Professional Documents

Culture Documents

RiskManagementExaminationManaul 08 AntiMoneyLaundering

Uploaded by

lphouneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RiskManagementExaminationManaul 08 AntiMoneyLaundering

Uploaded by

lphouneCopyright:

Available Formats

Guidelines for On-site Examination on AML/CFT compliance

Unofficial Translation

This translation is for the convenience of those unfamiliar

with the Thai language.

Please refer to the Thai text for the official version.

Guidelines for On-site Examination on

AML/CFT compliance

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

Contents

Examination Objectives

Scope of Examination

Examination Guidelines

1. Policy on AML/CFT established by FI

2. Guidelines and procedures in line with FIs AML/CFT policy

3. Procedures in line with AML/CFT policy

4. Organizational Structure

5. Rules and Manual/Operating Procedures Development for

Front-Line Staff

6. Training

10

7. Internal Control System

10

8. IT System

13

9. System for transactions reporting to AMLO and record keeping

14

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

Examination Objectives

1. To evaluate whether policies or measures and operating procedures

of information system pertaining to AML/CFT of financial institution (FI) are

adequate and compliant with international standard and regulatory rules.

2. To assess whether FIs internal control system regarding to

AML/CFT is equipped with restricted control, continuous review for regulation

adherence and independent inspection unit for operation of staff

3. To acknowledge FI of impacts or damage, inclusive of reputation

risk that might occur in light of partially or entirely involvement in AML/CFT in

order to prevent FI from being intermediaries for money launderer and terrorist

financier in using illegal money for legal activity

Scope of Examination

The scope for AML/CFT examination is to consider adequacy;

completeness and appropriateness of policies and measures for AML/CFT;

regulations, procedures and manual/operation procedures of risk induction unit and

risk monitoring unit; structure of responsible units as well as internal control system,

internal reporting system, client record keeping, process of reporting to AMLO or

other authorities, and sampling of transactions. In the case where examiner has found

suspicious transactions when conducting on-site examination, examiner shall verify

such transactions and interview relevant staff regarding reporting to AMLO.

Examination Guidelines

The examination is conducted by determining FIs policies on

AML/CFT, manual / guidelines / regulations including communication process and

training program specified by FI. Examiner shall interview, observe and conduct

sampling of various transactions such as account opening transactions, risk

classification report, review report, daily report and transaction report especially

suspicious transaction, exception report, and management report. Examiner shall also

verify suspicious transactions found from on-site examination.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

1. Policy on AML/CFT established by FI

Examiner should verify if the Board of Directors has established the

visibly written AML/CFT policy at least containing as of the followings.

1. FI includes within AML policies those international standards i.e.

customer due diligence for banks by BIS or 40+9 recommendations by FATF

2. Policy must comply with rules or regulatory policy with adequate

organizational structure, authority designation and follow-up control as well as

resource or budget management for such policy

3. Policy must comprise procedures of customer acceptance and

customer risk classification, including procedures for on-going account monitoring.

4. FI must develop customer acceptance policy and rules that require

more extensive due diligence for higher risk customers or persons whose names are

indicated in terrorist or warning lists of AMLOs or other organizations databases.

Note : According to BIS Customer Due Diligence for Banks, it is

important that the customer acceptance policy is not so restrictive that it results in a

denial of access by the general public to banking services, especially for people who

are financially or socially disadvantaged. On the other hand, quite extensive due

diligence would be essential for an individual with a high net worth whose source of

funds is unclear. Decisions to enter into business relationship with higher risk

customers should be taken exclusively at senior management level.

5. Risk factor assessment is in place for relevant units or transactions,

for non-compliance with rules and regulations or for operation malpractice that could

result from staff or operating procedures.

6. Action plan has been developed for relevant AML/CFT policies

completely, including plan monitoring and evaluation.

2. Guidelines and procedures in line with FIs AML/CFT policy

2.1 Know Your Customer (KYC) Procedures

To minimize the risk of FI from being intermediaries for money

laundering, when a customer opens a new account, FI should establish KYC by

interviewing and requesting customer identification in order to rate customer risk

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

exposure. Therefore, examiner shall verify if FI has developed guidelines and

procedures for operating transaction with risky customer at least as of the followings.

1. KYC standard must be compliant with both domestic and

international laws and regulations and also rules of home country.

2. Risk assessment process has been developed for conducting

financial transaction with new customer.

3. Information gathering and KYC is adequate and coherent with risk

exposure of customer.

4. The monitoring and accounting management process is adequate and

coherent with risk exposure of individual customer groups.

