Professional Documents

Culture Documents

Credit Rating Report On BSRM Iron & Steel Company Limited

Uploaded by

Amit SharafathOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Rating Report On BSRM Iron & Steel Company Limited

Uploaded by

Amit SharafathCopyright:

Available Formats

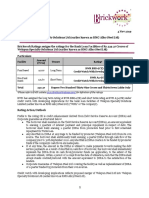

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

REPORT: RR/1579/12

Address:

CRISL

Nakshi Homes

(4th & 5th Floor)

6/1A, Segunbagicha,

Dhaka-1000

Tel: 9515807-8

9514767-8

Fax: 88-02-9565783

Email:

crisldhk@crislbd.com

Analysts:

Bipul Barua

bipul@crisl.org

A.K.M Saidur Rahman

saidur@crisl.org

Entity Rating

Long Term: A+

Short Term: ST-3

Outlook: Stable

BSRM IRON & STEEL

COMPANY LIMITED

ACTIVITY

Manufacturing of graded

Billet

DATE OF

INCORPORATION

April 13, 2005

CHAIRMAN&

MANAGING DIRECTOR

Mr. Alihussain Akberali,

FCA

EQUITY

Tk.1,346.90 million

TOTAL ASSETS

Tk.6,176.55 million

This is a credit rating report as per the provisions of the Credit Rating Companies Rules 1996. CRISLs entity rating is valid

one year for long-term rating and 6 months for short term rating. CRISLs Bank loan rating (blr) is valid one year for long

term facilities and up-to 365 days (according to tenure of short term facilities) for short term facilities. After the above

periods, these ratings will not carry any validity unless the entity goes for surveillance.

CRISL followed Corporate Rating Methodology published in CRISL website www.crislbd.com

Date of Rating

Surveillance Rating

Outlook

Bank Loan Ratings :

Bank/FIs

A.B Bank Ltd.

AL-Arafah Islami Bank Ltd.

Dhaka Bank Ltd.

Eastern Bank Ltd.

IIDFC

Janata Bank Ltd.

Islami Bank BD Ltd.

Mercantile Bank Ltd.

Mutual Trust Bank Ltd.

One Bank Ltd.

Prime Bank Ltd.

Shahjalal Islami Bank Ltd.

United Commercial Bank Ltd.

Social Islami Bank Ltd.

IPDC of Bangladesh Ltd.

United Leasing Co. Ltd.

June 28, 2012

Long Term

A+

Stable

Mode of Exposure (Figures in Million Tk.)

*WCL of Tk.520.00

**WCLO of Tk.44.88

***TLO of Tk.10.10

WCL of Tk.120.00

TLO of Tk.303.26

WCL of Tk.350.00

****STLO of Tk. 983.44

WCL of Tk.60.00

WCLO of Tk.136.90

WCLO of Tk.271.53

WCL of Tk.400.00

WCL of Tk.800.00

WCLO of Tk.156.81

WCLO of Tk.26.78

WCL of Tk.150.00

WCLO of Tk.25.15

TLO of Tk.108.73

TLO of Tk.48.28

Short Term

ST-3

Ratings

blr AAblr AAblr AAblr

blr

blr

blr

blr

blr

blr

blr

blr

blr

blr

blr

blr

AAAAAAAAAAAAAAAAAAAAAAAAAA-

*WCL Working Capital Limit **WCLO Working Capital Loan Outstanding ***TLO Term Loan Outstanding ****STLO

Syndicated Term Loan Outstanding

1.0

RATIONALE

CRISL has reaffirmed the Long Term rating of BSRM Iron & Steel Company Limited (BISCO) to

A+ (pronounced as single A plus) and the Short Term rating to ST-3 on the basis of its both

relevant quantitative and qualitative information up to the date of rating. The above ratings

have been reassigned due to consistent maintenance of fundamentals such as sound

infrastructural arrangement, strong forward linkage, experienced & qualified management

team, strong Group support etc. However, the above factors are moderated, to some extent,

by debt based capital structure, declining profitability trend, volatile price of raw materials,

absence of structured cost sharing policy etc.

Entities rated in this category are adjudged to offer adequate safety for timely repayment of

financial obligations. This level of rating indicates a corporate entity with an adequate credit

profile. Risk factors are more variable and greater in periods of economic stress than those

rated in the higher categories. The short term rating indicates good certainty of timely

payment. Liquidity factors and company fundamentals are sound. Although ongoing funding

needs may enlarge total financing requirements, access to financial markets is good with

small risk factors.

In assigning bank loan ratings (blr) CRISL also factored the security offered against the loan.

In addition to normal primary security, CRISL also reviewed the other security arrangements

against the loan. In consideration of the above, CRISL assigned the bank loan rating by one

notch above the entity rating subject to the security arrangements against the exposure.

CRISL also placed the company with Stable Outlook considering that its existing

fundamentals may remain unchanged in the foreseeable future.

2.0

Page 1 of 12

COMPANY PROFILE

BSRM Iron & Steel Company Limited, a high grade billet manufacturing company has been

operating as a sister concern of BSRM Group and is a subsidiary company of BSRM Steels

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

A sister concern of BSRM

Group

Subsidiary concern of

BSRM Steels Ltd.

Limited (BSRMSL). BISCO is one of the largest steel billet manufacturing plants in the country

with production capacity of 150,000 M. Ton per annum. Entire output (i.e. Billet) of the

company is consumed by BSRMSL. The company was incorporated on April 13, 2005 as a

private limited company under the Companies Act, 1994 and went into commercial production

on June 01, 2010. During the period under surveillance, no change in the ownership structure

of the company has been noticed. Mr. Alihussain Akberali, FCA is the Chairman and Managing

Director of the company having 29 years of experience in the steel industry and is now

considered as a business wizard in the same field. However, on February 24, 2011 the

company converted into public limited company (non-listed) by splitting its share value from

Tk.100.00 to Tk.10.00. At present, paid up capital of BISCO stood at Tk.1,100.00 million

against an authorized capital of Tk.3,000.00 million. The plant is located at 202-205,

Nasirabad Industrial Area, Baizid Bostami Road, Chittagong having its Head Office at Ali

Mansion, Sadarghat Road, Chittagong.

