Professional Documents

Culture Documents

Short-Term Industrial Business Statistics in Turkey

Uploaded by

dmaproiectOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Short-Term Industrial Business Statistics in Turkey

Uploaded by

dmaproiectCopyright:

Available Formats

Industry, trade and services Statistics in focus

Author: Cihat Erce ISBASAR

55/2008

Short-term industrial business statistics in Turkey

The aim of this short publication is to compare and The seasonally adjusted EU-27 index of production

contrast industrial developments in Turkey with generally followed a gradual upward trend over the

those of the European Union (EU-27) as a whole. period 2005 to 2007; the index was at its lowest level

There has been a considerable improvement in the (103.0) in March and May 2005 and at its highest level

transmission of Turkish short-term industrial (112.9) in August and October 2007.

business statistics to Eurostat in recent years, and

this is expected to continue in the coming months. The seasonally adjusted Turkish production index also

followed an upward trend with more accentuated

In this publication the evolution of industrial changes and was sometimes punctuated by sharp

developments in Turkey is also compared with the decreases: for example, -7.6 % in January 2006

two Member States that most recently joined the EU, (compared with the month before) or -4.6 % in December

Bulgaria and Romania, as well as another candidate 2007.

country, Croatia, from whom Eurostat also receives a

range of indicators. The comparison is based on During the period studied, the EU-27’s and Turkish

short-term business statistics that are a vital tool for seasonally adjusted employment indices initially followed

the analysis of business cycles. a downward trend until signs of modest increases in the

level of industrial employment from the second quarter of

2006 for Turkey and the fourth quarter of 2006 for the

EU-27. The relative stability of employment indices

compared with generally increasing industrial output

suggests that productivity in both the EU-27 and Turkey

was rising during the period considered.

Figure 1: Key indicators, seasonally adjusted (2000=100) (1)

150

140

130

120

110

100

90

J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D

2005 2006 2007

Production index: EU-27 Production index: Turkey Employment: EU-27

Employment: Turkey Hours worked: EU-27 Hours worked: Turkey

Source: Eurostat (STS)

(1) Production index: industry; employment and hours worked, manufacturing. Employment and hours worked for Turkey: quarterly series.

Industrial production

Figure 2: Production index, industry, seasonally adjusted (2000=100)

180

170

160

150

140

130

120

110

100

J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D

2005 2006 2007

EU-27 Bulgaria Romania Croatia Turkey

Source: Eurostat (STS)

Figure 3: Production index, seasonally adjusted (2000=100) (1)

Food and beverages manufacturing Textiles manufacturing

135 105

130 100

125 95

120

90

115

85

110

105 80

100 75

J A J O J A J O J A J O J A J O J A J O J A J O

2005 2006 2007 2005 2006 2007

EU-27 Turkey EU-27 Turkey

Basic metals manufacturing Motor vehicles & (semi-)trailers manufacturing

180 240

220

160

200

140 180

120 160

140

100

120

80 100

J A J O J A J O J A J O J A J O J A J O J A J O

2005 2006 2007 2005 2006 2007

EU-27 Turkey EU-27 Turkey

Source: Eurostat (STS)

(1) Note that a different scale has been used for each graph.

2 55/2008 — Statistics in focus

All of the countries shown in Figure 2 displayed an start of 2005 and the end of 2007 (compared with a loss

increasing trend in industrial output between January 2005 of 7.0 % for the EU-27).

and December 2007. In relation to the base year of 2000,

the highest output gains were recorded in Bulgaria, while While there was little overall change in the production

the rates of change in the industrial economies of Croatia, index for basic metals in either the EU-27 or Turkey

Romania and Turkey were very similar; the output of the during 2005, the index for Turkey subsequently

EU-27 grew in comparison at a lower rate. progressed by 10.8 % during 2006, growing at a slower

pace in 2007, with the maximum value for this series

A comparison of industrial production indices for specific (during the period studied) being recorded in November

manufacturing activities between the EU-27 and Turkey 2007. Between January 2005 and December 2007 the

shows that production indices for Turkey tended to remain production index for basic metals manufacturing rose

at a higher level than in the EU. The evolution of output for overall by 3.5 % for the EU-27 and 17.9 % for Turkey.

food and beverages manufacturing in Turkey followed a

rather erratic development, the index (2000=100) ranging Although erratic in terms of its development, the Turkish

between a high of 129.8 in August 2007 and a low of index of production for motor vehicles and (semi-)trailers

107.0 in April 2005 (the only time that a Turkish index was manufacturing rose overall by approximately 20 %

below the corresponding EU-27 figure among the four between the start of 2005 and the end of 2006. However,

activities covered in Figure 3). Two considerable output growth quickened in the second half of 2007, as

reductions in the output of food and beverages during production rose by 19.8% from August to November.

