Professional Documents

Culture Documents

Karnataka Value Added Tax Rules, 2005 Government of Karnataka (Department of Commercial Taxes)

Uploaded by

narayan0 ratings0% found this document useful (0 votes)

16 views3 pagesAn Accountant competent to appear before any authority under clause (c) of section 86 shall be a person possessing the qualification of an auditor of a Company in the State of Karnataka. An application in Form VAT 545 along with a treasury receipt in support of having paid an enrolment fee of one thousand rupees, may be made to the Commissioner of Commercial Taxes.

Original Description:

Original Title

55_howtobecomestp.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn Accountant competent to appear before any authority under clause (c) of section 86 shall be a person possessing the qualification of an auditor of a Company in the State of Karnataka. An application in Form VAT 545 along with a treasury receipt in support of having paid an enrolment fee of one thousand rupees, may be made to the Commissioner of Commercial Taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views3 pagesKarnataka Value Added Tax Rules, 2005 Government of Karnataka (Department of Commercial Taxes)

Uploaded by

narayanAn Accountant competent to appear before any authority under clause (c) of section 86 shall be a person possessing the qualification of an auditor of a Company in the State of Karnataka. An application in Form VAT 545 along with a treasury receipt in support of having paid an enrolment fee of one thousand rupees, may be made to the Commissioner of Commercial Taxes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

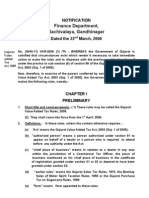

Karnataka Value Added Tax Rules, 2005

GOVERNMENT OF KARNATAKA (DEPARTMENT OF COMMERCIAL

TAXES)

No. FD 54 CSL 2005

Karnataka Government

Secretariat,Vidhana Soudha,

Bangalore, Dated: 31.03.2005

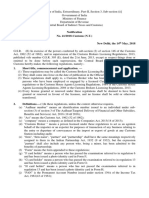

168. Provisions relating to an Accountant or Tax Practitioner: (1) An Accountant

competent to appear before any authority under clause (c) of section 86 shall be a person

possessing the qualification of an auditor of a Company in the State of Karnataka referred

to in section 226 of the Companies Act, 1956 (Central Act 1 of 1956).

(2) An application in Form VAT 545 along with a treasury receipt in support of having

paid an enrolment fee of one thousand rupees, may be made to the Commissioner of

Commercial Taxes for enrolment as Tax Practitioner by any person who satisfies any of

the conditions specified below, namely:

(a) that, before the commencement of this Act, he had appeared before any

authority under the Karnataka Sales Tax Act, 1957, (Karnataka Act. 25 of 1957)

for not less than two years on behalf of any dealer, otherwise than in the capacity

of an employee or relative of such dealer, in proceedings under the said Act; or

(b) that he is a retired officer of the Commercial Tax Department of the

Government of Karnataka or any other State Government who, during his service

under the Government, had worked in a post not lower in rank than that of a VAT

sub-officer for a period of not less than two years; or

(c) that he has passed.(i) a degree examination in Commerce, Law, Banking including Higher Auditing,

Corporate Secretaryship or Business Administration or Business Management of

any Indian University established by any law for the time being in force; or

(ii) a degree examination of any Foreign University recognized by any Indian

University as equivalent of the degree examination mentioned in clause (i); or

(iii) any other examination notified by Government for this purpose; or

(iv) any degree examination of an Indian University or of any Foreign University

recognized by any Indian University as equivalent of the degree examination and

has also passed any of the following examinations, namely.(a) final examination of the Institute of Cost and Works Accountants of India,

constituted under the Cost and Works Accountants Act, 1959 (Central Act

XXIII of 1959); or

(b) final examination of the Institute of Company Secretaries of India, New

Delhi; or

(c) final examination of the Institute of Chartered Accountants of India,

constituted under the Chartered Accountants Act, 1949 (38 of 1949); or

(d) any other examination notified by the Government for this purpose.