CRISL rated BISCO in the previous year and based on its fundamentals it was assigned A+

(pronounced as A plus) rating in the long term and ST-3 rating in the short term. The

company carried the rating comforts such as equity based capital structure, sound

infrastructural arrangement, experienced management, strong Group support, huge market

vacuum of quality product etc. with some constraints. This report is being prepared as a part

of rating surveillance, which covers the changes that took place in the fundamentals of the

company and might have an impact on the above ratings.

3.0

Good product quality

During the period under surveillance, no change in business operation has been observed. The

company has one of the largest steel billet manufacturing plants in the country with

production capacity of 150,000 M. Ton per annum. BISCO is established to manufacture prime

quality billet includes two different sizes like 130mm x 130m x 6/12m & 160 x 160 x 6/12m,

which is the basic raw material of MS Rod production. BISCO is an import substitute plant

operating as the backward linkage of BSRMSL. Besides steel melting works unit of Bangladesh

Steel Re-Rolling Mills Limited also involves in manufacturing MS Billet with a production

capacity of 120,000 M. Ton per annum. The said two concerns supply about 40% of Groups

in-house consumption. However, the rest are met through import from different countries.

Presently, quality billet manufacturers are very few in number and almost all the billet

manufacturers produce to meet their in-house consumption. A few players in this sector are

Kabir Group, Sheema Group, CSS Corporation Ltd., Ratanpur Steel Re-Rolling Mills Ltd.

(RSRM), Ehsan Steels Ltd. etc. In order to cope with the increasing demand, the Group also

envisages setting up another billet manufacturing plant located at Mirsarai, Chittagong.

4.0

Pioneer in steel industry

Page 2 of 12

BUSINESS OPERATION

GROUP SUMMARY

BSRM Group is known for its long exposures in different sub-sectors of steel industry including

scrap processing, billet manufacturing, manufacturing of MS Rod, Wire Rod as well as in other

ancillary operations. The Group started its journey in 1952 with steel business under the

splendid initiatives of five brothers (African Origin) of a single family. The successors of the

family have been successfully running the Group since long and it is regarded as one of the

best managed steel industry in the country.

According to the financial statement provided by the Group, consolidated asset base of the

Group stood at Tk.40,941.42 million as on December 31, 2011. Against the same, the Group

has outside liabilities of Tk.30,359.29 million and equity of Tk. 10,582.13 million, representing

a debt equity ratio of 74:26 respectively. As on date mentioned above, the Groups turnover

stood at Tk.51,529.98 million. All the Group concerns are running profitably. The above

financial position reflects that the Group is operating with a moderate equity base having

leverage of about 2.87 times.

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

The Group has been maintaining strong relation with different private commercial banks and

non bank financial institutions with a regular debt serving history. As on December 31, 2011 the Groups loan outstanding position stood at Tk.18,030.93 million as a short term loan and

Tk.2,615.22 million as long term loan.

5.0

CORPORATE GOVERNANCE

During the period under surveillance no major change in the management structure has been

observed. The Board members looks after the different policy related issues of the company.

All the Board members are eminent personalities having good experience in the same

industry.

5.1

Corporate Management

The operations of BISCO are being looked after by an experienced management team having

wide exposures in the Steel industry. A brief about the key professionals has been described

below:

Qualified & Experienced

management

Age

(Years)

Year of

Joining

Mr. Tapan Sengupta

Mr. Kazi Anwar Ahmed

Executive Director

General Manager

55

61

1982

1989

Mr. Md. Firoz

Head of Business

and product

Development

CFO-Group and

Company

Secretary

Head of Finance &

Accounts

Chief Financial

Officer

Head of Human

Resource

Head of Supply

Chain

General Manager

(Factory)

General Manager

(Sales &

Marketing)

AGM ( HR &

Admin)

58

2003

50

2002

M.Com

(Acct.), FCA

21

38

2007

FCA

13

35

2011

M.Com, ACA

42

2012

15

36

2008

M.Com

(Acct.)

MBA

56

2009

29

45

2009

B.Sc.

Eng.(Mech.)

MBA

(Marketing)

55

2006

29

Sr. Manager

(ERP-Project)

Sr. Manager

(Commercial)

Sr. Manager

(Accounts &

Finance)

37

2003

Post graduate

in Personnel

Management

MBA

68

2001

B. Com

34

49

2005

B. Com, CA

(CC)

23

Mr. Shekhar Ranjan Kar,

FCA

Mohammed Reazul Kabir,

FCA

Mr. Biplob Kanti Banik,

ACA

Mr. Ashfaq Amin

Chowdhury

Mr. Mohd. Imtiaz Uddin

Chowdhury

Mr. Azizul Haque

Mr. Shobhan Mahbub

Shahabuddin

Mr. A. Gaffar

Mr. Harun ur Rashid

Mr. Motaherul Hoque

Mr. Md. Habibullah

Page 3 of 12

Qualification and

Experience

Qualification

Experience

(Years)

B. Com

30

M.A

31

(Economics)

B. Sc. Eng.

31

(Mech.)

Designation

Name

10

16

11

BISCO follows the same human resource policy of the Group. The separate Human Resources

Department of the Group looks after different HR related policies including recruitment,

performance evaluation, promotion, firing etc. To meet up modern organization needs, BSRM

Group has shaped its HR system and the organizations structure by taking consultancy

support from PricewaterhouseCoopers (PwC). As on May 2012, BISCO has 328 employees;

out of them management employees are 113, non management employees are 215 (including

161 technicians). Besides, the company also deploys casual workers to support the smooth

operation. In order to improve the human resources and their quality in line with the modern

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

business need, BISCO has established its policy for training of its employees. It arranges inhouse training program to adjust the employees with modern operation. The Group has

strong IT (Information Technology) infrastructure facilities with modern equipments and an IT

department. The business and financial operations of the company are conducted and

exercised through an established internal control system. The internal audit department

having 11 members verifies and follows-up the activities of the internal control procedures

and reports directly to the Managing Director. The cell is free from any bar to conduct audit.