5. The customer identification process is in place to keep track of

customers possibly enlisted in AMLO lists, warning lists databases of other

organizations, or high risk persons specified by FATF.

2.2 Customer Due Diligence (CDD)

Examiner shall verify if FI have procedures for CDD in place

including;

1. FI has classified customers into groups with risk rating assigned to

each group for the purpose of developing customer database, which higher risk

customers are required more information than normal customers.

2. All factors such as customer history, country of origin, social status,

transactional account, transaction types and risk indicator tools must be considered.

3. FI needs to have more extensive due diligence for individual with a

high net worth whose source of funds is unclear, high risk individual specified by

FATF or BIS CDD, customers whose addresses are unidentified, or customers who

are suspected of being associated with terrorism (Terrorists List).

4. For high risk customers, approval for account opening should be

taken exclusively at senior management level.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

3. Procedures in line with AML/CFT policy

Examiner shall determine if CDD procedures is in writing and after

getting approval by the Board of FI, the written CDD should be acknowledged and

understood by the management and related staff. All the measures in the policy must

be adherent to regulations and international standards. Therefore, policy and operating

procedures should at least consist of

1. The identification process of client with whom FI conducts business;

the satisfactory verification of customers identity ; the up-to-date record retention of

client with regular review of such information

2. Specific operating procedures for non-resident

3. The customer identification process and information inspection for

private banking

4. The methodology to inspect information of customer whose banking

services were denied by other FIs

5. Operating procedures for existing customers having business

transaction afore the issuance of Customer Acceptance Policy and having

identification satisfactory problem

6. Operating procedures for customers that are themselves financial

institutions

7. Specific operating procedures for business transaction with

companies having nominee shareholders or shares of unidentified bearer form

8. Operating procedures and risk mitigation measures in light of

transaction with introducers or intermediaries or non-face-to-face customers

9. Policy and operating procedures in contacting with high-risk

customers.

10. Operating procedures in case of knowing or assuming the funding

is illegally received or misused from public money

11. Policy and operating procedures concerning correspondent

accounts

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

12. Policy and operating procedures for FIs branch or office locating

in countries whose anti-money laundering policy is lower standard

13. Operating procedures for verifying customers name against

terrorist lists provided by regulatory agencies, whenever suspicious persons name is

found, FI should contact AML/CFT compliance officer or related regulatory agency.

14. Reporting of suspicious transactions to the management and

regulatory agency

15. Review of policy compliance and operating procedures for

customer acceptance of relevant units

4. Organizational Structure

4.1 Specific Unit responsible for AML/CFT

Examiner shall verify if FI has established a specific unit independent

from business unit or has in place a compliance unit to corporate with the established

policy as well as to evaluate adequacy and appropriateness of policy and operating

measures pertaining to AML/CFT, to review the operation of staff for compliance

with the specified policy and operating procedures and for reporting to the senior

management or the Board of FI of transaction being defective from non-compliance.

Accordingly, senior management should take responsibility for assessment and review

of customer acceptance policy and directly report to the Board of financial institution.

4.2 Compliance Officer

Examiner shall verify if FI has appointed capable compliance officer to

take full responsibility in monitoring the AML/CFT compliance. In this concern, the

Board of FI and the management should authorize adequate power and resources to

compliance officer in handling all issues efficiently. Notwithstanding the compliance

officer could delegate the authority to another party, the compliance officer is yet

subject to full responsibility of the delegated staff, that is

1. Senior management must develop internal control system that covers

all regulations (approved afore by the Board of FI) i.e. account opening, reporting of

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

suspicious transactions, monitoring of operation and reporting of foreign currency

holding.

2. The compliance officer is subject to report to the management in

order to continuously monitor and entrust the complete compliance with law and

regulation pertaining to AML. Some presented reports include audit report, noncompliance report and resolution report.

3. All staff is subject to adhere with laws and regulations in regarding

to AML/CFT. This requirement as well should be clearly indicated in job description

of individual staff and be part of performance evaluation.

4.3 The Coordination between Front-Line Staff and Compliance

Examiner shall pay attention to the coordination between customer

acceptance unit and compliance unit because the operation of customer acceptance

unit such as depository and credit facility must conform to the regulation or order of

customer acceptance procedure, the requirement for customer identification, the

detailed identification evidence of customer and etc. Hence, should there be any

vagueness of customer acceptance policy or of financial institutions order or any

changes of regulations, front-line unit is required to cooperate with compliance unit to

find truths maintaining the clarity of regulation. Therefore, it is recommended the two

units meet and discuss regularly for effectiveness of operation and mitigation of

deficiency.