(3) On receipt of the application referred to in sub-rule (2), the Commissioner shall, after

making such enquiry as he considers necessary, enroll the applicant as a Tax Practitioner.

(4) Where the applicant is a retired officer of the Commercial Tax Department, the

Commissioner may place such restrictions as he thinks fit, regarding the areas in which

such applicant may practice as a Tax Practitioner till the expiry of a period of five years

from the date of his retirement.

(5) The enrolment made under sub-rule (3) shall be valid until it is cancelled.

(6) If any Tax Practitioner is found guilty of misconduct in connection with any

proceeding under the Act, the Commissioner may, by order, direct that he shall

henceforward be disqualified from the profession under section 86, after giving him the

opportunity of showing cause in writing against such disqualification.

(7) Any person whose application for enrolment made under sub-rule (2) has been

rejected and any Tax Practitioner against whom an order under sub-rule (6) is made, may,

within thirty days from the date of receipt of the order of rejection or the order under subrule (6), appeal to the State Government against such order.

(8) The Commissioner shall maintain the list of Tax Practitioners enrolled under sub-rule

(2) in Form VAT 550 and make such amendments to the list as may be necessary from

time to time, by reason of any change of address or death or disqualification of any

practitioner.

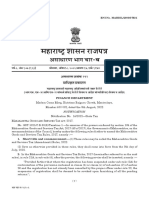

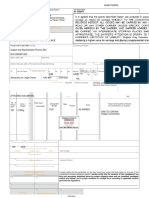

FORM VAT 545

[See rule 168]

Application for enrolment as a Tax Practitioner

To,

The Commissioner of Commercial Taxes in Karnataka, Bangalore.

I, (*a partner of the firm known as ) (address) ..

hereby apply for enrolment of my name in the list of Tax Practitioners under sub-rule

(8) of Rule 168 of the Karnataka Sales Tax Rules, 2005.

I declare that I am qualified to attend before any Authority under Section 86 of the

Karnataka Value Added Tax Act, 2003, in accordance with sub-rule (2) of Rule 168 of

the said Rules, in that*(a) I have appeared before ...(name and designation of Sales Tax Authority) on

behalf of . in the .. proceedings under Section of the Karnataka

Sales Tax Act, 1957 for not less than two years, otherwise than in the capacity of an

employee or relative of the said dealer for which I attach herewith a true copy of the

certificate granted by ..

*(b) I am a retired officer of the Commercial Tax Department of the Government of

State and while in service I had worked as . which is a post not lower

in rank than that of a VAT Subofficer for a period of not less than two years.

*(c) I have acquired the necessary educational qualification namely .. of . in

the examination held at . in the month of .. the year .. which is one of

the qualification specified in subrule (2) of rule 168.

*(d) I have passed the necessary final examination, viz . held at in the

month of . The year . specified in sub-rule (2) of Rule 168.

The above statements are true to the best of my knowledge and belief.

Place:

Date :

Signature .

*Strike out whichever is not applicable.

ACKNOWLEDGMENT

Received an application in Form from for enrolment under Rule

168(2) of the Karnataka Value Added Tax Rules, 2005.

Place:

Date : .

Serial No

Receiving Officer.

You might also like

- ITP Application & RulesDocument8 pagesITP Application & RulesShahaan Zulfiqar100% (2)

- Crew Deal MemoDocument2 pagesCrew Deal MemoEz A FilmmakerNo ratings yet

- Chapter 2 - Accounting For Partnership Formation2 (NO ILLUS)Document65 pagesChapter 2 - Accounting For Partnership Formation2 (NO ILLUS)PatOcampo50% (2)

- Sales Tax Rule BookDocument126 pagesSales Tax Rule BookAbhijeet SinghNo ratings yet

- Finance Department, Sachivalaya, Gandhinagar: NotificationDocument59 pagesFinance Department, Sachivalaya, Gandhinagar: NotificationNaren VmdNo ratings yet

- KGST RulesDocument107 pagesKGST RulesrajanraorajanNo ratings yet

- VAT Complete Rules 05.02.10Document116 pagesVAT Complete Rules 05.02.10CA Ashish BochiaNo ratings yet