2007 led to the Turkish index returning to the same level Among the four activities for which data are shown in

as for the EU-27 by the end of the period considered. Figure 3, motor vehicles and (semi-)trailers

manufacturing recorded the highest production gains

Both the EU-27 and Turkey recorded contractions in their during the period studied for both the EU-27 and Turkey.

output of textiles. Turkey reported a more erratic Output rose overall by 12.2 % for the EU-27 between

evolution, with particularly large reductions in April 2005 January 2005 and December 2007, while the

(-7.6 %), January 2006 (-12.2 %) and December 2007 corresponding rate for Turkey was more than three times

(-11.0 %). These losses contributed towards an overall as high (39.5 %).

reduction of 15.4 % in Turkish production between the

Figure 4: Production index, average annual rate of change, working day adjusted,

2005-2007 (%) (1)

-25 -20 -15 -10 -5 0 5 10 15 20 25 30 35

Other transport equipment

Metal ore mining

Electrical machinery & app. n.e.c.

Fabricated metal products

Office machinery & computers

Machinery & equipment n.e.c.

Basic metals

Coal and lignite mining

Wood & wood products

Motor vehicles & (semi-)trailers

Elec., gas & hot water supply

Chemicals & chemical products

Leather & leather products

Industry

Other mining & quarrying

Tobacco products

Food & beverages

Pulp, paper & paper products

Publish., print., recorded media

Coke, ref. petrol. prod. & nucl.

Other non-metallic mineral prod.

Textiles

Clothing & fur

Rubber & plastic

Medical, precision & optical instr.

Furniture & manufacturing n.e.c.

Turkey

Extr. of petroleum & natural gas

Radio, TV & commun. equip. EU-27

Source: Eurostat (STS)

(1) NACE divisions 12, 37 and 41, incomplete information.

Statistics in focus — 55/2008 3

Manufacturing employment and hours worked

The seasonally adjusted manufacturing indices of Among those countries shown in Figure 5, the most

employment and hours worked, unsurprisingly, followed pronounced reductions in manufacturing employment

a more stable evolution when compared with were recorded in Romania, where the manufacturing

developments in output. workforce contracted by 8.5 % overall between the start

of 2005 and the final quarter of 2007.

Indeed, there was only a slight change in manufacturing

employment levels in Turkey from the start of 2005 The manufacturing employment index for Bulgaria stood

through to the final quarter of 2007 (+1.1 % overall), with a out from the remaining series insofar as its level remained

gradual increase in persons employed from a low in the well above the base level (2000=100). Bulgaria recorded

first quarter of 2006. The index of employment for EU-27 an expansion in its manufacturing workforce (+3.3 %

manufacturing reached a low in the third quarter of 2006, overall between the first quarter of 2005 and the final

after which there was also a modest recovery, although quarter of 2007); while Croatia also recorded an overall

the total number of persons employed fell overall by 0.8 % gain in persons employed, equal to 2.0 % (through to the

from the start of 2005 to the end of 2007. third quarter of 2007).

Figure 5: Employment index, manufacturing, seasonally adjusted (2000=100)

110

100

90

80

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2005 2006 2007

EU-27 Bulgaria Romania Croatia Turkey

Source: Eurostat (STS)

Table 1: Hours worked index, quarter on quarter rate of change, manufacturing,

seasonally adjusted, (%) (1)

2005 2006 2007

Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

EU-27 0.5 -0.8 -0.1 0.4 -0.6 0.2 0.2 0.3 -0.1 0.2 -0.3

Bulgaria 1.1 0.8 2.9 0.8 0.4 -0.7 -0.2 1.2 0.0 0.2 -0.8

Romania -0.5 -2.3 -1.1 1.8 -1.1 -1.2 -0.6 -0.6 -0.8 -1.2 -0.7

Turkey -1.1 -0.3 0.3 -1.0 -0.1 0.8 1.0 1.2 -1.5 0.1 1.3

Source: Eurostat (STS)

(1) Croatia, not available.

