Professional Documents

Culture Documents

Chapter07 MCB

Uploaded by

anjney050592Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter07 MCB

Uploaded by

anjney050592Copyright:

Available Formats

07 - Credit Monitoring, Sickness and Rehabilitation

1 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

safaribooksonline.com

07 - Credit Monitoring, Sickness and

Rehabilitation

Safari Books Online

CHAPTER SEVEN

Credit Monitoring, Sickness and Rehabilitation

Understand why credit needs to be monitored after disbursal

Learn to recognise symptoms of sickness/triggers of financial

distress

Analyse whether to nurse or not to nurse

Understand how rehabilitation packages are framed

BASIC CONCEPTS

The Need for Credit Review and Monitoring

From the previous chapters, it is evident that credit management

in a bank consists of two distinct processesbefore and after the

credit sanction is made. After the credit sanction is made, and the

loan is disbursed to the borrower, it is important to ensure that the

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

2 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

principal and interest are fully recovered. Loan review is, therefore,

a vital post-sanction process.

Loan review helps in the following:

Continuously checking if the loan policy is being adhered to.

Identifying problem accounts even at the incipient stage.

Assessing the bank's exposure to credit risk.1

Assessing the bank's future capital requirements.2

A sound credit review process is necessary for the long-term

sustenance of the bank. Once a credit is granted, it is the

responsibility of the business unit, along with a credit administration

support team, to ensure that the credit limit is being operated well,

credit files, financial information and other information are updated

periodically and the account is monitored, to ensure that the debt

is serviced on time.

An effective credit monitoring system will have to include measures

to ensure the following:

The bank should periodically obtain and scrutinize the current

financial statements of the borrower.

Systems should be in place to ensure that covenants are

complied with, and any violation is immediately noticed.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

3 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

The system should periodically ensure that the security

coverage for the advances granted is not diluted.

Payment defaults under the loan contract should be immediately

noticed.

Loans with the potential to run into problems should be

classified in time to institute remedial action.

While individual borrowers should be subjected to intense

monitoring, banks also need to put in place a system for monitoring

the overall composition and quality of the credit portfolio.

It is seen that many problem credits reveal basic weaknesses in the

credit granting and monitoring processes. A strong internal credit

control process can, in many cases, offset the shortcomings in

external factors such as the economy or the specific industry. It also

follows that the monitoring policy need not be uniform, and can

instead provide more frequent reviews and financial updates for

riskier clients. Thus, rather than dedicating equal time to all credit

transactions, review and monitoring time could be allocated to high

risk and/or very large loans.

The structure of the credit review process would have to

periodically examine the assumptions on which every loan was

appraised and granted, and whether these assumptions have

changed materially enough to endanger the debt-servicing capacity

of the borrower. Typically, all or most of the following aspects are

reviewed for every loan till it is repaid in full.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

4 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Developments in the economy that may have an impact on the

industry in which the borrower operates.

Developments in the industry or sector in which the borrower

operates.

The borrower's financial health. Is the credit adequate? Has the

borrower over-or under-borrowed? Can the borrower sustain

debt service without default?

The borrower's payment record in this and other loans so far.

The quality, condition and value of the prime and collateral

securities.

The completeness of loan documentation, and developments in

law governing the instruments effecting credit delivery.

Adherence to loan covenants. Is there a danger of violating one

or more of these? How critical are these violations for the debt

service and the long-term relationship with the borrower?

Some borrowers may default on debt service due to factors out of

their control. In such cases, the bank may have to reschedule the

debt service requirements and alter some of the covenants, if

necessary.

Central banks of most countries have devised country-specific

definitions and control systems to tackle sick borrowers. There are

three categories of sickness that could afflict borrowers.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

5 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Sickness at birththe project itself has become infeasible either

due to faulty assumptions or a change in environment.

Induced sicknesscaused by management in competencies or

willful default.

Genuine sicknesswhere the circumstances leading to

sickness are beyond the borrowers control, and has happened

in spite of the borrowers sincere efforts to avert the situation.

When the borrower turns sick, the bank will have to investigate (a)

the reasons for sickness, and whether remedial measures can

revive the ailing firm; (b) the rationale for categorizing the borrower

as sick; (c) the risks involved in rehabilitating the borrowing firm

and (d) in case the bank decides to rehabilitate, the requirements

for such revival in the form of additional financing, government

support, management inputs or upgraded technology.

Triggers of Financial Distress

When does a firm face financial distress? Financial failure occurs

when there is a prolonged period of lack of profitability. The most

marked among the manifestations of lack of profitability is the

decay in the cash inflows. Due to this decay, even though the firm's

balance sheet could show a healthy level of current and fixed

assets, the firm would be unable to meet its current liabilities. An

example of such a situation is when the firm has a high level of

receivables, but these are not realizable. Or, inventories look high

but the quality is poor and items are non-moving, and due to low

profitability the firm does not write them off. Or, due to continuous

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

6 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

losses, the firm does not provide adequate depreciation, and the

fixed asset balances seem high. In fact, in these cases, the assets

are rapidly losing market value, which is not reflected in the balance

sheet. Thus, a situation finally arises when the firm's assets are not

all realizable, the cash flows are thinning out, and revenues have

not been covering expenses over a period of time. If such a state

prolongs, economic failure could occurthe rates of return from

investments drop below the cost of capital (COC), and the market

value of liabilities exceeds the market value of assets. The result is

insolvency.

There are several factors that lead to financial distress in firms. Any

of the risk factors listed in Annexure I of Chapter 5 could turn a

reality, and cause a firm to fail. The factors could range from

fundamental changes in the way firms do business, to sweeping

changes in the economy, industry and markets. The reasons could

also be endogenous to the firm, such as loss of major contracts or

customers, growth without adequate capital, superior competition,

management incompetence or poor financial management.

Lending banks would, therefore, be concerned with tackling the

following crucial issues:

What are the signals of financial distress?

Can banks detect signs of distress early enough, and initiate

remedial action, so that bank funds do not turn irrecoverable?

Can financial failure be predicted?

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

7 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Financial Distress ModelsThe Altman's Z Score

Typically, the statistical tools used to predict financial distress are

regression and discriminant analysis. Regression analysis uses

past data to forecast values of dependent variables. Discriminant

analysis classifies data into predetermined groups by generating an

index. The model most popular with bankers and analysts, apart

from ad hoc models, is the Altman's3 Z-score model. Since it has

been thoroughly tested and widely accepted, the model scores over

various others that have been subsequently developed and used

for predicting bankruptcy.4

The discriminant function Z was found to be:

where

X1 = working capital/total assets (%)

X2 = retained earnings/total assets (%)

X3 = EBIT/total assets (%)

X4 = market value of equity/book value of debt (%)

X5 = sales to total assets (times)

The firm is classified as financially sound if Z> 2.99 and financially

distressed or bankrupt if Z<1.81.