- Chartered Accountant1949 Act.Document67 pagesChartered Accountant1949 Act.AJAY GOYALNo ratings yet

- Bihar Value Added Tax Rules, 2005Document43 pagesBihar Value Added Tax Rules, 2005Saorabh KumarNo ratings yet

- Statement of Object and Reasons: The Payment of Bonus Act, 1965Document32 pagesStatement of Object and Reasons: The Payment of Bonus Act, 1965Japneet SinghNo ratings yet

- Madhya Pradesh Professional Tax Act, 1995Document40 pagesMadhya Pradesh Professional Tax Act, 1995sumitkejriwalNo ratings yet

- Jharkhand VAT Rules 2006Document53 pagesJharkhand VAT Rules 2006Krushna MishraNo ratings yet

- Central Sales Tax - Tamil Nadu - Rules 1957Document13 pagesCentral Sales Tax - Tamil Nadu - Rules 1957omselvaNo ratings yet

- 51 CI Entry RulesDocument17 pages51 CI Entry RulesreddyNo ratings yet

- Registration Under GSTDocument8 pagesRegistration Under GSTMahesh PawarNo ratings yet

- Notification No. 41/2018-Customs (N.T.)Document22 pagesNotification No. 41/2018-Customs (N.T.)ManikantaReddyNo ratings yet

- PT RuleDocument16 pagesPT RuleNiladri SenNo ratings yet

- Business Laws Vol 1Document27 pagesBusiness Laws Vol 1Sriram_VNo ratings yet

- VATRule 6232016111129 AMDocument99 pagesVATRule 6232016111129 AMCA Nsu IndiaNo ratings yet

- Pay Bonus ActDocument30 pagesPay Bonus ActAaju KausikNo ratings yet

- Customs Brokers Licensing Regulations, 2018Document24 pagesCustoms Brokers Licensing Regulations, 2018sitapodilaNo ratings yet

- Customs Brokers Licensing Regulations English 2019Document22 pagesCustoms Brokers Licensing Regulations English 2019abhishek ghagNo ratings yet

- 65 Luxurty Tax Rule 2009Document10 pages65 Luxurty Tax Rule 2009shanuNo ratings yet

- Himachal Pradesh Central Sales Tax Rules, 1970: Simla-2, The 3 March, 1970Document33 pagesHimachal Pradesh Central Sales Tax Rules, 1970: Simla-2, The 3 March, 1970kesar tubes indiaNo ratings yet

- Bonus ActDocument16 pagesBonus Actpranavv1100% (1)

- CST - RULES PondicherryDocument26 pagesCST - RULES PondicherrySR CapitalsNo ratings yet

- Tnvat Rules 2007Document22 pagesTnvat Rules 2007omselvaNo ratings yet

- Notification 14Document11 pagesNotification 14Amol MoreNo ratings yet

- Judgment MUHAMMAD MUNIR PERACHA, J. - The Petitioners Were Served With Show-Cause NoticeDocument6 pagesJudgment MUHAMMAD MUNIR PERACHA, J. - The Petitioners Were Served With Show-Cause NoticeMohammad AhmadNo ratings yet

- WBST - SOD - Act - 1999 - Incorporating The Changes Made in WB Taxation (Amendment) BILL, 2018 Dated 27.11.2018Document7 pagesWBST - SOD - Act - 1999 - Incorporating The Changes Made in WB Taxation (Amendment) BILL, 2018 Dated 27.11.2018Himangsu SekharNo ratings yet

- Telangana liquor license rule changesDocument4 pagesTelangana liquor license rule changesManishwar ReddyNo ratings yet

- The Payment of Bonus Act 1965Document38 pagesThe Payment of Bonus Act 1965Barnik GoswamiNo ratings yet

- TNVAT Act 2016Document27 pagesTNVAT Act 2016Manjunath SubramaniamNo ratings yet