4 55/2008 — Statistics in focus

The evolution of the index of hours worked fluctuated employed in Turkey for the manufacture of motor

slightly more than that for employment (perhaps as a vehicles & (semi-)trailers manufacturing and coke,

result of overtime being used/refused in peak/slack refined petroleum products and nuclear fuel (largely as a

periods, while employers may be less prone to hire/fire in result of very high growth in the third quarter of 2007).

response to short-term changes in demand). As such, it On the downside, there were considerable and persistent

is perhaps not surprising to find that the hours worked job losses recorded for radio, television & communication

index for manufacturing in Bulgaria followed an atypical equipment manufacturing.

pattern, reaching a high of 111.1 in the third quarter of

2007 and remaining well above its base value of The change in employment levels in the EU-27 fluctuated

2000=100. Hours worked remained relatively stable much less than for Turkey. The biggest increases in

between the start of 2005 and the end of 2007 for most EU-27 employment (averaged over the four quarters of

of the other countries for which data are available, 2007) were reported for the manufacture of fabricated

although there was a relatively large contraction in hours metal products and for the manufacture of machinery

worked in Romania between the start of 2005 and the and equipment n.e.c., with gains of 0.5 % or more each

end of 2007 (-8.2 %). quarter. The most rapid contraction of labour in the

EU-27 was recorded for the manufacture of clothing and

The evolution of the seasonally adjusted number of fur products, textiles, and tobacco products.

hours worked in manufacturing followed a similar pattern

in Turkey and the EU-27, as both recorded their There were sometimes quite large disparities between

minimum value in the second quarter of 2006, after the evolution of employment and hours worked indices

which the number of hours worked tended to rise slowly during 2007. For example, while the number of persons

back towards the level recorded at the start of 2005. employed in the motor vehicle manufacturing sector rose

in Turkey, the number of hours worked fell (in the second

Table 2 shows in more detail (NACE divisions) the latest and third quarters – although there was a big correction

evolution of employment and hours worked indices for in the final quarter of the year). In a similar vein, tobacco

Turkey and the EU-27. Across the four quarters of 2007, manufacturing in the EU-27 reported the largest average

the manufacture of electrical machinery and apparatus decline in persons employed, while registering almost no

n.e.c. recorded by far the highest employment growth in change in hours worked. These anomalies were,

Turkey, with gains of close to 5 % in each quarter however, generally against the rule, as hours worked and

(compared with the quarter before). There were also employment tended to evolve along similar paths.

considerable expansions in the number of persons

Table 2: Labour input indicators, quarter on quarter rate of change, seasonally adjusted, 2007 (%) (1)

Employment Hours worked

Turkey EU-27 Turkey EU-27

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Manufacturing D 0.7 -0.6 0.6 1.0 0.3 0.0 0.1 0.2 1.2 -1.5 0.1 1.3 0.2 -0.1 0.2 -0.2

Electrical machinery & app. n.e.c. 31 5.3 5.0 5.4 5.6 1.0 -0.1 0.6 0.1 7.9 3.5 1.7 5.4 0.3 0.0 0.6 -0.3

Motor vehicles & (semi-)trailers 34 2.5 0.4 2.8 5.2 0.2 0.3 0.0 0.6 0.4 -1.1 -2.6 11.1 0.7 0.4 0.5 -0.1

Coke, ref. petrol. prod. & nucl. fuel 23 -0.4 0.2 6.4 1.5 0.7 -0.4 0.0 -1.0 1.1 0.4 4.7 0.6 0.0 0.6 0.3 0.4

Rubber & plastic 25 1.1 0.7 1.7 3.3 0.5 0.7 0.5 0.2 1.4 0.6 1.7 2.5 0.5 0.4 0.5 0.3

Basic metals 27 3.2 -1.3 1.2 2.5 -0.2 -0.2 0.7 0.1 2.7 -2.3 1.8 2.5 0.3 -1.2 0.5 0.1