What are the model's attributes that lead to its continued validity in

most cases? The model is based on two important concepts of

corporate financeoperating leverage and asset utilization. A high

degree of operating leverage implies that a small change in sales

results in a relatively large change in net operating income. Lenders

are aware of the pitfalls of financing firms with high operating

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

8 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

leveragethey should be convinced that the borrowers can

withstand recessions or sudden dips in sales. Asset utilization

suffers when too many assets are held on the firm's balance sheet,

disproportionate to the operating requirements and the sales

generated. It is noteworthy that the model has total assets as the

denominator in four out of the five variables. Box 7.1 on the next

page provides a connective insight into the variables constituting

the model.

However, the Z-score model makes two basic assumptions. One,

that the firm's equity is publicly traded and second, that it is a firm

engaged in manufacturing activities.

Hence, it became necessary to look for alternate models that

predict financial distress in non-manufacturing or emerging market

settings.

Some Alternate Models Predicting Financial Distress

The following are some alternate models that predict financial

distress:

The ZETA score5 enables banks to appraise the risks involved

in firms outside the manufacturing sector. The score is reported

to provide warning signals 35 years prior to bankruptcy

(against 2 years for Z score). It considers variables such as (a)

return on assets (ROA), (b) earnings stability, (c) debt service,

(d) cumulative profitability, (e) current ratio, (f) capitalisation and

(g) size of the business as indicated by total tangible assets. An

increase in the score is a positive signal.6

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

9 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Often, in emerging economies, it is not possible to build a model

based on a sample from that country because of the lack of

credit experience there. To deal with this problem, Altman,

Hartzell and Peck (1995) have modified the original Altman's

Z-score model to create the Emerging Market Scoring (EMS)

model.7 One such EMS model is the Emerging Markets

Corporate Bonds Scoring System.8 The model can be applied to

both manufacturing and non-manufacturing companies, as well

as privately held and publicly owned firms. In this case, an EM

score is first developed as being equal to 6.56X1 + 3.26X2 +

6.72X3 + 1.05X4 + 3.25, where +X1 is defined as working the

capital/total assets, +X2 is defined as retained earnings/total

assets, +X3 is defined as operating income/total assets and +X4

is defined as the book value of equity/total liabilities. The EM

score is modified based on critical factors such as the firm's

vulnerability to currency devaluation, its industry environment,

and its competitive position in the industry. The resulting analyst

modified rating is compared with the actual bond rating, if any,

and other special features such as high quality collateral or

guarantees, the sovereign rating, etc. should be factored in.

Assume, e.g., a firm with a high operating leverage.

When sales decline, sales/assets also declines. Because of

the high operating leverage, earnings before interest and

taxes (EBIT) falls, leading to a fall in the EBIT/assets ratio.

When EBIT falls, it drives down the retained earnings, and,

thus, the ratio of retained earning/total assets.

A fall in retained earnings is linked to the working capital

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

10 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

and, therefore, the working capital/total assets fall.

The market does not perceive the declines in key ratios in a

favourable light, and the market value of equity falls. The

book value of debt remaining relatively unchanged, the ratio

market value of equity/book value of debt decreases.

The decline in market value of equity causes a dip in the firm

value and an increase in the financial leverage of the firm.

This implies higher financial risk to the firm, and, hence, a

higher probability of distress.

The above chain of events is encapsulated in a decline in

the Z score.

Influenced by the use of discriminant analysis in Altman's

model, subsequent researchers used logit analysis, probit

analysis and linear probability models to improve the accuracy

of predicting distress9.

The multinomial logit technique has been used to build models

to distinguish between financially distressed firms that survive

and financially distressed firms that ultimately go bankrupt.

Other researchers have proposed a gambler's ruin approach to

predict bankruptcies. This approach combines the net

liquidation value (total asset liquidation value less total liabilities)

with the net cash flows (cash inflows less cash outflows). Other

things being equal, the model predicts that the lower the net

liquidation value, the smaller the net cash flows, and the higher

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

11 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

the volatility of these cash flows, the higher would be the

probability of firm failure.11

Neural networks12 are also increasingly being used in predicting

financial distress.

An illustrative list of warning signs that banks should look out for is

provided in Annexure I.

The Workout Function

A loan is considered impaired if, based on the current situation, it

appears probable that the bank will be unable to collect all the

amount due (both prinicipal and interest) from the borrower, in

accordance with the terms of the loan agreement. The purpose of

credit review and monitoring is to watch out for warning signals,

identify troubled or sick loans, document the findings, revise

credit ratings, if necessary, and, finally, classify the credit exposures

under the appropriate categories for purpose of making provisions

against expected losses.13

The aims of establishing a separate workout function are primarily

to examine whether the credit granted is performing as expected

and, if not performing according to expectations, classify problem

credits appropriately, and, second, to explore possible solutions to

resolve the problem. Generally, banks have two choices for the

workoutrestructure the problem loan or liquidate it.

The skills, procedures and processes necessary for running a

workout organization are fundamentally different from those

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

12 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

relevant to credit appraisal, sanction and monitoring. The problem

loans are classified into appropriate risk categories, and the

workout procedure is decided. Though the line banker knows the

problem credit better, the loan workout department is constituted

with better expertise and experience in solving credit problems.

Banks without a separate workout function could see a rise in credit

defaults. If this happens, the quality of credit origination and

appraisal could also slacken.

An independent workout function must do well the following four

things14

It should establish clear rules for using a traditional workout

process. Sometimes, a lower-cost, streamlined collection

process via letters and phone calls would be sufficient to rectify

the default. Successful banks may have four or five separate

processes, depending on cost and potential for collection.

It should prioritize loan workout effort according to the urgency

of the situation, the possible economic impact and the

probability of success in order to achieve high recovery rates.

While it is necessary for loan workout to be reactive to

day-to-day crises, it is also equally important to set clear

priorities based on bottom-line impact.

The loan workout function should assemble the best skills. Each

situation will require a specific skill or combination of skills, such

as real estate, legal, credit assessment, financial analysis,

merchant banking, collateral evaluation and basic project

management among them. The bank's systems should allow for

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

13 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

flexibility to build an appropriate team from internal or external

resources.

The loan workout should assess available alternatives using

analytically driven decision rules. The basic choices facing a

bankrestructuring, loan sales, foreclosures, or do nothing

should be evaluated according to the net present value (NPV)

of each option multiplied by its probability of success. Such

analyses should take into account all costs, including operating

and carrying costs, as well as ROA (if any).