- 209A. (1) (I) (Ii)Document29 pages209A. (1) (I) (Ii)Manoj NamdevNo ratings yet

- Inter State Migrant Workmen Regulation of Employment and ConditionsDocument28 pagesInter State Migrant Workmen Regulation of Employment and ConditionsNishchay DhanaikNo ratings yet

- Companies Branch Audit Exemption RulesDocument6 pagesCompanies Branch Audit Exemption RulesPankaj KhindriaNo ratings yet

- Bihar Electricity Duty Rules 1949Document18 pagesBihar Electricity Duty Rules 1949Suyash PrakashNo ratings yet

- Audit RPT Nov 19Document44 pagesAudit RPT Nov 19himanshurjrNo ratings yet

- GST Assignment PDFDocument15 pagesGST Assignment PDFAzharNo ratings yet

- CBEC issues notification on Aadhaar authenticationDocument4 pagesCBEC issues notification on Aadhaar authenticationSIR GNo ratings yet

- Cost Audit ReportDocument39 pagesCost Audit ReportOlatunji AdewaleNo ratings yet

- Sub-Clause (Iii), (Iv), (V) and (Vi) of Clause (B) of Sub-Section (1) of Section 114Document4 pagesSub-Clause (Iii), (Iv), (V) and (Vi) of Clause (B) of Sub-Section (1) of Section 114Umair IftikharNo ratings yet

- Refund & Refund AuditDocument80 pagesRefund & Refund AuditSujeet KothawaleNo ratings yet

- Lottery TaxActsDocument61 pagesLottery TaxActsRAMU84IPSNo ratings yet

- TN Shops Establishments Act AmendmentDocument3 pagesTN Shops Establishments Act Amendmentakshay kharteNo ratings yet

- The Companies (Profits) Surtax Act, 1964Document16 pagesThe Companies (Profits) Surtax Act, 1964Mrigendra MishraNo ratings yet

- Akta PerniagaanDocument26 pagesAkta PerniagaanKai GustavNo ratings yet

- Cost and Management Accountants Act, 1966 & Cost and Management Accountants Regulations, 1990Document114 pagesCost and Management Accountants Act, 1966 & Cost and Management Accountants Regulations, 1990Asad IshaqNo ratings yet

- Karnataka Shops and Commercial Establishments Act, 1961. ObjectivesDocument11 pagesKarnataka Shops and Commercial Establishments Act, 1961. ObjectivesMITALI JADHAVNo ratings yet

- Taxation: 4. Other Percentage TaxDocument6 pagesTaxation: 4. Other Percentage TaxMarkuNo ratings yet

- Whether This Notice Can Be Considered As Legally Valid?Document9 pagesWhether This Notice Can Be Considered As Legally Valid?Sambasivam GanesanNo ratings yet

- The Payment of Bonus Act, 1965Document31 pagesThe Payment of Bonus Act, 1965Tewari UtkarshNo ratings yet

- Article On Assessment and AuditDocument33 pagesArticle On Assessment and Auditmks895525No ratings yet

- Rtpfinalnew Nov20 p3Document30 pagesRtpfinalnew Nov20 p3cdNo ratings yet

- The Companies Act, 1956: 211. Form and Contents of Balance-Sheet and Profit and Loss Account.Document10 pagesThe Companies Act, 1956: 211. Form and Contents of Balance-Sheet and Profit and Loss Account.Paul ArijitNo ratings yet

- audit reportDocument15 pagesaudit reportPapunNo ratings yet

- Datewise Vat 2007 033Document6 pagesDatewise Vat 2007 033rajeshutkurNo ratings yet

- Andhra RulesDocument110 pagesAndhra RulesDeepak RajpurohitNo ratings yet

- Ammendments 6D May 23Document31 pagesAmmendments 6D May 23fnNo ratings yet

- The Patents Rules 2003Document116 pagesThe Patents Rules 2003Anil SharmaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Burden of Proof ConceptDocument2 pagesBurden of Proof ConceptnikhilNo ratings yet