Tobacco products 16 1.9 -3.8 -4.5 11.0 -5.5 -2.8 0.0 -0.2 7.3 -8.5 -11.7 32.3 1.2 -2.1 0.7 -1.8

Machinery & equipment n.e.c. 29 1.7 -0.7 -0.6 3.8 0.6 1.2 0.6 0.7 0.6 -1.0 -2.4 4.7 0.6 0.7 0.7 0.6

Fabricated metal products 28 -1.2 0.0 1.4 3.4 1.4 0.7 0.5 0.9 0.6 0.0 0.8 2.3 0.9 0.6 0.9 0.2

Publish., print., recorded media 22 -3.2 -1.5 5.2 2.6 0.2 -0.5 -0.3 0.0 -1.4 -2.5 4.3 3.0 0.3 -0.6 0.1 0.0

Other non-metallic mineral prod. 26 1.6 -1.7 1.3 0.9 1.3 0.0 0.2 0.5 3.0 -2.9 1.4 1.0 1.8 -1.3 0.4 -0.8

Pulp, paper & paper products 21 1.4 -0.9 2.0 -0.9 -1.1 0.5 -1.6 -0.3 2.5 -3.1 1.9 -0.4 -0.5 -0.4 -0.9 -0.8

Food & beverages 15 4.4 -1.7 0.0 -1.7 -0.3 0.0 0.5 0.2 6.3 -2.5 -1.0 -1.3 0.0 -0.2 0.1 -0.3

Other transport equipment 35 -3.8 1.3 0.5 3.1 0.8 0.3 0.8 1.1 -1.7 0.3 1.4 2.1 0.6 0.8 0.7 0.6

Furniture & manufacturing n.e.c. 36 -0.3 -1.8 -1.4 3.5 -0.3 0.0 0.1 -0.1 0.9 -1.2 -2.0 7.9 0.4 -0.2 -0.3 -0.3

Wood & wood products 20 -4.4 -1.2 1.0 3.3 0.0 -0.5 0.3 -0.1 -3.6 -1.9 2.8 2.2 -0.7 -0.8 0.6 -1.2

Clothing & fur 18 -3.5 -2.4 2.3 2.2 -1.0 -1.4 -2.5 -2.0 -3.2 -3.2 3.5 0.2 -1.3 -1.3 -2.0 -1.8

Medical, precision & optical instr. 33 1.0 -3.7 -3.3 4.2 0.8 1.0 -0.1 0.2 0.6 -5.1 -3.4 8.1 1.5 -0.6 1.1 0.0

Textiles 17 1.5 -2.9 -0.4 -0.7 -2.1 -2.0 -1.6 -1.2 2.3 -2.1 -0.9 -1.9 0.9 -2.5 -0.3 -2.0

Chemicals & chemical products 24 -3.8 0.3 1.0 -0.1 0.0 -0.4 0.3 -0.4 -4.8 -1.4 2.4 -0.4 -0.2 -0.4 -0.4 -0.2

Leather & leather products 19 2.0 -5.7 2.6 -1.9 -0.5 -1.0 -1.4 -1.3 0.9 -4.3 0.2 -1.1 -1.1 -1.5 -1.7 -1.4

Office machinery & computers 30 7.7 -16.1 -0.2 -9.1 0.4 0.1 0.1 -0.1 7.8 -16.8 -4.2 2.7 3.1 -0.8 0.7 -1.0

Radio, TV & commun. equip. 32 -9.8 -9.5 -10.7 -4.9 -1.1 0.0 0.8 0.0 -11.3 -6.0 -2.0 -12.2 0.4 -1.7 1.3 -0.7

Source: Eurostat (STS)

(1) Ranked on employment growth in Turkey during 2007.

