Professional Documents

Culture Documents

Management Services Circular No: 47

Uploaded by

Anonymous dHyxmDOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management Services Circular No: 47

Uploaded by

Anonymous dHyxmDCopyright:

Available Formats

Management Services Circular No: 47

My No: DMSlAl20 1 1

Department of Management Services

General Treasury

Colombo 01.

22.12.20 1 1

To:

All Secretaries to Ministries1

Chairmen of Government Corporations and Fully Owned Government Companies

Payment of Bonus to Employees of Government Corporations and Fully

Owned Government Companies for the Year 2011

Payment of bonus to the employees of government corporations and fully owned

government companies for the year 201 1 should be incurred as per the following

provisions.

I. The annual bonus payable to employees of government corporations and fully owned

government companies which have earned profits within the relevant finance year but do

not pay other incentives is Rs. 10,0001=

2. If incentives based on attendance and performance or incentives of any other form are

paid, the annual bonus payable to the employees of such profitable government

corporations and fully owned government companies is Rs. 7500/=

3. Only a bonus of Rs.1,000/= is allowed to be paid to the employees of loss making

government corporations and fully owned government companies. However permission

is granted to pay Rs.20001- instead of Rs.10001- to the employees of institutions which

have reduced the loss compared to the last year even though they are currently operating

at loss. The said permission is granted only if the institution possesses adequate amount

of funds to incur the payments for the existing accounting year (201 1).

4. When a mid term allowance which can be considered as a bonus has been paid by a

certain institution to its employees, it has to be considered as an advance of the annual

bonus paid at the end of the year, unless it is given the special approval of the Cabinet to

be considered as an additional bonus allowance.

5. The approval of the Board of Directors or the Board of Management should be

obtained before the payment of annual bonus based on this circular.

6. In order to pay the bonus as mentioned above, the annual accounts of the relevant

government corporation and filly owned government companies have to be submitted to

the Auditor General on or before the due date as per the Public Finance Circular No :

PFlPEl21 dated 24.05.2002 and the instructions and guidelines related to good

governance of public enterprises issued by the Treasury have to be adhered.

7. Funds for the payment of bonus are not provided by the Treasury.

8. If a certain bonus is paid extraneous to the provisions of this circular, the prior

approval of the Cabinet of Ministers should be obtained.

9. If any further clarification is needed regarding the Circular, you are kindly informed to

contact Mr. A.K.N. Wickramasinghe, Director, Department of Management Services

(Telephone No. 0 11-24847581071-4429833) and Mr. K.S.M. Silva, Assistant Director,

Department of Public Enterprises (Telephone No. 0 1 1-24846271 071-4480690)

Signed1 P.A.Abeysekara

Deputy Secretary to the Treasury

Copies:

1. Secretary to the President

2. Secretary to the Prime Minister

3. Auditor General

4. Director General of Public Enterprises

You might also like

- Secured Credit WestbrookDocument13 pagesSecured Credit WestbrookBill Coleman100% (1)

- Final Formula Sheet DraftDocument5 pagesFinal Formula Sheet Draftsxzhou23No ratings yet

- Employee Bonus PlanDocument2 pagesEmployee Bonus PlanRocketLawyer100% (3)

- Understanding Master FeederDocument9 pagesUnderstanding Master FeedervinayvasyaniNo ratings yet

- Types of SecuritiesDocument8 pagesTypes of SecuritiesA U R U M MDNo ratings yet

- PF & Miscellaneous Provisions ActDocument19 pagesPF & Miscellaneous Provisions Actpriya_ammuNo ratings yet

- Cruel Schoool TeachersDocument15 pagesCruel Schoool TeachersAnonymous dHyxmDNo ratings yet

- BHEL Perks ManualDocument135 pagesBHEL Perks Manualpawann1997No ratings yet

- The Cruel SideDocument6 pagesThe Cruel SideAnonymous dHyxmDNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Provident FundDocument18 pagesProvident FundRashmi Ranjan Panigrahi100% (1)

- Case Study of Philips MorrisDocument13 pagesCase Study of Philips MorrisHaris BilalNo ratings yet

- Granting, Utilization and Liquidation of Cash AdvancesDocument8 pagesGranting, Utilization and Liquidation of Cash Advancesduskwitch100% (1)

- Cashflow Waterfall TutorialDocument2 pagesCashflow Waterfall TutorialRichard Neo67% (3)