6.0

Good market demand

INDUSTRY OVERVIEW

M.S Billet is used as the basic raw material for producing various types of iron and steel

products. The demand for steel will inevitably grow in line with the countrys economic and

infrastructural development. Major buyers of mild steel and re-rolled products include

individuals, government and institutional buyers (developers). The governments

infrastructure development activities are an important source of demand. The demand of MS

Rod in Bangladesh has been increasing day by day and is expected to increase at the growth

rate of 8% to support economic and infrastructural development of the country, expansion of

urbanization and booming construction of shopping mall, market, real estate and other

construction for industrial purposes. Construction of bridge, culvert as well as public

awareness and preference is increasing for quality building materials to ensure safety and

better building construction; more particularly, in recent time to save from earthquake, which

also helps for growing the industry. Due to growing consciousness among buyers and the

generic nature of the products; new manufactures with efficient and high quality technology

will dominate over the existing players using old technology, because of their quality and price

advantage. It has been revealed that current billet production is insignificant which indicates

the supply gap of billet in the market.

7.0

BUSINESS PERFORMANCE

(Year ended on 31st December)

Improving business

performance

Indicators

Installed Capacity (in M. Ton)

Production (in M. Ton)

Capacity Utilization (%)

Turnover (in M. Ton)

Turnover (in Million Tk.)

Sales Growth (%)

Cost of Goods Sold (In Million Tk.)

COGS Growth (%)

Gross Profit (in Million Tk.)

Profit After Tax (in Million Tk.)

Profit Growth (%)

FY2011

150,000

121,679

81

122,433

6,507.64

99.41

5,903.64

98.89

604.00

136.98

24.61

FY2010

150,000

78,243

51

76,490

3,263.48

2,968.34

295.14

109.93

-

During the period under surveillance the company has successfully enhanced its capacity

utilization to 81% in FY2011 within a span of more than one and half years of operation. The

company has increased production as well as sales which are reflected in the table above. Due

to the volatility of scrap steel both in national & international market the company faced

challenge to keep its production costs under control. Besides, the scarcity of gas and

electricity hampers the smooth flow of production which in turn restricts to attain economics

of scale. However, the sales growth in relative measure was better than the same of cost of

goods sold (COGS) growth indicating the companys good absorption capacity of production

cost with the sales price. However, the net profit growth is significantly low than sales growth

due to huge administrative & financial expenses. CRISL views that the company reported

good business performance in FY2011 as compared to previous year.

Page 4 of 12

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

8.0

Declining profitability

FINANCIAL PERFORMANCE

Indicators

Return on Average Assets After Tax (ROAA)%

Return on Average Equity After Tax (ROAE)%

Return on Average Capital Employed After Tax (ROACE)%

Gross Profit Margin %

Operating Profit Margin %

Net Profit Margin%

Cost to Revenue Ratio %

Admin. Expenses to Revenue Ratio %

Finance Cost to Revenue Ratio %

Earning Per Share (EPS) (Restated on Tk.10)

FY2011

2.51

10.71

5.49

9.28

8.64

2.10

90.72

0.65

6.39

1.25

FY2010

3.44

12.88

5.70

9.04

8.74

3.37

90.96

0.30

5.27

1.00

Overall financials of the company reveals a good performance over the last two years through

the above indicators. Comparative analysis revealed that the gross profit margin of BISCO

slightly increased in FY2011 due to comparatively lower increase of cost of sales than

revenue. The cost efficiency of the company largely depends on the price of the main raw

material i.e. scrap and sponge iron. The price of scrap and sponge iron is about 80%-85% of

the cost of goods sold. The company procures scraps both from local and international market

with the sharing of about 45:55 although another major raw material i.e. sponge iron is

procured from international market. However, operating profit margin and net profit margin

decreased due to huge administrative and financial expenses in FY2011. In line with the

same, ROAA, ROAE and ROACE were also decreased in FY2011 mainly due to comparative

decrease of net profit against assets, equity and capital employed respectively.

9.0

Debt based capital

structure

CAPITAL STRUCTURE AND SOLVENCY

BISCO is a debt based company as its capital structure contains specific long term bank loan

in addition to short term bank financing. As on December 31, 2011, the total assets of the

company stood at Tk.6,176.55 million which was financed by total shareholders equity of

Tk.1,346.90 million (21.81%), short-term loan Tk.2,349.88 million (38.05%), other current

liabilities of Tk.839.07 million (13.58%) and the balance Tk.1,640.70 million (26.56%) by

long term bank loan.

Indicators

Leverage Ratio (X)

Bank Borrowing to Equity (X)

Equity Multiplier (X)

Internal Capital Generation (%)

FY2011

3.59

2.96

4.59

0.11

FY2010

2.93

2.76

3.93

0.13

The companys bank dependency is yet to reach at comfortable level moreover; dependency is

increasing as observed from the above table. However, equity multiplier (which describes a

companys total assets per taka of shareholders equity) has been getting comfortable.

Internal capital generation of the company decreased due to higher equity growth than profit.

10.0

Moderate liquidity

Page 5 of 12

LIQUIDITY AND CASH FLOW ANALYSIS

Indicators

Current Ratio (X)

Quick Ratio (X)

Cash Conversion Cycle (Days)

FY2011

1.03

0.83

79

FY2010

1.14

0.85

101

BISCO has been operating with moderate liquidity due to its relatively comfortable cash

conversion cycle which stands at about 79 days in FY2011 due to planned safety stock and

duly credit collection from buyer namely BSRMSL. The Current ratio and Quick ratio fell

slightly in FY2011. In analyzing the cash flow position of BISCO, total fund from operation

stood at Tk.290.56 million. After arranging all operational procedure, operating cash flow of

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

the concern stood at Tk.106.61 million which might not be adequate to support its capital

expenditure as well extended working capital requirement and to support the same the

company raised bank/ outside finance during the period. However, as a sister concern of

renowned corporate house which has good reputation in money market as well as having

funding flexibility within the Group, the concern might not face any financial crisis.

11.0

FINANCIAL INSTITUTION LIABILITIES

11.1

Liability Position & Repayment Performance

Due to sound credibility and good market image, BISCO has been enjoying financial flexibility

to raise fund from bank and financial institutions. As on May 31, 2012, total outstanding bank

loan of BISCO stood at Tk.2,641.48 million (as short term loan of Tk.1,187.67 million and

long term loan of Tk.1,453.81 million). A summarized position of the above stands as follows:

(Figure in Million Tk.)

Limit Sanctioned

Bank & FIs

A.B Bank Ltd.

AL-Arafah Islami

Bank Ltd.

Significant bank liabilities

with regular loan

repayment history

Dhaka Bank Ltd.

Mode

Under

Group

Individual

IIDFC

Janata Bank Ltd.