5. Rules and Manual/Operating Procedures Development for

Front-Line Staff

Examiner shall verify rules and manual/operating procedures of front

line staff as follows.

5.1 Rules

Upon having written policy, examiner shall verify if FI has

incorporated the policy into written operating procedures, regulation or manual and

informed relevant staff to ensure the practical utility. To do so, FI should

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

1. Disseminate the abovementioned written operating procedures,

regulation or manual to enable relevant staff to study and correctly follow the written

documents to reach the objectives, for example, the requirement for identification of

new customer or of customer having cash transaction of more than or equal to 2

million baht.

2. Provide training or explanation including on-the-job training for the

effectiveness of operation and the channel to clarify any questioning issues.

3. In light of changes in regulation or newly issued measures or

contingent cases, FI could implement those as order for staff to follow as well as

readjust the existing manual/operational steps to reflect the changes.

4. Rules and regulation must be compliant with regulatory measures

and amendment is required when there are changes in regulatory measures or the

established rules are not practical.

5.2 Development of Manual/Operating Procedures of Front-Line

Staff

Manual/operating procedures of front-line staff is to allow relevant

customer acceptance staff to follow and operate in the same direction as well as to

specify the methodology to solve confronting problem in light of regulation is

changed and previous regulation needs adjustment i.e. in the form of order to modify

the regulation. Accordingly, the manual should contain

1. Rules for accepting depository customer must be adherent to the

notification of BOT and the notification of Identification Requirement of AMLO.

2. Rules for customer identification of both existing and new

customers.

3. Rules for transaction reporting in the form of PorPorNgor. 1-01 to

1 -03 and PorPorNgor. 1-05, according to AMLO regulations

Concerning complete manual/operating procedures, relevant staff is

obliged to study in detail and attend an explanatory and training session to minimize

any operation difficulties. Besides, relevant staff should study international guidelines

as well as the Anti-Money Laundering Act for better understanding.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

10

6. Training

6.1 Training Schedule

Examiner shall verify annual plan for human resource development

that FI has specified in advance. For the development or training of front-line staff, FI

should schedule the session based on the emergence of situation or the course of

contact. In this regard, cooporation with AMLO is recommended for the front-line

staff to participate in training session arranged by AMLO to familiarize the staff with

policy as well as procedures in preparing report according to AMLOs report forms.

6.2 Trainees from Front-Line Unit

Examiner shall verify if FI has conducted on-going training session

that embraces every angle of laws and regulation as well as policies and procedures of

AML/CFT. Contents and materials of training should be updated to reflect the

changes of laws and regulations and to enable training course remains up-to-date. In

addition, training course should acknowledge new means of money laundering as well

as provide examples and encourage trainees to attempt case studies. As a matter of

fact, a well-qualified training session should focus on

- Staff and the management contacting with customer, directly or

indirectly via telephone call

- Staff and the management reviewing transaction of customer

- Staff and the management handling cash deposit/withdrawal

- Staff and the management involving in branch / customer service

center / credit business / private banking / correspondent banking / transferring /

safety box / registrar

7. Internal Control System

In order to ensure the compliance of FI with laws and regulations

regarding to AML, examiner is advised to do the following.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

11

1. Verify the correctness and effectiveness of management system and

controlling of transaction testing especially the examination of units or financial

instruments or financial services with high risk to assure the rigorous compliance.

2. Assess the acknowledgement and understanding including operating

procedures of staff in regarding to enforced regulation.

3. Evaluate the adequacy of procedure used to identify suspicious

transactions

FI should have control and monitoring / examination system and

reporting system to the management by restricting the process according to the

measures established. In case of errors in spite of meticulously following the

regulation, it is likely that measures might be impractical. In that concern, review is

required. In most case, the problem arises from ignorance of regulation and leads to

organizational defection. Hereinafter, control and monitoring system is necessary.

7.1 Control and Monitoring System of Operating Procedures

Examiner shall verify as follows.

1. Relevant staffs have operated in compliant with established

regulations and to control the deficiency not to occur to FI for example, the CDD is

complete with no exception to particular customer

2. The operation for every new customer or when there is a suspicious

transaction that require restricted regulation conformity is achieved in order to

alleviate potential future problem. Should exception is applied, FI could be utilized as

intermediaries for money laundering and terrorist financier, exposing directly to

reputational risk of FI.

3. FI has in place preventive measures for conducting transactions with

high-risk customer to prevent the usage of FI as intermediaries for money laundering

or as source of fund for illegal business conduction, resulting directly to reputational

damage of FI, for example, FI should never agree to open an account or should inform

regulatory agency immediately whenever individual suspected of being associated

with terrorism has requested for account opening.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

12

4. Staffs have monitored whether customers follow accordingly to

what stated on the account opening date or credit application date or transaction date.