Statistics in focus — 55/2008 5

Industrial producer prices

The Turkish domestic industrial producer price index has its annual average growth (6.9 %) was lower than in

been more volatile during the period 2005 to 2007 than in Romania.

the EU-27 or other countries shown in Figure 6, although

Figure 6: Domestic output price index, industry (2003=100)

180

170

160

150

140

130

120

110

100

J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F

2005 2006 2007 2008

EU-27 Bulgaria Romania Croatia Turkey

Source: Eurostat (STS)

Table 3: Domestic producer price index, month on month rate of change (%)

Turkey EU-27

2007 2008 2007 2008

Sep Oct Nov Dec Jan Feb Sep Oct Nov Dec Jan Feb

Industry C-E 0.5 -0.5 1.1 0.1 0.1 2.7 0.5 1.0 1.2 0.3 1.1 0.5

Coal and lignite mining 10 0.3 6.7 0.2 1.2 0.6 0.5 0.6 1.2 1.0 2.0 6.6 0.1

Extr. of petroleum & natural gas 11 -6.8 7.5 3.8 9.7 -0.3 -2.2 4.2 4.4 6.3 1.3 3.3 2.9

Metal ore mining 13 -3.1 -3.3 -0.5 -0.3 11.7 1.8 -1.2 0.2 -10.4 -5.9 4.3 6.6

Other mining & quarrying 14 1.3 -2.7 0.5 -0.5 -0.9 0.9 -0.1 0.4 0.3 -0.3 3.1 2.1

Food & beverages 15 2.5 2.0 0.7 0.1 0.8 1.7 1.3 1.5 0.8 0.6 0.8 0.6

Tobacco products 16 0.0 0.0 1.4 0.0 -1.6 -0.1 0.0 0.2 0.0 0.1 0.8 0.0

Textiles 17 -1.8 1.1 -1.3 1.5 -0.7 2.4 0.1 0.2 0.3 -0.2 0.4 0.2

Clothing & fur 18 9.5 2.5 1.9 -0.5 -6.9 3.6 0.0 0.1 0.0 0.1 0.3 0.0

Leather & leather products 19 0.0 3.5 2.5 -0.1 -1.7 -1.1 0.4 0.2 -0.4 -0.1 -0.4 0.1

Wood & wood products 20 0.4 -0.4 -0.1 -0.2 0.4 -0.6 0.2 0.3 -0.1 -0.1 0.5 0.3

Pulp, paper & paper products 21 -1.6 -1.0 -1.4 -1.5 -0.3 -0.3 0.3 0.4 0.1 0.0 0.9 0.2

Publish., print., recorded media 22 0.1 0.0 3.8 0.3 1.8 0.3 0.1 0.1 0.2 0.1 0.5 0.0

Coke, ref. petrol. prod. & nucl. fuel 23 -0.2 0.2 11.7 -1.5 -0.1 2.4 2.4 1.4 7.4 0.1 -0.2 1.3

Chemicals & chemical products 24 0.0 -1.5 -0.1 2.1 2.0 0.6 -0.1 0.3 0.3 0.7 1.2 0.7

Rubber & plastic 25 1.4 -1.5 -0.2 0.0 0.4 -0.2 0.1 0.1 0.1 0.0 0.5 0.3

Other non-metallic mineral prod. 26 -0.2 0.1 -0.2 0.4 -0.4 0.2 -0.1 0.1 0.0 0.0 1.7 0.6

Basic metals 27 -1.9 -3.7 -2.2 0.3 4.1 6.6 -1.0 -0.2 -1.3 -1.5 0.9 1.6

Fabricated metal products 28 -0.2 0.3 -1.3 -0.1 2.2 1.5 -0.1 0.1 0.0 0.0 0.5 0.4

Machinery & equipment n.e.c. 29 0.0 -0.5 0.1 2.0 -0.6 1.0 0.2 0.1 0.1 0.1 0.7 0.6

Office machinery & computers 30 -7.8 -2.7 -6.3 0.2 -2.0 2.0 -0.5 -0.4 -0.1 -0.7 -0.6 -0.4

Electrical machinery & app. n.e.c. 31 0.5 -0.4 -0.4 -0.5 0.9 1.2 -0.1 0.4 0.0 -0.2 0.2 0.1

Radio, TV & commun. equip. 32 -1.8 -4.9 -1.0 -3.2 -0.4 -1.9 0.0 -0.3 0.1 -0.2 -0.1 -0.2

Medical, precision & optical instr. 33 0.9 -1.6 -1.5 -0.3 -0.2 -5.3 0.3 0.0 -0.3 0.0 0.6 0.2

Motor vehicles & (semi-)trailers 34 0.2 -0.3 0.0 -0.4 -0.1 0.0 0.1 0.2 0.1 0.1 0.1 0.1