Banks often centralize the workout function to ensure that state-

of-the-art methodologies are used to monitor overall risk response,

and to create an environment to improve decision making without

diffusing accountability. A well-designed central authority can

provide maintenance and monitoring of limit systems and portfolio

concentration; an early warning system authorized to place clients

on the watch list; industry and micro-economic analysis to identify

optimal portfolio composition and secondary market evaluation and

trading capability.

The workout officers examine the updated credit file, and meet with

the borrower to explore if the impaired credit can be revived and

the firm rehabilitated. If the firm's operations could be made viable

after restructuring, the loan will be restructured with modified terms

and some sacrifices on the part of the bank.

BANKS IN INDIACREDIT MONITORING AND REHABILITATION PROCESS

Debt Restructuring and Rehabilitation of Sick Firms in

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

14 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

IndiaPast and Present

Companies on the verge of liquidation had to seek protection under

the Sick Industrial Companies (Special Provisions) Act, 1985,

administered by the Board for Industrial and Financial

Reconstruction (BIFR). As of 2001, debt restructuring in India could

be achieved through one of the two modescontractual or courtbased. Neither the contractual restructuring nor the court-based

restructuring automatically insulated the company against suits or

other action by creditors. Thus, BIFR though aimed at rehabilitating

industrial enterprises, failed to achieve its objective. Moreover, it did

not help banks and the financial institutions (FIs) to recover their

debts.

The process of restructuring and rehabilitation has been revamped

since 2003. We will see how the process operates in case of small

enterprises in this section. In Annexure II, we will see how these

guidelines are modified to suit small medium enterprises (SMEs)

and large corporate borrowers under the Corporate Debt

Restructuring (CDR) Scheme. Annexure III presents a case study

of how CDR works in practice.

Debt Restructuring/Rehabilitation of Small Enterprises15 Small

enterprises are defined as those whose investment in plant and

machinery (original cost) is more than Rs. 25 lakh but does not

exceed Rs. 5 crore, if engaged in manufacturing, and is between

Rs. 10 lakh and Rs. 2 crore, if engaged in services.16

The RBI's current definition17 of a sick firm is as follows:

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

15 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

When any credit facility granted to the firm remains

substandard18 for more than 6 months, i.e., principal or interest

in respect of any credit facility has fallen due for payment and

remained unpaid for a period exceeding a year. (This

requirement of the overdue period exceeding 1 year will be

unchanged even if the current period requirements for

classification of an account as substandard, is reduced

subsequently.)

The firm's net worth is eroded due to accumulated cash losses

to the extent of 50 per cent of its net worth during the previous

accounting year.

The firm has been in commercial production for at least 2 years.

The central bank intends that the revised criteria would enable

banks to detect sickness at an early stage and facilitate corrective

action for revival of the firm.

An illustrative list of warning signals of incipient sickness is given as

follows:

Continuous irregularities in cash credit/overdraft accounts

inability to maintain stipulated margin on continuous basis, or

funds drawn from the account frequently exceeding sanctioned

limits, or periodical interest debited remaining unrealized.

Outstanding balance in cash credit account remaining

continuously at the maximum.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

16 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Failure to make timely payment of installments of principal and

interest on term loans.

Complaints from suppliers of raw materials, water and power,

about non-payment of bills.

Non-submission or undue delay in submission or submission of

incorrect stock statements and other control statements.

Attempts to divert sale proceeds through accounts with other

banks.

Downward trends in credit summations.

Frequent return of cheques or bills.

Steep decline in production figures.

Downward trends in sales and fall in profits.

Rising level of inventories, which may include large proportion of

slow or non-moving items.

Larger and longer outstanding in receivables.

Longer period of credit allowed on sale documents negotiated

through the bank and frequent return by the customers of the

same; also allowing large discount on sales.

Failure to pay statutory liabilities.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

17 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Diversion of bank funds for purposes other than running the

firm.

Not furnishing the required information/data on operations in

time and non co-operation or discrepancies noticed during

routine stock and other inspections by the bank.

Unreasonable/wide variations in sales/receivables levels.

Delay in meeting commitments towards payments of

installments due, crystallized liabilities under letters of credit or

bank guarantees.

Diverting/routing of receivables through non-lending banks.

The bank office familiar with the day-to-day operations in the

accounts exhibiting any of the above symptoms should be able to

grasp the significance of these warning signals and initiate timely

corrective measures. Such measures may include providing timely

financial assistance based on the assessed need, and seeking help

from the workout specialists at designated offices of the bank.

If restructuring or rehabilitation appears the better alternative, the

current guidelines stipulate that the rehabilitation package should

be fully implemented within 6 months or 90 days (in case of SME)

from the date the firm is declared as potentially viable/viable. A

firm will be considered potentially viable if, after implementing a

relief package from the lenders and government agencies, it is able

to service its debt obligations without the concessions extended for

rehabilitation, within a period of 5 years. The repayment period for

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

18 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

restructured (past) debts should not exceed 7 years from the date

of implementation of the relief package. During the period of

identifying and implementing rehabilitation package, banks can

allow the sick firm to withdraw funds from the cash credit account at

least to the extent of deposit of sale proceeds by the firm. This is

called a holding operation, ensuring that the firm is not starved for

finance during the implementation period of the rehabilitation

package.

The viability and the rehabilitation of a sick firm would depend

primarily on the firm's ability to continue to service its repayment

obligations including the past restructured debts. It is, therefore,

essential to ensure that there is no write-off, or scaling down of debt

such as by reduction in rate of interest with retrospective effect,

except to the extent indicated in the guidelines.

The broad parameters for grant of relief and concessions for revival

of potentially viable sick SSI units are as follows: (also applicable to

MSME)

1. Term loans

Waive penal interest and additional charges, if any, during

the intervening period between the account turning sick and

determination of the relief package.

The interest rate on the term loan may be reduced, if

necessary, by not more than 2 per cent below the contracted

rate. The unpaid interest from the date of cash losses is to

be segregated and funded. No interest is to be charged on

the funded interest loan, whose repayment should be made

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

19 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

within 3 years of implementation of the rehabilitation

programme.

Any unadjusted interest, such as interest charged between

the date of preparation of the rehabilitation package and its

actual implementation may also be funded on the above

terms.

Any fresh term loans sanctioned for revival of the firm will

carry an interest rate at the prevailing prime lending rate of

the bank.

It is to be noted that, other than penal interest, no interest or

principal write off is permitted. The reduced interest rates are

only prospective for the period of rehabilitation. Banks

reserve the right to claim the interest sacrificed once the

firm revives and turns healthy.

2. Cash credit accounts

Waive penal interest and additional charges, if any, during

the intervening period between the account turning sick and

determination of the relief package.