This is a proactive action that would allow financial institution to realize before the

haphazard actually happens. For example, a client stated the business for retail

banking but accounted item is somewhat different.

5. Staffs have conducted ongoing account monitoring in order to

frequently update clients information, especially of high-risk customers. In view of

suspicious accounting transaction, additional information from customer is necessary

and must be followed by reporting of such case to the management to completely

fulfill regulation requirement.

7.2 Internal Audit System

Examiner must assess whether internal audit system of FI;

1. Set up precise scope of examination in each year and get approved

correctly. For the scope or detail of examination, it should include the evaluation of

AML i.e. the testing amount of CDD, the inspection of reporting required by AMLO

and etc.

2. Establish in AML the initial assessment for risk level and clearly set

up scope of audit including sampling number for the audit program

3. Appoint appropriate task forces who are knowledgeable for

AML/CFT and well trained. The result of examination should be presented to the

audit committee and the Board of directors of FI.

4. Ensure the conformity with regulations such as whether updating of

information is required for high-risk customers and whether chief of audit is required

to control over each step of inspection i.e. allow explanation from inspected units

concerning incident found from initial inspection before presenting the audit result to

the audit committee.

5. Ensure that front-line unit operating procedures are consistent with

FIs rules and such rules are compliant with regulatory measures, for example,

documents relating to account opening or transaction conducting for at least five years

after an account is closed or the relationship is stopped.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

13

6. Verify if account opening transactions of both new and existing

customers have been conducted in compliance with rules, for example, all new

customers provide complete required evidences certified with signatures, while

existing customers were monitored and informed to submit up-to-date evidences.

Customers must be classified into groups for risk rating with explanation in light of

risk rating has been changed.

7. Verify if results of audit have been presented to the Audit

Committee within the timeline specified in the audit plan. Reasonable clarification in

light of extended period is necessary.

8. Follow the resolution required from inspection result of previous

year audit and investigate the problems arise to solve the deficiencies.

9. Verify if The Audit Committee has any recommendation on audit

results for further inspection.

8. IT System

To assess the IT system, examiner could assess the system by

determining the correctness of output data against the input data. Customer data

entered into computer system for online reporting to AMLO should be verified as

follows.

1. Verify the connection procedures between computer system of FI

and that of AMLO.

2. Evaluate the security system including the correctness of data for

internal data transmission and check if the data has been verified before submitting to

other persons or units.

3. Assess if FI has in place system for inspecting or detecting unusual

or suspicious transaction i.e. setting the deposit amount limit for each level and

having special monitoring system for high-risk accounts.

4. Assess if FI has in place system for on-going verifying both new and

existing customers names against with terrorist lists or suspicious names list

announced by regulatory agency.

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

14

5. Assess if FI has in place system linking inter- branches transactions

data for investigating and monitoring customer activities and verify if FI has reported

to AMLO in the case where any customer has deposited or withdrawn money in an

aggregate amount equal to or exceeding 2.0 million baht, either the same or different

accounts of all branches.

9. System for transactions reporting to AMLO and record keeping

9.1 System for transactions reporting to AMLO

Examiner shall assess the adequacy of computer system to support

transaction reporting of FI and pay close attention to customer identification process

including information summary process and system connection process of transaction

reporting from FI to AMLO. In this concern, it is recommended that examiner should

randomly inspect variety of transactions especially those with suspicious issues or

with huge amount of cash deposit and interview FIs officers for further assessment of

reporting required by the Anti-Money Laundering Act for FI to submit to AMLO.

Such reports are as follows.

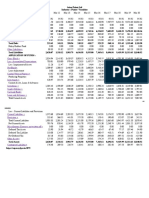

Report

PorPorGnor.1-01 Report of Cash Transaction for the transaction

Frequency

Every 15 Days

involves with cash in an amount equal to or exceeding 2 mil. baht

PorPorGnor.1-02 Report of Transaction relevant to Assets for the

Every 15 Days

transaction involves with an asset equal to or exceeding 5 mil. baht.

PorPorGnor.1-03 Report of Transaction with Suspicion

Every 15 Days

In the case where transaction is unusually complicated and deviated

from the normal transaction.