Other transport equipment 35 0.1 0.1 0.0 0.1 -1.8 -3.9 0.1 -0.2 0.1 0.3 0.8 0.0

Furniture & manufacturing n.e.c. 36 1.0 0.5 -2.1 -3.2 -3.5 2.3 0.1 0.3 0.1 0.2 1.0 0.5

Elec., gas & hot water supply 40 -0.3 -10.3 -0.9 -1.2 2.2 21.3 1.0 3.6 3.0 1.2 3.1 0.1

Water supply 41 0.5 0.4 8.1 0.6 0.2 0.2 0.0 0.1 0.1 0.1 1.2 0.2

Source: Eurostat (STS)

6 55/2008 — Statistics in focus

METHODOLOGICAL NOTES

Legal basis The index of the number of persons employed and the

hours worked index are required for Sections C, D and E,

The legal basis for the STS indices is Council Regulation but in this publication these indices are presented for

No 1165/98 of 19 May 1998 (1) concerning short-term NACE Rev. 1.1 Section D, in other words manufacturing.

statistics and Regulation (EC) No 1158/2005 of the

European Parliament and of the Council of 6 July The producer price index (or output price index) aims to

2005 (2) amending Council Regulation (EC) No 1165/98. show monthly changes in transaction prices. Indices are

compiled for the domestic and the non-domestic market:

Definition of indicators (3) and activity coverage the index shown in this publication is the domestic price

The production index aims to show changes in the index. All price-determining characteristics of the products

volume of output and provides a measure of the volume should be taken into account. The price excludes VAT and

trend in value added over a given period. The production similar deductible taxes on the goods and services

index is a theoretical measure that must be invoiced by the unit, while subsidies on products received

approximated by practical measures, for example using by the producer, if any, should be added.

deflated gross production values or labour input The producer price index is required for activities within

measures. Dependent on the approximation method NACE Rev. 1.1 Sections C, D and E, with the exceptions

used, the index of production should take account of: of Groups 12.0, 22.1, 23.3, 29.6, 35.1 and 35.3.

variations in type and quality of inputs and outputs;

changes in stocks of finished goods and work in Decomposition – forms of indices

progress; changes in technical input-output relations

(processing techniques); changes in related services. The normal breakdown of a gross or unadjusted time

The theoretical formula for an index of production is a series makes it possible to identify the trend, the cycle,

Laspeyres-type volume index. the seasonal variation and the erratic fluctuations. Most

of the indices presented in this publication are based on

The industrial production index is required for activities seasonally adjusted data.

within NACE Rev. 1.1 Sections C, D and E, except for

Division 41 and Group 40.3. Seasonal adjustment aims, after adjusting for calendar

effects, to take account of the impact of the known

The number of persons employed is defined as the total seasonal factors that have been observed in the past. If

number of persons who work in the observation unit the national statistical office providing the data does the

(inclusive of working proprietors, partners working seasonal adjustment, these series are used. If no

regularly in the unit and unpaid family workers), as well seasonally adjusted series are supplied, Eurostat

as persons who work outside the unit who belong to it perform the seasonal adjustment.

and are paid by it (e.g. repair and maintenance teams). It

includes persons absent for a short period (e.g. sick, paid Base year and comparison period

or special leave), and also those on strike, but not those Indices disseminated by Eurostat at the present time are

absent for an indefinite period. It also includes part-time set with 2000=100, and weights from the 2000 reference

workers who are regarded as such under the laws of the year are used for aggregation. An exercise to implement

country concerned and who are on the payroll, as well as weights from 2005, and to adopt 2005=100 as the

seasonal workers and apprentices on the payroll. The comparison period is underway and is expected to be

number of persons employed should be determined as a completed later in 2008. Some countries have already

representative figure for the reference period. Note that started rebasing the indices published nationally.

Member States may use an index of (paid) employees to

approximate the index of the number of persons In this publication the domestic PPI has been presented

employed. with 2003=100 as the comparison period, as 2003 is the

beginning of the Turkish PPI. In order to facilitate

The hours worked index aims to show the development in comparison the PPIs for the EU-27 and for the other

the volume of work done. The total number of hours countries presented have also been rescaled to

worked represents the hours actually worked for the 2003=100.

output of the observation unit during the reference period,

and so excludes hours paid but not actually worked (such Geographical coverage

as paid or sick leave), as well as meal breaks and The reporting entity of EU-27 is an aggregate that is

commuting between home and work. Included are normal consistently composed of the current 27 Member States.

and overtime hours and time at the place of work

preparing the site and short periods of rest at the Symbols

workplace.