Interest charged to the cash credit account, but remaining

unpaid, may be segregated to be repaid within 35 years (up

to 7 years in exceptional cases). This is called funded

interest, and can be extended as a term loan without

interest. It is noteworthy that this funded interest is a clean

loan (without any security backing), and represents income

that the bank should have earned. Therefore, the recovery of

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

20 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

funded interest should be monitored closely. No interest is to

be charged on the funded interest loan. Any unadjusted

interest, such as interest charged between the date of

preparation of the rehabilitation package and its actual

implementation may also be funded on the above terms.

Typically, a sick firm will exhibit an unsecured (called

irregular) portion in the cash credit account, which is not

backed by prime security. This portion is to be converted into

a working capital term loan (WCTL),19 to be repaid within 5

years. Where such WCTL is present, the interest is to be

charged at 1.5 per cent below the prevailing. Illustration 7.1

would clarify the methodology.

3. Cash losses: Even after the rehabilitation package is

implemented, the firm may continue to incur cash losses, till the

cash break even is reached. These cash losses can also be

funded by the bank and by other participating institutions.

4. Additional working capital : The firm being rehabilitated

requires working capital for carrying on operations. The bank

will have to assess the working capital needs as for any other

borrower (as explained in Chapter 5), but can grant the credit at

1.5 per cent below the prime lending rate.

5. Contingency assistance: Some firms under rehabilitation may

require financing for additional capital expenditure. If the bank

finds this reasonable, up to 15 per cent of the rehabilitation cost

can be provided as contingency assistance at the same reduced

rate as for the working capital.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

21 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

The outstanding advance in the cash credit account of a

borrower firm on the date of implementation of the rehabilitation

package is Rs. 60 lakhs. The drawing power (DP) evidenced by

the stock statements, as well as the actual stocks available to

cover the advance is Rs. 20 lakhs. The firm started incurring

cash losses continuously since 2004. The total interest charged

in the account since April 2004 up to the implementation of the

relief package is Rs. 32 lakhs.

Step 1

Compare the outstanding advance on the date of

implementation of the relief package with the DP on that date.

The difference is the irregularity in the cash credit account.

Thus,

a. Outstanding advance on date of

Rs. 60 lakhs

b. Less: Drawing power available

Rs. 20 lakhs

rehabilitation

c. Total irregularity on date of

implementation (AB)

Rs. 40 lakhs

Step 2

Compute the interest charged to the cash credit account from

the year the firm started showing continuous cash losses, up to

the date of the relief package. If this interest exceeds the total

irregularity in Step 1, the entire irregularity in the account is to

be treated as interest irregularity and converted into a funded

interest term loan (FITL). If less, the amount by which the total

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

22 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

irregularity exceeds the interest irregularity would be treated as

unsecured principal, and converted into a WCTL.

d. Interest charged from the year of

Rs. 32 lakhs

e. Difference to be treated as principal

Rs. 8 lakhs

f. The interest irregularity portion to be

Rs. 32 lakhs

g. The principal irregularity portion to

Rs. 8 lakhs

cash losses

irregularity (CD)

converted into FITL

be converted into WCTL

6. Start-up expenses and margin for working capital: The

liquidity problems of the ailing firm may have necessitated

deferring payments to pressing creditors or even statutory

liabilities. Once the firm commences operations under the

rehabilitation package, ensuring uninterrupted supply of raw

material and other services becomes imperative to continue

operations. The bank and other institutions funding the relief

package can pay off pressing creditors and statutory liabilities,

and treat such payments as part of term loans for start up.20

These term loans will carry interest at 1.5 per cent below the

prime lending rate.

7. Promoters contribution: The success of rehabilitation

depends on the total involvement of all capital providers

lenders and equity holders. Hence, the promoters of the firm

will have to evidence their involvement with the rehabilitation by

infusion of fresh long-term funds into the firm. Such fresh

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

23 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

infusion cannot be less than 20 per cent (generally 30 per cent

is preferred) of the assessed long-term requirement of funds,

including the monetary value of interest sacrificed by banks,

other lending institutions and the government, wherever

applicable. At least 50 per cent of the promoters equity has to

be brought in on the date of implementation of the rehabilitation,

while the remaining amount can be brought in within the

following 6 months, or as negotiated by the package. If the firm

had turned sick due to diversion of funds by the promoters, the

amount of such diverted funds should be compensated by the

promoters within a stipulated period.

8. Relief and concessions from other agencies/institutions:

Apart from banks and other lenders, rehabilitation calls for

sacrifices from the state and central governments, as well as the

management of beleaguered firm itself. An indicative list of such

relief measures is provided in Box 7.2.

State Government

(a) Sales tax loans at low rates of interest; (b) government

guarantee for fresh advances from the bank; (c) preferential

treatment for power supply, and uninterrupted power supply; (d)

rescheduling of payments due for power; (e) duties/levies of the

state government waived or provided at a concession; (f) speedier

resolution of labour disputes; (g) market support for products to be

produced by the firm under rehabilitation and (h) equity

contribution, wherever possible.

Central Government

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

24 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

(a) Exemption from or reduction of central excise; (b) for firms

operating in industries catering to public interest, budgetary support

through equity or interest free loans and (c) adequate market

support and price preferences.

Sacrifices from the management

(a) Waiver or reduction of remuneration; (b) foregoing interest on

loans made to the firm; (c) agreeing to reconstitution of board, if

necessary; and (d) agreeing for additional collateral.

Sacrifice from labour

(a) Agreeing to retrenchment of surplus workers; (b) phasing out

retrenchment compensation and (c) agreeing not to make fresh

demands till the firm is rehabilitated.

Rights of the Rehabilitating Bank There are two important rights

of the bank rehabilitating a sick firmthe right of review and the

right of recompense.

The Right of Review enables the bank to re-assess the

assumptions under which the rehabilitation has been embarked

upon, and revise conditions of sanction if the actual cash flows of

the firm are different from the expected cash flows. For example,

the bank can revise the interest rates upward (since they have

been lowered to aid the rehabilitation process) if the cash flows

from the firm justify the increase.

The Right of Recompense entitles the bank to recoup the interest

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

25 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

and other monetary sacrifices made by the bank, once the firm is

rehabilitated, and begins generating adequate positive cash flows.

Cases Where Rehabilitation Should not be Considered Firms

turning sick due to factors like mismanagement, willful default,

unauthorized diversion of funds and disputes among

partners/promoters should not be considered for rehabilitation and

steps should be taken for recovery of bank's dues. The categories

of willful default will broadly cover the following:

Deliberate non-payment of dues to the bank despite adequate

cash flow and net worth.