PorPorGnor.1-05 Report of Transaction having Belief or Suspicion

Within 7 Days

In the case where there is a probable cause to believe that such

following the

transaction may relate to asset involved in a commission of offense

day of belief or

or is a suspicious transaction.

suspicion

Summary Report of Transactions

Every 6

Months

Supervision Group

Bank of Thailand

November 2005

Guidelines for On-site Examination on AML/CFT compliance

15

9.2 Keeping of Customer Information and Transaction Data

Examiner shall conduct transaction sampling and interview FI

regarding to keeping of reports submitted to AMLO at least 5 years after the account

closure date or the cut off date to make them available and ready for ad hoc

examination. Besides, the record retention of individual FI could vary i.e. documents

may be classified by risk exposure because higher risk customers are required to keep

more information as well as individual account information while some FIs have not

yet to have risk classification system.

Supervision Group

Bank of Thailand

November 2005

You might also like

- Alpha/Beta Separation: Getting What You Pay ForDocument15 pagesAlpha/Beta Separation: Getting What You Pay Forilham100% (1)

- Get RichDocument11 pagesGet RichAnthony Donatelli100% (2)

- Aml CFTDocument35 pagesAml CFTBinod MehtaNo ratings yet

- Anti-Money Laundering/ Countering Financing of Terrorism (AML/CFT) Policies, Procedures and ControlsDocument29 pagesAnti-Money Laundering/ Countering Financing of Terrorism (AML/CFT) Policies, Procedures and ControlsWubneh AlemuNo ratings yet

- TKB Transaction Monitoring Policy and ProcedureDocument11 pagesTKB Transaction Monitoring Policy and ProcedureVishi SinghNo ratings yet

- Guide To US AML Requirements 5thedition ProtivitiDocument474 pagesGuide To US AML Requirements 5thedition ProtiviticheejustinNo ratings yet

- Consolidated KYC Risk ManagementDocument9 pagesConsolidated KYC Risk ManagementSri Harikanth Balijepalli100% (1)

- PMLA PolicyDocument36 pagesPMLA PolicySatwant singhNo ratings yet

- An Introduction To The FATF and Its WorkDocument6 pagesAn Introduction To The FATF and Its WorkShashikant PrajapatiNo ratings yet

- Anti-Money Laundering and Counter-Terrorism Financing PolicyDocument25 pagesAnti-Money Laundering and Counter-Terrorism Financing PolicyWubneh AlemuNo ratings yet

- Guideline 2: Suspicious TransactionsDocument41 pagesGuideline 2: Suspicious TransactionsGodsonNo ratings yet

- Fsa Aml SystemsDocument5 pagesFsa Aml SystemsSam 1980No ratings yet

- Writing Iap Smarten Up in Maths Age 7 8Document38 pagesWriting Iap Smarten Up in Maths Age 7 8lphoune100% (1)

- Specific Risk Factors in The Laundering of Proceeds of Corruption - Assistance To Reporting InstitutionsDocument48 pagesSpecific Risk Factors in The Laundering of Proceeds of Corruption - Assistance To Reporting InstitutionsFinancial Action Task Force (FATF)No ratings yet

- Anti Money Laundering Policy 2016-17Document30 pagesAnti Money Laundering Policy 2016-17nagallanraoNo ratings yet

- KYC/AML Policy SummaryDocument45 pagesKYC/AML Policy SummaryAkash100% (1)

- Item No. Required Informatio N Detail of The Required Information 1 Introduction To The PolicyDocument5 pagesItem No. Required Informatio N Detail of The Required Information 1 Introduction To The PolicyThuy NguyenNo ratings yet

- Wolfsberg Anti Money Laundering Questionnaire 2014Document3 pagesWolfsberg Anti Money Laundering Questionnaire 2014cheejustinNo ratings yet

- Gaming Site Regulatory Manual For Poker Games v.1 05.25.2016Document126 pagesGaming Site Regulatory Manual For Poker Games v.1 05.25.2016Telle MarieNo ratings yet

- Rba Module PracticalDocument16 pagesRba Module PracticalJosef ArnoNo ratings yet

- Guide to Internal Controls and Compliance for Securities BrokersDocument25 pagesGuide to Internal Controls and Compliance for Securities Brokerszubair_zNo ratings yet

- Bank's Know Your Customer and Anti Money Laundering PolicyDocument40 pagesBank's Know Your Customer and Anti Money Laundering PolicyAkshay RastogiNo ratings yet

- AML-CFT Policy - September 2013 PDFDocument75 pagesAML-CFT Policy - September 2013 PDFasif_azq84No ratings yet

- Home Loan - Old Application FormDocument4 pagesHome Loan - Old Application Formabhaykat0% (2)

- Real Property Evaluations GuideDocument6 pagesReal Property Evaluations GuideIchi MendozaNo ratings yet