- Portfolio Optimization Techniques in Mutual Funds - Trends and IssuesDocument66 pagesPortfolio Optimization Techniques in Mutual Funds - Trends and Issuesjitendra jaushik83% (6)

- Money and BankingDocument5 pagesMoney and BankingNiculaie RobertNo ratings yet

- Educ 207 - FINANCIAL ASPECTS IN EDUCATIONAL PLANNING v2Document7 pagesEduc 207 - FINANCIAL ASPECTS IN EDUCATIONAL PLANNING v2DARLING REMOLAR100% (1)

- c914 - 2016 Updates On DOSRI Rule PDFDocument19 pagesc914 - 2016 Updates On DOSRI Rule PDFJoey SulteNo ratings yet

- Creating A Capability-Led IT OrganizationDocument14 pagesCreating A Capability-Led IT OrganizationCognizantNo ratings yet

- Management Services Circular No. 46Document2 pagesManagement Services Circular No. 46Anushka AbeysingheNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- NIB d2011 PDFDocument190 pagesNIB d2011 PDFMahmood KhanNo ratings yet

- Dividend A Brief NoteDocument7 pagesDividend A Brief NoteaakashagarwalNo ratings yet

- Companies Act Section 197 & 198Document5 pagesCompanies Act Section 197 & 198Moumita GoswamiNo ratings yet

- Government of Orissa Department of Public Enterprises ResolutionDocument6 pagesGovernment of Orissa Department of Public Enterprises ResolutionJeetendra BeheraNo ratings yet

- Cabatuan Executive Summary 2012Document7 pagesCabatuan Executive Summary 2012Steve RodriguezNo ratings yet

- Amendment & Additions in Unified Directives, 2077: Flash AlertDocument3 pagesAmendment & Additions in Unified Directives, 2077: Flash AlertAnup KhanalNo ratings yet

- MSD 2012 48 enDocument2 pagesMSD 2012 48 enAnushka AbeysingheNo ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

- Managerial Remuneration SummaryDocument8 pagesManagerial Remuneration Summaryknowledge124No ratings yet

- Managerial RemunerationDocument18 pagesManagerial RemunerationIshita GoyalNo ratings yet

- DUSD Superintendent Chris Funk ContractDocument20 pagesDUSD Superintendent Chris Funk ContractCourtney TeagueNo ratings yet

- LGF Services Limited: 7th ANNUAL REPORT 2010-11Document22 pagesLGF Services Limited: 7th ANNUAL REPORT 2010-11Avinash SubramanyamNo ratings yet

- Employee Provident Fund (Epf)Document8 pagesEmployee Provident Fund (Epf)Astha AhujaNo ratings yet

- Managerial Remuneration Checklist FinalDocument4 pagesManagerial Remuneration Checklist FinaldhuvadpratikNo ratings yet

- Budget 2018Document5 pagesBudget 2018Srushti BhattNo ratings yet

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Direct Taxes Code 2010Document14 pagesDirect Taxes Code 2010musti_shahNo ratings yet

- Study Material - Remuneration - AM-X-CL-IIDocument11 pagesStudy Material - Remuneration - AM-X-CL-IISachetNo ratings yet

- ASC Group - Budget 2021 HighlightsDocument32 pagesASC Group - Budget 2021 Highlightssaurav royNo ratings yet

- Satish Jadav 101777 26504-1Document20 pagesSatish Jadav 101777 26504-1Rakhi JadavNo ratings yet

- Preparation of Balance Sheet and Profit and Loss Account: TotalDocument7 pagesPreparation of Balance Sheet and Profit and Loss Account: TotalAnil ChauhanNo ratings yet

- Payment of Bonus Act, 1965 – A Student Approach - Taxguru - inDocument19 pagesPayment of Bonus Act, 1965 – A Student Approach - Taxguru - inVenkat RamanNo ratings yet

- The Financial Kaleidoscope - July 19 PDFDocument8 pagesThe Financial Kaleidoscope - July 19 PDFhemanth1128No ratings yet

- Budget PLUS 2011Document108 pagesBudget PLUS 2011Meenu Mittal SinghalNo ratings yet

- Finance Depatment Notifications-2002 (55-164)Document96 pagesFinance Depatment Notifications-2002 (55-164)Humayoun Ahmad Farooqi100% (1)