Siphoning off funds by managers/promoters to the detriment of

the defaulting firm.

Assets intended to be financed from bank funds either have not

been purchased or have been sold and proceeds have been

diverted for other purposes without the bank's knowledge.

Misrepresentation/falsification of records or financial statements.

Disposal/removal of securities without bank's knowledge.

Fraudulent transactions by the borrower.

The views of the lending banks in regard to willful mismanagement

of funds/defaults will be treated as final.

Monitoring by the StatesState Level Inter-Institutional

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

26 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Committees

In order to deal with the problems of co-ordination for rehabilitation

of sick Micro and Small (MSE) units, State Level Inter-institutional

Committees (SLIICs) have been set up in all the states. The

meetings of these committees are convened by regional offices of

the RBI and presided over by the Secretary, Industry of the

concerned state government. It provides a useful forum for

adequate interfacing between the state government officials and

state level institutions on the one side and the term lending

institutions and banks on the other. It closely monitors timely

sanction of working capital to units, which have been provided term

loans by SFCs, implementation of special schemes such as Margin

Money Scheme of state governments, National Equity Fund

Scheme of SIDBI and reviews general problems faced by industries

and sickness in the MSE sector based on the data furnished by

banks. Among others, the representatives of the local state level

MSE associations are invited to the meetings of the SLIICs, which

are held quarterly. A sub-committee of the SLIIC looks into the

problems of individual sick units and submits its recommendations

to the forum for consideration.

Debt-Restructuring Mechanism for SMEs

Annexure II outlines the process of Corporate Debt Restructuring

(CDR). Similarly, detailed guidelines have been formulated for

restructuring of SMEs. The guidelines are applicable to potentially

viable SMEsboth corporate and non-corporate. However, SMEs

guilty of fraud or willful default, or those classified as loss assets

(described in the following chapter), will not be considered for

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

27 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

restructuring.

Credit management in a bank consists of two distinct

processesbefore and after the credit sanction is made. A

sound credit review process is necessary for the long-term

sustenance of the bank. Once a credit is granted, it is the

responsibility of the business unit, along with a credit

administration support team, to ensure that the credit limit is

being operated well. Once the credit is disbursed, credit flies,

financial information and other information will have to be

updated periodically, and the account monitored, to ensure that

the debt is serviced on time. The monitoring policy need not be

uniform, and can instead provide more frequent reviews and

financial updates for riskier clients.

When a borrower turns sick, the bank will have to investigate

(a) the reasons for sickness, and whether remedial measures

can revive the ailing firm; (b) the rationale for categorizing the

borrower as sick; (c) the risks involved in rehabilitating the

borrowing firm and (d) in case the bank decides to rehabilitate,

the requirements for such revival in the form of additional

financing, government support, management inputs or upgraded

technology.

It is crucial for lending banks to be able to identify the signals of

financial distress, detect them early enough and initiate remedial

action, so that bank funds do not turn irrecoverable.

The model to predict financial distress of firms most popular with

bankers and analysts, apart from ad hoc models, is the Altman's

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

28 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Z-score model. Since it has been thoroughly tested and widely

accepted, the model scores over various others that have been

subsequently developed and used for predicting bankruptcy.

The aims of establishing a separate workout function are

primarily to examine whether the credit granted is performing as

expected and if not performing according to expectations,

classify problem credits appropriately, and second, to explore

possible solutions to resolve the problem. Generally, banks have

two choices for the workoutrestructure the problem loan or

liquidate it.

The RBI has proposed various rehabilitation/workout schemes

for Micro, Small and Medium Enterprises, (MSME) as well as for

large corporate borrowers (CDR).

1. An over-levered Firm A, financed by Bank X, started making

cash losses. Bank X found the firm potentially viable and hence

decided to rehabilitate the firm. One year after implementation

of the rehabilitation package, the following developments were

noticed in the firm's financial statements.

1. Firm A generated quite a large amount of cash in that year

2. Total current liabilities of Firm A decreased

3. There was a fall in the amount of long-term assets

Give the reasons for the above phenomena

2. Why is it a prudent policy to separate credit appraisal and

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

29 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

sanctioning from the workout function?

3. You are the banker to Firm B and notice the following features of

the firm's cash flows. Explain how each of these observations

could endanger the bank's ability to collect its dues from Firm B.

1. The firm has used the money given by your bank for working

capital to buy plant and machinery.

2. The firm's COC and ROA is 15 per cent

3. Notes to accounts shows considerable exposure to

currency and interest rate swaps, to hedge the firm's export

activity

4. Notes to accounts shows a large possible write down in

asset value, which has not been carried out in the current

year

5. The firm's contingent liabilities are almost equal to the firm's

balance sheet size

6. The firm's operations also show investments in joint ventures

and off balance sheet special-purpose vehicles

7. The firm had taken over a firm in the same line of activity a

year ago

8. The firm has certain long-term contract deals for which

revenue is getting booked in the current year

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

30 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

What is the function of MIS in credit management? What kind of

control systems should a bank have to ensure that credit

management is done in a proper manner?

What are the circumstances under which the lender may fail to

perform a financial analysis of the borrower? Why is financial

analysis so vital to credit management?

Develop a checklist for credit reviews in a typical bank.

WARNING SIGNS THAT BANKS SHOULD LOOK OUT FORAN

ILLUSTRATIVE CHECKLIST

Warning Signs Endogenous to the Firm

1. Management related

Lacks technical expertise for the project/running the firm

Failure to control costs

Poor capacity utilization

Improper inventory and receivables management

accumulation of inventory, inefficient collection machinery

Inability to anticipate problems and take effective remedial

measures

Failure to anticipate competition, and loss of competitive

edge

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

31 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Diversion of funds, siphoning off funds by management for

personal or uses other than for the business

Indulging in fraudulent or speculative transactions, such as

hoarding of finished goods in anticipation of a price increase,

clandestine sale of goods at a premium

Disagreements/conflicts among promoters/directors/

managers

Improper delegation of duties, or one person dominating

decision-making

Owners have stake in more than one business, and they no

longer take pride in the business the bank has financed

Managers salaries show sharp reduction

Management is unwilling to provide budgets, projects or

interim information

The owners/managers of the firm do not know the present

position the firm is in, and in what direction it has to head in

the future

Frequent changes in senior management

The Board of Directors does not participate effectively.

Management lacks depth

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

32 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Resignation of key personnel

Non-compliance with covenants or excessive negotiation of

covenants

Management not able to or unwilling to explain unusual

off-balance sheet items

Visits by the bank to the borrowing firm's place of business

reveals deterioration in the general appearance of the

premises

2. Technology related

Adopting processes that have not been tested on a

commercial scale, or requiring major modifications after

implementation

Choice of obsolete process or technology

Wrong choice of technology or collaborationone that may

not be suited to or succeed in the conditions prevailing in the

country/state where the firm is located.