- Zicta Annual Report 2019 PDFDocument172 pagesZicta Annual Report 2019 PDFCurter Lance LusansoNo ratings yet

- DL Services Acknowledgement RohitDocument1 pageDL Services Acknowledgement RohitHoney SinghNo ratings yet

- FABM2 - Q1 - v1 Page 133 139Document7 pagesFABM2 - Q1 - v1 Page 133 139Kate thilyNo ratings yet

- Forms TPT 5000a 10316 0Document1 pageForms TPT 5000a 10316 0timclbNo ratings yet

- Consent Letter Karnataka1Document2 pagesConsent Letter Karnataka1sayeed66No ratings yet

- Regional Trial Court: CIVIL CASE No. 123456Document8 pagesRegional Trial Court: CIVIL CASE No. 123456Martel John MiloNo ratings yet

- PR HawcoplastDocument2 pagesPR HawcoplastRohan JoshiNo ratings yet

- Indian Stock Market MechanismDocument2 pagesIndian Stock Market Mechanismneo0157No ratings yet

- Idioms On CromeDocument2 pagesIdioms On CromeCida FeitosaNo ratings yet

- Ugrd-Ncm6308 Bioethics Prelim To Final QuizDocument39 pagesUgrd-Ncm6308 Bioethics Prelim To Final QuizMarckyJmzer033 OgabangNo ratings yet

- Election Offenses Omnibus Election CodeDocument12 pagesElection Offenses Omnibus Election CodeRaziele RanesesNo ratings yet

- FAST TEK GROUP, LLC v. PLASTECH ENGINEERED PRODUCTS, INC. - Document No. 10Document2 pagesFAST TEK GROUP, LLC v. PLASTECH ENGINEERED PRODUCTS, INC. - Document No. 10Justia.comNo ratings yet

- Dear Sir Request For Project Financing Amounting Rs. - FUNDED FACILITY RS. - & NON FUNDED FACITIY Rs.Document2 pagesDear Sir Request For Project Financing Amounting Rs. - FUNDED FACILITY RS. - & NON FUNDED FACITIY Rs.adnanNo ratings yet

- Awb Mjae21030099 Final 24.04Document2 pagesAwb Mjae21030099 Final 24.04Joe Venca PomaNo ratings yet

- Tanito GroupDocument4 pagesTanito GroupJony YuwonoNo ratings yet

- Earn 5 Unlocks For Every 10 Resources You UploadDocument1 pageEarn 5 Unlocks For Every 10 Resources You UploadHuber Emiro Riascos GomezNo ratings yet

- Rizal's Short BiographyDocument2 pagesRizal's Short BiographyAliah CyrilNo ratings yet

- GE 3 Phil-His Finals-ModuleDocument20 pagesGE 3 Phil-His Finals-ModuleElsie Joy LicarteNo ratings yet

- Office Objects Vocabulary Matching Exercise Worksheets For KidsDocument4 pagesOffice Objects Vocabulary Matching Exercise Worksheets For KidsNoelia Peirats AymerichNo ratings yet

- SocialinequalityDocument8 pagesSocialinequalityapi-353143592No ratings yet

- LL 131 LL3Document134 pagesLL 131 LL3PETGET GENERAL CONSULTING GROUPNo ratings yet

- Developing Understanding of Taxation AssignmentDocument2 pagesDeveloping Understanding of Taxation Assignmentnigus100% (2)

- Intercepting Android HTTPDocument13 pagesIntercepting Android HTTPJurgen DesprietNo ratings yet

- Gstinvoice 0047Document1 pageGstinvoice 0047Kalpatharu OrganicsNo ratings yet

- Review of Related Literature and StudiesDocument11 pagesReview of Related Literature and StudiesDevilo AtutuboNo ratings yet

- Chapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoDocument101 pagesChapter 6-The Companies Act, 2013 Incorporation of Company and Matters Incidental TheretoJay senthilNo ratings yet

- Residences by Armani CasaDocument2 pagesResidences by Armani CasaHakanNo ratings yet