- F 2848Document36 pagesF 2848Vineet AgrawalNo ratings yet

- Latest NRB CircularsDocument20 pagesLatest NRB CircularsNista ShresthaNo ratings yet

- CIMB Islamic Bank Berhad: Company No: 200401032872 (671380-H)Document276 pagesCIMB Islamic Bank Berhad: Company No: 200401032872 (671380-H)Anis AshsiffaNo ratings yet

- Performance Rewards Circular 2022Document6 pagesPerformance Rewards Circular 2022Syed Qalb-e-Raza NaqviNo ratings yet

- Provident Fund - SynopsisDocument9 pagesProvident Fund - SynopsisSIDDHANT MOHAPATRANo ratings yet

- Personnnel ManualDocument134 pagesPersonnnel Manualsanjay1435No ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- Budget 2021Document9 pagesBudget 2021VRINDA GUPTANo ratings yet

- PF ActDocument6 pagesPF ActmeenudhallNo ratings yet

- Amendment Applicable FOR Nov 2017 Examination There Is No Significant Amendment For Nov 2017 Exam Except As Given BelowDocument5 pagesAmendment Applicable FOR Nov 2017 Examination There Is No Significant Amendment For Nov 2017 Exam Except As Given BelowShubham JainNo ratings yet

- Clean OverdraftDocument8 pagesClean OverdraftfatincheguNo ratings yet

- ADMINISTRATIVE ORDER NO 263 Anniversary BonusDocument3 pagesADMINISTRATIVE ORDER NO 263 Anniversary BonusBee BlancNo ratings yet

- Wasim AkramDocument10 pagesWasim AkramtalhasadiqNo ratings yet

- GO (P) No 535-2011-Fin Dated 14-11-2011Document9 pagesGO (P) No 535-2011-Fin Dated 14-11-2011doctor82No ratings yet

- By CA Amit BansalDocument22 pagesBy CA Amit BansalSindhuja BhaskaraNo ratings yet

- Allowances, Fee & Honourarium, Cea and Advances AllowancesDocument11 pagesAllowances, Fee & Honourarium, Cea and Advances Allowancesronny38000No ratings yet

- ACBP6222 - LU 10 - Companies ActDocument32 pagesACBP6222 - LU 10 - Companies Actnishania pillayNo ratings yet

- Features of ESI ActDocument2 pagesFeatures of ESI ActAnoop Singh100% (1)

- IT Assignment 2Document7 pagesIT Assignment 2Srinivasulu Reddy PNo ratings yet

- Companies: B1 Self Assessment ForDocument10 pagesCompanies: B1 Self Assessment ForKen ChiaNo ratings yet

- FINANCE (Allowances) DEPARTMENT G.O.Ms - No.151, Dated 20 May 2019Document3 pagesFINANCE (Allowances) DEPARTMENT G.O.Ms - No.151, Dated 20 May 2019Ram RajNo ratings yet

- Declaration and Distribution of Dividends by A Company Under Indian LawDocument8 pagesDeclaration and Distribution of Dividends by A Company Under Indian LawHarimohan NamdevNo ratings yet

- 08-Looc2012 Part2-Findings and RecommendationsDocument10 pages08-Looc2012 Part2-Findings and RecommendationsMiss_AccountantNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- The Sixth StoryDocument3 pagesThe Sixth StoryAnonymous dHyxmDNo ratings yet

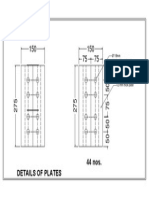

- A (Start) B (End) and C (Start) D (End) That Supports A Beam B (Start) D (End)Document1 pageA (Start) B (End) and C (Start) D (End) That Supports A Beam B (Start) D (End)Anonymous dHyxmDNo ratings yet

- Hospital Model - PDF OCT 01 02Document1 pageHospital Model - PDF OCT 01 02Anonymous dHyxmDNo ratings yet

- Five 'PS' For A Life of Grace Dignity: While You Focus On Staying at The Wicket, Remember The Following FIVE 'PS'Document6 pagesFive 'PS' For A Life of Grace Dignity: While You Focus On Staying at The Wicket, Remember The Following FIVE 'PS'Anonymous dHyxmDNo ratings yet

- A Criticism of Self Compacting ConcreteDocument7 pagesA Criticism of Self Compacting ConcreteAnonymous dHyxmDNo ratings yet