Unsuitable or non-optimal location of the firm

Design of plant of an uneconomic size

Choice of faulty or unsuitable equipment, without verifying

the credentials and capacity of the supplier

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

33 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Production bottlenecks arising from improper balancing of

plant and equipment

Inadequate maintenance of plant and machinery, leading to

frequent breakdowns and production losses

Unusually high production wastages

Failure to take cognizance of environmental factors while

locating the firm

Inadequate quality control procedures, leading to product

rejections by customers

Inappropriate choice of product mix while deciding on plant

and machinery

Factory operating well below capacity

Adoption of obsolete production methods

3. Product related

Overestimation of demand for products of the firm

Orders slowing down in comparison with previous years, and

in relation to the orders received by competitors

The borrower changes suppliers frequently

Inventory to one customer increases

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

34 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Concentration shifts from major well-known customer to one

of lesser stature

The firm loses an important supplier or customer.

Demand for product falls

Obsolete product distribution methods are still adopted by

the firm

The firm still supplies to troubled customers and industries

The product is priced improperly

Increasing sales discounts or sales returns

Large orders have been booked at fixed prices under

inflationary conditions

Ineffective marketing set up

Unscrupulous sales and purchase practices

Improper launch of new products

Overestimation of demand for products, both existing and

new

4. Financial management related

Underestimating project costs at the time of project planning

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

35 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

and implementation

Inadequate working capital due to diversion of funds or faulty

estimation of requirements

Inappropriate costing methods for product pricing.

Financial risk due to high leverage

A liberal dividend policy even under adverse circumstances

Application of bank funds for purposes other than those for

which they were intended

Deferring payment of payables and creditors frequently.

Unusual items appear in the financial statements

Negative trends in key indicators such as sales, gross and

net profits

Slow down in collection of accounts receivables, and

increase in the age of debtors

Where the owners have multiple businesses, intercompany

payables and receivables are not being explained

satisfactorily

Substantial reduction in cash balances, overdrawn cash

balances or uncollected cash during normally liquid periods

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

36 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Inability to avail of trade discounts, either because of poor

inventory turnover or the supplier refusing trade discounts

Deferred payment of statutory liabilities

Creditors are not completely paid out at the end of the

working capital cycle

Interim results either not provided at all or provided

incomplete

Late release of financial statements to banks and investors

Suppliers cut back favourable terms

Accumulation of creditors and debtors, with no satisfactory

explanation from the borrower

Large and frequent loans are made to or from managers and

affiliates

The bank overestimates the seasonal peaks and troughs,

and lends excessively

The firm is unable to repay bank debt from internal

generation, and rotates or restructures bank debt for

repayment

Large customers creditworthiness has not been investigated

by the firm

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

37 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

The firm has over-expanded without adequate working

capital

Financial controls are weak

Excessive investment in fixed assets, not matched by sales

and profit growth

Sale proceeds from fixed assets and other securities used to

fund working capital

Sale of a profitable division or product line

The firm has not been making deposits in trust funds in time,

such as pension and provident funds

There are unexplained significant variances in key result

areas as compared to the previous years or budget

The credit limits are always utilized to the brim, and the firm

approaches the bank frequently for ad hoc increases in

credit limits

Increase in off-balance sheet investments, not adequately

explained by the management

Warning Signs Exogenous to the Firm

1. At the project implementation stage

Currency riskif the project depends heavily on imported

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

38 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

equipment. Adverse changes in exchange rates may result

in steep increases in the project cost

Upward revision of import duties or excise duties may

escalate the project cost

Delay in receipt of approvals for the project from the

government and other statutory bodies

Delay in sanction of term loans from FIs and banks.

Force major eventsacts of God

2. At the production stage

Non-availability or limited availability of raw material and

other inputs

Power cuts

Transport bottlenecks

Delay in supply of critical components by subcontractors

Bottlenecks arising from monsoons and other acts of God

Technological innovation may lead to production process

becoming obsolete

3. At the sales/marketing stage

Delay in commissioning downstream projects intended for

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

39 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

purchase of project's output

Withdrawal or reduction in the degree of protection by the

government

Market is saturated since the entry barriers are low and

competition is catching up

Price undercutting by other established firms with more

financial muscle

Availability of cheaper substitutes in the market

General economic downturn

4. Financial Management

Non-availability of adequate credit from banks due to policy

measures of the central bank/government

Inordinate delay in release of adequate funding by banks

and other funding agencies

1. Morton Glantz. Managing Bank Risk, Chapter 9, pp. 299330

(Academic Press, 2003) USA.

2. RBI, Guidelines for Rehabilitation of Sick Small Scale Industrial

Units, dated 16 January 2002.

SMALL/MEDIUM ENTERPRISE AND CORPORATE DEBT RESTRUCTURING

IN INDIA

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

40 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Debt-Restructuring Mechanism for SMEs21Salient Features

The RBI defines an SME22 as a small/medium enterprise with

investment in plant and machinery between Rs. 25 lakh and Rs. 10

crore if in the manufacturing activity, and between Rs. 10 lakh and

Rs. 5 crore if engaged in providing services.

Who Is Eligible? Non-corporate and corporate SMEs, who are

viable or potentially viable, are eligble irrespective of their level of

borrowings from a single bank or multiple banks.

Who Is Not Eligible? The following are the ones not eligible:

SMEs who are involved in wilful default, fraud and malfeasance.

SMEs classified by banks as loss assets.

Viability Benchmark The rehabilitated firm should turn financially

viable in 7 years, with the repayment period for the restructured

debt not exceeding 10 years.

How Do We Treat Restructured Accounts? Standard assets

would not be downgraded to sub-standard merely due to the

restructuring or principal installments, provided that the borrowing

firm's outstanding advances are fully backed by tangible security.

Similarly, a standard asset would not downgrade if the present

value of interest sacrifice is either written off or provision made for

the entire amount of sacrifice.

Similarly, sub-standard or doubtful assets would remain in the

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

41 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

same category provided that the borrower's advances outstanding

are fully covered by tangible security, and the present value of the

interest sacrifice is written off or provided for.

Additional finance provided for rehabilitation would be treated as

standard asset in all cases up to a period of 1 year.

Time Frame for Workout The restructuring package will have to

be implemented by the bank within a maximum period of 60 days

from the date of borrower's request for rehabilitation.

Review On a quarterly basis.

Disclosure Banks should disclose in their annual reports, under

Notes on Accounts, the total amount of assets under restructuring

during the year, classified as standard, substandard and doubtful.