: not available

(1) Official Journal No L 162, of 5 June 1998.

(2) Official Journal No L 191, of 22 July 2005.

(3) Official Journal No L 281, of 12 October 2006.

Statistics in focus — 55/2008 7

Further information

Data: Eurostat Website: http://ec.europa.eu/eurostat

Select your theme on the left side of the homepage and then ‘Data’ from the menu.

Data:EUROSTAT Website/Home page/Industry, trade and services/Short-term

business statistics/Data

Industry, trade and services - horizontal view

Short-term Business Statistics - Monthly and Quarterly (Industry, Construction,

Retail Trade and Other Services)

Industry (NACE Rev.1 C-F)

Construction (NACE Rev.1 F) - Building and civil engineering

Trade and other services (NACE Rev.1 G-K)

Journalists can contact the media support service:

Bech Building Office A4/125 L - 2920 Luxembourg

Tel. (352) 4301 33408 Fax (352) 4301 35349

E-mail: eurostat-mediasupport@ec.europa.eu

European Statistical Data Support:

Eurostat set up with the members of the ‘European statistical system’ a network of

support centres, which will exist in nearly all Member States as well as in some EFTA

countries.

Their mission is to provide help and guidance to Internet users of European statistical

data.

Contact details for this support network can be found on our Internet site:

http://ec.europa.eu/eurostat/

A list of worldwide sales outlets is available at the:

Office for Official Publications of the European Communities.

2, rue Mercier

L - 2985 Luxembourg

URL: http://publications.europa.eu

E-mail: info@publications.europa.eu

Manuscript completed on: 09.06.2008

Data extracted on: 13.03.2008

ISSN 1977-0316

Catalogue number: KS-SF-08-055-EN-C

© European Communities, 2008

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Finman Case 1Document9 pagesFinman Case 1Jastine Sosa100% (1)

- Investors in People - The Impact of Investors in People On People Management Practices and Firm PerformanceDocument127 pagesInvestors in People - The Impact of Investors in People On People Management Practices and Firm PerformancedmaproiectNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- UnescoDocument124 pagesUnescoo8o0o_o0o8o2533No ratings yet

- Corporate Finance NPV and IRR SolutionsDocument3 pagesCorporate Finance NPV and IRR SolutionsMark HarveyNo ratings yet

- Electric Vehicles in IndiaDocument24 pagesElectric Vehicles in Indiabunny1006100% (5)

- What Is Urban PlannigDocument4 pagesWhat Is Urban PlannigDesy Mulyasari DesyNo ratings yet

- Profit Sharing Standardized 401k Adoption AgreementDocument2 pagesProfit Sharing Standardized 401k Adoption AgreementYiZhangNo ratings yet

- Developing Market Entry Strategy English KPMGDocument24 pagesDeveloping Market Entry Strategy English KPMGMeoki YoNo ratings yet

- Donor Approaches To Improving Business Environment For Small EnterprisesDocument90 pagesDonor Approaches To Improving Business Environment For Small EnterprisesdmaproiectNo ratings yet

- The Hungarian Investment and Trade Development AgencyDocument5 pagesThe Hungarian Investment and Trade Development AgencydmaproiectNo ratings yet

- Donor Approaches To Improving Business Environment For Small EnterprisesDocument90 pagesDonor Approaches To Improving Business Environment For Small EnterprisesdmaproiectNo ratings yet

- Competition in Professional Services New Light and New ChallengesDocument13 pagesCompetition in Professional Services New Light and New ChallengesdmaproiectNo ratings yet

- ARIS - Agentia Romana Pentru Investitii StraineDocument2 pagesARIS - Agentia Romana Pentru Investitii StrainedmaproiectNo ratings yet

- LOWRI EVAN'S INTRODUCTORY SPEECH AT "RZECZPOSPOLITA", WARSAW ON 4 MARCH 2005 - Competition in Professional Services1 - enDocument6 pagesLOWRI EVAN'S INTRODUCTORY SPEECH AT "RZECZPOSPOLITA", WARSAW ON 4 MARCH 2005 - Competition in Professional Services1 - endmaproiectNo ratings yet

