pages1 PDFAnonymous Feglbx5No ratings yet

- Midtown South, Northbound Rents: PostingsDocument1 pageMidtown South, Northbound Rents: Postingsjotham_sederstr7655No ratings yet

- 2015 Annual Housing Market SurveyDocument73 pages2015 Annual Housing Market SurveyC.A.R. Research & EconomicsNo ratings yet

- Manhattan Beach Real Estate Market Conditions - December 2013Document15 pagesManhattan Beach Real Estate Market Conditions - December 2013Mother & Son South Bay Real Estate AgentsNo ratings yet

- Office Market Snapshot: Washington, DCDocument2 pagesOffice Market Snapshot: Washington, DCAnonymous Feglbx5No ratings yet

- Office Q2 2016 FullReportDocument17 pagesOffice Q2 2016 FullReportWilliam HarrisNo ratings yet

- CIO Bulletin - DiliVer LLC (Final)Document2 pagesCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- 4Q18 Washington, D.C. Local Apartment ReportDocument4 pages4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Atlanta Local Apartment ReportDocument4 pages4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- 4Q18 South Florida Local Apartment ReportDocument8 pages4Q18 South Florida Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 North Carolina Local Apartment ReportDocument8 pages4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 New York City Local Apartment ReportDocument8 pages4Q18 New York City Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Philadelphia Local Apartment ReportDocument4 pages4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Houston Local Apartment ReportDocument4 pages4Q18 Houston Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Boston Local Apartment ReportDocument4 pages4Q18 Boston Local Apartment ReportAnonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- 4Q18 Dallas Fort Worth Local Apartment ReportDocument4 pages4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5No ratings yet

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDocument9 pages2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- 3Q18 Philadelphia Office MarketDocument7 pages3Q18 Philadelphia Office MarketAnonymous Feglbx5No ratings yet

- Wilmington Office MarketDocument5 pagesWilmington Office MarketWilliam HarrisNo ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Office Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Office Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Leida Mae Bumanlag Refresher B Answers To 2016 Bar Examination On Taxation LawDocument10 pagesLeida Mae Bumanlag Refresher B Answers To 2016 Bar Examination On Taxation LawLei BumanlagNo ratings yet

- ICSE - LAND CertificateDocument2 pagesICSE - LAND CertificateDhirendra MishraNo ratings yet

- Ifrs 16 Leases MiningDocument48 pagesIfrs 16 Leases MiningBill LiNo ratings yet

- Lease Agreement Hourly 1 Day RentalDocument1 pageLease Agreement Hourly 1 Day RentaltharleylawNo ratings yet

- Ra 1054 & Ra 124Document3 pagesRa 1054 & Ra 124ulcNo ratings yet

- Ang Ping Vs RTCDocument7 pagesAng Ping Vs RTCJoseph AbadianoNo ratings yet

- James, Moyo-Majwabu & Nyoni Legal Practitioners BulawayoDocument3 pagesJames, Moyo-Majwabu & Nyoni Legal Practitioners Bulawayosimdumise magwalibaNo ratings yet

- FAR.0732 - Leases PDFDocument16 pagesFAR.0732 - Leases PDFMinie KimNo ratings yet

- FDSFDSFDocument9 pagesFDSFDSFlividNo ratings yet

- SLL 2710 Property LawDocument4 pagesSLL 2710 Property LawSuditi TandonNo ratings yet

- RatificationDocument4 pagesRatificationCaraB CRNo ratings yet

- NBCC RFP Hotel ITPO FINAL PDFDocument62 pagesNBCC RFP Hotel ITPO FINAL PDFGarima AgarwalNo ratings yet

- Digest Alberto V Alberto, Irao V by The BayDocument2 pagesDigest Alberto V Alberto, Irao V by The BayEduardo SalvadorNo ratings yet

- Leasing & HPDocument35 pagesLeasing & HPVenkat GVNo ratings yet

- Chapter 10Document44 pagesChapter 10Rifai RifaiNo ratings yet

- Land Use Act Laws of The Federation of Nigeria 2004: Chapter L5Document36 pagesLand Use Act Laws of The Federation of Nigeria 2004: Chapter L5Adeyemi Ayanfeoluwa TemitopeNo ratings yet

- Activity 1.1 - Corporate - Jack TooheyDocument24 pagesActivity 1.1 - Corporate - Jack TooheyBoomer KingsleyNo ratings yet

- 2b - CM Schmoll - Cover Letter & ResumeDocument3 pages2b - CM Schmoll - Cover Letter & ResumeCasey SchmollNo ratings yet

- Deed of AssignmentDocument3 pagesDeed of AssignmentOghogho OmoregieNo ratings yet