- Standard Guidelines On AML-CFT (MALAYSIA)Document27 pagesStandard Guidelines On AML-CFT (MALAYSIA)titooluwa100% (1)

- Facts About GamblingDocument2 pagesFacts About GamblingJohn Partridge100% (1)

- Aml Intermediate For Fintech: Study GuideDocument74 pagesAml Intermediate For Fintech: Study GuideYohannleidy AlvesNo ratings yet

- Flow of Accounting Entries in Oracle AppDocument19 pagesFlow of Accounting Entries in Oracle AppSrinivas AzureNo ratings yet

- Chapter 10: Transaction C'eycle - The Expenditure Cycle True/FalseDocument13 pagesChapter 10: Transaction C'eycle - The Expenditure Cycle True/FalseHong NguyenNo ratings yet

- CREATIVE ACCOUNTING TECHNIQUES AND IMPLICATIONSDocument18 pagesCREATIVE ACCOUNTING TECHNIQUES AND IMPLICATIONSNurulain MD AnuarNo ratings yet

- The ML/TF Risk Assessment - Is It Fit For Purpose?: Aub Chapman, CAMSDocument15 pagesThe ML/TF Risk Assessment - Is It Fit For Purpose?: Aub Chapman, CAMSInga CimbalistėNo ratings yet

- Pmla PolicyDocument56 pagesPmla PolicyRaviprakash KumarNo ratings yet

- Aml/ Kyc: Policy & Procedures For Prevention of Money LaunderingDocument10 pagesAml/ Kyc: Policy & Procedures For Prevention of Money LaunderingmustafahashimNo ratings yet

- MCB AML KYC QuestionnnaireDocument3 pagesMCB AML KYC QuestionnnaireM.Ali HassanNo ratings yet

- Aml Final ReportDocument98 pagesAml Final ReportHadi Sumartono100% (1)

- FATF Report On Emerging Terrorist Financing Risks 2015 PDFDocument50 pagesFATF Report On Emerging Terrorist Financing Risks 2015 PDFKania NiaNo ratings yet

- Agribusiness Accounting Guide for Non-AccountantsDocument39 pagesAgribusiness Accounting Guide for Non-AccountantsAlexander Kim Waing100% (1)

- Prevention of Money Laundering and Combating The Financing of Terrorism Guidance For Remote and Non-Remote Casinos - July 2013Document51 pagesPrevention of Money Laundering and Combating The Financing of Terrorism Guidance For Remote and Non-Remote Casinos - July 2013cheejustin100% (1)

- Aml CFT LessonsDocument155 pagesAml CFT LessonsDanielle PerryNo ratings yet

- Anti Money Laundering ActivitiesDocument33 pagesAnti Money Laundering Activitiesshovon mukitNo ratings yet

- AMENDMENT OF GUIDANCE NOTES ON PREVENTION OF MONEY LAUNDERING AND TERRORIST FINANCINGDocument72 pagesAMENDMENT OF GUIDANCE NOTES ON PREVENTION OF MONEY LAUNDERING AND TERRORIST FINANCINGSagor ChakrabortyNo ratings yet

- AML Questionnaire UOBT2009Document3 pagesAML Questionnaire UOBT2009lphouneNo ratings yet

- Interview Question Answer For KYC AML Profile 1677153332Document13 pagesInterview Question Answer For KYC AML Profile 1677153332shivali guptaNo ratings yet

- DOP Guidelines AML KYC For MTSS and Forex13112018Document19 pagesDOP Guidelines AML KYC For MTSS and Forex13112018DEBADITYA CHAKRABORTYNo ratings yet

- Mas Aml-Cft GuidelinesDocument54 pagesMas Aml-Cft GuidelinesJ100% (1)

- Outreach Networks Case StudyDocument9 pagesOutreach Networks Case Studymothermonk100% (3)

- KYC Policy Guidelines 2014 15 For WebsiteDocument121 pagesKYC Policy Guidelines 2014 15 For WebsiteBharat PhegadeNo ratings yet

- ComplianceDocument16 pagesCompliancelphoune100% (1)

- ComplianceDocument16 pagesCompliancelphoune100% (1)

- FAQ On KYC AMLDocument4 pagesFAQ On KYC AMLlphouneNo ratings yet

- Prevent Money Laundering with Correspondent Banking ComplianceDocument6 pagesPrevent Money Laundering with Correspondent Banking CompliancePradeep YadavNo ratings yet

- AML CFT Risk Based Management GuidelineENG VersionDocument5 pagesAML CFT Risk Based Management GuidelineENG VersionfrancistsyNo ratings yet