Out of Court Settlement Out of court settlement (OTS) can be

implemented for recovery of non-performing assets below Rs. 10

crores.

Corporate Debt Restructuring [CDR]23Salient Features

The CDR Scheme, originally proposed in 2001, was revised for

implementation in 2002 based on the recommendations made by

the Working Group under the Chairmanship of Shri Vepa

Kamesam, Deputy Governor, RBI.

Objectives of the Scheme The objectives of the scheme are

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

42 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Ensuring timely and transparent mechanism for restructuring

debts of those corporate entities facing problems, for the benefit

of all concerned.

Preserving viable corporate entities affected by internal and

external factors.

Minimizing losses to creditors and other stakeholders through

an orderly and coordinated restructuring programme.

Features The features of the scheme are as follows:

The scheme operates as a voluntary, non-statutory system.

It covers all corporate borrowing accounts, whether under

multiple banking, syndication or consortium arrangements.

However, it will not apply to accounts involving only one FI/bank.

It is based on the principle of super majority.

It is applicable to accounts where the minimum outstanding

credit exposure is over Rs. 10 crores.24

Cases pending under the BIFR and the Debt Recovery Tribunal

are also considered for CD, if such accounts are very large and

have been recommended by the CDR Core Group

Cases of willful default, frauds and malfeasance are excluded

from the CDR scheme.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

43 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Two categories of debt restructuring are provided. Accounts

classified as standard and sub-standard in the books of the

lenders, will be restructured under the first category (Category

1). Accounts that are classified as doubtful in the books of the

lenders would be restructured under the second category

(Category 2).

The accounts where recovery suits have been filed by the

lenders against the company, may be eligible for consideration

under the CDR system provided, the initiative to resolve the

case under the CDR system is taken by at least 75 per cent of

the lenders (by value). In addition, the supporting creditors

should constitute at least 60 per cent of the number of

creditors.25

OTS would be allowed under the revised guidelines (2005) to

make the exit option more flexible.

Details of CDR during the year should be disclosed in the

banks financial statements under Notes on Accounts.

The accounting treatment of accounts restructured under CDR

system, including accounts classified as doubtful under

Category 2 CDR, would be governed by the prudential norms

indicated in RBI's Master Circular dated 30 March 2001.

The Methodology The methodology is similar to the rehabilitation

schemes operated for SSI sector (see Section II of the chapter) and

the SME sector.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

44 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Extending the repayment period of loans

Converting the unserviced interest portion into term loans

Reducing the rate of interest on outstanding advances

The CDR Structure The mechanism operates with a three-tier

structure, consisting of the following.

The CDR standing forum: The CDR standing forum would be

the representative general body of all FIs and banks

participating in the CDR system. It is suggested by the RBI that

all FIs and banks should participate in the system in their own

interest. The CDR standing forum will be a self-empowered

body, which will lay down policies and guidelines and monitor

the progress of CDR. The forum will also provide an official

platform for both creditors and borrowers (by consultation) to

amicably and collectively evolve policies and guidelines for

working out debt-restructuring plans in the interests of all

stakeholders. A CDR core group will be carved out of the CDR

standing forum to assist the forum in convening the meetings

and taking decisions relating to policy, on behalf of the forum.

The CDR core group would lay down the policies and guidelines

to be followed by the CDR empowered group and CDR cell for

debt restructuring. These guidelines shall also suitably address

the operational difficulties experienced in the functioning of the

CDR empowered group. The CDR core group shall also

prescribe the timelines for processing of cases referred to the

CDR system and decide on the modalities for enforcement of

the time frame. The CDR core group shall also lay down

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

45 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

guidelines to ensure that over-optimistic projections are not

assumed while preparing/approving restructuring proposals.

The CDR empowered group: This group is the decision-

making body for individual cases of restructuring. If the group

decides, after studying the preliminary feasibility report, that the

restructuring is feasible and the borrower firm is potentially

viable, the detailed restructuring package will be worked out by

the CDR cell along with the lead lending institution. The time

frame allowed for the decision to restructure is 90 days, which,

at a maximum, can be 180 days. While approving the

restructuring package, the group will also indicate acceptable

viability benchmarks such as, ROCE (return on capital

employed), DSCR (debt service coverage ratio), the gap

between the IRR (internal rate of return) and the COC, and the

extent of sacrifice. If restructuring is not found viable at this

stage, the creditors would be free to initiate recovery

proceedings.

The CDR cell: The CDR standing forum and the CDR

empowered group will be assisted by a CDR cell in all their

functions. The cell will carry out the initial appraisal of the

rehabilitation proposals received from borrowers/lenders, and

make its recommendations to the CDR empowered group,

within 1 month. If restructuring is found feasible, the CDR cell

will prepare a detailed rehabilitation plan with the help of lenders

and, if necessary, outside experts. If restructuring is not

considered feasible, the lenders may start action for recovery of

their dues.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

46 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

The Legal Issues The legal issues are as follows:

The debtor-creditor agreement (DCA) and the intercreditor

agreement (ICA) provide the legal basis to the CDR

mechanism.

All participants in the CDR mechanism through their

membership of the standing forum shall have to enter into a

legally binding agreement, with necessary enforcement and

penal clauses, to operate the system through laid-down policies

and guidelines.

The ICA signed by the creditors will be initially valid for a period

of 3 years and subject to renewal for further periods of 3 years,

thereafter. It is to be noted that foreign lenders are not a part of

the CDR system.

An important element of the DCA is the stand-still agreement

binding on both parties for 90 days or 180 days. Under this

clause, both parties commit to a standstillimplying that the

parties would not resort to any other legal action during this

period.

However, the standstill clause will not be applicable to criminal

action against any of the counterparties. Further, during the

standstill period, issues like outstanding foreign exchange

forward contracts, and derivative products can be crystallized,

provided the borrower is agreeable to such crystallization. The

borrower will additionally undertake that during the stand-still

period the documents will stand extended for the purpose of

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

47 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

limitation and also that he will not approach any other authority

for any relief and the directors of the borrowing company will not

resign from the Board.

CASE STUDIES: DEBT RESTRUCTURED UNDER CDR

A Look at how the Scheme has Worked in India

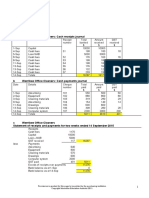

The data in Tables 7.1 and 7.2 show that the scheme has worked

quite well so far. At the end of March 2009, 184 companies were

being restructured under the scheme, with an outstanding debt of

about Rs. 86,536 crores.

Of these, the iron and steel sector has accounted for a lion's share

of about 36 per cent. This is primarily due to CDR Group having

approved the debt restructuring of three steel majors, Essar Steel,

Jindal Vijaynagar Steel and Ispat Industries, through the CDR

mechanism.