520.00

900.00

26.20

10.10

L/C, LTR, OD

120.00

6.68

Regular

293.61

303.26

7.50

Regular

Regular

L/C, LTR,

Time Loan

Syn. Term

Loan

CC (H)

350.00

*1,362.00

983.44

44.88

Regular

Regular

60.00

59.52

Regular

Islami Bank BD

Ltd.

Mercantile Bank

Ltd.

Mutual Trust Bank

Ltd.

One Bank Ltd.

L/C, LTR, BM

2,000.00

136.90

Regular

L/C, LTR,

Time Loan

L/C,LTR, SOD

1,500.00

271.53

Regular

400.00

13.31

Regular

L/C,LTR, OD

800.00

121.90

Regular

Prime Bank Ltd.

L/C,LTR, OD

750.00

156.81

Regular

2,000.00

26.78

Regular

150.00

18.61

Regular

800.00

25.15

Regular

150.00

108.73

Regular

60.00

48.28

Regular

2,903.61

1,453.81

1,187.67

Shahjalal Islami

Bank Ltd.

United Commercial

Bank Ltd.

Social Islami Bank

Ltd.

IPDC of

Bangladesh Ltd.

United Leasing Co.

Ltd.

Total

L/C, LTR, BM

L/C, LTR, OD

L/C,LTR, BM

Term Loan

Lease Finance

7,950.00

Note: * BISCO has taken syndicated term loan of

Development Finance Co. (IIDFC) is the lead arranger

Development Bank Ltd., Bank Asia Ltd., City Bank Ltd.,

Ltd., One Bank Ltd., Rupali Bank Ltd., Sonali Bank Ltd.,

Bank Ltd. and Dhaka Bank Ltd.)

Page 6 of 12

Repayment

Status

L/C, LTR, TL,

OD

L/C, LTR ,

Baim (C)

HPSM

Lease Finance

Eastern Bank Ltd.

Outstanding

Amount as on

31.05.2012

Term

Short

Loan

Term

Loan

298.10

Tk.1,362.00 million where Industrial & Infrastructural

of the syndication finance with 13 banks ( Bangladesh

Eastern Bank Ltd., Janata Bank Ltd., Mutual Trust Bank

Standard Bank Ltd., Trust Bank Ltd., United Commercial

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

11.2

Security Arrangement against Loan Exposures

The mode of the security offered under each banking facilities are summarized below:

Bank/FIs

A.B Bank Ltd.

AL-Arafah Islami

Bank Ltd.

Dhaka Bank Limited

Eastern Bank Ltd.

Adequate security

arrangement

IIDFC

Janata Bank Ltd.

Islami Bank BD Ltd.

Page 7 of 12

Security Arrangement

Primary Security:

i.

5% cash margin on L/C

ii.

Trust receipt

iii. Hypothecation of stock and receivable

iv. Usual charge documents

Support /Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

iii. Post dated cheque.

Primary Security:

i.

5% cash margin on L/C

ii.

DP Note

iii. Trust Receipt

iv. Hypothecation of goods (Steel scrap, Billets)

v.

Usual charge documents

Support/Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

iii. Post dated cheques

Primary Security:

i.

5% Cash margin on L/c

ii.

Advance lease deposit of 1 months lease rental to be obtained

iii. Ownership of the machinery to be imported

Support/Guarantee:

i.

Post dated cheque

ii.

Corporate guarantee

iii. Directors personal guarantee

Primary Security:

i.

Usual charge documents

ii.

Parri-passu charge on stock

iii. Parri-passu charge on Book debt of the company

Secondary Security/Collateral:

i.

1st priority fixed and floating charge over all plant, machinery,

equipment and floating assets.

ii.

1st priority registered mortgage along with IGPA on 2.68 acres of land

situated at 202-205 Nasirabad I/A, Chittagong.

Support /Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

Primary Security:

i.

Usual charge documents

ii.

Hypothecation of machinery, furniture & fixtures, equipments etc.

Secondary Security/Collateral:

i.

Registered mortgage on project land, building on 1st ranking parri- passu basis.

Support /Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

Primary Security:

i.

Usual charge documents

ii.

Submission of charge documents

Support/Guarantee:

i.

Directors personal guarantee

Primary Security:

i.

5% cash security on CFR value

ii.

10% cash security on landed cost

iii. Pledge of Bai-Murabaha goods

iv. Hypothecation on stocks & book debts

Secondary Security:

i.

Reg. Mortgage of 1,205.75 decimal of vacant land.

ii.

2nd charge on the present and future assets including book debts of

BSRM in favor of bank with the Registrar of RJSC.

Support/Guarantee:

i.

Personal Guarantee

ii.

Corporate Guarantee

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

Bank/FIs

Mercantile Bank Ltd.

Mutual Trust Bank

Ltd.

One Bank Ltd.

Prime Bank Ltd.

Shahjalal Islami

Bank Ltd.

United Commercial

Bank Ltd.

Social Islami Bank

Ltd.

IPDC of Bangladesh

Ltd.

Page 8 of 12

Security Arrangement

Security:

10% Cash margin on L/C

LC related documents

Trust Receipt

Hypothecation of stock & Book debts

Usual Charge documents

/ Guarantee:

Directors Personal guarantee.

Un-dated Cheque

Security:

5% Cash margin on L/C

Usual charge documents

/Guarantee:

Corporate guarantee

Post dated cheque

Security:

i.5% Cash L/C margin

DP Note

Registered hypothecation by way of charge with RJSC on inventory,

Receivables and Plant & Machinery.

Support/Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

iii. Post dated cheques

Primary Security:

i.

10% Cash margin on L/C

ii.

L/C related shipping documents

iii. Usual charge documents

iv. Hypothecation of stock

Secondary Security/ Collateral:

i.

2nd charge on all fixed & floating assets

Support/Guarantee:

i.

Corporate guarantee

ii.

Directors personal guarantee

iii. Post dated cheque

Primary Security:

i.

Trust Receipt

ii.

Hypothecation of stock

iii. Usual Charge documents

Support/ Guarantee:

i.

Cross corporate Guarantee

ii.

Post dated Cheques.

iii. Directors Personal Guarantee

Primary Security:

i.

5% Cash margin on L/C

ii.

Usual charge documents

Support /Guarantee:

i.

Corporate guarantee

ii.

Post dated cheque

Primary Security:

i.

5% margin on L/C

ii.

L/C related shipping documents

Primary

i.

ii.

iii.

iv.

v.

Support

i.

ii.