- Money Laundering Regulation and Risk Based Decision-MakingDocument6 pagesMoney Laundering Regulation and Risk Based Decision-MakingAmeer ShafiqNo ratings yet

- Fatf PDFDocument42 pagesFatf PDFHEMANT SARVANKARNo ratings yet

- Mal Module10Document42 pagesMal Module10sjmpakNo ratings yet

- ICA International Diploma in Financial Crime Prevention Assignment 2Document25 pagesICA International Diploma in Financial Crime Prevention Assignment 2devonnaNo ratings yet

- Anti Money Laundering Guidance For The Accountancy Sector IcaewDocument116 pagesAnti Money Laundering Guidance For The Accountancy Sector IcaewcakmattNo ratings yet

- AML Policy SampleDocument83 pagesAML Policy SampleGremar CacachoNo ratings yet

- UK Anti Money LaunderingDocument12 pagesUK Anti Money LaunderingtyrwerNo ratings yet

- Financial Action Task Force: Reference GuideDocument7 pagesFinancial Action Task Force: Reference GuideAGRIMAN2009No ratings yet

- GAFI Risk BasedDocument47 pagesGAFI Risk BasedwillisamqNo ratings yet

- PD Digital Currency v.14 14.12.17Document51 pagesPD Digital Currency v.14 14.12.17Li ZhenNo ratings yet

- KYC AML LatestDocument77 pagesKYC AML Latestbandari3943100% (1)

- The Money Laundering and Terrorist Financing (Amendment) (High-Risk Countries) Regulations 2021Document4 pagesThe Money Laundering and Terrorist Financing (Amendment) (High-Risk Countries) Regulations 2021L'express Maurice100% (1)

- Anti Money LaunderingDocument8 pagesAnti Money LaunderingShanKumarNo ratings yet

- Money Laundering Methods & PreventionDocument7 pagesMoney Laundering Methods & Preventionvaishnav reddy100% (1)

- Money Laundering Prevention Guidance NotesDocument90 pagesMoney Laundering Prevention Guidance NotesLogan's LtdNo ratings yet

- Bank of Taiwan South Africa Branch KYCDocument8 pagesBank of Taiwan South Africa Branch KYCJagadeesh H JaganNo ratings yet

- Wegagen Bank, S.C.: August 2010Document40 pagesWegagen Bank, S.C.: August 2010Addis Alemayehu100% (1)

- DRAFT RED HERRING PROSPECTUS FOR COMPUTER AGE MANAGEMENT SERVICES LIMITEDDocument275 pagesDRAFT RED HERRING PROSPECTUS FOR COMPUTER AGE MANAGEMENT SERVICES LIMITEDNihal YnNo ratings yet

- ABIS 2016 Registration Form WebDocument4 pagesABIS 2016 Registration Form WeblphouneNo ratings yet

- Message From Director UNESCO Paris Ms - Irina BOKOVADocument2 pagesMessage From Director UNESCO Paris Ms - Irina BOKOVAlphouneNo ratings yet

- New AML CTF Regulations Buckle Up To Avoid RisksDocument6 pagesNew AML CTF Regulations Buckle Up To Avoid RiskslphouneNo ratings yet

- AOFFormNonIndividual ENGLISHDocument6 pagesAOFFormNonIndividual ENGLISHlphouneNo ratings yet

- 2nd Asia Pacific Conference On Advanced ResearchDocument3 pages2nd Asia Pacific Conference On Advanced ResearchlphouneNo ratings yet

- Attachment Pro FormaDocument2 pagesAttachment Pro FormalphouneNo ratings yet

- CIMB Group's AML Questionnaire and PoliciesDocument7 pagesCIMB Group's AML Questionnaire and PolicieslphouneNo ratings yet

- Raewyn - Connell PublicationsDocument7 pagesRaewyn - Connell PublicationslphouneNo ratings yet

- Un Pan 019171Document19 pagesUn Pan 019171lphouneNo ratings yet

- 2013 Jul Complinet AML ThailandDocument3 pages2013 Jul Complinet AML ThailandlphouneNo ratings yet

- BNI AML CFT Policy StatementDocument1 pageBNI AML CFT Policy StatementlphouneNo ratings yet

- Application Form For Opening Individual/ Jointaccount: Customer DetailsDocument6 pagesApplication Form For Opening Individual/ Jointaccount: Customer DetailsIdrees ShahNo ratings yet

- AccountOpeningForm enDocument4 pagesAccountOpeningForm enlphouneNo ratings yet

- AML CFT RegulationsDocument35 pagesAML CFT RegulationsMussadaq JavedNo ratings yet