- R&D Expenditure and Personnel - R&D Intensity in The EU-25 Unchanged at 1.85% in 2005 Compared To 2004, But China Making Rapid ProgressDocument8 pagesR&D Expenditure and Personnel - R&D Intensity in The EU-25 Unchanged at 1.85% in 2005 Compared To 2004, But China Making Rapid ProgressdmaproiectNo ratings yet

- Patents and R&D Expenditure - Most EPO Patent Applications Submitted by EU BusinessesDocument8 pagesPatents and R&D Expenditure - Most EPO Patent Applications Submitted by EU BusinessesdmaproiectNo ratings yet

- Isint BrochureDocument12 pagesIsint BrochureCristian GuerraNo ratings yet

- BudgetDocument3 pagesBudgetkawalkaurNo ratings yet

- Murdzhev P PDFDocument354 pagesMurdzhev P PDFAleksandar RistićNo ratings yet

- Sale Deed EnglishDocument4 pagesSale Deed Englishnavneet0% (1)

- SA Climate Action and Adaptation PlanDocument92 pagesSA Climate Action and Adaptation PlanDavid IbanezNo ratings yet

- Theoretical Framework of E-Business Competitiveness: SciencedirectDocument6 pagesTheoretical Framework of E-Business Competitiveness: SciencedirectAnonymous JmeZ95P0No ratings yet

- Denver Equipment Company Handbook - IndexDocument6 pagesDenver Equipment Company Handbook - IndexCristiam MercadoNo ratings yet

- Preliminary and Preoperative ExpensesDocument12 pagesPreliminary and Preoperative ExpensesYogesh TileNo ratings yet

- Multiple Choice Questions Distrubution Logistic PDFDocument14 pagesMultiple Choice Questions Distrubution Logistic PDFYogesh Bantanur50% (2)

- Ray Dalio - The CycleDocument20 pagesRay Dalio - The CyclePhương LộcNo ratings yet

- Multiplier-Accelerator IntroductionDocument2 pagesMultiplier-Accelerator Introductiongnarayanswami82No ratings yet

- Canara - Epassbook - 2023-11-02 200708.530629Document95 pagesCanara - Epassbook - 2023-11-02 200708.530629manojsailor855No ratings yet

- Department of Education: Project Proposal IDocument6 pagesDepartment of Education: Project Proposal IIt's AlfredNo ratings yet

- Short Note On LIC and Insurance SectorDocument37 pagesShort Note On LIC and Insurance Sectorappliedjobz50% (2)

- Trustees Objection To Mark A. Leonard's Bankruptcy ExemtionsDocument4 pagesTrustees Objection To Mark A. Leonard's Bankruptcy ExemtionsBrokenTractorNo ratings yet

- Project Capstone Abhishek AcharyaDocument54 pagesProject Capstone Abhishek AcharyaRajan PrasadNo ratings yet

- MIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolDocument25 pagesMIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolRatika GuptaNo ratings yet

- Notice: Applications, Hearings, Determinations, Etc.: Gas Transmission Northwest Corp.Document2 pagesNotice: Applications, Hearings, Determinations, Etc.: Gas Transmission Northwest Corp.Justia.comNo ratings yet

- Boq 3Document2 pagesBoq 3China AlemayehouNo ratings yet

- Peter Thiel Lecture Set - Stanford University CS183Document267 pagesPeter Thiel Lecture Set - Stanford University CS183Johanna Lopez100% (1)

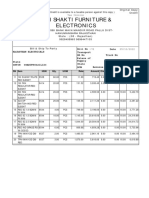

- Shri Shakti Furniture & Electronics: Credit OrginalDocument1 pageShri Shakti Furniture & Electronics: Credit OrginalRahul BansalNo ratings yet

- Bir Hisar Reject Kharif 2022 Insured PolicyDocument2 pagesBir Hisar Reject Kharif 2022 Insured PolicyJ StudioNo ratings yet

- Draft Resolution (Saudi Arabia, Usa, Japan)Document2 pagesDraft Resolution (Saudi Arabia, Usa, Japan)Aishwarya PotdarNo ratings yet