Primary

i.

ii.

Support

i.

ii.

Primary

i.

ii.

iii.

iii.

Hypothecation of raw materials to be imported /purchase under bank finance

iv. Usual charge documents

Support/Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

iii. Post dated cheque for Tk. 1,400.00 million

Primary Security:

i.

Floating charge on all the movable assets of the company, duly

registered with RJSC

ii.

Security cheque of Tk. 150.00 million

iii. DP note

Support /Guarantee:

i.

Directors personal guarantee

ii.

Corporate guarantee

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

Bank/FIs

United Leasing

Company Ltd.

12.0

Primary

i.

ii.

iii.

Support

i.

ii.

Security Arrangement

Security:

Usual charge documents

Refundable lease advance of Tk. 1.78 million

DP Note

/Guarantee:

Directors personal guarantee

Corporate guarantee

RISK MANAGEMENT

CRISL reviewed the following risks in the previous year for BISCO, which are yet to be

mitigated.

12.1

Financial Risk

The company is enjoying a significant amount of working capital loan and term loan, which

occupies the major portion of the total liability. This type of dependency creates financial cost

burden that grabs a significant portion of the mark up. Moreover, recent imposition of tax on

gross receipt of the company may create an extra financial burden. However, the company is

regular in VAT and tax payment.

12.2

Supply Risk

BISCO generally procures about 55% raw materials through import from India, USA, New

Zealand, South Africa, UK, Poland and Australia and the balance 45% from local sources

especially from ship breakers. The company may not face any risk in case of import supply

due to availability and reliable supply source although it may face problem for local sourcing

due to present vulnerable position of ship breaking industry.

Exposure to interest rate

risk

12.3

Interest Rate Risk

The company has to depend highly on bank fund for working capital management. As a bank

fund borrower, the entity needs to pay a significant amount of bank interest and charge.

Bangladesh Bank has moved to remove the interest rate ceiling on lending in the wake of a

massive liquidity crisis in the financial market letting the price to be determined by functioning

of demand-supply interaction. This measure may invite interest rate instability which also

would create volatility in the profitability of corporate houses like BISCO.

12.4

Market Risk

The company may not face any major market risk as the entire finished products are

consumed by BSRMSL. Presently, BSRMSL has commendable market reputation which

exposed the company to low market risk.

Exposure to price

fluctuation risk

Page 9 of 12

12.5

Price Fluctuation and Exchange Rate Risk

Raw material prices are exposed to risk due to volatility of its prices in the international

market including fluctuation of exchange rate. During 2011, the prices of scrap and sponge

iron in international market rose significantly. The rise in input prices can only be

compensated through increasing the selling price without compromising the quality. Such

increase in prices pushed the company to sell the graded billets at comparatively higher prices

lowering its market competitiveness. Exchange rate risk arises from currency fluctuation in

international trade. If Bangladeshi Taka is devalued and/or foreign currency revalued then the

price of imported billets will go up which will decrease the overall profit margin. Thus the

company has a high exposure of price fluctuation risk.

12.6

Changes in Govt. Policy

In General, Bangladesh economy is an example of many sick industry created out of the

change of the government policy. The Government policy changes frequently with the change

of government. Reverse impact on investment returns could stem from a change in

government, legislative bodies, other foreign policy makers or military control. BISCO may

suffer from such loss in the case of tightened foreign exchange repatriation rules or from

increased credit risk if the government changes policies to make it difficult for the company to

pay creditors. Government may change the import

duty on MS scrap and sponge iron

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

which will affect not only BISCO but also all other above based mills.

13.0

OBSERVATION SUMMARY

Rating Comforts:

Sound infrastructural arrangement

Strong forward linkage

Experienced & qualified management

team

Strong Group support

Rating Concerns:

Debt based capital structure

Declining profitability trend

Volatile price of raw materials

Exposure to financial risk

Exposure to interest rate risk

Exposure to price fluctuation risk

Absence of structured cost sharing

policy

Business Prospects:

Huge market exposure

Capacity expansion

Business Challenges:

Gas shortage in Chittagong zone

Increased competition in the industry

Changes in Government policy

14.0

PROSPECTS

The demand for MS Billet is expected to continue to rise at a greater rate in future in line with

steel industrys growth in the countrys economic development and requirement for

infrastructural support. However, CRISL believes that under the dynamic leadership of Mr.

Alihussain Akberali, the management team of BISCO will be able to remove present

shortcomings of the organization and will be one of the best MS Billet manufacturing company

in Bangladesh in terms of providing quality product.

END OF THE REPORT

(Information used herein is obtained from sources believed to be accurate and reliable. However, CRISL does not

guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or

omissions or for the results obtained from the use of such information. Rating is an opinion on credit quality only

and is not a recommendation to buy or sell any securities. All rights of this report are reserved by CRISL. Contents

may be used by news media and researchers with due acknowledgement)

[We have examined, prepared, finalized and issued this report without compromising with the matters of any

conflict of interest. We have also complied with all the requirements, policy procedures of the SEC rules as

prescribed by the Securities and Exchange Commission.]

Page 10 of 12

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

CRISL RATING SCALES AND DEFINITIONS

LONG-TERM RATINGS OF CORPORATE

RATING

AAA

Triple A

(Highest Safety)

AA+, AA, AA(Double A)

(High Safety)

A+, A, ASingle A

(Adequate

Safety)

BBB+, BBB,

BBBTriple B

(Moderate

Safety)

BB+, BB, BBDouble B

(Inadequate

Safety)

B+, B, BSingle B

(Risky)

CCC+,CCC,

CCCTriple C

(Vulnerable)

CC+,CC, CCDouble C

(High

Vulnerable)

C+,C,CSingle C

(Extremely

Speculative)

D

(Default)

DEFINITION

Investment Grade

Entities rated in this category are adjudged to be of best quality, offer highest safety and have

highest credit quality. Risk factors are negligible and risk free, nearest to risk free Government

bonds and securities. Changing economic circumstances are unlikely to have any serious impact on

this category of companies.

Entities rated in this category are adjudged to be of high quality, offer higher safety and have high

credit quality. This level of rating indicates a corporate entity with a sound credit profile and

without significant problems. Risks are modest and may vary slightly from time to time because of

economic conditions.

Entities rated in this category are adjudged to offer adequate safety for timely repayment of

financial obligations. This level of rating indicates a corporate entity with an adequate credit profile.