- Management Services Circular No: 49: To: All Secretaries To Ministries1Document2 pagesManagement Services Circular No: 49: To: All Secretaries To Ministries1Anonymous dHyxmDNo ratings yet

- Appliance - Watts Appliance - Watts Appliance - WattsDocument1 pageAppliance - Watts Appliance - Watts Appliance - WattsAnonymous dHyxmDNo ratings yet

- Buddha'S Lesson On WastingDocument2 pagesBuddha'S Lesson On WastingAnonymous dHyxmDNo ratings yet

- 17 Equations That Changed The WorldDocument2 pages17 Equations That Changed The WorldAnonymous dHyxmDNo ratings yet

- Mining Engineering: About ERE (Earth Resources Engineering)Document1 pageMining Engineering: About ERE (Earth Resources Engineering)Anonymous dHyxmDNo ratings yet

- "The Moon" Is The Correct AnswerDocument1 page"The Moon" Is The Correct AnswerAnonymous dHyxmDNo ratings yet

- FACTORY - DWG Rivision 1-ModelDocument1 pageFACTORY - DWG Rivision 1-ModelAnonymous dHyxmDNo ratings yet

- To: Date: Attention:: Your Valuable Comments in This Regards Would Be Highly AppreciatedDocument1 pageTo: Date: Attention:: Your Valuable Comments in This Regards Would Be Highly AppreciatedAnonymous dHyxmDNo ratings yet

- Instability at Joints ErrorDocument12 pagesInstability at Joints ErrorAnonymous dHyxmDNo ratings yet

- Hutch-Vodafone Merger & AcquisitionDocument15 pagesHutch-Vodafone Merger & AcquisitionRahul Atodaria100% (1)

- Feasibility Study OutlineDocument1 pageFeasibility Study OutlineGabrielle AlonzoNo ratings yet

- A Study On Investors Perception Towards Sharemarket in Sharekhan LTDDocument9 pagesA Study On Investors Perception Towards Sharemarket in Sharekhan LTDEditor IJTSRDNo ratings yet

- Panama Papers - Chetan Kapur and Kabir Kapur 3Document1,003 pagesPanama Papers - Chetan Kapur and Kabir Kapur 3The Indian ExpressNo ratings yet

- NJ MarsDocument42 pagesNJ MarsajaybsinghNo ratings yet

- TVLC Voluntary Petition Chapter 11 2016-11-08Document271 pagesTVLC Voluntary Petition Chapter 11 2016-11-08LivermoreParentsNo ratings yet

- JPM Weekly MKT Recap 9-10-12Document2 pagesJPM Weekly MKT Recap 9-10-12Flat Fee PortfoliosNo ratings yet

- RAB BondsDocument708 pagesRAB BondsAnonymous 52qjOHavDNo ratings yet

- Feasibility StudyDocument3 pagesFeasibility StudyShielle Azon100% (1)

- Chapter 8 - Stock MarketsDocument3 pagesChapter 8 - Stock MarketsKaiNo ratings yet

- Apar IndustriesDocument16 pagesApar Industriesh_o_mNo ratings yet

- PDFDocument7 pagesPDFKhansa AttaNo ratings yet

- Regional Trading BlocsDocument51 pagesRegional Trading BlocsNirlipta SwainNo ratings yet

- Accounting in Business: Lecture 1 & 2Document42 pagesAccounting in Business: Lecture 1 & 2Noraishah IsmailNo ratings yet

- Two Days Specialized Training Workshop On Islamic Banking & Finance in CanadaDocument7 pagesTwo Days Specialized Training Workshop On Islamic Banking & Finance in CanadaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- Slaus 550 2012Document12 pagesSlaus 550 2012samaanNo ratings yet

- Board Question Paper: March 2018: (3) The Capital Balances Are Ascertained by PreparingDocument5 pagesBoard Question Paper: March 2018: (3) The Capital Balances Are Ascertained by PreparingNeha BhanushaliNo ratings yet

- New Economic Policy of 1991Document20 pagesNew Economic Policy of 1991Chetan PanaraNo ratings yet

- SPDR ETF QuicksheetDocument2 pagesSPDR ETF QuicksheetmeuoftroNo ratings yet

- Final Report EntrepreneurshipDocument23 pagesFinal Report EntrepreneurshiphelperforeuNo ratings yet