- WBC Wolfs Berg QuestionnaireDocument3 pagesWBC Wolfs Berg QuestionnairelphouneNo ratings yet

- AmosWEB Is Economics - Encyclonomic WEB - PediaDocument4 pagesAmosWEB Is Economics - Encyclonomic WEB - PedialphouneNo ratings yet

- Business DatasetsDocument4 pagesBusiness DatasetslphouneNo ratings yet

- TranslationsDocument3 pagesTranslationslphouneNo ratings yet

- Practical Missing Data Analysis in SPSSDocument19 pagesPractical Missing Data Analysis in SPSSlphouneNo ratings yet

- Lao Insurance Industry 25aug2010Document86 pagesLao Insurance Industry 25aug2010lphouneNo ratings yet

- Introduction - Grade 3 Mathematics: Released Test QuestionsDocument32 pagesIntroduction - Grade 3 Mathematics: Released Test QuestionslphouneNo ratings yet

- MinutesDocument5 pagesMinutesDaniel JonesNo ratings yet

- Conso IFRS BCEL Audit31Dec2010 Final 27 July 2011 FormattedDocument48 pagesConso IFRS BCEL Audit31Dec2010 Final 27 July 2011 FormattedlphouneNo ratings yet

- 2005 Law On EnterprisesDocument91 pages2005 Law On EnterpriseslphouneNo ratings yet

- Times Tables 1Document80 pagesTimes Tables 1lphouneNo ratings yet

- Court Paperwork Regarding Detailing Foreclosure of Ramada PlazaDocument25 pagesCourt Paperwork Regarding Detailing Foreclosure of Ramada PlazaNews10NBCNo ratings yet

- CBSE Class 11 Accountancy Revision Notes Chapter-2 Theory Base of AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-2 Theory Base of AccountingAyush PatelNo ratings yet

- Chapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessDocument51 pagesChapter Two & Three: Priciples & Basis of Accounting For NFP Entities and Accounting & Budgeting ProcessabateNo ratings yet

- ACC421 Chapter 18 Questions and AnswersDocument11 pagesACC421 Chapter 18 Questions and AnswersNhel AlvaroNo ratings yet

- CHE374 - Course Outline - 2012F PDFDocument3 pagesCHE374 - Course Outline - 2012F PDFHaiderNo ratings yet

- Accounting Notes On LedgersDocument3 pagesAccounting Notes On LedgersAlisha shenazNo ratings yet

- Apple Inc. 2021 Financial ResultsDocument2 pagesApple Inc. 2021 Financial ResultsJodie NguyễnNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- BBFA2303 Sample Exam QuestionDocument11 pagesBBFA2303 Sample Exam QuestionAnnieNo ratings yet

- AU Small Finance Bank 23-Mar-2023Document6 pagesAU Small Finance Bank 23-Mar-2023vaibhav vidwansNo ratings yet

- Working Capital Managmnet - Pune University - MBA Project Report - Set2Document48 pagesWorking Capital Managmnet - Pune University - MBA Project Report - Set2amol.naleNo ratings yet

- Paper 1.4Document137 pagesPaper 1.4vijaykumartaxNo ratings yet

- Intrim Report - Avinash Kumar SinghDocument26 pagesIntrim Report - Avinash Kumar SinghArjun KhareNo ratings yet

- Assignment 2Document2 pagesAssignment 2Eindra Nwe100% (1)

- Sudhanshu IB AssignmentDocument10 pagesSudhanshu IB AssignmentDevanand PandeyNo ratings yet

- BCTC Case 2Document10 pagesBCTC Case 2Trâm Nguyễn QuỳnhNo ratings yet

- Consolidation Worksheet for Less-than-Wholly Owned SubsidiaryDocument3 pagesConsolidation Worksheet for Less-than-Wholly Owned SubsidiaryDian Nur IlmiNo ratings yet

- Gold Pecker Official Setup GuideDocument4 pagesGold Pecker Official Setup GuideRei MaNo ratings yet

- Insurance Sector in CambodiaDocument8 pagesInsurance Sector in CambodiaJake C. SengNo ratings yet

- Math 6 DLP 52 - Solving Word Problems Involving Simple InterestDocument10 pagesMath 6 DLP 52 - Solving Word Problems Involving Simple Interestmarlon manantanNo ratings yet

- Understanding Yield Curves and How They Impact InvestingDocument8 pagesUnderstanding Yield Curves and How They Impact InvestingThúy LêNo ratings yet

- Gsis LawDocument17 pagesGsis LawJohn Ree Esquivel DoctorNo ratings yet