Risk factors are more variable and greater in periods of economic stress than those rated in the

higher categories.

Entities rated in this category are adjudged to offer moderate degree of safety for timely repayment

of financial obligations. This level of rating indicates that a company is under-performing in some

areas. Risk factors are more variable in periods of economic stress than those rated in the higher

categories. These entities are however considered to have the capability to overcome the abovementioned limitations.

Speculative Grade

Entities rated in this category are adjudged to lack key protection factors, which results in an

inadequate safety. This level of rating indicates a company as below investment grade but deemed

likely to meet obligations when due. Overall quality may move up or down frequently within this

category.

Entities rated in this category are adjudged to be with high risk. Timely repayment of financial

obligations is impaired by serious problems which the entity is faced with. Whilst an entity rated in

this category might be currently meeting obligations in time through creating external liabilities.

Entities rated in this category are adjudged to be vulnerable and might fail to meet its repayments

frequently or it may currently meeting obligations in time through creating external liabilities.

Continuance of this would depend upon favorable economic conditions or on some degree of

external support.

Entities rated in this category are adjudged to be very highly vulnerable. Entities might not have

required financial flexibility to continue meeting obligations; however, continuance of timely

repayment is subject to external support.

Entities rated in this category are adjudged to be with extremely speculative in timely repayment of

financial obligations. This level of rating indicates entities with very serious problems and unless

external support is provided, they would be unable to meet financial obligations.

Default Grade

Entities rated in this category are adjudged to be either already in default or expected to be in

default.

Note: For long-term ratings, CRISL assigns + (Positive) sign to indicate that the issue is ranked at the upper-end of its generic rating category and (Minus) sign to indicate that the issue is ranked at the bottom end of its generic rating category. Long-term ratings without any sign denote mid-levels

of each group.

ST-1

ST-2

ST-3

ST-4

ST-5

ST-6

Page 11 of 12

SHORT-TERM RATINGS OF CORPORATE

Highest Grade

Highest certainty of timely payment. Short-term liquidity including internal fund generation is very

strong and access to alternative sources of funds is outstanding. Safety is almost like risk free

Government short-term obligations.

High Grade

High certainty of timely payment. Liquidity factors are strong and supported by good fundamental

protection factors. Risk factors are very small.

Good Grade

Good certainty of timely payment. Liquidity factors and company fundamentals are sound.

Although ongoing funding needs may enlarge total financing requirements, access to capital

markets is good. Risk factors are small.

Moderate Grade

Moderate liquidity and other protection factors qualify an entity to be in investment grade. Risk

factors are larger and subject to more variation.

Non-Investment/Speculative Grade

Speculative investment characteristics. Liquidity is not sufficient to ensure discharging debt

obligations. Operating factors and market access may be subject to a high degree of variation.

Default

Entity is in default or is likely to default in discharging its short-term obligations. Market access for

liquidity and external support is uncertain.

CREDIT RATING REPORT

On

BSRM IRON & STEEL COMPANY LIMITED

CRISL RATING SCALES AND DEFINITIONS

BANK LOAN/ FACILITY RATING SCALES AND DEFINITIONS- LONG-TERM

RATING

DEFINITION

blr AAA

Investment Grade

(blr Triple A)

Bank Loan/ Facilities enjoyed by banking clients rated in this category are adjudged to have

(Highest Safety)

highest credit quality, offer highest safety and carry almost no risk. Risk factors are negligible

and almost nearest to risk free Government bonds and securities. Changing economic

circumstances are unlikely to have any serious impact on this category of loans/ facilities.

blr AA+, blr AA, blr

Bank Loan/ Facilities enjoyed by banking clients rated in this category are adjudged to have

AAhigh credit quality, offer higher safety and have high credit quality. This level of rating indicates

(Double A)

that the loan / facilities enjoyed by an entity has sound credit profile and without any

(High Safety)

significant problem. Risks are modest and may vary slightly from time to time because of

economic conditions.

blr A+, blr A,

Bank Loan/ Facilities rated in this category are adjudged to carry adequate safety for timely

blr Arepayment/ settlement. This level of rating indicates that the loan / facilities enjoyed by an

Single A

entity have adequate and reliable credit profile. Risk factors are more variable and greater in

(Adequate Safety)

periods of economic stress than those rated in the higher categories.

blr BBB+, blr BBB,

Bank Loan/ Facilities rated in this category are adjudged to offer moderate degree of safety for

blr BBBtimely repayment /fulfilling commitments. This level of rating indicates that the client enjoying

Triple B

loans/ facilities under-performing in some areas. However, these clients are considered to have

(Moderate Safety)

the capability to overcome the above-mentioned limitations. Cash flows are irregular but the

same is sufficient to service the loan/ fulfill commitments. Risk factors are more variable in

periods of economic stress than those rated in the higher categories.

blr BB+, blr BB,

Speculative/ Non investment Grade

blr BBBank Loan/ Facilities rated in this category are adjudged to lack key protection factors, which

Duble B

results in an inadequate safety. This level of rating indicates loans/ facilities enjoyed by a client

(Inadequate Safety)

are below investment grade. However, clients may discharge the obligation irregularly within

reasonable time although they are in financial/ cash problem. These loans / facilities need

strong monitoring from bankers side. There is possibility of overcoming the business situation

with the support from group concerns/ owners. Overall quality may move up or down

frequently within this category.

blr B+, blr B,

Bank Loan/ Facilities rated in this category are adjudged to have weak protection factors.

blr BTimely repayment of financial obligations may be impaired by problems. Whilst a Bank loan

Single B

rated in this category might be currently meeting obligations in time, continuance of this would

(Somewhat Risk)

depend upon favorable economic conditions or on some degree of external support. Special

monitoring is needed from the financial institutions to recover the installments.

blr CCC+, blr CCC,

Risky Grade

blr CCCBank Loan/ Facilities rated in this category are adjudged to be in vulnerable status and the

Triple C

clients enjoying these loans/ facilities might fail to meet its repayments frequently or it may

(Risky )

currently meeting obligations through creating external support/liabilities. Continuance of this

would depend upon favorable economic conditions or on some degree of external support.