In this annexure, we will also study how two companies could turn

round in a short span aided by a package under the CDR Scheme.

TABLE 7.1 CASES UNDER CDR (STATUS OF PROPOSALS

REFERRED TO CDR AS ON 31 DECEMBER 2009)

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

48 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Source: http://www.cdrindia.org

TABLE 7.2 INDUSTRYWISE DISTRIBUTION OF APPROVED

CASES UNDER CDR (AS ON 31 MARCH 2009)

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

49 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Source: http://www.cdrindia.org

Case Study I: India Cements Ltd

Need for Restructuring When India Cements Ltd submitted a

CDR proposal to the FIs at the end of 2002, it had stated that the

bunching up of debt repayments over the next few years and

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

50 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

inadequate cash flow generation was making it difficult for the

company to meet its obligations.

On 31 March 2002, India Cements total outstanding debt was Rs.

1,793 crores made up of Rs. 447 crores of term loans, Rs. 759

crores of debentures, Rs. 164 crores of short-term unsecured

loans, Rs. 363 crores of working capital cash credit/overdraft and

Rs. 60 crores of public deposits. With earnings before interest,

depreciation, tax and amortization of Rs. 83 crores, it would have

been hardly able to meet its debt and preference capital obligations

of Rs. 729 crores for the year (including repayment and interest).

India Cements Debt Restructuring India Cements mandated

HSBC Securities and Capital Markets (India) Pvt. Ltd as exclusive

adviser in the restructuring process. As part of the

debt-restructuring exercise, India Cements agreed to divest its

entire stake in Visaka Cement Industry Ltd. and other non-core

assets, which expected to yield Rs. 410 crores net of debt and

interest outstanding of Rs. 190 crores in Visaka.

The Debt-Restructuring Proposal26 According to the

debt-restructuring proposal, India Cements would use the proceeds

from the sale of Visaka Cement to settle the debt in that company

and then settle certain loans and interest and pressing creditors. It

also created a contingency fund to meet any shortfall in Visaka's

divestment realization. The balance bank borrowings were to be

restructured along with term debt such that the entire outstanding

debt had a moratorium of 3 years on principal repayments, with an

overall tenor of 10 years for principal and interest payments and a

yield to maturity of 11 per cent, achieved through a ballooning of

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

51 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

interest rates from 2 per cent for FY2003 to 50 per cent for FY2012.

Accordingly, the debt repayment schedule of India Cements and

Visaka together was estimated at Rs. 779 crores in 20022003, Rs.

449 crores in 20032004, Rs. 459 crores in 20042005, Rs. 500

crores in 20052006, Rs. 206 crores in 20062007 and Rs. 116

crores in 20072008. However, the projected operating cash flows

for these years, at Rs. 31 crores, Rs. 117 crores, Rs. 215 crores,

Rs. 371 crores, Rs. 470 crores and Rs. 376 crores for 20072008,

indicated the company's inability to meet its debt obligations.

Post-restructuring, India Cements expected to register a net loss of

Rs. 57 crores for 20022003, and a net profit of Rs. 7 crores the

next year. The net profit was projected to increase to Rs. 31 crores

in 20042005, Rs. 75 crores in 20052006, Rs. 52 crores in

20062007, Rs. 26 crores in 20072008, Rs. 14 crores in

20082009, Rs. 10 crores in 20092010, Rs. 20 crores in

20102011 and Rs. 42 crores in 20112012.

Plan Under the CDR27 In a debt-restructuring plan cleared by the

CDR Forum of FIs and banks, the company had committed to the

following:

Sell off its non-core assets by March 2004, including ICL

Shipping Ltd and real estate assets, to raise about Rs. 60

crores.

Cut 1,000 jobs through a voluntary retirement scheme costing

Rs. 50 crores, but estimated to save Rs. 10 crores per year.

Two-year moratorium on repayments.

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

52 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

Back-ended payments after the 2-year period with interest rates

under different categories ranging between 3 per cent and 18.5

per cent.

The Rs. 1,706 crores debt-restructuring proposal was cleared by 30

odd lenders comprising banks and FIs, the progress of which would

be monitored by Industrial Development Bank of India.

As per the debt-restructuring proposal approved by the lenders, the

cut-off date for the package was 1 January 2003. All debts

excluding deposits from the public would be restructured. There

would be multiple options available to the lenders with different exit

options and yields. Additional working capital would be released to

the company on assessing requirements.

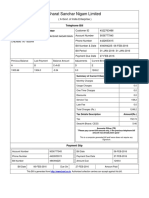

India Cements Today-Post-CDR28 Partly due to the restructuring

and partly due to the booming cement market, India Cements has

managed to post record profits up to December 2009. Table 7.3

shows the progress.

The net profit of Rs. 112.59 crores for the quarter ended 30 June

2006 is the highest ever profit made by the company. The good

demand for cement and the favourable prices are expected to last

for about 23 years, according to the company sources. Aided by

this trend, the company wiped out its accumulated losses by the

third quarter of 2006.

At the time of restructuring, the company's total debt stood at Rs.

1,280 crores, of which about Rs. 500 crores would come under the

CDR scheme. India Cements hoped to repay a substantial portion

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

53 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

of this high-cost debt during the year, thus, bringing down its

average cost of borrowings from 10.5 per cent. The debt equity

stood at 1.4 in March 2007, and fell to 0.6 in March 2009.

TABLE 7.3 INDIA CEMENTSKEY FINANCIALINDICATORS

QUARTERS ENDED JUNE2005 AND 2006

Source: www.indiacements.co.in

CASE STUDY II : PRIVATE EQUITY AND CDR

Kitply Industries29

When India Debt Management, a group company of Hong

Kong-based ADM Capital, infused Rs. 120 crores of private equity

into the ailing Kitply Industries in April 2008, it heralded a new trend

in the CDR mechanism. It signified not only restructuring but also a

change of management at the plywood firm that owns the popular

brand Kitply.

The private equity funds brought in will be used partly to repay the

lenders to Kitply and partly to revive its operations. The company

had outstanding loans of Rs. 500 crores to about 15 lenders. The

22-08-2015 00:52

07 - Credit Monitoring, Sickness and Rehabilitation

54 of 54

about:reader?url=https://www.safaribooksonline.com/library/view/man...

company's operations were hit due to an earlier slowdown in the

economy and a family dispute over management control.

The restructuring of Kitply was referred in 2006 to the CDR forum.

The restructuring package proposes that Rs. 7580 crores would

be used to repay the lenders, while the balance Rs. 4045 crores

would be infused as equity into the company. While some of the