These loans / facilities need strong monitoring from bankers side for recovery.

blr CC+, blr CC,

Bank Loan/ Facilities rated in this category are adjudged to carry high risk. Client enjoying the

blr CCloan/ facility might not have required financial flexibility to continue meeting obligations;

Double C

however, continuance of timely repayment is subject to external support. These loans /

(High Risky)

facilities need strong monitoring from bankers side for recovery.

blr C+, blr C,

Bank Loan/ Facilities rated in this category are adjudged to be extremely risky in timely

blr Crepayment/ fulfilling commitments. This level of rating indicates that the clients enjoying these

(Extremely

loan/ facilities are with very serious problems and unless external support is provided, they

Speculative)

would be unable to meet financial obligations.

blr D

Default Grade

(Default)

Entities rated in this category are adjudged to be either already in default or expected to be in

default.

SHORT-TERM RATINGS

Highest Grade

Highest certainty of timely payment. Short-term liquidity including internal fund generation is

blr ST-1

very strong and access to alternative sources of funds is outstanding, Safety is almost like risk

free Government short-term obligations.

High Grade

blr ST-2

High certainty of timely payment. Liquidity factors are strong and supported by good

fundamental protection factors. Risk factors are very small.

Good Grade

Good certainty of timely payment. Liquidity factors and company fundamentals are sound.

blr ST-3

Although ongoing funding needs may enlarge total financing requirements, access to capital

markets is good. Risk factors are small.

Satisfactory Grade

blr ST-4

Satisfactory liquidity and other protection factors qualify issues as to invest grade. Risk factors

are larger and subject to more variation.

Non-Investment Grade

blr ST-5

Speculative investment characteristics. Liquidity is not sufficient to insure against disruption in

debt service. Operating factors and market access may be subject to a high degree of variation.

blr ST-6

Default

Institution failed to meet financial obligations

Page 12 of 12

You might also like

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- BSRM Credit Rating ReportDocument1 pageBSRM Credit Rating ReportRadioactivekhanNo ratings yet

- BSRM Steels LimitedDocument2 pagesBSRM Steels Limitedashek ishtiak haqNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- Credit Rating Report On Pinaki Garments LimitedDocument1 pageCredit Rating Report On Pinaki Garments LimitedNishita AkterNo ratings yet

- Marketing Strategy of BSRMDocument42 pagesMarketing Strategy of BSRMMuhammad Hassan64% (11)

- SWOT Analysis of BSRMDocument3 pagesSWOT Analysis of BSRMNazmulHasanNo ratings yet

- Performance Evaluation of Activities of Commercial Department On Supply Chain Management of BSRM Steels Group of CompaniesDocument76 pagesPerformance Evaluation of Activities of Commercial Department On Supply Chain Management of BSRM Steels Group of CompaniesRezaul Hasan SiddiqueNo ratings yet

- RSRM IpoDocument4 pagesRSRM IpoMohammad Jubayer AhmedNo ratings yet

- Jindal Strips To Hive Off Subsidiaries Into Separate CompaniesDocument4 pagesJindal Strips To Hive Off Subsidiaries Into Separate CompaniesHiren VyasNo ratings yet

- Performance Analysis of Bhushan Steel Limited: Pre, During and Post CIRP A Case StudyDocument6 pagesPerformance Analysis of Bhushan Steel Limited: Pre, During and Post CIRP A Case StudykIkiNo ratings yet

- Analysis of Working Capital Management at Bokaro Steel PlantDocument58 pagesAnalysis of Working Capital Management at Bokaro Steel PlantRajesh Kumar100% (1)

- Sail Report 2011 12Document128 pagesSail Report 2011 12biomedmaulikNo ratings yet

- Welspun-Specialty-Solutions-4Nov2019 BrickworkDocument7 pagesWelspun-Specialty-Solutions-4Nov2019 BrickworkPuneet367No ratings yet

- BSRMLTD Annual Report 2017 18 PDFDocument236 pagesBSRMLTD Annual Report 2017 18 PDFYasir AlamNo ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Fsapm AssignmentDocument19 pagesFsapm AssignmentAnkita DasNo ratings yet

- Directors Report: A View of Hot Metal Pouring ProcessDocument5 pagesDirectors Report: A View of Hot Metal Pouring ProcessRavish Kumar ThakurNo ratings yet

- Arcelormittal Sa: Summary of Rated InstrumentsDocument6 pagesArcelormittal Sa: Summary of Rated Instrumentspavan reddyNo ratings yet

- Steel IndustryDocument31 pagesSteel IndustrypracashNo ratings yet

- SWOT Analysis BSRM Steels LTD BangladeshDocument3 pagesSWOT Analysis BSRM Steels LTD BangladeshMahmudur Rahman86% (7)

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Agrani 1Document1 pageAgrani 1Mohsinat NasrinNo ratings yet

- SKH Metals Limited: Summary of Rated InstrumentsDocument8 pagesSKH Metals Limited: Summary of Rated InstrumentsShivank SharmaNo ratings yet

- Bhushan Steel: A Tryst With DestinyDocument18 pagesBhushan Steel: A Tryst With DestinyKhushal UpraityNo ratings yet

- CementDocument2 pagesCementRohit ReturajNo ratings yet

- Subodha Accounts Term PaperDocument51 pagesSubodha Accounts Term PaperRakesh KumarNo ratings yet

- Financial Analysis of Sail: A Little Bit of SAIL in Everybody's LifeDocument28 pagesFinancial Analysis of Sail: A Little Bit of SAIL in Everybody's LifeYashas PariharNo ratings yet

- Good Luck Credit Rating Upgraded by ICRA (Company Update)Document2 pagesGood Luck Credit Rating Upgraded by ICRA (Company Update)Shyam SunderNo ratings yet

- My Industrial TourDocument21 pagesMy Industrial TourRashedul Hasan RashedNo ratings yet

- Nezone Pipes & Structures-R-05042018Document7 pagesNezone Pipes & Structures-R-05042018rahul badgujarNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- Equity Note - GPH Ispat LimitedDocument2 pagesEquity Note - GPH Ispat LimitedOsmaan GóÑÍNo ratings yet

- Track Components - ICRADocument8 pagesTrack Components - ICRAPuneet367No ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Financial Statement Analysis On JSW STEEL LTDDocument10 pagesFinancial Statement Analysis On JSW STEEL LTDSanthosh KcNo ratings yet

- Annual Report 2010 -11 HighlightsDocument152 pagesAnnual Report 2010 -11 HighlightsMohd IqbalNo ratings yet

- A Project Report On Ratio Analysis at Patel Shanti Steel Private LTD, RAICHURDocument80 pagesA Project Report On Ratio Analysis at Patel Shanti Steel Private LTD, RAICHURrammi13180% (1)

- Tata-Steel-case StudyDocument24 pagesTata-Steel-case StudySaurabh SahuNo ratings yet

- Bokaro Steel Plant Financial AnalysisDocument14 pagesBokaro Steel Plant Financial AnalysisnisteelroyNo ratings yet

- HDFC-Research SteelCast Buy at 147Document6 pagesHDFC-Research SteelCast Buy at 147DeepakGarudNo ratings yet

- BSRM Steels LTD BangladeshDocument13 pagesBSRM Steels LTD BangladeshMahmudul Hassan MehediNo ratings yet

- Project Report Mega Project Bil Final 17.12.09Document78 pagesProject Report Mega Project Bil Final 17.12.09ChandraShekhar KadukarNo ratings yet

- Steel Exchange India Ltd acquires GSAL India LtdDocument8 pagesSteel Exchange India Ltd acquires GSAL India Ltdvinay jodNo ratings yet

- RAM 2019 PressMetal Rationale (Final)Document26 pagesRAM 2019 PressMetal Rationale (Final)Joshua LimNo ratings yet

- CARE_Sunflag_4.01.2024Document9 pagesCARE_Sunflag_4.01.2024Swapnil SomkuwarNo ratings yet

- MSP Metallics Ltd.Document5 pagesMSP Metallics Ltd.Suraj ShawNo ratings yet

- Rashmi Metaliks LTD - Financial Health ReportDocument9 pagesRashmi Metaliks LTD - Financial Health ReportNishant GauravNo ratings yet

- July 8, 2021Document12 pagesJuly 8, 2021786rohitsandujaNo ratings yet

- Bhushan SteelDocument46 pagesBhushan SteelVidhan SrivastavaNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Krakatau Steel ADocument13 pagesKrakatau Steel ALeloulanNo ratings yet

- JSW Steel Financial AnalysisDocument12 pagesJSW Steel Financial AnalysisAadya SuriNo ratings yet

- Case Study - HRDocument51 pagesCase Study - HRabhi1111118382% (11)

- SRC Chemicals Private LimitedDocument8 pagesSRC Chemicals Private Limitedgcgary87No ratings yet

- Credit Rating Report On Dana Sweater Industries LimitedDocument1 pageCredit Rating Report On Dana Sweater Industries LimitedMdBelaluddinNo ratings yet

- Corporate Governance: A practical guide for accountantsFrom EverandCorporate Governance: A practical guide for accountantsRating: 5 out of 5 stars5/5 (1)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Maintenance CapexDocument2 pagesMaintenance CapexGaurav JainNo ratings yet

- The Better Momentum IndicatorDocument9 pagesThe Better Momentum IndicatorcoachbiznesuNo ratings yet

- BHP - Enterprise Risk ManagementDocument35 pagesBHP - Enterprise Risk ManagementArturo MejiaNo ratings yet

- Currency ConversionDocument3 pagesCurrency ConversionDynafromNo ratings yet

- DematprocessDocument13 pagesDematprocessapi-3853817No ratings yet

- Crestmont PEDocument19 pagesCrestmont PEAdam ClontzNo ratings yet

- The Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksDocument5 pagesThe Lonely Trader: Calendar GMT Event MKT Risk Exp Prev RemarksJay SchneiderNo ratings yet

- NSE - National Stock Exchange of India LTD PDFDocument3 pagesNSE - National Stock Exchange of India LTD PDFhitekshaNo ratings yet

- Question Bank - IFM SubjectDocument11 pagesQuestion Bank - IFM Subjectdiwakar sidduNo ratings yet

- Agimat & Renko RevBDocument12 pagesAgimat & Renko RevBn1ghtwalk3rr0% (1)

- NestleDocument4 pagesNestleNikita GulguleNo ratings yet

- The Volume Synchronized Probability of INformed Trading (VPIN) ModelDocument10 pagesThe Volume Synchronized Probability of INformed Trading (VPIN) ModelMudleygroupNo ratings yet

- Finance - Treasury BillDocument38 pagesFinance - Treasury BillJayesh BhagatNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Top 10 Mistakes (FOREX TRADING)Document12 pagesTop 10 Mistakes (FOREX TRADING)Marie Chris Abragan YañezNo ratings yet

- 1.1 Background of The Study: VolatilityDocument10 pages1.1 Background of The Study: VolatilityrajendrakumarNo ratings yet

- Office Market Snapshot: Northern VirginiaDocument2 pagesOffice Market Snapshot: Northern VirginiaAnonymous Feglbx5No ratings yet

- PGDM II FINANCE ElectivesDocument21 pagesPGDM II FINANCE ElectivesSonia BhagwatNo ratings yet

- Simulate option strategies and analyze payoff diagramsDocument3 pagesSimulate option strategies and analyze payoff diagramssanjuNo ratings yet

- Name of The Bank Name of The Branch CentreDocument28 pagesName of The Bank Name of The Branch CentreAbhilashPadmanabhanNo ratings yet

- Innovative Services in Banking SectorDocument32 pagesInnovative Services in Banking SectormeghkumawatNo ratings yet

- Catherine Austin Fitts Financial Coup D'etatDocument10 pagesCatherine Austin Fitts Financial Coup D'etatStephanie White Tulip Popescu67% (3)

- Oracle MantasDocument31 pagesOracle Mantascrejoc100% (1)

- Strategy Tester Report: Voltrap_Diamond Strategy Achieves 6.47% ProfitDocument1 pageStrategy Tester Report: Voltrap_Diamond Strategy Achieves 6.47% ProfitThobib OtaiNo ratings yet

- Week 6 The is-LM ModelDocument32 pagesWeek 6 The is-LM ModelBiswajit DasNo ratings yet

- FIN 542 - Answer Scheme OCT 2009Document8 pagesFIN 542 - Answer Scheme OCT 2009Rafiedah OmarNo ratings yet

- Getting Started With Forex TradingDocument1 pageGetting Started With Forex TradingChung NguyenNo ratings yet

- CEBU PacificDocument62 pagesCEBU PacificacesmaelNo ratings yet

- Analytics Capital Markets TcsDocument13 pagesAnalytics Capital Markets TcsRahul ToshniwalNo ratings yet